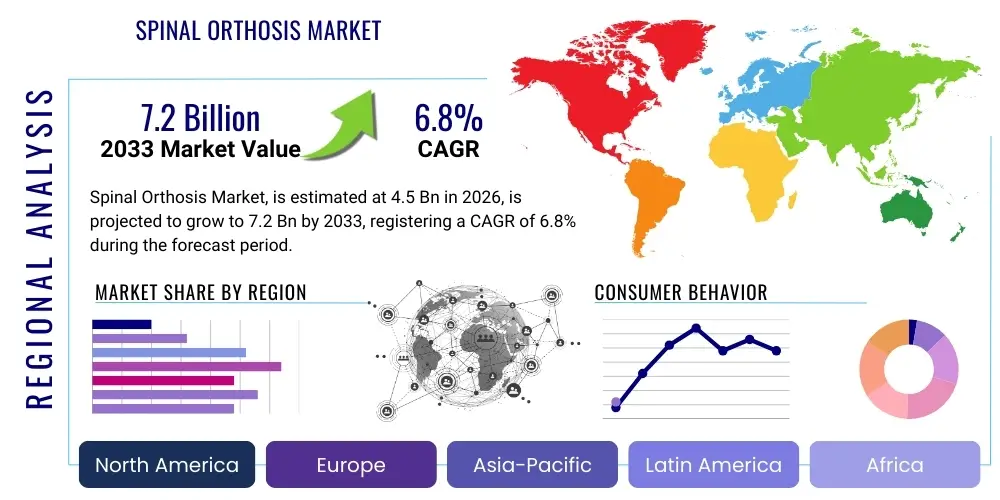

Spinal Orthosis Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442214 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Spinal Orthosis Market Size

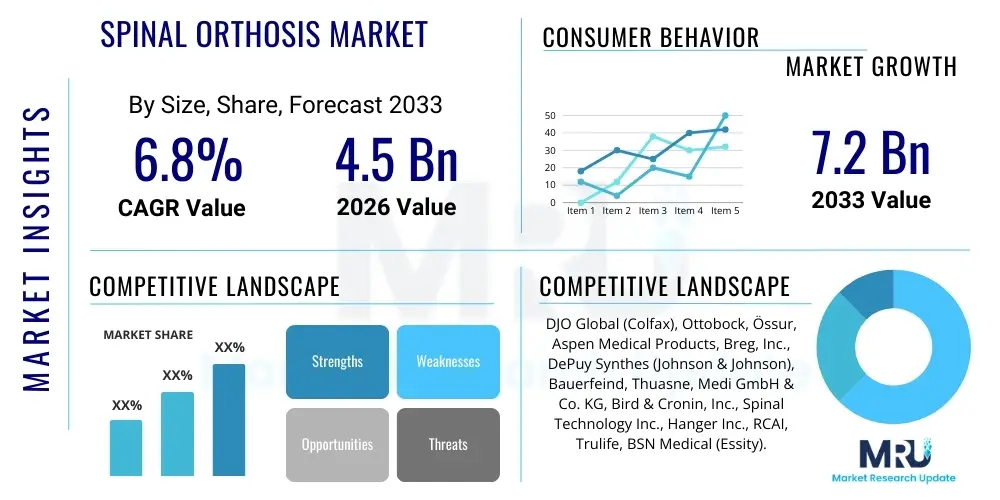

The Spinal Orthosis Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033. This robust expansion is fueled primarily by the global demographic shift toward an aging population, which inherently increases the incidence of spinal degenerative diseases, combined with continuous technological advancements in personalized orthotic device manufacturing, particularly through the integration of 3D printing and advanced materials science. The increasing awareness regarding non-surgical treatment options for spinal deformities, such as scoliosis and kyphosis, also contributes significantly to market valuation growth.

Spinal Orthosis Market introduction

The Spinal Orthosis Market encompasses devices designed to support, stabilize, correct, or immobilize the spine, ranging from the cervical to the sacral regions. These specialized medical devices, often referred to as spinal braces or supports, are critical in managing a wide array of orthopedic and neurological conditions, including acute trauma, post-operative stabilization, degenerative disc disease, spinal stenosis, and complex pediatric deformities like scoliosis and kyphosis. The core function of a spinal orthosis is to limit undesirable spinal motion, reduce painful loads on spinal structures, and facilitate functional recovery by promoting proper anatomical alignment.

Major applications of spinal orthoses are categorized broadly into therapeutic and prophylactic uses. Therapeutically, they are essential for non-operative management of adolescent idiopathic scoliosis (AIS), providing external counter-forces to prevent curve progression, or following surgical interventions to ensure optimal fusion healing and protect internal instrumentation. Prophylactic applications often involve workplace safety and sports injury prevention, providing enhanced support to individuals engaged in physically demanding activities. Key benefits derived from the utilization of these devices include significant pain reduction, improved mobility and posture correction, and often, the avoidance or delay of invasive surgical procedures, thereby reducing overall healthcare costs and recovery times.

Driving factors for sustained market growth include the escalating global burden of chronic back pain, largely attributed to sedentary lifestyles and obesity, alongside the increasing prevalence of sports-related spinal injuries. Furthermore, improved diagnostic capabilities allowing for earlier detection of spinal conditions, coupled with favorable reimbursement policies in developed economies supporting non-operative management, solidify the demand landscape for high-quality, customized spinal orthotic solutions. The development of lightweight, breathable, and highly customizable materials enhances patient compliance, further bolstering market adoption rates globally.

Spinal Orthosis Market Executive Summary

The Spinal Orthosis Market is characterized by dynamic innovation centered on customization and material science, positioning it for sustained mid-to-high single-digit growth through the forecast period. Business trends indicate a marked shift from traditional casting methods toward advanced digital workflows, including 3D scanning, CAD/CAM design, and Additive Manufacturing (3D printing). This digital transformation not only accelerates production but also drastically improves device accuracy, fit, and aesthetic appeal, directly addressing historical issues related to patient compliance. Strategic mergers and acquisitions are prevalent as major healthcare conglomerates seek to integrate specialized orthotic technology providers to capture economies of scale and expand product portfolios, particularly in the premium, customized segment.

Regionally, North America maintains its market dominance, underpinned by high healthcare expenditure, sophisticated reimbursement frameworks, and the widespread availability of advanced therapeutic technologies. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), driven by rapidly improving healthcare infrastructure, massive untapped patient populations in emerging economies like China and India, and increasing government investment in public health programs targeting spinal health. European markets show stable growth, heavily influenced by strict regulatory adherence to medical device standards and strong geriatric care provisions.

Segment trends highlight the Thoracic Lumbar Sacral Orthosis (TLSO) segment as a leading revenue generator due to its extensive application in scoliosis and severe trauma management. Concurrently, the rise of ‘Smart Orthotics’—devices integrated with embedded sensors to monitor patient usage, adherence, and biomechanical feedback—represents a pivotal segment trend. This technological integration is transforming orthosis from a static device into a personalized, data-driven therapeutic tool, which is particularly appealing to healthcare providers focused on objective patient outcomes and compliance metrics.

AI Impact Analysis on Spinal Orthosis Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) in the Spinal Orthosis Market typically revolve around whether AI can improve diagnostic precision for spinal deformities, how machine learning algorithms personalize the orthosis design, and the potential for AI to optimize patient compliance tracking and treatment efficacy prediction. Users are keen to understand if AI-driven simulation tools can predict curve progression in scoliosis more accurately than traditional methods, thereby refining the timing and specifications of orthotic intervention. Key themes emerging from these questions emphasize automation, predictive healthcare modeling, and the integration of AI with 3D printing workflows to achieve unprecedented levels of patient-specific customization, ultimately aiming for improved clinical outcomes and reduced costs associated with trial-and-error fitting processes.

AI is transforming the spinal orthosis ecosystem by enabling faster, more accurate measurements and design parameters derived from complex patient anatomical data. Machine learning algorithms analyze 3D scans, radiological images, and gait analysis data to generate optimal orthotic geometries that account for biomechanical stress and postural correction requirements unique to each patient. This data-driven approach moves beyond standardized sizing towards true personalization. Furthermore, AI is utilized in quality control during additive manufacturing processes, ensuring material integrity and structural compliance with prescribed specifications. The ability of AI to process vast datasets related to treatment variables and patient demographics also allows clinicians to forecast treatment success probabilities, leading to better-informed therapeutic decisions and enhanced resource allocation within clinics.

- AI-driven automated analysis of spinal radiographic images for precise deformity classification and measurement.

- Machine learning algorithms optimizing personalized orthosis design parameters based on patient biomechanics and desired corrective forces.

- Predictive modeling using AI to forecast scoliosis curve progression, guiding intervention timing (watchful waiting vs. bracing).

- Integration of AI with 3D scanning technologies to accelerate the custom fitting process, minimizing errors and clinic time.

- Real-time compliance monitoring using sensor data analyzed by AI to provide feedback on brace wearing hours and fit effectiveness.

- Optimization of manufacturing processes, including material usage and print path efficiency in 3D printing.

DRO & Impact Forces Of Spinal Orthosis Market

The Spinal Orthosis Market is predominantly driven by the increasing global prevalence of chronic spinal disorders, propelled by an aging population susceptible to degenerative conditions such as osteoporosis and spinal stenosis. Technological advancements, particularly in the form of custom-made, lightweight, and aesthetically acceptable orthoses facilitated by 3D printing and CAD/CAM technologies, significantly enhance patient acceptance and compliance, acting as a critical market driver. However, the market faces significant restraints, including the substantial cost associated with highly customized orthotic devices and the enduring challenge of poor patient adherence, especially among adolescent scoliosis patients who must wear the brace for extended periods. The high degree of skill required for precise fitting and adjustments also presents a bottleneck in regions lacking specialized orthotists.

Opportunities for market growth are abundant within the integration of smart technology into orthoses, offering real-time data on usage and biomechanical performance, which promises to revolutionize compliance monitoring and clinical feedback loops. Expanding healthcare access and improving insurance coverage for specialized orthotic treatment in emerging economies also represent substantial future avenues for revenue generation. The primary impact forces influencing this market trajectory include the regulatory scrutiny on medical device quality and safety (influencing manufacturing standards) and the economic factor of healthcare cost containment, which favors effective non-operative solutions over expensive surgical interventions, bolstering the demand for orthoses as a first-line treatment.

The collective interplay of these forces dictates market development. The push for personalized medicine (Opportunity) leverages 3D printing technology (Driver) to counteract the historically high abandonment rate (Restraint). The increasing demand for non-invasive solutions (Driver) provides a cost-effective alternative to surgery, placing the market in a favorable position within global healthcare strategies focused on efficacy and efficiency. Therefore, while challenges like compliance and cost persist, the innovation pipeline, particularly in materials and digitalization, ensures a positive impact on overall market growth.

Segmentation Analysis

The Spinal Orthosis Market is segmented based on product type, indication, and end-user, reflecting the diverse clinical applications and patient needs across the orthopedic spectrum. Product segmentation differentiates devices based on the spinal region they target and their structural rigidity, ranging from rigid support for fractures to flexible dynamic braces for postural alignment. Indication-based segmentation highlights the primary therapeutic applications, with spinal deformity management, particularly scoliosis, often constituting the largest segment due to the long-term bracing required for pediatric patients. End-user categorization emphasizes the primary channels of device distribution and fitting, dominated by specialized institutions capable of providing custom fitting and patient education.

- By Product Type:

- Cervical Orthosis (CO)

- Thoracic Lumbar Sacral Orthosis (TLSO)

- Lumbar Sacral Orthosis (LSO)

- Cervical Thoracic Lumbar Sacral Orthosis (CTLSO)

- Sacroiliac Orthosis (SIO)

- By Indication:

- Spinal Deformity (Scoliosis, Kyphosis, Lordosis)

- Trauma and Fracture Management

- Post-Operative Stabilization

- Degenerative Disc Disease (DDD) and Osteoporosis

- Spinal Stenosis

- Low Back Pain Management

- By End User:

- Hospitals and Surgical Centers

- Specialty Orthopedic Clinics

- Ambulatory Surgical Centers (ASCs)

- Home Care Settings and Rehabilitation Centers

- By Type of Customization:

- Off-the-Shelf Orthoses

- Custom-Fabricated Orthoses (CAD/CAM and 3D Printed)

Value Chain Analysis For Spinal Orthosis Market

The value chain for the Spinal Orthosis Market commences with upstream activities involving the sourcing and refinement of specialized raw materials, primarily high-grade polymers (polypropylene, polyethylene), carbon fiber composites, and increasingly, specialized biocompatible 3D printing filaments. Material quality is paramount as it dictates the device's durability, weight, and clinical effectiveness. Key upstream suppliers include specialized chemical and material manufacturers who must meet stringent medical-grade standards. The manufacturing phase utilizes advanced technologies such as robotic fabrication, CAD/CAM systems, and Additive Manufacturing, demanding significant investment in digital infrastructure and skilled technical personnel to transition patient scan data into a finalized, precise device. Research and Development (R&D) efforts focus intensely on material innovation for enhanced breathability and reduced weight.

The midstream phase focuses on assembly, rigorous quality control, and obtaining regulatory clearance (e.g., FDA, CE Mark). This phase is heavily integrated with clinical input, as device design often requires iterative adjustments based on orthotists' feedback. The downstream segment, the distribution channel, is complex due to the personalized nature of the product. Direct distribution involves manufacturers supplying devices directly to large hospital systems or proprietary orthotic clinics. However, the indirect channel is dominant, relying on specialized distributors, certified orthotist practices, and medical equipment providers who handle the critical step of prescription verification, customized fitting, patient education, and follow-up adjustments. Due to the requirement for professional fitting, Spinal Orthoses are rarely sold directly to the consumer without clinical oversight.

The interaction between manufacturers and end-users is mediated heavily by certified Orthotists/Prosthetists (O&P professionals). These specialists are crucial in transforming the mass-produced or semi-customized component into a patient-specific therapeutic tool, ensuring optimal fit and maximum compliance. The final delivery and utilization occur predominantly within specialty clinics and hospitals, where the multidisciplinary team—comprising orthopedic surgeons, physical therapists, and orthotists—collaborate on the patient's comprehensive treatment plan. The reimbursement landscape significantly impacts the channel profitability, with detailed documentation required at every step to validate clinical necessity and secure payment from governmental or private insurers.

Spinal Orthosis Market Potential Customers

The primary potential customers and end-users of spinal orthoses are diverse medical institutions and patient care settings requiring specialized devices for musculoskeletal management and rehabilitation. Hospitals, particularly those with strong orthopedic, trauma, and rehabilitation departments, represent the largest volume purchasers. These institutions require a wide range of orthoses for post-operative stabilization, acute injury management (fractures), and the immediate care of severe spinal conditions. Specialty orthopedic clinics and rehabilitation centers are also significant customers, focusing on long-term management of chronic conditions, such as scoliosis and degenerative diseases, and requiring a steady supply of custom-made and off-the-shelf devices for outpatient care.

Individual patients, while not directly purchasing the devices in most scenarios due to the prescription and fitting requirement, are the ultimate beneficiaries and drivers of demand. This includes the geriatric population suffering from age-related spinal deterioration (osteoporosis, stenosis), adolescents requiring bracing for idiopathic scoliosis, and athletes seeking support for sports-related injuries or prophylaxis. Health maintenance organizations (HMOs) and private insurance payers are indirect but highly influential customers, as their coverage policies dictate the accessibility and demand for specific, often higher-cost, custom orthotic solutions. A growing segment includes telemedicine and remote monitoring services integrating orthotic data, seeking devices compatible with digital health platforms.

Orthotists and Prosthetists (O&P) practices serve as crucial immediate customers. They procure raw materials, semi-finished components, or complete off-the-shelf units from manufacturers, and then apply their expertise to customize, fit, and dispense the device directly to the patient based on physician prescription. These professionals act as the interface between the manufacturing sector and clinical application, making them vital partners in the distribution chain. Their purchasing decisions are heavily influenced by factors such as material innovation, ease of customization (e.g., CAD/CAM compatibility), and manufacturer support for advanced technological training.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DJO Global (Colfax), Ottobock, Össur, Aspen Medical Products, Breg, Inc., DePuy Synthes (Johnson & Johnson), Bauerfeind, Thuasne, Medi GmbH & Co. KG, Bird & Cronin, Inc., Spinal Technology Inc., Hanger Inc., RCAI, Trulife, BSN Medical (Essity). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Spinal Orthosis Market Key Technology Landscape

The technology landscape of the Spinal Orthosis Market is currently undergoing a rapid digital transformation, primarily driven by the adoption of sophisticated digital measurement and manufacturing techniques. Computer-Aided Design and Computer-Aided Manufacturing (CAD/CAM) systems have become foundational, replacing tedious and inaccurate plaster casting. These systems utilize advanced 3D scanning technologies to capture precise patient anatomical data, which is then fed into software for digital modification and design optimization. This technological shift allows for highly accurate, custom-fitted orthoses that minimize skin irritation and pressure points, leading to vastly improved patient comfort and efficacy. The accuracy of CAD/CAM reduces the time required for adjustments and remakes, streamlining the clinical workflow.

Additive Manufacturing, or 3D Printing, represents the most disruptive technological advancement in this sector. 3D printing enables the creation of complex geometries that are impossible or impractical with traditional thermoforming methods, leading to lightweight, perforated, and aesthetically pleasing braces. This technology allows for the rapid fabrication of patient-specific devices using durable, medical-grade materials like Nylon 12 or carbon-fiber reinforced composites. Beyond material efficiency, 3D printing facilitates localized production, potentially shortening the supply chain and delivery times, especially crucial for acute care or rapidly progressing pediatric conditions. The cost efficiency of 3D printing is continuously improving, making customized orthoses increasingly accessible.

The emergence of 'Smart Orthotics' integrates micro-electronic sensors and Internet of Things (IoT) connectivity into the spinal braces. These embedded systems monitor key metrics such as compliance (wear time), temperature, humidity, and the application of corrective forces. The data collected is wirelessly transmitted to clinicians and parents (in the case of pediatric patients), offering objective evidence of adherence and device function. This feedback loop is essential for optimizing treatment plans and addressing the persistent problem of low compliance in long-term bracing protocols. Furthermore, advancements in specialized materials, including smart fabrics and antimicrobial coatings, are enhancing the hygienic and therapeutic properties of the devices, contributing significantly to patient quality of life during treatment.

Regional Highlights

Regional dynamics play a crucial role in the Spinal Orthosis Market, influenced by healthcare expenditure, regulatory environments, and demographic profiles. North America, particularly the United States, commands the largest market share due to its well-established healthcare infrastructure, high incidence of sports injuries and age-related spinal issues, and advanced reimbursement policies that facilitate access to high-cost custom devices and technological innovations like 3D printing. The presence of major market players and early adopters of smart orthosis technology solidifies the region's dominance. High awareness among healthcare professionals regarding the clinical benefits of early orthotic intervention further supports market growth in this region.

Europe represents a mature market characterized by stringent regulatory standards (MDR compliance) and government-backed healthcare systems. Germany, France, and the UK are key contributors, driven by a large geriatric population and standardized treatment protocols for scoliosis and lower back pain. While growth is steady, it is primarily fueled by continuous innovation in lightweight materials and personalized solutions that align with the high quality of life expectations within the European Union. Reimbursement varies significantly by country but generally favors clinically proven, non-invasive treatments, supporting orthotic device sales.

The Asia Pacific (APAC) region is poised for the most rapid growth during the forecast period. This growth is a result of increasing disposable incomes, significant improvements in medical infrastructure, and a vast, largely underserved patient population. Countries like China and India are experiencing a massive increase in healthcare investment, coupled with rising awareness about non-surgical spine management. The challenge in APAC remains the heterogeneity of reimbursement and the varying levels of access to specialized orthotists, yet the sheer volume of potential patients, especially adolescents requiring scoliosis treatment, provides immense expansion opportunities. Latin America, the Middle East, and Africa (LAMEA) remain nascent markets, with growth concentrated in urban centers and private healthcare facilities, often constrained by limited public sector coverage and dependency on imported high-tech solutions.

- North America (Dominant Market): High healthcare spending, rapid adoption of 3D printing for customization, high prevalence of degenerative spinal conditions, and favorable reimbursement structures.

- Europe (Steady Growth): Robust geriatric care policies, strict adherence to quality standards (MDR), and strong focus on specialized orthotist training and material research.

- Asia Pacific (Fastest Growth): Expanding healthcare infrastructure, large patient pools in China and India, increasing medical tourism, and rising awareness regarding early intervention for spinal deformities.

- Latin America, Middle East & Africa (Emerging Markets): Growth driven by privatization of healthcare, improving medical capabilities in key urban areas, and increasing demand for trauma orthoses.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Spinal Orthosis Market.- DJO Global (Colfax Corporation)

- Ottobock SE & Co. KGaA

- Össur hf

- Aspen Medical Products, LLC

- Breg, Inc.

- DePuy Synthes (Johnson & Johnson)

- Bauerfeind AG

- Thuasne SAS

- Medi GmbH & Co. KG

- Bird & Cronin, Inc.

- Spinal Technology Inc.

- Hanger Inc. (Orthotics & Prosthetics)

- RCAI (Restorative Care of America, Inc.)

- Trulife Group Ltd.

- Scoliosis Systems (ScoliosisCare)

- SureStep, LLC

- Orthomerica Products, Inc.

- Prime Medical, Inc.

- Optec USA, Inc.

Frequently Asked Questions

Analyze common user questions about the Spinal Orthosis market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Spinal Orthosis Market?

The primary driver is the accelerating prevalence of age-related spinal disorders, such as osteoporosis and degenerative disc disease, coupled with the increasing adoption of personalized orthoses created using advanced 3D printing and CAD/CAM technologies, which significantly improve patient compliance and treatment efficacy.

How is 3D printing impacting the customization of spinal orthoses?

3D printing allows for the rapid, accurate, and cost-effective fabrication of custom-fit spinal braces based on patient-specific 3D scan data. This technology enables complex designs that are lighter and more comfortable than traditional thermoformed devices, directly addressing historical issues of poor patient adherence.

Which product segment holds the largest share in the Spinal Orthosis Market?

The Thoracic Lumbar Sacral Orthosis (TLSO) segment typically holds the largest market share due to its widespread and long-term application in the non-operative management of adolescent idiopathic scoliosis (AIS), trauma stabilization, and severe post-operative spinal fusion care.

What are 'Smart Orthotics' and how do they enhance patient outcomes?

Smart Orthotics are spinal braces equipped with embedded sensors and IoT capabilities that monitor patient compliance (wear time) and biomechanical data. They enhance outcomes by providing objective, real-time feedback to clinicians, allowing for timely intervention to improve adherence to the prescribed treatment protocol.

Why is North America the leading region in the Spinal Orthosis Market?

North America leads due to its high volume of spinal procedures, mature healthcare expenditure capacity, advanced diagnostic technologies leading to early intervention, and robust reimbursement systems that support the utilization of high-cost, specialized, and customized spinal orthotic devices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager