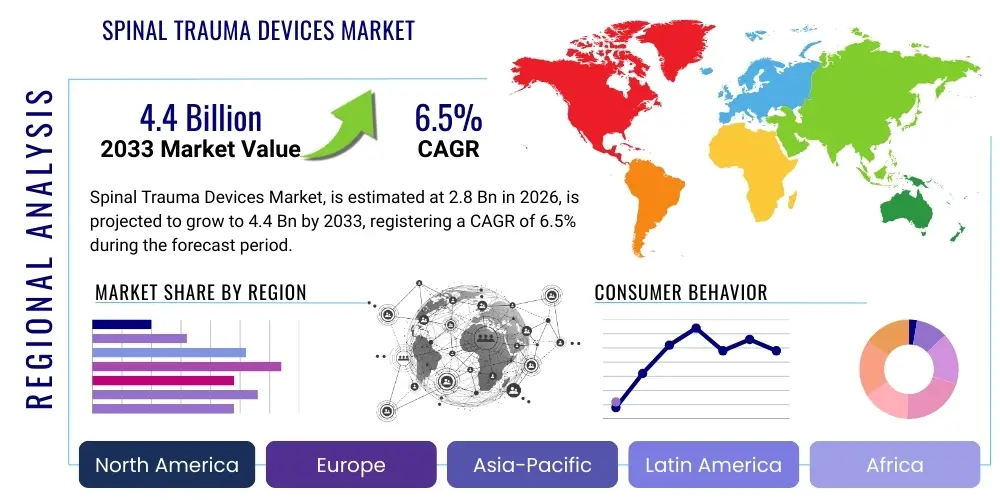

Spinal Trauma Devices Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443159 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Spinal Trauma Devices Market Size

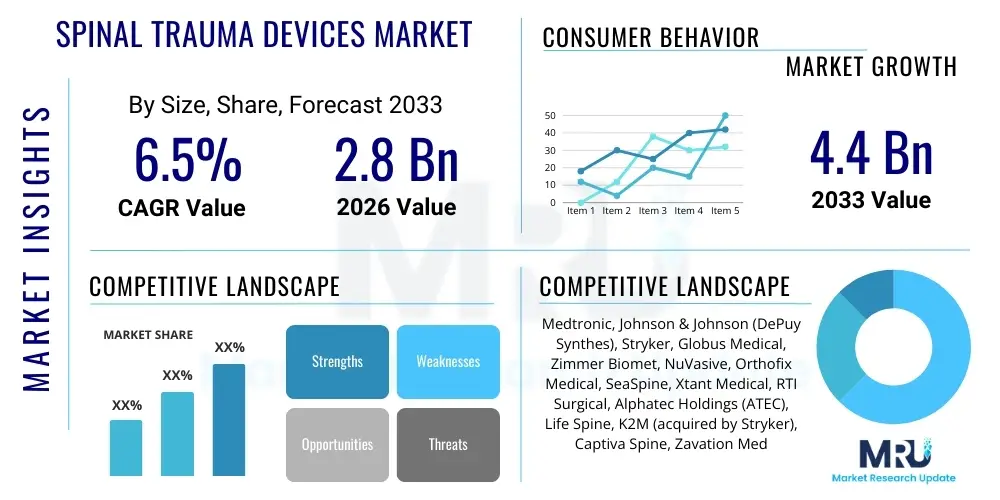

The Spinal Trauma Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 2.8 Billion in 2026 and is projected to reach USD 4.4 Billion by the end of the forecast period in 2033.

Spinal Trauma Devices Market introduction

The Spinal Trauma Devices Market encompasses a specialized segment within the orthopedic and neurosurgical device industry, focusing on instruments and implants utilized for the stabilization, fusion, and repair of spinal column injuries resulting from acute trauma such as vehicular accidents, falls, and sports injuries. These devices are critical for restoring structural integrity to the spine, decompressing neural elements, and preventing secondary injury, thereby facilitating patient recovery and minimizing long-term neurological deficits. Key product categories include spinal fixation systems (rods, screws, plates), vertebral augmentation devices, and interbody cages designed specifically for traumatic indications. The inherent complexity of spinal injuries necessitates highly robust and biocompatible materials, driving continuous innovation in device design and surgical techniques, particularly towards minimally invasive approaches that reduce patient morbidity and accelerate rehabilitation timelines.

Major applications of these devices span fracture fixation (e.g., burst fractures, compression fractures), dislocation management, and reconstructive surgery following tumor or infection-related structural instability exacerbated by trauma. The market growth is substantially driven by the increasing global incidence of high-energy trauma, particularly in rapidly urbanizing economies, coupled with an aging demographic that is more susceptible to fragility fractures exacerbated by conditions like osteoporosis. Furthermore, advancements in diagnostic imaging technologies, such as high-resolution CT and MRI, allow for more precise injury classification, enabling surgeons to select the optimal device and surgical strategy, thus improving procedural efficacy and expanding the clinical adoption of advanced spinal trauma solutions.

The primary benefits offered by contemporary spinal trauma devices include enhanced biomechanical stability, reduced hospital stay durations through minimally invasive surgery (MIS), and improved patient functional outcomes. Driving factors for market expansion include escalating R&D investments by key manufacturers focused on developing personalized implants and smart devices, growing penetration of sophisticated healthcare infrastructure in emerging markets, and favorable reimbursement policies for complex spine surgeries. These combined elements underscore the critical role of spinal trauma devices in modern healthcare systems dedicated to managing severe musculoskeletal injuries and improving quality of life for trauma victims.

Spinal Trauma Devices Market Executive Summary

The Spinal Trauma Devices Market is poised for consistent expansion, fueled predominantly by demographic shifts characterized by an aging population prone to high-risk falls and the rising global burden of high-velocity accidents. Business trends emphasize strategic mergers and acquisitions among major players aiming to consolidate technological portfolios, especially in hybrid fixation systems and biodegradable materials. Companies are increasingly focusing on vertical integration to control supply chains, ensuring the availability of specialized materials like titanium alloys and PEEK composites. Furthermore, there is a distinct business shift toward establishing dedicated trauma management training programs for surgeons, which indirectly accelerates the adoption rate of complex and novel devices, particularly in rapidly evolving surgical centers of excellence.

Regionally, North America maintains market dominance due to high healthcare expenditure, sophisticated trauma care infrastructure, and widespread adoption of premium, next-generation implants. However, the Asia Pacific region is projected to exhibit the highest growth trajectory, driven by massive investments in public health facilities, improvements in trauma network systems, and increasing patient awareness regarding advanced spinal interventions. European markets are characterized by stringent regulatory environments but rapid adoption of novel minimally invasive surgical techniques, often influenced by favorable health technology assessment (HTA) outcomes in key countries such as Germany and the UK. Localization of manufacturing and distribution networks is a critical regional trend observed globally to mitigate logistical risks and comply with diverse regulatory mandates.

Segmentation trends highlight the increasing preference for advanced spinal fixation devices, particularly pedicle screw systems, due to their versatility and proven efficacy in stabilizing complex multi-level fractures. The minimally invasive approach segment is experiencing accelerated growth, driven by patient demand for reduced incision size and quicker recovery times, pushing manufacturers to redesign instrumentation kits and implant geometries suitable for MIS procedures. Within end-user segments, specialized trauma centers and large hospital networks remain the primary consumers, although the rise of sophisticated Ambulatory Surgical Centers (ASCs) capable of handling less complex trauma cases presents a nascent yet significant growth area, reflecting a broader shift towards outpatient procedural management where feasible and safe for spinal injury recovery.

AI Impact Analysis on Spinal Trauma Devices Market

User inquiries concerning AI's role in the Spinal Trauma Devices Market primarily revolve around its capabilities in enhancing surgical precision, optimizing patient-specific treatment planning, and automating complex diagnostic imaging analysis. Key themes center on the feasibility of AI algorithms to predict hardware failure or identify high-risk fracture patterns missed by the human eye, alongside concerns about data privacy, regulatory approval pathways for AI-driven surgical robotics, and the potential displacement of traditional surgical planning roles. Expectations are high regarding AI's contribution to personalized medicine, specifically through rapid analysis of patient biomechanical data to design optimal, custom 3D-printed implants, thereby minimizing operative time and maximizing long-term stability.

- AI-Enhanced Pre-operative Planning: Algorithms analyze complex CT/MRI data to generate 3D models, predicting optimal screw trajectory and fusion angles, minimizing surgical margin of error.

- Robotic-Assisted Surgery Integration: AI drives advanced navigation systems for robotic arms, ensuring highly precise placement of fixation hardware, critical in unstable trauma scenarios.

- Fracture Pattern Recognition: Machine learning models assist radiologists in rapid, automated classification of vertebral fractures (e.g., AO Spine classification), improving triage efficiency in emergency settings.

- Predictive Outcome Modeling: AI analyzes large datasets of trauma patient outcomes to predict complication risk, implant longevity, and patient functional recovery trajectory based on device selection.

- Custom Implant Design Optimization: Generative design AI is used to quickly iterate and optimize patient-specific implants (e.g., cages, plates) for superior biomechanical fit and stress distribution, particularly beneficial for complex, comminuted fractures.

DRO & Impact Forces Of Spinal Trauma Devices Market

The Spinal Trauma Devices Market is powerfully driven by the escalating global prevalence of traumatic spinal cord injuries (SCI), largely attributed to increasing road traffic accidents, industrial mishaps, and sports-related trauma. This underlying driver is amplified by demographic shifts, specifically the rapid growth in the elderly population segment across developed and developing nations, which inherently increases the vulnerability to low-energy trauma resulting in vertebral compression fractures requiring surgical stabilization. Counterbalancing these drivers are significant restraints, including the inherently high cost of advanced spinal trauma procedures, which often involves specialized implants and lengthy hospital stays, leading to challenges in reimbursement particularly in price-sensitive markets. Furthermore, the stringent and complex regulatory approval pathways for novel implants, especially those incorporating advanced materials or technologies, pose significant barriers to entry and slow down the commercialization cycle for small and mid-sized innovators.

Opportunities for growth are prominently situated within the continued maturation and adoption of Minimally Invasive Surgical (MIS) techniques for trauma management. MIS procedures offer substantial benefits such as reduced blood loss, decreased post-operative pain, and faster patient mobilization, making them increasingly attractive to both surgeons and patients. The innovation pipeline is rich with next-generation materials, including specialized bioresorbable polymers and smart implants embedded with sensors capable of monitoring fusion progression or mechanical load, presenting vast potential for product differentiation and premium pricing strategies. Additionally, untapped growth potential lies in strengthening trauma infrastructure in emerging markets, where rapid industrialization is correlating directly with higher rates of serious traumatic injuries, necessitating the establishment of effective and well-equipped spinal trauma care centers supported by modern device inventories.

The market is subjected to several critical impact forces that shape its competitive structure and operational environment. Technological advancements act as a major positive impact force, driving efficiency and safety through better navigation tools, robotics, and customizable implants. Conversely, intense price competition and market saturation in commodity segments (e.g., standard pedicle screws) exert downward pressure on average selling prices (ASPs), requiring companies to continuously justify the premium associated with proprietary designs and advanced features. Regulatory compliance, specifically regarding device efficacy and long-term performance data, is a persistent force, necessitating extensive post-market surveillance and clinical trials to maintain market credibility and approval, ultimately influencing investment prioritization and product development timelines across the industry.

Segmentation Analysis

The Spinal Trauma Devices Market is strategically segmented based on factors such as the type of product utilized, the nature of the injury treated, the material composition of the implants, and the primary end-user facility. This segmentation provides a granular view of market dynamics, highlighting areas of high growth (e.g., vertebral augmentation) versus more mature segments (e.g., traditional fusion devices). Understanding these segments is crucial for manufacturers to tailor R&D efforts and marketing strategies, focusing resources where technological innovation is most highly valued and where the clinical necessity is most acute, particularly given the shift towards patient-specific solutions in complex trauma care scenarios.

- Product Type: Spinal Fixation Devices (Posterior Fixation Systems, Anterior Fixation Systems, Pedicle Screw Systems, Rods, Hooks, Plates, Wires, and Cables), Vertebral Compression Fracture (VCF) Treatment Devices (Kyphoplasty Kits, Vertebroplasty Kits), Spinal Fusion Devices (Interbody Cages, Bone Graft Substitutes).

- End-User: Hospitals (Acute Care Hospitals, Tertiary Trauma Centers), Ambulatory Surgical Centers (ASCs), Specialty Orthopedic and Neurosurgical Clinics.

- Material: Titanium and Titanium Alloys, PEEK (Polyetheretherketone), Stainless Steel, Combined/Hybrid Materials (e.g., Carbon Fiber Reinforced PEEK).

- Injury Type: Spinal Fractures (Compression, Burst, Chance Fractures), Spinal Dislocations, Ligamentous Injuries, Subluxations.

- Surgical Approach: Minimally Invasive Surgery (MIS) Devices, Open Surgery Devices.

Value Chain Analysis For Spinal Trauma Devices Market

The value chain for spinal trauma devices is intricate, beginning with specialized upstream activities focused on the sourcing and processing of high-grade biocompatible raw materials such as medical-grade titanium alloys and advanced polymers like PEEK. Upstream suppliers are typically highly specialized material science companies that must adhere to stringent quality standards (ISO 13485) as the mechanical integrity and biological safety of the final implant depend entirely on these inputs. This stage includes complex material preparation and pre-machining processes before the materials are handed over to the device manufacturers. Maintaining strict control over the supply of these essential raw materials is a critical competitive advantage, especially given the global volatility in metal prices and the necessary regulatory traceability required for every batch of material used in implantable devices.

The core manufacturing stage involves sophisticated processes including CNC machining, forging, additive manufacturing (3D printing), and surface treatment (e.g., plasma spraying, porous coating) to create the final implants and instrumentation kits. Downstream activities involve rigorous testing, quality assurance, sterilization, and specialized packaging, often done in cleanroom environments to meet sterilization assurance level (SAL) requirements. Distribution channels are highly specialized, typically involving direct sales forces for large accounts (major trauma centers, integrated delivery networks) supplemented by highly trained, specialized distributors or third-party logistics (3PL) providers for smaller markets or immediate trauma needs. Direct channels are preferred by leading companies for high-value, complex systems to maintain control over inventory, pricing, and specialized technical support required during surgery.

The final stage in the value chain involves the end-users—hospitals and surgeons—who ultimately procure and utilize the devices. The sales cycle heavily relies on clinical evidence, peer-reviewed publications, and demonstration of superior long-term clinical outcomes. Both direct and indirect distribution methods are utilized; indirect distribution through regional distributors is common in developing economies to leverage local market knowledge and access. In contrast, direct sales teams, often supported by clinical specialists, are essential in mature markets to ensure complex instrument setup, intraoperative technical troubleshooting, and ongoing product education, reinforcing the high-touch service model characteristic of the spinal trauma device industry.

Spinal Trauma Devices Market Potential Customers

The primary consumers and end-users of spinal trauma devices are highly specialized clinical facilities equipped to handle acute orthopedic and neurological emergencies. These facilities include Level I and Level II trauma centers, which are designed to provide comprehensive care for severe injuries and maintain surgical readiness 24/7. Within these settings, orthopedic surgeons specializing in spine trauma, neurosurgeons, and emergency department physicians act as key decision-makers and influencers regarding the selection and adoption of specific device brands and technologies. These buyers prioritize product efficacy, ease of use in high-stress trauma situations, availability of comprehensive instrumentation sets, and strong clinical support from the manufacturer.

A secondary, yet rapidly growing, customer segment includes Ambulatory Surgical Centers (ASCs) and specialized spine clinics that manage less severe trauma cases, such as isolated vertebral compression fractures. The demand from ASCs is driven by the desire to perform elective or semi-urgent procedures outside the higher cost environment of a hospital, pushing the need for streamlined, cost-effective devices and kits that facilitate quick turnover. Furthermore, the burgeoning segment of geriatric care facilities and long-term acute care hospitals represents potential customers for vertebral augmentation products necessary for treating fragility fractures, where patient fragility necessitates minimally invasive, rapid stabilization solutions.

The procurement process is often centralized, especially within large Integrated Delivery Networks (IDNs) or national healthcare systems (e.g., NHS in the UK). These large buyers focus heavily on total cost of ownership, standardization across facilities, and securing volume-based discounts, requiring manufacturers to engage in sophisticated contract negotiation and value-based pricing strategies. The ultimate goal across all customer types is the immediate stabilization of the spine, effective neural decompression, and a reliable path toward long-term fusion or healing, making safety and proven clinical track record the paramount purchasing criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.8 Billion |

| Market Forecast in 2033 | USD 4.4 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, Johnson & Johnson (DePuy Synthes), Stryker, Globus Medical, Zimmer Biomet, NuVasive, Orthofix Medical, SeaSpine, Xtant Medical, RTI Surgical, Alphatec Holdings (ATEC), Life Spine, K2M (acquired by Stryker), Captiva Spine, Zavation Medical, Pioneer Surgical, B. Braun Melsungen, Integra LifeSciences, LDR Holding (acquired by Zimmer Biomet), Spineart. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Spinal Trauma Devices Market Key Technology Landscape

The technological landscape of the Spinal Trauma Devices Market is characterized by a rapid evolution toward precision medicine, driven by engineering innovations focused on minimizing invasiveness while maximizing biomechanical stability. A key technological focus is the continuous refinement of pedicle screw systems, which now often incorporate polyaxial or uniplanar designs and surface modifications to enhance osseointegration and reduce the risk of screw loosening, a common failure point in trauma fixation. Furthermore, the development and integration of specialized instrumentation for Minimally Invasive Surgery (MIS) techniques, including expandable tubular retractors and percutaneous screw placement systems, are paramount. These instruments require high levels of material strength and miniaturization, enabling complex stabilization procedures through small incisions, thereby contributing significantly to patient recovery speed and reduced hospital costs, which is a major value proposition in the current healthcare ecosystem.

Another dominant technological trend is the rise of Additive Manufacturing (3D Printing) for producing highly customized and porous implants, particularly interbody cages and patient-specific plates. 3D printing allows manufacturers to create intricate lattice structures that mimic natural bone cancellous architecture, which promotes faster and stronger biological fusion post-trauma. This technology is especially critical in complex trauma cases where standard off-the-shelf implants may not adequately conform to severely compromised or deformed spinal anatomy. Concurrently, the increasing utilization of advanced navigation and robotics in the operating room ensures unparalleled accuracy in implant placement, mitigating the risks associated with freehand techniques, particularly in the delicate cervical and upper thoracic regions, which is crucial for preventing neural damage and ensuring long-term device stability.

The market is also witnessing early integration of sensor technology and smart materials. Researchers are exploring implants embedded with micro-sensors that can wirelessly monitor vital metrics such as localized strain, temperature, and pH levels, providing real-time data on the progress of bone fusion or early detection of hardware failure. While still nascent, these "smart" devices represent the future of post-operative management, allowing clinicians to intervene proactively. Additionally, the adoption of specialized biomaterials like bioresorbable polymers for temporary fixation and advanced PEEK formulations with enhanced radiolucency and anti-infective properties continues to improve the safety profile and diagnostic clarity following complex spinal trauma reconstruction, ensuring that the devices meet both immediate stabilization needs and long-term biological integration requirements.

Regional Highlights

- North America (U.S. and Canada): Dominates the market share due to highly sophisticated trauma centers, high incidence of sports and vehicular injuries, and significant healthcare spending facilitating the rapid adoption of premium robotic and navigation technologies. The U.S. remains the primary innovation hub for new spinal trauma device patents and clinical trials.

- Europe (Germany, UK, France): Characterized by advanced healthcare systems and strong regulatory frameworks (EU MDR compliance). Germany leads in procedural volume and adoption of vertebral augmentation techniques, while the region overall shows a strong preference for clinical efficacy supported by rigorous health technology assessments.

- Asia Pacific (China, Japan, India): Projected as the fastest-growing region, driven by massive investments in public health infrastructure, increasing road traffic accident rates associated with economic growth, and an expanding elderly population. China and India are emerging as major markets due to improving accessibility of advanced surgical care and growing disposable incomes.

- Latin America (Brazil, Mexico): Represents a developing market with significant potential. Growth is constrained by inconsistent reimbursement policies but driven by high urbanization rates leading to increased trauma incidence. Brazil is a key focus area due to its large population and efforts to modernize healthcare facilities.

- Middle East and Africa (MEA): Growth is concentrated in affluent Gulf Cooperation Council (GCC) countries, supported by government initiatives to establish world-class trauma centers and medical tourism. South Africa serves as a regional hub for advanced surgical procedures, though market penetration remains uneven across the continent.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Spinal Trauma Devices Market.- Medtronic

- Johnson & Johnson (DePuy Synthes)

- Stryker

- Globus Medical

- Zimmer Biomet

- NuVasive

- Orthofix Medical

- SeaSpine

- Xtant Medical

- RTI Surgical

- Alphatec Holdings (ATEC)

- Life Spine

- K2M (acquired by Stryker)

- Captiva Spine

- Zavation Medical

- Pioneer Surgical

- B. Braun Melsungen

- Integra LifeSciences

- LDR Holding (acquired by Zimmer Biomet)

- Spineart

Frequently Asked Questions

Analyze common user questions about the Spinal Trauma Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current growth in the Spinal Trauma Devices Market?

Market growth is primarily driven by the rising global incidence of high-energy trauma (e.g., vehicular accidents), the expanding geriatric population susceptible to fragility fractures (like vertebral compression fractures), and continuous technological advancements favoring Minimally Invasive Surgical (MIS) approaches.

Which product segment holds the largest market share in spinal trauma devices?

The Spinal Fixation Devices segment, particularly pedicle screw systems and rods, typically holds the largest market share due to their essential role in stabilizing a wide range of acute and complex spinal fractures and dislocations, making them fundamental for trauma reconstruction procedures.

How is Minimally Invasive Surgery (MIS) impacting the device market?

MIS techniques are driving demand for specialized instruments and smaller, streamlined implant designs optimized for percutaneous placement. This shift is increasing market penetration by offering patients reduced morbidity, shorter hospital stays, and quicker functional recovery compared to traditional open surgery.

What are the primary restraints affecting the adoption of advanced spinal trauma devices?

Major restraints include the high initial cost of advanced surgical systems (like robotics and navigation), the substantial expense associated with proprietary implants, and complex, time-consuming regulatory approval processes required for novel biomaterials and digital surgical solutions globally.

Which geographical region is expected to show the fastest growth rate?

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid improvements in healthcare infrastructure, increasing awareness of advanced treatments, and a substantial increase in road traffic accidents and elderly populations in major economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager