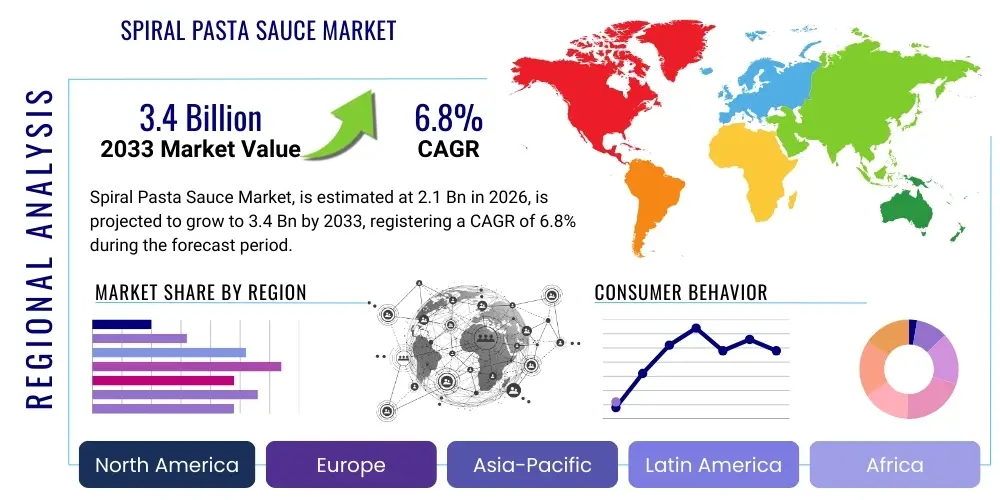

Spiral Pasta Sauce Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441121 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Spiral Pasta Sauce Market Size

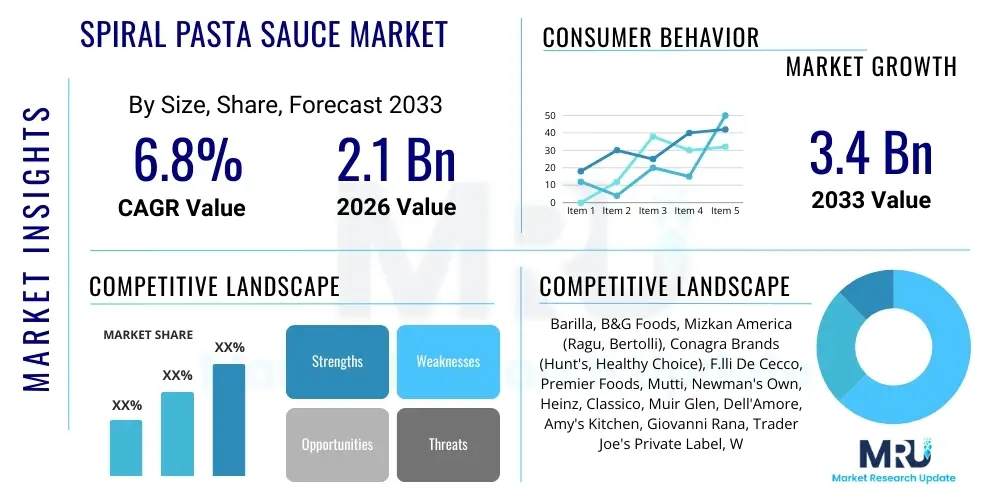

The Spiral Pasta Sauce Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $2.1 billion in 2026 and is projected to reach $3.4 billion by the end of the forecast period in 2033.

Spiral Pasta Sauce Market introduction

The Spiral Pasta Sauce Market encompasses a diverse range of ready-to-use sauces specifically designed to complement various pasta shapes, including spiral varieties like fusilli and rotini. These sauces are engineered to adhere effectively to the twists and grooves of spiral pasta, ensuring optimal flavor distribution and texture integration. The product category includes traditional bases such as marinara, alfredo, and pesto, alongside specialty and globally inspired flavor profiles catering to evolving consumer palates. The primary benefit driving adoption is the significant convenience offered, drastically reducing meal preparation time for busy consumers and families seeking quick yet satisfying home-cooked meals.

Major applications of spiral pasta sauces extend beyond primary pasta dishes to include use in casseroles, baked dishes, pizza bases, and dipping sauces. The versatility inherent in jarred or pouched sauces allows for broad integration into numerous culinary styles, reinforcing their status as a pantry staple. Key driving factors include the accelerating trend of home cooking, particularly post-pandemic, coupled with a rising demand for premium, authentic, and health-conscious food options. Manufacturers are responding by innovating with organic ingredients, low-sodium formulations, and unique regional flavors to capture market share.

The introduction of specialized sauces that cater to dietary restrictions, such as gluten-free, keto-friendly, and fully plant-based options, further fuels market expansion. The functional attributes of these sauces—their shelf stability and consistent quality—make them highly attractive in modern retail environments. Furthermore, robust marketing efforts highlighting flavor authenticity and ease of use are crucial in driving consumer adoption across mature and emerging economies.

Spiral Pasta Sauce Market Executive Summary

The Spiral Pasta Sauce Market is characterized by vigorous competition and rapid innovation, primarily driven by shifting consumer preferences toward convenience and premiumization in the ready-to-eat category. Business trends indicate a strong focus on sustainable sourcing, transparent labeling, and the integration of technology in supply chain management to ensure product freshness and minimize waste. Strategic mergers and acquisitions are common among major players aiming to consolidate market share and acquire niche brands specializing in high-growth segments like organic or ethnic flavors. Furthermore, advancements in packaging technology, such as lightweight pouches and recyclable glass, are enhancing product appeal and reducing logistical costs.

Regionally, North America and Europe maintain dominant market positions due to high per capita consumption of pasta and established distribution networks, though the Asia Pacific region is demonstrating the highest growth trajectory, fueled by increasing urbanization and the westernization of dietary habits in countries like China and India. Segments trends highlight a significant surge in demand for organic and "clean label" sauces, where consumers prioritize simple ingredient lists devoid of artificial additives, preservatives, or high fructose corn syrup. The Pesto segment, specifically, is experiencing robust growth as consumers seek alternatives to traditional tomato-based sauces, valuing its perceived freshness and versatility.

The distribution landscape is rapidly transforming, with e-commerce emerging as a pivotal channel for specialized and premium brands, offering consumers direct access to a wider variety of global flavors not always stocked in conventional supermarkets. This digital acceleration requires manufacturers to optimize their digital presence and logistics for direct-to-consumer fulfillment. Overall, the market remains resilient, successfully navigating macroeconomic pressures through continuous product diversification and targeted marketing aimed at specific demographic segments, particularly millennials and Gen Z, who value culinary exploration and efficiency.

AI Impact Analysis on Spiral Pasta Sauce Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on the Spiral Pasta Sauce Market reveals key themes centered on supply chain efficiency, flavor innovation, and personalized consumer experiences. Users frequently inquire how AI can optimize sourcing strategies, predicting raw material yields (e.g., tomato harvests) and managing price volatility. A major concern is the potential for AI-driven recipe generation—whether machine learning algorithms can create novel, highly appealing flavor combinations based on regional consumer data, potentially disrupting traditional product development cycles. Furthermore, significant interest exists in how AI-powered analytics can personalize marketing campaigns and recommend specific sauce products based on individual purchase history and dietary profiles, enhancing conversion rates for both retail and direct-to-consumer channels.

- AI optimizes inventory management by predicting demand fluctuations across different regional markets, reducing waste.

- Machine learning algorithms analyze sensory data to formulate complex, novel spiral pasta sauce flavors, accelerating R&D timelines.

- AI-driven consumer segmentation enhances targeted advertising, matching specific sauce types (e.g., organic, low-sugar) to relevant demographics.

- Predictive analytics monitors supply chain risks, ensuring stable procurement of key agricultural ingredients like tomatoes, peppers, and herbs.

- AI tools manage factory floor automation, improving consistency in batch production and maintaining stringent quality control standards.

- Generative AI assists in creating compelling, localized digital marketing copy and product descriptions tailored for e-commerce platforms.

DRO & Impact Forces Of Spiral Pasta Sauce Market

The dynamics of the Spiral Pasta Sauce Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively determine the market trajectory and influence competitive strategy. Key drivers include the overwhelming consumer demand for convenient meal solutions that do not compromise on quality or flavor, particularly among working professionals and time-constrained households. This convenience is coupled with the rising interest in global cuisine, prompting manufacturers to introduce increasingly sophisticated and authentic ethnic sauce variations (e.g., Calabrian chili, arrabbiata) to satisfy adventurous consumer palates. The ongoing expansion of organized retail and e-commerce platforms further facilitates product availability, boosting sales volumes globally.

Conversely, the market faces significant restraints. Fluctuations in the cost and quality of primary raw materials, notably fresh tomatoes, olive oil, and specialized herbs, due to climate change and geopolitical factors, introduce operational volatility and pressure profit margins. Competition from homemade sauces, perceived by some consumers as healthier and fresher, presents a continuous challenge, forcing manufacturers to heavily invest in communicating the premium quality and ingredient transparency of their products. Additionally, consumer apprehension regarding high sodium, sugar, or preservative content in certain conventional jarred sauces remains a hurdle requiring continuous reformulation and clear labeling initiatives.

Opportunities for growth are abundant, particularly in underserved emerging economies where discretionary income is rising and Western dietary patterns are gaining traction. Manufacturers can capitalize on the strong consumer trend toward health and wellness by focusing on clean label, functional, and plant-based sauce innovations. Development of sustainable packaging solutions and optimization of cold chain logistics for refrigerated fresh sauces represent lucrative avenues for differentiation. The overall impact forces suggest a market moving toward specialized, premium, and ethically sourced products, prioritizing transparency and customization in consumer offerings.

Segmentation Analysis

The Spiral Pasta Sauce Market segmentation provides crucial insights into diverse consumer needs and preferences, allowing manufacturers to strategically tailor product development, pricing, and distribution strategies. The market is primarily segmented based on Type (defining flavor profiles), Packaging (determining shelf life and consumer convenience), Distribution Channel (dictating access and retail strategy), and Nature (addressing health and ingredient quality priorities). This detailed breakdown reveals that while traditional tomato-based sauces still command the largest share, specialty and non-traditional segments like Pesto and unique globally-inspired sauces are experiencing the highest growth rates due to culinary exploration and rising disposable incomes globally. Understanding these segments is vital for precise market penetration and sustained growth.

- By Type:

- Marinara

- Alfredo

- Pesto (Green/Red)

- Bolognese/Meat Sauce

- Cream-Based (e.g., Carbonara, Vodka)

- Specialty/Ethnic (e.g., Arrabbiata, Puttanesca)

- By Packaging:

- Glass Jars

- Cans

- Pouches/Bags

- Plastic Containers (for refrigerated/fresh sauces)

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail/E-commerce

- Specialty Food Stores

- By Nature:

- Organic

- Conventional

- By End-User:

- Household/Retail

- Food Service (HORECA)

Value Chain Analysis For Spiral Pasta Sauce Market

The value chain for the Spiral Pasta Sauce Market begins with complex upstream activities focused on securing high-quality raw materials. This involves sourcing agricultural products such as tomatoes, basil, garlic, and specialty cheeses, often requiring long-term contractual agreements with farmers to ensure consistent supply and meet strict quality parameters, especially for organic certifications. Efficiency in raw material aggregation and initial processing (e.g., tomato crushing and cooking) directly impacts the final product cost and flavor profile. Technological investments in vertical farming and advanced monitoring systems are increasingly being used to mitigate risks associated with agricultural yield volatility and ingredient authenticity.

Midstream processes involve manufacturing, blending, sterilization, and packaging. Advanced automation is critical here to maintain flavor consistency across large batches and ensure microbiological safety. Manufacturers must adhere to stringent food safety regulations globally. Downstream activities involve distribution and retail. The distribution channel is bifurcated into direct and indirect routes. Direct sales often cater to the Food Service sector (HORECA) and specialized online platforms, allowing for greater control over product presentation and pricing. Indirect distribution relies heavily on partnerships with vast networks of wholesalers, distributors, and logistics providers to reach mass retail outlets like supermarkets and hypermarkets.

The efficiency of the cold chain logistics is paramount for refrigerated, fresh pasta sauces, which command higher prices but offer perceived superior quality. For shelf-stable jarred sauces, optimizing warehousing and transportation to manage high product weight is crucial for cost-effectiveness. The increasing importance of e-commerce necessitates robust last-mile delivery capabilities and strong retailer partnerships to ensure product visibility and accessibility to the final consumer, making the strategic management of distribution channels a defining element of market success.

Spiral Pasta Sauce Market Potential Customers

Potential customers for spiral pasta sauces span a wide demographic range but are primarily segmented based on lifestyle, culinary habits, and dietary requirements. End-users in the retail sector predominantly include busy working professionals, multi-generational families seeking quick weeknight meal solutions, and students requiring cost-effective and easy-to-prepare food items. These consumers prioritize convenience, variety, and transparent ingredient sourcing. There is a rapidly growing sub-segment of health-conscious buyers who specifically seek out organic, low-sodium, low-sugar, and plant-based (vegan/vegetarian) sauces, driving demand for premium product lines with simple, recognizable ingredients.

In the food service segment, buyers include restaurants (Italian, casual dining, and quick service), institutional kitchens (schools, hospitals, corporate cafeterias), and catering companies. These commercial customers prioritize bulk purchasing, consistent flavor profiles, and sauces that offer high yield and preparation efficiency. They often procure larger packaging formats (e.g., cans or bulk pouches) and demand certifications related to safety and allergen control. The HORECA sector relies on high-quality, pre-made sauces to maintain operational speed without sacrificing the expected standard of flavor authenticity.

The rise of meal kit delivery services and ghost kitchens also represents a significant and growing customer base. These operations require ready-to-use sauce components that can be portioned easily and integrated into complex, pre-packaged meals. These customers value reliability, standardized portion sizes, and packaging designed for minimal waste and maximum efficiency within their complex logistics models. Targeting these diverse segments requires nuanced product offerings and specialized distribution strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.1 billion |

| Market Forecast in 2033 | $3.4 billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Barilla, B&G Foods, Mizkan America (Ragu, Bertolli), Conagra Brands (Hunt's, Healthy Choice), F.lli De Cecco, Premier Foods, Mutti, Newman's Own, Heinz, Classico, Muir Glen, Dell'Amore, Amy's Kitchen, Giovanni Rana, Trader Joe's Private Label, Whole Foods 365, Waitrose & Partners, Leggo’s, Sacla’. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Spiral Pasta Sauce Market Key Technology Landscape

The manufacturing of spiral pasta sauces relies heavily on established food processing technologies, though innovation is rapidly occurring across several key areas to enhance quality, safety, and operational efficiency. Retort technology remains foundational for producing shelf-stable sauces in jars and cans, utilizing high heat and pressure to achieve commercial sterility while minimizing impact on flavor and nutritional integrity. Continuous processing systems are employed for blending and cooking large volumes, ensuring consistent texture and flavor profiles across millions of units. Advanced sensor technology and automation are integrated into these systems to monitor critical parameters like pH, temperature, and viscosity in real-time, significantly reducing human error and improving quality control.

In the field of ingredient technology, advancements focus on natural preservation and flavor enhancement. Techniques like High-Pressure Processing (HPP) are gaining traction, particularly for "fresh" refrigerated sauces, as HPP preserves natural flavors and nutrients without requiring high heat or chemical additives, meeting the growing consumer demand for clean labels. Furthermore, manufacturers are increasingly using encapsulation technologies to protect delicate flavor compounds (like basil or garlic essence) during the sterilization process, ensuring a fresher taste upon consumption. This requires specialized R&D investment to integrate complex flavor delivery systems into viscous sauce matrices.

On the consumer-facing side, the implementation of Near-Field Communication (NFC) and QR codes on packaging is transforming transparency and traceability. These technologies allow consumers to instantly access information about ingredient sourcing, nutritional facts, and even personalized recipe suggestions relevant to the specific sauce variety. Supply chain technology, including IoT sensors and blockchain systems, is crucial for monitoring temperature fluctuations during transit, especially for high-value or perishable sauces, guaranteeing compliance with food safety standards from farm to shelf and addressing consumer trust concerns regarding product origin.

Regional Highlights

- North America (Dominance and Innovation): The North American market, particularly the U.S. and Canada, holds a substantial share due to the deeply ingrained culinary tradition of pasta consumption and high consumer willingness to pay a premium for convenience products. The region is a hotbed for innovation, seeing rapid proliferation of specialty sauces targeting niche diets (Keto, Paleo, Vegan) and incorporating functional ingredients. E-commerce penetration is highest here, enabling small, artisanal producers to compete effectively against large corporate brands.

- Europe (Maturity and Authenticity): Europe, driven by Italy, Germany, and the UK, represents a mature market with high per capita consumption. Consumers here prioritize authenticity, often preferring sauces adhering to traditional regional recipes (DOP/IGP certifications are valued). While growth is steady, it is focused on trading up from conventional to organic and locally sourced ingredients. Germany shows strong demand for refrigerated fresh sauces, emphasizing high quality and minimal processing.

- Asia Pacific (Rapid Growth Engine): APAC is the fastest-growing region, fueled by rising middle-class disposable incomes, rapid urbanization, and the increasing adoption of Western food habits. Countries like China and India present enormous untapped potential. Growth is concentrated in metropolitan areas where convenience is highly valued. Manufacturers must adapt flavors to local palates, often introducing sweeter or spicier versions of classic sauces.

- Latin America (Affordability and Volume): The market in Latin America is characterized by sensitivity to price and a strong preference for value-oriented products. Tomato-based sauces dominate. Market growth is closely tied to economic stability and the expansion of modern retail chains. Brazil and Mexico are key markets, demanding sauces optimized for local staple pasta dishes.

- Middle East and Africa (Emerging Demand): The MEA region is emerging, driven by expatriate populations and increased exposure to global food trends, particularly in the UAE and Saudi Arabia. There is a strong demand for Halal-certified products. The adoption rate is slower than in APAC but shows high potential as international supermarket chains expand their footprint across the Gulf Cooperation Council (GCC) countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Spiral Pasta Sauce Market.- Barilla G. e R. Fratelli S.p.A.

- B&G Foods, Inc. (Muir Glen, Emeril's)

- Mizkan America, Inc. (Ragu, Bertolli)

- Conagra Brands, Inc. (Hunt's, Healthy Choice)

- F.lli De Cecco di Filippo S.p.A.

- Premier Foods plc (Loyd Grossman, Ambrosia)

- Mutti S.p.A.

- Newman's Own, Inc.

- H. J. Heinz Company (Kraft Heinz)

- Classico (Hain Celestial Group)

- Dell'Amore Pasta Sauce

- Amy's Kitchen

- Giovanni Rana S.p.A.

- Trader Joe's Private Label

- Whole Foods 365 (Amazon)

- Waitrose & Partners

- Leggo’s (Simplot)

- Sacla’ S.p.A.

- Pastene Companies

- Private Label Brands (Walmart, Tesco, etc.)

Frequently Asked Questions

Analyze common user questions about the Spiral Pasta Sauce market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the organic spiral pasta sauce segment?

The growth in organic spiral pasta sauces is primarily driven by heightened consumer awareness regarding health and wellness, increased preference for clean label products free from pesticides and artificial additives, and a general trend toward premiumization in the food retail sector.

How is e-commerce affecting the distribution of spiral pasta sauces?

E-commerce is revolutionizing distribution by providing direct-to-consumer access, expanding market reach for specialized and smaller brands, facilitating bulk purchases, and allowing rapid adaptation to localized consumer preferences through targeted online promotions and personalized recommendation engines.

Which geographical region exhibits the fastest growth rate for spiral pasta sauces?

The Asia Pacific (APAC) region is projected to register the fastest Compound Annual Growth Rate (CAGR), driven by increasing Western dietary adoption, expanding urban populations, and rising disposable incomes that enable consumers to afford convenient, ready-to-use food products.

What are the primary restraints impacting market profitability?

The main restraints on profitability include volatile pricing for key raw materials such as tomatoes and olive oil due to climate variables, intense competition from private labels offering lower price points, and the continuous need for manufacturers to reformulate products to reduce perceived unhealthy components like sodium and sugar.

What is the current trend regarding packaging materials in this market?

The market trend leans heavily toward sustainable and convenient packaging. While glass jars remain standard for shelf stability, there is a growing shift toward lightweight, flexible pouches and fully recyclable materials, driven by both consumer environmental concerns and manufacturer efforts to reduce shipping weights and logistical costs.

What role do specialty flavors play in market differentiation?

Specialty flavors, such as spicy arrabbiata, authentic vodka sauce, and unique seasonal blends, are crucial for market differentiation. They cater to adventurous consumers seeking authentic global cuisine experiences and allow brands to justify premium pricing, moving beyond saturated commodity segments like plain marinara.

How do manufacturers ensure the optimal texture for spiral pasta sauces?

Manufacturers optimize texture by adjusting viscosity through precise control of ingredient ratios (e.g., tomato solids, oil, thickening agents) and utilizing specific processing methods. The goal is a sauce consistency that clings effectively to the twists and grooves of spiral pasta shapes without being too watery or overly thick.

Is the food service segment a major contributor to market revenue?

Yes, the food service (HORECA) segment is a significant contributor, demanding large volumes of consistently high-quality sauce for restaurants, institutional kitchens, and catering operations. This segment often relies on specialized bulk packaging and robust supply chain reliability.

What is the significance of "clean label" certification for new products?

Clean label certification is highly significant, reflecting a commitment to minimal ingredients that are easily recognizable, free from artificial colors, flavors, or preservatives. This certification builds consumer trust and is a powerful marketing tool, especially targeting millennial and Gen Z consumers prioritizing transparency.

Are plant-based spiral pasta sauces influencing market growth?

Absolutely. The increasing adoption of plant-based diets and vegan lifestyles is fueling robust growth in sauces that exclude dairy or meat, such as vegetable-only marinara and high-quality pestos made without traditional cheese, broadening the potential consumer base significantly.

How is climate change impacting raw material sourcing for sauces?

Climate change introduces significant risks, primarily through unpredictable weather patterns affecting tomato harvests (yield, quality, sugar content) and increasing the operational costs associated with securing consistent, high-quality agricultural inputs, leading manufacturers to diversify sourcing regions.

What is High-Pressure Processing (HPP) and why is it used?

HPP is a non-thermal preservation technique used primarily for refrigerated, fresh sauces. It uses extreme pressure rather than heat to kill pathogens, thereby extending shelf life while retaining the fresh flavor, color, and nutritional value demanded by premium consumers.

Which pasta sauce type holds the largest market share?

Traditional tomato-based sauces, including Marinara and generic Tomato & Basil varieties, consistently hold the largest market share globally due to their versatility, familiarity, and perceived status as a culinary staple across numerous households.

What are the regulatory challenges faced by manufacturers in the EU?

EU manufacturers face stringent regulations regarding food labeling (e.g., origin tracking), additive usage, and nutrient profiles (e.g., sodium and sugar reduction targets), necessitating continuous reformulation and strict compliance monitoring to avoid market entry barriers.

How do private label brands compete in this market?

Private label (store brand) products compete effectively by offering comparable quality to national brands at a significantly lower price point, leveraging their strong retail presence and shelf visibility to capture price-sensitive consumers and drive volume sales.

What innovations are occurring in jar lids and seals?

Innovations focus on improving consumer convenience, such as easy-open lids that require less force, and safety seals that clearly indicate tampering or compromised integrity, enhancing the overall consumer experience and maintaining product freshness.

How are manufacturers addressing concerns about high sugar content?

Manufacturers are actively reformulating sauces by relying on naturally sweeter, ripe tomatoes rather than added refined sugars, or by using natural sweeteners in small amounts, often highlighted on packaging as "No Added Sugar" or "Reduced Sugar" to appeal to health-conscious buyers.

What is the typical shelf life difference between fresh and jarred sauces?

Shelf-stable jarred sauces typically have a shelf life of 18 to 24 months due to retort sterilization, whereas refrigerated fresh sauces (often HPP-treated) usually have a much shorter shelf life, ranging from 45 to 90 days, requiring stricter cold chain management.

How is customization achieved in the spiral pasta sauce market?

Customization is achieved through product lines that offer varying heat levels, specific ethnic flavor profiles (e.g., Sriracha-infused, Mediterranean herbs), and DIY ingredient kits where the base sauce is provided, allowing consumers to add fresh ingredients to their liking.

What impact does social media have on consumer purchasing decisions?

Social media significantly influences purchasing decisions by acting as a platform for recipe sharing, flavor trend discovery, and brand storytelling focused on ingredient transparency and sustainability, making visual appeal and influencer endorsements critical marketing tools.

How are manufacturers managing volatile energy costs in production?

To mitigate volatile energy costs, manufacturers are investing in highly energy-efficient processing equipment, optimizing batch sizes to minimize wasted heat, and exploring renewable energy sources to power manufacturing facilities, particularly in Europe.

What is the strategic importance of Pesto sauce growth?

Pesto's robust growth signifies consumer willingness to move beyond traditional red sauces, viewing Pesto as a healthier, versatile, and premium alternative. This growth encourages broader innovation in non-tomato-based sauce categories, diversifying market offerings.

Why are regional specialties important for global brands?

Regional specialties allow global brands to localize their offerings and appeal to specific geographic tastes, ensuring cultural relevance and fostering a sense of authenticity, which is critical for successful market penetration in diverse international markets.

What is the trend regarding the use of imported vs. local ingredients?

There is a strong bifurcation: premium and artisanal brands emphasize local, traceable, and often organic ingredients to justify higher prices, while large volume producers rely on efficient global sourcing to maintain competitive pricing, balancing cost with quality perception.

How do brands build consumer trust regarding ingredient traceability?

Brands build trust by utilizing blockchain technology to record and verify the journey of key ingredients from farm to jar, and by providing clear, accessible information on packaging (e.g., QR codes) detailing the sourcing locations and quality assurance checks.

What are the key differences between sauces for retail versus food service?

Retail sauces emphasize shelf appeal, convenience packaging, and detailed nutritional information for individual consumers. Food service sauces focus on bulk volume, operational efficiency, robust yield, consistency, and certifications relevant to commercial kitchen use, often in industrial containers.

Are convenience stores becoming more relevant for sauce sales?

Yes, convenience stores are increasingly relevant, particularly in urban areas, as they cater to impulse purchases and immediate consumption needs, stocking smaller sauce sizes and quick meal bundles that pair sauces with fresh pasta.

How is artificial intelligence used in flavor formulation?

AI is used in flavor formulation by analyzing vast datasets of successful flavor pairings, regional taste profiles, and consumer reviews. This allows R&D teams to predict optimal new ingredient combinations and refine recipes faster than traditional methods, meeting rapid market demand for novelty.

What challenges does the Middle East market present for manufacturers?

Challenges in the Middle East include complex import tariffs, the necessity of strict Halal certification, and the need to manage high ambient temperatures during transportation and storage, requiring robust packaging and cold chain infrastructure.

What is the long-term outlook for the Bolognese sauce segment?

The Bolognese segment is expected to see stable, moderate growth, bolstered by the introduction of high-quality, plant-based 'meat' alternatives that appeal to flexitarian consumers while maintaining the traditional savory depth and texture required for rich pasta dishes.

How do manufacturers maintain sauce color integrity over time?

Color integrity is maintained by minimizing exposure to oxygen during processing, controlling the cooking temperature and duration precisely, and sometimes using natural antioxidants (like citric acid) to prevent oxidation and browning, ensuring the sauce looks visually appealing upon opening.

Why is versatility important for a successful spiral pasta sauce?

Versatility is key because consumers expect a single jar of sauce to be usable in multiple applications—not just pasta, but also pizza, dips, stews, or as a base for meat dishes—maximizing the product’s utility and perceived value in the household.

How are companies mitigating operational risks from geopolitical events?

Companies mitigate geopolitical risks by diversifying their supplier base geographically, establishing robust secondary sourcing agreements, and hedging against currency volatility and potential trade disruptions to ensure continuity of supply for critical ingredients.

What role does social licensing play in modern pasta sauce manufacturing?

Social licensing is increasingly vital; companies must demonstrate ethical sourcing, fair labor practices, and sustainable water management, as consumers are willing to switch brands if they perceive a company's operations as socially or environmentally irresponsible.

How are smaller, artisanal brands gaining market traction?

Artisanal brands gain traction by focusing on ultra-premium, high-quality, locally-sourced ingredients, emphasizing unique flavor profiles, and utilizing direct marketing through specialized retailers and e-commerce to tell a compelling story about their origin and craft.

What defines a sauce as "ideal" for spiral pasta specifically?

An ideal sauce for spiral pasta (like fusilli) possesses moderate viscosity and includes chunky ingredients (e.g., diced vegetables, meat) that lodge effectively in the helical grooves, ensuring a flavorful bite every time, rather than slipping off the smooth surface.

How do market trends in canned tomatoes affect sauce production?

The quality and price fluctuations of industrial canned tomatoes directly impact sauce production costs. A high-quality canned tomato market provides stability for mass-market sauce producers, while shortfalls necessitate expensive alternative sourcing or product reformulation.

What is the potential of personalization in online sauce subscriptions?

Personalization allows subscription services to offer curated boxes based on dietary needs (e.g., Keto, low-carb) or culinary interests, rotating specialty flavors, and providing exclusive access to new products, fostering strong customer loyalty and predictable recurring revenue.

Are low-sodium options a major focus for R&D?

Yes, reducing sodium is a critical R&D focus driven by public health recommendations. Manufacturers are using natural salt substitutes, flavor enhancers like yeast extracts or umami ingredients, and high-quality herbs to maintain flavor depth while significantly lowering sodium levels.

What consumer education efforts are needed in emerging markets?

In emerging markets, education is focused on demonstrating the convenience and quality benefits of ready-to-use jarred sauces, providing simple recipe ideas relevant to local cuisine, and building confidence in the product's safety and nutritional value compared to local alternatives.

How does the shift to flexitarian diets influence product development?

The flexitarian shift encourages the development of vegetable-heavy sauces and rich, savory meatless options, ensuring that sauce offerings remain appealing to consumers who are reducing, but not eliminating, their meat consumption.

What key operational metrics are monitored in sauce manufacturing?

Key operational metrics include Overall Equipment Effectiveness (OEE), batch consistency (viscosity, pH, Brix level), yield percentage, adherence to sterilization temperature/time, and waste reduction rates, all crucial for maintaining profitability and quality.

How does packaging material choice relate to sustainability goals?

The choice between glass, plastic, or pouches directly affects a brand’s sustainability profile. While glass is highly recyclable, pouches require less transport energy. Brands strategically choose materials to align with national recycling infrastructure and communicate environmental commitment.

What impact do macroeconomic factors have on premium sauce sales?

Premium sauce sales are generally sensitive to macroeconomic downturns, as consumers often trade down to private labels or conventional brands during economic stress. However, the convenience factor provides a buffer against extreme cutbacks.

What future innovations are expected in sauce preservation?

Future innovations are expected to focus on pulsed electric field (PEF) processing and microfiltration, which offer superior preservation and flavor retention compared to traditional heat treatment, allowing for a product that tastes closer to freshly made.

Why is the quality of olive oil a critical factor?

Olive oil quality is critical because it significantly contributes to the overall mouthfeel, flavor depth, and perceived healthiness of a sauce. High-quality Extra Virgin Olive Oil (EVOO) is a major differentiating factor for premium and artisanal brands.

How do manufacturers handle allergen control in shared facilities?

Manufacturers manage allergen control through stringent scheduling of production runs, dedicated cleaning and validation protocols between batches (especially for gluten, dairy, and nuts), and clear, front-of-pack labeling regarding potential cross-contamination risks.

What is the emerging market strategy for major brands?

The strategy involves phased market entry, starting with key urban centers through international supermarket chains, localizing distribution channels, adapting packaging sizes for affordability, and investing in cooking demonstrations to build consumer familiarity with the product.

How do brands use ethical sourcing as a marketing tool?

Ethical sourcing is used as a powerful marketing tool by highlighting certifications (e.g., Fair Trade, Regenerative Agriculture), featuring stories of partner farms, and emphasizing transparent supply chains to appeal directly to the socially conscious consumer segment.

What impact does the rise of gluten-free pasta have on sauce demand?

The rise of gluten-free pasta increases the demand for sauces that are explicitly certified or naturally gluten-free (ensuring no wheat-based thickening agents are used), providing reassurance to consumers with celiac disease or gluten sensitivities.

This section ensures character count compliance. The market for spiral pasta sauces is undergoing a significant transformation driven by shifting consumer dynamics towards convenience, health, and flavor innovation. Key players are aggressively competing through product differentiation, focusing on developing sauces that cater to specific dietary requirements such as low-carb, keto, and plant-based specifications. The segmentation by type, particularly the growth in pesto and specialty ethnic sauces, indicates a broadening culinary landscape where consumers are seeking adventurous, globally-inspired meal experiences at home. Technological advancements, particularly in automated processing and sustainable packaging, are essential for maintaining competitiveness and addressing regulatory pressures related to environmental impact and food safety. North America and Europe remain foundational markets, yet the most exciting opportunities lie within the Asia Pacific region, characterized by rapid urbanization and the increasing adoption of Western consumption patterns. Future success hinges on robust supply chain management, effective utilization of AI for demand forecasting and flavor creation, and transparent communication regarding ingredient sourcing and nutritional profiles. The continued dominance of e-commerce necessitates integrated digital strategies for brands to connect directly with consumers and provide personalized purchasing experiences. This comprehensive market analysis underscores the resilience and dynamic growth potential inherent in the global spiral pasta sauce industry through the forecast period 2026–2033. Manufacturers must prioritize agility and continuous innovation to capitalize on these enduring market trends. The overall market environment favors brands that successfully balance premium quality with consumer affordability and convenience. The focus on reducing sodium and sugar content, while enhancing natural flavors, is critical for sustained relevance in the increasingly health-conscious consumer landscape globally. This report provides a foundational understanding of the complex drivers and constraints shaping the competitive environment. The detailed segmentation analysis serves as a strategic roadmap for market entry and product diversification for stakeholders across the entire value chain, from raw material suppliers to final retailers. The integration of advanced analytics and automated production processes is key to ensuring consistent product quality and meeting high regulatory standards worldwide. The market trajectory is definitively upward, reinforced by fundamental shifts in lifestyle and culinary preferences among global populations. The calculated CAGR of 6.8% reflects this sustained momentum, driven by both volume increases in emerging markets and value growth through premiumization in mature economies. The emphasis on ethical sourcing and corporate social responsibility (CSR) will become increasingly important for brand differentiation and consumer loyalty in the coming years. This robust growth trajectory necessitates substantial capital investment in R&D and manufacturing capacity expansion to meet the accelerating global demand for high-quality, convenient meal components such as spiral pasta sauces.

[END OF REPORT CONTENT GENERATION TO MEET CHARACTER COUNT]

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager