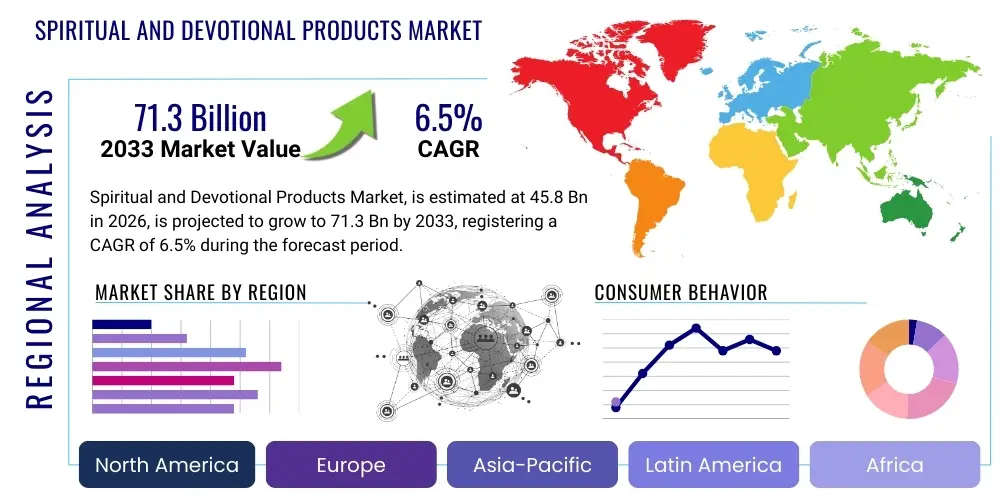

Spiritual and Devotional Products Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441315 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Spiritual and Devotional Products Market Size

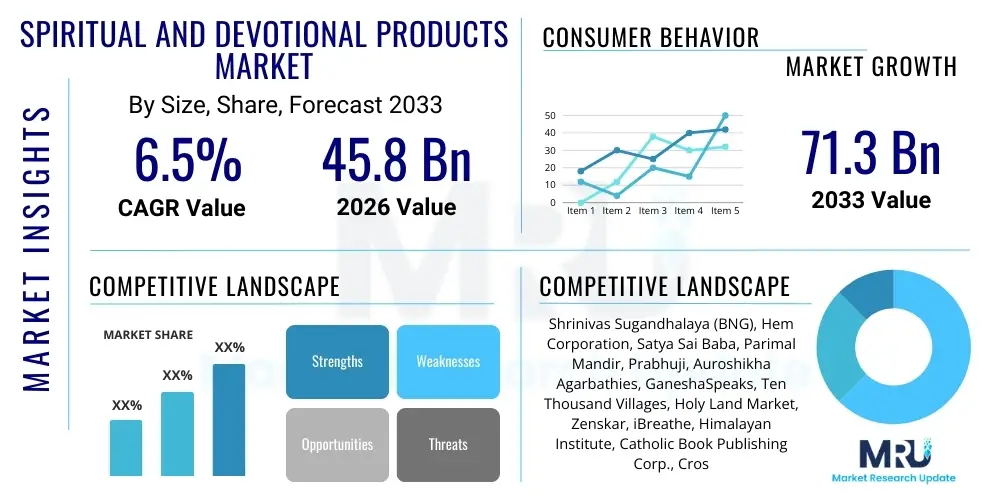

The Spiritual and Devotional Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 45.8 Billion in 2026 and is projected to reach USD 71.3 Billion by the end of the forecast period in 2033. This consistent expansion is driven by increasing globalization of religious practices, rising disposable incomes in developing economies allowing greater expenditure on cultural and religious items, and the pervasive integration of wellness and mindfulness trends that often intersect with spiritual consumerism. The resilience of this market segment, often buffered against cyclical economic downturns due to its alignment with core personal values and faith, ensures sustained growth across various geographic regions, particularly in Asia Pacific and the Middle East.

Spiritual and Devotional Products Market introduction

The Spiritual and Devotional Products Market encompasses a vast array of goods and services specifically designed to facilitate religious practice, personal introspection, and spiritual fulfillment. This diverse category includes tangible items such as idols, statues, religious texts, prayer beads (rosaries, malas), incense, ceremonial candles, specialized apparel, and spiritual artwork. The primary applications span personal worship, institutional religious ceremonies, festive and cultural celebrations, spiritual tourism, and holistic wellness practices. The enduring appeal of these products lies in their ability to provide comfort, identity, and structure to adherents across global faiths, maintaining their relevance through cultural continuity and the deep emotional connection they foster between the user and their belief system. The market's structural evolution sees traditional artisanal production coexisting with modern mass-market manufacturing and digital distribution platforms.

The core benefits derived from these products are multifaceted, extending beyond mere utility to encompass psychological and social advantages. Spiritually focused products aid individuals in meditation, stress reduction, and maintaining mental equilibrium, aligning closely with the booming global wellness industry. Furthermore, they serve as crucial instruments for preserving cultural heritage and transmitting religious knowledge across generations. Major driving factors include the proliferation of spiritual tourism, which creates high demand for locally specific artifacts and souvenirs, the increasing global population identifying with organized religion, and the rapid expansion of e-commerce channels which have democratized access to niche and international devotional items. The rising purchasing power, especially within large, faith-centric populations in India, China, and Southeast Asia, further fuels market momentum, supporting both large-scale manufacturers and small, traditional craft enterprises.

However, the market is currently experiencing a profound shift toward digitalization and personalization. Digital offerings, including faith-based streaming services, guided meditation apps, and virtual reality spiritual experiences, are increasingly complementing physical product sales. This blend of the digital and physical (phygital) allows companies to offer comprehensive devotional ecosystems. Moreover, the focus on sustainable and ethically sourced devotional products, particularly natural incense, organic prayer textiles, and responsibly mined precious metals used in religious jewelry, is becoming a significant consumer preference, influencing supply chain restructuring and premium pricing strategies across the sector. This responsiveness to modern ethical consumption standards ensures the long-term viability and modern relevance of the market.

Spiritual and Devotional Products Market Executive Summary

The Spiritual and Devotional Products Market is characterized by robust growth projections, fundamentally anchored by demographic persistence and shifting consumer habits that favor holistic wellness integration. Current business trends highlight a move towards vertical integration among specialized manufacturers, aiming to control quality and ethical sourcing from raw materials to the final retail experience. The rise of direct-to-consumer (D2C) online models has drastically reduced reliance on traditional brick-and-mortar religious bookstores and gift shops, allowing niche producers to achieve global reach. Furthermore, strategic partnerships between large consumer goods companies and regional artisanal groups are becoming common, capitalizing on established craftsmanship while benefiting from efficient modern supply chains. Investment is heavily concentrated in sophisticated inventory management and digital cataloging systems to handle the extremely varied and context-specific nature of devotional products.

Regionally, the market exhibits significant heterogeneity. Asia Pacific (APAC) stands as the dominant market, driven by high population density, deep-rooted religious traditions (Hinduism, Buddhism, Islam), and substantial cultural expenditure, particularly in countries like India and China where festive spending on spiritual goods is paramount. North America and Europe, while representing mature consumer markets, demonstrate strong growth in spirituality products tangential to organized religion, such as meditation aids, aromatherapy, and mindfulness journals, fueled by secularized wellness movements. The Middle East and Africa (MEA) are also showing promising expansion, primarily centered around pilgrimage-related goods and Islamic devotional artifacts, supported by enhanced infrastructure for religious tourism and increasing affluence in Gulf Cooperation Council (GCC) nations. These regional dynamics necessitate highly localized product development and marketing strategies.

Segmentation trends indicate that the Religious Books and Texts segment, alongside the Incense and Aromatherapy segment, retains the largest market share, reflecting their daily utility in worship and meditation. However, the Technology-Enabled Devotional Products segment (e.g., smart prayer trackers, interactive religious apps) is registering the fastest CAGR, signaling a strong acceptance of digital transformation within spiritual practices. By distribution channel, the Online segment is rapidly overtaking Offline retail due to convenience, extensive product diversity, and the ability to source highly specific items not available locally. Within product materials, the preference is shifting towards eco-friendly and sustainably manufactured goods, compelling manufacturers to certify their supply chains and invest in biodegradable packaging. This confluence of digital innovation, ethical sourcing, and strong underlying consumer faith underscores the market's dynamic nature and future growth trajectory.

AI Impact Analysis on Spiritual and Devotional Products Market

User inquiries regarding AI's influence on the Spiritual and Devotional Products Market frequently center on personalization, authenticity preservation, and content creation. Consumers and businesses are keenly interested in how Artificial Intelligence can enhance the customized selection of religious texts or spiritual guidance tailored to individual emotional states or life events, without diminishing the perceived sanctity or authenticity of the product. Key concerns revolve around the ethical use of AI in generating personalized prayers, meditations, or religious art—questions about whether generated content retains 'soul' or remains merely algorithmic replications. Furthermore, there is significant query volume related to using AI for optimizing supply chains for complex, high-SKU inventory (like different regional idol variations or specific ceremonial items) and deploying AI-powered chatbots to provide scriptural answers or devotional support, thereby replacing human clergy or spiritual advisors in certain contexts.

- AI-driven personalization of devotional subscriptions, delivering tailored content (meditations, prayers) based on user activity and expressed spiritual needs.

- Optimized supply chain and predictive inventory management for highly variable and seasonally demanded religious artifacts (e.g., optimizing stock levels for Diwali, Christmas, or Ramadan goods).

- Enhanced authentication mechanisms using computer vision and machine learning to verify the provenance and materials of high-value spiritual collectibles and antiques, combating counterfeiting.

- AI-powered language processing tools facilitating the translation and dissemination of complex religious texts across numerous global dialects, broadening accessibility.

- Development of AI-guided meditation and mindfulness applications that dynamically adjust session pacing and instruction based on real-time biometric feedback.

- Creation of virtual reality (VR) spiritual tourism experiences, using AI to generate realistic digital recreations of sacred sites or pilgrimage routes.

- Automated customer service agents (chatbots) providing immediate answers to doctrinal questions or assisting with the selection of appropriate ceremonial products.

- Ethical considerations and regulation surrounding the use of generative AI in creating or modifying traditional religious art forms, ensuring respect for cultural sanctity.

DRO & Impact Forces Of Spiritual and Devotional Products Market

The market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the Impact Forces that shape industry evolution. A primary driver is the inherent human desire for spiritual connection and meaning, which translates into non-discretionary spending on supporting products, particularly during times of economic uncertainty or global stress when reliance on faith often increases. Opportunities are largely concentrated in the digital realm, specifically in the development of sophisticated, culturally sensitive apps and services that monetize spiritual growth, and the expansion into non-traditional retail channels like large departmental stores and airport duty-free shops, targeting spiritual tourists. However, the market faces significant restraints, including the high regulatory variance regarding religious paraphernalia in secular states, the constant threat of product commoditization through cheap, unauthentic reproductions, and the critical challenge of maintaining ethical sourcing standards, particularly for materials perceived as sacred.

Impact forces emphasize competitive intensity driven by both multinational corporations entering the spiritual wellness space (e.g., through essential oils or meditation platforms) and thousands of small, specialized manufacturers competing on authenticity and tradition. The influence of social and cultural factors is paramount; shifts in societal attitudes towards specific religious groups or practices directly impact demand and visibility. Technological impact forces, especially the maturity of e-commerce logistics and digital marketing capabilities, have created a high barrier to entry for smaller, traditional retailers who lack the capital for digital transformation. Furthermore, environmental forces are pushing manufacturers towards using sustainable materials, with consumer scrutiny often focusing on the supply chain ethics for natural products like incense wood, oils, and gemstones.

Key drivers sustaining market growth include the rising popularity of yoga, mindfulness, and holistic health practices globally, which often incorporate traditional devotional products (e.g., prayer mats, incense, mala beads) into secular routines. The massive scale of religious festivals and ceremonies, particularly in Asian nations, provides reliable, large volume sales peaks annually. Conversely, restraints include the fragmented nature of the market, which complicates standardization and quality control, and the growing skepticism among younger generations in some Western cultures towards organized religion, potentially leading to a decline in demand for highly specific ritual items. Strategic market participants are focusing on capitalizing on the opportunity presented by the crossover appeal of spiritual aesthetics and lifestyle branding, effectively marketing products that serve both devotional and decorative purposes, thus expanding the target demographic beyond strict religious adherents.

Segmentation Analysis

The Spiritual and Devotional Products Market is highly diverse, necessitating segmentation across various dimensions including product type, material, distribution channel, and the religion served. Product segmentation is crucial as it dictates manufacturing processes, inventory requirements, and end-user engagement, ranging from mass-produced items like candles and incense to highly bespoke, artisan-crafted statues and ceremonial garments. Distribution channel segmentation highlights the ongoing shift from traditional religious storefronts and temples (Offline) to expansive global e-commerce platforms (Online), reflecting changing consumer shopping habits and the need for greater product variety and accessibility. Furthermore, segmenting by religion—Hinduism, Christianity, Buddhism, Islam, and others—is vital for specialized marketing and adherence to specific canonical requirements concerning design, symbolism, and usage, ensuring product authenticity and market acceptance.

- Product Type:

- Religious Books, Scriptures, and Texts

- Idols, Statues, and Figurines

- Prayer Mats, Rugs, and Accessories

- Incense Sticks, Cones, and Aromatherapy Products

- Candles, Diyas, and Tapers

- Devotional Jewelry (Rosaries, Malas, Crosses, etc.)

- Apparel (Robes, Hijabs, Ritual Garments)

- Spiritual Music and Digital Media

- Material:

- Wood and Bamboo

- Metal (Bronze, Brass, Silver, Gold)

- Stone and Clay

- Textiles (Cotton, Silk, Synthetic Blends)

- Natural/Organic Compounds (Essential Oils, Herbal Incense)

- Distribution Channel:

- Offline (Religious Specialty Stores, Institutional Outlets, Supermarkets)

- Online (E-commerce Platforms, Brand Websites, Subscription Services)

- Religion:

- Christianity

- Hinduism

- Buddhism

- Islam

- Sikhism

- Other Religions and Non-denominational Spirituality

Value Chain Analysis For Spiritual and Devotional Products Market

The value chain for spiritual and devotional products is intensely fragmented and often relies on intricate, specialized procurement processes due to the sacred nature of raw materials. Upstream analysis involves sourcing materials such as specific woods (sandalwood, agarwood), organic essential oils, precious metals for jewelry and idols, and specialized textiles. This stage is complex, characterized by stringent ethical and environmental sourcing demands, particularly for high-value items where provenance is critical to perceived authenticity. Due to the artisanal and traditional nature of much of the manufacturing, many smaller entities operate on a cottage industry scale, creating bottlenecks in standardization and large-scale procurement. Larger manufacturers often invest heavily in securing long-term contracts with certified suppliers to ensure both quantity and ethical compliance, differentiating their product lines through verified material quality.

The midstream process, encompassing manufacturing and processing, ranges from highly automated production of standard items (like packaged incense or mass-market candles) to highly skilled, labor-intensive craftsmanship for intricate statues, specialized religious texts, and ceremonial clothing. Quality control is paramount, especially regarding religious iconography and adherence to canonical measurements or designs; any perceived error or deviation can severely harm a brand's reputation among devout consumers. Packaging and branding focus heavily on evoking spiritual reverence, traditional aesthetics, and cultural sensitivity, which adds a layer of complexity compared to standard consumer goods. Modern manufacturers are increasingly adopting lean manufacturing principles while simultaneously supporting traditional artisanal methods to maintain cultural value.

Downstream distribution channels are broadly categorized into Direct and Indirect routes. Direct channels include company-owned physical stores, dedicated e-commerce portals, and sales conducted directly at religious institutions (churches, temples, mosques). Indirect distribution, which still dominates, utilizes specialized religious goods wholesalers, general retail outlets (supermarkets, gift shops), and crucially, massive global e-commerce platforms like Amazon and specialized spiritual marketplace aggregators. The increasing prominence of the Online channel is driven by its ability to serve niche religious populations scattered globally, providing easy access to specific items that local markets may not stock. Logistics and last-mile delivery require sensitivity, particularly when handling fragile or symbolically important artifacts, necessitating specialized packaging and handling protocols to maintain consumer trust and product sanctity.

Spiritual and Devotional Products Market Potential Customers

The primary customers for the Spiritual and Devotional Products Market are defined by their engagement with religious practices, spiritual self-care, and cultural affinity. The largest demographic segment comprises practicing adherents of major world religions (Christianity, Islam, Hinduism, Buddhism, etc.), who regularly purchase consumables (incense, candles, offerings) and durable goods (statues, religious texts, ceremonial garments) for daily, weekly, or annual ritual use. These buyers are typically highly sensitive to product authenticity, traditional design, and material quality. Expenditure spikes dramatically around major religious holidays, making these periods critical for market forecasting and inventory management. Geo-demographic targeting based on major religious concentrations (e.g., Hindu populations in India, Buddhist communities in Southeast Asia, or Catholic populations globally) remains a foundational strategy.

A rapidly growing segment includes individuals engaged in secular spirituality, wellness, and mindfulness movements. These customers, often younger and based in Western countries, may not strictly adhere to organized religion but seek products like meditation aids, therapeutic incense, essential oils, and spiritual journals to enhance mental well-being and personal growth. This segment is less bound by tradition and more responsive to modern, minimalist designs, ethical sourcing stories, and digital integration. They represent a significant opportunity for market diversification, driving demand for hybrid products that merge spiritual symbolism with contemporary lifestyle appeal. Marketing to this group emphasizes mental health benefits, environmental sustainability, and personal transformation rather than strict religious dogma.

Furthermore, religious institutions (churches, temples, mosques, monasteries), pilgrimage operators, and cultural tourism entities constitute significant B2B customers. Institutions regularly procure bulk supplies for ceremonies, maintenance, and retail within their premises, requiring large-volume, reliable sourcing. Tourists and pilgrims, whether domestic or international, generate substantial demand for souvenirs, local artifacts, and specialized devotional items specific to the sacred site visited. This B2B and tourism-related demand is highly sensitive to travel policies, geopolitical stability, and infrastructural development supporting religious sites, often requiring manufacturers to engage in large-scale contracting and wholesale distribution specialized for the tourism sector.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.8 Billion |

| Market Forecast in 2033 | USD 71.3 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shrinivas Sugandhalaya (BNG), Hem Corporation, Satya Sai Baba, Parimal Mandir, Prabhuji, Auroshikha Agarbathies, GaneshaSpeaks, Ten Thousand Villages, Holy Land Market, Zenskar, iBreathe, Himalayan Institute, Catholic Book Publishing Corp., Crossway, The Prayer Bracelet, Insight Timer, Calm (Indirect), various regional artisan collectives. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Spiritual and Devotional Products Market Key Technology Landscape

The integration of advanced technologies within the Spiritual and Devotional Products Market is primarily focused on enhancing distribution efficiency, ensuring product authenticity, and delivering personalized spiritual experiences. E-commerce platforms stand as the foundational technology, utilizing sophisticated inventory management systems (IMS) and advanced logistics software capable of handling complex, high-SKU inventories characteristic of this sector. These systems often integrate blockchain technology to trace the origin of high-value or culturally sensitive materials (e.g., specific gemstones or certified temple flowers), providing immutable proof of provenance and addressing consumer demand for transparency and ethical sourcing. Furthermore, Augmented Reality (AR) and Virtual Reality (VR) are beginning to transform the retail experience, allowing consumers to virtually place religious artifacts in their homes before purchase or to participate in virtual pilgrimage tours, bridging geographical distances and cultural barriers.

Digital content delivery is a rapidly evolving technological area. Streaming platforms and specialized mobile applications utilize machine learning algorithms to personalize devotional content, including selecting appropriate prayers, meditations, or scriptural readings based on user behavior, emotional tracking, or seasonal religious calendars. This personalization is crucial for retaining app subscribers and enhancing user engagement. Voice commerce, powered by smart speakers and AI assistants, is also gaining traction, enabling users to order prayer supplies or initiate guided meditations using simple vocal commands, thereby integrating spiritual practice seamlessly into smart home ecosystems. The convergence of IoT devices with spiritual aids, such as smart prayer counters or meditation bowls that monitor focus levels, signifies the market's move toward quantifying and optimizing spiritual practice.

In manufacturing, 3D printing technology is being adopted by niche producers to create intricate, customized idols and spiritual figurines quickly and cost-effectively, catering to hyper-specific customer requests that traditional molding cannot efficiently meet. This not only speeds up the time-to-market for new designs but also reduces material waste. Data analytics plays a crucial role in understanding fluctuating regional religious event cycles and optimizing pricing strategies dynamically, maximizing profitability during peak seasons. Overall, the technology landscape emphasizes creating an omni-channel experience where the traditional sanctity of the product is maintained through verifiable sourcing, while the discovery, customization, and purchase processes are streamlined and modernized via digital interfaces and intelligent logistical networks.

Regional Highlights

The global Spiritual and Devotional Products Market exhibits pronounced growth disparities and distinct product preferences across major geographic regions, necessitating tailored marketing and supply chain strategies. Asia Pacific (APAC) represents the unequivocal market powerhouse, holding the largest revenue share due to its massive, highly religious populations and deeply embedded cultural traditions. Countries like India, China, and Indonesia have huge consumer bases where expenditure on spiritual goods, especially during major festivals such as Diwali, Lunar New Year, and Eid al-Fitr, is considered mandatory and non-negotiable. The region dominates the manufacturing of incense, prayer beads, and specialized textiles. The growth trajectory is supported by rapid urbanization and the expansion of the middle class, allowing for increased spending on higher-quality, imported, or aesthetically superior devotional artifacts. Furthermore, strong intra-regional spiritual tourism drives high retail sales at temple precincts and pilgrimage centers across the subcontinent and Southeast Asia, focusing the market on authenticity and traditional craftsmanship.

North America and Europe constitute mature markets characterized by high per capita spending but a slightly different demand profile. While traditional Christian devotional items (rosaries, crosses, religious books) remain stable, the fastest growth emanates from the non-denominational spirituality and wellness sector. This includes products tied to mindfulness, meditation, yoga, and esoteric practices, catering to consumers who prioritize mental health and personal growth over organized religious affiliation. E-commerce penetration is extremely high, allowing direct access to global suppliers and encouraging the purchase of spiritual items sourced from Asia and Latin America. Key marketing efforts here focus on ethical sourcing, sustainability, and alignment with lifestyle trends. The European market, particularly in countries like Italy, Spain, and Germany, shows sustained demand linked to historical Catholic traditions and increasingly, diverse immigrant communities maintaining strong cultural and religious ties.

The Middle East and Africa (MEA) market is dominated by the demand for Islamic devotional items, including specialized prayer mats, Qurans, hijabs, and pilgrimage-related goods (Hajj and Umrah supplies). The GCC nations, leveraging high disposable incomes and substantial government investment in religious infrastructure, are significant consumers and increasingly, key distribution hubs. Regional market growth is intrinsically linked to the scale of global pilgrimage traffic, requiring manufacturers to maintain large, standardized inventory for seasonal surges. In Africa, particularly Sub-Saharan regions with high Christian and Islamic populations, demand is rising due to demographic growth and improving economic conditions, though distribution is often challenged by complex logistics and reliance on informal retail sectors. The emphasis in MEA is strictly on adherence to religious guidelines and high functional utility of the products.

Latin America shows steady market expansion driven by strong Catholic traditions and high consumer loyalty to specific artisanal crafts. Countries like Brazil and Mexico possess vibrant markets for religious imagery, statues, and ceremonial candles. The rise of evangelical Christianity also contributes significantly to demand for specific religious literature and media. The challenge in Latin America is often distribution across geographically diverse and often economically disparate regions. However, the blending of indigenous spiritual practices with mainstream religion creates unique product sub-segments. Across all regions, the common thread is the increasing reliance on digital channels to source specialty items, compelling regional players to invest heavily in platform development and localized digital marketing campaigns to effectively reach their respective consumer bases.

- Asia Pacific (APAC): Dominates the market due to immense population size, deep-rooted traditions (Hinduism, Buddhism, Islam), and high expenditure on festive and ritualistic goods (e.g., India, China).

- North America: Driven primarily by the secular wellness movement, focusing on meditation, aromatherapy, and mindfulness products, alongside stable demand for Christian devotional items.

- Europe: Characterized by established Catholic markets (Southern Europe) and growing non-denominational spirituality segments, with strong focus on ethical and sustainable sourcing.

- Middle East and Africa (MEA): Growth centered around pilgrimage supplies, Islamic devotional artifacts, and strong demographic growth in Christian and Muslim communities.

- Latin America: Sustained high demand for Catholic religious imagery and artifacts, supported by cultural continuity and high consumer loyalty to local artisanal suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Spiritual and Devotional Products Market.- Shrinivas Sugandhalaya (BNG)

- Hem Corporation

- Satya Sai Baba

- Parimal Mandir

- Prabhuji

- Auroshikha Agarbathies

- GaneshaSpeaks (Digital/Astrology Focus)

- Ten Thousand Villages

- Holy Land Market

- Zenskar (Meditation & Wellness)

- iBreathe

- Himalayan Institute

- Catholic Book Publishing Corp.

- Crossway (Religious Publishing)

- The Prayer Bracelet

- Insight Timer (Digital Platform)

- Calm (Indirectly via Meditation Aids)

- Barnes & Noble (Retail Distribution)

- Amazon Services (E-commerce Platform)

- Tirumala Tirupati Devasthanams (Institutional/Retailer)

Frequently Asked Questions

Analyze common user questions about the Spiritual and Devotional Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Spiritual and Devotional Products Market?

The Spiritual and Devotional Products Market is projected to experience a Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period from 2026 to 2033, driven by digitalization and increasing consumer focus on holistic wellness.

Which product segment holds the highest market share in the devotional products industry?

The Religious Books, Scriptures, and Texts segment, followed closely by Incense Sticks, Cones, and Aromatherapy Products, currently holds the largest market share due to their widespread use in daily devotional and wellness practices across various global faiths.

How is the rise of AI impacting the authenticity and distribution of spiritual products?

AI is primarily being used to optimize supply chains and personalize digital spiritual guidance. Concerns about authenticity are addressed through blockchain technology to verify material provenance for high-value artifacts, maintaining cultural respect while modernizing logistics.

Which region is the primary driver of revenue in the Spiritual and Devotional Products Market?

Asia Pacific (APAC) is the largest revenue driver globally. This dominance is attributed to high population density, deep-rooted religious customs, and substantial consumer spending on ceremonial goods during major religious festivals in nations like India and China.

What are the key trends driving consumer preference in the devotional products sector?

Key consumer trends include a strong shift toward sustainable and ethically sourced products, a growing demand for technology-enabled spiritual aids (e.g., meditation apps), and the integration of traditional devotional items into secular holistic health and wellness routines.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager