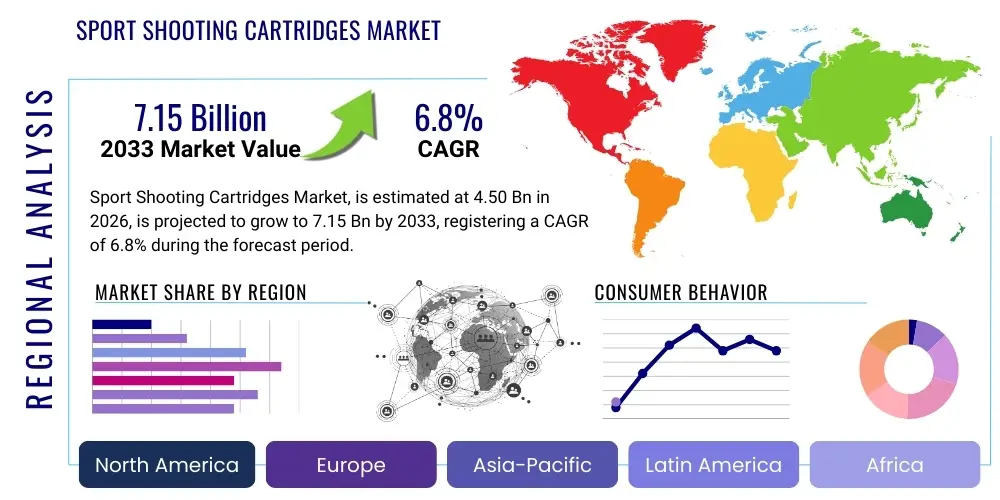

Sport Shooting Cartridges Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442367 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Sport Shooting Cartridges Market Size

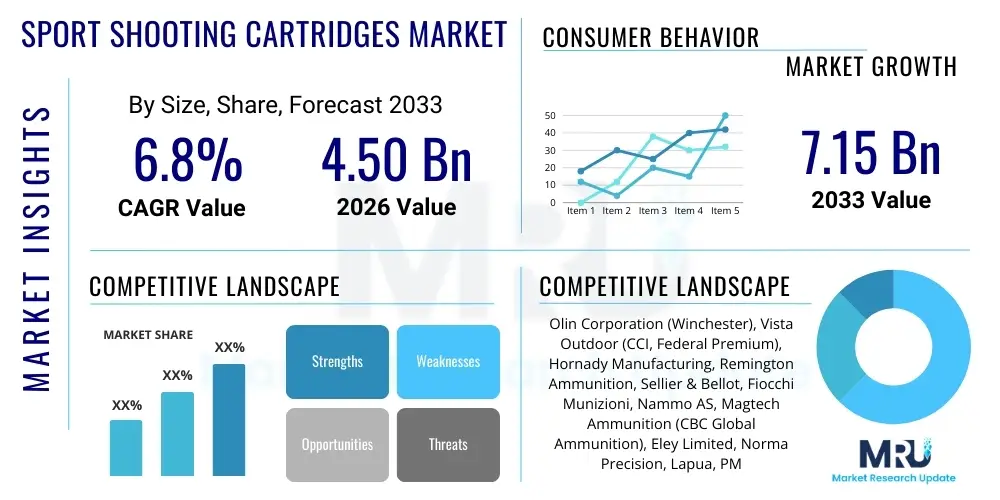

The Sport Shooting Cartridges Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.50 Billion in 2026 and is projected to reach USD 7.15 Billion by the end of the forecast period in 2033. This consistent expansion is underpinned by the increasing global popularity of recreational shooting sports, including clay pigeon shooting, target practice, and competitive events sanctioned by international bodies. The market size reflects the combined value of small-caliber ammunition, shotgun shells, and specialized centerfire cartridges designed explicitly for non-military, non-law enforcement applications, emphasizing precision, consistency, and adherence to specific sporting regulations.

Sport Shooting Cartridges Market introduction

The Sport Shooting Cartridges Market encompasses the manufacturing, distribution, and sale of specialized ammunition tailored for civilian recreational and competitive shooting activities. These cartridges are distinct from military or hunting ammunition, focusing primarily on consistency, accuracy, and compliance with sporting organization guidelines. Products range from common rimfire cartridges (like .22 LR used widely for entry-level practice) to high-precision centerfire rifle cartridges and specialized shotgun shells utilized in skeet, trap, and sporting clays disciplines. The fundamental components of these cartridges—the casing, primer, propellant, and projectile—are engineered for optimal performance in designated sporting firearms, prioritizing safety and predictable ballistic behavior.

Major applications of sport shooting cartridges include organized competitive events such as the Olympic Games shooting disciplines, International Practical Shooting Confederation (IPSC) matches, and local recreational target practice at certified ranges. The core benefits derived from high-quality sport cartridges include enhanced accuracy due to tighter manufacturing tolerances, superior ballistic consistency critical for competitive edge, and reliability under varied environmental conditions. Furthermore, the availability of specialized lead-free or frangible projectiles caters to specific indoor range requirements or environmental regulations, promoting safer and more sustainable participation in the sport. These technical advantages drive consumer preference towards established and innovative manufacturers capable of delivering consistent quality.

The market growth is primarily driven by the expanding global acceptance of shooting sports as a legitimate leisure activity, particularly in North America and Europe, coupled with the rising number of shooting ranges and competitive events worldwide. Increased personal disposable income in emerging economies allows more individuals to invest in sporting firearms and continuous ammunition supplies. Moreover, advancements in propellant chemistry and projectile design, aiming for reduced recoil and improved terminal performance consistency, continually attract new participants and encourage existing enthusiasts to upgrade their equipment and consumables. Government initiatives supporting national shooting teams and promoting safe firearm handling also contribute positively to market dynamics, establishing a stable consumer base dedicated to regular training and competition.

Sport Shooting Cartridges Market Executive Summary

The Sport Shooting Cartridges Market is characterized by robust business trends focusing on sustainable material innovation and supply chain resilience. Manufacturers are heavily investing in vertical integration to mitigate volatility in raw material costs, particularly copper, brass, and specialized powders. A significant trend involves the development of environmentally friendly ammunition, including biodegradable components and reduced-hazard primers, responding to stringent environmental regulations and consumer demand for "green" products. Furthermore, strategic mergers and acquisitions among key players are aimed at consolidating manufacturing capacity and expanding distribution networks, particularly in fast-growing Asian markets, enhancing market equilibrium and competitive pricing strategies. E-commerce penetration for non-regulated ammunition accessories and range supplies is also shaping direct-to-consumer business models, optimizing inventory management and reducing reliance on traditional retail channels.

Regionally, North America remains the dominant market owing to deeply entrenched gun culture, a high prevalence of recreational shooters, and a vast infrastructure of shooting ranges and competitive organizations. However, the Asia Pacific (APAC) region, spearheaded by strong participation growth in countries like Australia, India, and specific Southeast Asian nations, is projected to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by rising urbanization and increasing discretionary spending allocated to specialized hobbies. European markets demonstrate stability, driven by strict regulatory frameworks that necessitate traceable, high-quality ammunition for certified sports clubs, emphasizing precision-focused segments. The Middle East and Africa (MEA) market shows nascent growth, supported by government investment in organized sports and security training applications that utilize sport-grade cartridges for high-volume practice.

Segment trends highlight the premiumization of centerfire rifle cartridges and specialized shotgun shells. Competitive shooters are increasingly demanding custom-loaded or match-grade ammunition, pushing manufacturers to leverage sophisticated quality control and ballistic testing technologies. The Rimfire segment, while volume-driven, is experiencing innovation focused on improved consistency to meet training standards, moving away from purely bulk-commodity status. Furthermore, the accessories segment, including reloading components and specialized storage solutions, is witnessing steady growth as experienced enthusiasts seek customization and cost-effective ways to manage their high-volume consumption. Caliber standardization across major shooting disciplines also favors mass production of specific common calibers, ensuring high scalability and manufacturing efficiency, thereby maintaining favorable price points for frequent users.

AI Impact Analysis on Sport Shooting Cartridges Market

Common user questions regarding AI's influence in the Sport Shooting Cartridges Market typically revolve around operational efficiency, product consistency, and future training methodologies. Users frequently inquire about how AI can enhance the precision of manufacturing processes, particularly in powder loading and projectile seating, where micro-variations significantly affect ballistic outcomes. Concerns are often raised regarding the security and privacy of supply chain data managed by AI systems, and whether AI-driven inventory management could lead to over-centralization of production. Expectations center on AI's potential to personalize training through predictive analysis of shooter performance and to optimize factory production lines for match-grade quality at scalable volumes. The overarching theme is the integration of advanced data analytics to move beyond traditional quality control methods, ensuring every cartridge meets exacting competitive standards while optimizing the complex logistics of explosive material movement.

- AI-driven predictive maintenance optimizes ammunition manufacturing machinery, drastically reducing downtime and improving equipment lifespan reliability.

- Machine learning algorithms enhance quality control by analyzing high-speed imagery of cartridge assembly, identifying micro-defects in casings, primers, and powder charge weights that human inspection may miss.

- Supply chain AI optimizes logistics for sensitive materials (propellants and primers), ensuring regulatory compliance, efficient warehousing, and minimizing lead times through predictive inventory management across global distributors.

- AI-powered ballistic simulation and design tools accelerate the R&D cycle for new propellants and projectile shapes, optimizing aerodynamic performance before physical testing is required.

- Personalized shooter training platforms utilize AI to analyze shooting data (shot tracking, grouping patterns) and provide real-time, customized feedback, increasing the rate of ammunition consumption for practice.

- Enhanced security protocols for sensitive manufacturing data, managed by AI, ensure intellectual property regarding proprietary propellant formulas remains protected against industrial espionage.

DRO & Impact Forces Of Sport Shooting Cartridges Market

The dynamics of the Sport Shooting Cartridges Market are influenced by a convergence of powerful drivers, structural restraints, and emerging opportunities, collectively shaping the direction and pace of growth. Key drivers include the global increase in organized competitive shooting events and the steady growth of recreational participation, supported by continuous investment in range infrastructure. Opportunities arise from technological advancements in materials science, particularly the push for non-toxic and environmentally benign ammunition components, opening new market segments in highly regulated regions. Conversely, the market is restrained by stringent governmental regulations surrounding the import, export, and domestic sale of ammunition, coupled with persistent volatility in the prices of critical raw materials suchable brass, lead, and specific chemical powders. These forces interact to create a complex operating environment where innovation must constantly balance regulatory adherence with cost efficiency and consumer demand for superior consistency.

The primary driving force remains the cultural acceptance and institutional support for shooting sports, especially in major markets like the United States and Canada, where civilian gun ownership and accompanying recreational activities generate massive volume demand. Internationally, the prestige associated with Olympic and international competitive shooting fosters continuous demand for high-end, match-grade cartridges. Furthermore, the proliferation of private and commercial shooting ranges that cater to diverse skill levels ensures accessibility, lowering the barrier to entry for new participants. This constant influx of new recreational users, coupled with the high consumption rate of experienced competitors who require thousands of rounds annually for practice and competition, provides a foundational stability to the demand side of the market equation, encouraging manufacturers to invest in scaling production capabilities efficiently.

Restraints are dominated by the regulatory landscape, which varies dramatically by jurisdiction, imposing significant overhead costs related to licensing, storage, transportation, and safety compliance. Trade restrictions and tariffs on ammunition components or finished products can disrupt global supply chains, affecting pricing stability and availability for consumers. Moreover, the socio-political climate surrounding firearms regulation introduces market uncertainty; periods of legislative debate often lead to panic buying followed by protracted inventory stabilization, complicating long-term forecasting. The environmental impact of spent ammunition materials, particularly lead contamination at shooting ranges, continues to pose a significant challenge, compelling manufacturers to invest heavily in non-lead alternatives which often entail higher production costs and different ballistic properties, creating a necessary but costly hurdle to widespread market adoption.

The impact forces influencing the market trajectory are multifaceted. Technological impact forces, particularly the integration of automation and precision engineering, are boosting manufacturing quality, reducing lot-to-lot variation, which is crucial for competitive success. Economic forces, such as global inflation and commodity price fluctuations, directly affect the cost of goods sold, forcing strategic pricing decisions and supply chain renegotiation. Social impact forces, including the growth of women's participation in shooting sports and the increasing focus on safe firearm training programs, expand the demographic base of consumers. Lastly, competitive forces are intensifying, with specialized boutique manufacturers challenging established giants by focusing exclusively on niche, ultra-precision segments, pushing the overall quality benchmark higher across the industry. Successful navigation of these forces requires dynamic strategic planning, regulatory foresight, and continuous technological differentiation to maintain market share and profitability.

Segmentation Analysis

The Sport Shooting Cartridges Market is strategically segmented based on factors such as Cartridge Type, Caliber, End-Use, and Distribution Channel to reflect the diverse needs of shooters and market dynamics. Understanding these segments is crucial for manufacturers to tailor their product offerings, marketing strategies, and distribution logistics effectively. The dominance of certain calibers in high-volume training contrasts sharply with the specialized requirements of match-grade rifle ammunition, leading to distinct production lines and pricing tiers. The segmentation by end-use clearly differentiates between the high demands of professional competitors and the bulk needs of recreational or casual shooters, directly influencing packaging size and consistency standards.

Segmentation by Cartridge Type distinguishes between the large, dominant segments of Shotgun Shells, Centerfire Cartridges, and Rimfire Cartridges. Shotgun shells are primarily consumed in skeet, trap, and sporting clays, demanding consistent patterns and velocity. Centerfire cartridges cover a broad spectrum, from handgun cartridges used in dynamic shooting to high-power rifle cartridges optimized for long-range precision. Rimfire ammunition, predominantly the .22 LR, constitutes the highest volume segment, critical for introductory training and low-cost recreational practice. Analyzing the growth rates within these types helps predict investment focus, showing a persistent trend toward premiumization within the Centerfire and Shotgun segments due to competitive demands, while the Rimfire segment focuses on maximizing cost-effective mass production.

- By Cartridge Type:

- Shotgun Shells (Skeet, Trap, Sporting Clays)

- Centerfire Cartridges (Rifle, Handgun)

- Rimfire Cartridges (Primarily .22 LR)

- By Caliber:

- Small Caliber (e.g., .22 LR, 9mm, .40 S&W)

- Medium Caliber (e.g., .223 Rem/5.56mm, .308 Win, .30-06)

- Large Caliber (Specialized Benchrest/Long-Range)

- By End-Use:

- Competitive Shooting (Match Grade, High Precision)

- Recreational Shooting and Practice (Bulk Ammunition)

- Training and Instruction Facilities

- By Distribution Channel:

- Specialty Retailers and Gun Stores

- Online Retail (Direct-to-Consumer & Third-Party Platforms)

- Sporting Goods Stores (Large Format Retail)

- Direct Sales to Shooting Ranges and Clubs

Value Chain Analysis For Sport Shooting Cartridges Market

The value chain for the Sport Shooting Cartridges Market is complex, beginning with highly regulated upstream sourcing and culminating in specialized, often restricted, downstream distribution. Upstream analysis focuses on the procurement of primary raw materials: brass or polymer for casings, lead or non-toxic alternatives (copper, steel) for projectiles, and chemical components for primers (initiators) and propellants (powder). Raw material suppliers operate under strict quality control standards, as the consistency of these inputs directly dictates the performance and safety of the final product. Manufacturers often seek long-term contracts and dual-sourcing strategies to mitigate supply chain risks inherent to commodity price volatility and geopolitical instability affecting mining and chemical production. Vertical integration, where major ammunition companies control component manufacturing (e.g., primers or brass fabrication), is a key strategy for cost control and quality assurance in this phase.

The core manufacturing and assembly stage involves high-precision machinery for casing preparation, automated powder filling, projectile seating, and crimping, all subject to rigorous testing and quality assurance protocols (QC). Given the potentially volatile nature of the materials, safety and regulatory compliance are paramount. The midstream involves packaging, branding, and extensive inventory management, focusing on batch traceability, which is crucial for recall management and regulatory scrutiny. Manufacturers invest heavily in proprietary technologies to ensure consistent propellant burn rates and uniform projectile weights, distinguishing match-grade products from standard bulk ammunition. Efficiency gains at this stage directly translate to competitive pricing and reduced waste.

Downstream analysis covers distribution channels, which include direct sales to large shooting clubs and government training facilities, and indirect sales through a tiered network of national distributors, specialty retailers, and, increasingly, regulated e-commerce platforms. Due to the nature of the product, distribution is heavily constrained by logistics related to shipping hazardous materials (HAZMAT) and adherence to local, state, and international transportation laws. Direct and indirect channels both play vital roles; direct sales often cater to large volume, institutional buyers seeking specific contract terms, while the indirect channel serves the vast consumer market through local gun stores and large sporting goods chains. Specialty retailers remain critical as they offer expertise and access to high-end, niche caliber ammunition that requires personalized consumer guidance. The reliance on indirect channels is often higher in regions with high population density and established retail infrastructure, maximizing geographic coverage and consumer convenience.

Sport Shooting Cartridges Market Potential Customers

The potential customer base for the Sport Shooting Cartridges Market is primarily segmented into three distinct categories: Competitive Shooters, Recreational Enthusiasts, and Institutional Training Facilities. Competitive shooters represent the high-value segment, characterized by their demand for extremely high-quality, match-grade ammunition, regardless of the premium price. These individuals participate in structured events (e.g., Olympic disciplines, precision rifle competitions) and require guaranteed consistency, purchasing specialized calibers in high volumes annually for both training and competition rounds. Their purchasing decisions are driven by performance and brand loyalty established through proven results, making them ideal targets for premium product lines and sponsored endorsements.

Recreational enthusiasts constitute the highest volume segment, encompassing casual target shooters, private gun owners utilizing ranges for proficiency maintenance, and individuals participating in less formal shooting events. This segment prioritizes value, reliability, and accessibility. Their purchases often involve bulk quantities of common, lower-cost calibers such as .22 LR, 9mm, and standard 12-gauge shotgun shells. Marketing to this group focuses on large-format packaging, promotional pricing, and widespread availability through general sporting goods stores and online retailers, emphasizing safety, dependability, and cost-effectiveness for frequent practice sessions.

Institutional customers include certified shooting ranges, commercial training academies, and specialized security/law enforcement contract training facilities that utilize sport-grade ammunition for high-volume, non-lethal practice scenarios. These buyers require large, consistent batches delivered under contractual terms, focusing on regulatory compliance, reliable supply, and competitive institutional pricing. They often serve as key testing grounds for new, non-toxic, or specialized training ammunition designs before wider commercial release. Securing contracts with major institutional facilities provides manufacturers with stable, predictable revenue streams and validation of product quality under high-stress, high-volume operational environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.50 Billion |

| Market Forecast in 2033 | USD 7.15 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Olin Corporation (Winchester), Vista Outdoor (CCI, Federal Premium), Hornady Manufacturing, Remington Ammunition, Sellier & Bellot, Fiocchi Munizioni, Nammo AS, Magtech Ammunition (CBC Global Ammunition), Eley Limited, Norma Precision, Lapua, PMC Ammunition, Prvi Partizan (PPU), GECO, RUAG Ammotec, Black Hills Ammunition, Browning Ammunition, Aguila Ammunition, Sterling Ammunition, Kent Cartridge. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sport Shooting Cartridges Market Key Technology Landscape

The technological landscape of the Sport Shooting Cartridges Market is centered on achieving ultra-high consistency and compliance with environmental standards, moving far beyond traditional mass-production techniques. A primary focus is on advanced propellant formulation, using specialized double-base and triple-base smokeless powders engineered for extremely stable burn rates across varying temperatures and humidity levels, crucial for match-grade consistency. Manufacturers employ sophisticated metrology and sensor technology during the loading process, including ultrasonic detection and high-speed laser measurement systems, to verify powder charge weight and projectile seating depth with micron-level accuracy, minimizing ballistic variation (Standard Deviation) between rounds within a batch. This precision engineering significantly enhances the performance envelope for competitive shooters who demand absolute uniformity.

Another crucial area of innovation is in projectile design and material science. There is a strong industry shift towards non-lead projectiles, driven by environmental regulations and range mandates. Technologies include frangible copper-polymer composites, solid copper machined bullets, and specialized coated bullets designed to reduce friction and barrel wear while maintaining ballistic coefficients competitive with traditional lead core designs. Furthermore, casing technology, particularly the use of high-strength, temperature-resistant brass alloys and proprietary annealing processes, ensures consistent case integrity and dimensional uniformity, which are critical for precision reloading enthusiasts and overall product reliability. These material advancements are key differentiators in the premium segment, justifying higher price points through superior technical performance and regulatory compliance.

The manufacturing infrastructure itself is leveraging Industry 4.0 principles, integrating sophisticated automation and digital twins for production line monitoring. Robotics handle repetitive tasks, reducing the risk of human error and exposure to hazardous materials, while supervisory control and data acquisition (SCADA) systems monitor every production parameter in real-time. Traceability technology, involving microscopic etching or integrated RFID tracking in packaging, allows manufacturers to maintain comprehensive records for every batch, meeting increasingly strict regulatory requirements for cradle-to-grave product tracking. This combination of advanced material engineering, ultra-precise assembly technology, and digitalized manufacturing processes defines the current technological edge, ensuring that modern sport cartridges are safer, more accurate, and more environmentally conscientious than their predecessors.

Regional Highlights

The global Sport Shooting Cartridges Market exhibits distinct regional consumption patterns and growth trajectories, heavily influenced by cultural factors, regulatory frameworks, and economic stability. North America, encompassing the United States and Canada, stands as the largest consumer base globally. This dominance is attributed to a long history of civilian gun ownership, well-established infrastructure for competitive and recreational shooting (including thousands of private and public ranges), and robust domestic manufacturing capacity. Demand here is high-volume, spanning all segments from affordable .22 LR to premium long-range rifle cartridges. The US market, in particular, drives innovation in bulk efficiency and niche, high-performance calibers, remaining the crucial bellwether for global industry trends and pricing.

Europe represents a mature market characterized by strict regulation but strong demand from organized sports. Countries such as Germany, the UK, Czech Republic, and Italy host major competitive events (e.g., ISSF World Cups) and possess strong domestic manufacturing capabilities (e.g., Fiocchi, Sellier & Bellot, RUAG). The demand focus in Europe is heavily skewed towards high-consistency, match-grade ammunition required for certified club practice and official competitions. Environmental mandates are particularly strong here, accelerating the adoption of non-toxic primers and lead-free projectiles. Growth in the European region is stable, underpinned by formalized sporting structures and governmental support for national shooting teams, ensuring predictable demand from institutional users.

Asia Pacific (APAC) is positioned as the fastest-growing regional market, driven by rapidly increasing urbanization, rising middle-class disposable incomes, and the modernization of sporting infrastructure in countries like Australia, New Zealand, India, and select Southeast Asian nations. While regulations vary significantly, the increasing participation in international shooting sports, particularly following success in global events, stimulates demand for both high-quality training ammunition and match rounds. Manufacturers are strategically establishing regional distribution hubs and local partnerships to navigate import/export complexities and capitalize on this high-growth potential. Latin America and the Middle East & Africa (MEA) currently represent smaller but developing markets, where growth is contingent upon geopolitical stability and increased investment in formalized sports and training programs, often tied to government-led security initiatives that include high-volume, cost-effective target practice.

- North America (Dominant Market): High volume consumption across all segments, extensive infrastructure, strong domestic manufacturing base (Winchester, Federal Premium). Market sensitive to political and economic cycles affecting firearm ownership.

- Europe (Mature & Precision-Focused): Stable growth driven by formal competitive shooting structures, high demand for precision and match-grade ammunition, strict regulatory pressure promoting non-toxic material adoption.

- Asia Pacific (Highest Growth Rate): Rapidly expanding due to increased discretionary spending, modernization of sports facilities, and growing interest in Olympic shooting disciplines. Key growth countries include Australia and India.

- Latin America (Emerging Market): Growth potential linked to improving economic stability and the development of organized shooting leagues and ranges. Demand focused primarily on common handgun and rifle calibers.

- Middle East and Africa (MEA) (Niche Market): Smaller commercial presence; demand is often concentrated around specialized training academies and institutional sports programs, requiring reliable, medium-volume supplies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sport Shooting Cartridges Market.- Olin Corporation (Winchester)

- Vista Outdoor (CCI, Federal Premium, Speer)

- Hornady Manufacturing

- Remington Ammunition

- Sellier & Bellot

- Fiocchi Munizioni

- Nammo AS

- Magtech Ammunition (CBC Global Ammunition)

- Eley Limited

- Norma Precision

- Lapua

- PMC Ammunition

- Prvi Partizan (PPU)

- GECO

- RUAG Ammotec

- Black Hills Ammunition

- Browning Ammunition

- Aguila Ammunition

- Sterling Ammunition

- Kent Cartridge

Frequently Asked Questions

Analyze common user questions about the Sport Shooting Cartridges market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current demand for non-toxic sport shooting cartridges?

Demand is primarily driven by increasingly stringent environmental regulations, particularly in Europe and parts of North America, which seek to mitigate lead contamination at outdoor and indoor shooting ranges. This shift compels competitive organizations and range operators to adopt lead-free primers and copper-based projectiles, supporting the market growth for specialty ecological ammunition products.

How does the volatile cost of raw materials impact the pricing of sport ammunition?

Volatility in commodity prices, especially for brass (a copper-zinc alloy), lead, and specific chemical components for propellants, directly affects manufacturing costs. As these materials fluctuate, manufacturers must adjust pricing, often leading to temporary price hikes for consumers, impacting bulk purchase decisions and strategic inventory management by retailers.

Which segment of the Sport Shooting Cartridges Market is showing the highest growth potential?

The Centerfire Rifle Cartridges segment, particularly those designed for long-range precision and competitive benchrest shooting, exhibits high growth potential. This is fueled by the rising global popularity of precision rifle series (PRS) matches and the premiumization trend demanding extremely consistent, match-grade ammunition that requires superior manufacturing quality and technical specification.

What role does digitalization play in the future manufacturing of ammunition?

Digitalization, including the use of AI for quality control and Industry 4.0 automation, is crucial for optimizing manufacturing consistency and reducing lot-to-lot variation, which is essential for competitive ammunition. These technologies enable real-time monitoring of powder charges and projectile seating, guaranteeing the micro-precision required by high-level professional shooters.

Is the regulatory environment the biggest restraint facing the global market?

Yes, the highly diverse and often conflicting regulatory environment across different countries regarding the sale, ownership, import, and export of ammunition is arguably the single largest restraint. These regulatory hurdles necessitate complex logistical compliance, add significant overhead costs, and introduce market uncertainty, especially across international borders.

The comprehensive analysis provided herein reflects a deeply competitive global landscape where technological precision, regulatory compliance, and effective supply chain management are critical determinants of market success. The shift towards sustainable materials and the integration of advanced manufacturing technologies are redefining product quality and operational efficiency within the sport shooting sector, paving the way for sustained, albeit regulated, market growth through 2033.

Further detailed investigation reveals that while North America continues to provide the largest revenue base, the strategic emphasis for future expansion lies heavily within the Asia Pacific region, capitalizing on evolving consumer spending habits and governmental investment in sporting infrastructure. Manufacturers are adopting dual strategies: leveraging highly automated processes for mass-produced rimfire and common pistol calibers, while maintaining specialized, highly technical lines for match-grade rifle and premium shotgun ammunition. This tailored approach ensures that market players can simultaneously capture high-volume recreational demand and high-margin competitive needs, balancing cost efficiency with uncompromising quality standards required by professional athletes.

Moreover, the integration of consumer data analytics is becoming increasingly vital. By understanding consumption patterns, preferred calibers in specific geographical clusters, and the timing of competitive season cycles, key market players can optimize production forecasts and inventory holding, minimizing risks associated with the highly sensitive nature of the product. The success of manufacturers in this market will increasingly depend not only on the ballistic performance of their cartridges but also on their ability to swiftly adapt to new environmental mandates and leverage digital technologies to maintain a lean, responsive, and rigorously compliant global operational footprint. This strategic alignment across R&D, manufacturing, and distribution will be the hallmark of market leadership in the coming decade.

The increasing prominence of competitive long-range shooting has significantly influenced research and development spending. Unlike traditional recreational shooting, long-range disciplines require ammunition that performs flawlessly under extreme environmental variables over distances exceeding 1,000 yards. This necessitates investments in advanced chronographs, high-speed cameras, and computational fluid dynamics (CFD) software to meticulously refine projectile designs for optimal ballistic coefficients and minimal atmospheric drag. The resultant technologies, often first commercialized in the premium segment, gradually trickle down to improve the consistency of standard hunting and mid-range target ammunition, benefiting the entire consumer base and validating the high cost of specialized R&D programs within the industry.

The regulatory restraint concerning international trade of ammunition and components poses a substantial operational challenge. The complex web of treaties, national export licenses, and end-user certificates often creates significant delays and uncertainty in cross-border supply chains. For global manufacturers, this requires dedicated regulatory compliance teams and sophisticated logistics planning to ensure seamless delivery to regional distributors and specialized shooting organizations worldwide. Any breach of these regulations can result in severe penalties, emphasizing the importance of robust internal controls and deep understanding of geopolitical shifts. This regulatory burden acts as a natural barrier to entry for smaller manufacturers, solidifying the market position of established, multinational corporations capable of managing high-level compliance infrastructure across multiple jurisdictions.

Opportunity areas are rapidly emerging in specialized training ammunition designed for use in indoor ranges and urban environments. These products often incorporate frangible technology—bullets that disintegrate upon impact with hard surfaces—to prevent ricochets and reduce environmental hazards, making them safer for steel target shooting and close-quarters training scenarios. The growth of private security training academies and increased demand for practical, yet safe, proficiency maintenance among licensed carriers contribute significantly to this niche segment's expansion. Furthermore, the development of high-quality, standardized reloading components (casings, primers, and bulk projectiles) addresses the economic needs of high-volume competitive shooters who seek to customize their loads while maintaining cost efficiency, fostering an interdependent ecosystem within the market that supports both factory-loaded products and enthusiast customization.

The long-term health of the Sport Shooting Cartridges Market is intrinsically linked to the continued promotion of shooting sports as safe, legitimate activities globally. Investment in youth programs, formalized training courses that emphasize safety and responsibility, and public relations efforts to counter negative socio-political narratives are vital for sustaining consumer interest and ensuring regulatory support. Manufacturers are increasingly partnering with non-profit organizations and competitive bodies to sponsor events, provide educational materials, and advocate for reasonable firearm regulations that protect the rights of sportsmen while ensuring public safety. This engagement strategy is crucial for fostering a positive ecosystem that encourages continuous participation and, consequently, stable demand for specialized sport shooting cartridges well into the forecast period.

Technological advancement is not limited to the physical product but extends into consumer engagement platforms. Digital ballistic calculators, mobile applications that interface with shot-tracking devices, and proprietary web tools that allow users to compare batch data and specific load performance are enhancing the user experience. These tools provide competitive shooters with unparalleled levels of data necessary for performance optimization, driving demand for ammunition that can deliver the extreme consistency needed to capitalize on such detailed analysis. This convergence of high-tech digital tools and precision physical products represents the modern consumer expectation in the competitive shooting world, further cementing the need for manufacturers to prioritize data integrity and advanced R&D.

The competitive landscape is characterized by oligopolistic dominance among a few major global players—Olin (Winchester), Vista Outdoor (Federal, CCI), and the European conglomerate structures (like RUAG Ammotec, Nammo AS)—who control the majority of mass-market production and distribution networks. However, the market structure is permeable to highly specialized boutique manufacturers (e.g., Black Hills, specialized custom loaders) who excel in the ultra-precision, low-volume segments. These smaller firms often innovate faster in specific niches, forcing the large players to respond by either acquiring the specialized technology or launching their own premium sub-brands. This dynamic competition ensures continuous innovation and quality improvement across all price points, benefiting the end consumer, particularly in the competitive end-use segment.

In summary, the Sport Shooting Cartridges Market is exhibiting resilience and growth driven by global sporting trends, offset by considerable regulatory and supply chain constraints. Success relies on strategic vertical integration to stabilize input costs, continuous investment in non-toxic and precision-enhancing technologies, and adept navigation of diverse international distribution requirements. The long-term projection remains positive, predicated on the enduring appeal of shooting sports and the industry’s capacity to innovate responsibly and sustainably.

Further analysis of the Centerfire segment reveals a critical sub-trend towards the standardization of specialized calibers originally developed for military or long-range defense applications, now heavily adopted for sporting use (e.g., 6.5 Creedmoor, .300 Win Mag derivatives). This cross-pollination benefits manufacturers by allowing them to leverage existing component supply chains while catering to the high demands of professional competitors seeking the latest ballistic superiority. The adoption of these high-performance cartridges necessitates commensurate improvements in firearm technology and consumer education regarding complex ballistics, further supporting specialized ammunition sales and high-margin product offerings within the competitive strata.

Regarding the Rimfire segment, although it is perceived as the volume leader, manufacturers are concentrating efforts on enhancing ignition reliability and projectile uniformity, historically the weak points of mass-produced .22 LR ammunition. Innovations like specialized wax coatings and proprietary priming mixes are designed to elevate the consistency of bulk ammunition, making it suitable for entry-level competitive training (e.g., small-bore rifle events). This focus ensures that the largest market segment maintains relevance even as premium segments drive higher margins, sustaining the foundational pipeline of new participants entering the broader shooting sports community. The health of the Rimfire segment is a key indicator of the market's accessibility and long-term recruitment potential.

The supply chain integration strategy, particularly the control over primer manufacturing, represents a decisive competitive advantage. Primers are highly technical and highly regulated components, susceptible to supply bottlenecks and geopolitical risks. Companies that maintain captive production capabilities for primers are better insulated from market fluctuations and can ensure superior quality control over the most critical element of the cartridge's ignition system. This level of vertical control allows them to market their products as having unmatched reliability, a key selling point for match-grade and high-volume training ammunition where misfires are unacceptable. Non-integrated manufacturers are constantly challenged by sourcing uncertainties and relying on third-party suppliers, which can affect production scalability and cost predictability, underscoring the strategic value of component self-sufficiency in this specialized market.

Finally, the geographical shift towards APAC is not solely based on rising income but also on institutional support from governmental and private organizations investing in world-class sporting facilities. Countries hosting or aspiring to host major international shooting championships are mandated to provide state-of-the-art ranges and related resources, thereby generating immediate, high-volume demand for certified training and competition cartridges. This institutional pull creates a lucrative entry point for global manufacturers willing to establish compliant distribution chains and navigate complex local bureaucracy. The growth in APAC is thus characterized by a sharp demand for premium products supported by infrastructural investment, contrasting with the more organic, recreational-driven growth observed in North American bulk markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager