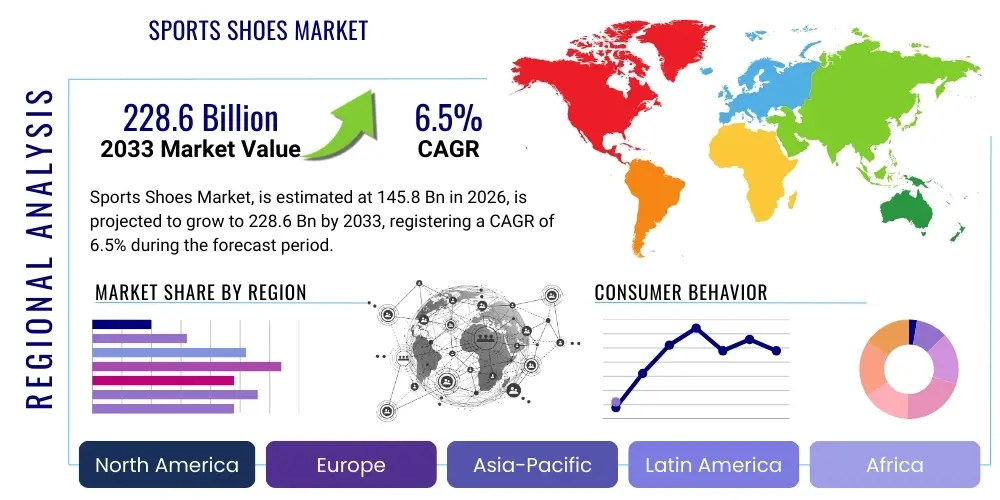

Sports Shoes Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440994 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Sports Shoes Market Size

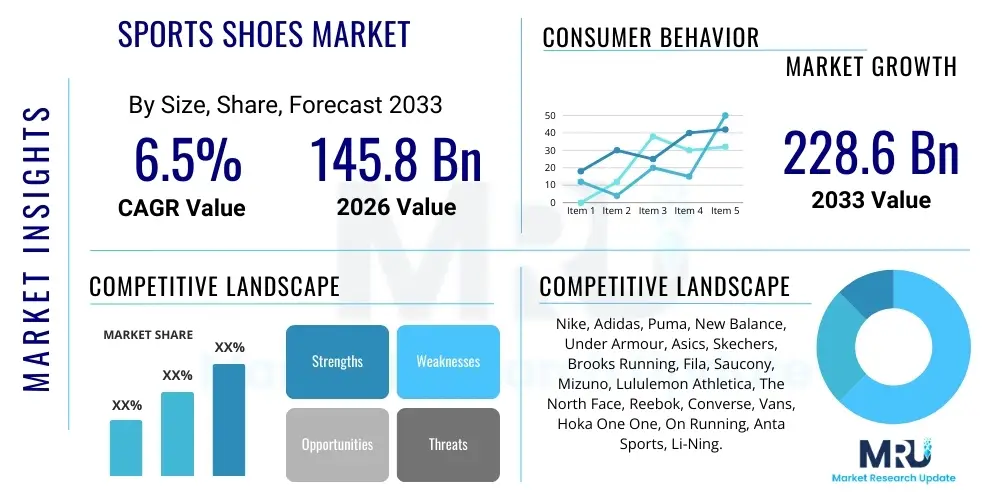

The Sports Shoes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $145.8 Billion in 2026 and is projected to reach $228.6 Billion by the end of the forecast period in 2033.

Sports Shoes Market introduction

The Sports Shoes Market encompasses the design, manufacturing, distribution, and sale of specialized footwear engineered for athletic performance, leisure activities, and daily physical exercise. These products are characterized by specific technological integrations such as enhanced cushioning systems, lightweight materials, superior traction designs, and ergonomic fits tailored to distinct sporting requirements, ranging from high-intensity running and basketball to general fitness training and outdoor adventure. The evolution of sports footwear has shifted significantly from purely utilitarian products to high-fashion performance items, driven by increasing consumer awareness regarding health and fitness, coupled with the mainstreaming of athletic apparel (athleisure) into everyday wear. This dual functionality—performance and style—underpins the sustained demand across diverse demographic segments globally.

Major applications for sports shoes span professional athletics, organized sports (such as football, tennis, and golf), recreational fitness activities (like gym workouts and jogging), and casual lifestyle use. Key benefits offered by modern sports shoes include injury prevention through stability and shock absorption, improved athletic performance due to specialized features like energy return foam, enhanced comfort for extended wear, and personalization options that cater to specific foot mechanics and aesthetic preferences. The technological arms race among leading manufacturers, involving innovations in material science (e.g., sustainable and bio-based polymers) and manufacturing processes (e.g., 3D printing), ensures a continuous flow of high-value products into the market.

Driving factors sustaining the market's robust expansion include the global rise in disposable income, particularly in emerging economies; aggressive marketing campaigns centered around celebrity endorsements and major sporting events; and governmental initiatives promoting physical health and combating sedentary lifestyles. Furthermore, the rapid expansion of e-commerce platforms and digital direct-to-consumer (DTC) models has significantly broadened market access, allowing brands to bypass traditional retail structures and forge closer relationships with consumers, thereby facilitating faster product adoption and personalized service offerings. The continuous pursuit of marginal gains in athletic performance also necessitates frequent replacement cycles for specialized, high-end footwear.

Sports Shoes Market Executive Summary

The global Sports Shoes Market is characterized by intense competition, rapid technological advancements, and strong consumer adoption, evidenced by the projected high single-digit CAGR through 2033. Current business trends indicate a critical shift towards sustainability, with major brands investing heavily in circular economy models, recycled materials, and reduced manufacturing waste. Digitization remains paramount, with virtual try-on technologies and personalized recommendation engines becoming standard practice, enhancing the online retail experience. Furthermore, strategic collaborations between traditional sports brands and luxury fashion houses continue to blur the lines between performance wear and high-street fashion, boosting the premium segment’s valuation and accessibility.

Regionally, the market exhibits varied maturity levels and growth trajectories. Asia Pacific (APAC) is positioned as the primary growth engine, fueled by burgeoning middle-class populations, increasing urbanization, and the normalization of fitness culture, especially in countries like China and India. North America and Europe, while mature, maintain strong market share, primarily driven by high average selling prices (ASPs) for performance and fashion-forward premium products, and sustained innovation in niche categories like trail running and specialized training. Emerging markets in Latin America and MEA are increasingly relevant due to expanding retail infrastructure and rising consumer interest in global athletic brands, translating into significant opportunities for market penetration.

Segment trends reveal that the running and training shoe categories dominate the market by volume, owing to their mass appeal and utility in general fitness. However, the lifestyle/athleisure segment is experiencing the fastest growth rate, reflecting the consumer shift towards comfort-focused, athletic-inspired daily footwear. Distribution channel analysis shows a strong migration toward online sales, benefiting both established DTC channels and major e-retail platforms, though physical retail remains crucial for product education, fitting, and brand experience. In terms of end-users, the Women's and Kids' segments are outpacing the traditional Men's segment in growth, driven by targeted product innovations and the rising participation of women and youth in organized sports and fitness activities globally. Premium pricing strategies remain resilient despite economic fluctuations, highlighting the perceived value of technological superiority and brand equity in this industry.

AI Impact Analysis on Sports Shoes Market

User inquiries regarding Artificial Intelligence (AI) in the Sports Shoes Market primarily focus on personalization, supply chain efficiency, and retail transformation. Consumers are keen to know how AI can lead to better fitting shoes, predicting durability, and customizing designs based on gait analysis and performance data. Manufacturers frequently inquire about leveraging AI for predictive demand forecasting, optimizing complex global supply chains, and accelerating sustainable material innovation. Retailers are focused on AI-driven inventory management, dynamic pricing strategies, and creating highly individualized virtual shopping experiences. The consensus expectation is that AI will fundamentally transform the shoe lifecycle, moving from mass production to mass customization while simultaneously improving operational sustainability and reducing time-to-market for new designs, addressing key concerns about waste and inefficiency in traditional manufacturing.

- AI-driven Predictive Analytics for Demand Forecasting: Enhancing inventory accuracy and reducing stockouts/overstocking across diverse SKUs.

- Generative Design and Material Science: Utilizing machine learning algorithms to discover novel, lightweight, and sustainable materials and optimize shoe component geometry.

- Personalized Biometric Fit Assessment: Implementing AI vision and sensor data (e.g., gait analysis, pressure mapping) to recommend or design shoes tailored to individual biomechanics, significantly reducing sizing errors and injury risks.

- Supply Chain Optimization: Real-time monitoring and dynamic adjustment of logistics networks, predicting potential disruptions, and optimizing manufacturing scheduling.

- Enhanced Retail Experience: AI-powered virtual try-on, personalized recommendation engines, and chatbot assistance improving customer engagement in e-commerce channels.

- Manufacturing Automation: Integrating machine vision and robotics in production lines for precision assembly and quality control, leading to higher consistency and efficiency.

- Customization at Scale: Enabling cost-effective production of unique, personalized sports shoes based on user-submitted parameters or performance data.

DRO & Impact Forces Of Sports Shoes Market

The Sports Shoes Market is propelled by robust societal trends centered on health and wellness awareness, driving consistent demand for specialized performance gear. Key drivers include the global expansion of fitness infrastructure (gyms, running events), the successful integration of athletic wear into casual fashion (athleisure), and continuous investment in performance-enhancing technologies like advanced foam cushioning and carbon plate integration. However, the market faces significant restraints, notably the high cost associated with advanced footwear, which limits penetration in price-sensitive segments, and the persistent challenge of counterfeiting, which erodes brand equity and profitability. Opportunities abound in sustainability innovation, catering to the growing environmentally conscious consumer base, and leveraging digital transformation for mass customization, creating unique market niches. These forces collectively shape a competitive landscape where technological superiority, brand heritage, and responsive supply chains are critical determinants of market leadership and sustained growth.

Drivers fueling market growth include global population health consciousness, leading to higher participation rates in fitness activities; aggressive marketing and promotional spending by major global brands, creating aspirational value; technological innovation focused on safety, comfort, and performance gains; and supportive government policies promoting sports and physical education programs. The shift towards non-competitive, recreational fitness activities like jogging and cross-training further broadens the addressable market beyond elite athletes. Furthermore, the high replacement rate driven by the specialized nature of shoes (e.g., separating running shoes from court shoes) ensures continuous demand, particularly in the premium performance tiers where shoes are expected to be replaced every 300–500 miles.

Restraints include intense competition leading to margin pressure in the mass-market segment; regulatory complexities concerning material safety and labor standards across global supply chains; and economic volatility that can depress consumer spending on non-essential, premium athletic wear. Opportunities are particularly strong in developing innovative distribution models, expanding into underserved niche sports (e.g., extreme outdoor running, pickleball), and capitalizing on the burgeoning market for digital wearables integration within footwear. The primary impact forces influencing the market trajectory are technology integration, sustainability mandates, and the cultural acceptance of athleisure wear, which collectively dictate consumer purchasing behavior and competitive strategies. Manufacturers must balance performance enhancement demands with increasing pressure to adopt ethical and environmentally sound sourcing and production practices, navigating trade-offs between cost and compliance.

Segmentation Analysis

The Sports Shoes Market is extensively segmented across multiple dimensions to accurately reflect diverse consumer needs and usage patterns. Primary segmentation criteria include product type (differentiating specialized performance categories like running, training, and basketball), application (catering to men, women, and children with gender-specific design and fit characteristics), and distribution channel (analyzing the flow through physical retail versus burgeoning e-commerce platforms). This granular segmentation is crucial for targeted product development, precise marketing campaigns, and optimizing inventory allocation across various regional markets. The performance segment remains the engine for innovation, while the lifestyle segment dictates volume and broad market reach, driven primarily by fashion trends and brand collaborations.

- By Product Type:

- Running Shoes

- Training and Gym Shoes

- Walking Shoes

- Casual and Lifestyle Shoes (Athleisure)

- Specialized Sport Shoes (e.g., Basketball, Football/Soccer, Golf, Tennis, Hiking)

- By End-User (Application):

- Men

- Women

- Kids

- By Distribution Channel:

- Offline Channels (Specialty Sports Stores, Department Stores, Brand Outlets)

- Online Channels (E-commerce Multi-brand Retailers, Direct-to-Consumer (DTC) Websites)

- By Pricing Range:

- Premium (High-end performance and designer collaborations)

- Mid-Range

- Economy

Value Chain Analysis For Sports Shoes Market

The value chain of the Sports Shoes Market is complex, beginning with upstream activities focused on raw material sourcing and research and development (R&D). Upstream analysis centers on material suppliers—such as producers of specialized polymers, synthetic textiles, natural fibers, and advanced foaming agents—who significantly influence the final product's performance and cost structure. R&D is highly prioritized, focusing on biomechanics, materials science, and digital integration (e.g., embedded sensors). Key brand manufacturers then integrate these materials into sophisticated designs, focusing on mass production efficiency and quality control, often utilizing manufacturing hubs in Asia Pacific countries like Vietnam, Indonesia, and China to leverage cost efficiencies and established industrial ecosystems. Strong intellectual property protection surrounding proprietary cushioning and structural technologies is a critical component of the upstream value capture.

Midstream activities involve core manufacturing, assembly, and rigorous quality assurance processes. This stage is becoming increasingly automated, incorporating advanced technologies such as laser cutting, robotic assembly, and data-driven material management to reduce waste and enhance product consistency. The supply chain demands high levels of coordination due to the global sourcing of diverse components and the frequent need for rapid production adjustments based on fluctuating fashion trends and seasonality. Effective logistics management, including international shipping and warehousing, is crucial for maintaining inventory levels and meeting retail timelines across global distribution networks. Sustainability commitments often complicate this stage, requiring manufacturers to trace and verify the ethical sourcing of materials and maintain energy-efficient production facilities.

Downstream activities focus on bringing the finished product to the end consumer through various distribution channels, categorized as direct and indirect. Direct distribution includes brand-owned retail stores and the highly strategic direct-to-consumer (DTC) e-commerce websites and mobile applications, allowing brands maximum control over pricing, branding, and customer data. Indirect distribution involves wholesale partnerships with large multi-brand sporting goods retailers, department stores, and specialized regional shops. The shift towards online sales is reshaping the downstream environment, demanding seamless omnichannel experiences. Successful distribution strategies rely heavily on digital marketing, influencer partnerships, and localized fulfillment infrastructure to ensure rapid and efficient product delivery, which is a major determinant of customer satisfaction and repeat purchase behavior.

Sports Shoes Market Potential Customers

The potential customer base for the Sports Shoes Market is exceptionally broad, encompassing virtually all demographic segments but can be segmented based on their primary motivation for purchase. The largest segment comprises individuals engaged in recreational fitness activities, such as general gym-goers, daily runners, and those seeking comfortable footwear for walking and general lifestyle use (the athleisure consumer). These end-users prioritize comfort, durability, and stylistic versatility. A second, high-value segment consists of professional and amateur athletes who demand specialized, high-performance footwear engineered for specific sports (e.g., marathon runners seeking maximum energy return, or basketball players requiring ankle support and responsive grip). This segment is less price-sensitive and drives demand for the latest technological innovations and premium pricing tiers, acting as early adopters for new product features.

A third crucial segment is the youth market (Kids), driven by parental purchases for school sports, physical education, and fashion trends. This segment requires durable, supportive, and often brightly styled products, representing a long-term investment for brands establishing early loyalty. Finally, the older adult population represents a growing segment, particularly those focused on health management, walking, and low-impact exercise. This demographic requires shoes focused on stability, ease of wear, and enhanced cushioning for joint protection. Effective targeting requires brands to tailor product features, sizing options, and marketing messages specifically to the biomechanical needs and purchasing drivers unique to each distinct end-user group, spanning across geographical and economic strata. The growth of the female participation in sports has led to the development of highly specialized products addressing anatomical differences, representing a high-potential target market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $145.8 Billion |

| Market Forecast in 2033 | $228.6 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nike, Adidas, Puma, New Balance, Under Armour, Asics, Skechers, Brooks Running, Fila, Saucony, Mizuno, Lululemon Athletica, The North Face, Reebok, Converse, Vans, Hoka One One, On Running, Anta Sports, Li-Ning. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sports Shoes Market Key Technology Landscape

The Sports Shoes Market is defined by a continuous technological arms race focused on enhancing material performance, optimizing manufacturing efficiency, and integrating digital features. A core technology area involves advanced midsole cushioning systems, such as proprietary energy-returning foams (e.g., thermoplastic polyurethanes (TPU) and high-rebound ethylene-vinyl acetate (EVA) compounds) and the adoption of carbon fiber plates for increased propulsion and efficiency, particularly in competitive running models. These material science innovations are crucial drivers of premium pricing and differentiation. Furthermore, sustainable material technologies, including bio-based plastics, recycled polyester, and waste-reducing manufacturing methods like knitting (Flyknit equivalents), are rapidly moving from niche features to industry standards, driven by stringent consumer and regulatory demands for environmentally responsible products. The challenge lies in maintaining performance characteristics while utilizing circular or renewable materials.

Manufacturing technology is undergoing radical transformation, moving towards precision engineering and mass customization. Technologies such as 3D printing (Additive Manufacturing) are increasingly utilized for prototyping complex geometric structures and producing specialized components like bespoke midsoles or lattice-structured cushioning tailored to individual pressure points. Automation via robotics and machine vision systems in assembly lines ensures greater consistency and allows for highly complex designs to be manufactured at scale with minimal human error. This push for automation is coupled with investments in smart factory concepts, leveraging IoT sensors and data analytics to optimize workflow, predict maintenance needs, and manage material flow efficiently across distributed global production sites, significantly reducing lead times.

Finally, digital integration technologies are transforming the consumer experience and performance tracking. Footwear increasingly incorporates smart components, such as embedded sensors or integrated chips, that connect to mobile applications to track performance metrics (e.g., distance, pace, foot strike mechanics). Furthermore, augmented reality (AR) and virtual reality (VR) technologies are being deployed in the retail space, offering virtual try-on capabilities and advanced gait analysis without requiring physical contact, which is crucial for enhancing the online purchasing experience and reducing return rates. The effective utilization of consumer performance data, often processed via AI algorithms, allows brands to iterate design faster and offer hyper-personalized product recommendations, solidifying the market’s reliance on digital ecosystems.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to register the highest growth rate due to its substantial population base, rapid economic development, and increasing prioritization of fitness and recreational activities. China and India are the primary market engines, where urbanization and rising disposable incomes have fueled robust demand for both mid-range and premium global brands. Local manufacturing capabilities also make APAC a critical supply hub.

- North America: North America holds a dominant market share, driven by high consumer spending power, strong presence of key market players (e.g., Nike, Under Armour), and a deeply entrenched culture of organized sports and athleisure. The market here is highly mature and receptive to premium, performance-oriented technological innovations, alongside robust demand for retro/lifestyle sneaker fashion.

- Europe: Europe is a significant market, characterized by strong consumer preference for technical excellence, sustainability, and quality materials. Western European countries, particularly Germany, the UK, and France, exhibit high per capita spending on running and specialized outdoor footwear. Regulatory focus on ESG (Environmental, Social, and Governance) factors drives innovation in eco-friendly product lines.

- Latin America (LATAM): LATAM presents considerable long-term potential, with Brazil and Mexico leading the regional expansion. Growth is driven by improving economic stability, expanding retail infrastructure, and increasing exposure to global fitness trends. The challenge remains navigating import tariffs and volatile local currencies, often leading to a focus on mid-range and economy segments.

- Middle East and Africa (MEA): The MEA market is accelerating, spurred by large-scale government investments in sports infrastructure (e.g., FIFA World Cup, Olympic bids) and the rising participation in fitness in affluent Gulf nations. Demand is heavily skewed towards premium and luxury athletic wear, although logistical complexities persist in accessing sub-Saharan African markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sports Shoes Market.- Nike Inc.

- Adidas AG

- Puma SE

- New Balance Athletics, Inc.

- Under Armour, Inc.

- Asics Corporation

- Skechers USA, Inc.

- Brooks Running Company

- Fila Holdings Corp.

- Saucony (Wolverine World Wide, Inc.)

- Mizuno Corporation

- Lululemon Athletica Inc.

- The North Face (VF Corporation)

- Reebok (Authentic Brands Group)

- Converse (Nike subsidiary)

- Vans (VF Corporation)

- Hoka One One (Deckers Brands)

- On Holding AG

- Anta Sports Products Limited

- Li-Ning Company Limited

Frequently Asked Questions

Analyze common user questions about the Sports Shoes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Athleisure segment in the Sports Shoes Market?

The Athleisure segment growth is primarily driven by the convergence of fashion and comfort, increased casualization of work environments, and strong celebrity/influencer endorsement, making athletic-inspired shoes acceptable for diverse social settings while prioritizing all-day comfort.

How is sustainability impacting the manufacturing of modern sports shoes?

Sustainability mandates are forcing manufacturers to prioritize recycled materials (e.g., ocean plastic, polyester), implement circular design principles, minimize waste through automated knitting and 3D printing, and ensure transparent, ethical sourcing of all component materials, increasing initial R&D costs but improving brand perception.

What role does the Direct-to-Consumer (DTC) channel play in market sales?

The DTC channel, primarily through brand websites and mobile apps, is crucial for maximizing profit margins, gathering valuable consumer data for personalized marketing, controlling the brand narrative, and accelerating the launch and feedback cycle for new technological products, bypassing traditional retail middlemen.

Which geographical region offers the most significant growth opportunity for sports shoe brands?

The Asia Pacific (APAC) region offers the most significant immediate growth opportunity, propelled by expanding middle classes, rapid urbanization, government promotion of sports, and strong consumer adoption of global brands in high-volume markets like China and India.

How are new technologies like carbon plates affecting running shoe market dynamics?

The integration of advanced technologies like carbon fiber plates in running shoes has created a highly differentiated premium performance segment, boosting Average Selling Prices (ASPs), driving innovation cycles, and compelling serious runners to frequently upgrade their footwear for marginal performance gains, intensifying competition in the elite category.

The detailed analysis of the Sports Shoes Market reveals a sector highly sensitive to consumer health trends, technological innovation, and retail digitization. The dominance of a few major global players, coupled with the rising influence of regional specialized brands, creates a dynamic competitive environment where investment in material science and supply chain agility is paramount for achieving sustained profitability. The shift towards conscious consumerism necessitates a strategic pivot towards verifiable sustainability credentials, impacting everything from raw material procurement to end-of-life product management. Future growth will be significantly influenced by the ability of brands to scale personalized product offerings and effectively integrate digital performance tracking features into their footwear ecosystems, capitalizing on the high intersectionality between athletic performance and daily lifestyle wear. The long-term trajectory confirms robust expansion, underpinned by demographic shifts favoring active lifestyles globally and the ongoing premiumization of high-performance footwear.

Further examination of the market segment by product type indicates that running shoes remain the largest revenue generator, benefiting from ubiquitous appeal and constant technological upgrades. The training and gym category exhibits steady growth, fueled by the proliferation of specialized fitness programs and boutique gyms globally, requiring multi-purpose stability and cushioning. However, the lifestyle segment is the primary volume driver, often utilizing brand heritage and limited edition collaborations to generate scarcity and drive high consumer engagement. Basketball shoes, while geographically concentrated, command high ASPs due to fashion influence and athlete endorsements. Specialized categories such as hiking and outdoor shoes are also gaining prominence, particularly in mature markets like Europe and North America, driven by the increasing popularity of outdoor recreational activities post-pandemic, demanding specific waterproof and traction technologies. The interplay between performance features and aesthetic design defines success across these diverse product categories, requiring brands to maintain distinct R&D pipelines tailored to unique user requirements and environmental conditions.

In terms of distribution, the ongoing digital transformation is recalibrating the retail landscape. While brick-and-mortar stores remain essential for the crucial try-on and fitting process, particularly for highly technical running and specialized sports footwear, the dominance of online channels continues to strengthen. DTC e-commerce offers brands unparalleled control over consumer interaction and inventory, allowing for faster adaptation to market feedback and the efficient deployment of personalized offers. Third-party e-retailers provide scale and market reach, particularly in regions where brand-specific infrastructure is limited. The future of distribution is undeniably omnichannel, where physical stores serve as experience centers and fulfillment hubs, seamlessly integrating with robust digital platforms. Successful market entrants and established leaders alike must prioritize investment in logistics technology to ensure speedy delivery, minimize returns, and manage cross-border complexities effectively, particularly in the fragmented APAC region, where localized logistics partnerships are critical for market penetration.

The competitive analysis underscores the oligopolistic nature of the market, led by Nike, Adidas, and Puma, whose sheer marketing power and global distribution networks create high barriers to entry. However, niche and specialized brands like Hoka One One (running) and On Running (performance lifestyle) are rapidly gaining market share by focusing intently on specific technological advantages (e.g., maximalist cushioning or unique cloud technology) and cultivating strong community loyalty. This fragmentation at the specialty level provides sustained dynamism and fuels the innovation cycle, preventing stagnation in product development. Strategic mergers and acquisitions remain a common tactic, allowing large corporations to absorb disruptive technologies and specialized market access. Furthermore, the rise of powerful Chinese domestic brands, such as Anta and Li-Ning, driven by aggressive domestic expansion and strategic international visibility via sponsorships, presents a long-term challenge to the Western incumbents, particularly in the high-growth APAC theatre, necessitating localized competitive strategies and product offerings tailored to regional cultural preferences and athletic disciplines.

Financial performance within the sector is highly correlated with effective inventory management and pricing power. Brands that successfully innovate and establish clear performance differentiation can sustain higher margins, mitigating the constant pressure from economic volatility and raw material cost inflation. The reliance on manufacturing in Asia introduces inherent geopolitical and logistical risks, which leading firms are attempting to mitigate through supply chain diversification and investment in more flexible, closer-to-market production facilities (nearshoring). Currency fluctuations significantly impact profitability for companies operating globally, requiring sophisticated hedging strategies. Investor sentiment remains positive for companies demonstrating clear leadership in sustainability and digital engagement, viewed as essential indicators of future resilience and brand relevance among younger, socially conscious consumers. Capital investment is increasingly directed towards AI-powered R&D and digital retail infrastructure rather than purely traditional advertising, signaling a fundamental shift in value creation within the sports footwear industry.

The environmental footprint of sports shoe manufacturing is a growing area of regulatory and consumer scrutiny. Traditional processes involve significant use of petrochemicals, adhesives, and large volumes of water, resulting in substantial carbon emissions. The industry's response involves holistic lifecycle assessment, focusing on reducing the impact at every stage, from material cultivation to manufacturing and disposal. Innovations include the development of solvent-free bonding methods, utilization of waste rubber and textiles, and the launch of product take-back and recycling programs designed to close the loop on material usage. These sustainability investments, while initially costly, are fast becoming a necessary prerequisite for maintaining market access, especially in highly regulated European markets, and are actively integrated into brand storytelling to enhance competitive positioning and align with Generation Z purchasing values. Transparency regarding environmental, social, and governance (ESG) performance is transitioning from a niche requirement to a core business imperative, reshaping global supply chain auditing practices.

Further technological exploration must address the seamless integration of digital health ecosystems. Future sports shoes are expected to function as sophisticated biometric monitoring devices, providing highly accurate data on gait, impact forces, and fatigue levels directly to users and professional trainers. This integration requires advancements in miniaturized, durable sensor technology and robust data processing algorithms capable of providing actionable real-time insights without compromising the shoe's primary function or comfort. Ethical concerns surrounding user data privacy and security are paramount in this domain, requiring brands to establish transparent data governance policies and secure encryption protocols. The potential for personalized coaching and injury prediction, leveraging AI analysis of footwear-derived biomechanical data, represents a massive potential growth segment, effectively merging the sports shoe market with the broader digital health and wellness industry, offering subscription-based services built around personalized performance insights.

The influence of socio-cultural trends, specifically the normalization of fitness, is critical to sustained market expansion. Globally, the rise of social media platforms has amplified fitness challenges, shared running routes, and community-driven sports participation, generating consistent consumer demand for high-quality, aspirational athletic footwear. Furthermore, collaborations between sportswear brands and non-traditional partners, such as artists, musicians, and haute couture designers, have successfully positioned certain product lines as cultural artifacts and investment pieces rather than mere performance equipment. This strategy drives cyclical demand, particularly in the sneakerhead culture, where scarcity and exclusivity lead to significant secondary market activity and drive brand buzz. Maintaining relevance in this rapidly changing cultural landscape requires continuous engagement with emerging trends, rapid design adaptation, and strategic limited-edition releases to maintain high perceived brand desirability and cultural cachet across diverse youth segments globally.

The specialized performance segments are increasingly focusing on extreme or niche sports, reflecting market maturity in core categories. For instance, the market for trail running shoes demands distinct technological features focused on superior grip, rugged durability, and protection against environmental elements, differentiating them sharply from road running counterparts. Similarly, specialized indoor court shoes require non-marking soles and lateral stability features unique to sports like volleyball or badminton. Targeting these niche segments successfully requires deep understanding of specific athletic requirements and collaboration with specialized athletes and communities. While these segments may not command the volume of the general fitness market, they often feature high ASPs and allow brands to demonstrate their specialized engineering capabilities, creating a halo effect that boosts credibility across the entire product portfolio and sustaining incremental revenue growth through highly committed consumer bases.

The detailed segmentation by end-user, particularly the women's category, highlights a significant shift in design focus. Historical design practices often utilized scaled-down versions of men’s shoes, but modern market leaders are investing in research specific to female foot morphology, gait patterns, and style preferences. This results in products offering better fit, reduced injury rates, and aesthetically appealing designs that cater to the rapidly increasing participation of women in running, HIIT, and specialized training programs. The kids' segment also presents unique challenges and opportunities, driven by the need for durable, supportive, and frequently replaced footwear necessary for rapid growth and high-impact activity. Marketing in the kids' segment must appeal to both the children (style) and the parents (value, safety, and durability), often leveraging family-focused media and digital channels for effective outreach. Recognizing and addressing the specific technical and aesthetic needs of these non-male segments is fundamental to maximizing overall market penetration and growth through 2033.

Finally, governmental influence, particularly in large developing markets, acts as a subtle but powerful market driver. Initiatives promoting public health, physical education, and hosting international sporting events (like the Olympics or World Cups) necessitate substantial investment in sports infrastructure and increase public awareness and participation, directly translating into higher demand for athletic footwear. These macro factors provide a stable foundation for long-term investment by global brands in emerging economies, often alongside local manufacturing partnerships to comply with regulatory requirements and minimize logistical complexities. Brands that successfully align their corporate social responsibility (CSR) initiatives with governmental health mandates are often better positioned to secure favorable regulatory treatment and public goodwill, further solidifying their competitive standing within complex international markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager