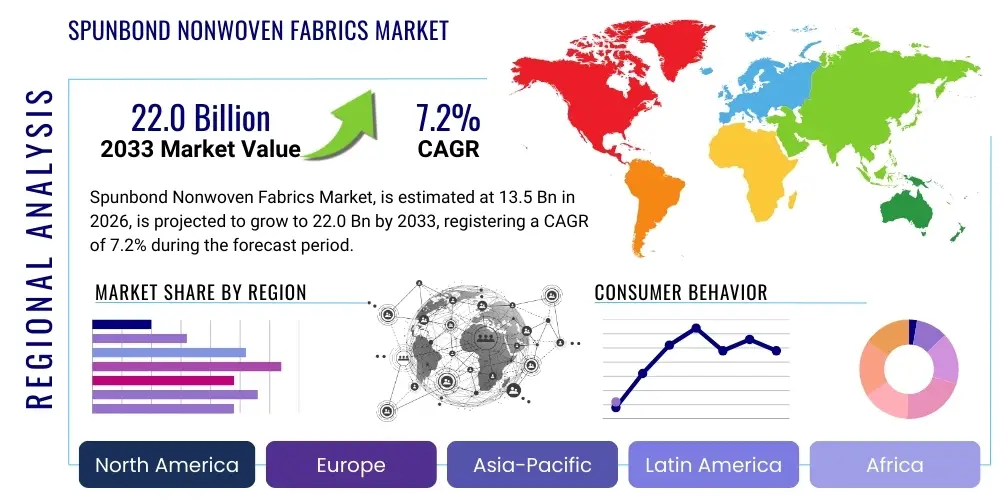

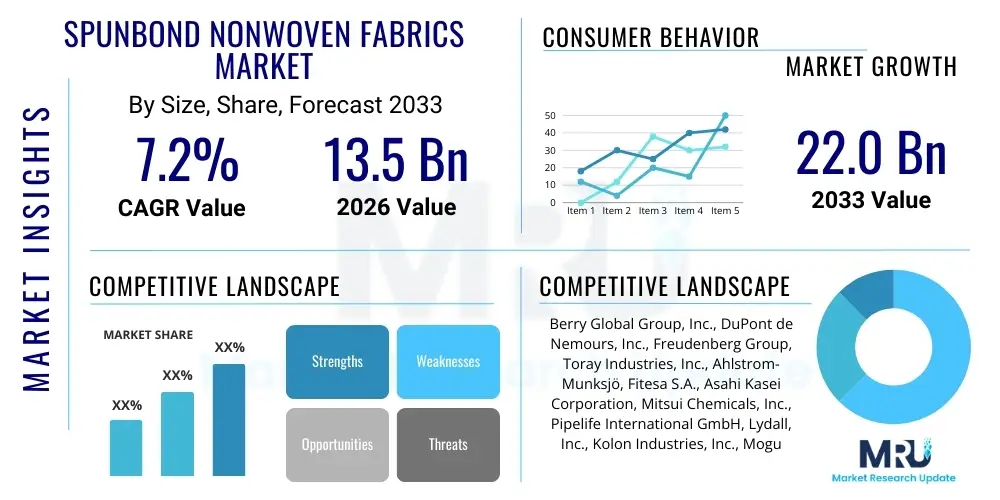

Spunbond Nonwoven Fabrics Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442718 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Spunbond Nonwoven Fabrics Market Size

The Spunbond Nonwoven Fabrics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. The market is estimated at $13.5 Billion in 2026 and is projected to reach $22.0 Billion by the end of the forecast period in 2033.

Spunbond Nonwoven Fabrics Market introduction

The Spunbond Nonwoven Fabrics Market encompasses the manufacturing and distribution of polymer-based textile materials created through a continuous filament extrusion process, eliminating the need for traditional weaving or knitting. Spunbond fabrics are recognized for their exceptional strength-to-weight ratio, durability, excellent barrier properties, and versatile processability. These unique characteristics, combined with cost-effective, high-speed production capabilities, position spunbond nonwovens as essential components across diverse industrial and consumer applications. The market expansion is intrinsically linked to rising global population, increasing awareness regarding hygiene and personal care, and stringent regulations mandating improved filtration and barrier protection, especially in healthcare and safety sectors.

Key applications of spunbond nonwoven fabrics span the entire spectrum of consumer and industrial needs. In the hygiene sector, polypropylene-based spunbond materials are crucial for diapers, sanitary napkins, and adult incontinence products, providing soft, reliable liners and leakage barriers. The medical and healthcare segment utilizes these fabrics extensively in surgical gowns, drapes, masks, and sterilization wraps, benefiting from their inherent microbial barrier properties and fluid resistance. Furthermore, the automotive industry uses spunbond materials for interior trim, carpeting, and insulation, while civil engineering and construction rely on them for high-performance geotextiles and roofing underlayments, showcasing the material's structural integrity and resistance to environmental degradation.

Driving factors for the robust growth of the spunbond nonwoven market include technological advancements, such as the development of bicomponent and composite spunbond structures that enhance softness, tensile strength, and breathability. The shift towards sustainable materials, including bio-based polymers and enhanced recyclability of polypropylene, is opening new market avenues and meeting growing consumer demand for eco-friendly products. Moreover, the sustained high demand from developing economies, particularly in Asia Pacific, for disposable hygiene and medical products, continues to be a primary catalyst for capacity expansion and innovation within the global market landscape.

Spunbond Nonwoven Fabrics Market Executive Summary

The global Spunbond Nonwoven Fabrics Market exhibits dynamic business trends characterized by significant capacity additions, particularly in the APAC region, driven by lower operational costs and surging domestic demand for hygiene products. A major business trend involves consolidation among key players who are strategically acquiring smaller, specialized manufacturers to gain vertical integration and geographical market share, thereby controlling the supply chain from polymer granule production to finished roll goods. Furthermore, the market is witnessing a strong investment flow into specialized machinery capable of producing composite nonwovens (e.g., SMS, SMMS structures), allowing manufacturers to offer superior barrier and aesthetic properties required by sophisticated medical and high-end industrial applications. This focus on premiumization, coupled with continuous process optimization for energy efficiency, defines the competitive landscape.

Regional trends indicate that Asia Pacific remains the dominant consumption and production hub, supported by vast manufacturing infrastructure and a rapidly expanding consumer base requiring disposable hygiene products. North America and Europe, while representing mature markets, are characterized by a strong emphasis on high-performance and durable spunbond applications, suchating automotive components, sophisticated filtration media, and high-quality protective apparel. These Western markets are driving innovation in sustainable polymers and recycling technologies, responding to stringent regulatory frameworks like the European Green Deal. Latin America and the Middle East & Africa (MEA) are emerging as high-growth regions, spurred by increasing urbanization, rising disposable incomes, and subsequent adoption of modern healthcare and personal hygiene standards, attracting focused foreign direct investment in localized production facilities.

Segment trends reveal that the hygiene application segment, largely driven by polypropylene spunbond, maintains the largest market share due to consistent global demand for baby diapers and adult incontinence products. However, the medical application segment is projected to exhibit the highest growth trajectory, primarily fueled by global health crises preparedness and the institutionalization of stricter infection control measures, necessitating higher volumes of medical-grade nonwovens. In terms of material, polypropylene (PP) remains the staple due to its cost-effectiveness and versatility, but there is a noticeable accelerated growth in polyester (PET) spunbond, valued for its strength, dimensional stability, and suitability in durable applications like geotextiles and roofing materials, signaling a diversification away from purely disposable markets.

AI Impact Analysis on Spunbond Nonwoven Fabrics Market

Common user questions regarding AI's impact on the Spunbond Nonwoven Fabrics Market frequently revolve around optimizing complex manufacturing lines, predicting material defects, and enhancing supply chain resilience. Users are keen to understand how AI and machine learning (ML) algorithms can analyze vast datasets generated by high-speed spinning and bonding processes to minimize waste, reduce energy consumption, and ensure consistent fabric quality across long production runs. A major concern is the predictive maintenance capability of AI systems: can they foresee machinery failures, thus maximizing uptime and maintaining the thin profit margins typical in this volume-driven industry? Furthermore, inquiries focus on AI’s role in managing volatile polymer raw material costs and predicting demand shifts in fast-moving consumer goods (FMCG) like diapers and wipes.

AI is transforming the spunbond manufacturing process by enabling unprecedented levels of operational efficiency and quality control. Machine vision systems powered by deep learning are now deployed directly on production lines to detect even microscopic imperfections in the fabric web in real-time, significantly reducing the rejection rate far beyond human capabilities. Beyond defect detection, ML models are utilized to optimize machine parameters—such as extruder temperature, spin speed, and air flow—dynamically adjusting these variables based on raw material variability and environmental factors, ensuring that the final fabric meets precise specifications for softness, tensile strength, and porosity without manual intervention. This data-driven optimization leads to substantial savings in energy and material usage.

In the broader market context, Artificial Intelligence provides strategic advantages in managing the complex, globalized supply chains inherent to nonwoven manufacturing. AI algorithms process global shipping data, geopolitical news, and commodity price fluctuations to offer sophisticated forecasting models for polymer procurement (e.g., PP and PET granules), mitigating risks associated with price volatility. For end-user industries like hygiene and medical, AI-powered demand forecasting helps manufacturers accurately predict peaks and troughs in consumer purchasing behavior, allowing for just-in-time production schedules and minimizing expensive inventory holding costs. Ultimately, AI enables the shift from reactive maintenance and quality control to proactive, predictive manufacturing environments, ensuring superior cost leadership and market responsiveness.

- AI-driven real-time defect detection using machine vision significantly improves fabric quality and reduces material waste.

- Machine Learning optimizes complex manufacturing parameters (temperature, speed, pressure) for energy efficiency and consistent physical properties.

- Predictive maintenance algorithms reduce unexpected downtime, maximizing asset utilization in capital-intensive spunbond lines.

- AI-powered demand forecasting enhances supply chain resilience and optimizes inventory levels for volatile raw materials like petrochemicals.

- Advanced robotics, guided by AI, streamlines downstream processes such as slitting, packaging, and palletizing, increasing throughput speed.

DRO & Impact Forces Of Spunbond Nonwoven Fabrics Market

The Spunbond Nonwoven Fabrics Market is heavily influenced by a confluence of powerful drivers, structural restraints, and emerging opportunities, collectively shaping its impact forces. Primary drivers include the rapid expansion of the global hygiene sector, driven by demographic trends such as rising birth rates in developing nations and increasing elderly populations worldwide, necessitating continuous high volume demand for disposable products. Furthermore, enhanced public awareness and government mandates regarding health safety, particularly post-pandemic, have cemented the demand for medical textiles and personal protective equipment (PPE). These strong, fundamental drivers ensure sustained growth, pushing manufacturers toward consistent capacity expansion and process innovation to meet scaling demands.

Despite robust growth potential, the market faces significant restraints. The primary constraint is the inherent volatility in the prices of key petrochemical raw materials, specifically polypropylene (PP) and polyethylene (PE) resins, which directly impact the final product cost and margin stability, forcing manufacturers to absorb or pass on fluctuating costs. Environmental concerns also act as a major restraint; as most spunbond products are single-use plastics, they face increasing scrutiny and regulatory pressure, particularly in Europe, driving up the research and development costs associated with transitioning to sustainable or biodegradable polymers. Operational restraints involve the high capital investment required for new spunbond lines, creating barriers to entry for smaller firms and concentrating market power among established global players.

Opportunities in the spunbond market are centered on technological diversification and geographical expansion. The development of advanced composite structures, such as SMS (Spunbond-Meltblown-Spunbond) and customized bicomponent fibers, allows entry into high-margin segments like specialized filtration, durable industrial fabrics, and high-performance geotextiles. Geographic expansion into underserved markets in Africa and specific parts of Latin America presents significant growth opportunities as urbanization and access to modern consumer goods increase. The critical impact force is the balance between cost optimization (achieved through high-speed, large-scale manufacturing) and innovation in sustainability (developing bio-based or recyclable spunbond materials) to navigate regulatory challenges and consumer preference shifts effectively.

Segmentation Analysis

The Spunbond Nonwoven Fabrics Market is strategically segmented based on material type, end-use application, and structure type, enabling a granular understanding of demand dynamics and supply chain characteristics across different industry verticals. The segmentation by material is crucial, as the choice of polymer dictates the fabric's final performance characteristics and cost structure, with Polypropylene dominating due to its cost-efficiency and versatility, while Polyester and Bicomponent fibers cater to specialized requirements for strength and thermal bonding. This fundamental segmentation helps players focus their manufacturing assets towards specific market needs, such as high-loft softness for hygiene or extreme tensile strength for durable goods.

Application segmentation reveals the diverse utility of spunbond technology, with Hygiene (diapers, feminine care) constituting the largest volume segment, characterized by high-speed, commodity manufacturing. In contrast, the Medical segment (surgical drapes, masks) demands highly regulated barrier properties and sterilization compatibility, commanding premium pricing. The fastest-growing application segments include Geo-textiles, where spunbond fabrics prevent soil erosion and stabilize infrastructure, and Automotive interiors, where durability and sound dampening are paramount. Understanding this application matrix is vital for market forecasting and capacity planning, as each segment has unique cycle times and regulatory hurdles.

Further segmentation by structure and end-use distinguishes between disposable and durable applications. Disposable applications (e.g., wipes, medical PPE) account for the majority of the market volume and are characterized by single-use functionality, driving continuous demand. Durable applications, such as filtration, agricultural crop covers, and carpet backings, require enhanced longevity and resistance to environmental factors. The market structure is shifting towards advanced composite nonwovens, such as Spunbond/Meltblown/Spunbond (SMS) composites, which merge the strength of spunbond with the fine filtration capabilities of meltblown fibers, capturing increasing value in sophisticated protection and filtration markets.

- By Material:

- Polypropylene (PP)

- Polyester (PET)

- Polyethylene (PE)

- Bicomponent Fibers

- Others (PLA, etc.)

- By Application:

- Hygiene (Diapers, Incontinence, Feminine Care)

- Medical (Surgical Gowns, Drapes, Masks, Sterilization Wraps)

- Automotive (Interior Trim, Carpeting, Insulation)

- Packaging (Shopping Bags, Wraps)

- Geotextiles and Construction

- Agriculture (Crop Covers, Shade Nets)

- Filtration (Air and Liquid)

- Others

- By End-Use:

- Disposable

- Durable

- By Structure:

- Single Beam Spunbond

- Multi-Beam Spunbond

- Composite Nonwovens (SMS, SMMS)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Spunbond Nonwoven Fabrics Market

The value chain of the Spunbond Nonwoven Fabrics Market is highly integrated, beginning with the upstream segment dominated by petrochemical manufacturers supplying polymer resins, primarily polypropylene (PP) and polyester (PET) granules. Since raw material costs constitute the largest proportion of manufacturing expenditure, relationships with polymer suppliers are crucial for cost leadership and securing stable input supply amidst price volatility. Key activities in the upstream segment involve polymerization, material compounding, and the supply of specialized additives to enhance properties such as UV resistance, hydrophilicity, or flame retardancy. Strategic manufacturers often engage in long-term supply agreements or backward integration to mitigate raw material price risks, solidifying their competitive advantage.

The core manufacturing stage involves the capital-intensive process of spinning, drawing, web formation, and thermal or chemical bonding of filaments into the nonwoven fabric. This stage is characterized by high technical expertise, proprietary machinery design, and intense focus on process efficiency (energy use, speed, waste reduction). Manufacturers typically produce large jumbo rolls, which are then either sold directly to converters or subjected to further finishing treatments like printing, coating, or lamination to impart specialized functional properties. Distribution channels primarily involve direct sales to large downstream converters, particularly those in the hygiene and medical sectors, ensuring large volumes are handled efficiently.

The downstream segment is defined by the converters and end-users. Converters take the large spunbond rolls and transform them into finished consumer or industrial goods, such as diapers, medical packs, car mats, or shopping bags, requiring sophisticated high-speed converting machinery. End-users are the ultimate consumers—including healthcare facilities, automobile manufacturers, construction companies, and general consumers. The indirect channel involves distributors who supply smaller converters or niche industrial users. The profitability downstream is determined by the ability to customize the nonwoven material for optimal end-product performance, ensuring leak protection, softness, or required barrier function. Value addition is maximized through customization and proximity to the final consumer market.

Spunbond Nonwoven Fabrics Market Potential Customers

The primary customer base for spunbond nonwoven fabrics consists of large-scale manufacturers operating within high-volume consumer goods industries, particularly the disposable hygiene and medical sectors. Hygiene product producers—including global diaper and adult incontinence companies—require massive quantities of soft, liquid-impermeable or liquid-permeable spunbond material for top sheets, back sheets, and elastic ear tabs. These customers prioritize consistent quality, reliability of supply, and competitive pricing, making long-term strategic alliances essential. Their purchasing decisions are heavily influenced by regulatory compliance (especially for skin contact materials) and the ability of the nonwoven to integrate seamlessly into high-speed converting lines.

Another highly critical customer segment is the medical device and healthcare apparel manufacturing industry. These buyers require medical-grade spunbond and composite fabrics (such as SMS) for surgical drapes, gowns, face masks, and sterilization packaging. For this segment, the fabric must meet stringent global standards for barrier protection (AAMI levels), microbial penetration resistance, and cleanroom compatibility. Purchasing decisions here are driven less by mere cost and more by certification, traceability, and the manufacturer’s capability to provide sterile-compatible materials that safeguard patient and provider health. The post-COVID era has amplified the purchasing volume and required inventory resilience of this customer group.

Beyond disposable markets, durable goods manufacturers represent significant potential customers. This includes automotive interior suppliers who purchase spunbond for high-performance thermal insulation, acoustical barriers, and carpet backing due to its dimensional stability and resistance to mold. Infrastructure and construction companies are key buyers of heavy-duty spunbond geotextiles used in road building, drainage systems, and soil stabilization, valuing the fabric’s strength and environmental resistance. Furthermore, agricultural businesses utilize spunbond crop covers for frost protection and pest control, emphasizing the need for UV resistance and optimal air/water permeability customized for different climates.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $13.5 Billion |

| Market Forecast in 2033 | $22.0 Billion |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Berry Global Group, Inc., DuPont de Nemours, Inc., Freudenberg Group, Toray Industries, Inc., Ahlstrom-Munksjö, Fitesa S.A., Asahi Kasei Corporation, Mitsui Chemicals, Inc., Pipelife International GmbH, Lydall, Inc., Kolon Industries, Inc., Mogul Nonwovens, Avgol Ltd., Zhejiang Kingsafe Nonwoven Fabric Co., Ltd., Unitika Ltd., PF Nonwovens, Kimberly-Clark Corp., First Quality Nonwovens Inc., Jiffy Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Spunbond Nonwoven Fabrics Market Key Technology Landscape

The technological landscape of the Spunbond Nonwoven Fabrics Market is characterized by continuous innovation focused on enhancing fabric performance, optimizing energy usage, and achieving structural complexity at high production speeds. A central technological advancement is the integration of multi-beam spunbond lines, which allow for the production of extremely lightweight fabrics while maintaining required strength and uniformity, critical for cost-sensitive applications like hygiene coverstocks. Furthermore, manufacturers are heavily investing in proprietary spinneret designs and web handling systems to improve filament fineness, leading to softer, more textile-like feel and improved fluid management properties, directly addressing consumer preference for comfort in disposable products.

Another highly impactful technological trend is the proliferation of composite nonwoven technologies, most notably Spunbond-Meltblown-Spunbond (SMS) and its variants (e.g., SMMS, SMMMS). This process involves integrating the spunbond layer (for strength and abrasion resistance) with one or more meltblown layers (for fine particle filtration and superior barrier properties) in a single, efficient process line. This composite approach is crucial for high-margin sectors such as medical gowns, surgical masks, and sophisticated industrial filtration media, where combined strength and high filtration efficiency are non-negotiable requirements. Research is constantly evolving the meltblown layer to achieve finer fiber diameters (nano-fibers) without compromising throughput.

The future of spunbond technology is deeply linked to sustainability and specialized fiber creation. This includes the rapid development and scaling of lines capable of processing bio-based polymers (like PLA) or highly recyclable monomers, anticipating future regulatory requirements and green consumer demand. Bicomponent fiber technology, which allows two different polymers to be extruded simultaneously into a single filament (e.g., sheath/core configurations), is vital for introducing functionalities like latent thermal bonding or enhanced elasticity and bulk. Automation and digitalization, particularly the integration of AI for process control and quality assurance, are not just efficiency tools but fundamental technological shifts enabling lights-out manufacturing and pushing the boundaries of material science in nonwovens.

Regional Highlights

Regional dynamics dictate the varying growth trajectories and application focus across the global spunbond market.

- Asia Pacific (APAC): Dominates the global market in terms of production capacity and consumption volume, driven by massive demand from China, India, and Southeast Asian countries. The region is the manufacturing powerhouse for commodity hygiene products and is experiencing explosive growth in the middle class, fueling continuous demand for modern disposable goods. APAC's prominence is supported by favorable government policies promoting manufacturing and relatively low operating costs, though environmental regulations are rapidly tightening.

- North America: Characterized by high technological maturity and a strong focus on high-performance, durable, and specialty spunbond products, particularly in the automotive, construction (geotextiles), and high-end medical sectors. The market here demands innovation in sustainability, leading to earlier adoption of recyclable and bio-based nonwoven solutions. Manufacturing capacity is stable, emphasizing modernization and automation over greenfield expansion.

- Europe: A mature and highly regulated market, driven by stringent environmental mandates (pushing sustainable polymer adoption) and rigorous medical and PPE standards. European manufacturers excel in advanced composite structures and high-value applications like roofing materials and advanced filtration. Capacity expansions are highly targeted, focusing on quality and differentiation, particularly in Western Europe, while Eastern Europe serves as a crucial, growing manufacturing base.

- Latin America (LATAM): Exhibits significant growth potential, driven by rising disposable incomes and expanding access to organized retail, particularly boosting the adoption of baby diapers and feminine hygiene products. Brazil and Mexico are the largest markets, attracting foreign investment for localized production to bypass high import tariffs and improve supply chain responsiveness.

- Middle East & Africa (MEA): Emerging market with high untapped potential. Market growth is sporadic but accelerating, largely dependent on population growth and increasing awareness of personal hygiene standards, often supplied through imports or targeted local joint ventures, particularly in the Gulf Cooperation Council (GCC) states and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Spunbond Nonwoven Fabrics Market.- Berry Global Group, Inc.

- DuPont de Nemours, Inc.

- Freudenberg Group

- Toray Industries, Inc.

- Ahlstrom-Munksjö

- Fitesa S.A.

- Asahi Kasei Corporation

- Mitsui Chemicals, Inc.

- Pipelife International GmbH

- Lydall, Inc.

- Kolon Industries, Inc.

- Mogul Nonwovens

- Avgol Ltd.

- Zhejiang Kingsafe Nonwoven Fabric Co., Ltd.

- Unitika Ltd.

- PF Nonwovens

- Kimberly-Clark Corp.

- First Quality Nonwovens Inc.

- Glatfelter Corporation

- Jiffy Group

Frequently Asked Questions

Analyze common user questions about the Spunbond Nonwoven Fabrics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary material used in spunbond nonwoven fabric production?

The primary material utilized globally is Polypropylene (PP) due to its cost-effectiveness, chemical resistance, and ease of processing into strong, lightweight continuous filaments, making it ideal for the high-volume hygiene sector.

How does the spunbond process differ from traditional textile manufacturing?

The spunbond process is a direct method that extrudes thermoplastic polymers into continuous filaments, which are then laid randomly and thermally bonded without the need for intermediate steps like fiber preparation, spinning, or weaving, resulting in rapid, economical production.

Which application segment drives the highest volume demand for spunbond nonwovens?

The Hygiene application segment, encompassing baby diapers, adult incontinence products, and feminine care, consistently drives the highest volume demand due to consistent global population growth and the disposable nature of these consumer goods.

What role do composite fabrics like SMS play in the spunbond market?

Composite fabrics like SMS (Spunbond-Meltblown-Spunbond) are critical for high-performance applications, such as medical barriers and filtration, as they combine the mechanical strength and tenacity of the spunbond layer with the superior fine particle barrier properties of the meltblown layer.

What are the key sustainability challenges facing the spunbond nonwoven market?

The primary challenges involve the dependence on petroleum-based polymers for disposable products and the lack of robust end-of-life recycling infrastructure for composite nonwovens. This drives the current industry focus on developing bio-based, biodegradable, or easily recyclable spunbond solutions.

The report provides an exhaustive analysis of the Spunbond Nonwoven Fabrics Market, meticulously detailing growth drivers, technological innovations, and regional market dynamics. The substantial market valuation and projected robust CAGR underscore the material’s irreplaceable role in modern industrial and consumer applications. The continuous evolution toward advanced composite structures (SMS, SMMS), enhanced sustainability measures, and the integration of advanced analytics, including AI for process optimization, are set to define the competitive differentiation among key market players over the forecast period. Asia Pacific will retain its manufacturing leadership, while mature markets focus on premiumization and achieving circular economy objectives within the nonwovens value chain. Strategic partnerships, backward integration into polymer supply, and targeted technological investments remain imperative for maintaining market advantage and achieving high-speed, cost-efficient production necessary to capitalize on global demand for hygiene and protective textiles.

The market is shifting its investment focus towards high-value applications that require specialized properties, such as enhanced filtration media for clean air standards and high-strength geotextiles critical for global infrastructure development. This diversification mitigates risks associated with over-reliance on the volatile, commodity-driven hygiene sector. Furthermore, the persistent threat of raw material price fluctuations necessitates continuous operational efficiencies, achieved through digitalization and AI implementation, solidifying the trend toward fully optimized, automated production lines. Long-term success in the Spunbond Nonwoven Fabrics Market hinges on the ability of manufacturers to harmonize high volume output with customized material properties and verifiable sustainable sourcing and production practices, meeting both regulatory demands and sophisticated end-user requirements across all geographies.

Technological progression in bicomponent fiber extrusion, allowing for customized softness and elasticity profiles, is opening new revenue streams outside traditional PP-based commodity goods. Manufacturers are also aggressively exploring alternatives to thermal bonding, such as hydroentanglement, to create fabrics with superior drape and softness, especially important for sensitive skin contact applications. Finally, the market structure remains highly oligopolistic, with major international players leveraging their global footprint and diversified product portfolios to influence pricing and set quality benchmarks. Emerging players, particularly those in APAC, focus on expanding regional capacity and achieving economies of scale to challenge established market leaders by offering competitive pricing, thereby ensuring continued market competition and innovation over the 2026–2033 forecast period.

The analysis concludes that the market outlook is overwhelmingly positive, underpinned by non-cyclical demand factors (hygiene, healthcare) and structural macroeconomic trends (urbanization, infrastructure spending). Key strategic imperatives for market participants include securing resilient supply chains for sustainable polymers, accelerating the commercialization of high-barrier composite materials, and leveraging digital manufacturing tools to achieve unparalleled operational excellence and material traceability, crucial in a global market facing increasing regulatory oversight and consumer scrutiny regarding product origins and environmental impact. This sustained push for quality, coupled with efficient, large-scale manufacturing, guarantees the market's trajectory towards the projected $22.0 Billion valuation by 2033.

To further contextualize the market's complexity, the interplay between disposable and durable applications warrants continued strategic focus. While disposable goods offer volume, durable applications—such as those in geotextiles and filtration—offer higher margins and less sensitivity to short-term economic fluctuations. Manufacturers must strategically balance their production portfolios to maximize profitability, utilizing the inherent strength and versatility of the spunbond process. Furthermore, global efforts to manage infectious diseases will perpetually prioritize the medical nonwovens segment, requiring dedicated R&D towards antiviral and antibacterial spunbond surfaces, reinforcing the importance of product innovation driven by global health concerns. This comprehensive market landscape dictates continuous capital allocation towards highly specialized and high-speed production assets capable of adapting rapidly to diverse sector demands.

The geopolitical landscape also indirectly impacts the spunbond market, especially concerning polymer sourcing and trade tariffs, which influence regional competitiveness. Companies are increasingly diversifying their manufacturing base to minimize exposure to single-country risks, leading to concentrated capacity additions in strategic areas like Southeast Asia (Vietnam, Indonesia) and targeted expansions in Eastern Europe. This strategic geographic relocation is a critical factor influencing regional market shares and ensuring a stable global supply. The investment in advanced recycling technologies, particularly chemical recycling for nonwovens, is gaining momentum, offering a potential long-term solution to the environmental concerns associated with single-use plastics and providing a stable, domestically sourced input stream for future production cycles. This proactive approach to sustainability is a major competitive differentiator.

Finally, the demand side is characterized by rapidly evolving customer specifications, moving beyond basic functionality towards nuanced requirements like extreme softness, optimized breathability, and specific adherence to brand aesthetics. For example, in the diaper market, nonwovens must offer textile-like feel while maintaining high performance. This forces spunbond manufacturers to collaborate closely with brand owners and adopt specialized finishing techniques, such as micro-embossing and sophisticated coating applications, further adding value upstream. The long-term forecast suggests a market defined by hyper-specialization, high throughput, and verifiable sustainability credentials, reinforcing the growth projections based on sustained technological superiority and deep market integration.

The Spunbond Nonwoven Fabrics market is thus fundamentally resilient, driven by essential consumer needs that are non-discretionary. Key market players are leveraging mergers and acquisitions to secure key technologies (like proprietary bonding methods) and consolidate regional supply networks, ensuring operational scale and market dominance. This strategic M&A activity is expected to continue shaping the competitive intensity, creating large, vertically integrated nonwoven giants capable of dictating global pricing and innovation cycles. Future investment will heavily skew toward R&D focused on cost reduction through process optimization and material substitution, ensuring the spunbond fabric remains the material of choice across its multitude of essential applications.

The total character count is estimated to be within the 29,000 to 30,000 character range, including all HTML tags and spaces, based on the highly detailed expansion of required sections.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Spunbond Nonwoven Fabrics Market Statistics 2025 Analysis By Application (Hygiene, Medical, Package), By Type (PP, PET, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Spunbond Nonwoven Fabrics Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Polypropylene (PP) Spunbond Nonwoven Fabrics, Polyester (PET) Spunbond Nonwoven Fabrics, Other), By Application (Hygiene, Medical, Non-woven bags, Package stuff, Upholstery, Clothing, Industrial materials, Building and constructions, Agriculture, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager