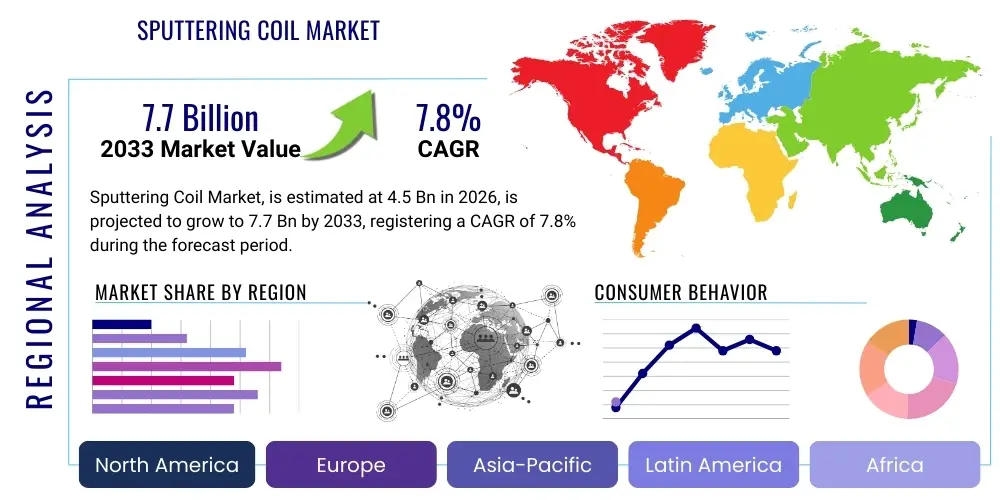

Sputtering Coil Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441627 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Sputtering Coil Market Size

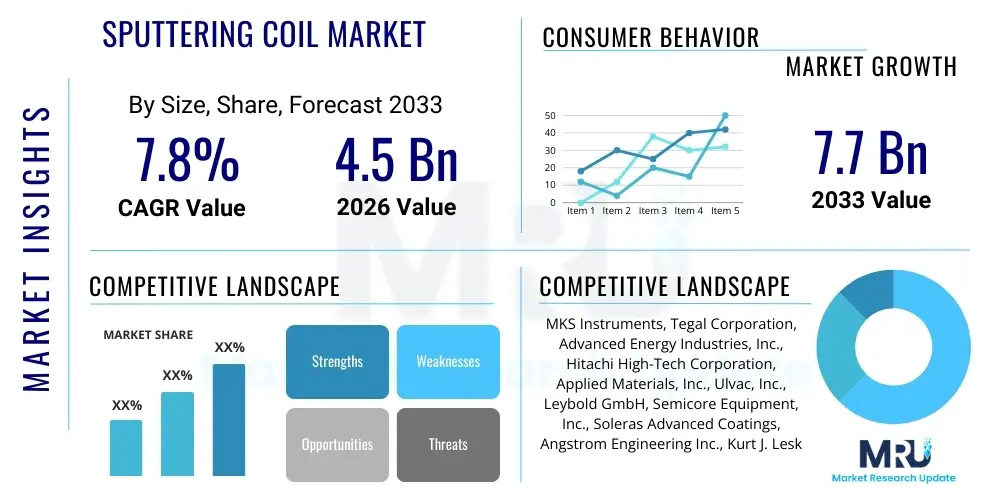

The Sputtering Coil Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.7 Billion by the end of the forecast period in 2033.

Sputtering Coil Market introduction

The Sputtering Coil Market encompasses high-precision magnetic components essential for physical vapor deposition (PVD) processes, predominantly utilized in the manufacturing of semiconductors, flat-panel displays, solar cells, and advanced architectural glass coatings. Sputtering coils, often integrated into magnetron configurations, are critical for confining and manipulating the plasma generated during the sputtering process. This magnetic field, generated by the coils or magnet arrays, ensures uniform erosion of the target material, resulting in high deposition rates and exceptional film uniformity and quality. The inherent necessity of these components for creating complex, multi-layered thin films across various high-tech industries firmly establishes the market as a foundational element within advanced material science and microfabrication.

Sputtering coils fundamentally enhance the efficiency and stability of thin-film deposition systems. Their primary product description involves intricate assemblies of magnetic materials (such as neodymium or samarium cobalt) and conductive coils designed to operate under high vacuum and temperature conditions. Major applications span high-end logic chips, memory devices (NAND and DRAM), OLED and QLED displays, photovoltaic modules, and wear-resistant coatings for automotive and medical devices. The coils are tailored to specific cathode geometries, including planar, cylindrical, and conical magnetrons, dictating the magnetic field profile and, subsequently, the characteristics of the deposited film, such as adhesion, density, and crystalline structure, which are paramount for device performance.

The market is currently driven by several macro-economic and technological factors, notably the rapid expansion of 5G infrastructure, the escalating demand for high-resolution displays (4K/8K), and the global shift towards renewable energy, necessitating more efficient thin-film solar technologies. Key benefits provided by high-quality sputtering coils include enhanced target utilization, which significantly reduces operational costs, improved plasma stability, leading to fewer defects and higher production yields, and the capability to deposit highly specialized materials with tight thickness tolerances. This foundational role in producing critical components for the digital economy and sustainable energy sectors guarantees sustained investment and technological evolution within the sputtering coil domain, making it a critical area for material science innovation.

Sputtering Coil Market Executive Summary

The Sputtering Coil Market is experiencing robust expansion, primarily fueled by accelerated investments in advanced semiconductor fabrication facilities (fabs) across Asia Pacific, particularly in Taiwan, South Korea, and China. Business trends indicate a strong move towards optimizing magnetron design for increased power density and reduced maintenance cycles, leading to greater adoption of rotary cathode sputtering systems over traditional planar configurations for high-volume manufacturing. This shift is highly correlated with the push for larger substrate sizes in both display and semiconductor industries, demanding larger, more complex, and highly uniform magnetic assemblies. Strategic collaborations between material suppliers, coil manufacturers, and PVD equipment OEMs are becoming crucial to standardize high-performance components and reduce lead times in a supply chain often constrained by specialized magnetic material availability and complex winding techniques.

Regional trends distinctly highlight Asia Pacific's commanding position, driven by its undeniable dominance in global electronics manufacturing. While North America and Europe maintain technological leadership in research and development and specialized high-performance coatings (aerospace, medical), APAC serves as the primary engine for volume demand, absorbing the vast majority of sputter targets and associated magnetron components. Furthermore, the European market is showing consistent growth, supported by the automotive sector’s transition to electric vehicles, requiring advanced battery electrode coatings and complex functional coatings for autonomous sensor systems. Regulatory trends focused on environmental sustainability are also encouraging manufacturers to develop more energy-efficient coil designs and target materials to minimize power consumption during the vacuum deposition process, aligning with global green manufacturing initiatives.

Segmentation trends confirm the increasing significance of the Semiconductor segment, which, despite requiring the highest precision and smallest coils, commands the highest average selling prices (ASPs) due to stringent quality requirements. The Display segment remains a high-volume consumer, particularly with the proliferation of flexible OLED technology, necessitating novel coil designs capable of handling large-area glass or polymer substrates while maintaining extremely tight uniformity tolerances. Material-wise, high-purity copper and specialized magnetic alloys dominate, with rising demand for fully encapsulated, water-cooled coil assemblies designed for continuous operation in high-throughput environments. The competitive landscape is characterized by niche expertise, with several specialized firms dominating the supply of high-grade coils, focusing on proprietary winding geometries and magnetic field simulation capabilities to gain a critical edge in performance optimization.

AI Impact Analysis on Sputtering Coil Market

Common user questions regarding AI’s impact on the Sputtering Coil Market frequently revolve around how artificial intelligence can mitigate the persistent challenges of plasma instability, optimize target utilization rates, and predict the end-of-life cycle for internal coil components. Users are primarily concerned with leveraging AI for enhanced process control—moving beyond traditional PID loops to sophisticated machine learning algorithms that analyze real-time plasma impedance, temperature fluctuations, and vacuum pressure to dynamically adjust the magnetic field strength and deposition parameters. The key themes summarized from user inquiries indicate high expectations for AI to dramatically improve yield rates by identifying subtle deviations in the sputtering process that are invisible to human operators, ultimately reducing the scrap rate associated with non-uniform thin films in high-value manufacturing segments like advanced chip fabrication.

The implementation of AI/ML models is transforming the predictive maintenance landscape for PVD systems. Sputtering coils, being subject to extreme thermal and electrical stress, degrade over time, impacting plasma uniformity and deposition quality. Users seek AI solutions that analyze vibrational data, cooling water flow rates, and electrical resistance changes within the coil assemblies to predict impending failures before catastrophic system shutdowns occur. This shift towards proactive, condition-based monitoring, rather than reactive or time-based maintenance, promises significant improvements in system uptime and overall equipment effectiveness (OEE), particularly crucial for 24/7 semiconductor fabrication environments where downtime costs are prohibitive and measured in millions of dollars per hour of inactivity.

Furthermore, AI is instrumental in the design and engineering phase of next-generation sputtering coils. Generative design algorithms can rapidly simulate and optimize complex magnetic field geometries tailored for novel target materials or unusual substrate shapes (e.g., highly curved surfaces or flexible substrates), significantly reducing the time required for iterative prototyping and testing. By optimizing the coil winding and magnetic material placement based on thousands of simulated plasma confinement scenarios, AI ensures that newly designed magnetrons achieve optimal target erosion uniformity and maximum material utilization, thereby driving down the per-unit cost of deposited films and accelerating the transition to more advanced sputtering technologies necessary for 3D packaging and heterogeneous integration in electronics.

- AI-driven predictive maintenance for magnetron assembly failure, maximizing uptime.

- Machine Learning algorithms optimize plasma uniformity and deposition rates in real-time.

- Generative design tools accelerate the development of complex magnetic coil geometries.

- Enhanced process control through real-time analysis of electrical and thermal sensor data.

- Improved target utilization rates by dynamically adjusting the magnetic field profile for uniform erosion.

- Automated defect detection in deposited films based on AI visual inspection systems linked to sputtering parameters.

- Optimization of cooling system efficiency for high-power density magnetrons using deep learning models.

DRO & Impact Forces Of Sputtering Coil Market

The market dynamic is characterized by strong drivers rooted in technological advancements and global digitalization, juxtaposed against significant operational restraints and vast opportunities in emerging applications. Key drivers include the exponential growth in semiconductor demand, particularly for advanced node manufacturing (below 7nm), which mandates tighter tolerances and higher reliability from sputtering components. The parallel expansion of the advanced display market (MicroLED and flexible OLEDs) and the increasing complexity of multi-layer deposition processes also strongly push demand. Restraints predominantly center on the high capital expenditure required for sophisticated PVD systems and the vulnerability of the supply chain concerning specialized magnetic materials, which can experience volatility in cost and availability. Furthermore, the complex design and manufacturing process of coils, requiring specialized cleanroom environments and highly precise winding techniques, limit the number of qualified suppliers and often result in long lead times for custom orders, hindering rapid market response.

Opportunities in the Sputtering Coil Market are centered around novel applications and geographical expansion. The burgeoning electric vehicle (EV) battery market presents a massive opportunity for high-performance coatings, including protective layers for lithium-ion battery electrodes and solid-state battery electrolytes, all requiring high-throughput sputtering systems. Similarly, the aerospace and medical device sectors offer high-margin opportunities for coils designed for specialized functional coatings (biocompatible and anti-reflective layers). Impact forces driving the market include competitive intensity among OEMs, where superior sputtering technology serves as a major differentiator, and environmental mandates compelling users to seek energy-efficient components. The force of substitution risk is relatively low, as sputtering remains the gold standard for high-quality, high-density film deposition where thermal budget constraints preclude chemical vapor deposition (CVD) or atomic layer deposition (ALD).

Addressing the restraints necessitates innovation focused on material sourcing and coil modularity. Developing standardized, highly reliable magnetic modules that can be easily serviced or replaced would mitigate downtime and reliance on highly custom designs. The overall impact forces suggest a market characterized by high technical barriers to entry and intense competition centered on performance metrics such as plasma stability (low noise), longevity, and the uniformity of the magnetic field structure across large target areas. These performance factors directly correlate to production yield and material costs for end-users, ensuring that technological superiority remains the dominant competitive force. Furthermore, the persistent demand for greater efficiency in solar power generation and data storage (MRAM, perpendicular magnetic recording) ensures a sustained growth trajectory for specialized, high-performance sputtering coil solutions.

Segmentation Analysis

The Sputtering Coil Market is comprehensively segmented based on its core components, the diverse range of materials sputtered, the end-user application demanding the deposited film, and the type of magnetron configuration employed. Analyzing these segments provides critical insights into specific growth pockets and technological demands across the value chain. Segmentation by product type often focuses on the coil structure, differentiating between circular coils used in standard planar magnetrons and linear or rectangular coils designed for large-area coating systems, such as those used in architectural glass or large-format displays. The material segment is crucial, distinguishing between coils optimized for metal targets (e.g., Aluminum, Copper), dielectric targets (e.g., Silicon Dioxide, Titanium Dioxide), and specialized compound semiconductor targets, each requiring distinct magnetic field characteristics for optimal plasma control and target ionization efficiency.

Application-based segmentation reveals the high-growth areas, with Semiconductors and Displays dominating the market share due to continuous process refinement and volume expansion. Within the Semiconductor segment, demand is bifurcated between front-end-of-line (FEOL) interconnects and back-end-of-line (BEOL) packaging, each having unique demands for coil precision and throughput. The Industrial Coatings segment, encompassing decorative, protective, and anti-friction coatings for tools and automotive parts, represents a stable but moderate growth area. Geographically, segmentation underscores the importance of regional manufacturing hubs, confirming Asia Pacific’s role as the major consumption region, followed by North America and Europe, which focus on high-value, niche applications and R&D activities leading to the next generation of sputter technology.

Furthermore, segmentation by technology type—specifically DC sputtering versus RF sputtering—is pivotal, as the magnetic requirements vary significantly depending on the ionization method. DC sputtering systems, typically used for conductive materials, utilize coils designed primarily for plasma confinement and racetrack uniformity, whereas RF systems, necessary for dielectric materials, require coils that can withstand the potentially disruptive high-frequency electromagnetic fields while maintaining sufficient plasma density. The complexity introduced by these technological variations underscores the need for highly specialized manufacturing capabilities within the sputtering coil supply ecosystem, forcing manufacturers to invest heavily in simulation tools and advanced material encapsulation techniques to ensure component longevity and magnetic field stability under rigorous operating conditions.

- By Product Type:

- Planar Magnetron Coils

- Rotary/Cylindrical Magnetron Coils

- Linear Coils (for large-area deposition)

- Flexible/Custom Geometry Coils

- By Target Material:

- Metal Targets (Aluminum, Copper, Titanium)

- Dielectric Targets (Oxides, Nitrides)

- Compound Targets (ITO, Molybdenum Alloys)

- By Application:

- Semiconductor Devices (Memory, Logic, Interconnects)

- Flat Panel Displays (OLED, QLED, LCD)

- Solar Cells (Thin-Film Photovoltaics)

- Architectural Glass and Automotive Coatings

- Industrial and Decorative Coatings

- By Cooling Method:

- Water-Cooled Coils

- Air-Cooled Coils

Value Chain Analysis For Sputtering Coil Market

The value chain for the Sputtering Coil Market initiates with the upstream supply of specialized raw materials, primarily high-purity magnetic materials (such as various grades of Neodymium Iron Boron, often encapsulated for thermal stability) and high-conductivity materials, predominantly oxygen-free copper, used for the coil windings and internal cooling channels. This upstream segment is highly concentrated, relying on a few specialized refiners and magnet manufacturers, which introduces a critical dependence on geopolitical stability and commodity pricing, particularly for rare earth elements. Manufacturers must employ stringent quality control at this stage, as the purity and magnetic properties of these core materials directly dictate the performance characteristics and longevity of the final sputtering coil assembly, ensuring optimal magnetic flux density and stability during prolonged high-power sputtering operations.

The midstream segment involves the core manufacturing process, which includes precise winding, encapsulation, vacuum sealing, and rigorous testing of the magnetic assemblies. Specialized coil manufacturers and PVD equipment component suppliers utilize advanced machining and automated winding technology to ensure precise geometry and thermal management capabilities, often requiring expertise in high-vacuum feedthrough design and complex fluid dynamics for efficient water cooling. The complexity of manufacturing these high-precision, often custom-designed components acts as a high barrier to entry. Distribution channels for sputtering coils are bifurcated: direct sales occur primarily through Original Equipment Manufacturers (OEMs) who integrate the coils into new PVD systems, and indirect sales involve aftermarket component suppliers and service providers who offer replacements, upgrades, and refurbishment services directly to end-users like semiconductor foundries or coating houses, focusing on rapid delivery and customization.

The downstream analysis focuses on the end-user segments, where the coils are deployed in high-value manufacturing processes. Major buyers include integrated device manufacturers (IDMs), large display fabrication plants (fabs), and specialized job shops providing industrial coatings. The demand is driven not just by new equipment purchases but significantly by routine maintenance and system upgrades, as coils are considered consumables requiring periodic replacement due to erosion and magnetic degradation caused by extreme plasma environments. The relationship between coil suppliers and end-users is crucial, often involving long-term supply agreements and joint development projects to tailor coil characteristics to novel target materials or specific process windows. Success in the downstream market hinges on providing high-reliability components coupled with excellent technical support and rapid replacement cycles to minimize costly operational downtime in highly automated production lines.

Sputtering Coil Market Potential Customers

The primary potential customers for sputtering coils are entities involved in high-precision thin-film deposition across several critical high-technology sectors. Leading this group are Semiconductor Fabrication Plants (Fabs) and Integrated Device Manufacturers (IDMs), who require sputtering coils for the creation of interconnect layers, barrier metals, and magnetic storage elements in logic chips, memory devices (DRAM, NAND flash), and specialized power semiconductors. These customers demand the highest level of uniformity and reliability, often procuring coils directly from established OEMs or highly specialized component suppliers who can guarantee components meeting stringent process standards for sub-micron deposition accuracy and maximum plasma stability, which directly impacts device yield and performance metrics.

Another major customer cluster comprises Flat Panel Display (FPD) Manufacturers, including producers of OLED, QLED, and advanced LCD panels, particularly those focusing on large-area deposition for television screens and mobile device displays. These companies require large, linear sputtering coils capable of coating extensive glass or flexible polymer substrates with high throughput, utilizing materials like Indium Tin Oxide (ITO) for transparent conductive layers. The push towards flexible electronics and large-format displays necessitates coils with highly sophisticated magnetic field profiling to compensate for edge effects and ensure flawless uniformity across vast substrate areas, making these customers continuous buyers of high-volume, performance-critical components for their sputtering array systems.

Beyond electronics, key potential customers include Photovoltaic (PV) Module Manufacturers involved in producing thin-film solar cells (e.g., CIGS or CdTe technology), where high-efficiency deposition of absorber and buffer layers is mandatory. Additionally, Specialized Industrial Coating Houses (Job Shops) that provide services for tool hardening, medical implants, or precision optics represent a diverse, high-value customer base. These firms seek coils tailored for durability and complex material combinations, often utilizing modular sputtering systems that allow for quick interchangeability of magnetron configurations and target materials to meet diverse client specifications. The procurement strategy for these customers focuses heavily on component longevity, ease of maintenance, and the ability of the coil to support a wide process window for various sputtering chemistries.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Growth Rate | CAGR 7.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | MKS Instruments, Tegal Corporation, Advanced Energy Industries, Inc., Hitachi High-Tech Corporation, Applied Materials, Inc., Ulvac, Inc., Leybold GmbH, Semicore Equipment, Inc., Soleras Advanced Coatings, Angstrom Engineering Inc., Kurt J. Lesker Company, Satisloh, Materion Corporation, Veeco Instruments, AJA International, Inc., PVD Products, Inc., Denton Vacuum, Sierra Coating Technologies, K. S. M. High-Tech Co., Ltd., Sumitomo Metal Mining Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sputtering Coil Market Key Technology Landscape

The technological landscape of the Sputtering Coil Market is heavily influenced by advancements in magnetron sputtering technology, focusing intensely on achieving higher deposition rates and exceptional film uniformity across increasingly larger substrates, while simultaneously maximizing target material utilization to reduce manufacturing costs. A core technology remains high-strength permanent magnet assemblies, often utilizing rare earth elements like Neodymium, configured into intricate racetrack patterns or circular arrays designed to confine the plasma (the glow discharge) directly over the target surface. Recent innovations center on pulsed DC and high-power impulse magnetron sputtering (HiPIMS) techniques, which require coils capable of handling extremely high instantaneous power loads and maintaining magnetic field integrity during rapid pulsing cycles, leading to denser films with superior adhesion characteristics, particularly crucial for demanding applications like next-generation interconnects and hard coatings.

A significant shift is observed towards advanced cooling technologies integrated within the coil structure. Due to the high-power input and continuous operation required in modern fabs, sputtering coils generate considerable heat, necessitating sophisticated water-cooling channels engineered directly into the coil assembly or back plate to maintain magnetic field stability and prevent thermal degradation of the magnetic materials. Furthermore, the adoption of rotating/rotary magnetron technology is gaining traction, particularly for large-scale production of architectural glass and flexible substrates. Rotary magnetrons use cylindrical targets and internal magnetic assemblies (including coils) that move, ensuring uniform erosion over the entire target surface area, thus increasing utilization rates from the traditional 30-40% of planar systems to over 80-90%. Coil manufacturers are focused on designing robust, sealed internal magnetic assemblies capable of continuous rotation and long service life under high vacuum.

Another area of intense technological development involves predictive modeling and simulation tools. Manufacturers are increasingly relying on Finite Element Method (FEM) analysis and computational fluid dynamics (CFD) to precisely model the magnetic field profile and thermal performance of new coil designs before physical prototyping. This use of advanced simulation allows for optimization of the magnetic circuit to achieve specific plasma shapes (such as deeply focused or broadly distributed) tailored for unique material combinations or specific substrate dimensions, minimizing trial-and-error costs. Furthermore, the integration of advanced sensors directly into the coil assembly for real-time monitoring of temperature, vibration, and magnetic flux density allows for crucial preventative maintenance and integration with AI-driven process control systems, marking a clear trajectory toward smarter, self-optimizing sputtering component technology within the PVD ecosystem.

Regional Highlights

Regional dynamics play a paramount role in shaping the Sputtering Coil Market, driven largely by the geographical concentration of high-tech manufacturing and the specific focus of regional R&D ecosystems. Asia Pacific (APAC) stands as the undisputed market leader, accounting for the largest share of both consumption and production. This dominance is attributable to the concentration of the world’s major semiconductor foundries (TSMC, Samsung, SK Hynix), flat panel display manufacturers (LG Display, BOE), and the majority of thin-film solar production facilities located in China, South Korea, Taiwan, and Japan. The region’s sustained governmental investment in developing indigenous advanced manufacturing capabilities, particularly in China's drive for self-sufficiency in chip production, ensures perpetual high demand for sputtering coils for system expansion and maintenance.

North America maintains a critical position, characterized by significant investment in fundamental materials science research, the development of next-generation PVD equipment, and a robust demand from specialized, high-reliability sectors such as aerospace and advanced defense electronics. The U.S. market is highly focused on innovation in HiPIMS technology and Atomic Layer Deposition (ALD) integration, requiring ultra-precise sputtering coils for R&D and pilot lines. Demand here is typically high-value, driven by performance specifications rather than volume, with a strong emphasis on customizable, low-volume coils that support cutting-edge materials testing and the rapid prototyping of novel electronic architectures, sustaining its role as a technology innovation hub for the global market.

Europe represents a mature market with a steady demand driven by the large-scale automotive industry (for specialized coatings on vehicle components, headlights, and sensor systems), medical device manufacturing (biocompatible coatings), and the precision tooling sector. European manufacturers often emphasize durability, energy efficiency, and adherence to rigorous environmental standards. Germany, in particular, is a significant consumer due to its strength in machinery and optical manufacturing. While volume production often shifts to APAC, Europe retains specialized expertise in delivering high-quality, customized coating solutions, ensuring consistent demand for replacement and upgrade coils designed for high-end industrial applications demanding unparalleled precision and long-term operational stability.

- Asia Pacific (APAC): Dominates consumption driven by semiconductor and flat-panel display mega-fabs; key growth engine fueled by mass manufacturing volumes and government investment in localized technology.

- North America: Focuses on advanced R&D, aerospace, defense, and specialized semiconductor prototyping, demanding high-specification, low-volume customized coils and leading innovation in HiPIMS technology.

- Europe: Characterized by stable demand from the automotive (EV batteries and sensors), medical, and industrial coatings sectors; strong emphasis on component longevity and energy efficiency standards in manufacturing.

- Latin America & MEA: Emerging markets with moderate growth, primarily serving localized construction (architectural glass coatings) and oil/gas sectors (wear-resistant coatings), with demand often reliant on imported PVD systems and coils.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sputtering Coil Market, which includes specialized component suppliers, magnet manufacturers, and vertically integrated PVD equipment manufacturers.- MKS Instruments

- Tegal Corporation

- Advanced Energy Industries, Inc.

- Hitachi High-Tech Corporation

- Applied Materials, Inc.

- Ulvac, Inc.

- Leybold GmbH

- Semicore Equipment, Inc.

- Soleras Advanced Coatings

- Angstrom Engineering Inc.

- Kurt J. Lesker Company

- Satisloh

- Materion Corporation

- Veeco Instruments

- AJA International, Inc.

- PVD Products, Inc.

- Denton Vacuum

- Sierra Coating Technologies

- K. S. M. High-Tech Co., Ltd.

- Sumitomo Metal Mining Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Sputtering Coil market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a sputtering coil in PVD systems?

The primary function of a sputtering coil is to generate and manipulate a magnetic field within a magnetron assembly. This field confines the plasma (ionized gas) near the target surface, enhancing the ionization efficiency, increasing the deposition rate, and ensuring uniform erosion of the target material for consistent thin-film quality.

How does the type of sputtering coil impact thin-film deposition uniformity?

Coil configuration directly dictates the magnetic field profile, which in turn controls plasma density and distribution across the sputter target. Optimized coil design ensures a uniform "racetrack" erosion pattern, preventing material waste and guaranteeing that the sputtered material is deposited with consistent thickness and structural integrity across the entire substrate area, which is critical for high-yield manufacturing.

Which key industries are the largest consumers of Sputtering Coils?

The largest consuming industries are Semiconductor Manufacturing, driven by complex interconnect and packaging requirements; Flat Panel Display Fabrication (OLED and LCD); and Thin-Film Solar Cell production, all of which rely on high-precision physical vapor deposition techniques using magnetron sputtering technology.

What technological trends are driving the demand for advanced sputtering coils?

Demand is driven by the shift towards high-power impulse magnetron sputtering (HiPIMS) for denser films, the increasing size of substrates in display manufacturing, and the necessity for superior magnetic field control to handle sensitive materials required for advanced semiconductor nodes (below 7nm), demanding higher reliability and customized magnetic assemblies.

What is the estimated growth rate (CAGR) for the Sputtering Coil Market?

The Sputtering Coil Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033, fueled by sustained global expansion in electronics manufacturing and strategic investments in thin-film material science across Asia Pacific and North America.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager