Stabilizers for Boats Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440955 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Stabilizers for Boats Market Size

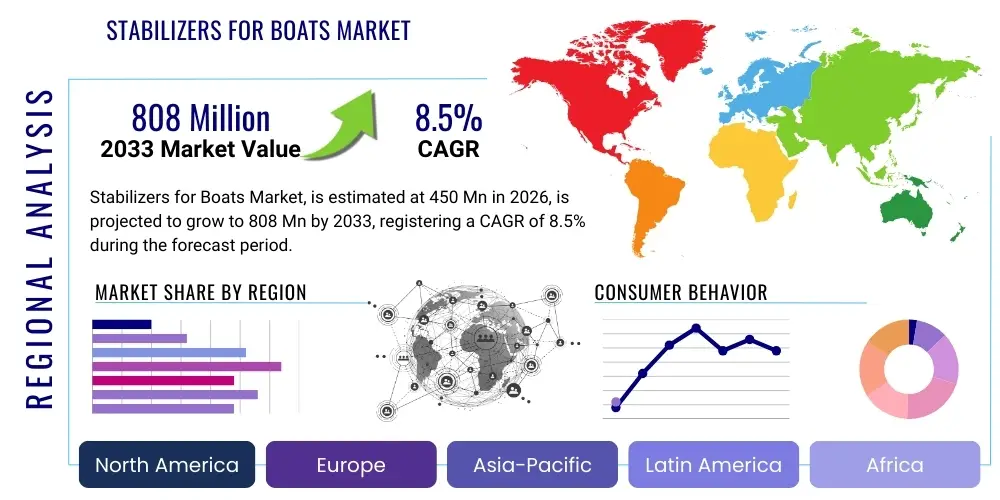

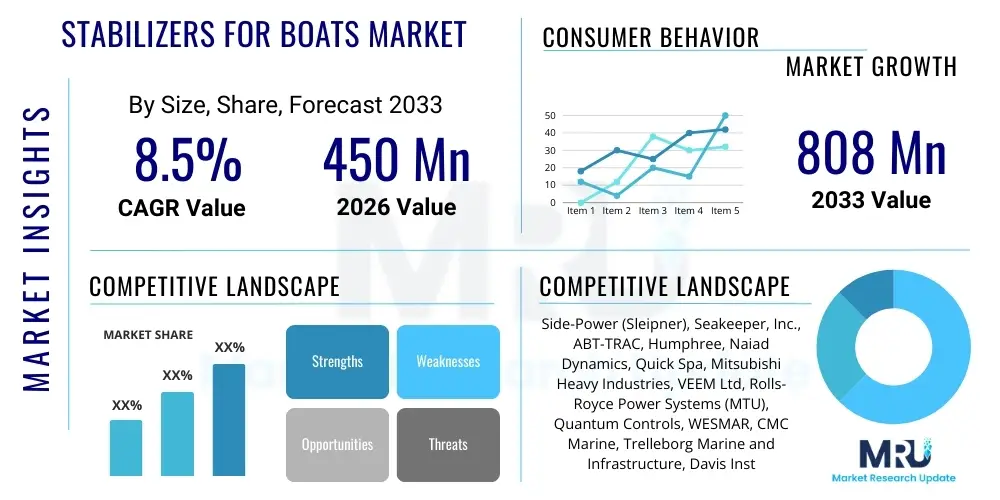

The Stabilizers for Boats Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 808 Million by the end of the forecast period in 2033.

Stabilizers for Boats Market introduction

The Stabilizers for Boats Market encompasses the design, manufacturing, and integration of mechanical and electronic systems specifically engineered to mitigate the rolling, pitching, and yawing motions of maritime vessels. These systems are crucial for enhancing vessel stability, improving passenger comfort and safety, and reducing the risks associated with rough seas. The core technology generally revolves around active stabilization devices, primarily classified into fin stabilizers and gyroscopic stabilizers. While fin stabilizers rely on hydrodynamic lift generated by external appendages reacting to speed and water flow, gyroscopic stabilizers utilize the angular momentum of a spinning flywheel, offering effective stabilization both underway and at zero speed (anchor). The increasing demand for luxury yachting, coupled with stricter safety regulations for commercial and military applications, is fundamentally shaping the market's trajectory.

Product descriptions vary significantly across the market depending on the vessel size and intended application. Fin stabilizers, historically dominant in large cruise ships and commercial tankers, are robust, scalable, and highly effective at speed. Their primary drawback remains the need for vessel movement to generate lift and their structural footprint. Conversely, gyroscopic stabilizers, which operate internally, have revolutionized the small to medium-sized yacht market. These systems offer unparalleled zero-speed stabilization, crucial for luxury applications where comfort at anchor is paramount. Both types of systems rely heavily on sophisticated sensor packages and control algorithms to anticipate wave patterns and deploy counter-measures swiftly and precisely. Major applications span leisure marine, defense and security, commercial transportation, and specialized research vessels, each requiring tailored stabilization solutions.

The primary driving factors propelling the expansion of this market include the global rise in discretionary income fueling the luxury yacht industry, increasing awareness among boat owners regarding the dangers and discomfort associated with vessel instability, and technological advancements leading to more compact, efficient, and retrofit-friendly stabilization units. Furthermore, the commercial sector, particularly offshore wind service vessels and high-speed ferries, is adopting advanced stabilization technologies to improve operational efficiency and crew well-being. The benefits derived from these systems—such as reduced seasickness, enhanced safety during emergency maneuvers, and minimized cargo damage—outweigh the significant initial investment, thus securing their critical role in modern maritime operations.

Stabilizers for Boats Market Executive Summary

The Stabilizers for Boats Market is characterized by robust growth, driven primarily by technological innovation in gyroscopic systems and increasing regulatory pressure concerning maritime safety and crew comfort. Current business trends indicate a strong shift towards zero-speed stabilization capabilities, leading to intensified competition and rapid product development among key manufacturers. Original Equipment Manufacturers (OEMs) are integrating these systems earlier in the shipbuilding process, while the retrofit market remains highly lucrative, especially for the large population of existing yachts and commercial patrol boats seeking modern upgrades. Supply chain resilience, particularly concerning the sourcing of high-tolerance mechanical components and sophisticated electronic control units (ECUs), is a key focus area for mitigating risks associated with global trade volatility and ensuring timely deliveries to high-value shipbuilding projects. Strategic alliances and acquisitions focused on consolidating advanced sensor technology and software capabilities are defining the competitive landscape.

Regionally, North America and Europe maintain dominance, acting as historical centers for yacht manufacturing and advanced naval technology. However, the Asia Pacific (APAC) region is demonstrating the most significant growth trajectory, primarily fueled by the burgeoning middle and affluent classes in coastal countries like China, Australia, and parts of Southeast Asia, leading to escalating demand for recreational boating. Furthermore, significant defense modernization programs across APAC nations necessitate advanced stability solutions for new fleets. Trends in Latin America and the Middle East & Africa (MEA) are more focused on commercial applications, particularly oil and gas service vessels and luxury superyachts owned by regional high-net-worth individuals (HNWIs). Infrastructure development supporting maritime leisure in these emerging markets will be crucial for sustained growth beyond the forecast period.

Segment trends reveal that the Gyroscopic Stabilizer segment is expected to outpace the growth of traditional Fin Stabilizers, largely due to its effectiveness in smaller vessel classes and superior zero-speed performance, which is a key requirement in the luxury sector. Application analysis confirms that the Luxury Yacht segment holds the largest market share in value due to the high integration rate of premium stabilization solutions. However, the Commercial Vessel segment is projected to exhibit a steady and dependable growth rate, driven by return-on-investment calculations based on reduced operational downtime and improved crew productivity. Vessel size segmentation highlights that medium to large vessels (30 feet and above) are the primary adopters, although technological miniaturization is starting to make stabilization solutions economically viable for smaller pleasure craft, broadening the available market base substantially.

AI Impact Analysis on Stabilizers for Boats Market

User inquiries regarding AI's influence in the Stabilizers for Boats Market frequently center on themes of predictive performance, autonomous control, and system efficiency. Common questions include how AI algorithms can anticipate wave movements better than traditional sensors, whether machine learning can optimize power consumption for stabilization systems, and the role of AI in integrating multiple vessel control systems (e.g., propulsion, dynamic positioning, and stabilization). These inquiries reflect a high expectation that AI will move stabilization technology beyond reactive control towards proactive, anticipatory operation, potentially leading to smoother operation, significant energy savings, and reduced wear and tear on mechanical components. Users are particularly keen on understanding how deep learning models, trained on vast datasets of sea conditions and vessel dynamics, can enhance stability under highly unpredictable environmental conditions, minimizing human intervention.

The application of Artificial Intelligence and advanced machine learning models is poised to fundamentally transform the design and operational effectiveness of marine stabilization systems. Current generation systems use sophisticated but largely deterministic algorithms based on classical control theory. The introduction of AI allows systems to learn from historical data and real-time environmental input to predict imminent rolling moments and adjust stabilizer settings—whether fin angles or gyroscopic rpm—milliseconds before the disturbance occurs. This predictive capability translates directly into demonstrably superior stabilization quality, minimizing latency and maximizing energy efficiency by only deploying the necessary corrective force. Furthermore, AI facilitates real-time fault detection and predictive maintenance scheduling, significantly reducing the likelihood of catastrophic system failures at sea and lowering overall lifetime ownership costs for vessel operators.

Beyond core stabilization, AI contributes substantially to system integration and human-machine interface (HMI) design. Generative algorithms can optimize the placement and sizing of stabilization units during the vessel design phase, simulating millions of operational scenarios to determine the most effective configuration. For crew operation, AI assists in simplifying complex control schemes, providing intuitive dashboards that distill massive amounts of sensor data into actionable insights, ensuring that even under duress, operators can make informed decisions. This optimization, driven by data science, ensures that stabilization units contribute positively to overall vessel performance, encompassing fuel efficiency and speed, rather than operating in isolation as a purely comfort-focused accessory.

- Predictive Stabilization Control: AI uses deep learning to analyze oceanographic data (wave height, frequency, direction) for anticipatory deployment of stabilizers.

- Energy Optimization: Machine learning algorithms dynamically adjust system power draw based on real-time stability requirements, minimizing energy consumption.

- Autonomous System Health Monitoring: AI-driven diagnostics identify potential mechanical failures in hydraulic systems or gyroscopic bearings before they become critical.

- Integrated Vessel Dynamics: AI facilitates the harmonization of stabilizer input with steering, propulsion, and dynamic positioning systems for holistic vessel control.

- Design Optimization: Generative AI assists naval architects in optimizing stabilizer unit placement and reducing hull resistance related to fin protrusion.

DRO & Impact Forces Of Stabilizers for Boats Market

The market for boat stabilizers is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO). Key drivers include the exponential growth in the global luxury yacht fleet and the increasing focus on passenger comfort and safety standards, especially within the cruising and high-speed ferry sectors. Regulations mandating safer operational envelopes and the desire for extended operational windows in adverse weather conditions also push adoption rates upwards. However, significant restraints challenge market expansion, primarily the high initial capital investment required for procurement and installation of sophisticated systems, which can be prohibitive for smaller vessel owners or price-sensitive commercial operators. Furthermore, technical complexity and the requirement for specialized maintenance personnel in remote locations pose logistical hurdles. These opposing forces dictate market penetration rates and influence pricing strategies across different segments.

Opportunities within the market are predominantly tied to technological innovation and geographical expansion. The development of smaller, more power-efficient gyroscopic stabilizers suitable for mass-market recreational boats presents a vast untapped opportunity. Furthermore, the growth of the retrofit market, fueled by advancements that make installation simpler and less intrusive on existing hulls, is highly promising. Emerging markets in Asia and South America, characterized by rapid infrastructure development in maritime tourism and defense sectors, offer significant regional expansion prospects for global manufacturers. The industry is also exploring novel stabilization methods, such as active interceptor systems and multi-axis control integration, which could offer complementary or alternative solutions to traditional fins and gyros, broadening the technological scope.

The impact forces currently defining the market are heavily weighted towards technological superiority and stringent regulatory environments. The intense competition between gyroscopic and fin stabilizer technologies forces manufacturers into rapid cycles of R&D investment, leading to continuous improvement in performance metrics like zero-speed effectiveness and noise reduction. Regulatory impact forces, particularly those relating to maritime safety organizations (e.g., IMO, class societies), increasingly require vessels exceeding specific size thresholds to demonstrate enhanced stability characteristics, thereby driving mandatory adoption. Economically, the elasticity of demand in the luxury sector means performance and brand reputation are more impactful than marginal price fluctuations, contrasting with the commercial sector where total cost of ownership (TCO) remains the dominant purchasing factor. The ongoing impact of environmental regulations also drives the need for more compact, energy-efficient stabilization solutions to comply with stricter emission standards.

Segmentation Analysis

The Stabilizers for Boats Market is comprehensively segmented based on technology type, vessel application, and vessel size, providing critical insight into market dynamics and growth potential across various operational domains. Understanding these segments is paramount for strategic planning, allowing companies to tailor their product offerings, marketing efforts, and distribution networks to specific customer needs. The market is increasingly polarizing between performance requirements—high-speed efficiency needed by commercial ferries—and zero-speed comfort demanded by luxury yachts, dictating the dominance of either fin or gyroscopic technologies within respective segments. This structured segmentation helps in identifying high-growth niches, such as the adoption of advanced gyro technology in specialized military vessels and medium-sized fishing fleets seeking improved operational efficiency and safety in rough waters.

- By Technology Type:

- Fin Stabilizers

- Gyroscopic Stabilizers (Gyro Stabilizers)

- Rotor Stabilizers (Magnus Effect)

- Active Interceptors/Tabs

- By Vessel Application:

- Luxury Yachts and Pleasure Boats

- Commercial Vessels (Ferries, Cargo, Research)

- Military and Defense Vessels (Naval Ships, Patrol Boats)

- Offshore Service Vessels (OSVs, Crew Transfer Vessels)

- By Vessel Size:

- Small Boats (Up to 30 feet)

- Medium Boats (30 feet to 60 feet)

- Large Vessels (Above 60 feet, including Superyachts and Ships)

- By Installation (End-Use Market):

- OEM (Original Equipment Manufacturer)

- Aftermarket (Retrofit)

Value Chain Analysis For Stabilizers for Boats Market

The Value Chain for the Stabilizers for Boats Market begins with highly specialized Upstream Activities focused on the sourcing of critical raw materials and precision components. This includes high-grade, corrosion-resistant metals (such as marine-grade stainless steel and aluminum alloys) for hydraulic actuators, fins, and outer casings, and specialized composite materials for lightweight gyroscopic flywheels. Crucially, the supply of sophisticated electronic components, including high-speed microprocessors, inertial measurement units (IMUs), and robust power electronics (VFDs for gyros), forms a significant portion of upstream costs. Dependence on a limited number of global suppliers for these high-tolerance, certified components creates complexity, requiring robust supply chain management to maintain quality standards and mitigate disruption risks associated with geopolitical shifts or material scarcity.

The central stage involves the Manufacturing and Assembly processes, where core competencies in precision engineering and complex system integration are crucial. Manufacturers must manage complex processes ranging from the winding of electric motors for gyros and the casting and machining of fin assemblies, to the final calibration and testing of the integrated control systems. Quality assurance is exceptionally stringent, given the safety-critical nature of the equipment operating in harsh marine environments. The distribution channel then dictates how the finished product reaches the end-user. Direct channels involve manufacturers selling high-value, large-scale systems directly to major shipyards (OEM market) or negotiating complex retrofit projects directly with superyacht management companies.

Indirect channels primarily involve a network of specialized marine equipment distributors and authorized service providers who handle the sales, installation, and after-sales support for smaller vessels and the general aftermarket. These distributors require highly technical expertise due to the complexity of the installation process, which often involves hull modification and integration with existing vessel power and navigation systems. Downstream activities are heavily focused on service, maintenance, and diagnostics. Because stabilization systems require periodic specialized servicing (e.g., hydraulic fluid replacements, gyroscope bearing checks, software updates), the aftermarket service network provides a continuous revenue stream and is critical for maintaining customer satisfaction and product longevity, significantly impacting the total lifetime value proposition.

Stabilizers for Boats Market Potential Customers

The potential customer base for boat stabilizers is highly diversified, spanning both high-net-worth individual consumers (B2C) and large institutional or commercial entities (B2B). The Luxury Yacht segment represents the highest value customer base, characterized by owners demanding the highest level of comfort, performance, and aesthetic integration, often favoring zero-speed gyroscopic technology regardless of the premium price. These customers include private individuals, charter companies, and yacht management firms responsible for vessels ranging from 30-foot cabin cruisers to 100+ meter superyachts. The purchasing decision is heavily influenced by brand reputation, perceived performance superiority, and the ease of integration into existing or newly commissioned vessels, making naval architects and custom shipbuilders key opinion leaders in this segment.

In the B2B commercial sector, potential customers include global shipping companies, passenger ferry operators, offshore wind farm developers utilizing specialized crew transfer vessels (CTVs), research institutions operating oceanographic vessels, and national defense ministries. For these customers, the purchasing criteria are primarily focused on tangible return on investment (ROI) metrics: minimizing weather-related delays, reducing fuel consumption through optimized stabilization, ensuring crew safety and productivity, and protecting sensitive cargo or scientific equipment. Military and defense customers prioritize robust, high-endurance systems that can maintain operational capability under extreme sea states, often favoring custom-engineered fin stabilizer solutions integrated with sophisticated, military-grade control software.

The retrofit market represents a distinct and substantial customer segment, comprising owners of older vessels across all categories (leisure, commercial, and defense) seeking to modernize their stability profiles without incurring the cost of a full vessel replacement. These customers prioritize solutions that minimize dry-dock time and require minimal structural modification, making compact, modular gyroscopic stabilizers increasingly popular in this segment due to their relatively smaller footprint and easier installation compared to full fin systems. Ship repair yards and specialized marine retrofit companies act as vital intermediaries serving this significant customer demographic, ensuring technical compliance and seamless integration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 808 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Side-Power (Sleipner), Seakeeper, Inc., ABT-TRAC, Humphree, Naiad Dynamics, Quick Spa, Mitsubishi Heavy Industries, VEEM Ltd, Rolls-Royce Power Systems (MTU), Quantum Controls, WESMAR, CMC Marine, Trelleborg Marine and Infrastructure, Davis Instruments, Marine Dynamics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Stabilizers for Boats Market Key Technology Landscape

The technology landscape of the Stabilizers for Boats Market is dominated by the duality of Fin and Gyroscopic systems, with continuous innovation focused on optimizing performance, minimizing size, and maximizing energy efficiency. Fin stabilizers utilize sophisticated hydraulic actuation systems coupled with high-speed electronic control units (ECUs) that process data from inertial sensors (IMUs) to rapidly adjust the angle of attack of the fins. Recent technological advancements in fin design include the use of high-lift hydrofoils and retractable mechanisms that minimize drag when the system is inactive, improving overall vessel fuel economy. Furthermore, integration with vessel management systems (VMS) allows for predictive control based on input from navigation systems and weather feeds, offering a semi-proactive stabilization capability while underway, enhancing overall stability envelopes significantly compared to historical, purely reactive designs.

Gyroscopic stabilizers represent the most significant technological disruption in the leisure marine sector over the last decade. These systems function by mounting a heavy flywheel spinning at extremely high revolutions per minute (RPM) inside a vacuum-sealed housing. When the vessel begins to roll, the gyroscope tilts fore or aft, harnessing the angular momentum (precession torque) to counteract the roll motion immediately. Technological breakthroughs have focused on improving the power density of the flywheel (often using advanced composites or specialized alloys) and optimizing the control mechanisms (hydraulic tilting systems) to deliver maximum anti-roll torque per unit of system weight and size. Crucially, variable frequency drives (VFDs) manage the flywheel speed, allowing operators to fine-tune stabilization intensity based on sea conditions and minimize energy consumption when stability demands are lower, optimizing performance characteristics.

Beyond the core Fin and Gyro systems, the market is seeing increased adoption of complementary and alternative technologies. Active interceptors, similar to advanced trim tabs, are increasingly used on high-speed planing hulls. These interceptors rapidly deploy small, vertical blades from the transom to create hydrodynamic lift, which is used to correct both trim (pitch) and roll motions dynamically. While less effective than gyros or fins for major stabilization on displacement hulls, they offer fast reaction times and are highly efficient for correcting high-speed running attitudes. Furthermore, advancements in sensor technology, including fiber optic gyros (FOGs) and highly accurate accelerometers, provide the high-fidelity input necessary for the sophisticated AI-driven control algorithms now being integrated into top-tier stabilization systems, ensuring unparalleled precision and operational reliability in the harsh marine environment.

Regional Highlights

- North America: North America remains a crucial market, driven by high disposable income, a strong culture of recreational boating, and significant defense spending on modernizing naval fleets. The U.S. West Coast and Florida represent major hubs for luxury yacht sales and associated aftermarket services. The region leads in the adoption of gyroscopic stabilizers, particularly in the medium-sized boat segment, driven by manufacturers based in the U.S. and strategic partnerships with European suppliers. Strict maritime safety standards further bolster demand across the commercial and government vessel sectors.

- Europe: Europe holds the largest market share in value, primarily due to its dominance in superyacht construction (e.g., Italy, Netherlands, Germany) and the large scale of commercial shipping and cruising activities. European manufacturers are technological leaders in both fin and gyroscopic systems, focusing heavily on integration with advanced vessel control and monitoring systems. The retrofit market is exceptionally strong, targeting the extensive, aging fleet of vessels requiring modernization to meet contemporary comfort and stability expectations.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market, spurred by rising wealth in countries like China, Japan, and Australia, leading to increased investment in marine leisure infrastructure and vessel acquisition. Additionally, significant investments in national defense and the expansion of offshore energy production in Southeast Asia drive demand for robust, large-scale fin stabilization systems for commercial and military vessels. Manufacturing capabilities within the region, particularly in South Korea and China, are rapidly evolving, challenging the historical dominance of Western suppliers.

- Latin America (LATAM): Growth in LATAM is more nascent and highly dependent on specific country economies, with concentrated demand in countries like Brazil and Mexico. The market is primarily driven by coastal tourism development and the local ownership of smaller to medium-sized luxury yachts. Commercial demand is tied heavily to the offshore energy sector, necessitating stabilizers for platform supply vessels and crew boats, though adoption rates lag behind global averages due to cost sensitivities and regulatory variability.

- Middle East and Africa (MEA): The MEA region is characterized by high demand in the ultra-luxury segment, particularly the superyacht market centered around the UAE and Saudi Arabia. This niche market focuses exclusively on premium, high-performance stabilization, driving high unit values. Commercial demand exists, concentrated around critical shipping lanes and coastal security patrols, with regional instability sometimes driving accelerated acquisition of high-stability patrol craft. Market growth is sensitive to oil price fluctuations, which impact both private wealth and government spending.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Stabilizers for Boats Market.- Seakeeper, Inc.

- Naiad Dynamics (Twin Disc, Inc.)

- ABT-TRAC (American Bow Thruster)

- Side-Power (Sleipner Motor AS)

- CMC Marine S.R.L.

- Quantum Controls Inc.

- VEEM Ltd

- Mitsubishi Heavy Industries Marine Machinery & Equipment Co., Ltd.

- Rolls-Royce Power Systems (MTU)

- Humphree AB

- Quick Spa

- WESMAR (Western Marine Electronics)

- Trelleborg Marine and Infrastructure

- Kawasaki Heavy Industries, Ltd.

- ZF Friedrichshafen AG

- Arcturus Marine Systems

- Swell Control Systems

- Pneumatic Control Systems (PCS)

- Yacht Controller

- Northern Lights, Inc.

Frequently Asked Questions

Analyze common user questions about the Stabilizers for Boats market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between gyroscopic and fin stabilizers for boats?

Gyroscopic stabilizers operate internally by harnessing the angular momentum of a high-speed flywheel to generate anti-roll torque, providing excellent stabilization both underway and at zero speed (anchor). Fin stabilizers are external appendages that rely on the forward motion of the vessel to generate hydrodynamic lift, making them highly effective at speed but generally less efficient or ineffective when the boat is stationary or moving slowly.

Which factors should be considered when selecting the appropriate stabilizer size for a vessel?

Selection depends critically on the vessel’s displacement (weight), waterline length, metacentric height, hull type (planning vs. displacement), and the expected operational profile (e.g., cruising speed vs. time spent at anchor). Sizing requires complex calculations performed by naval architects or system manufacturers to ensure the unit generates sufficient counter-torque to meet performance targets under predicted sea conditions.

Are boat stabilizers effective in reducing seasickness for passengers?

Yes, stabilization systems are highly effective in reducing seasickness. Seasickness is primarily triggered by the cyclical, repetitive rolling motion of the vessel. By significantly dampening the roll angle and reducing the acceleration forces experienced during waves, stabilizers create a far more stable and comfortable environment, thus minimizing the physiological triggers for motion sickness across all vessel applications.

What is the typical lifespan and maintenance requirement for modern boat stabilization systems?

The typical lifespan for major stabilization units, such as high-quality gyros and fin systems, often exceeds 15 to 20 years with proper maintenance. Maintenance requirements are rigorous and specialized, typically involving annual inspections of hydraulic fluids, seals, bearings, and electrical components, along with periodic software updates and calibration. Gyroscopic systems may require specific service intervals for internal bearing packs.

Is the aftermarket (retrofit) installation of stabilization systems feasible for existing boats?

Yes, the retrofit market is substantial and growing, particularly for gyroscopic stabilizers due to their contained nature and smaller hull penetrations compared to external fins. Feasibility depends on available space for installation, hull structure (to handle the forces generated), and the vessel's electrical and power capacity, requiring a professional survey and structural assessment prior to committing to the modification.

How does the integration of Artificial Intelligence (AI) enhance stabilizer performance?

AI integration enhances stabilizer performance by enabling predictive control. Instead of merely reacting to a roll moment detected by sensors, AI algorithms analyze real-time environmental data (wave patterns, wind, current) and historical vessel responses to anticipate the onset of instability. This allows the system to proactively deploy corrective torque milliseconds earlier than conventional systems, resulting in smoother, more energy-efficient stabilization and optimal operational deployment.

What are the key environmental concerns related to fin stabilizers?

The primary environmental concern associated with fin stabilizers involves potential harm to marine life, particularly slow-moving or stationary animals, if the fins are deployed and actively moving in shallow or high-traffic areas. To mitigate this risk, modern systems incorporate robust safety features and interlocks, often retracting fins automatically when navigating very shallow waters or operating under zero speed conditions, although this depends on system design.

Do stabilizers affect the fuel efficiency or speed of a boat?

Yes, stabilizers can impact both speed and fuel efficiency. Fin stabilizers, being external appendages, introduce drag, which can slightly reduce top speed and increase fuel consumption while underway, though retracted fins mitigate this. Gyroscopic stabilizers, being internal, add weight and draw electrical power, slightly increasing fuel consumption to run the generator or electrical system, but this consumption is often offset by the ability to maintain optimal hull trim facilitated by the stability system.

What is the role of stabilization technology in the military and defense sector?

In the military and defense sector, stabilization technology is critical for maintaining operational readiness and maximizing crew performance. It ensures stable weapon platforms for accurate firing, improves the launch and recovery of aircraft or drones in rough seas, and enhances the operational effectiveness of sensitive electronic surveillance and radar equipment. Stability also reduces crew fatigue, which is crucial for extended patrol missions.

How are stability systems evolving to meet sustainability demands?

Stability systems are evolving toward sustainability through two main avenues: power efficiency and material use. Manufacturers are developing high-efficiency electric actuators and motors for both fins and gyros, replacing less efficient hydraulic systems where possible. Furthermore, optimization algorithms, often AI-driven, minimize the energy required to achieve the desired stability level, directly reducing the vessel’s overall carbon footprint, alongside the adoption of lighter, more durable, and recyclable materials in system construction.

What distinguishes active interceptor systems from traditional trim tabs?

Active interceptor systems are fundamentally different from traditional fixed or hydraulically-operated trim tabs primarily in their speed of deployment and precise computerized control. Interceptors deploy vertically only a few centimeters into the water at high speed, creating hydrodynamic lift almost instantaneously. They are integrated with high-speed control loops, allowing them to adjust roll and pitch dynamically in response to sea conditions, unlike basic trim tabs which primarily adjust running trim.

Can stabilization systems compensate for poor vessel loading or design flaws?

While stabilization systems significantly improve stability and comfort, they are designed to counteract external forces like waves, not fundamental vessel instability issues. They cannot fully compensate for severe design flaws or grossly improper loading (e.g., excessive top weight or off-center load). They are supplementary systems intended to enhance the already inherent stability characteristics of a well-designed and properly loaded vessel, not mask structural problems.

What is the significance of zero-speed stabilization in the luxury yacht market?

Zero-speed stabilization is paramount in the luxury yacht market because a significant amount of time is spent anchored, docking, or idling, where traditional fin stabilizers are ineffective. Gyroscopic zero-speed capability ensures superior guest comfort while dining, sleeping, or socializing at anchor, dramatically enhancing the luxury experience and thus driving the purchasing decisions for high-value vessels and justifying the premium cost of gyro systems.

How do class societies and regulatory bodies impact the market for boat stabilizers?

Class societies (like Lloyd’s Register or DNV) and regulatory bodies (like IMO) impose stringent safety and performance standards, particularly for commercial and large passenger vessels. These regulations often mandate minimum stability criteria and system redundancy, driving the adoption of certified and highly reliable stabilization equipment. Compliance with these rules ensures market access and is a key driver for technological advancement in system integrity and redundancy.

What role do advanced sensor technologies play in modern stabilizer operation?

Advanced sensor technologies, particularly Inertial Measurement Units (IMUs) incorporating sophisticated gyroscopes and accelerometers, are the foundation of modern stabilizer operation. These sensors measure the vessel’s roll, pitch, and yaw rates with extreme precision and speed (often hundreds of times per second). This high-fidelity data feeds the control algorithms, allowing the stabilizers to react instantaneously and proportionally, ensuring seamless and highly effective roll mitigation.

What are the primary challenges facing manufacturers in the upstream supply chain?

Manufacturers face significant challenges in the upstream supply chain, including reliance on a limited number of specialized suppliers for high-tolerance components such as precision-machined stainless steel parts and high-capacity Variable Frequency Drives (VFDs). Volatility in raw material prices, particularly specialized alloys and rare earth magnets used in high-performance motors, and geopolitical trade restrictions pose risks to cost management and production timelines, necessitating strategic sourcing and inventory management.

How does the market differentiate between stability augmentation and vessel trim control?

Stability augmentation, the primary function of stabilizers, actively minimizes side-to-side roll motion caused by waves to improve safety and comfort. Vessel trim control focuses on optimizing the boat's fore-and-aft attitude (pitch) or heel (list) to improve speed, fuel efficiency, and sightlines, usually via specialized trim tabs or interceptors. While some advanced interceptors provide integrated solutions, traditional stabilizers focus predominantly on active roll reduction.

What is the influence of emerging markets like Asia Pacific on global stabilizer demand?

The Asia Pacific market exerts a strong influence on global demand through increased luxury vessel acquisition, coupled with extensive naval modernization and commercial shipping expansion. This high-growth region drives demand for both specialized military-grade stability systems and premium consumer-grade gyros. APAC's rapid shipbuilding capacity also creates opportunities for high-volume OEM sales, shifting manufacturing and assembly focus eastward for some components.

How do hydraulic systems remain relevant amidst the shift towards electric stabilization?

While smaller, newer systems favor all-electric designs for simplicity and efficiency, hydraulic systems remain highly relevant, particularly for large fin stabilizers and the tilting mechanism in large gyros. Hydraulics offer superior power density and torque necessary to rapidly move massive fins or tilt heavy gyroscopic units under high-stress conditions found on large commercial vessels and superyachts, where reliable, high-force actuation is critical to operational integrity.

What financial benefits can commercial vessel operators realize from installing stabilizers?

Commercial operators realize significant financial benefits through reduced operational downtime, as stabilizers allow vessels to operate effectively in harsher weather conditions that would otherwise necessitate delays. Furthermore, improved stability reduces cargo damage (especially sensitive freight), enhances crew productivity by minimizing fatigue and seasickness, and can slightly improve fuel efficiency by maintaining optimal running trim, contributing to lower total ownership costs.

What are the primary safety considerations during the installation and operation of stabilizers?

Safety considerations are paramount. Installation requires meticulous hull integrity work (for fin systems) or securing heavy, rotating masses (for gyros) against immense operational forces. Operationally, safety focuses on preventing human contact with external fins, ensuring robust redundancy in hydraulic and electrical systems, and implementing fail-safe mechanisms that prevent runaway systems or catastrophic mechanical failure under peak load, requiring certified professional installation and adherence to class rules.

How are manufacturers addressing the issue of noise and vibration associated with stabilization systems?

Manufacturers are tackling noise and vibration through advanced engineering, especially critical in luxury yacht applications. For gyros, this involves vacuum encapsulation and optimized bearing technologies to minimize operational hum. For fin systems, it includes advanced passive hydrodynamic shaping to reduce cavitation noise and designing robust, vibration-dampening mounts and bulkheads to isolate mechanical noise transmission into the vessel structure, enhancing onboard acoustic comfort.

What is the future outlook for Rotor (Magnus Effect) stabilizers in the market?

Rotor (Magnus Effect) stabilizers, while highly effective and potentially offering better zero-speed performance than fins without the heavy components of gyros, currently occupy a niche market. Their future outlook is positive in specialized large vessels (like cruise ships) due to potential for dynamic lift generation and passive stability, but widespread adoption faces hurdles related to high profile (above the waterline), complex deployment mechanisms, and managing the significant aerodynamic forces generated, making them less suitable for smaller craft.

How does digital twin technology benefit the design and servicing of boat stabilizers?

Digital twin technology is instrumental in the design phase, allowing engineers to simulate the stabilizer's performance under millions of real-world sea conditions before physical construction, optimizing parameters like size, placement, and control algorithms. For servicing, a digital twin provides a real-time, virtual representation of the system’s health, enabling predictive maintenance, rapid fault isolation, and remote diagnostics, drastically reducing repair time and improving system reliability through the operational lifecycle.

What regulatory trends are emerging concerning the energy consumption of stabilization systems?

Emerging regulatory trends, influenced by IMO's focus on decarbonization (EEDI and EEXI indices), are increasingly scrutinizing the energy consumption of auxiliary vessel systems, including stabilizers. This is driving a mandatory shift towards high-efficiency components, smart power management systems, and requirements for manufacturers to provide documented energy efficiency metrics, incentivizing the market's move away from energy-intensive legacy hydraulic and mechanical designs towards optimized electric and hybrid solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager