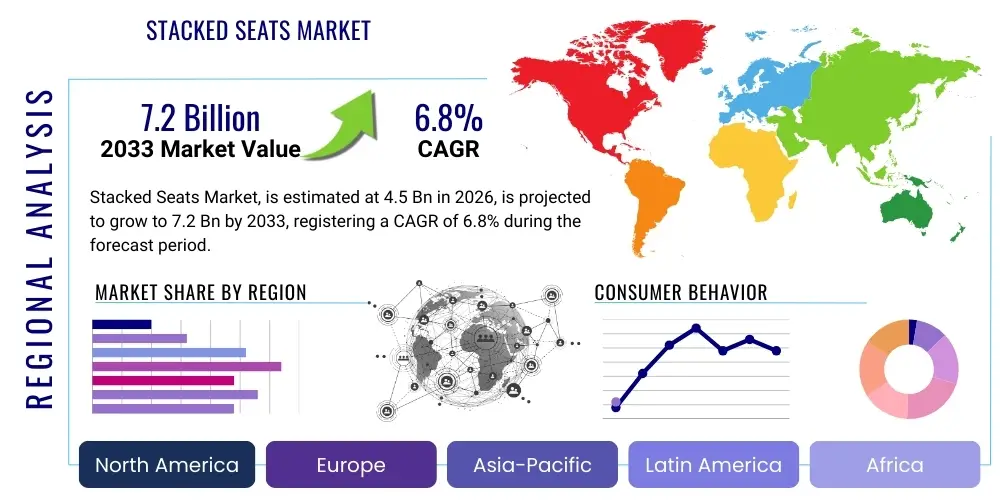

Stacked Seats Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442381 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Stacked Seats Market Size

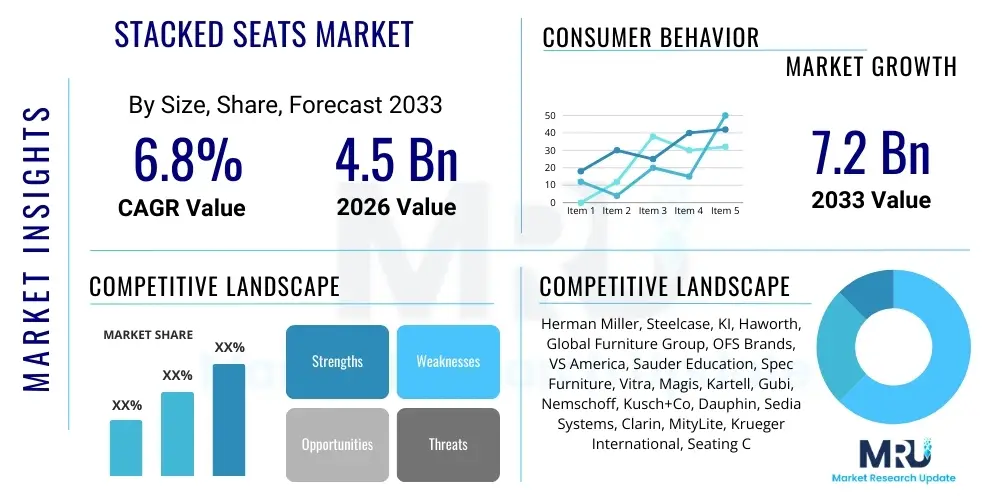

The Stacked Seats Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally underpinned by the escalating requirement for flexible and adaptable seating solutions across diverse institutional and commercial environments globally. Stacked seats, also known as stacking chairs or nesting chairs, provide optimal space utilization and operational efficiency, making them indispensable for venues frequently requiring quick reconfiguration, such as multipurpose halls, educational lecture theatres, and corporate training rooms.

The valuation reflects robust demand driven by renewed infrastructure investments in emerging economies and the ongoing modernization of existing facilities in developed markets. Specifically, the education sector's transition towards collaborative learning spaces, coupled with the hospitality industry's focus on maximizing event space capacity, are critical accelerators. Market expansion is further supported by technological advancements in materials science, leading to the development of lightweight, highly durable, and ergonomically superior stacked seating options that comply with stringent international safety and environmental standards. The projected financial increase signifies a strong commitment from commercial entities towards functional design and sustainable procurement practices.

Stacked Seats Market introduction

The Stacked Seats Market encompasses the manufacturing, distribution, and sale of chairs specifically engineered to be stacked vertically for efficient storage and minimized floor space consumption when not in use. These products are crucial elements in environments that demand high flexibility in seating arrangements, ranging from large public venues to small modular offices. The primary product description centers on robust structural integrity combined with lightweight design, ensuring ease of handling and high durability under frequent usage and movement. Materials commonly used include high-grade plastics, reinforced metals (aluminum and steel), engineered wood, and various composite hybrid materials tailored for specific aesthetic and structural requirements.

Major applications of stacked seats span the educational sector, including universities and school auditoriums; the corporate domain, particularly in conference centers, training facilities, and flexible workspaces; the hospitality industry, prevalent in banquet halls and event centers; and public venues suching as churches, community centers, and governmental institutions. The essential utility of stacked seating lies in its capability to maximize venue occupancy during events while allowing for rapid, organized storage when the space needs to be utilized for alternative functions or requires comprehensive cleaning. This functional adaptability is the core value proposition driving market penetration across various sectors seeking operational agility.

Key benefits derived from adopting stacked seating solutions include substantial space savings, reduced logistical costs associated with event setup and breakdown, and enhanced longevity due to robust construction designed for high-frequency use. Driving factors fueling market growth include global trends towards open-plan offices and collaborative educational settings, urbanization necessitating more efficient use of limited commercial real estate, and increasing consumer preference for ergonomic and aesthetically pleasing designs that do not compromise on practicality. Furthermore, the regulatory emphasis on fire safety and material sustainability is pushing manufacturers toward innovation in compliant, greener product lines, continually refreshing market offerings and stimulating demand.

Stacked Seats Market Executive Summary

The Stacked Seats Market is characterized by vigorous business trends focusing on material innovation and ergonomic design integration. Manufacturers are increasingly prioritizing sustainability, utilizing recycled plastics and responsibly sourced wood to meet rising consumer expectations for eco-friendly products, which in turn necessitates higher upfront investment in production technologies but delivers long-term brand differentiation. Concurrent trends include the integration of antimicrobial coatings, particularly relevant post-2020, enhancing hygiene standards crucial for educational and healthcare applications, alongside the development of smart stacking features, such as integrated dollies and specialized storage carts designed for minimal physical strain during transport.

Regional trends indicate North America and Europe maintaining leadership in market value due to established corporate infrastructure and high institutional spending on modernizing facilities. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth CAGR, propelled by rapid urbanization, significant government investment in educational infrastructure, and the booming hospitality sector, particularly in China and India. Latin America and the Middle East & Africa (MEA) are emerging markets, primarily driven by expanding tourism and educational reforms, focusing heavily on durable, low-maintenance plastic and metal variants suitable for high-humidity or challenging climatic conditions prevalent in these areas.

Segmentation trends highlight a pronounced shift towards hybrid materials offering the best balance of weight, strength, and aesthetic appeal, particularly in the premium corporate and hospitality segments where design is paramount. By application, the corporate and hospitality sectors represent the largest market shares due to high volume purchasing for large venues and frequent turnover requirements. The educational segment remains a stable, essential consumer, favoring durable plastic and metal seats optimized for institutional longevity and student ergonomics. The overall market summary points toward sustained expansion, underpinned by functional necessity and accelerated by innovations focused on material science and user-centric design.

AI Impact Analysis on Stacked Seats Market

Common user questions regarding AI's impact on the Stacked Seats Market often revolve around manufacturing efficiency, supply chain optimization, and predictive maintenance. Users frequently inquire about how AI can automate quality control checks during mass production, predict optimal inventory levels for varying regional demands, and design more efficient stacking mechanisms. Key themes center on reducing manufacturing waste, improving logistics through dynamic route planning for furniture delivery, and utilizing generative design algorithms to innovate new, lighter, and stronger chair geometries. There is also significant interest in AI-driven space planning tools that recommend optimal quantities and configurations of stacked seating based on venue dimensions and expected usage patterns, effectively bridging the gap between product manufacturing and end-user application efficiency.

The implementation of Artificial Intelligence and associated automation technologies is beginning to subtly transform the operational landscape of the Stacked Seats Market, moving beyond simple manufacturing automation towards complex, integrated system management. In production, AI is utilized for prescriptive analytics to minimize material waste by optimizing cutting patterns for wood and metal components and controlling injection molding processes for plastics, ensuring consistency and reducing defects. This precision manufacturing not only improves product quality but also significantly lowers operational costs, allowing manufacturers to offer more competitive pricing while maintaining higher profit margins. The impact is primarily felt in enhanced product reliability and faster time-to-market for complex designs, which is crucial in a competitive, commoditized furniture segment.

Furthermore, the influence extends deeply into the supply chain and end-user experience. AI-powered demand forecasting analyzes historical sales data, seasonal trends, and large-scale event schedules (e.g., major sporting events, corporate conventions) to predict fluctuating regional needs for stacking seating, allowing manufacturers to hold appropriate inventory levels and reduce warehousing costs. In logistics, AI optimizes pallet configuration and stacking limits for shipping containers, maximizing load efficiency and minimizing transportation expenses. For consumers, the impact is becoming visible through augmented reality (AR) applications, often integrated with AI algorithms, allowing buyers to visualize hundreds of stacked seat configurations within their specific venue digitally before making a purchase, improving customer confidence and reducing return rates related to misjudged spatial requirements.

- AI-driven generative design optimizes structural integrity while minimizing material use, leading to lighter, stronger seats.

- Predictive maintenance algorithms monitor automated manufacturing equipment, reducing downtime and ensuring continuous production flow.

- Automated quality control systems use computer vision to identify defects (e.g., surface imperfections, weld consistency) in real-time.

- AI-powered demand forecasting enhances supply chain resilience by accurately predicting regional spikes in institutional or event-based orders.

- Integration with Building Information Modeling (BIM) and AR tools facilitates precise spatial planning and product placement for large-scale buyers.

- Robotics and automation, guided by AI, streamline the actual stacking and palletizing process in distribution centers, improving warehouse efficiency.

DRO & Impact Forces Of Stacked Seats Market

The Stacked Seats Market is fundamentally driven by the increasing global emphasis on versatile architectural design and maximizing the functional capacity of commercial and institutional spaces. Key drivers include the necessity for flexible, multi-purpose facilities across educational and corporate environments, coupled with the rapid growth of the global events and hospitality sectors, which rely heavily on quick space reconfiguration. However, this growth is constrained by restraints such as intense price competition resulting from market fragmentation, particularly in the lower-end plastic seating segment, and the increasing cost volatility of raw materials like steel and specialized polymers. Opportunities abound in emerging markets through government investments in public infrastructure and the high-end market segment, focusing on integrating superior ergonomics and aesthetically customized designs into stacked seating solutions. These forces collectively shape the market's trajectory, mandating a strategic balance between cost efficiency, material innovation, and compliance with increasingly rigorous sustainability standards globally.

The primary Drivers (D) for the stacked seats sector involve the ongoing global trend toward density optimization in urban environments, where commercial real estate costs are prohibitive. Stacked seating directly addresses this pressure by enabling high-density occupancy during use and minimal footprint during storage. Furthermore, the modern pedagogic shift toward flexible classrooms and collaborative learning setups requires furniture that can be easily rearranged by students and faculty, fueling demand for lightweight, intuitively stackable designs. The expansion of cultural and athletic venues, requiring rapid conversion capabilities between different event types, also acts as a powerful demand accelerator, especially for robust, high-capacity stacking models.

Restraints (R) primarily relate to the perception of stacked seating as a commodity product, leading to pressure on profit margins, especially among manufacturers targeting the budget segment. A significant technical restraint involves balancing lightweight design with mandatory load-bearing standards and stability requirements, which can limit material choices and design complexity. The market also faces cyclical demand tied to institutional budget allocations (e.g., school renovation cycles, corporate capital expenditure pauses), making revenue streams occasionally unpredictable. Moreover, the increasing regulatory focus on fire retardancy and volatile organic compound (VOC) emissions mandates continuous, costly material testing and reformulation, posing challenges for smaller manufacturers.

Opportunities (O) for market growth are concentrated in sustainable innovation, including the utilization of bio-based plastics and fully recycled or easily disassembled components for end-of-life recycling. The development of 'smart' stacking chairs, potentially incorporating IoT sensors for asset tracking or occupancy monitoring, represents a high-value niche. Geographically, untapped potential remains high in developing regions where infrastructure construction is accelerating, particularly in sub-Saharan Africa and Southeast Asia, where there is a massive need for durable, cost-effective institutional seating. The impact forces are thus heavily weighted by the necessity for innovation (driven by competition and regulation) and geographical expansion (driven by infrastructure investment), forcing manufacturers to constantly upgrade both material quality and logistical efficiency.

Segmentation Analysis

The Stacked Seats Market is segmented comprehensively based on Material Type, Application, Product Type, and Distribution Channel, providing a granular view of market dynamics and consumer preferences across different purchasing environments. Understanding these segments is crucial for strategic market entry and targeted product development, as the requirements for a stacked chair used in a high-end banquet hall (demanding aesthetics and comfort) differ significantly from one utilized in a public school gymnasium (prioritizing durability and budget). The differentiation often dictates pricing strategies, material selection, and required certifications, ensuring that manufacturers can efficiently allocate resources to meet specific sectoral needs.

The segmentation structure highlights the divergence between the mass market, dominated by metal frames and plastic shells for cost efficiency, and the specialty market, which favors wood or hybrid composite designs for improved aesthetic integration and ergonomic performance in premium settings. Application segmentation confirms that institutional and commercial environments remain the primary consumers, although the emerging trend of flexible home office setups utilizing stackable, minimalist designs is starting to create a small but growing residential application segment. This detailed categorization facilitates competitive analysis and allows stakeholders to pinpoint areas of greatest future growth, such as sustainable material adoption within the education and corporate sectors.

- Material Type:

- Plastic (Polypropylene, Polycarbonate, HDPE)

- Metal (Steel, Aluminum)

- Wood (Plywood, Solid Wood, Engineered Wood)

- Hybrid/Composite Materials

- Application:

- Educational Institutions (Schools, Universities, Libraries)

- Corporate & Offices (Conference Rooms, Training Centers)

- Hospitality (Hotels, Banquet Halls, Restaurants)

- Public Venues (Auditoriums, Community Centers, Churches, Stadiums)

- Healthcare Facilities (Waiting Areas, Day Rooms)

- Product Type:

- Stacking Chairs (Standard stacking height)

- Nesting Chairs (Designed to nest sideways for even greater space savings)

- Folding Chairs (Often used interchangeably but form a distinct subset)

- Stacking Stools and Benches

- Distribution Channel:

- Direct Sales (B2B Institutional Contracts)

- Distributors & Dealers (Wholesalers, Furniture Agents)

- Online Retail & E-commerce

Value Chain Analysis For Stacked Seats Market

The value chain for the Stacked Seats Market commences with upstream analysis, focusing on the sourcing and processing of core raw materials, predominantly metals (steel and aluminum tubing), various polymers (polypropylene and nylon for shells and components), and wood products (lumber and plywood for frames or seat backs). Raw material price fluctuations, dictated by global commodity markets and energy costs, directly impact manufacturing profitability and product pricing. Key activities at this stage involve meticulous quality control of raw inputs and initial component fabrication, such as metal bending and welding or plastic injection molding. Manufacturers must maintain strong, often international, relationships with reliable suppliers to ensure material consistency, sustainability compliance, and resilient supply chain logistics, which is increasingly complex due to geopolitical instability.

The core manufacturing process constitutes the midstream, where assembly, upholstery, finishing (e.g., powder coating, varnishing), and final quality assurance take place. Differentiation at this stage is achieved through investment in advanced robotics for precision assembly and proprietary technologies for ergonomic design. Downstream analysis encompasses the distribution channel, which is highly fragmented and relies heavily on specialized B2B furniture dealers and institutional contract sales. Direct sales channels are common for large volume governmental or university procurements, whereas smaller orders and specialized products often move through established dealer networks who provide local delivery, installation, and after-sales service. The effectiveness of the downstream channel hinges on efficient warehousing, transport logistics, and the ability of the dealers to maintain relationships with specific institutional clients.

The primary distribution method involves a mix of direct and indirect channels. Direct sales are critical for major institutional purchases, such as fitting out a new convention center or a large chain of schools, where competitive bidding and customization are required. Indirect channels, using authorized dealers and specialized wholesalers, handle the bulk of smaller commercial orders and provide localized market penetration. E-commerce and online retail are gaining traction, particularly for smaller quantity purchases by small businesses or residential users, but the complexity of shipping large furniture items limits its dominance in the high-volume institutional segment. Efficient distribution must also account for specialized packaging required to protect the chairs during transit and ensure stackability remains unimpaired upon delivery to the final customer site.

Stacked Seats Market Potential Customers

The potential customer base for the Stacked Seats Market is highly diverse, categorized primarily as institutional and commercial end-users who require scalable, flexible, and durable seating arrangements. The largest and most consistent buyers are educational institutions, ranging from kindergarten facilities to major research universities, which constantly require seating for classrooms, auditoriums, lecture halls, and multipurpose gymnasiums. These buyers prioritize robust construction, high resistance to wear and tear, ease of cleaning, and strict compliance with public procurement regulations often favoring bulk orders and long-term warranties. Demand within this sector is largely inelastic, driven by population demographics and government funding cycles for infrastructure upgrades.

Another major segment comprises the hospitality and corporate sectors. Hotels, resorts, dedicated conference centers, and banquet facilities represent significant end-users, frequently purchasing high volumes of aesthetically refined stacked seating that balances comfort with design to enhance the event experience. Corporate customers, including multinational corporations and startups, utilize these seats in training rooms, large meeting spaces, and flexible co-working environments, focusing on ergonomic design and integration with modern office aesthetics. These customers often have higher budgets and look for chairs made from premium, hybrid materials that convey quality and professionalism, differentiating them from the lower-cost institutional buyers.

The final significant group includes public venues such as governmental buildings, churches, community centers, and mass transit waiting areas. These buyers often seek medium-to-high durability, ease of maintenance, and adherence to specific fire and safety codes. Given the public nature of these spaces, the procurement process can be lengthy and contract-driven. Furthermore, specialized markets, including healthcare facilities (for waiting rooms and therapy areas) and large-scale sports venues (for temporary seating overlays), also constitute important niche buyers. All potential customers share the fundamental need for seating that offers maximum flexibility in space management, ensuring efficient use of commercial real estate and minimizing storage complexity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Herman Miller, Steelcase, KI, Haworth, Global Furniture Group, OFS Brands, VS America, Sauder Education, Spec Furniture, Vitra, Magis, Kartell, Gubi, Nemschoff, Kusch+Co, Dauphin, Sedia Systems, Clarin, MityLite, Krueger International, Seating Concepts, Sandler Seating, Falcon Products, National Office Furniture, Source International |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Stacked Seats Market Key Technology Landscape

The technological landscape of the Stacked Seats Market is defined less by radical digital innovation and more by continuous material science advancements and sophisticated manufacturing processes designed to enhance durability, aesthetics, and user comfort while preserving stackability. A critical technology involves advanced injection molding techniques for plastic components, allowing for the creation of structurally complex chair shells that are lightweight yet incredibly strong, often incorporating glass fiber or carbon fiber reinforcement to meet stringent load-bearing requirements without excessive weight. Furthermore, specialized powder coating and finishing technologies are essential for metal frames, providing corrosion resistance and maintaining aesthetic appeal under high frequency use in diverse climatic conditions, thereby extending the lifespan of the products, which is a major purchasing criterion for institutional buyers.

The manufacturing technology also heavily utilizes Computer Numerically Controlled (CNC) machinery for precise cutting, bending, and welding of metal and wood frames. This precision ensures tight tolerances across mass-produced units, which is paramount for achieving consistent, safe stacking capabilities—a key functional requirement. Ergonomic design software plays a crucial role in modeling new chair forms, utilizing human factors data to optimize seat geometry, lumbar support, and flexibility, ensuring that even temporary seating solutions comply with modern ergonomic standards. This is particularly important for high-end corporate and educational applications where sitting comfort directly impacts user performance and well-being.

In terms of materials, the landscape is shifting towards incorporating sustainable and circular economy technologies. This includes utilizing post-consumer recycled (PCR) plastics, developing modular designs where components can be easily replaced or separated for recycling, and employing non-toxic, low-VOC adhesives and finishes. The use of specialized lightweight alloys, particularly aluminum, allows for easy handling and high stacking density, significantly reducing the logistical effort required by end-users. The continuous evolution in foam technology for cushioning, focusing on high-resilience, long-lasting materials, further contributes to the overall value proposition of modern stacked seating solutions, ensuring comfort does not degrade over the product's lifespan, thereby justifying premium pricing in specialized market niches.

Regional Highlights

North America maintains a dominant position in the Stacked Seats Market, characterized by high institutional spending, sophisticated design demands, and a mature infrastructure for corporate, educational, and hospitality venues. The US market, in particular, drives demand through consistent remodeling and expansion projects in higher education and major corporate campuses, where emphasis is placed on ergonomic quality, compliance with BIFMA standards, and rapid adoption of innovative materials. Manufacturers in this region benefit from robust supply chains and a strong domestic focus on product warranty and customer service, contributing significantly to the overall market revenue. The demand here often focuses on mid-to-high-end products utilizing hybrid materials and advanced ergonomic features, reflecting a willingness to invest in comfort and longevity.

Europe represents another key region, distinguished by its strong emphasis on high design, aesthetics, and rigorous environmental certifications, such as the EU Ecolabel. Western European markets (Germany, UK, France) exhibit strong demand, especially from the contract furniture sector and high-end hospitality venues, valuing heritage brands and sustainable sourcing practices. Southern and Eastern Europe are increasingly contributing to demand driven by the growth of affordable travel and modernization of public facilities. European market leaders often focus on collaborations with renowned industrial designers, integrating stacked functionality seamlessly into aesthetically pleasing, permanent-looking furniture pieces suitable for design-conscious spaces.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally. This exponential growth is underpinned by massive government investments in education infrastructure and the rapid expansion of the commercial real estate and hotel sectors, particularly in China, India, and Southeast Asian countries. Demand in APAC is characterized by a dual market structure: high-volume, cost-sensitive demand for plastic and metal chairs in public schools and budget institutions, juxtaposed with rapidly growing premium demand for sophisticated stacking solutions in new multinational corporate offices and luxury hotels. The sheer scale of infrastructural development in this region ensures a sustained high rate of new installation volume over the forecast period.

Latin America (LATAM) and the Middle East & Africa (MEA) are characterized as emerging markets, showing considerable potential tied to urbanization and infrastructure development, especially in the tourism and educational sectors. In the MEA, major construction projects related to global events (e.g., expos, sporting championships) drive temporary spikes in demand for high-capacity, durable stacked seating. LATAM demand is steady, driven primarily by school systems and public facilities, requiring robust, affordable solutions. These regions often face greater challenges related to localized logistics and procurement processes but represent significant long-term growth opportunities as their economies mature and investment in permanent institutional facilities increases.

- North America: Dominant market share; driven by corporate and higher education investment; focus on ergonomics and BIFMA standards compliance.

- Europe: High value market; emphasis on design aesthetics, sustainability, and adherence to rigorous EU environmental regulations; strong contract furniture sector.

- Asia Pacific (APAC): Highest projected CAGR; fueled by rapid urbanization, massive infrastructure projects (education, hospitality); characterized by high volume, cost-sensitive requirements.

- Latin America (LATAM): Steady growth linked to public sector procurement and educational reforms; demand focused on durability and cost-effectiveness.

- Middle East & Africa (MEA): Growth driven by major event infrastructure (tourism, sports) and educational expansion; potential for high-volume, durable outdoor/indoor seating solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Stacked Seats Market.- Herman Miller (now MillerKnoll)

- Steelcase

- KI (Krueger International)

- Haworth

- Global Furniture Group

- OFS Brands

- VS America

- Sauder Education

- Spec Furniture

- Vitra

- Magis

- Kartell

- Gubi

- Nemschoff (a subsidiary of Herman Miller)

- Kusch+Co

- Dauphin HumanDesign Group

- Sedia Systems

- Clarin (A division of Hussey Seating Company)

- MityLite

- Source International

- Sandler Seating

- National Office Furniture

- Falcon Products

- Integra Seating

Frequently Asked Questions

Analyze common user questions about the Stacked Seats market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Stacked Seats Market?

The Stacked Seats Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033, driven primarily by the global demand for flexible, space-saving furniture in educational and corporate environments.

Which application segment holds the largest market share in the Stacked Seats Market?

The Corporate and Hospitality sectors collectively hold the largest market share due to the continuous high-volume demand for multi-purpose seating required for conference rooms, training facilities, and banquet halls, necessitating rapid space reconfiguration.

How is sustainability impacting the selection of materials for stacking chairs?

Sustainability is a crucial factor, driving manufacturers to utilize Post-Consumer Recycled (PCR) plastics, responsibly sourced wood, and materials that are fully recyclable at the end of the product lifecycle. This shift meets stringent corporate and governmental green procurement standards.

Which geographical region is expected to demonstrate the fastest growth in this market?

The Asia Pacific (APAC) region is anticipated to record the fastest growth CAGR, propelled by robust infrastructure investment, rapid urbanization, and significant expansion across the education and hospitality sectors in countries like China and India.

What are the primary advantages of investing in high-end hybrid stacked seating solutions?

High-end hybrid stacked seating offers superior ergonomic support, enhanced aesthetic appeal suitable for premium venues, and significantly greater longevity and durability compared to standard plastic or metal alternatives, justifying the higher initial investment for corporate and design-focused hospitality clients.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager