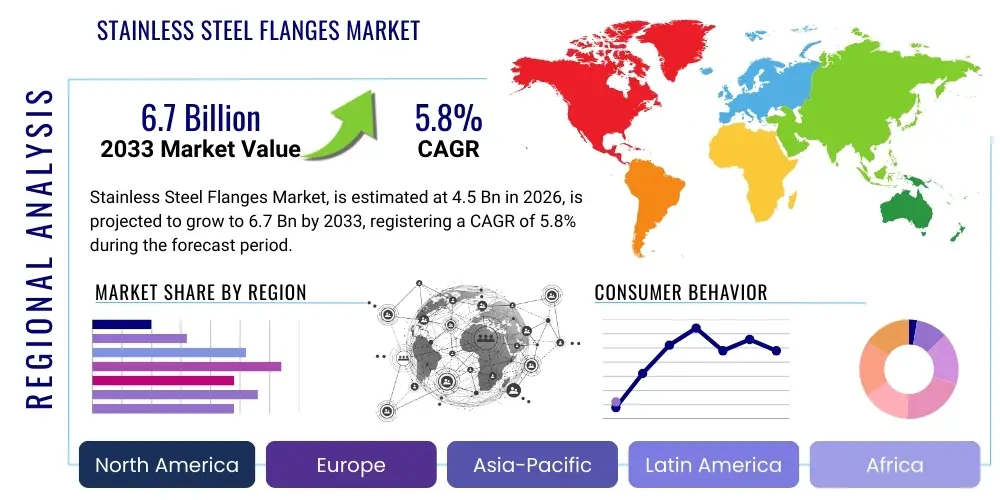

Stainless Steel Flanges Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443580 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Stainless Steel Flanges Market Size

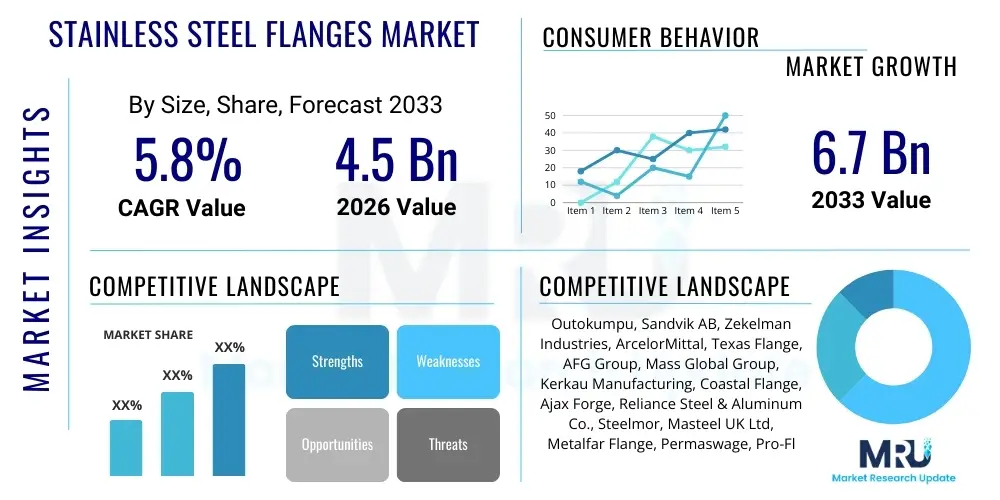

The Stainless Steel Flanges Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Stainless Steel Flanges Market introduction

The Stainless Steel Flanges Market encompasses the production, distribution, and utilization of circular plates designed to connect pipes, valves, pumps, and other equipment to form an effective piping system. These components are predominantly manufactured from various grades of stainless steel, such as 304, 316, and duplex alloys, leveraging their superior resistance to corrosion, high temperature tolerance, and exceptional mechanical strength. The primary function of a flange is to provide a means of disassembly and reassembly without damaging the piping structure, ensuring maintenance accessibility and system flexibility across diverse industrial settings. The intrinsic properties of stainless steel make these flanges indispensable in environments where longevity and reliability under harsh operating conditions are paramount.

Stainless steel flanges find extensive applications across critical infrastructure sectors, including, but not limited to, oil and gas exploration and refining, petrochemical processing, power generation, water and wastewater treatment, and pharmaceutical manufacturing. Their robust performance in corrosive or high-pressure steam systems drives consistent demand. The inherent benefits, such as excellent hygienic properties (crucial for food and pharma sectors), superior weldability, and resistance to pitting and crevice corrosion, position stainless steel flanges as the preferred connection method over alternatives like carbon steel in sensitive applications. Furthermore, regulatory standards mandating high safety and environmental protection in industrial fluid handling contribute significantly to the stable growth trajectory of this market.

The market is significantly driven by escalating global energy demand, necessitating substantial investments in new pipeline infrastructure and refinery expansion, particularly in emerging economies. The surging need for reliable and leak-proof connections in offshore drilling platforms and liquefied natural gas (LNG) terminals further propels demand. Additionally, rapid urbanization and industrialization are increasing the scope of municipal water treatment projects and chemical plant installations, demanding high-integrity stainless steel components. These macroeconomic factors, combined with stringent industry specifications regarding material quality and manufacturing precision, solidify the market's continuous expansion.

Stainless Steel Flanges Market Executive Summary

The Stainless Steel Flanges Market is exhibiting robust growth, propelled primarily by massive capital expenditure projects in the global oil, gas, and chemical sectors, alongside the burgeoning requirements of modern infrastructure development, especially in the Asia Pacific region. Business trends highlight a strong shift towards highly specialized and certified flanges, particularly those conforming to international standards like ASME and EN, reflecting a heightened focus on operational safety and system integrity across process industries. Manufacturers are increasingly investing in advanced forging and machining technologies to enhance product consistency and reduce material waste, thereby improving cost competitiveness and meeting complex client specifications for high-pressure and high-temperature environments. Furthermore, supply chain resilience and digitalization of inventory management are emerging as key competitive differentiators among leading market players.

Regional trends indicate that Asia Pacific dominates the market, driven by accelerated industrial output, extensive infrastructure modernization, and massive investments in refining and petrochemical complexes in countries such as China, India, and Southeast Asian nations. North America and Europe maintain significant market shares, characterized by stringent regulatory environments that necessitate the frequent replacement of aging infrastructure with higher-grade stainless steel components, focusing heavily on sustainability and reduced maintenance cycles. The Middle East and Africa (MEA) region shows rapid growth potential, fueled by ongoing megaprojects in upstream and midstream oil and gas sectors designed to maximize export capabilities and refine indigenous resources. These varied regional dynamics underscore the market's dependence on global energy policies and industrial development cycles.

Segmentation analysis reveals that Weld Neck and Blind Flanges hold dominant positions due to their critical role in high-pressure and isolation applications, respectively. The 316-grade stainless steel segment is expected to witness the fastest growth, attributed to its superior corrosion resistance in marine and acidic environments, essential for chemical and offshore operations. End-use trends confirm the Oil & Gas industry as the primary revenue generator, though Water Treatment and Power Generation segments are projected to increase their relative shares significantly, driven by global climate change mitigation efforts requiring updated, high-efficiency utility networks. The market is thus characterized by specialized demand across multiple vertical sectors, favoring suppliers capable of providing a broad, certified product portfolio.

AI Impact Analysis on Stainless Steel Flanges Market

Common user questions regarding the impact of AI on the Stainless Steel Flanges Market frequently revolve around predictive maintenance capabilities, optimization of the forging and machining processes, and enhancing quality control. Users are keen to understand how AI-driven analytics can minimize operational downtime by accurately forecasting flange fatigue and potential failure points in high-stress piping systems. Furthermore, there is significant interest in applying machine learning algorithms to optimize raw material inventory, forecast demand volatility, and streamline complex supply chains, which are often sensitive to global commodity price fluctuations. The key themes summarized from these inquiries center on using AI to transcend traditional manufacturing limitations, improve material traceability, and achieve superior precision, thereby raising the overall quality standard of industrial piping components globally.

- AI-driven predictive maintenance modeling allows operators to forecast flange lifespan and schedule replacements proactively, minimizing catastrophic failures in high-pressure systems.

- Optimization of forging parameters and heat treatment cycles using machine learning algorithms to enhance the metallurgical integrity and mechanical properties of the stainless steel.

- Automated visual inspection systems utilizing computer vision for rapid and highly accurate detection of surface defects, weld inconsistencies, and dimensional deviations during manufacturing.

- Enhanced supply chain visibility and risk management through AI, predicting raw material shortages or geopolitical disruptions impacting stainless steel alloy procurement.

- Demand forecasting improvements leading to optimized production planning, reduced inventory holding costs, and faster response times to customized or large project orders.

- Simulation and digital twin technology implementation for testing flange performance under extreme virtual stress, reducing physical prototyping and accelerating new product development cycles.

DRO & Impact Forces Of Stainless Steel Flanges Market

The Stainless Steel Flanges Market is powerfully influenced by the synergy between robust industrial expansion drivers and significant countervailing restraints. The primary market driver is the sustained global investment in complex infrastructure projects, particularly within the energy sector, which mandates highly reliable and corrosive-resistant connecting elements. Concurrently, strict environmental and safety regulations enforce the use of premium materials like stainless steel to prevent leaks and ensure long-term operational integrity, especially in handling hazardous fluids. However, the market faces significant restraints, chiefly stemming from the high volatility of raw material prices—nickel and chromium—which directly impacts manufacturing costs and profit margins. Furthermore, the slow pace of infrastructure replacement in developed economies acts as a limiting factor. Opportunities lie in the burgeoning adoption of specialized duplex and super duplex stainless steel grades for extreme environments, alongside the growing repair and maintenance segment driven by aging pipeline networks globally. These impact forces collectively determine the competitive landscape and strategic investment decisions within the sector.

The enduring demand for stainless steel flanges in emerging markets, propelled by urbanization and industrialization, provides a continuous growth impetus. This growth is heavily concentrated in APAC, where new power plants, chemical factories, and refineries are being commissioned at an accelerated pace. Conversely, the market is restrained by the increasing adoption of alternative joining technologies, such as advanced composite piping systems and specialized mechanical connectors, though stainless steel flanges retain superiority in high-pressure, high-temperature, and corrosive applications. The long-term opportunities are substantial, particularly in sustainable energy projects (e.g., geothermal, hydrogen transport), where the superior material properties of stainless steel are non-negotiable for system safety and efficiency. Successful navigation of the impact forces requires strategic sourcing, technological innovation in manufacturing processes, and specialization in high-margin, technically demanding product variants.

The key impact forces shaping the competitive trajectory include intensive quality control mandates, which differentiate reliable suppliers from lower-quality producers, and the pressure for standardization across international trade agreements. The threat of substitutes, while present, is mitigated by the unmatched chemical resistance and durability of stainless steel, especially in critical fluid handling. The bargaining power of buyers remains moderately high due to the standardized nature of many flange types (e.g., ASME B16.5), necessitating competitive pricing strategies, although specialized, custom-engineered flanges offer manufacturers higher leverage. Overall, the market remains driven by capital expenditures in heavy industry, tempered by global commodity price cycles and the constant need for compliance with evolving safety standards.

Segmentation Analysis

The Stainless Steel Flanges Market is meticulously segmented based on Type, Standard, Grade, and End-Use Industry, reflecting the diverse technical requirements across various industrial applications. Segmentation by Type, including Weld Neck, Slip-On, Blind, and Socket Weld, highlights functional differences crucial for system design, determining pressure handling capacity and ease of installation. Standardized segmentation (ASME, EN, JIS) ensures interchangeability and compliance with regional safety codes, which is vital for international project execution. The Grade segmentation, spanning 304, 316, and specialized duplex alloys, addresses the spectrum of required corrosion resistance and mechanical strength, directly correlated to the operational environment. End-Use Industry analysis provides insight into the major revenue streams, confirming the heavy reliance on the Oil & Gas, Chemical, and Power Generation sectors, which are the most demanding users of high-integrity fluid connection components.

Analysis of the Type segment shows that Weld Neck flanges command a significant market share due to their superior structural integrity and suitability for severe service conditions involving high pressures and temperatures, critical for pipeline transport and refinery operations. Blind flanges also represent a substantial segment, being essential for isolating sections of piping or equipment during maintenance and repair, thus ensuring operational safety. Within the Grade segment, 316 Stainless Steel is expected to see accelerated growth owing to its molybdenum content, offering enhanced resistance to chlorides and acidic media, making it indispensable for chemical processing plants and offshore oil installations. This granular segmentation allows market participants to tailor their production capabilities and marketing strategies to address specific technical niche requirements effectively.

The End-Use segmentation confirms the strategic importance of heavy industry. The persistent demand from the Oil & Gas sector, covering upstream, midstream, and downstream activities, remains the dominant revenue driver. However, the fastest growth is anticipated in the Water Treatment segment, driven by global initiatives for clean water access, desalination projects, and municipal wastewater system upgrades, requiring large volumes of corrosion-resistant 304 and 316 stainless steel flanges. The pharmaceutical and food processing industries, requiring high levels of hygiene and non-contaminating components, also contribute stable, high-value demand for specialized, polished stainless steel flanges, further diversifying the market landscape beyond traditional energy sectors.

- By Type:

- Weld Neck Flanges

- Slip-On Flanges

- Blind Flanges

- Socket Weld Flanges

- Threaded Flanges

- Lap Joint Flanges

- Orifice Flanges

- By Standard:

- ASME/ANSI B16.5

- ASME B16.47

- EN 1092-1 (DIN)

- JIS (Japanese Industrial Standards)

- AWWA (American Water Works Association)

- By Grade:

- Stainless Steel 304/304L

- Stainless Steel 316/316L

- Stainless Steel 310S

- Duplex and Super Duplex Grades (2205, 2507)

- High Nickel Alloys

- By End-Use Industry:

- Oil & Gas (Upstream, Midstream, Downstream)

- Chemical and Petrochemical

- Power Generation (Thermal, Nuclear, Renewable)

- Water and Wastewater Treatment

- Marine and Shipbuilding

- Pharmaceutical and Biotechnology

- Food and Beverage Processing

Value Chain Analysis For Stainless Steel Flanges Market

The value chain for the Stainless Steel Flanges Market commences with the upstream extraction and processing of raw materials, primarily nickel, chromium, iron ore, and molybdenum, which are essential constituents of stainless steel alloys. This stage is dominated by large, integrated steel producers who supply steel billets or bars to flange manufacturers. Fluctuations in global commodity markets for these metals significantly impact the cost structure of the final product. The core manufacturing process involves hot forging, heat treatment, and precision machining, often requiring specialized, high-capacity equipment to meet stringent dimensional tolerances and surface finish requirements specified by standards like ASME. Quality control, including non-destructive testing (NDT), hydrostatic testing, and material certification, constitutes a critical value-adding step before the product enters the distribution phase. Effective management of this upstream complexity, particularly securing consistent, high-quality steel supply, is paramount for maintaining competitive manufacturing costs.

The downstream segment of the value chain is characterized by a multi-tiered distribution channel connecting manufacturers to the end-users. Direct distribution channels are predominantly used for large, complex engineering, procurement, and construction (EPC) projects where manufacturers collaborate closely with engineering firms and project owners to supply customized or bulk orders requiring full traceability and technical support. This direct model emphasizes long-term relationships and specialized logistical capabilities. Conversely, indirect distribution utilizes a network of authorized distributors, stockists, and traders who manage inventory, handle smaller, urgent maintenance orders, and provide local accessibility to standardized flanges. These distributors play a crucial role in aggregating demand across multiple smaller end-users, ensuring product availability for routine maintenance, repair, and overhaul (MRO) activities.

The ultimate buyers are the end-use industries, whose demands dictate specific material grades and connection types. For instance, the oil and gas sector demands high-integrity, certified flanges with complete material traceability, leveraging both direct (EPC) and indirect (MRO) channels. The efficiency of the distribution network is crucial; rapid fulfillment of MRO orders often determines operational continuity for end-users. Technological advancements in inventory management and enterprise resource planning (ERP) systems are increasingly being used to optimize lead times and reduce the market lag between production and installation, enhancing overall value delivery across the chain. The high regulatory requirements in the downstream sectors, particularly regarding quality certification, ensure that only reputable suppliers who adhere to stringent quality standards can participate effectively in the market.

Stainless Steel Flanges Market Potential Customers

The primary consumers and potential buyers in the Stainless Steel Flanges Market are large industrial entities and infrastructure developers that rely on robust, leak-proof piping systems to transport or process fluids and gases under various conditions of pressure and temperature. End-users fall broadly into capital expenditure (CapEx) buyers—those involved in building new plants or infrastructure—and operational expenditure (OpEx) buyers—those focused on maintenance, repair, and upgrades (MRO). CapEx buyers, primarily global EPC contractors and project owners in energy and heavy industry, require large volumes of new, specified flanges during the construction phase. OpEx buyers, comprising plant operators, facility managers, and local maintenance firms, require consistent, localized supply of replacement flanges for ongoing system upkeep. Both customer types prioritize material quality, adherence to international standards (e.g., ASME, EN), and reliable delivery schedules.

Specific sectors that constitute the most significant customer base include petroleum refineries, chemical and petrochemical complexes, liquefied natural gas (LNG) terminals, and global power generation facilities (both fossil fuel and nuclear). These environments inherently involve corrosive media, extreme temperatures, and high operational pressures, making the superior mechanical and chemical resistance of stainless steel flanges indispensable for safety and efficiency. Furthermore, the specialized demands of the marine sector, particularly shipbuilding and offshore platform maintenance, require flanges made from specific grades like 316 or duplex stainless steel to withstand saline and brackish environments without premature corrosion. Successful engagement with these customers requires manufacturers to offer comprehensive material certifications and guaranteed product longevity.

Emerging customer segments are found in the expanding green infrastructure domains, notably in renewable energy infrastructure, such as hydrogen production and transport facilities, and advanced municipal infrastructure, like large-scale desalination and advanced water recycling plants. These customers are driven not only by performance but also by sustainability and long-term asset value. For manufacturers, understanding the specific pressure classes, corrosion allowances, and maintenance philosophies of these diverse end-users is crucial for tailoring product offerings and penetrating high-growth niche markets. Customer relationships are heavily dependent on technical expertise, regulatory compliance, and the ability to fulfill complex logistical requirements globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Outokumpu, Sandvik AB, Zekelman Industries, ArcelorMittal, Texas Flange, AFG Group, Mass Global Group, Kerkau Manufacturing, Coastal Flange, Ajax Forge, Reliance Steel & Aluminum Co., Steelmor, Masteel UK Ltd, Metalfar Flange, Permaswage, Pro-Flange, Supreme Forge, JFE Steel Corporation, Nippon Steel Corporation, TISCO (Taiyuan Iron and Steel Co. Ltd.) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Stainless Steel Flanges Market Key Technology Landscape

The Stainless Steel Flanges Market is technologically driven by advancements in precision manufacturing and quality assurance methodologies aimed at improving material integrity and dimensional accuracy under extreme conditions. A foundational technology remains hot forging, which aligns the grain structure of the stainless steel, thereby enhancing the flange's mechanical strength and resistance to fatigue and stress corrosion cracking. Modern forging presses are often integrated with automated temperature control systems and advanced robotics to ensure consistent, defect-free material formation, minimizing the need for extensive post-forging machining. Furthermore, the selection and precise application of specialized heat treatment techniques, such as solution annealing, are critical for optimizing the corrosion resistance and ductility of specific stainless steel grades, particularly high-performance alloys like Duplex and Super Duplex stainless steels used in demanding chemical and offshore environments.

Precision machining constitutes another vital technological area, utilizing multi-axis CNC (Computer Numerical Control) machines equipped with specialized tooling and sophisticated measurement systems. These technologies enable manufacturers to achieve extremely tight tolerances on bore diameters, bolt circles, and facing finishes (such as raised face or ring type joint), which are crucial for ensuring a perfect, leak-proof seal under high pressure. Surface finishing technologies, including specialized coating applications (though less common than for carbon steel, still relevant for wear resistance), and specialized machining techniques for RTJ (Ring Type Joint) grooves, are continually refined to meet increasingly rigorous sealing performance standards demanded by the Oil & Gas industry. The combination of optimized forging and ultra-precise machining ensures that the final product adheres perfectly to international standards like ASME B16.5 and B16.47.

In addition to manufacturing processes, the technology landscape is significantly shaped by non-destructive testing (NDT) and material traceability solutions. Ultrasonic testing (UT), magnetic particle inspection (MPI), and radiography are standard NDT techniques used to detect internal flaws, cracks, or voids invisible to the naked eye, ensuring the structural integrity of the flange. Furthermore, the integration of advanced traceability technologies, such as permanent marking (low stress stamping) and utilizing digital blockchain records for material certificates (MTCs), is becoming standard practice. This technological push is mandated by end-users to maintain stringent quality control and complete lifecycle tracking, especially important in sectors governed by nuclear safety or high-risk chemical regulations, thereby guaranteeing the authenticity and quality of the stainless steel alloy used.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for stainless steel flanges, primarily driven by rapid industrialization, massive investments in infrastructure development, and substantial government spending on energy and water utility projects across China, India, and Southeast Asia. The region’s dominance is supported by the rapid expansion of petrochemical and refining capacities, which necessitate large quantities of durable piping components.

- North America: This region holds a mature market characterized by stringent regulatory frameworks, particularly in the oil and gas sector (shale gas extraction and pipeline maintenance). Demand is stable, driven mainly by the modernization and replacement of aging pipeline infrastructure, focusing on high-grade stainless steel to ensure environmental compliance and reduced maintenance costs.

- Europe: Europe is characterized by advanced manufacturing capabilities and a strong emphasis on high-quality, standardized components (EN/DIN standards). Market growth is moderate, driven by replacement demand in the chemical, pharmaceutical, and nuclear power sectors, with a growing focus on specialty alloys for corrosion-intensive applications and adherence to high European safety standards.

- Middle East and Africa (MEA): MEA is a critical growth region, fueled by extensive upstream and downstream oil and gas megaprojects aimed at maximizing production and export capabilities. The harsh desert and marine environments require specialized, high-performance stainless steel and duplex flanges, leading to high-value transactions concentrated in key producing nations like Saudi Arabia, UAE, and Qatar.

- Latin America (LATAM): The market in LATAM is gradually expanding, heavily dependent on investment cycles in the domestic oil and gas sector (e.g., Brazil, Mexico) and mining operations. Economic stability and governmental policies regarding infrastructure modernization remain key determinants of demand, focusing primarily on maintenance and localized industrial growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Stainless Steel Flanges Market.- Outokumpu

- Sandvik AB

- Zekelman Industries

- ArcelorMittal

- Texas Flange

- AFG Group

- Mass Global Group

- Kerkau Manufacturing

- Coastal Flange

- Ajax Forge

- Reliance Steel & Aluminum Co.

- Steelmor

- Masteel UK Ltd

- Metalfar Flange

- Permaswage

- Pro-Flange

- Supreme Forge

- JFE Steel Corporation

- Nippon Steel Corporation

- TISCO (Taiyuan Iron and Steel Co. Ltd.)

- Forgital Group S.p.A.

- Ulma Forja S. Coop.

- Vogt Valves

- Wärtsilä Corporation

- Pentair plc

Frequently Asked Questions

Analyze common user questions about the Stainless Steel Flanges market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Stainless Steel Flanges globally?

The primary driver is the sustained, large-scale investment in global energy infrastructure, particularly within the Oil & Gas, Chemical, and Power Generation sectors, which mandate high-integrity, corrosion-resistant connecting components for safety and operational longevity. Rapid industrial expansion in the Asia Pacific region further amplifies this demand.

Which stainless steel grades are most widely used for industrial flanges and why?

Stainless steel grades 304/304L and 316/316L are the most common. Grade 304 offers general corrosion resistance for non-critical applications, while Grade 316/316L, containing molybdenum, is preferred for highly corrosive environments, such as marine, chemical processing, and acidic media handling, due to its superior resistance to pitting and crevice corrosion.

How does the volatility of raw material prices impact the Stainless Steel Flanges Market?

The cost of stainless steel flanges is highly sensitive to the volatile global prices of alloying elements, particularly nickel and chromium. Price fluctuations in these commodities directly influence manufacturing costs, procurement budgets of end-users, and the overall profitability margins of flange manufacturers, leading to complex pricing strategies.

What are the key technological advancements influencing the manufacturing of stainless steel flanges?

Key technological advancements include the integration of CNC (Computer Numerical Control) precision machining for tighter dimensional tolerances, advanced hot forging techniques for superior material grain structure, and the widespread application of Non-Destructive Testing (NDT) methods like ultrasonic and radiographic testing to ensure internal material integrity and flawless performance.

Which flange type holds the largest market share in terms of revenue?

Weld Neck Flanges typically hold the largest revenue share. Their design, which features a long tapered hub, provides superior stress distribution across the pipe, making them the preferred choice for high-pressure, high-temperature, and critical services across the Oil & Gas and Power Generation industries where system integrity is paramount.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Stainless Steel Flanges Market Statistics 2025 Analysis By Application (Petrochemical Industry, Food and Pharmaceutical Industry, Architectural Decoration Industry, Others), By Type (Weld Flange, Blind Flange, Slip-On Flange, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Stainless Steel Flanges Market Statistics 2025 Analysis By Application (Petrochemical Industry, Food and Pharmaceutical Industry, Architectural Decoration Industry), By Type (Weld Flange, Blind Flange, Slip-On Flange), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager