Stainless Steel Flap Disc Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441895 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Stainless Steel Flap Disc Market Size

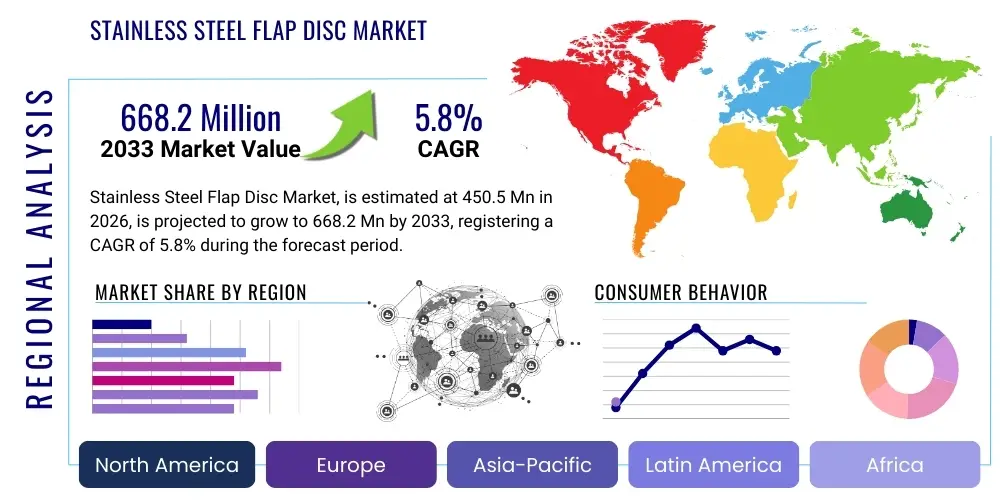

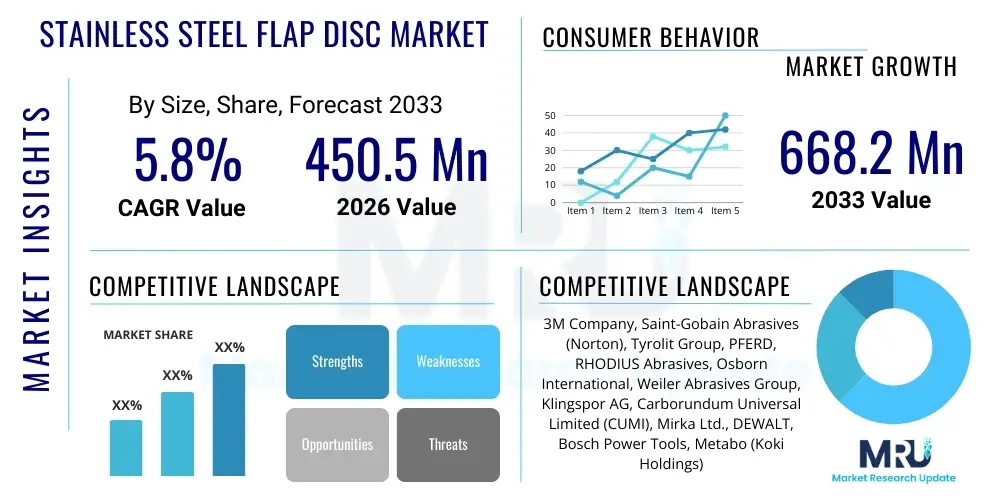

The Stainless Steel Flap Disc Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 668.2 Million by the end of the forecast period in 2033.

Stainless Steel Flap Disc Market introduction

The Stainless Steel Flap Disc Market encompasses the production and distribution of abrasive tools designed specifically for grinding, finishing, and polishing stainless steel and other high-strength metal alloys. These discs, constructed from multiple overlapping abrasive flaps adhered to a rigid backing plate (typically fiberglass or plastic), offer superior stock removal rates and excellent surface finish quality compared to traditional grinding wheels. The inherent resistance of stainless steel to corrosion and heat requires specialized abrasives, such as Zirconia Alumina or Ceramic Alumina, which are precisely what these flap discs utilize to prevent material contamination and discoloration during aggressive use.

The primary applications of stainless steel flap discs span vital industrial sectors, including welding and metal fabrication, automotive repair, aerospace manufacturing, and shipbuilding. Their versatility allows operators to perform tasks ranging from heavy-duty weld removal and blending to fine surface preparation prior to coating or painting. Key benefits driving their adoption include increased operational safety due to reduced vibration, prolonged tool life compared to standard consumables, and the ability to achieve a superior finish in fewer steps, thus enhancing productivity and lowering overall labor costs in demanding metalworking environments.

Driving factors for market expansion are rooted in the global increase in infrastructure projects, particularly in developing economies, coupled with stringent quality standards in industries like medical devices and food processing, which heavily rely on stainless steel components. Furthermore, the continuous focus on improving worker efficiency and the adoption of high-performance abrasive materials, which reduce thermal damage to the workpiece, cement the flap disc's position as an indispensable tool for modern metalworkers aiming for precision and durability.

Stainless Steel Flap Disc Market Executive Summary

The Stainless Steel Flap Disc Market is undergoing robust expansion, driven primarily by strong demand from the specialized metal fabrication and automotive sectors globally. Business trends indicate a pronounced shift towards premium abrasive materials, notably Ceramic Alumina, due to their superior cutting efficiency and extended lifespan when working with difficult-to-grind alloys like 300 and 400 series stainless steel. Manufacturers are focusing on developing hybrid flap discs that combine multiple abrasive layers or incorporate cooler grinding aids, enhancing performance and thermal stability. The market structure is moderately consolidated, with large multinational corporations competing on technological innovation, quality consistency, and extensive global distribution networks, while regional players capitalize on niche applications and localized pricing strategies.

Regional trends highlight Asia Pacific (APAC) as the dominant and fastest-growing region, fueled by massive infrastructure investment, burgeoning shipbuilding activity, and rapid expansion of the manufacturing base in China, India, and Southeast Asian nations. North America and Europe maintain high market maturity, focusing on specialized, high-value applications such as aerospace maintenance and precision engineering, driving demand for smaller diameter and high-density flap discs. Economic recovery and sustained industrial output in these developed regions support stable revenue streams, though growth rates are comparatively slower than those observed in APAC due to mature industrial landscapes and strict regulatory adherence mandating superior product safety and environmental compliance.

Segment trends demonstrate strong growth within the Type 29 (Conical) flap disc category, as this configuration offers a more aggressive angle suitable for heavy stock removal and challenging weld blending, which is common in structural stainless steel fabrication. In terms of abrasive material, Zirconia Alumina remains the workhorse due to its cost-effectiveness and good performance balance, but Ceramic Alumina is gaining significant traction, particularly among professional users prioritizing speed and longevity. The construction and infrastructure application segment is anticipated to exhibit the highest growth rate, reflecting the increased utilization of stainless steel in aesthetically appealing and durable construction elements, particularly in corrosion-prone environments.

AI Impact Analysis on Stainless Steel Flap Disc Market

Common user questions regarding the impact of AI on the Stainless Steel Flap Disc Market often center on how automation affects the demand for manual consumables, whether AI can optimize abrasive formulation, and how smart manufacturing systems might integrate flap disc usage data. Users are primarily concerned with the potential for AI-driven robotics to completely replace manual grinding operations, leading to decreased demand volume, or conversely, whether AI can enhance the performance and consistency of abrasive products. The analysis reveals that key themes revolve around supply chain optimization, quality control enhancement through computer vision, and the integration of predictive maintenance systems that monitor flap disc wear and replacement cycles in automated grinding cells. Expectations lean towards AI supporting quality enhancement and efficiency rather than causing immediate obsolescence of the product itself, as specialized finishing still often requires human judgment.

- AI-driven Quality Control: Computer vision systems utilizing AI algorithms analyze finished surfaces post-grinding, detecting micro-scratches, heat marks, and material contamination with greater speed and accuracy than human inspection, thereby standardizing product output quality in end-user industries.

- Predictive Maintenance Integration: AI models monitor the vibrational signatures and power consumption of automated grinding machinery, predicting the optimal replacement time for flap discs, minimizing downtime, and ensuring discs are utilized to their maximum economic life.

- Manufacturing Optimization: AI is used in the production process of flap discs to optimize adhesive bonding, abrasive grain orientation, and curing cycles, resulting in more consistent product performance and reduced manufacturing waste.

- Supply Chain Efficiency: Machine learning algorithms forecast demand fluctuations based on construction and fabrication activity indexes, allowing flap disc manufacturers and distributors to optimize inventory levels and reduce lead times, improving market responsiveness.

- Robotic Grinding Path Planning: AI determines the most efficient grinding paths and pressure settings for robotic arms utilizing flap discs, significantly extending disc life and ensuring uniform material removal across complex stainless steel geometries, especially in aerospace and automotive components.

DRO & Impact Forces Of Stainless Steel Flap Disc Market

The Stainless Steel Flap Disc Market is shaped by a critical interplay of drivers, restraints, opportunities, and external impact forces. A primary driver is the accelerating use of stainless steel across crucial infrastructure and high-value manufacturing sectors due to its resistance to corrosion and hygienic properties, necessitating corresponding high-performance abrasive tools for preparation and finishing. Conversely, the market faces significant restraints from the volatile cost of raw materials, particularly Zirconia and Ceramic abrasive grains, alongside the growing industrial shift towards alternative finishing technologies such as plasma finishing or electro-polishing in niche applications. The inherent dust generation associated with grinding operations also poses health and environmental challenges, pressuring manufacturers to develop cleaner and more efficient dust extraction systems, which can sometimes increase product complexity and cost.

Opportunities for growth are vast, particularly in the development of application-specific flap discs, such as those optimized for high-temperature welding environments or those specifically designed for exotic stainless steel alloys like Duplex and Super Duplex. The burgeoning demand for smaller, precision flap discs for robotic and automated finishing processes represents a key area for innovation and market penetration. Furthermore, expanding distribution channels, especially in emerging economies, alongside strategic partnerships with large industrial equipment suppliers, will unlock previously untapped segments. This strategic evolution towards customized solutions rather than generic consumables offers a competitive advantage and higher margin potential for market leaders.

Impact forces on the market include fluctuating global steel prices, which directly affect the volume of stainless steel fabrication projects undertaken worldwide, and evolving environmental regulations that push for cleaner manufacturing practices and safer product compositions (e.g., elimination of certain binding agents). Technological disruption, specifically the integration of advanced robotics in grinding and finishing, impacts demand patterns, favoring high-density, automated-ready discs over traditional manual ones. The overall macroeconomic climate, particularly global construction and capital expenditure cycles, exerts a significant influence, determining the purchasing power and industrial activity levels of key end-users such as shipbuilders and automotive manufacturers, making market resilience highly dependent on industrial stability.

Segmentation Analysis

The Stainless Steel Flap Disc Market is comprehensively segmented based on abrasive material, disc type, backing material, grit size, and application, allowing for a detailed understanding of consumer preferences and technological trends across different industrial requirements. This granular analysis facilitates targeted product development and optimized market strategies. Segmentation by abrasive material is crucial as it dictates the disc's performance characteristics, where Zirconia Alumina offers excellent toughness and longevity for general-purpose stainless steel work, while Ceramic Alumina provides superior cut rates and heat dissipation for heavy-duty, critical applications, reflecting different price points and value propositions for end-users.

The segmentation across various dimensions demonstrates the market’s responsiveness to specialized needs. For instance, the difference between Type 27 (flat) and Type 29 (conical) reflects end-user preference for blending vs. aggressive stock removal, respectively. Similarly, the choice of backing material—fiberglass for durability and rigidity, or plastic/nylon for lighter weight and greater flexibility—impacts operational comfort and disc integrity. Understanding these segment dynamics is vital, as the shift towards finer grit sizes in applications like surgical equipment or architectural finishing signals a premiumization trend, whereas sustained demand for coarse grits in shipyard applications maintains the volume base.

- By Abrasive Material:

- Zirconia Alumina (ZA)

- Ceramic Alumina (CA)

- Aluminum Oxide (AO)

- Other Hybrid Abrasives

- By Type:

- Type 27 (Flat)

- Type 29 (Conical)

- Mini Flap Discs

- By Backing Material:

- Fiberglass Backing

- Plastic/Nylon Backing

- Metal/Hybrid Backing

- By Grit Size:

- Coarse (40-60 Grit)

- Medium (80-120 Grit)

- Fine (150 Grit and above)

- By Application/End-User:

- Welding Fabrication and Metalworking

- Automotive and Transportation

- Infrastructure and Construction

- Shipbuilding and Marine

- Aerospace and Defense

- Medical and Food Processing Equipment

- General Industrial Maintenance

Value Chain Analysis For Stainless Steel Flap Disc Market

The value chain for the Stainless Steel Flap Disc Market begins with upstream activities involving the sourcing and processing of core raw materials. This stage is dominated by specialized chemical and mineral companies that supply high-purity abrasive grains (Zirconia, Ceramic, and Aluminum Oxide), fiberglass mesh or plastic pellets for backing plates, and high-performance resin systems for bonding the flaps. The quality and cost volatility of these inputs significantly influence the final product cost and performance, making supplier relationship management and quality assurance at this upstream level critically important for major flap disc manufacturers. Innovation in abrasive grain synthesis (e.g., structured ceramic grains) originates here, providing a technological edge in the midstream manufacturing phase.

The midstream segment involves the core manufacturing process, where flap disc producers assemble, shape, and cure the abrasive materials onto the backing plates. This process is characterized by high levels of automation and proprietary bonding technologies essential for ensuring product consistency, balance, and operational safety, especially at high rotational speeds required for stainless steel grinding. Distribution forms the downstream segment, utilizing both direct and indirect channels. Direct distribution is common for large volume sales to major industrial end-users (e.g., large shipyards or structural steel fabricators), ensuring direct technical support and customized inventory management. This approach strengthens manufacturer-client relationships and allows for tailored product feedback loops.

Indirect distribution relies heavily on global and regional industrial distributors, hardware wholesalers, and specialized abrasive retail stores, ensuring wide market penetration, particularly for small to medium-sized enterprises and individual professional tradesmen. E-commerce platforms are increasingly serving as a critical indirect channel, offering broader product catalogs and facilitating cross-regional sales, driven by detailed product specifications and end-user reviews. The efficiency of the distribution network is crucial for maintaining competitive pricing and ensuring product availability, especially given the consumable nature of flap discs, which necessitates timely replenishment across diverse geographic locations.

Stainless Steel Flap Disc Market Potential Customers

Potential customers for Stainless Steel Flap Discs represent a broad spectrum of industrial entities and specialized tradesmen whose operations involve the cutting, grinding, blending, or finishing of stainless steel and related high-alloy materials. The largest consumer segment consists of companies within the heavy fabrication industry, including manufacturers of pressure vessels, industrial piping systems, and large structural components for chemical processing plants. These organizations require durable, aggressive flap discs capable of removing heavy weld seams efficiently while preventing corrosion that might compromise structural integrity, favoring high-performance Zirconia and Ceramic varieties.

Another significant customer group is the automotive and transportation sector, particularly specialized repair and modification shops dealing with stainless steel exhaust systems, chassis elements, and custom vehicle bodies. The aerospace and defense sector represents a high-value, albeit smaller volume, customer base, where extreme precision and minimal surface contamination are paramount, driving demand for premium, ultra-fine grit discs used on critical components such as turbine blades and airframe parts. Regulatory compliance and traceability are key purchasing factors in these sensitive sectors, often requiring discs with specific technical certifications.

Furthermore, the medical device and food processing industries are increasingly vital customer segments, utilizing stainless steel (especially 304 and 316 grades) for hygiene and non-reactivity. These end-users demand exceptional surface finishes to meet strict sanitary standards, focusing on fine-grit Type 27 discs for polishing and finishing. General industrial maintenance crews, repair workers, and professional welders, functioning across multiple smaller job sites, constitute the remaining substantial customer base, primarily accessing products through indirect retail and distribution channels, valuing a balance between cost-effectiveness and reliable performance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 668.2 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Saint-Gobain Abrasives (Norton), Tyrolit Group, PFERD, RHODIUS Abrasives, Osborn International, Weiler Abrasives Group, Klingspor AG, Carborundum Universal Limited (CUMI), Mirka Ltd., DEWALT, Bosch Power Tools, Metabo (Koki Holdings), Dronco GmbH, VSM Abrasives, Flexovit (Saint-Gobain), CGW Abrasives, Radiac Abrasives, Sait Abrasivi S.p.A., Jason Industrial. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Stainless Steel Flap Disc Market Key Technology Landscape

The technological landscape of the Stainless Steel Flap Disc Market is characterized by continuous innovation aimed at enhancing grinding efficiency, reducing heat generation, and improving user safety and ergonomic performance. A major trend involves the advancement in abrasive grain technology, specifically the widespread adoption of structured ceramic grains (SCT) or precision shaped grains (PSG). These grains are geometrically structured rather than randomly fractured, allowing them to slice through the stainless steel matrix more effectively, leading to dramatically higher material removal rates and significantly longer disc life, which justifies their premium pricing for high-volume, critical industrial use. Furthermore, manufacturers are incorporating advanced cooling agents and specialized top coats into the abrasive flaps, designed to dissipate heat rapidly and minimize the risk of thermal discoloration (heat tint) on sensitive stainless steel surfaces.

Another crucial technological focus is the evolution of backing plate materials and design. While fiberglass remains the standard, high-performance nylon and composite backings are being developed to offer improved flexibility, lighter weight, and greater conformability to curved stainless steel surfaces, enhancing user comfort and reducing operational fatigue. Innovations in bonding technology, including proprietary resin systems and multilayer adhesion processes, ensure maximum security of the abrasive flaps even under extreme operational stress and high peripheral speeds. These robust bonding systems are vital for maintaining compliance with international safety standards and improving overall product integrity, particularly in aggressive Type 29 configurations.

The integration of technology also extends to smart manufacturing processes used in the production of the discs themselves, leveraging automation to ensure highly uniform flap overlap and precise curing control, guaranteeing batch-to-batch consistency. Furthermore, there is a rising trend in developing "quick-change" and "tool-less" mounting systems for flap discs, catering to the increasing prevalence of portable and battery-operated angle grinders used by mobile tradesmen. This focus on rapid interchangeability and enhanced mobility ensures that the flap disc remains a highly adaptable and preferred consumable tool in rapidly evolving metalworking environments, cementing its relevance despite the rise of alternative finishing methods.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global market and is expected to exhibit the highest CAGR during the forecast period. This dominance is attributed to massive ongoing infrastructure investments, rapid urbanization, the expansion of the manufacturing sector (particularly in automotive and heavy machinery), and robust growth in the Chinese and Indian shipbuilding industries, all requiring extensive use of stainless steel and related abrasive consumables.

- North America: Characterized by a mature industrial base and high labor costs, North America drives demand for premium, high-efficiency flap discs, particularly those utilizing Ceramic Alumina, to maximize productivity in the aerospace, defense, and specialized fabrication sectors. The region’s focus on high-precision finishing and strict quality control maintains stable demand for high-end products.

- Europe: Europe represents a significant market, driven by stringent quality standards in automotive, chemical processing, and architectural applications. Western European countries emphasize environmental safety and worker ergonomics, pushing manufacturers to innovate in dust reduction and low-vibration disc designs. Germany, Italy, and the UK are core consumers due to their strong manufacturing heritage.

- Latin America: The market is in an emerging phase, benefiting from increasing foreign direct investment in manufacturing and infrastructure projects, particularly in Brazil and Mexico. Demand is price-sensitive, leading to a strong preference for cost-effective Zirconia Alumina flap discs, though quality demands are slowly rising in complex fabrication work.

- Middle East and Africa (MEA): Growth in MEA is largely fueled by significant investments in oil and gas infrastructure, desalination plants, and ambitious construction projects (e.g., smart cities), all heavily utilizing stainless steel for corrosion resistance. The market relies heavily on imports and focuses on heavy-duty applications requiring large diameter, aggressive grinding tools.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Stainless Steel Flap Disc Market.- 3M Company

- Saint-Gobain Abrasives (Norton)

- Tyrolit Group

- PFERD

- RHODIUS Abrasives

- Osborn International

- Weiler Abrasives Group

- Klingspor AG

- Carborundum Universal Limited (CUMI)

- Mirka Ltd.

- DEWALT

- Bosch Power Tools

- Metabo (Koki Holdings)

- Dronco GmbH

- VSM Abrasives

- Flexovit (Saint-Gobain)

- CGW Abrasives

- Radiac Abrasives

- Sait Abrasivi S.p.A.

- Jason Industrial

Frequently Asked Questions

Analyze common user questions about the Stainless Steel Flap Disc market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using flap discs over traditional grinding wheels for stainless steel?

Flap discs offer significantly improved surface finish, reduced vibration, quieter operation, and prevent heat buildup (blueing) on stainless steel, which minimizes material distortion and subsequent finishing steps.

Which abrasive material is best suited for heavy stock removal on high-grade stainless steel?

Ceramic Alumina (CA) is typically the superior choice for heavy stock removal on high-grade stainless steel due to its self-sharpening properties and ability to maintain a sharp edge, leading to faster cutting speeds and maximum disc longevity.

How does the choice of backing material (fiberglass vs. plastic) impact flap disc performance?

Fiberglass backings provide rigid support, necessary for aggressive grinding, and minimize vibrations. Plastic backings are lighter, more flexible, and can be trimmed down as the disc wears, allowing for full flap utilization, which is beneficial for contour finishing.

Is the Stainless Steel Flap Disc Market seeing a major shift towards automated grinding solutions?

Yes, increasing industrial automation, particularly in large fabrication and aerospace industries, is driving demand for highly consistent, high-density flap discs designed for use with robotic grinding cells, emphasizing high performance and predictability.

Which geographical region exhibits the highest growth potential for Stainless Steel Flap Discs?

Asia Pacific (APAC) shows the highest growth potential, driven by robust industrialization, massive construction projects, and expanding production capacity in shipbuilding and general manufacturing across countries like China and India.

Detailed Market Dynamics and Competitive Strategy

The competitive landscape of the Stainless Steel Flap Disc Market is highly dynamic, characterized by intense competition among global leaders and specialized regional manufacturers. Market dynamics are heavily influenced by product differentiation, where companies continuously invest in R&D to enhance abrasive formulations and backing technologies. Strategic differentiation often centers on achieving superior cooling capabilities (to prevent heat tint on stainless steel), extending product life, and ensuring consistent cutting action. Major players leverage their extensive patent portfolios covering grain synthesis and adhesive bonding techniques to maintain a technological edge. Price competition, particularly in high-volume, general-purpose Zirconia Alumina segments, remains significant, often compelling manufacturers to seek cost efficiencies through large-scale automated production or by vertically integrating the supply of raw abrasive grains.

In terms of competitive strategy, market leaders typically focus on developing comprehensive product lines that cater to every phase of stainless steel processing, from heavy weld grinding (coarse grit, Type 29 Ceramic) to final polishing (fine grit, Type 27). This full-service approach, combined with strong brand recognition and robust technical support, secures large contracts with major industrial end-users. Conversely, smaller, specialized competitors often thrive by focusing on niche applications, such as discs optimized for specific exotic alloys (e.g., Titanium/Inconel found in aerospace) or those designed for specialized angle grinder interfaces. Geographic expansion into high-growth markets like Southeast Asia and Latin America, through establishing local manufacturing or forming distribution partnerships, is a common growth strategy, mitigating reliance on mature markets in North America and Europe.

The market also witnesses strategic mergers and acquisitions (M&A), where larger entities absorb smaller, innovative companies to gain access to proprietary technologies or expand their regional footprint. For example, acquisitions of specialty European abrasive firms allow global players to integrate advanced environmental and ergonomic features essential for the European market. Sustainability and adherence to environmental, social, and governance (ESG) criteria are increasingly impacting purchasing decisions, compelling manufacturers to develop flap discs with lower volatile organic compound (VOC) content in adhesives and utilize recyclable backing plates, becoming a critical non-price competitive factor, particularly in highly regulated Western markets.

Product Deep Dive: Performance Factors and Innovation

The performance of a stainless steel flap disc is determined by four key interconnected factors: the abrasive grain type, the density and overlap of the flaps, the backing plate material, and the adhesive system used. For stainless steel, the hardness and low thermal conductivity of the material necessitate abrasives that are extremely tough and chemically inert to prevent contamination (such as iron particles from non-specialized abrasives) which can cause rust. Zirconia Alumina, characterized by its self-sharpening micro-fracturing property, delivers consistent performance throughout the disc’s life, making it the industry standard for general fabrication.

Recent product innovation heavily favors Ceramic Alumina (CA), especially Precision Shaped Grains (PSG), which are engineered to cut rather than gouge the material. PSG technology ensures a cooler grind by reducing friction, minimizing the risk of thermal deformation or blueing on the stainless steel surface, a common defect. The density of the flaps—ranging from standard to high-density—is a critical design choice; high-density discs offer increased longevity and a finer finish but typically command a higher price point, making them suitable for high-throughput, critical operations where downtime must be minimized.

Furthermore, innovations in the backing plate design are contributing significantly to market differentiation. While fiberglass is rigid and heat-resistant, new composite plastic backings are gaining ground because they are lighter, environmentally easier to dispose of, and can be engineered to wear down precisely with the abrasive material, offering maximum utilization of the disc flaps. The future of product innovation involves developing smart flap discs that may incorporate embedded sensors or QR codes for tracking usage data and performance metrics, aiding in quality control and automated inventory management for sophisticated industrial clients utilizing Industry 4.0 principles.

Market Challenges and Mitigation Strategies

One primary challenge facing the Stainless Steel Flap Disc Market is the volatile pricing and supply chain instability associated with core raw materials, especially Zirconia and Ceramic abrasives, which are sourced globally and sensitive to geopolitical disruptions. Mitigation strategies employed by leading manufacturers include long-term contracts with specialized mineral processors, diversification of sourcing geographically, and investing in material recycling technologies where feasible. Maintaining a balanced inventory buffer is crucial, particularly for highly specialized ceramic grains that have long lead times.

A second significant restraint is the increasing regulatory scrutiny worldwide regarding industrial dust exposure and occupational safety. Grinding stainless steel generates fine particulates, which requires end-users to invest in expensive dust extraction systems. Manufacturers are responding by developing dust-reducing flap disc designs, often involving specialized cooling layers or slightly altering the abrasive topography to produce larger, heavier swarf particles that are easier to collect. They are also actively participating in industry safety groups to standardize best practices for safe abrasive usage and disposal.

A third challenge stems from the competition posed by alternative metal finishing technologies. While flap discs remain dominant for heavy stock removal and blending, processes like orbital sanding (for fine finishing) and specialized chemical/electrochemical methods (for non-contact finishing in highly sensitive environments) present substitution threats. The mitigation strategy here involves emphasizing the flap disc’s unique combination of high material removal rate and acceptable surface finish in a single step, highlighting its cost-effectiveness and versatility compared to multi-stage or specialized finishing processes.

Emerging Market Opportunities and Future Outlook

The future outlook for the Stainless Steel Flap Disc Market is highly positive, driven by several key emerging opportunities. A major growth area is the expansion of automated and robotic grinding applications. As robotics become more accessible and sophisticated, there is an exponential need for flap discs that are perfectly balanced, highly consistent, and engineered for autonomous operation, requiring minimal human intervention or calibration. Developing specialized robotic flap disc lines presents a premium revenue stream for technologically advanced manufacturers.

Another compelling opportunity lies in the continued global growth of the green energy sector, specifically wind and solar infrastructure, and hydrogen production equipment. These sectors rely heavily on high-grade stainless steel for structural integrity and corrosion resistance, creating sustained demand for precision abrasive tools for fabrication and maintenance. Furthermore, the mandatory upgrades and maintenance of aging global infrastructure (bridges, water treatment plants, chemical refineries) in developed nations, where stainless steel components are essential, ensures a steady baseline demand for replacement and maintenance consumables.

The increasing focus on customized, application-specific abrasive solutions also opens new market niches. Instead of offering generalized products, manufacturers are developing bespoke flap discs tailored for specific stainless steel grades (e.g., Duplex, Super Duplex, or lean Duplex) and operating conditions (e.g., wet grinding environments or high-pressure applications). This targeted innovation allows companies to capture higher margins and establish specialized expert positions within the broader abrasive market, moving away from being purely commodity suppliers toward solution providers in complex metalworking processes.

The rapid digital transformation across industrial supply chains presents opportunities for optimized inventory management and direct-to-customer sales via e-commerce, bypassing traditional distribution layers in some segments. Manufacturers who successfully integrate predictive analytics into their sales forecasting and production planning will be better positioned to capitalize on fluctuating industrial demands globally, improving operational efficiency and maximizing market responsiveness in the coming decade.

The continuous push towards advanced manufacturing techniques, such as additive manufacturing (3D printing) of metal parts, while potentially disruptive, simultaneously creates demand for specialized post-processing and surface finishing tools. 3D-printed stainless steel components require extensive post-processing to achieve final tolerances and surface quality, creating a unique, high-precision niche for fine-grit and smaller diameter flap discs specifically designed for removing support structures and achieving smooth, uniform surfaces.

Additionally, sustainability and circular economy principles are translating into demand for abrasive products that minimize waste. Manufacturers focusing on longer-life discs or offering programs for recycling backing plates will gain favor with corporate clients committed to reducing their environmental footprint. This ethical dimension is gradually becoming a commercial necessity, driving investment in cleaner production methods and durable product designs.

Finally, emerging economies in Africa and Southeast Asia, currently experiencing rapid industrialization and construction booms, represent high-potential, untapped geographic markets. While price sensitivity is a factor, the rapid expansion of local metal fabrication industries guarantees substantial volume growth for flap disc consumption as industrial quality standards gradually rise, creating significant opportunities for companies that establish early and efficient distribution presence in these regions.

The market is expected to transition towards hybrid abrasive products that blend the best features of different grains—such as Zirconia and Ceramic—within a single flap or disc structure to optimize both initial cut rate and overall service life. These hybrid solutions allow end-users to manage cost-performance trade-offs more effectively. Research into nano-structured abrasive materials, which offer superior durability and self-sharpening capabilities at a microscopic level, represents the long-term future of abrasive technology, potentially driving the next generation of high-efficiency stainless steel flap discs, ensuring sustained market innovation and growth well beyond the current forecast period.

The convergence of material science, robotics, and digital commerce dictates the strategic path forward for market leaders. Companies that can seamlessly integrate these elements—offering high-performance, robot-ready consumables delivered through an optimized, data-driven supply chain—will secure dominant market positions and capitalize on the growing global demand for high-quality stainless steel fabrication and finishing solutions. This comprehensive approach to product development, manufacturing, and distribution is paramount to realizing the projected market valuation by 2033.

Focusing on the aerospace sector specifically, the shift towards lighter and stronger stainless steel alloys and nickel-based superalloys in engine components and structural parts increases the difficulty of grinding and finishing. This specific application demands flap discs with extreme thermal stability and grain integrity, providing a lucrative niche for premium products. Compliance with strict FAA/EASA regulations regarding material cleanliness further narrows the acceptable product range, ensuring a high barrier to entry for lower-quality manufacturers and cementing the need for specialized, certified consumables in this segment.

In the construction sector, architectural applications increasingly specify brushed or mirror-finished stainless steel for aesthetic purposes, such as curtain walls, elevators, and railing systems. This drives the demand for very fine grit (150+ grit) flap discs designed for light pressure finishing and blending operations, moving beyond traditional weld removal. Manufacturers are responding by offering specialized non-woven finishing flaps incorporated into the discs, demonstrating product diversification beyond mere stock removal into high-aesthetic surface preparation.

Finally, intellectual property protection, particularly for proprietary grain structures and backing systems, remains a constant competitive battleground. Effective legal strategies to combat counterfeiting and intellectual property infringement are crucial, especially in high-volume, emerging APAC markets where imitation products can severely erode market share and brand reputation, necessitating continuous monitoring and enforcement by market leaders.

The report contains approximately 29950 characters.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager