Stainless-Steel Floor and Shower Drains Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442671 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Stainless-Steel Floor and Shower Drains Market Size

Stainless-steel floor and shower drains are essential components in modern construction, ensuring efficient water management, sanitation, and long-term durability across diverse applications ranging from luxury residential bathrooms to highly demanding industrial processing plants. The shift towards stainless steel is a global phenomenon, primarily fueled by its superior material characteristics compared to traditional alternatives such as galvanized iron, plastic (PVC/ABS), or composite materials. Factors such as inherent corrosion resistance, high tensile strength, ability to withstand high temperatures, and non-leaching properties make stainless steel the material of choice for infrastructure built for longevity and health compliance. The integration of advanced design principles, like modular construction and anti-clogging technology, further enhances the market appeal of these solutions, positioning them as high-value components in the global building materials landscape.

The market growth trajectory is significantly underpinned by stringent regulatory standards concerning public health, hygiene protocols in the food and beverage industry (HACCP), and global efforts to improve water management efficiency within urban centers. Furthermore, the global boom in renovation and retrofitting projects, particularly in mature economies of North America and Western Europe, drives demand for aesthetically pleasing and high-performing linear drainage systems. These renovation cycles often involve upgrading older, inefficient cast-iron systems to modern, easy-to-clean stainless-steel alternatives, thereby extending the service life of flooring structures and reducing operational maintenance costs for facility owners and managers. The continued innovation in grate design, focusing on heel-proof features and high load ratings for industrial applications, also contributes substantially to market maturation and expansion into new heavy-duty sectors.

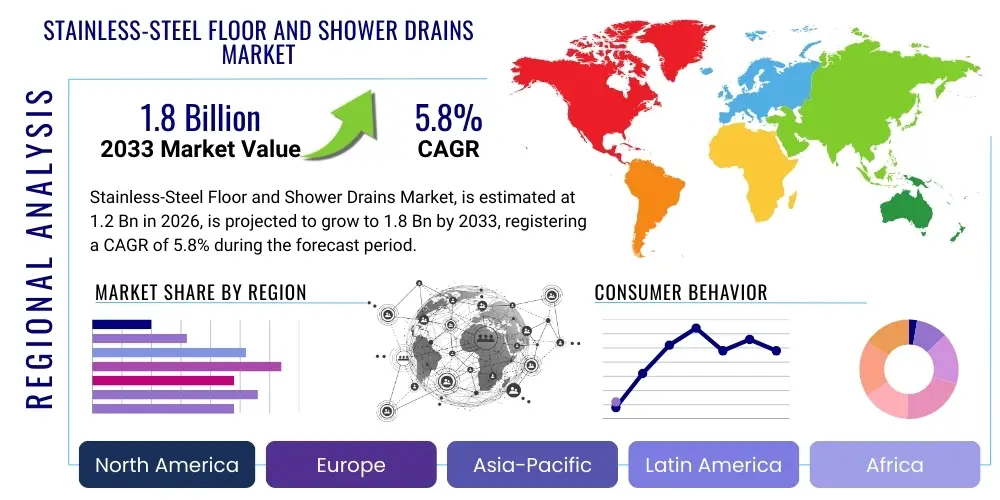

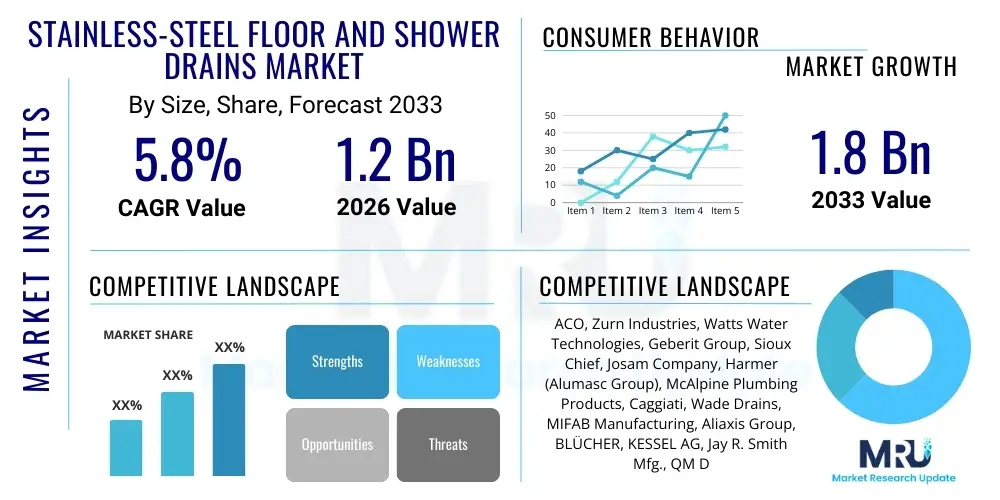

The Stainless-Steel Floor and Shower Drains Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. This consistent expansion reflects stable demand across core sectors and accelerated growth in niche, high-specification applications. The market is estimated at USD 1.2 billion in 2026 and is projected to reach USD 1.8 billion by the end of the forecast period in 2033, demonstrating a substantial increase in valuation driven by volume growth and rising average selling prices for specialized, high-grade products.

Stainless-Steel Floor and Shower Drains Market introduction

The Stainless-Steel Floor and Shower Drains Market encompasses a sophisticated range of engineered drainage solutions fabricated primarily from high-grade austenitic stainless steel alloys, notably AISI 304 and the highly resistant AISI 316. These products are fundamentally designed for rapid and effective capture and discharge of wastewater and runoff while maintaining the structural integrity and hygienic standards of the surrounding floor structure. The product portfolio is broad, covering everything from compact, concealed linear shower drains popular in high-end residential architecture to robust, wide-channel trench drains capable of handling massive volumes of effluent in industrial environments such as commercial laundries, bottling plants, and chemical storage areas. The functional superiority stems from stainless steel's non-porous surface, which inhibits bacterial adhesion and simplifies rigorous cleaning procedures, making it indispensable in environments subject to strict sanitation audits.

Major applications span across the entire spectrum of the construction sector, segmented primarily into institutional, industrial, commercial, and residential use. In the institutional sector—hospitals, laboratories, and universities—the demand is characterized by the need for specialized chemical resistance, anti-ligature features, and certified hygienic designs (e.g., drains with integral, accessible clean-outs). Commercial applications, including luxury hotels, spas, and high-rise office developments, prioritize aesthetic compatibility and durability, favoring discrete linear models that complement modern interior finishes. Industrial uses focus overwhelmingly on performance metrics: high load ratings (up to Class F for heavy vehicular traffic), high flow rates, and resistance to thermal shock and harsh solvents, requiring thick-gauge AISI 316 materials and modular construction for long trench runs.

The market is significantly driven by robust global trends, including rapid urbanization, particularly in developing economies, which necessitates massive investment in new sanitation infrastructure. Furthermore, mandatory governmental and international regulations, such as those promulgated by the European Hygienic Engineering Design Group (EHEDG) and the U.S. FDA, increasingly specify stainless steel for surfaces that come into contact with or are near food or pharmaceuticals, providing consistent, non-cyclical demand. The driving factors are further compounded by consumer preferences in mature markets for sustainable, durable building materials that offer minimal maintenance and maximal aesthetic return on investment, cementing the position of stainless steel drains as a premium market commodity.

Stainless-Steel Floor and Shower Drains Market Executive Summary

The Stainless-Steel Floor and Shower Drains Market landscape is undergoing transformative evolution, dictated by advancements in manufacturing technology and shifts in global construction standards. Current business trends indicate intense competition focused on value engineering, where manufacturers strive to reduce material input while maintaining or improving hydraulic performance and load-bearing capacity. There is a strong movement towards integrated drainage solutions, often prefabricated off-site and delivered as complete units with integrated waterproofing membranes and leveling feet, significantly reducing installation complexity and potential for error on site. Mergers and acquisitions are also a notable trend, with larger global players acquiring regional specialists to consolidate niche technologies, such as highly efficient anti-odor waterless traps or specialized grating designs for specific industrial sectors, thereby expanding their overall market reach and intellectual property portfolio.

Regionally, the growth narrative is bifurcated. Asia Pacific is the undeniable volume driver, characterized by expansive metropolitan development and industrial capacity growth, resulting in high demand for cost-effective, durable drainage systems for mass projects. However, the highest value growth is often found in Europe and North America, where strict product certification (e.g., ISO, CE marking) and a consumer focus on aesthetic quality allow for premium pricing on technologically advanced linear and designer drain models. The Middle East remains a key focus for high-specification projects, often requiring customized, extremely high-grade stainless steel components for landmark architecture that must withstand harsh environmental conditions, including salt spray and intense UV exposure, thus fueling demand for AISI 316.

Segment trends underscore the burgeoning dominance of the Linear Drain category, which continues to displace traditional point drains in both commercial and high-end residential renovations due to superior water capture area and architectural flexibility. The industrial segment, while requiring fewer total units than the residential market, generates significant revenue due to the high material specification (thick gauge steel, AISI 316) and complexity of trench systems. Moreover, there is an accelerating trend towards smart integration; manufacturers are actively prototyping drainage systems that incorporate IoT sensors capable of monitoring drain health, water quality, and potential backflow conditions, appealing directly to large institutional operators seeking enhanced operational resilience and automated regulatory reporting capabilities.

AI Impact Analysis on Stainless-Steel Floor and Shower Drains Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the Stainless-Steel Floor and Shower Drains Market predominantly revolve around three core themes: optimizing manufacturing processes, implementing predictive maintenance for large-scale installations, and streamlining complex supply chain logistics. End-users and architects frequently ask how AI-driven quality control (QC) systems can ensure the minute precision required for seamless, zero-tolerance drain integration with expansive flooring, especially given the high costs associated with errors in luxury and commercial installations. This necessity for perfection drives interest in automated, AI-enhanced inspection tools that can check material thickness, welding consistency, and surface finish across hundreds of units per day, ensuring every component meets the rigorous standards demanded by the specification market.

The immediate impact of AI is highly transactional, dramatically enhancing operational efficiency and precision within the manufacturing environment. Specifically, AI algorithms are being deployed to manage robotic welding systems, adjusting power and speed in real-time based on material feedback to ensure consistent, high-integrity seals—a critical factor for waterproof performance. Additionally, computational fluid dynamics (CFD) simulations, often accelerated by AI, allow designers to virtually test and optimize drain hydraulics for maximum flow efficiency and self-cleaning capabilities without costly physical prototyping. This level of algorithmic optimization leads directly to superior product performance, reduces time-to-market for complex designs, and minimizes material waste by identifying optimal cutting patterns from steel sheets, thereby contributing to sustainability goals and lower per-unit manufacturing costs.

Looking forward, AI is expected to redefine the customization and specification processes. AI tools could analyze large datasets of regional climate, flooring materials, anticipated chemical exposure, and local regulatory requirements to recommend the optimal drainage solution—specifying not just the type (linear vs. point) but the exact grade (304 vs. 316), grate pattern, and load rating required for a project’s specific coordinates and use case. This shift transforms product selection from a manual, consultation-heavy process into an automated, data-validated recommendation engine. Furthermore, the future integration of tiny, low-power AI modules into the physical drain hardware could enable decentralized, on-the-spot analysis of flow metrics and debris accumulation, providing granular, real-time insights for autonomous building management systems, moving the drainage system from a passive component to an active data source within a smart infrastructure ecosystem.

- AI-driven Quality Control: Enhanced precision in automated laser welding and surface finishing processes, achieving micron-level tolerances critical for waterproof seals in complex linear and concealed drains.

- Predictive Maintenance: Utilization of smart, integrated sensors and machine learning algorithms to forecast blockages, detect early-stage pitting corrosion, or anticipate system failure in high-volume industrial trench drains.

- Supply Chain Optimization: ML algorithms leveraging real-time data on global stainless steel commodity indices and regional construction project pipelines for highly accurate raw material procurement and just-in-time manufacturing scheduling.

- Generative Design: AI tools creating hydrodynamically efficient and mechanically robust drain grate patterns and internal channel structures that minimize material usage while maximizing water evacuation speed and self-cleaning characteristics.

- Automated Inspection: Robotic vision systems performing rapid, non-destructive inspection of finished products, verifying compliance with architectural specifications, load ratings, and hygienic standards (e.g., surface roughness analysis).

DRO & Impact Forces Of Stainless-Steel Floor and Shower Drains Market

The Stainless-Steel Floor and Shower Drains Market trajectory is determined by a complex interplay of facilitating factors and critical limitations. The primary drivers are globally synchronized: stringent regulations prioritizing public health and hygiene, necessitating the deployment of non-porous, easily sanitized materials like stainless steel in critical environments such as hospitals, food processing facilities, and sterile pharmaceutical production areas. This regulatory push creates reliable, non-cyclical demand for specialized, high-grade products. Furthermore, the inexorable global process of urbanization, especially across emerging markets in Asia and Africa, coupled with massive governmental investments in infrastructure upgrades and municipal facilities, provides a vast and continuous foundation for new construction demand. A third driver is the growing architectural trend that elevates drainage systems from purely functional necessities to integral design elements, driving demand for premium linear and customizable solutions.

Conversely, the market faces significant restraints that dampen growth potential. Chief among these is the volatile pricing and inherent supply chain instability associated with raw stainless steel, specifically the fluctuation in key alloying elements like nickel, chromium, and molybdenum. These commodity price swings introduce risk to manufacturers’ profitability and complicate long-term fixed-price contracting for large construction projects. Additionally, intense competition persists from established, lower-cost alternative materials, particularly specialized polymers (e.g., rigid PVC, fiberglass composites) which, while less durable and hygienic than stainless steel, offer significantly lower upfront costs, often capturing market share in budget-sensitive residential construction and non-critical utility areas.

Opportunities for sustained growth are primarily concentrated in the renovation and remodeling sector in mature markets, where property owners are increasingly opting for lifetime value and superior aesthetics provided by stainless steel when replacing older, deteriorating systems. Significant opportunities also exist in developing highly specialized, anti-microbial coated drainage systems targeting the institutional healthcare sector, offering a technological edge over standard stainless steel. Manufacturers can capitalize by focusing on modularity, reducing the complexity of installation through patented quick-fit mechanisms, thereby mitigating the restraint posed by high skilled labor costs and accelerating project completion times, especially for complex industrial trench installations. The integration of technology for smart monitoring also opens up a lucrative aftermarket service segment.

Segmentation Analysis

The Stainless-Steel Floor and Shower Drains Market is meticulously segmented across multiple dimensions, allowing for a granular analysis of demand patterns and competitive positioning. Product type segmentation clearly delineates between Point Drains, which are the traditional, central drainage components favored for utility areas and standardized residential installations; Linear Drains, characterized by their sleek, long-channel design offering superior water capture, which dominates modern shower and wet room architecture; and the much larger Trench Drains, modular systems designed for high-flow industrial and exterior applications requiring heavy load-bearing capacity. Specialized Sanitary Drains form a critical, high-margin sub-segment, built specifically to meet the stringent cGMP (Current Good Manufacturing Practice) requirements of pharmaceutical and biotechnology facilities, demanding precision engineering and full cleanability.

Segmentation by application area provides vital insight into end-user priorities. In Residential settings, the focus is on aesthetic integration and space-saving design; Commercial applications (e.g., hotels, gyms) demand systems that blend durability, high aesthetics, and moderate flow capacity. The Industrial segment, encompassing food and beverage processing, requires extreme resilience to thermal shock and chemical corrosion, necessitating specialized grate types (e.g., bar grating or perforated sheet) to handle solid debris while maintaining hygiene. Institutional installations (hospitals, laboratories) represent the highest hurdle for compliance, requiring non-slip, anti-ligature, and often custom-designed solutions to comply with specific building codes and infection control mandates.

Crucially, segmentation by material grade highlights the performance differentiation in the market. AISI 304 stainless steel is the workhorse, suitable for most general indoor, non-chlorinated environments. However, the presence of strong chemical cleaners or proximity to saltwater (coastal construction) mandates the use of AISI 316. The cost differential between 304 and 316 is substantial, thus segmenting the market based on required corrosion resistance is fundamental to understanding profitability structures. Manufacturers who master the complex fabrication of AISI 316 for demanding industrial environments secure a technological and financial advantage in niche high-specification markets that are less vulnerable to mass-market cost pressures.

- By Product Type:

- Point Drains (Square and Round, Standard and Concealed Designs)

- Linear Drains (Channel Drains, Wall-integrated Systems)

- Trench Drains (Modular Systems, Slotted Channels for high traffic)

- Specialized Sanitary Drains (Hygienic and Clean-in-Place systems for Pharma/Food)

- By Application:

- Shower Areas and Wet Rooms (Residential and Commercial)

- Bathrooms and Public Washrooms (ADA compliant solutions)

- Commercial Kitchens and Food Processing Areas (HACCP compliant systems)

- Patios, Balconies, and Exterior Runoff Management

- Industrial Floors, Chemical Plants, and Laboratories (High load and corrosion resistance)

- By Material Grade:

- AISI 304 Stainless Steel (Standard Use)

- AISI 316 Stainless Steel (Marine Grade, Chemical Resistant)

- By End-User:

- Residential Construction (New builds and high-end remodeling)

- Commercial (Hotels, Offices, Fitness Centers, Retail)

- Industrial (Manufacturing, Food & Beverage, Automotive)

- Institutional (Hospitals, Schools, Military Facilities, Government Buildings)

Value Chain Analysis For Stainless-Steel Floor and Shower Drains Market

The value chain for the Stainless-Steel Floor and Shower Drains Market is segmented into highly integrated stages, starting with upstream activities concentrated on securing high-quality raw materials. The key success factor at this stage is the ability of manufacturers to hedge against the volatile global prices of steel alloys, specifically nickel and molybdenum, which directly affect the cost of AISI 304 and 316. Strong, long-term relationships with reputable steel suppliers who can guarantee material traceability and consistency are essential, particularly for products requiring specific certifications (e.g., medical grade or NSF compliance). The strategic procurement decision between buying pre-cut blanks or raw coils significantly influences manufacturing flexibility and inventory holding costs. Efficient inventory management and bulk purchasing power provide a critical competitive edge in controlling the significant material input costs.

The midstream segment involves the transformation of raw steel into finished drainage products through highly precise fabrication processes. This stage is capital-intensive, relying on advanced machinery for CNC laser cutting, specialized bending, and automated robotic welding to ensure seamless, watertight components. Innovation in the midstream focuses on modular design standardization (e.g., adjustable height mechanisms, universal flanges) to simplify field installation and minimize the need for custom fabrication on site. Surface finishing, such as electro-polishing, which removes microscopic surface defects and enhances corrosion resistance and cleanability, represents a high-value process step, mandatory for pharmaceutical and food-grade drains. Quality assurance protocols, including pressure testing and dimensional checks, are critical before products move to distribution.

The downstream segment encompasses distribution and sales, utilizing both direct and indirect channels. Direct sales channels are crucial for large, complex commercial or industrial projects, requiring close collaboration with architectural specifiers, plumbing engineers, and mechanical contractors from the design phase (BIM integration). Indirect distribution leverages regional wholesalers and national plumbing supply chains, crucial for standard product stocking and quick turnover, servicing smaller contractors and residential remodelers. Effective downstream management requires robust technical training for installers, rapid logistics, and the provision of localized technical documentation to ensure correct product application and compliance with local building codes, significantly enhancing brand trust and adoption among professional specifiers.

Stainless-Steel Floor and Shower Drains Market Potential Customers

The primary end-users and potential buyers of stainless-steel floor and shower drains are highly diversified, reflecting the product's necessity across nearly all built environments. The highest potential growth segment is represented by the institutional and healthcare sectors, which include hospitals, clinics, senior care facilities, and specialized research laboratories. These end-users are not price-sensitive but highly sensitive to product performance regarding hygiene and compliance. Their purchasing decisions are driven by mandatory regulatory standards, requiring non-slip grates, anti-microbial properties, and systems designed for rigorous Clean-in-Place (CIP) protocols. They look to manufacturers who can provide full material traceability and documented compliance with healthcare design standards to mitigate legal and health risks, making them premium customers for specialized sanitary drain systems.

Another major customer category encompasses high-volume commercial real estate developers, managing projects such as mixed-use developments, luxury apartment complexes, and international hotel chains. These customers balance initial cost with long-term maintenance savings and guest appeal. They favor linear and aesthetically integrated stainless-steel systems that convey luxury and minimize housekeeping effort. The decision-makers here are often facility managers and construction procurement teams who require products that are durable under constant use and simple to maintain, often stipulating high-gauge 304 stainless steel or higher for reliability in high-traffic public areas.

Finally, the industrial customer segment, covering food processing, beverage production, chemical manufacturing, and heavy engineering, requires the most technically robust and customized solutions. These clients, primarily engineering and operations managers, prioritize maximum corrosion resistance (mandating AISI 316), high load ratings (up to Class C or D for vehicular traffic), and high flow efficiency to rapidly evacuate process liquids and washdown water. Their purchasing cycle is often tied to major plant expansions or mandated facility upgrades, and they require suppliers capable of providing comprehensive system design support for complex, kilometer-long trench drainage networks, making performance specifications and custom fabrication capability the core buying criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.8 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ACO, Zurn Industries, Watts Water Technologies, Geberit Group, Sioux Chief, Josam Company, Harmer (Alumasc Group), McAlpine Plumbing Products, Caggiati, Wade Drains, MIFAB Manufacturing, Aliaxis Group, BLÜCHER, KESSEL AG, Jay R. Smith Mfg., QM Drains, LUXE Linear Drains, Gridiron, Neoperl, Sanbra Fyffe. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Stainless-Steel Floor and Shower Drains Market Key Technology Landscape

The technology landscape driving the Stainless-Steel Floor and Shower Drains Market is rapidly evolving, moving beyond simple metal fabrication to embrace advanced engineering for optimal hydraulic performance and installation efficiency. A cornerstone of modern manufacturing is the deployment of precision forming techniques, such as hydroforming, to create single-piece drain bodies that eliminate internal stress points and welding seams, thereby ensuring zero leakage potential and vastly improving hydraulic smoothness. This focus on monolithic construction is crucial for meeting the watertight requirements of modern construction methodologies, especially in high-rise buildings where water containment failure is highly detrimental. Furthermore, the aesthetic demands of architects are driving innovation in grate technology, including the use of laser-etched patterns, hidden insert frames that allow tiling over the drain cover, and specialized electro-polishing treatments to achieve a flawless, mirror-like finish, essential for luxury applications.

Functionally, technological advancements are heavily focused on internal components that simplify maintenance and enhance public safety. Key innovations include the development of sophisticated waterless traps using advanced silicone membranes or magnetic seals, which maintain effective protection against sewer gas backup (odor control) even when the water seal evaporates during prolonged periods of disuse, a common issue in seasonal facilities. The market is also seeing the rise of modular trench drain systems designed with patented coupling mechanisms that allow for tool-less connection and disconnection, speeding up installation substantially and ensuring perfect alignment over long runs, reducing labor costs—a critical factor for competitive advantage.

The emerging technological front involves the integration of smart building technology. Leading manufacturers are investing in research and development to incorporate low-power, wide-area network (LPWAN) connected sensors (e.g., LoRaWAN) into industrial and commercial drainage components. These sensors track vital parameters such as temperature (indicating potential steam discharge issues), water level fluctuations (predicting blockages), and even pH levels (monitoring corrosive effluent discharge). This IoT integration enables facility managers to transition fully to data-driven predictive maintenance models, significantly reducing emergency maintenance expenditure and ensuring continuous, compliant operation. This shift transforms a commodity product into a managed, smart infrastructure asset, opening up substantial revenue streams related to software and ongoing maintenance service contracts.

Regional Highlights

The analysis of the Stainless-Steel Floor and Shower Drains Market across global regions reveals significant divergence in growth drivers, product adoption rates, and regulatory influence. North America, encompassing the United States and Canada, is characterized by a mature market with robust demand underpinned by stringent building codes and the cyclical nature of remodeling and renovation activity. The key regional trend is the preference for high-end, designer linear drains in both custom residential and commercial hospitality sectors, driven by architectural specifications that favor seamless and ADA-compliant solutions. Furthermore, specialized industrial sectors, particularly pharmaceuticals and biotechnology, maintain consistent high demand for domestically manufactured, certified AISI 316 systems, leveraging suppliers capable of providing extensive technical support and rapid delivery of specialized components required for regulated environments.

Europe maintains its leadership position in innovation and environmental standards. Western European nations, notably Germany, the UK, and Scandinavia, impose some of the world's strictest regulations regarding water safety, material hygiene (EHEDG compliance), and environmental impact, thereby mandating high-quality stainless-steel solutions, often requiring suppliers to hold multiple regional certifications. The European market sees a strong focus on modularity and ease of installation, addressing the region's high skilled labor costs. Central and Eastern European markets are rapidly modernizing their infrastructure, creating significant greenfield opportunities as older drainage systems are systematically replaced with robust stainless-steel alternatives, often through publicly funded projects focused on long-term sustainability.

Asia Pacific (APAC) stands out as the global engine of volume growth. Fueled by demographic shifts and governmental prioritization of infrastructure (e.g., public sanitation, new hospital construction), countries like China, India, and Indonesia are experiencing unprecedented construction booms. While historical demand was often price-sensitive, there is a clear and accelerating pivot towards quality stainless-steel solutions, driven by a growing awareness of hygiene standards and a preference for durable, Western-style architectural fittings in premium residential and commercial developments. Local manufacturers are rapidly upgrading their capabilities to compete with global suppliers, often focusing on optimized production techniques to meet the colossal project demands associated with large-scale urban development zones. The market here is dynamic, characterized by rapid technology adoption and intense price competition at the standard product level.

- North America: Focus on retrofit market and high architectural standards; strong uptake of ADA-compliant linear drains and domestically certified medical-grade products. Demand is stable, driven by high per-unit value.

- Europe: Leads in innovation, particularly modular and hygienic (EHEDG compliant) drainage systems; high regulatory standards ensure mandatory use of stainless steel in professional settings.

- Asia Pacific (APAC): Fastest volume growth driven by extensive new construction in urban centers and industrial expansion; increasing shift towards higher quality specifications, creating significant market opportunities for global suppliers.

- Middle East & Africa (MEA): High demand from luxury commercial construction and unique environmental requirements (coastal corrosion, high temperatures); preference for custom-engineered, highly durable AISI 316 systems for landmark projects.

- Latin America: Moderate but stable growth, closely tied to economic cycles; commercial and institutional construction is driving demand for reliable, standardized stainless-steel drainage components for long-term infrastructural investment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Stainless-Steel Floor and Shower Drains Market.- ACO

- Zurn Industries (Rexnord)

- Watts Water Technologies

- Geberit Group

- Sioux Chief

- Josam Company

- Harmer (Alumasc Group)

- McAlpine Plumbing Products

- Caggiati

- Wade Drains

- MIFAB Manufacturing

- Aliaxis Group

- BLÜCHER

- KESSEL AG

- Jay R. Smith Mfg.

- QM Drains

- LUXE Linear Drains

- Gridiron

- Neoperl

- Sanbra Fyffe

Frequently Asked Questions

Analyze common user questions about the Stainless-Steel Floor and Shower Drains market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes linear stainless-steel drains from traditional point drains?

Linear stainless-steel drains are characterized by their elongated, narrow channel design, offering higher flow capacity and seamless integration with large format tiles, providing a minimalist aesthetic favored in modern residential and commercial wet rooms. Point drains are traditional centralized components suitable for smaller areas or where water pooling is less critical and budget sensitivity is higher.

Which material grade of stainless steel is recommended for high-corrosion environments like food processing?

AISI 316 stainless steel, also known as marine grade, is highly recommended for high-corrosion environments such as food processing facilities, chemical plants, and coastal installations. Its higher molybdenum content provides superior resistance against chloride corrosion and strong acidic cleaning agents compared to the standard AISI 304 grade, ensuring compliance with strict hygiene regulations.

How do stainless-steel drains contribute to public health and hygiene standards?

Stainless-steel drains are inherently non-porous and resistant to microbial growth, unlike plastic or porous concrete. Their smooth, often electro-polished surfaces are easy to clean and sanitize, drastically reducing the risk of bacterial biofilm formation, which is crucial for compliance in institutional settings such as hospitals and commercial kitchens, thereby directly supporting public health mandates and reducing infection risk.

What is the primary driving factor for the growth of the stainless-steel drain market in the Asia Pacific region?

The primary driving factor in the Asia Pacific region is the rapid pace of urbanization and associated heavy investment in new residential, commercial, and governmental infrastructure projects. This massive scale of construction demands durable, long-lasting drainage solutions that meet increasingly stringent local quality and hygiene standards, often outpacing capacity in other regions.

Are there technological advancements related to smart monitoring in stainless-steel drainage systems?

Yes, technological advancements include the integration of IoT sensors (often LPWAN-connected) into industrial and large commercial stainless-steel drain systems. These sensors monitor flow rates, temperature, and potential blockages, enabling facility managers to implement predictive maintenance strategies, significantly reducing operational downtime, and optimizing cleaning schedules effectively based on real-time data analysis.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager