Stainless Steel Kirschner Wires Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440907 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Stainless Steel Kirschner Wires Market Size

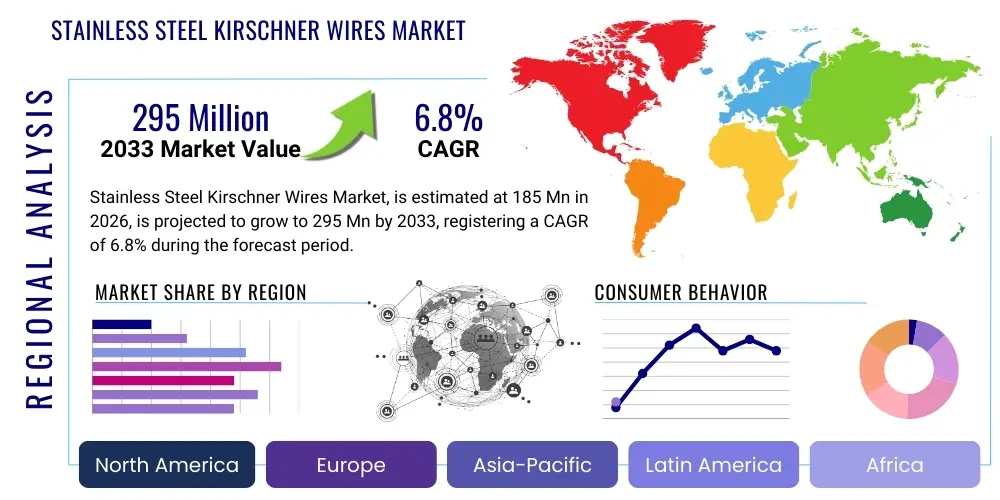

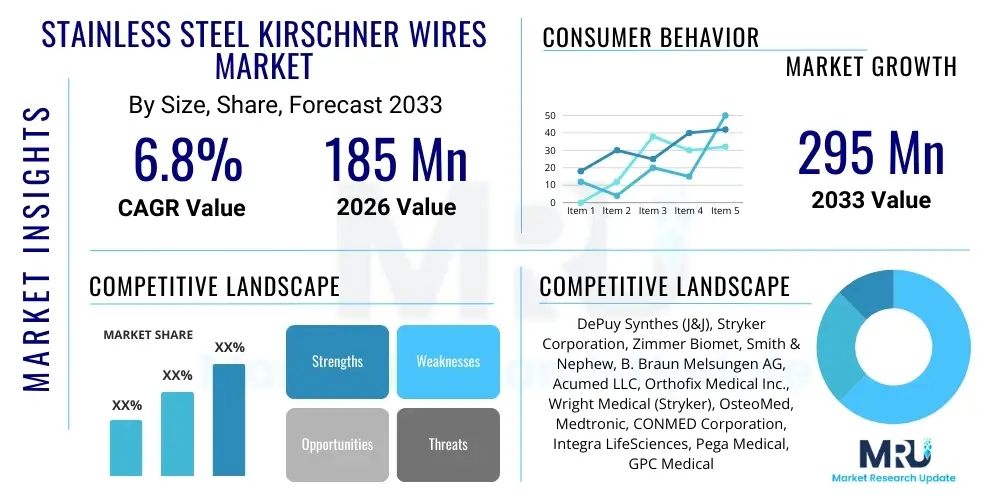

The Stainless Steel Kirschner Wires Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 185 Million in 2026 and is projected to reach USD 295 Million by the end of the forecast period in 2033.

Stainless Steel Kirschner Wires Market introduction

Stainless Steel Kirschner Wires, universally recognized as K-wires, constitute a fundamental and indispensable class of orthopedic surgical tools. Their primary utility spans temporary internal fixation, serving as critical guide wires for cannulated instruments, and facilitating skeletal traction, particularly in the management of complex or comminuted fractures. Fabricated exclusively from high-purity, medical-grade stainless steel alloys, predominantly 316L or occasionally 304, these devices are specifically engineered to possess exceptional mechanical integrity, including high resistance to bending and fatigue, coupled with necessary biocompatibility for temporary residence within human osseous tissue. The clinical versatility of K-wires is derived from their availability in a comprehensive range of diameters (gauges) and tip configurations, such as the sharply pointed trocar or the diamond point, which dictates their penetration ease and efficacy in dense cortical bone versus softer cancellous bone, thus enabling precision stabilization across a multitude of anatomical regions.

The core applications of K-wires are concentrated within trauma surgery, reconstructive orthopedic procedures, and specialized pediatric interventions. they are routinely employed for the definitive stabilization of smaller fractures, such as those impacting the distal radius, metacarpals, or phalanges, utilizing percutaneous techniques that minimize surgical exposure. Furthermore, in cases of severe trauma, K-wires are pivotal for provisional stabilization, allowing surgeons to maintain critical alignment while definitive fixation strategies, often involving plates and screws, are planned or executed. The primary clinical benefit of K-wires remains their highly minimally invasive profile; their insertion requires only minute skin punctures, which drastically reduces soft tissue dissection and minimizes perioperative morbidity. This characteristic contributes directly to reduced patient pain, shorter hospital stays, and quicker initial mobilization relative to procedures requiring extensive exposure, translating into significant efficiencies within the healthcare system.

Market growth is robustly supported by several macro-level trends. Fundamentally, the global increase in both frequency and severity of traumatic injuries, attributable to factors such as expanded motor vehicle usage and heightened participation in high-impact recreational sports, continually replenishes the pool of patients requiring acute fracture management. Concurrently, the globally accelerating growth of the geriatric demographic—a population segment inherently prone to low-energy fragility fractures (osteoporotic fractures) of the hip, wrist, and shoulder—drives a sustained and escalating demand for reliable temporary fixation devices. Additionally, the proliferation of minimally invasive orthopedic surgery (MIOS) techniques, which rely heavily on precise, image-guided percutaneous K-wire placement for initial fragment control and definitive guidewire placement, further cements the continuous necessity for these high-quality, consumable surgical implements, ensuring the market’s steady trajectory of expansion over the forecast period. The combination of cost-effectiveness and proven efficacy reinforces stainless steel K-wires as essential tools in both developed and emerging orthopedic markets worldwide, securing their long-term position despite ongoing innovation in competitive fixation technologies.

Stainless Steel Kirschner Wires Market Executive Summary

The global Stainless Steel Kirschner Wires market demonstrates robust growth, primarily driven by demographic shifts, namely the increasing geriatric population and the resultant surge in fragility fractures, coupled with persistent high rates of trauma incidents worldwide. Key business trends indicate a focused effort by major orthopedic device manufacturers to refine wire geometry, improve material coatings to minimize infection risk, and integrate K-wires seamlessly into comprehensive surgical kits designed for specific anatomical regions, such as hand or foot surgery. Competition remains fierce, emphasizing efficiency in supply chain management and maintaining competitive pricing for high-volume consumable products. The shift towards Ambulatory Surgical Centers (ASCs) in developed markets is influencing procurement patterns, favoring bulk purchasing of standardized, high-quality instrumentation that promotes procedural efficiency and cost containment, compelling manufacturers to adapt their packaging and logistics accordingly.

Regionally, North America and Europe maintain market dominance due to established healthcare infrastructure, high reimbursement rates for orthopedic procedures, and early adoption of advanced surgical protocols. These regions represent mature markets focused on product specialization and premium quality assurance. However, the Asia Pacific region is poised for the fastest expansion, fueled by burgeoning medical tourism, rapid development of hospital infrastructure in densely populated countries like China and India, and increasing patient awareness regarding accessible and standardized fracture care. Economic growth in Latin America and the Middle East is also contributing positively, leading to greater investment in trauma care facilities and subsequently increasing the procedural volume necessitating the use of standardized, reliable K-wire fixation tools across various clinical environments.

Segmentation trends highlight the continued dominance of smooth K-wires in high-volume applications, largely due to their ease of insertion and economical profile, particularly in guide wire usage and provisional reduction. However, threaded wires are gaining traction in procedures demanding greater rotational stability and superior pull-out strength, especially in securing metaphyseal or epiphyseal fragments in osteoporotic bone. The end-user segment is heavily concentrated in high-volume trauma hospitals, yet the rising operational efficiency and cost-effectiveness of ASCs are driving notable penetration rates in that segment, forcing manufacturers to optimize their product offerings for outpatient surgical environments. Material science advancements, while maintaining stainless steel as the core component, are increasingly focused on surface integrity and antimicrobial properties to enhance safety and clinical outcomes, affirming stainless steel's status as the indispensable, cost-effective standard material.

AI Impact Analysis on Stainless Steel Kirschner Wires Market

User inquiries regarding AI's influence on the Stainless Steel Kirschner Wires market overwhelmingly center on how digital technologies can enhance pre-operative planning, optimize surgical navigation systems, and potentially automate certain aspects of fixation, leading to questions about the longevity of manual K-wire insertion techniques. Users express key concerns about improved surgical accuracy, reduced complications related to malpositioning or pin tract infections, and the role of machine learning in predicting patient-specific biomechanical outcomes post-fixation. The overarching expectation is that AI will not replace the wires themselves, which are simple mechanical structures, but rather will significantly refine the methodology and precision of their deployment. This refinement, facilitated by AI-driven analysis of imaging and biomechanical data, is expected to make K-wire procedures safer, more repeatable, and applicable across a broader range of complex cases, thereby boosting overall procedural confidence and volume.

The core value proposition of AI in this context is the standardization of complex manual skills. By utilizing AI algorithms to analyze high-resolution 3D radiographic data, surgeons can obtain highly precise, predictive models for K-wire trajectory, minimizing the trial-and-error often associated with percutaneous fixation. This analytical capability is particularly relevant in minimizing the risk of iatrogenic damage to adjacent critical structures, such as nerves and blood vessels, especially in anatomically constrained areas like the wrist or ankle. Furthermore, AI-powered real-time image guidance systems can automatically adjust navigation overlays based on subtle changes in patient positioning during the procedure, ensuring the planned trajectory remains accurate throughout the insertion phase, a level of precision unattainable through conventional fluoroscopy alone.

The long-term impact analysis suggests that AI adoption will foster a two-tiered system: advanced trauma centers will leverage AI and robotics for complex, high-stakes K-wire placements, while community hospitals will benefit from streamlined, AI-optimized training protocols and simplified procedural planning tools. This widespread technological adoption, although costly initially, is expected to reduce long-term healthcare expenditure by significantly lowering the incidence of complications like pin tract infections and non-union related to poor fixation, reinforcing the clinical utility and cost-effectiveness of high-quality stainless steel K-wires when utilized within a digitized surgical ecosystem. Consequently, manufacturers must ensure their K-wire products are fully compatible with emerging digital navigation and robotic systems, positioning them as components of an advanced procedural platform.

- AI integration optimizes pre-operative planning by generating patient-specific, high-fidelity fracture models and simulating optimal K-wire placement trajectories, reducing procedural time and risks associated with multiple insertion attempts.

- Machine learning algorithms assist in processing real-time fluoroscopic or CT images during surgery, providing instantaneous feedback on alignment and position accuracy, effectively acting as an advanced intraoperative guidance system.

- Predictive analytics frameworks leverage vast datasets of past surgical outcomes to forecast biomechanical stability and potential failure points based on selected K-wire configuration and local bone density, leading to more personalized and evidence-based fixation strategies.

- Robotic surgical assistance systems, leveraging AI for motion planning and execution, enable highly precise and stable K-wire insertion, crucial for achieving percutaneous stabilization in difficult anatomical regions, minimizing human tremor and targeting errors while ensuring optimal wire penetration depth.

- AI systems are being deployed in advanced supply chain logistics and demand forecasting models, ensuring that specialized inventories of K-wires (specific gauges, lengths, and tip types) are optimally stocked across major trauma centers globally, reducing stockouts and maximizing procedural readiness, particularly for unpredictable trauma cases.

- Enhanced quality control utilizes computer vision and machine learning for automated inspection during K-wire manufacturing, detecting microscopic surface irregularities or dimensional inconsistencies with greater accuracy than human inspectors, thereby ensuring superior product safety, uniformity, and adherence to stringent medical device standards.

- AI-driven training modules offer virtual reality simulations that allow novice surgeons to practice complex K-wire placement in a controlled environment, rapidly improving surgical proficiency and reducing the steep learning curve associated with demanding fracture patterns and minimizing early complications due to inexperience.

DRO & Impact Forces Of Stainless Steel Kirschner Wires Market

The operational landscape of the Stainless Steel Kirschner Wires Market is fundamentally shaped by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), collectively manifesting as distinct impact forces. The primary drivers are deeply rooted in demographic realities and evolving surgical preferences. Specifically, the global surge in the elderly population—a demographic cohort highly susceptible to low-energy osteoporotic fractures, particularly of the wrist and shoulder—creates a constant baseline demand for temporary fixation solutions. This is compounded by persistently high rates of multi-system trauma worldwide, often resulting from vehicular and industrial accidents, necessitating immediate and reliable orthopedic intervention. The ongoing paradigm shift towards minimally invasive surgical techniques further acts as a powerful driver, as K-wires are often the preferred, most cost-effective method for percutaneous fracture reduction and provisional stabilization prior to definitive internal fixation, aligning perfectly with modern surgical mandates for reduced patient morbidity.

Restraints impose essential limitations on exponential market growth and include significant clinical challenges inherently linked to K-wire use. The most prominent restraint is the risk of pin tract infection, a potentially serious complication that necessitates antibiotic treatment or early wire removal, thereby prolonging patient recovery and increasing healthcare costs. Additionally, the increasing availability and adoption of alternative temporary fixation methods, such as bioresorbable pins (made from polymers that dissolve over time) or specialized external fixation clamps, offer competing solutions that may alleviate the need for a secondary removal procedure, posing a competitive threat to traditional stainless steel wires, particularly in elective procedures. Stringent regulatory frameworks for temporary implantable devices across major economies (e.g., FDA 510(k) in the US, MDR in Europe) enforce rigorous testing and documentation, potentially increasing the time-to-market and compliance costs for manufacturers, particularly those introducing minor design innovations or new antibacterial coatings.

Opportunities for sustained market expansion are concentrated in technological innovation aimed at complication reduction and geographic market diversification. There is substantial potential for specialized K-wires featuring advanced surface modifications, such as antimicrobial coatings (e.e.g., silver nanoparticle deposition) or bio-active compounds, designed to actively mitigate the risk of pin tract infection, thereby addressing a core restraint and increasing physician confidence and patient acceptance. Furthermore, the expansion of modern healthcare infrastructure into burgeoning economies in the APAC and LATAM regions represents significant untapped market potential, where K-wires’ cost-effectiveness and versatility make them ideal first-line orthopedic consumables due to budget constraints and high procedural volumes. The primary impact forces shaping competitive intensity include continuous pressure on manufacturers for cost optimization due to the consumable nature of the product, necessitating streamlined production processes and maximizing economies of scale, and the rising influence of group purchasing organizations (GPOs) demanding standardized, low-cost products for high-volume use in trauma centers globally, pushing down average selling prices.

Segmentation Analysis

The Stainless Steel Kirschner Wires market is comprehensively segmented based on various technical and utilization parameters, allowing for detailed market assessment across product types, material grades, specific clinical applications, and diverse end-user facilities. This granular segmentation provides clarity on which product features are driving demand, such as the preference between smooth and threaded designs for specific biomechanical requirements, and where geographical investment in orthopedic infrastructure is concentrating, reflected in the procedural volumes across different application areas. Understanding these segments is critical for manufacturers in tailoring their product portfolios to meet specific surgical needs, from pediatric hand surgery requiring fine-diameter wires to adult trauma involving larger gauges for skeletal traction or large fragment manipulation in lower extremities. Strategic product development must align with these identified segmental needs to maximize market penetration.

- By Type: Smooth K-Wires, Threaded K-Wires

- By Material: 316L Stainless Steel, 304 Stainless Steel

- By Application: Upper Extremity Fixation (Hand, Wrist, Elbow), Lower Extremity Fixation (Foot, Ankle, Knee, Tibia), Spinal Stabilization (Temporary Guide for Pedicle Screws), Maxillofacial and Dental Surgery

- By End-User: Hospitals (Trauma and Orthopedic Departments), Ambulatory Surgical Centers (ASCs), Orthopedic Specialty Clinics and Outpatient Facilities

Analyzing the segmentation by Application reveals that Upper Extremity Fixation, encompassing high-prevalence fractures in the hand and wrist—often requiring delicate, high-precision wires—constitutes the dominant revenue-generating segment globally. The technical demands of micro-orthopedics necessitate the use of extremely fine-gauge K-wires (0.8mm to 1.6mm), driving specialization among manufacturers. Conversely, Lower Extremity Fixation, while having a high procedural volume due to ankle and foot trauma, often utilizes thicker wires (1.6mm to 3.0mm) and is influenced by the rising incidence of diabetes and related foot complications requiring temporary stabilization. The Spinal Stabilization application is highly specialized, where K-wires serve strictly as initial guides for pedicle screw placement, demanding exceptional rigidity and tip strength for penetration of dense vertebral bone, reinforcing the importance of high-grade materials like 316L SS.

The End-User segmentation underscores the ongoing shift in service delivery. While large acute care Hospitals remain the primary volume consumers, the ASC segment is experiencing disproportionately high growth. ASCs prefer pre-packaged, single-use, standardized K-wire kits that optimize procedural flow for high-volume outpatient procedures. This purchasing behavior exerts downward pressure on unit pricing for standardized K-wires but opens opportunities for premium pricing on integrated kit components. The Material segmentation confirms 316L stainless steel's status as the industry gold standard due to its superior clinical performance and regulatory acceptance, although 304 stainless steel persists in certain cost-sensitive markets where regulatory oversight may be less stringent or for specific non-load-bearing provisional applications. Overall market strategy necessitates balancing high-volume production of standardized 316L smooth wires with specialized, higher-margin threaded and coated variants targeting specific, complication-sensitive applications like ankle or wrist fixation.

Value Chain Analysis For Stainless Steel Kirschner Wires Market

The value chain for Stainless Steel Kirschner Wires begins with the upstream procurement of highly specialized medical-grade stainless steel alloys, primarily 316L or 304. This raw material procurement stage is highly sensitive to global commodity prices and requires stringent quality control regarding metal purity and mechanical properties necessary for biocompatibility and strength, adhering strictly to ISO standards for surgical implants. Manufacturing involves precision processes like cold drawing to achieve superior mechanical strength and highly accurate diameter tolerances, followed by cutting, specialized CNC grinding for tip formation (trocar or diamond), and meticulous surface treatment via electropolishing and passivation to ensure a mirror finish, minimize friction upon insertion, and maximize corrosion resistance. The initial cost investment in high-precision manufacturing equipment and the ongoing maintenance of sterile production environments constitute significant entry barriers in this upstream phase.

Downstream analysis focuses heavily on the distribution network, which is pivotal given the product's classification as a high-volume, disposable consumable essential for trauma care. Efficient logistics and inventory management are paramount to ensure that trauma centers maintain adequate stock of diverse wire gauges and lengths at all times. Distribution channels typically involve a mix of direct sales forces employed by global market leaders to manage lucrative contracts with large integrated delivery networks (IDNs) and third-party medical device distributors. These distributors manage regional markets, smaller specialty clinics, and handle last-mile delivery, often providing crucial local regulatory knowledge and established customer relationships. The efficiency of this distribution channel directly impacts the overall cost structure and the ability of healthcare providers to access necessary supplies rapidly, which is especially critical in acute trauma settings where time sensitivity is high.

Direct distribution, utilized by leading global players, allows for tighter control over pricing, inventory, and customer service, fostering immediate relationships with key opinion leaders and high-volume surgical centers, and facilitating faster product iteration based on direct surgical feedback. Indirect channels, employing specialized medical distributors, are indispensable for penetrating geographically diverse or fragmented markets, particularly in emerging economies where local market knowledge is required for navigating diverse procurement procedures and regulatory compliance. The final delivery point is the sterile field of the operating room or procedure suite, emphasizing the absolute necessity of robust, sterile packaging and clear product identification to ensure seamless and safe integration into surgical procedures. The economic impact forces within the value chain consistently push for cost-effectiveness, as K-wires are often procured under intense budgetary scrutiny, requiring manufacturers to maximize production efficiency without compromising the mandated high-quality standards of a temporary implantable medical device.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185 Million |

| Market Forecast in 2033 | USD 295 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DePuy Synthes (J&J), Stryker Corporation, Zimmer Biomet, Smith & Nephew, B. Braun Melsungen AG, Acumed LLC, Orthofix Medical Inc., Wright Medical (Stryker), OsteoMed, Medtronic, CONMED Corporation, Integra LifeSciences, Pega Medical, GPC Medical Ltd., Meril Life Sciences, Double Medical, Trauson (Stryker Subsidiary), Advanced Orthopaedic Solutions, Bioventus. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Stainless Steel Kirschner Wires Market Key Technology Landscape

The foundational technology underpinning the Stainless Steel Kirschner Wires market is centered on achieving ultra-high-precision in metallurgical processing and geometrical conformity across high volumes. Manufacturing relies heavily on advanced cold drawing techniques, which modify the crystalline structure of the 316L stainless steel alloy, significantly enhancing its fatigue strength and stiffness, ensuring the wire does not buckle or break under high surgical loads or prolonged in vivo stress. Following drawing, the critical step of tip formation employs specialized Computer Numerical Control (CNC) grinding machines that achieve micron-level accuracy in shaping trocar or diamond points, essential for smooth, controlled penetration of dense cortical bone without excessive thermal necrosis or fragmentation of the bone or surrounding tissue. The final stage involves advanced surface finishing, often utilizing electropolishing and chemical passivation baths, which remove micro-contaminants and create a highly corrosion-resistant oxide layer, complying with ISO standards for implantable metals and maximizing biocompatibility within the human environment.

Contemporary technological advancements are focused heavily on mitigating the primary clinical complications associated with K-wires: infection and migration. Significant Research and Development efforts are channeled into developing and scaling up the application of proprietary surface coatings. These include silver-ion infused coatings, hydrogel surfaces containing antibiotic elution capabilities, or nano-structured titanium oxide layers, all aimed at actively inhibiting bacterial colonization at the skin-wire interface and reducing the incidence of pin tract infections, which remains a primary cause of post-operative morbidity and subsequent costs. Furthermore, innovation in wire design extends to specialized thread patterns in threaded K-wires (e.g., modified buttress threads or partial threads) engineered to enhance pull-out strength in fragile or osteoporotic bone without overly damaging the bone structure upon insertion or removal, optimizing fixation reliability in challenging patient demographics. The continuous refinement of single-use, pre-sterilized packaging technology is also paramount, utilizing advanced barrier materials and standardized labeling to ensure product sterility and ease of integration into the sterile surgical field.

Integration technology represents another major focus, specifically linking K-wires with sophisticated guidance systems. This involves developing K-wire insertion tools and specialized drill sleeves that can interface seamlessly with robotic navigation platforms and 3D intraoperative imaging (e.g., C-arms with navigational capabilities). This integration allows surgeons to pre-plan the exact three-dimensional trajectory of the wire using AI-assisted software and execute the placement with sub-millimeter accuracy, significantly reducing the risks associated with blind or manual percutaneous insertion, such as nerve damage or suboptimal fixation angle. This technological symbiosis ensures that while the K-wire remains a simple, cost-effective stainless steel structure, its deployment is elevated by the precision of modern digital surgery, enhancing surgical outcomes and expanding the range of fractures suitable for minimally invasive treatment. The emphasis on high-throughput, automated inspection technologies using laser micrometers and spectral analysis ensures that the vast volume of manufactured wires adheres universally to global safety and performance specifications.

Regional Highlights

- North America: North America, particularly the United States, holds the largest market share, driven by its well-established and highly sophisticated healthcare system characterized by high expenditure on orthopedic consumables and surgical technology. The region benefits from high rates of elective and trauma-related orthopedic procedures, strong consumer awareness regarding advanced surgical options, and the early adoption of minimally invasive techniques often utilizing K-wires for initial stabilization. Furthermore, the robust presence of key global industry leaders (e.g., DePuy Synthes, Stryker, Zimmer Biomet) and favorable reimbursement policies for trauma surgery underpin its market dominance and focus on high-quality, specialized product variants.

- Europe: Europe represents a mature market with stable demand, primarily fueled by the accelerating aging population across Western and Northern European countries, leading to a consistent need for fracture management services, particularly involving wrist, ankle, and shoulder trauma. Nations like Germany, the UK, and France possess established trauma networks and high standards of orthopedic care. The market is subject to strict European Medical Device Regulation (MDR) standards, ensuring high quality but also imposing significant compliance costs on manufacturers. Strategic initiatives focus on integrating K-wires into single-use, dedicated surgical kits tailored for specific European surgical protocols and efficient operating room throughput.

- Asia Pacific (APAC): The APAC region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is fundamentally driven by the enormous population base, improving economic conditions, and subsequent government investment in expanding and modernizing public and private healthcare infrastructure, especially in emergency and trauma care. The increasing prevalence of complex infrastructure projects and associated industrial accidents further contributes to trauma volume. Countries such as China, India, South Korea, and Japan are investing heavily in establishing advanced orthopedic centers, creating significant demand for cost-effective, high-quality orthopedic consumables like stainless steel K-wires, often sourcing these from both local and global vendors to meet escalating demands.

- Latin America (LATAM): Growth in Latin America is moderate but steady, largely influenced by high rates of road traffic accidents in densely populated urban centers and increasing access to specialized medical care, particularly in major economies like Brazil, Mexico, and Argentina. The market often faces challenges related to procurement costs and currency fluctuation, leading to a strong preference for cost-efficient solutions and large-scale bulk purchasing. K-wires’ inherently low cost relative to complex plating systems makes them highly attractive for broad utilization in public health systems tackling high volumes of trauma cases across diverse socioeconomic settings, often favoring standardized products from major international manufacturers.

- Middle East and Africa (MEA): The MEA market presents a dichotomy. The GCC countries (Saudi Arabia, UAE, Qatar) demonstrate advanced, high-spending medical sectors driven by medical tourism and national health investment programs, readily adopting premium K-wire products and advanced surgical technologies. Conversely, most African nations rely heavily on essential surgical supplies for basic fracture management, valuing accessibility and extreme cost-effectiveness, positioning basic, robust stainless steel K-wires as essential components of their surgical inventory. Political stability and consistent investment in public health infrastructure remain key determinants of long-term market maturation and demand normalization in this highly diverse region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Stainless Steel Kirschner Wires Market.- DePuy Synthes (Johnson & Johnson)

- Stryker Corporation

- Zimmer Biomet

- Smith & Nephew

- B. Braun Melsungen AG

- Acumed LLC

- Orthofix Medical Inc.

- Wright Medical (acquired by Stryker)

- OsteoMed

- Medtronic

- CONMED Corporation

- Integra LifeSciences

- Pega Medical

- GPC Medical Ltd.

- Meril Life Sciences

- Double Medical

- Trauson (Stryker Subsidiary)

- Advanced Orthopaedic Solutions

- Bioventus

Frequently Asked Questions

Analyze common user questions about the Stainless Steel Kirschner Wires market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Stainless Steel Kirschner Wires in orthopedic surgery?

K-wires serve primarily as temporary skeletal fixation devices to hold bone fragments in anatomical alignment prior to definitive fixation, or as reliable guidewires for the insertion of cannulated screws. They are crucial for maintaining reduction in complex fractures, particularly in small bones like those in the hand and foot, due to their ease of percutaneous insertion and minimal invasiveness.

Why is 316L Stainless Steel commonly used for K-wires over other materials?

316L stainless steel is the standard material due to its exceptional biocompatibility, high resistance to corrosion (crucial for temporary implantation), and superior mechanical strength. It offers the optimal balance of stiffness, ductility, and material purity required to reliably withstand surgical insertion forces and in vivo stresses without adverse biological reaction, while remaining highly cost-effective and globally recognized.

What are the key differences between smooth and threaded Kirschner Wires?

Smooth K-wires are simpler to deploy and remove and are widely used as guidewires and provisional fixators, offering excellent penetration. Threaded K-wires are designed with threads only near the tip or along the shaft to achieve superior grip, pull-out resistance, and rotational stability, making them preferred for specific applications where fragment migration prevention is paramount, such as joint fusion procedures or metaphyseal fixation.

How is the market impacted by the increasing preference for Ambulatory Surgical Centers (ASCs)?

The shift toward ASCs drives market growth by increasing the overall volume of outpatient orthopedic procedures suitable for K-wire fixation (e.g., hand and foot surgeries). ASCs favor vendors providing high-quality, standardized, and cost-efficient consumable products, including K-wires packaged optimally for quick turnover and reduced inventory complexity in an efficient outpatient setting.

What technological advancements are addressing the risk of K-wire pin tract infections?

Technological innovation primarily focuses on advanced surface engineering, including the application of proprietary antimicrobial coatings (e.g., silver-based) or specialized ceramic treatments to the K-wire surface. These coatings actively work to inhibit bacterial colonization at the skin insertion site, significantly reducing the post-operative complication rate associated with pin tract infections, thereby increasing overall patient safety and reducing healthcare burden.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager