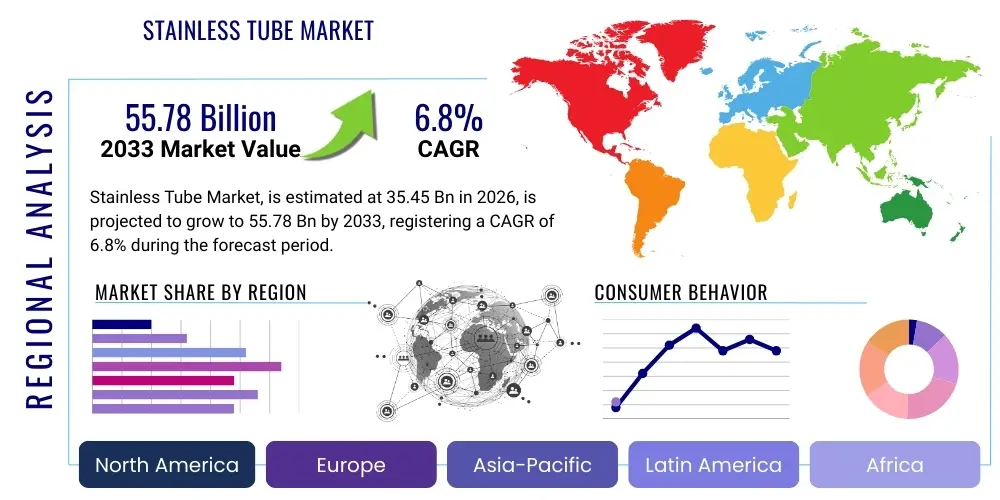

Stainless Tube Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442244 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Stainless Tube Market Size

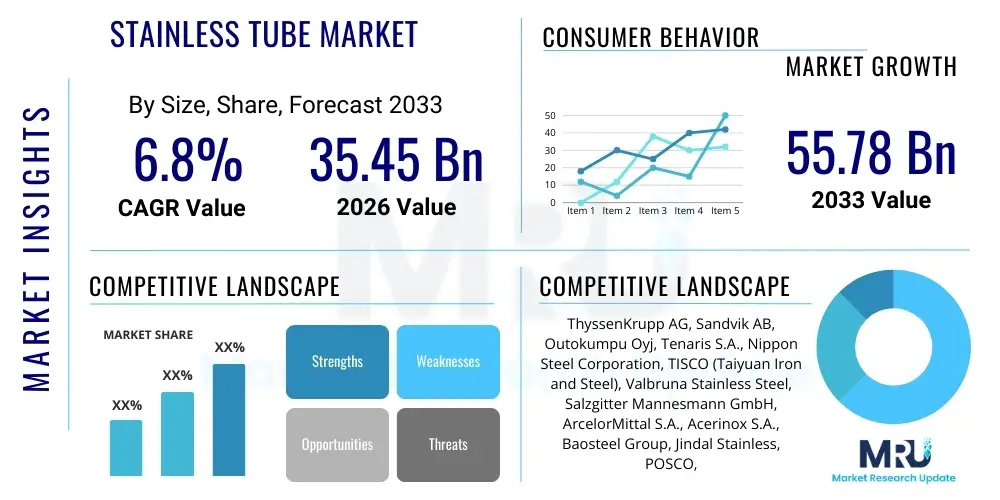

The Stainless Tube Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 35.45 Billion in 2026 and is projected to reach USD 55.78 Billion by the end of the forecast period in 2033.

Stainless Tube Market introduction

The Stainless Tube Market encompasses the production, distribution, and consumption of various types of tubular products manufactured from different grades of stainless steel, primarily categorized by their alloying elements such as chromium, nickel, and molybdenum. These products are crucial structural and conveyance components utilized across a multitude of heavy and specialized industries due to their exceptional corrosion resistance, high strength-to-weight ratio, superior durability, and resistance to extreme temperatures. Key product categories include seamless tubes, which offer enhanced structural integrity and pressure handling capabilities, and welded tubes, which provide cost-effectiveness and versatility across standard applications. The seamless variety is typically favored in high-pressure environments like oil and gas extraction and nuclear power generation, while welded tubes find extensive use in architectural components, food processing equipment, and general plumbing systems.

Major applications of stainless tubes span critical sectors including chemical processing, where resistance to aggressive chemical media is paramount; oil and gas transportation and refining, demanding high operational integrity; and automotive manufacturing, focusing on exhaust systems and structural safety components. Furthermore, the burgeoning demand in power generation, particularly in thermal and renewable energy installations (e.g., heat exchangers in concentrated solar power plants), continues to drive market expansion. The inherent benefits of stainless steel—namely longevity, minimal maintenance requirements, and hygienic properties—make it the preferred material over conventional carbon steel in environments necessitating stringent purity standards or corrosive defense, thereby solidifying its indispensable role in modern industrial infrastructure.

Driving factors underpinning the sustained growth of the Stainless Tube Market include rapid global industrialization, especially in the Asia Pacific region, leading to increased infrastructure development and capital expenditure in manufacturing sectors. Stricter environmental regulations compelling industries to adopt corrosion-resistant materials to enhance operational lifecycles and minimize leakage risks also significantly bolster demand. Additionally, technological advancements in tube manufacturing processes, such as the introduction of high-precision welding techniques and the development of specialized duplex and super-duplex steel grades, facilitate expansion into demanding application environments previously served by expensive exotic alloys. The continuous expansion of complex pipeline networks for water, natural gas, and chemical feedstock further accelerates market velocity, positioning stainless steel tubes as foundational components for reliable industrial operations globally.

Stainless Tube Market Executive Summary

The global Stainless Tube Market demonstrates resilient business trends characterized by a shift towards high-grade, specialized products, particularly duplex and super-duplex stainless steels, driven by increasing project complexities in upstream oil and gas and deep-sea exploration activities. Key market players are strategically focusing on vertical integration, extending from raw material procurement (nickel and chrome) to finished product manufacturing, aiming to mitigate supply chain volatility and maintain competitive pricing structures. Furthermore, the market is observing a significant consolidation trend, where major manufacturers are acquiring smaller, specialized fabricators to gain access to niche technologies, regional distribution networks, and specialized client bases in high-growth end-user industries like aerospace and medical devices. Sustainability has emerged as a crucial business theme, with manufacturers investing heavily in energy-efficient production techniques, maximizing the use of recycled stainless steel scrap, and providing comprehensive product lifecycle solutions to satisfy environmentally conscious procurement policies from major industrial consumers.

Regionally, Asia Pacific (APAC) remains the undisputed epicenter of market demand, predominantly fueled by infrastructural mega-projects in China, India, and Southeast Asia, coupled with aggressive expansion in chemical manufacturing and automotive production capacity. Europe, while experiencing slower overall industrial growth, exhibits robust demand for premium, high-specification seamless tubes, primarily driven by stringent regulatory requirements in the pharmaceutical and nuclear energy sectors. North America is characterized by cyclical demand closely tied to the performance of the domestic oil and gas industry, yet sustained investment in revitalizing aging pipeline infrastructure and modernizing power generation facilities ensures stable, high-value consumption. Emerging markets in the Middle East and Africa (MEA) are projected to witness the fastest growth, underpinned by massive government investments in diversification strategies focusing on non-oil industrial bases, large-scale water desalination plants, and renewable energy projects requiring extensive corrosion-resistant piping.

Segment trends reveal that the seamless tube category, despite its higher production cost, is capturing increasing market share in critical applications where zero failure tolerance is essential, such as high-temperature boiler applications and nuclear reactor components. Conversely, the welded tube segment benefits significantly from large-volume, standardized applications in the construction and general fabrication sectors, where advancements in laser welding technology are continually improving quality and consistency. By material grade, the Austenitic class (particularly 304 and 316L) continues to dominate the volume consumed due to its versatility and established use profile across food processing and general industry. However, Duplex stainless steel grades are rapidly gaining traction, offering superior resistance to stress corrosion cracking and pitting in highly demanding marine and subsea environments, thus reflecting the market’s underlying pursuit of enhanced material performance and operational longevity in increasingly challenging industrial settings.

AI Impact Analysis on Stainless Tube Market

Common user questions regarding AI's impact on the Stainless Tube Market center primarily on how advanced data analytics and machine learning (ML) can optimize complex manufacturing processes, particularly in welding precision, defect detection, and predictive maintenance of mill equipment. Users are keenly interested in quantifying the expected reduction in material waste and energy consumption resulting from AI-driven process controls. Furthermore, inquiries frequently focus on the potential for AI to enhance supply chain resilience by providing more accurate demand forecasting—given the volatility of raw material prices (nickel, chromium)—and optimizing inventory management across global distribution networks. A prevalent theme is the expectation that AI and computer vision systems will elevate quality control standards beyond human capability, particularly in identifying microscopic flaws in seamless tube walls, ultimately leading to higher-specification products and reduced risk of catastrophic failures in high-pressure applications. The overall expectation is that AI will move the industry toward 'Smart Manufacturing' or Industry 4.0, transforming production from a material-intensive process to a data-intensive, highly efficient operation.

- AI-driven predictive maintenance significantly reduces unplanned downtime of tube mill machinery, optimizing asset utilization rates and extending equipment lifespan.

- Integration of computer vision and ML algorithms allows for real-time, high-precision automated inspection of weld seams and surface finish, improving product quality consistency and reducing manual quality assurance costs.

- AI-powered demand forecasting models enhance inventory management of costly stainless steel billets and scrap, mitigating risks associated with volatile raw material commodity prices.

- Optimization of energy consumption during heating and annealing processes through deep learning controls, resulting in substantial operational cost savings and reduced environmental footprint.

- Simulation and generative design platforms, enabled by AI, accelerate the development and testing of new high-performance alloy compositions (e.g., advanced Duplex grades) specific to niche application requirements.

- Improved process control in high-speed welding and drawing operations, utilizing sensor data feedback and machine learning to minimize dimensional variations and scrap rates.

- Enhanced supply chain risk assessment and vendor selection by analyzing complex geopolitical and logistical data, ensuring stable and timely delivery of specialized tube products.

DRO & Impact Forces Of Stainless Tube Market

The Stainless Tube Market is primarily driven by accelerating global infrastructure development, particularly massive urbanization projects in developing economies, which necessitate vast quantities of reliable, corrosion-resistant materials for water distribution, sewage systems, and energy transport. A significant restraint, however, remains the high volatility and upward trend in the cost of key alloying elements, specifically nickel and molybdenum, which directly impacts the final price of stainless steel tubes and can deter price-sensitive buyers in the construction sector. Opportunities abound in the rapid technological shifts towards green energy infrastructure, including hydrogen transportation and carbon capture systems, which demand specialized, high-alloy stainless steel tubes capable of handling extreme pressures and media compositions. These forces are collectively impacted by the industry's response to geopolitical instability affecting raw material sourcing, coupled with the ongoing regulatory push for enhanced material traceability and sustainability in high-risk applications, pressuring manufacturers to innovate and secure resilient supply chains.

Segmentation Analysis

The segmentation of the Stainless Tube Market provides a granular understanding of demand dynamics across varied product specifications, metallurgical compositions, and end-use requirements. The market is fundamentally segmented by Manufacturing Type, differentiating between seamless and welded methodologies, reflecting critical performance characteristics such as pressure rating and structural integrity. Segmentation by Material Grade is essential, distinguishing between widely used Austenitic grades, high-strength Duplex grades, and specialized Ferritic/Martensitic options, each catering to specific chemical and thermal exposure profiles. The Application segmentation separates general industrial piping from specialized uses like heat exchangers or structural components, while the End-Use Industry segment reveals cyclical and long-term consumption patterns across macro sectors such as Power Generation, Oil & Gas, and Automotive. Analyzing these segments is critical for manufacturers tailoring production strategies and for investors seeking insights into the most profitable and fastest-growing market niches, allowing for strategic resource allocation toward materials and processes aligned with evolving industrial standards and regulatory frameworks globally.

- By Type:

- Seamless Stainless Tube

- Welded Stainless Tube (ERW, TIG, Laser Welded)

- By Material Grade:

- Austenitic Stainless Steel (e.g., SS 304, 316)

- Ferritic Stainless Steel (e.g., SS 430)

- Martensitic Stainless Steel (e.g., SS 410)

- Duplex Stainless Steel (e.g., UNS S31803, S32750)

- By Application:

- Industrial Piping and Tubing

- Heat Exchangers

- Structural and Mechanical Applications

- Instrumentation Tubing

- By End-Use Industry:

- Oil & Gas

- Chemical Processing & Petrochemicals

- Power Generation (Thermal, Nuclear, Renewable)

- Automotive & Transportation

- Construction & Infrastructure

- Food & Beverage and Pharmaceutical

Value Chain Analysis For Stainless Tube Market

The value chain for the Stainless Tube Market commences with the upstream extraction and processing of primary raw materials, notably nickel, chromium, iron ore, and molybdenum, which are crucial determinants of the final alloy properties and production costs. The immediate upstream phase involves specialized stainless steel production, converting these raw materials into billets or strips through sophisticated melting, refining (AOD/VOD), and continuous casting processes. Given that stainless steel tubes represent a significant value-add component, stability in the supply of high-purity ferroalloys and scrap metal is paramount. Price volatility in nickel futures markets poses a constant challenge, forcing manufacturers to adopt robust hedging strategies and long-term procurement contracts to stabilize their input costs, thereby ensuring predictable pricing for downstream fabricators and end-users.

Midstream activities constitute the core manufacturing processes: piercing and rolling for seamless tubes, or cold forming and welding for welded tubes. This phase is capital-intensive, requiring advanced technology such as cold-drawing benches, pilger mills, and high-frequency induction welding equipment, along with rigorous quality control standards (NDT, hydrostatic testing) to meet demanding industry specifications (e.g., API, ASME). Downstream distribution channels involve a complex network comprising large global distributors, specialized regional stockholders, and direct sales relationships with major EPC (Engineering, Procurement, and Construction) firms and large end-users like national oil companies. The choice between direct and indirect channels is often dictated by the complexity of the tube requirements; highly specialized and customized orders are typically handled directly, ensuring precise technical consultation, while standard inventory products move rapidly through comprehensive stocking distributors who provide value-added services such as cutting, bending, and specialized coating.

The distribution logistics are critical, given the high bulk and varying lengths of the products. Indirect channels leverage extensive logistical infrastructure to offer just-in-time delivery to smaller fabrication shops and construction sites, effectively bridging the geographical gap between large production mills (often located in Asia) and consumption centers in North America and Europe. This multi-layered distribution structure ensures market penetration and responsiveness across diverse customer segments, from large-scale power plant constructors utilizing direct supply for specialized piping to small workshops purchasing standard grades from local metal service centers. Efficiency in the logistics component, specifically optimizing freight costs and minimizing transit damage, provides a significant competitive edge in the highly commoditized segments of the stainless tube market, while technical expertise and certification compliance dominate competition in the specialized segments.

Stainless Tube Market Potential Customers

The primary end-users and potential customers of stainless steel tubes span mission-critical heavy industries where material failure is prohibitively expensive or catastrophic, leading to a strong preference for durable, high-integrity products. Key customers include large multinational oil and gas corporations involved in exploration, production, and refining, which rely extensively on stainless tubes for high-pressure conveyance systems, heat exchangers, and umbilical applications, especially in highly corrosive offshore and sour service environments. Another significant customer base lies within the chemical and petrochemical industries, encompassing producers of fertilizers, plastics, and various industrial chemicals, where resistance to highly acidic or alkaline media necessitates the continuous use of specialized austenitic and duplex stainless steel grades (e.g., 316L and 904L) to ensure process safety and product purity, preventing costly contamination and shutdowns.

Beyond the resource sectors, the power generation industry represents a massive consumer, particularly in thermal power plants (boilers and superheaters) and nuclear facilities, requiring high-temperature, high-pressure, seamless tubing with extremely low tolerances for defects, thereby prioritizing quality and certification above immediate cost considerations. Furthermore, the burgeoning renewable energy sector, specifically Concentrated Solar Power (CSP) and emerging hydrogen infrastructure projects, generates unique demand for highly specialized alloys capable of handling corrosive salt media or high-pressure gas transport. These customers demand tubes manufactured under the most stringent quality protocols, often requiring third-party verification and detailed material traceability documentation spanning the entire production lifecycle from the raw melt stage to final installation, reinforcing the market’s premium on reliability.

Other vital customer segments include the automotive sector, utilizing stainless tubes for corrosion-resistant exhaust systems, fuel lines, and catalytic converters, driven by tightening emission standards globally. The food, beverage, and pharmaceutical industries represent stable markets characterized by high volume consumption of sanitary, polished stainless steel tubing (typically 304 and 316L) where surface finish and cleanability are non-negotiable requirements to meet strict hygiene and regulatory standards (e.g., FDA, EHEDG). Finally, general infrastructure and construction projects, while utilizing lower volumes of highly specialized alloys, are major volume buyers of standard welded tubing for architectural elements, handrails, and general structural support, providing a broad, cyclical demand base responsive to economic growth cycles and government infrastructure spending initiatives across various global economies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.45 Billion |

| Market Forecast in 2033 | USD 55.78 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ThyssenKrupp AG, Sandvik AB, Outokumpu Oyj, Tenaris S.A., Nippon Steel Corporation, TISCO (Taiyuan Iron and Steel), Valbruna Stainless Steel, Salzgitter Mannesmann GmbH, ArcelorMittal S.A., Acerinox S.A., Baosteel Group, Jindal Stainless, POSCO, Tubacex S.A., Marcegaglia Specialties S.p.A., Centravis, Kubota Corporation, Shoreline Stainless Tube, Penn Stainless Products, Maxim Tubes Company Pvt. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Stainless Tube Market Key Technology Landscape

The technological landscape of the Stainless Tube Market is undergoing continuous refinement, primarily focused on enhancing production efficiency, improving material integrity, and expanding the capabilities of specialized alloys to meet severe service conditions. A foundational technological area is the advancement in seamless tube manufacturing, specifically the use of high-efficiency rotary piercing mills and advanced mandrel technology, which minimizes ovality and wall thickness variations, thereby improving consistency and reducing scrap rates, crucial for high-specification products used in aerospace and nuclear applications. For welded tubes, the shift from traditional TIG (Tungsten Inert Gas) welding to high-frequency laser welding and plasma welding has dramatically increased production speed and weld quality, allowing welded tubes to increasingly penetrate markets previously dominated by seamless products, especially in heat exchanger and standard industrial applications, due to superior seam consistency and minimal heat-affected zones (HAZ).

Material technology represents another critical pillar, with significant investment directed toward optimizing the composition and processing of Duplex and Super Duplex stainless steels. This involves sophisticated thermo-mechanical processing to achieve the optimal 50/50 ferrite-austenite phase balance, which grants these tubes their exceptional resistance to pitting, crevice corrosion, and stress corrosion cracking—properties indispensable for offshore oil and gas risers and petrochemical processing equipment. Furthermore, advancements in specialized coatings and surface treatments, such as electropolishing, passivation, and internal bore finishing, are becoming standard requirements, particularly for sanitary tubes used in the food and pharmaceutical industries, ensuring ultra-smooth surfaces that inhibit bacterial adhesion and facilitate clean-in-place (CIP) procedures. Digital twin technology is increasingly leveraged in high-end mills to simulate the entire manufacturing process, from billet heating to final finishing, enabling real-time adjustments and predictive quality management, ensuring compliance with complex international standards like ASTM and EN specifications before physical production commences.

The integration of Industry 4.0 principles, including pervasive sensor technology and the Internet of Things (IoT), is revolutionizing operational intelligence across the stainless tube manufacturing chain. Advanced Non-Destructive Testing (NDT) techniques—such as phased array ultrasonic testing (PAUT) and eddy current testing (ECT)—are now integrated inline, providing instantaneous quality feedback superior to traditional offline methods, thus guaranteeing 100% inspection coverage for critical applications. This technological shift is complemented by robotics and automation in material handling and packaging, reducing labor costs and improving workplace safety. Moreover, significant research is focused on developing next-generation stainless alloys, including high-manganese and low-nickel grades, aimed at addressing price volatility and scarcity of nickel while maintaining or improving corrosion resistance and mechanical properties. This continuous technological evolution is essential for sustaining the stainless tube market's competitive edge and meeting the escalating performance demands from sectors like supercritical power generation and emerging green hydrogen energy transport systems, which require tubes capable of withstanding pressures up to 1,000 bar and temperatures exceeding 650°C over extended operational lifetimes, driving innovation in both forming and metallurgical science.

Regional Highlights

- Asia Pacific (APAC): APAC commands the largest market share and exhibits the highest growth trajectory, primarily driven by massive infrastructure spending, rapid urbanization, and the region's status as a global manufacturing hub. Countries like China and India are experiencing sustained demand from chemical processing plants, automotive production expansion, and large-scale power generation projects, including both coal-fired and nascent nuclear facilities. The relocation of global supply chains into Southeast Asian nations further fuels demand for stainless tubing in new industrial construction and equipment fabrication. This region is characterized by high-volume production of both standard and specialized grades, benefiting from lower labor costs and significant domestic raw material processing capacity, positioning it as the primary global supplier for stainless tube products, while concurrently being the largest consumer market globally.

- Europe: The European market is characterized by high demand for premium, high-specification products, driven by strict regulatory standards, particularly in the pharmaceutical, chemical (REACH compliance), and nuclear power sectors. Western Europe leads in consuming high-alloy grades such as Super Duplex and 6-Moly stainless steels for niche applications, including marine environment protection and specialized heat exchangers in industrial complexes. Although industrial growth rates are moderate compared to APAC, the emphasis on upgrading existing infrastructure, stringent environmental legislation promoting materials with longer operational life, and ongoing investment in high-ppurity process systems ensure stable, high-value demand, with Germany, Italy, and the UK being key consuming nations.

- North America: North America presents a mature but highly cyclical market, heavily influenced by capital expenditure in the oil and gas sector, particularly pipeline construction and maintenance, and petrochemical refining capacity expansions. The demand for seamless tubes, especially for high-pressure drilling and transportation applications in the Gulf of Mexico and Permian Basin, is robust. Furthermore, the push for modernization of aging utility infrastructure and sustained growth in the food and beverage industry (requiring sanitary tubing) contribute significantly to consumption. Government initiatives focusing on revitalizing domestic manufacturing capacity and tightening regulations concerning pipeline safety further support the market for high-integrity stainless tube products, emphasizing domestic production capability and stringent quality certifications.

- Middle East and Africa (MEA): MEA is poised for significant future growth, spurred by economic diversification strategies in the GCC nations moving away from pure oil reliance toward industrial complexes, tourism infrastructure, and water management solutions. Massive investments in desalination plants—essential infrastructure in arid regions—are creating exceptional demand for highly corrosion-resistant materials, specifically Duplex and Super Duplex stainless steel tubes. The region's vast oil and gas reserves, requiring extensive maintenance and new pipeline networks for extraction and export, also remain a fundamental market driver. Growth here is characterized by large, project-based tenders where international quality certifications and technical expertise are critical selection criteria for suppliers.

- Latin America: The Latin American market exhibits sporadic growth, largely dependent on macroeconomic stability and commodity price cycles, particularly mining and petrochemical activities in Brazil, Mexico, and Chile. There is sustained underlying demand for tubes in infrastructure repairs and expansion within the mining sector, which requires materials resistant to highly abrasive and corrosive slurries. While manufacturing growth is often challenged by geopolitical volatility and economic hurdles, long-term potential exists in the modernization of aging energy infrastructure and potential future expansions in the regional automotive and construction sectors, contingent upon foreign direct investment and supportive governmental policies facilitating industrial expansion and modernization projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Stainless Tube Market.- ThyssenKrupp AG

- Sandvik AB

- Outokumpu Oyj

- Tenaris S.A.

- Nippon Steel Corporation

- TISCO (Taiyuan Iron and Steel)

- Valbruna Stainless Steel

- Salzgitter Mannesmann GmbH

- ArcelorMittal S.A.

- Acerinox S.A.

- Baosteel Group

- Jindal Stainless

- POSCO

- Tubacex S.A.

- Marcegaglia Specialties S.p.A.

- Centravis

- Kubota Corporation

- Shoreline Stainless Tube

- Penn Stainless Products

- Maxim Tubes Company Pvt. Ltd.

- Aperam S.A.

- Shanghai Metal Corporation

- Walsin Lihwa Corp.

- Cangzhou Seamless Steel Pipe Co. Ltd.

- Metaltek International

Frequently Asked Questions

Analyze common user questions about the Stainless Tube market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Duplex Stainless Steel tubes?

The increasing complexity and harshness of environments in the oil and gas and chemical processing industries, particularly offshore and corrosive media applications, primarily drive demand. Duplex tubes offer superior mechanical strength and exceptional resistance to stress corrosion cracking compared to standard austenitic grades, enabling safer and more cost-effective operations in severe service conditions.

How does raw material price volatility, specifically nickel, affect the Stainless Tube Market?

Nickel is a primary alloying element influencing corrosion resistance and stability, and its price volatility directly translates into fluctuations in the manufacturing costs and final market price of high-grade stainless tubes. This uncertainty forces manufacturers to implement hedging strategies and complicates long-term procurement planning for major end-users, potentially affecting project commencement timelines.

What are the key technical differences between seamless and welded stainless steel tubes and their applications?

Seamless tubes are preferred for high-pressure, high-temperature, and critical structural applications (e.g., boilers, nuclear reactors) due to superior homogeneity and uniform strength derived from the extrusion process. Welded tubes are generally more cost-effective, offer greater dimensional flexibility, and are widely used in architectural, sanitary, and standard industrial piping where high-pressure integrity is less critical than mass volume production capabilities.

Which geographical region dominates the consumption and production of stainless steel tubes globally?

The Asia Pacific (APAC) region currently dominates both the consumption and production of stainless steel tubes, largely led by China and India. This dominance is attributed to intense governmental investment in infrastructure, robust industrial expansion, and the region's role as the central manufacturing base for key global industries, including automotive and petrochemicals.

How is Industry 4.0 influencing quality control within stainless tube manufacturing?

Industry 4.0 leverages IoT sensors, AI-driven process control, and advanced NDT methods (like PAUT) integrated into the production line. This technology minimizes human error, provides real-time defect detection, ensures optimal material usage, and guarantees adherence to stringent global quality standards, leading to higher product reliability, especially for mission-critical applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager