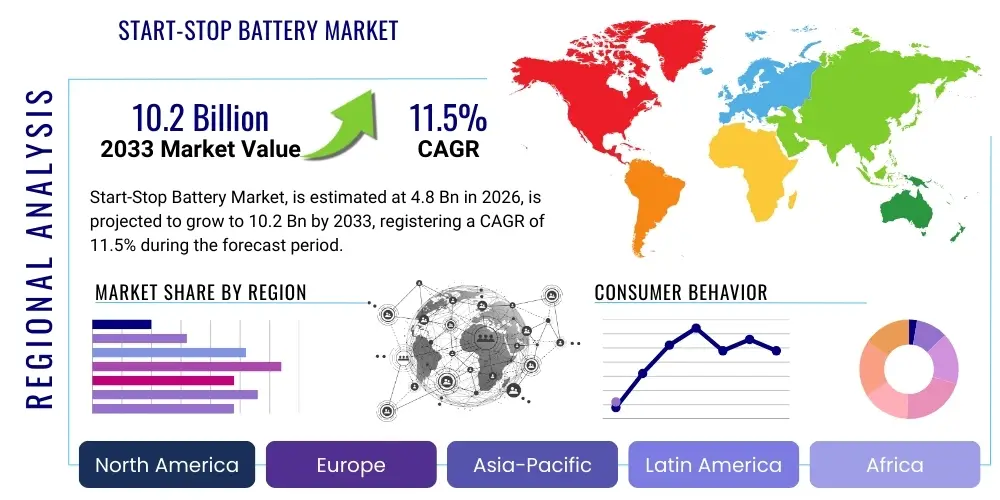

Start-Stop Battery Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441456 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Start-Stop Battery Market Size

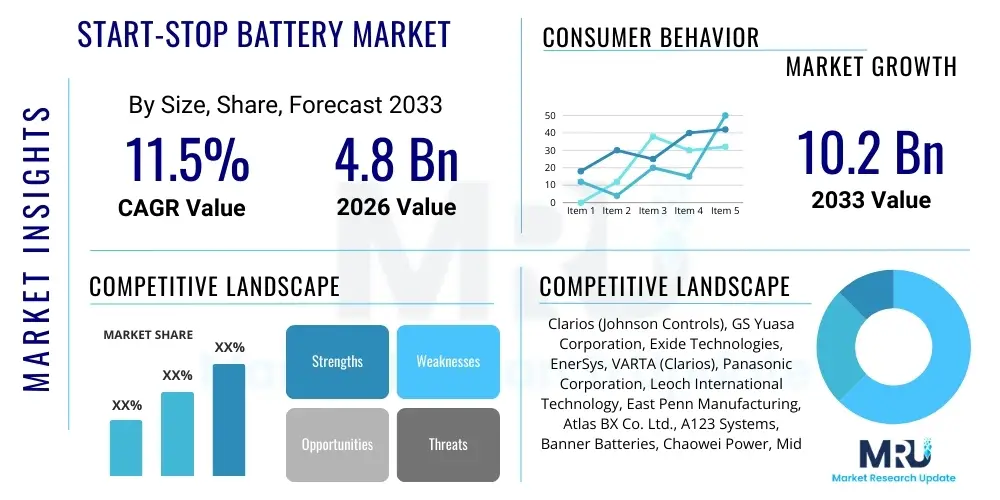

The Start-Stop Battery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 10.2 Billion by the end of the forecast period in 2033.

Start-Stop Battery Market introduction

The Start-Stop Battery Market encompasses specialized 12-volt batteries designed for vehicles equipped with engine start-stop systems, which automatically shut off the engine when the vehicle is stationary (e.g., at traffic lights) and restart it seamlessly when the driver releases the brake pedal. These systems are crucial for improving fuel efficiency and reducing emissions, aligning with stringent global environmental regulations. Unlike conventional flooded batteries, start-stop systems require batteries capable of handling frequent, deep cycling, rapid recharging, and sustaining electrical loads while the engine is off. The primary product technologies dominating this segment are Enhanced Flooded Batteries (EFB) and Absorbent Glass Mat (AGM) batteries, with AGM being the preferred choice for high-end and demanding start-stop applications due to their superior performance characteristics and reliability under stress. The fundamental purpose of these specialized batteries is to support the micro-hybrid functionality inherent in modern vehicle design.

Major applications for these specialized batteries reside primarily within the automotive sector, targeting Original Equipment Manufacturers (OEMs) for integration into new vehicles and the aftermarket segment for replacement purposes. Start-stop batteries are essential components of modern micro-hybrid and mild-hybrid vehicle architectures, facilitating sophisticated energy management functions such as regenerative braking energy storage and powering auxiliary systems during engine idling. The core benefits include significant reductions in carbon dioxide emissions and fuel consumption, particularly in urban driving conditions characterized by frequent stops, directly assisting automakers in meeting increasingly strict Corporate Average Fuel Economy (CAFE) standards globally. Furthermore, their robust design ensures reliable power supply for increasingly complex in-car electronics, including advanced driver-assistance systems (ADAS) and infotainment, even during the engine-off phase, thus maintaining passenger comfort and operational safety without system interruption.

Driving factors propelling this market growth include the escalating global focus on automotive emission reduction standards, particularly in Europe and Asia Pacific, mandating the adoption of technologies that enhance vehicle efficiency. The continuous increase in vehicle electrification, moving towards mild hybridization, inherently relies on high-performance 12V battery systems like AGM for auxiliary and safety functions. Moreover, the expanding volume of vehicles globally equipped with these fuel-saving mechanisms—both new vehicle sales and the growing replacement market as the installed base matures—sustains strong demand, ensuring long-term revenue streams for manufacturers. Technological advancements improving battery cycle life, power density, and cold-cranking capabilities also contribute significantly to market expansion and consumer acceptance by mitigating performance concerns previously associated with initial start-stop battery generations.

Start-Stop Battery Market Executive Summary

The Start-Stop Battery Market is experiencing robust expansion, primarily driven by stringent global regulatory mandates promoting vehicle fuel efficiency and the ubiquitous integration of engine start-stop technology across new vehicle platforms. A key business trend shaping the market is the strategic pivot by major battery manufacturers towards maximizing output of high-performance Absorbent Glass Mat (AGM) technology. This shift is necessitated by the escalating electrical demands of modern vehicles, which incorporate high levels of connectivity, advanced infotainment systems, and complex safety features, all requiring superior deep cycle resilience that AGM batteries provide. Consequently, manufacturers are optimizing supply chains and investing in advanced automation to narrow the cost gap between AGM and the more conventional Enhanced Flooded Batteries (EFB), aiming to solidify long-term OEM partnerships based on quality and consistent supply reliability globally.

Geographically, market growth exhibits significant regional variation. Asia Pacific, spearheaded by the massive automotive production hubs in China and India, is registering the most accelerated growth rate. This expansion is fueled by rising domestic demand, urbanization increasing traffic congestion (where start-stop systems yield maximum benefit), and the rapid adoption of new, localized emission standards that mandate efficiency improvements. Conversely, Europe retains its position as the largest market by value, characterized by mature adoption rates and a significant installed base that is transitioning into the lucrative aftermarket replacement cycle. North America shows stable, high-value growth, driven by the increasing application of start-stop systems in large SUVs and light trucks, vehicles demanding high-capacity AGM units to handle substantial ancillary electrical loads, thus emphasizing performance over initial cost savings.

The segmentation analysis confirms that the AGM battery type holds the dominant share in terms of market revenue, reflecting its necessity in premium and complex micro-hybrid applications. However, the EFB segment is vital for volume growth, especially within the mid-range and compact vehicle segments across emerging economies where cost-effectiveness is a primary purchasing criterion for OEMs. Strategically, the Original Equipment Manufacturer (OEM) segment dictates technological standards and immediate volumes. Yet, the Aftermarket segment is the critical long-term growth driver, forecasted to exhibit faster expansion toward the end of the decade as millions of vehicles equipped with initial start-stop batteries reach their typical replacement age, generating sustained demand that is less sensitive to cyclical new vehicle sales fluctuations.

AI Impact Analysis on Start-Stop Battery Market

Common user questions regarding AI’s impact on the Start-Stop Battery Market frequently center on its role in prolonging battery life, optimizing energy recovery from regenerative braking, and ensuring seamless integration within complex vehicle electrical architectures. Users are particularly interested in how Artificial Intelligence and machine learning (ML) algorithms can be leveraged to mitigate the primary challenge of start-stop technology—namely, the high stress placed on the 12V battery due to frequent cycling and sustained accessory power draw. Key themes highlight the expectation that AI can provide predictive analytics, allowing vehicles to anticipate failure or degradation long before manual checks, thereby improving vehicle reliability and reducing costly warranty claims for both battery manufacturers and OEMs. The market anticipates AI will transition the monitoring of these specialized batteries from simple State of Charge (SOC) tracking to sophisticated State of Health (SOH) assessments.

The core influence of Artificial Intelligence in this market lies in optimizing the performance envelope and extending the operational life of specialized 12V batteries within dynamic vehicle environments. AI algorithms are becoming indispensable components of advanced Battery Management Systems (BMS) in micro-hybrid vehicles, where the need for quick recharging and resilience against partial State of Charge (PSOC) operation is critical. By continuously analyzing extensive datasets related to driver behavior, external temperature fluctuations, system load profiles, and traffic patterns, AI can accurately model battery degradation curves. This capability facilitates proactive, adaptive control over the alternator output and the initiation/suppression of the start-stop function itself, ensuring that the battery remains within optimal operational limits, maximizing efficiency gains without undue wear and tear.

Furthermore, the integration of AI is fostering the development of smarter start-stop systems capable of dynamic self-adjustment. For instance, ML models can predict whether an upcoming stop will be brief or long based on real-time navigation data, deciding whether to engage the engine-off mode to maximize fuel saving or keep the engine running to protect the battery from a potentially damaging deep discharge cycle. This level of predictive energy management is paramount for high-performance AGM batteries and is driving innovations in sensor technology embedded within the battery casing for more accurate data acquisition. Consequently, while AI doesn't alter the lead-acid chemistry, its application in intelligent management systems is pivotal for unlocking the full potential efficiency of start-stop vehicles, boosting consumer satisfaction, and ensuring compliance with manufacturer performance specifications throughout the battery's service life.

- AI-driven Predictive Maintenance: Utilizing ML models to analyze battery data, forecasting potential failure points and recommending service before operational impact, minimizing roadside assistance incidents.

- Optimized Charging Strategies: Implementing adaptive algorithms that modulate alternator voltage and current in real-time based on temperature, age, and immediate power demands to maximize charge acceptance and minimize sulfation.

- Enhanced Energy Management Systems (EMS): AI controls power allocation to ancillary loads (HVAC, infotainment) during engine-off events, maintaining comfort while safeguarding the battery from excessive discharge.

- Manufacturing Quality Control: Employing AI vision systems and data analytics on production lines to detect minute defects in plate formation or assembly, significantly reducing variance and improving battery reliability.

- Dynamic System Integration: ML algorithms enable seamless communication and calibration between the start-stop battery, regenerative braking systems, and the vehicle's central control unit for superior energy harvesting and quick restarts.

- Personalized Start-Stop Behavior: Customizing system engagement based on individual driver profiles and frequent route analysis to maximize efficiency under specific operating conditions.

DRO & Impact Forces Of Start-Stop Battery Market

The growth trajectory of the Start-Stop Battery Market is fundamentally guided by a robust set of Drivers, counterbalanced by inherent Restraints, while new Opportunities continuously emerge, all operating under the influence of powerful Impact Forces. The primary Driver is the high regulatory pressure emanating from global governmental bodies demanding increasingly aggressive reductions in CO2 emissions and improved fleet fuel efficiency, making the adoption of start-stop systems nearly mandatory for meeting fleet averages. This push is amplified by the widespread commercial success and increasing production volume of micro-hybrid vehicles, which inherently rely on these specialized batteries. Conversely, the market faces a significant restraint in the form of the substantially higher initial acquisition cost of specialized AGM and EFB batteries relative to conventional counterparts. This cost differential creates price resistance, particularly in emerging markets or entry-level vehicle segments, potentially slowing down the transition rate. Furthermore, user perception related to system lag or reliability issues in extreme climate conditions poses a behavioral restraint that manufacturers must address through technology refinement and improved consumer education.

Analyzing the impact forces reveals that Governmental and Regulatory Influence carries the highest impact, as mandates directly dictate technological adoption rates and penetration levels across the automotive industry. Technological Impact is moderate to high, centered around ongoing research to enhance the materials science of lead-acid batteries, specifically focusing on optimizing carbon additives, improving acid stratification resistance, and developing robust case designs to handle engine vibration and temperature extremes. Competitive Rivalry is intense, particularly within the Original Equipment Manufacturer (OEM) supply chain, where key global players vie for exclusivity and high-volume, multi-year contracts, often using reliability metrics and global manufacturing footprint as key differentiators. The threat of substitutes, while present from lithium-ion technologies in some high-end 48V mild-hybrid applications, remains low to moderate for the standard 12V function due to cost, established lead-acid recycling infrastructure, and regulatory inertia.

Significant opportunities exist in the burgeoning aftermarket segment, which promises a stable, high-margin revenue stream as the current global fleet of start-stop enabled vehicles ages and requires scheduled battery replacements, a wave projected to intensify significantly post-2027. Another major opportunity lies in the continued integration with advanced mild-hybrid architectures; even as 48V systems grow, the 12V AGM/EFB battery retains its crucial role for safety and auxiliary power. Successfully overcoming the cost restraint through process efficiency gains and economies of scale, especially in EFB production, will enable market players to capture the large volume segments in APAC and LATAM. Manufacturers who can leverage digital tools for predictive battery health monitoring and advanced thermal management stand to gain competitive advantage by offering verifiable product longevity and reliability.

- Drivers:

- Strict global emission standards (e.g., Euro 7, CAFE standards) compelling OEM adoption of efficiency technologies.

- Rapid and sustained growth in the production volume of micro-hybrid and entry-level mild-hybrid vehicles worldwide.

- Increasing integration of complex electronic features in vehicles, demanding superior deep-cycle power from 12V batteries.

- Maturing global vehicle fleet equipped with start-stop systems, creating a massive, predictable replacement market demand.

- Restraints:

- Significantly higher manufacturing complexity and initial cost of AGM and EFB batteries compared to traditional SLI batteries, restricting broader penetration in cost-sensitive segments.

- Potential for performance degradation and reduced efficiency in extreme high or low temperatures, affecting consumer satisfaction in certain regions.

- Weight considerations and constraints in vehicle design, prompting exploration of alternative lightweight solutions.

- Opportunities:

- Technological breakthroughs in material science (e.g., carbon additives, special grid alloys) extending cycle life and improving charge acceptance.

- Expansion into emerging automotive markets (APAC, LATAM) as they adopt stricter localized emission control mandates.

- Development of integrated 12V solutions specifically optimized to support 48V mild-hybrid vehicle platforms.

- Strategic partnerships with automotive diagnostic tool providers to integrate predictive battery health analytics into service centers.

Segmentation Analysis

The Start-Stop Battery Market is dissected through comprehensive segmentation analysis to provide granular insights into market dynamics, enabling targeted strategic planning for stakeholders. The foundational segmentation is by Technology, differentiating between Absorbent Glass Mat (AGM) and Enhanced Flooded Batteries (EFB). AGM technology commands the higher value segment, favored for premium vehicles, vehicles with high electrical loads (e.g., heavy ADAS integration), and diesel engines, owing to its superior deep cycling capability and resilience. EFB technology captures the high-volume, mid-market segment, offering a cost-effective compliance solution for entry-level start-stop systems, particularly prevalent in Asian and European compact car production. This technological divergence dictates manufacturing specialization, pricing strategies, and target OEM partnerships.

Segmentation by Vehicle Type emphasizes that Passenger Cars dominate the market in terms of both volume and value, given the immense global production scale of sedans, hatchbacks, and SUVs incorporating efficiency technologies. However, the Commercial Vehicle segment, encompassing light commercial vehicles (LCVs) used for urban deliveries and certain bus fleets, is a rapidly growing niche. The adoption in commercial vehicles is driven by regulations targeting urban air quality, where LCVs frequently idle, thus requiring robust EFB or AGM solutions to withstand intensive urban stop-go traffic cycles. This segmentation highlights the need for battery manufacturers to offer varied physical dimensions and capacity ratings tailored to the distinct power requirements of different vehicle categories.

A crucial strategic segmentation is by Sales Channel: Original Equipment Manufacturer (OEM) versus Aftermarket. The OEM channel is characterized by high volume, rigorous quality control, and intense price competition, providing the necessary scale for technology standardization. Success in the OEM segment ensures long-term contractual security and establishes technological credibility. In contrast, the Aftermarket channel, focused on replacement sales, offers higher profit margins and requires a robust, geographically dispersed distribution network to ensure immediate availability to repair shops and end-users. The lifecycle analysis of the market indicates that while OEM sales dominate initial volumes, the Aftermarket channel will experience faster proportional growth over the forecast period as the global installed base of equipped vehicles ages, making long-term Aftermarket strategy essential for revenue sustainability.

- By Technology:

- Absorbent Glass Mat (AGM) Batteries

- Enhanced Flooded Batteries (EFB)

- By Vehicle Type:

- Passenger Cars (Hatchbacks, Sedans, SUVs)

- Commercial Vehicles (Light Commercial Vehicles, Buses)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Retail, Independent Garages, Dealership Service Centers)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (APAC) (China, Japan, India, South Korea, Rest of APAC)

- Latin America (LATAM) (Brazil, Argentina, Rest of LATAM)

- Middle East and Africa (MEA) (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Start-Stop Battery Market

The value chain of the Start-Stop Battery Market is a complex and capital-intensive structure that starts with the highly consolidated upstream segment: raw material procurement. The primary raw material is lead, followed by sulfuric acid, specialized separators (like high-surface area glass mats for AGM), and various plastics. Volatility in global lead commodity prices necessitates sophisticated sourcing and hedging strategies, as lead constitutes a significant portion of the total manufacturing cost. Key manufacturers must maintain stable, long-term relationships with large-scale lead recyclers and refiners, given the industry’s reliance on circular economy models. The upstream phase also involves R&D into proprietary grid alloys and carbon additives to enhance battery performance, particularly deep cycling and charge acceptance rates, establishing a foundation for competitive differentiation.

The core midstream activity is battery manufacturing and assembly, which is characterized by high barriers to entry due to the necessity for specialized, high-precision equipment required for producing AGM and EFB specific components. Processes include complex plate pasting, curing, and formation optimized for extreme cycling requirements. Quality control is paramount, as failure rates are unacceptable to OEMs; this segment demands investment in advanced quality testing and automation. Following production, the distribution segment is sharply divided. The direct channel serves the OEM market globally, requiring highly precise logistics, adherence to Just-In-Time (JIT) schedules, and robust inventory management near assembly plants. This direct relationship is strategic, often involving joint development and certification processes that lock in suppliers for the vehicle's production life.

The indirect channel manages the high-margin Aftermarket sales, utilizing a vast network of national distributors, regional wholesalers, and local retail and service chains. Success in this downstream segment relies heavily on brand recognition (e.g., VARTA, Exide, ACDelco), providing comprehensive warranty services, and maintaining local inventory to meet immediate replacement needs. Effective inventory forecasting is critical in the aftermarket to stock the correct battery size and technology (AGM or EFB) for diverse vehicle models. Overall, profitability within the value chain is maximized by players who can seamlessly manage the technological complexity of manufacturing specialized batteries, secure favorable long-term OEM contracts through direct channels, and effectively dominate the decentralized, high-margin aftermarket through robust indirect distribution networks.

Start-Stop Battery Market Potential Customers

The potential customer landscape for the Start-Stop Battery Market is diverse yet concentrated, falling into two major categories: Original Equipment Manufacturers (OEMs) and the Aftermarket Service Industry, which mediates the sale to the ultimate end-user. OEMs represent the most significant high-volume customer segment. Global automotive giants such as Daimler, Stellantis, BMW, Renault-Nissan-Mitsubishi Alliance, and key Asian manufacturers like Hyundai and Toyota constitute this group. Their buying criteria are exceedingly rigorous, prioritizing the supplier's technical compliance with specific vehicle power requirements, global manufacturing capacity, reliability (low defect rates), and adherence to strict cost-reduction timelines. OEMs rely on these batteries to meet mandatory government emission and fuel efficiency standards, making the procurement decision strategic and compliance-driven.

The Aftermarket Service Industry serves as the primary conduit for replacement sales once the OEM-installed battery reaches its end-of-life. This category includes national and international automotive parts distributors (e.g., LKQ, Robert Bosch Service Centers), franchised dealership service departments, and large chains of independent repair garages. These professional customers focus on product availability, breadth of SKU offerings (to cover diverse vehicle models), speed of delivery from the distribution center, and attractive margin structures. Their purchasing behavior is geared towards supplying high-quality, reliable batteries that minimize customer comebacks and honor competitive warranty periods, often preferring established, globally recognized battery brands that instill consumer confidence.

Finally, the individual vehicle owner represents the end-user, though their interaction is often channeled through the service or retail network. While the end-user ultimately pays for the product, their decisions are highly influenced by perceived reliability, recommended brand endorsements from service professionals, and acceptable price points for a replacement part essential for the vehicle's proper function. As the average age of start-stop equipped vehicles increases globally, particularly in Europe and North America, this end-user segment is poised to drive explosive growth in the replacement market, demanding robust, durable, and easily accessible aftermarket solutions that restore the full functionality of their micro-hybrid system, including rapid restarts and sustained ancillary power.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 10.2 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Clarios (Johnson Controls), GS Yuasa Corporation, Exide Technologies, EnerSys, VARTA (Clarios), Panasonic Corporation, Leoch International Technology, East Penn Manufacturing, Atlas BX Co. Ltd., A123 Systems, Banner Batteries, Chaowei Power, Middle East Battery Company, MOLL Batterien GmbH, HBL Power Systems, FIAMM Energy Technology S.p.A., Amara Raja Batteries, ACDelco, TUDOR (Exide), Robert Bosch GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Start-Stop Battery Market Key Technology Landscape

The technological core of the Start-Stop Battery Market relies on highly specialized iterations of lead-acid battery chemistry, primarily Absorbent Glass Mat (AGM) and Enhanced Flooded Battery (EFB) designs, both engineered to withstand the extreme operational demands of frequent engine cycling and high electrical loads during engine-off periods. AGM technology, representing the cutting edge of 12V lead-acid solutions, employs an internal structure where the electrolyte is held immobilized within dense fiberglass mats, allowing for efficient gas recombination and preventing electrolyte spillage. This design results in significantly lower internal resistance, facilitating faster charging capabilities crucial for utilizing regenerative braking energy, and provides exceptional deep-cycle resilience, making it the preferred choice for vehicles with complex electrical systems and premium performance requirements. Current technological innovation in AGM focuses on improving the conductivity of lead alloys, optimizing plate design geometry, and enhancing the compression methods of the glass mat to further extend cycle life and reduce sensitivity to high under-hood temperatures.

Enhanced Flooded Battery (EFB) technology represents a robust evolution of the conventional flooded battery, featuring a higher quality construction designed for moderate start-stop applications. EFBs incorporate thicker plates, specialized plate additives (often carbon), and advanced separators to better resist sulfation and degradation under partial State of Charge (PSOC) conditions, which are endemic to start-stop usage. While EFBs offer superior performance compared to standard batteries, they provide a lower cost alternative to AGM, making them highly attractive for mass-market, entry-level start-stop vehicles, especially in cost-sensitive emerging markets. Technological advances in EFB are heavily invested in material science, focusing specifically on optimizing the carbon additive composition and placement within the negative plates to dramatically improve dynamic charge acceptance—the critical factor determining its effectiveness in real-world driving cycles—allowing them to compete more closely with entry-level AGM performance metrics.

Looking ahead, the technological landscape is increasingly shaped by integration challenges stemming from the introduction of 48V mild-hybrid systems. Although 48V systems are dedicated to powertrain assistance, the 12V AGM/EFB battery retains its non-negotiable role in powering safety-critical functions and core auxiliary systems. This synergy mandates advancements in integrated Battery Monitoring Sensors (BMS) and sophisticated communication protocols that allow the 12V system to seamlessly interact with the 48V architecture and the vehicle's central energy management unit. Future technology development is also concentrating on advanced thermal management techniques and material recycling processes to enhance sustainability, ensuring that these specialized batteries can operate reliably across diverse climatic zones while meeting stringent environmental targets regarding end-of-life battery treatment and material circularity. These continuous refinements are crucial for maintaining the competitiveness and relevance of lead-acid technology against emerging battery chemistries for auxiliary power functions.

Regional Highlights

Europe holds a dominant position in the Start-Stop Battery Market in terms of value and technological maturity, primarily due to the continent’s early adoption and stringent enforcement of Euro emission standards, necessitating the widespread integration of start-stop technology since the early 2010s. This historical context has fostered a highly specialized OEM supply chain and a massive installed fleet, resulting in a substantial and highly profitable aftermarket replacement segment. European automotive manufacturers heavily favor Absorbent Glass Mat (AGM) technology, particularly in key markets like Germany, France, and the UK, owing to the high penetration of complex diesel vehicles and luxury cars that require AGM’s superior deep-cycle performance and high energy throughput. The region drives technological benchmarks, focusing intensely on battery resilience, long-term reliability, and precise integration with complex vehicle electronics, ensuring its continuous leadership in specialized battery demand.

Asia Pacific (APAC) represents the primary engine of volume growth and is the most dynamic region in the market. Driven by unprecedented vehicle production scales in China, India, and Southeast Asia, coupled with the rapid implementation of local emission regulations equivalent to global standards, demand for both EFB and AGM batteries is surging. China's massive market and India's shift to Bharat Stage (BS) VI standards have particularly accelerated the adoption of start-stop technology across mass-market segments. EFB batteries are gaining significant traction in APAC due to their advantageous cost-to-performance ratio, making them accessible for the large volume of compact and mid-range passenger vehicles. However, rising affluence and the local production of luxury vehicles are simultaneously fueling robust growth in the AGM segment. The regional challenge lies in balancing cost optimization with performance requirements, necessitating aggressive localization of manufacturing and supply chain strategies by international battery producers to effectively serve these sprawling markets.

North America is characterized by robust, steady growth, largely spurred by manufacturers equipping their historically larger vehicle segments—such as SUVs and light trucks—with start-stop systems to comply with CAFE requirements. These larger vehicles typically demand higher-capacity batteries, almost exclusively favoring high-end AGM technology to handle substantial electrical loads required by luxury features, safety systems, and extended cold-cranking requirements prevalent in parts of the US and Canada. While OEM penetration took longer than in Europe, the North American aftermarket is highly valuable and maturing quickly. Latin America (LATAM) and the Middle East and Africa (MEA) remain emerging markets. Adoption is driven by vehicle fleet modernization and the import of European or Asian vehicle platforms already equipped with start-stop technology. In these regions, the emphasis is often on cost-efficiency, leaning towards EFB technology, although market volatility and infrastructure challenges present unique distribution hurdles that require flexible sales and service models.

- Europe: Largest market by value; mature OEM and replacement sectors; high technological standards; strong preference for AGM batteries due to high diesel and premium vehicle penetration.

- Asia Pacific (APAC): Fastest-growing region by volume; massive OEM production base in China and India; balanced adoption of both EFB (mass market) and AGM (premium); growth driven by new emission standards.

- North America: Stable, high-value growth; strong demand for high-capacity AGM for large SUVs and light trucks; lucrative and expanding aftermarket segment due to high average vehicle age.

- Latin America (LATAM) & Middle East and Africa (MEA): Emerging markets; growth tied to fleet modernization and urbanization; high price sensitivity favoring EFB technology in entry-level vehicles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Start-Stop Battery Market.- Clarios (formerly Johnson Controls Power Solutions)

- GS Yuasa Corporation

- Exide Technologies

- EnerSys

- VARTA (Clarios)

- Panasonic Corporation

- Leoch International Technology Ltd.

- East Penn Manufacturing Co.

- Atlas BX Co. Ltd. (Hankook & Company)

- Banner Batteries

- Chaowei Power Holdings Limited

- Middle East Battery Company (MEBCO)

- MOLL Batterien GmbH

- HBL Power Systems Ltd.

- FIAMM Energy Technology S.p.A.

- Amara Raja Batteries Ltd.

- ACDelco (General Motors)

- TUDOR (Exide)

- Robert Bosch GmbH

Frequently Asked Questions

Analyze common user questions about the Start-Stop Battery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between an AGM and an EFB start-stop battery?

AGM (Absorbent Glass Mat) batteries immobilize the electrolyte in glass mats, offering superior deep-cycling resilience, faster recharging, and lower internal resistance, essential for high-demand, premium vehicles. EFB (Enhanced Flooded Batteries) use reinforced plates and specialized additives, providing better cycle life than conventional batteries but are positioned as a cost-effective solution for basic, mass-market start-stop systems.

Why are start-stop batteries more expensive than standard car batteries?

Start-stop batteries require specialized internal components, including reinforced grids, denser plate materials, and high-surface area mats, to handle the unique stresses of frequent deep discharge and recharge cycles inherent in micro-hybrid systems. This increased material complexity, coupled with stringent manufacturing standards for reliability, results in a higher production cost compared to traditional SLI (Starting, Lighting, Ignition) batteries.

How long is the typical lifespan of an OEM start-stop battery before replacement is needed?

The typical lifespan of an OEM-installed start-stop battery generally ranges between 3 to 6 years, contingent upon factors such as driving environment (urban vs. highway), the level of parasitic electrical load from vehicle accessories, and exposure to extreme temperatures. AGM batteries often lean towards the upper end of this range due to their inherent durability and deep cycle capacity.

Which key factors are driving the long-term growth of the Start-Stop Battery Market?

Long-term market growth is primarily driven by strict global governmental mandates on CO2 emission reduction and fuel economy improvement, which compel OEMs to install start-stop technology across new vehicle platforms. Furthermore, the rapid expansion and aging of the current global fleet of start-stop equipped vehicles ensure a stable and high-margin replacement demand in the aftermarket segment for the foreseeable future.

Is it permissible to replace an AGM or EFB start-stop battery with a standard battery?

No. Replacing a specialized start-stop battery (AGM or EFB) with a standard SLI battery is highly discouraged and often leads to immediate system malfunctions or premature battery failure. The vehicle’s charging system and energy management system are calibrated specifically for the dynamic cycling and high charge acceptance rates of AGM or EFB technology, meaning a standard battery cannot handle the operational stress and will fail rapidly.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager