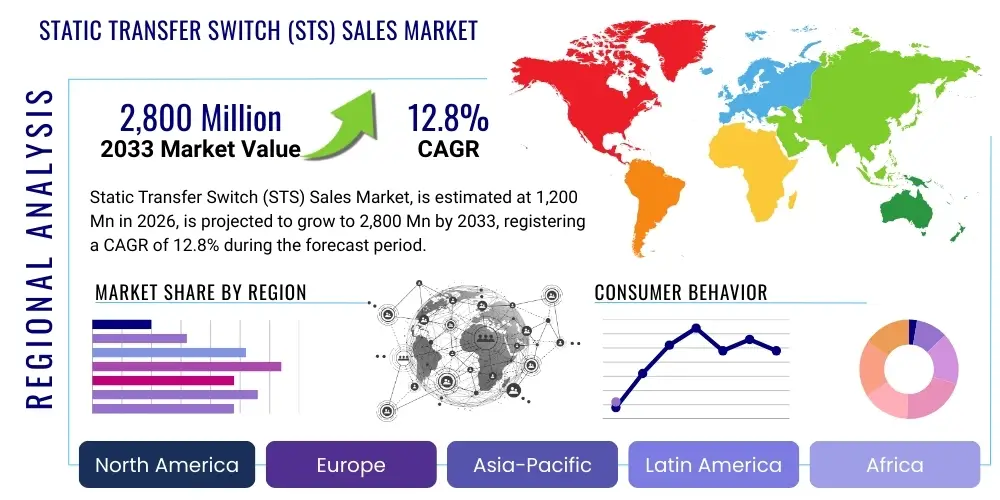

Static Transfer Switch (STS) Sales Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442400 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Static Transfer Switch (STS) Sales Market Size

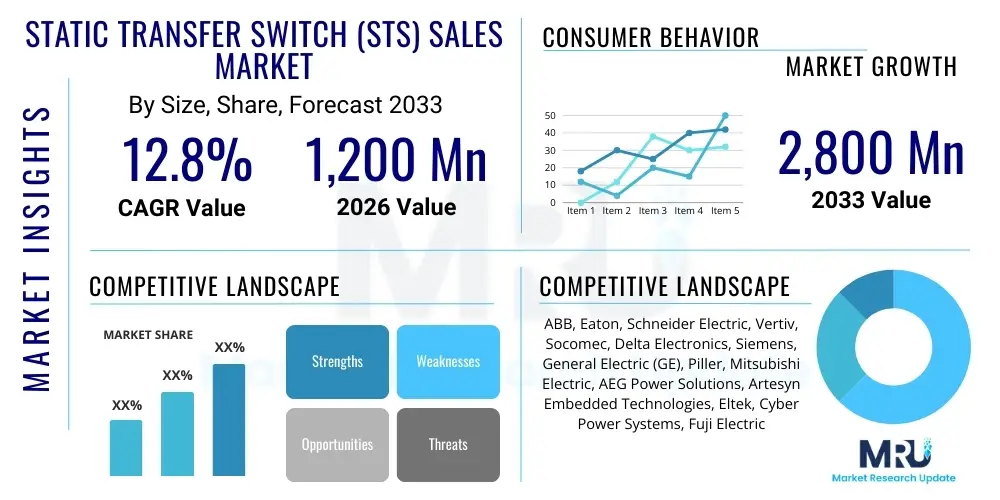

The Static Transfer Switch (STS) Sales Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at USD 1,200 Million in 2026 and is projected to reach USD 2,800 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global demand for uninterrupted power supply, particularly within critical infrastructure sectors such as hyperscale data centers, telecommunications, and high-precision manufacturing facilities. The increasing deployment of digital technologies and the consequent rise in data processing requirements necessitate highly reliable power distribution systems, making STS technology indispensable for maintaining operational continuity.

Static Transfer Switch (STS) Sales Market introduction

The Static Transfer Switch (STS) Sales Market comprises the manufacturing, distribution, and utilization of advanced electrical devices designed to instantaneously switch critical loads between two independent AC power sources, typically within 4 to 8 milliseconds. An STS employs semiconductor technology, primarily Silicon Controlled Rectifiers (SCRs) or Insulated Gate Bipolar Transistors (IGBTs), rather than electromechanical components, to ensure seamless transition and protect sensitive electronic equipment from power disturbances. This rapid switching capability is crucial for systems requiring zero downtime, offering a layer of redundancy superior to conventional automatic transfer switches (ATS) or manual switching methods. The core function of the STS is to identify power quality degradation or failure in the primary source and transfer the load to a healthy secondary source, often another utility feed or an Uninterruptible Power Supply (UPS) system, thereby maximizing uptime and minimizing operational risk.

Major applications for STS technology are heavily concentrated in environments where the financial and operational cost of downtime is exceptionally high. Data centers, ranging from small enterprise facilities to massive hyperscale cloud infrastructures, represent the largest end-user segment due to the inherent criticality of continuous data availability. Furthermore, the burgeoning telecommunications sector, driven by 5G network deployment and edge computing initiatives, utilizes STS units to ensure base stations and network hubs remain operational during power events. Healthcare facilities, particularly hospitals and surgical centers, also rely heavily on STS to guarantee reliable power to life support systems and essential medical equipment. The increasing complexity of industrial automation and smart manufacturing processes further fuels demand, as power quality dips can severely impact sophisticated robotics and control systems, leading to costly production losses.

The principal benefits driving market expansion include enhanced power reliability, superior load protection, and integration capability with broader power management systems. Factors such as the relentless growth of cloud computing, the exponential increase in Internet of Things (IoT) devices, and mandatory regulatory compliance regarding infrastructure uptime directly propel the adoption of robust power redundancy solutions like STS. Furthermore, technological advancements focusing on improved efficiency, modular design, and increased power density in STS units are making them more attractive for modern, space-constrained facilities. The ongoing global trend toward digitalization across all economic sectors ensures a sustained and accelerating need for high-performance STS solutions throughout the forecast period.

Static Transfer Switch (STS) Sales Market Executive Summary

The Static Transfer Switch (STS) Sales Market is undergoing a rapid technological transformation characterized by a shift toward higher voltage capabilities, enhanced modularity, and deeper integration with digital control systems. Current business trends indicate intense competitive pressures driving innovation in IGBT-based designs, which offer superior efficiency and reduced footprint compared to legacy SCR systems. A key trend is the consolidation of power solutions, where STS units are increasingly bundled or integrated directly into modular data center architectures and large-scale UPS systems, offering clients comprehensive redundancy packages. Furthermore, manufacturers are focusing on developing predictive maintenance features and remote diagnostic capabilities, leveraging IoT connectivity to enhance product lifecycle management and minimize unexpected failures, thereby increasing customer value and loyalty in this highly specialized segment. Mergers and acquisitions remain pivotal, allowing key players to acquire specialized technology and expand regional distribution networks, particularly in fast-growing emerging markets.

Regionally, the market is segmented into distinct growth patterns. North America, characterized by mature infrastructure and the presence of major hyperscale cloud providers, remains the largest revenue contributor, focusing primarily on high-amperage, three-phase STS units for massive facilities. Conversely, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by significant investments in digitalization, rapid establishment of new data center clusters (especially in Southeast Asia and India), and governmental initiatives promoting smart city development. Europe demonstrates steady growth, driven by stringent data sovereignty laws and a strong commitment to energy efficiency, leading to higher adoption rates of innovative, highly efficient STS models. The competitive landscape is intensely focused on achieving optimal reliability metrics (MTBF) and ensuring product compliance with rigorous international safety and quality standards, fostering a competitive environment where performance superiority dictates market share.

Segment trends reveal a strong preference for three-phase STS units due to their inherent suitability for large, three-phase power infrastructure typical of modern data centers and heavy industrial applications. The low voltage segment dominates the market volume, though the medium voltage STS segment is gaining traction, especially in utility and large campus environments where power distribution is handled at higher voltages. Application-wise, the data center segment is the undeniable engine of growth, though the rise of edge computing is creating a significant opportunity for smaller, single-phase, rack-mounted STS units designed for distributed network architectures. This diversification in product requirements—from massive centralized units to compact, distributed solutions—mandates that manufacturers maintain flexible production capabilities and a diverse product portfolio to capture evolving market needs effectively.

AI Impact Analysis on Static Transfer Switch (STS) Sales Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies is profoundly altering the requirements for power infrastructure reliability, thus significantly impacting the Static Transfer Switch (STS) Sales Market. Common user questions often center on whether existing STS infrastructure can handle the immense, fluctuating power demands of AI computing clusters, how AI can enhance the reliability and predictive maintenance of STS units themselves, and what new redundancy standards are needed for critical edge AI deployments. Users express concerns about the power density required by high-performance GPUs and AI accelerators, which strain traditional power distribution limits, requiring STS units that can manage high current loads with extremely tight tolerances on power quality. The prevailing expectation is that AI will not only drive massive demand for new data center capacity, requiring more STS units but will also necessitate smarter, AI-enabled STS technology capable of predictive failure analysis and autonomous load balancing across dual sources. This increased sophistication requires the STS to transition from a passive switching device to an active, intelligent component of the overall power management ecosystem.

- AI workload intensity significantly increases power density in data centers, necessitating higher-amperage, three-phase STS solutions.

- Edge AI deployments drive demand for smaller, modular STS units suitable for distributed and often harsh environmental conditions.

- Machine Learning models are integrated into STS monitoring systems for predictive maintenance, anticipating component failure and reducing Mean Time Between Failures (MTBF).

- AI-driven Data Center Infrastructure Management (DCIM) utilizes STS data to optimize energy usage and power path utilization in real-time.

- The complexity and criticality of AI training clusters demand near-perfect power quality, reinforcing the reliance on sub-cycle switching speed offered by high-end STS units.

- AI development mandates robust redundancy; STS becomes a cornerstone technology ensuring continuous power flow to compute-intensive, high-value operations.

DRO & Impact Forces Of Static Transfer Switch (STS) Sales Market

The market dynamics for Static Transfer Switches are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and technological investment cycles. The foremost driver is the unceasing global proliferation of data centers, underpinned by cloud migration, 5G rollouts, and the exponential growth of IoT devices, all of which require highly resilient power infrastructure to guarantee service level agreements (SLAs). Furthermore, regulatory mandates and corporate demands for maximum uptime in critical sectors like finance, telecommunications, and healthcare enforce the adoption of redundancy solutions such as STS. These factors exert a profound, positive impact force, ensuring sustained volume growth and driving innovation toward faster, more reliable switching mechanisms. The simultaneous global push towards digitalization and electrification solidifies the STS market's position as essential infrastructure technology.

However, the market faces significant restraints that dampen adoption rates in specific segments. The primary restraint remains the high initial capital expenditure associated with purchasing and implementing sophisticated STS units, especially when compared to traditional, slower electromechanical transfer switches. Additionally, the complexity involved in integrating STS units into legacy power systems and the requirement for highly specialized technical expertise for installation and maintenance pose barriers for smaller enterprises. Moreover, ongoing concerns regarding standardization and interoperability between different vendors' STS and UPS systems occasionally cause hesitancy among buyers. These restraining forces, primarily cost and complexity, require manufacturers to focus on improving the cost-to-performance ratio and simplifying installation processes through modular, user-friendly designs to broaden market penetration.

Opportunities for growth are abundant, particularly in emerging technological frontiers. The increasing integration of renewable energy sources, such as solar and wind power, into corporate and utility microgrids creates a unique demand for STS capable of managing and rapidly transferring between fluctuating renewable sources and stable grid power. The transition toward modular and prefabricated data centers (PFM) offers a streamlined sales channel for bundled STS solutions. Furthermore, the development of Medium Voltage (MV) STS units opens lucrative markets in large campus environments, utility substations, and major industrial complexes previously dominated by bulkier traditional switchgear. The dominant impact force influencing future development will be the increasing necessity for seamless power quality management, pushing STS technology to evolve rapidly in efficiency, speed, and intelligence to meet the rigorous demands of next-generation critical loads.

Segmentation Analysis

The Static Transfer Switch (STS) Sales Market is comprehensively segmented based on product characteristics, power rating specifications, and diverse application environments, allowing for granular analysis of demand patterns and competitive positioning. Segmentation by Phase (Single Phase and Three Phase) dictates the unit's suitability for different electrical infrastructure scales, with Three Phase units dominating the high-growth data center segment. Segmentation by Voltage Class (Low Voltage and Medium Voltage) reflects the application environment, where low voltage units handle the majority of critical IT loads within a facility, while medium voltage units are utilized for upstream power management in larger distribution networks. This detailed segmentation is vital for manufacturers to tailor their R&D investments and marketing strategies to target the most promising vertical markets effectively.

- By Phase:

- Single Phase STS

- Three Phase STS

- By Voltage Class:

- Low Voltage (Below 1000V)

- Medium Voltage (1kV to 38kV)

- By Current Rating:

- Below 100 A

- 100 A to 400 A

- Above 400 A

- By Application:

- Data Centers (Hyperscale, Colocation, Enterprise)

- Industrial Manufacturing and Process Control

- Telecommunication

- Healthcare and Medical Facilities

- Banking, Financial Services, and Insurance (BFSI)

- Government and Defense

Value Chain Analysis For Static Transfer Switch (STS) Sales Market

The value chain for the Static Transfer Switch market begins with the procurement of highly specialized raw materials, primarily focusing on advanced semiconductor components such as Silicon Controlled Rectifiers (SCRs) and Insulated Gate Bipolar Transistors (IGBTs), alongside high-grade copper, aluminum, and sophisticated control circuitry. Upstream activities involve stringent quality control over component manufacturing, as the reliability of the final STS unit is directly dependent on the quality and robustness of these power electronics. Key players often maintain strong relationships with specialized semiconductor suppliers to ensure a stable supply chain and integrate the latest technological advances, which is crucial given the rapid evolution of power semiconductor efficiency and switching speed. Manufacturing then focuses on precision assembly, integrating the power modules, control boards, and cooling systems into robust, often modular, enclosures designed for severe operational environments.

The downstream component of the value chain is dominated by complex distribution and service networks. Direct sales channels are highly prevalent for large, strategic projects, such as hyperscale data centers or specialized industrial applications, where manufacturers engage directly with end-users or large Engineering, Procurement, and Construction (EPC) firms to provide custom solutions and installation services. Indirect distribution involves reliance on channel partners, including electrical distributors, system integrators, and value-added resellers (VARs), who provide regional access and bundle STS units with other critical power equipment like UPS systems, transformers, and switchgear. These indirect channels are crucial for reaching smaller enterprises and penetrating emerging regional markets where local presence and tailored support are necessary.

After-sales service constitutes a significant portion of the value delivered, encompassing installation, commissioning, preventative maintenance contracts, and 24/7 technical support. Given the criticality of STS operation, service contracts focusing on proactive monitoring and rapid response capabilities are highly valued by customers. The optimization of this value chain emphasizes efficiency in sourcing advanced power semiconductors and establishing reliable, specialized service networks globally, ensuring that the total cost of ownership (TCO) remains competitive while maximizing the guaranteed reliability of the product. The trend toward software-defined power management is also integrating the STS further into the digital services layer of the value chain, adding opportunities for recurring revenue through software maintenance and upgrades.

Static Transfer Switch (STS) Sales Market Potential Customers

The primary end-users and potential customers for Static Transfer Switch technology are organizations and facilities where power continuity is paramount, and the costs associated with operational downtime are extremely high. Hyperscale data center operators (e.g., Google, Amazon, Microsoft) constitute the most significant segment, continually investing in large-scale, high-amperage STS units to protect their core cloud infrastructure. Colocation and enterprise data center providers follow closely, driven by the need to meet rigorous customer SLAs regarding uptime and redundancy. These buyers prioritize product efficiency, transfer speed, and seamless integration with existing UPS and Battery Energy Storage Systems (BESS) infrastructure, viewing the STS as an essential hedge against power fluctuations and single points of failure in the utility supply or internal distribution.

Beyond the data center sphere, telecommunication companies are major consumers, especially as they rapidly deploy 5G network components and sophisticated edge computing nodes requiring reliable power sources far from centralized infrastructure. Hospitals, research laboratories, and other critical healthcare environments represent a non-negotiable demand segment, where STS units protect life-saving equipment and maintain clinical operations during grid instability. Financial institutions, including major banks and stock exchanges, also heavily invest in STS to ensure continuous transactional processing and protect sensitive market data from power interruptions, often requiring multiple layers of redundancy in their infrastructure design.

Furthermore, specialized industrial sectors, particularly semiconductor fabrication, pharmaceutical manufacturing, and complex chemical processing plants, are expanding their adoption of STS. These environments rely on constant, clean power to prevent the scrapping of batches or damage to delicate, high-value machinery caused by transient power dips or surges. The common thread among all potential customers is the high value placed on resiliency, justifying the investment in high-end STS technology over conventional transfer methods. Manufacturers must therefore tailor their sales strategy to emphasize Mean Time Between Failure (MTBF) rates, transfer latency metrics, and compliance with industry-specific power quality standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,200 Million |

| Market Forecast in 2033 | USD 2,800 Million |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB, Eaton, Schneider Electric, Vertiv, Socomec, Delta Electronics, Siemens, General Electric (GE), Piller, Mitsubishi Electric, AEG Power Solutions, Artesyn Embedded Technologies, Eltek, Cyber Power Systems, Fuji Electric |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Static Transfer Switch (STS) Sales Market Key Technology Landscape

The technological landscape of the Static Transfer Switch market is primarily defined by the ongoing transition from Silicon Controlled Rectifiers (SCRs) to Insulated Gate Bipolar Transistors (IGBTs). While SCR-based STS units have historically offered robust performance, IGBT technology is increasingly favored due to its superior efficiency, smaller footprint, and ability to handle higher switching frequencies and cleaner power output. Modern IGBT-based STS units offer near-instantaneous transfer times (often under 4 milliseconds), which is essential for protecting the most sensitive server and networking equipment from any discernible power gap. Furthermore, technological innovation is heavily focused on increasing power density, allowing manufacturers to pack more capacity into smaller physical chassis, which is critical for space-constrained urban data centers and edge computing deployments. This optimization of power handling capabilities while reducing size is a major competitive differentiator.

Another pivotal technological development involves the integration of sophisticated monitoring and control capabilities. Contemporary STS units are no longer just passive switches; they are intelligent devices featuring advanced microprocessors for rapid decision-making, harmonic monitoring, and predictive failure analysis. Communication protocols such as Modbus and SNMP are standard, enabling seamless communication with wider Data Center Infrastructure Management (DCIM) and Building Management Systems (BMS). This connectivity allows operators to remotely monitor the health, load balance, and operational status of STS units across geographically dispersed facilities, improving overall network resilience and reducing the need for costly manual inspections. The emphasis on software control is effectively transforming the STS into a smart grid component.

Furthermore, there is a clear trend towards modular and scalable STS architectures. Modular designs allow customers to scale up capacity incrementally, matching power protection to fluctuating load requirements without costly over-provisioning. This modularity not only aids in installation and maintenance (hot-swappable components) but also improves system resilience, as a failure in one module does not necessitate shutting down the entire system. Future developments are anticipated to heavily leverage Wide Band Gap (WBG) semiconductors, such as Silicon Carbide (SiC), which promise even higher efficiencies and power densities, further accelerating the performance capabilities of next-generation STS units and ensuring their continued relevance in highly demanding critical power applications.

Regional Highlights

- North America: Market Maturity and Hyperscale Dominance

North America currently holds the largest market share in the STS sales market, driven by the early adoption of advanced power infrastructure and the highest concentration of hyperscale data centers globally. The region's demand is characterized by high-amperage, three-phase STS units required to support massive cloud computing and colocation facilities. Stringent regulatory standards for power reliability in sectors like BFSI and government mandate the use of redundant solutions. Technological innovation in the region focuses on developing medium voltage STS solutions and integrating sophisticated DCIM platforms. The presence of major market players and robust R&D spending further solidifies North America's leadership position, though future growth rates may be tempered by market maturity.

The United States and Canada are the core drivers of demand, with significant investment ongoing in new data center construction and the modernization of existing power grids. Buyers in this region prioritize ultra-low transfer times and energy efficiency, often demanding custom-engineered solutions that integrate seamlessly with advanced UPS technology. The rapid deployment of edge computing infrastructure to support distributed applications is now driving a new wave of demand for smaller, cabinet-level STS units, supplementing the existing dominance of large floor-standing models.

- Asia Pacific (APAC): Highest Growth Trajectory

The APAC region is projected to register the fastest CAGR during the forecast period. This rapid expansion is fundamentally fueled by explosive economic growth, mass digitalization efforts, and significant governmental investment in internet infrastructure, particularly in countries like China, India, and Southeast Asian nations. The region is witnessing a boom in both enterprise data center construction and the establishment of international cloud provider facilities seeking to capitalize on growing populations and digital service consumption. Demand is strong for both low-voltage STS units supporting internal IT loads and medium-voltage solutions for new industrial parks and large commercial complexes.

Challenges in APAC include fragmented power grids and varying levels of regulatory enforcement, which paradoxically increases the need for robust power protection technologies like STS. Local manufacturing competition is intense, focusing on providing cost-effective, high-reliability products tailored to regional specifications. The expansion of 5G networks throughout the region is another major catalyst, requiring thousands of reliable STS units to protect critical telecom nodes from power fluctuations common in developing areas. Investment in localized technical support and channel partnerships is essential for manufacturers aiming to capture this dynamic and highly competitive growth market.

- Europe: Focus on Efficiency and Regulatory Compliance

The European market for STS sales is characterized by steady, stable growth, heavily influenced by strict environmental regulations and high standards for operational efficiency (e.g., the EU Code of Conduct for Data Centers). European customers place a premium on energy-efficient STS designs, favoring advanced IGBT-based models that minimize heat loss and maximize system effectiveness. Countries such as Germany, the UK, and the Netherlands lead in adopting STS solutions, largely due to their roles as major financial and data-hosting hubs requiring unparalleled power reliability.

The market in Europe is also driven by ongoing infrastructure modernization efforts and the push toward sustainable power sources. STS units are increasingly necessary for managing power transfer within microgrids that incorporate solar and wind energy, ensuring that critical loads maintain stability despite intermittent supply. Furthermore, strict data protection and security requirements necessitate robust redundancy, making STS an indispensable component of compliance strategies. Competitive differentiation in Europe is often achieved through certified efficiency ratings and modular designs that facilitate easier system maintenance and upgrades.

- Latin America and Middle East & Africa (LAMEA): Emerging Markets and Infrastructure Development

The LAMEA regions represent emerging markets with substantial long-term potential for STS sales. Growth is currently driven by government-led initiatives to improve digital connectivity, increasing foreign investment in data center infrastructure (particularly in the UAE, Saudi Arabia, Brazil, and Mexico), and the expansion of the telecommunications sector. While still smaller than the established markets, these regions exhibit high growth potential as power grid stability remains a challenge, thereby increasing the necessity for STS as a reliability component.

In the Middle East, large-scale projects related to smart city development and oil & gas infrastructure drive demand for high-capacity, robust STS units capable of operating reliably in harsh environmental conditions (high temperatures). In Latin America, the primary market drivers are the expansion of local cloud services and the modernization of financial infrastructure. Localized sales efforts and the development of channel partnerships that can manage complex logistics and provide on-site technical expertise are crucial for penetrating these diverse and geographically challenging markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Static Transfer Switch (STS) Sales Market.- ABB

- Eaton

- Schneider Electric

- Vertiv

- Socomec

- Delta Electronics

- Siemens

- General Electric (GE)

- Piller

- Mitsubishi Electric

- AEG Power Solutions

- Artesyn Embedded Technologies

- Eltek

- Cyber Power Systems

- Fuji Electric

Frequently Asked Questions

What is the primary function of a Static Transfer Switch (STS) in data centers?

The primary function of an STS in a data center is to provide ultra-fast, seamless redundancy by instantaneously switching critical IT loads between two independent, synchronized AC power sources (typically within 4-8 milliseconds) if the primary source experiences a failure or power quality disturbance. This prevents server downtime and ensures continuous operation for mission-critical applications.

How does IGBT technology benefit the performance of modern STS units?

Insulated Gate Bipolar Transistor (IGBT) technology is replacing older SCR designs by offering superior energy efficiency, higher power density, and a smaller physical footprint. Critically, IGBTs facilitate faster, cleaner switching with lower power losses, making them ideal for high-performance data centers requiring maximum operational efficiency and reliability in a compact space.

Which application segment drives the highest demand for Static Transfer Switches?

The Data Center segment, encompassing hyperscale, colocation, and enterprise facilities, drives the highest demand for Static Transfer Switches. The non-negotiable requirement for high availability (up to five nines) and the substantial financial impact of downtime make STS redundancy an essential component of the data center power distribution architecture globally.

What is the projected Compound Annual Growth Rate (CAGR) for the STS Sales Market?

The Static Transfer Switch Sales Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. This growth rate is primarily sustained by the global expansion of digital infrastructure, particularly 5G networks, IoT deployment, and cloud computing capacity build-out in the Asia Pacific region.

Are Medium Voltage (MV) STS units becoming more relevant in the market?

Yes, Medium Voltage (MV) STS units are gaining relevance, particularly in large industrial parks, utility substations, and major campus data centers. MV STS allows for power redundancy at the upstream distribution level, simplifying overall power architecture, improving reliability for large loads, and reducing the complexity associated with cascading multiple low-voltage transfer devices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager