Stationary Centrifugal Compressor Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441180 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Stationary Centrifugal Compressor Market Size

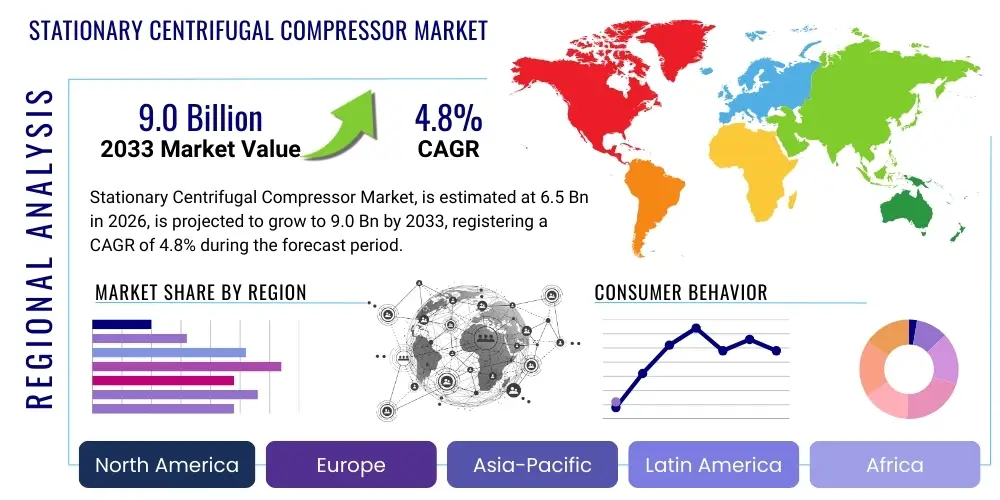

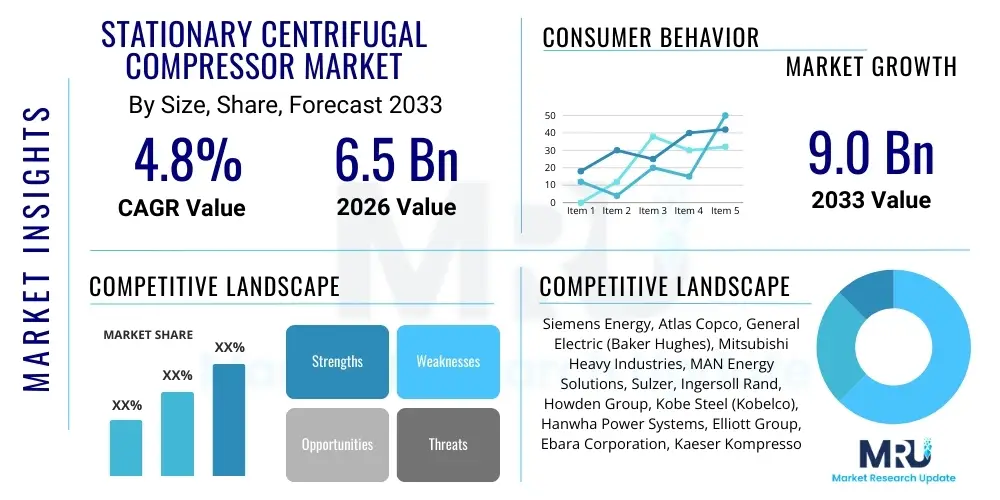

The Stationary Centrifugal Compressor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 6.5 billion in 2026 and is projected to reach USD 9.0 billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by robust industrial expansion, particularly in the chemicals, oil and gas, and power generation sectors, which require reliable, high-volume compression solutions for critical process operations. The adoption of energy-efficient centrifugal designs is increasingly driving investment decisions across developed and rapidly industrializing economies.

Stationary Centrifugal Compressor Market introduction

Stationary centrifugal compressors are dynamic machines engineered to increase the pressure and density of gases by utilizing rotating impellers that impart kinetic energy, which is subsequently converted into potential energy (pressure) in a diffuser. These compressors are characterized by their stationary installation, high flow rates, relative oil-free operation capabilities, and suitability for continuous, heavy-duty industrial applications. Unlike positive displacement compressors, centrifugal models are ideal for large process plants where throughput and reliability over long operational cycles are paramount, such as air separation units, natural gas processing facilities, and large-scale manufacturing sites.

The primary applications of stationary centrifugal compressors span across pivotal industrial infrastructure, including the compression of air for instrument air systems, process gas handling in fertilizer production, and the critical service of natural gas transmission and storage. Benefits derived from their use include superior energy efficiency at partial loads, significantly reduced maintenance requirements due to fewer moving parts compared to reciprocating designs, and the ability to achieve very high flow rates required by modern industrial complexes. Their robust design ensures long operational lifespans, contributing substantially to operational uptime and cost-effectiveness in major capital-intensive industries.

Market growth is largely driven by sustained global energy demand, necessitating increased exploration, processing, and distribution of natural gas and petrochemical products. Furthermore, stringent environmental regulations are favoring the adoption of oil-free and more energy-efficient compression technologies, pushing end-users to upgrade or replace older, less efficient reciprocating or screw compressors with modern centrifugal units. Investments in renewable energy infrastructure, particularly the need for hydrogen compression and large-scale industrial gas production, are also contributing factors fueling market expansion across key geographical regions.

Stationary Centrifugal Compressor Market Executive Summary

The Stationary Centrifugal Compressor Market is currently defined by significant technological advancements centered on enhancing efficiency, integrating smart monitoring systems, and developing specialized components for extreme operating conditions, such as high pressure or corrosive gas environments. Business trends indicate a strong move toward digitalization, with leading original equipment manufacturers (OEMs) focusing on offering integrated service contracts and predictive maintenance solutions powered by Industrial Internet of Things (IIoT) capabilities. Mergers and acquisitions remain a strategic tool for expanding regional footprints and acquiring specialized technology in areas like hydrogen compression and carbon capture utilization and storage (CCUS) applications, positioning the market for moderate yet steady growth.

Regionally, the market exhibits high demand volatility tied to capital expenditure cycles in the oil and gas sector. Asia Pacific (APAC) stands out as the fastest-growing region, driven by massive investments in new refinery expansions, petrochemical complexes, and rapidly increasing energy consumption, particularly in China and India. North America remains a crucial market, dominated by the established natural gas production and transmission infrastructure, coupled with a push for modernization and efficiency improvements in existing facilities. Europe demonstrates steady demand, heavily influenced by decarbonization goals, focusing on compressors tailored for industrial gas processing and renewable energy integration, requiring high reliability and minimum environmental impact.

Segment trends reveal that the multi-stage compressor segment, particularly the integrally geared type, commands a dominant share due to its superior efficiency, compact design, and suitability for diverse medium-to-high pressure applications. The end-user analysis confirms that the Oil & Gas and Chemicals & Petrochemicals sectors are the largest consumers, demanding custom-engineered units for complex process applications. However, the emerging wastewater treatment and general manufacturing sectors are showing accelerated adoption rates, driven by the need for reliable compressed air systems and process blowers, thereby diversifying the overall market demand structure away from traditional energy-intensive industries.

AI Impact Analysis on Stationary Centrifugal Compressor Market

User questions regarding AI's influence in the centrifugal compressor sector often revolve around predictive maintenance capabilities, energy efficiency optimization, and autonomous operation potential. Key concerns center on the reliability of AI algorithms in handling complex mechanical failure signatures and the cybersecurity risks associated with integrating networked smart sensors into mission-critical plant equipment. Users widely expect AI to significantly reduce unplanned downtime, enhance operational safety, and provide real-time performance diagnostics, moving away from time-based maintenance schedules. The consensus is that AI deployment will transform the aftermarket service segment and operational management of large-scale compressor fleets.

- AI-driven predictive maintenance optimizes service schedules by analyzing vibration, temperature, and pressure data, significantly reducing unplanned failures and enhancing asset uptime.

- Machine learning algorithms fine-tune compressor control systems in real-time to optimize airflow and pressure ratios, minimizing power consumption and achieving maximum energy efficiency under varying load conditions.

- Enhanced fault detection and diagnosis utilize deep learning models to identify subtle anomalies, improving the accuracy of root cause analysis faster than traditional condition monitoring techniques.

- Digital twins, supported by AI simulation, allow operators to test control strategies and potential operational changes in a virtual environment before deployment, reducing risks and commissioning time.

- Automated performance benchmarking and operational drift correction ensure compressors maintain peak efficiency specifications throughout their operational lifecycle, addressing long-term degradation effects.

DRO & Impact Forces Of Stationary Centrifugal Compressor Market

The Stationary Centrifugal Compressor Market dynamics are governed by powerful drivers related to global industrial output and energy infrastructure development, balanced by restraints linked to high initial capital investment and specific regulatory challenges. Opportunities emerge primarily through technological niches, such as the accelerating demand for compressors in the hydrogen economy and carbon capture projects. These factors collectively exert significant impact forces on market profitability, supply chain resilience, and competitive landscape, necessitating strategic adaptation by key market players to navigate cyclical demand fluctuations inherent in the energy and process industries.

Key drivers stimulating growth include the continuous global demand for natural gas and derived petrochemical products, forcing capacity expansion in processing plants. Furthermore, the stringent focus on reducing industrial carbon footprints and the corresponding requirement for high-efficiency turbomachinery accelerates the replacement cycle for older units. However, major restraints involve the significant upfront capital expenditure required for large-scale centrifugal compressors, making them viable predominantly for large corporations. Additionally, market performance is highly susceptible to global macroeconomic volatility and fluctuating commodity prices, which directly influence capital expenditure in the upstream and midstream sectors of the oil and gas industry.

Opportunities for market expansion are strongly rooted in the energy transition, specifically the proliferation of industrial gas applications like large-scale oxygen and nitrogen production units, essential for metallurgy and chemicals. The critical role of centrifugal compressors in emerging sectors like CO2 compression for Enhanced Oil Recovery (EOR) and permanent storage, alongside high-pressure hydrogen compression for transport and storage, represents future growth avenues. The combined influence of high energy costs (a driver for efficiency) and ongoing geopolitical stability concerns (a restraint on investment) creates complex market dynamics, ensuring that only resilient and technologically advanced suppliers maintain market leadership.

Segmentation Analysis

The Stationary Centrifugal Compressor Market is segmented based on critical design parameters, including the type of mechanism, the number of stages, operating pressure capability, and the primary industrial end-user application. Analyzing these segments provides a nuanced understanding of market demand characteristics and technological preferences across diverse industries. The segmentation highlights the dominance of multi-stage and integrally geared configurations, reflecting the widespread need for reliable, high-pressure, and highly efficient compression solutions across major industrial hubs globally. Understanding segment growth dynamics is crucial for manufacturers tailoring product portfolios to specific industry needs.

- By Type:

- Single-stage Centrifugal Compressors

- Multi-stage Centrifugal Compressors

- Integrally Geared Centrifugal Compressors

- By Stage:

- Axial Compressors

- Radial/Centrifugal Compressors

- By Pressure:

- Low Pressure (Up to 3 bar)

- Medium Pressure (3 bar to 10 bar)

- High Pressure (Above 10 bar)

- By End-User Industry:

- Oil & Gas (Upstream, Midstream, Downstream)

- Chemicals & Petrochemicals

- Power Generation (Gas Turbines, Process Air)

- General Manufacturing and HVAC

- Wastewater Treatment and Water Utilities

- Industrial Gases (Air Separation Units)

Value Chain Analysis For Stationary Centrifugal Compressor Market

The stationary centrifugal compressor value chain begins with highly specialized upstream activities, involving the sourcing of high-grade materials such as specialized steel alloys for impellers, high-precision bearings, and sophisticated control system components. Key technological inputs include advanced computational fluid dynamics (CFD) modeling for impeller design and rotor dynamic analysis, which are crucial for ensuring high efficiency and operational stability. Manufacturing processes are capital-intensive, requiring advanced machining centers and rigorous quality control protocols to meet the demanding standards of the oil and gas and petrochemical industries, establishing high barriers to entry for new competitors.

The downstream segment involves complex logistics, installation, and commissioning, often requiring specialized field services due to the large size and integration complexity of these machines within major process plants. Distribution channels are typically dual-layered: direct sales for large, custom-engineered projects, involving close collaboration between the OEM and the end-user engineering procurement construction (EPC) firm, and indirect distribution through established regional distributors and authorized service partners for standardized units and aftermarket services. The profitability often shifts heavily towards the aftermarket segment, encompassing spare parts, repairs, and long-term maintenance contracts, providing reliable revenue streams for OEMs.

Direct distribution is paramount for custom, high-value turbomachinery used in critical services like LNG liquefaction or ethylene production, where specialized engineering support and risk management are mandatory. Conversely, indirect channels are essential for reaching diverse industrial end-users, such as textile factories or general manufacturing plants, which utilize standardized compressors for plant air or utility services. Efficient management of the service network, ensuring rapid access to critical spares and highly trained technicians, is a defining factor in maintaining customer satisfaction and securing repeat business throughout the life cycle of these long-lasting assets.

Stationary Centrifugal Compressor Market Potential Customers

The primary customers for stationary centrifugal compressors are large industrial organizations requiring continuous, high-volume flow of compressed gas or air for their core operational processes. These customers typically operate plants characterized by high capacity utilization, process criticality, and substantial energy expenditure, making the efficiency and reliability of the compression machinery a determining factor in overall profitability. Target buyers include national and international oil companies (NOCs and IOCs), large independent power producers, and global chemical conglomerates involved in fertilizer, plastics, and industrial gas production.

Specific potential customers within the Oil & Gas sector include operators of natural gas pipelines (midstream), LNG terminals (liquefaction and regasification), and refineries (downstream). In the Chemicals & Petrochemicals industry, buyers include producers of ammonia, urea, methanol, and ethylene, where centrifugal compressors are integral to synthesis and refrigeration loops. Furthermore, municipal bodies and utility companies operating large wastewater treatment plants are increasingly adopting centrifugal blowers for aeration, driven by efficiency mandates and the need for non-pulsating flow characteristics.

The purchasing process for these assets is highly technical and lengthy, often involving multi-year tendering processes led by procurement teams and technical specialists who evaluate performance metrics, Mean Time Between Failures (MTBF), total cost of ownership (TCO), and compliance with global engineering standards. Decisions are rarely based solely on initial cost, prioritizing long-term reliability and the OEM’s capacity to provide integrated, high-quality after-sales support and advanced digital diagnostic solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 9.0 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens Energy, Atlas Copco, General Electric (Baker Hughes), Mitsubishi Heavy Industries, MAN Energy Solutions, Sulzer, Ingersoll Rand, Howden Group, Kobe Steel (Kobelco), Hanwha Power Systems, Elliott Group, Ebara Corporation, Kaeser Kompressoren, Boge Kompressoren, Fusheng, Airex Energy, Gardner Denver, IHI Corporation, Aerzen, Hitachi Industrial Equipment Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Stationary Centrifugal Compressor Market Key Technology Landscape

The technological landscape of the stationary centrifugal compressor market is dominated by advancements aimed at increasing operational efficiency, extending operational lifespan, and reducing noise and vibration footprints. A core technological focus involves the optimization of aerodynamic design, utilizing advanced Computational Fluid Dynamics (CFD) to refine impeller geometry, diffuser channels, and volute design, thereby maximizing polytropic efficiency across a broader operating map. Furthermore, the integration of magnetic bearing technology is gaining traction, particularly in high-speed, oil-free applications, eliminating friction losses and the requirement for complex lubrication systems, which is crucial for sensitive process environments.

Another significant technological trend is the adoption of advanced materials science, specifically in coating technologies and impeller fabrication. High-strength titanium and specialized aluminum alloys are used to reduce rotating mass and improve resistance to corrosive gases common in petrochemical environments. Furthermore, Variable Speed Drives (VSDs) are now standard across most mid-to-large centrifugal units, offering precise flow control and significant energy savings, particularly during turndown or fluctuating load conditions, moving the market away from traditional throttle valve control mechanisms.

Digitalization forms the third pillar of technological innovation. Modern stationary compressors are equipped with comprehensive sensor arrays and integrated communication platforms that enable real-time condition monitoring, remote diagnostics, and integration into plant-wide control systems (DCS/SCADA). These smart capabilities support the shift towards predictive maintenance models, leveraging IIoT connectivity and cloud computing to analyze operational data, predict potential failures, and optimize operational parameters automatically, significantly enhancing reliability and contributing to the overall decrease in TCO.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of market growth due to unparalleled infrastructure development, led primarily by massive investments in refineries, liquefied natural gas (LNG) import and regasification terminals, and large-scale industrial parks in countries like China, India, and Southeast Asia. The continuous build-out of petrochemical capacity, particularly for plastics and basic chemicals, mandates the installation of numerous high-capacity multi-stage centrifugal compressors. Government initiatives supporting industrial self-sufficiency and urban expansion further fuel demand for utility air and process gas compression equipment across diverse manufacturing sectors.

- North America: North America represents a mature yet dynamic market, heavily influenced by the robust natural gas production (shale boom) and extensive pipeline network. Demand here is characterized by the need for high-pressure compressors for gas gathering, processing, and transportation (midstream). A key driver is the modernization of aging infrastructure and the increasing focus on adopting compressors compatible with harsh weather conditions and strict environmental regulations, emphasizing leak reduction and energy efficiency, particularly in the U.S. Gulf Coast region.

- Europe: The European market demonstrates steady, technologically advanced demand, driven by stringent energy efficiency directives and a strong commitment to decarbonization. The focus is shifting towards specialized centrifugal compressors for industrial gas production (e.g., oxygen for steelmaking), high-efficiency air compression for manufacturing, and emerging applications in green hydrogen production and carbon capture (CCUS). Germany, the UK, and the Benelux countries are major centers for innovation and consumption, prioritizing highly integrated, compact, and low-maintenance designs.

- Middle East and Africa (MEA): This region is a major hub for large, capital-intensive projects, primarily driven by state-owned oil companies investing heavily in upstream gas processing and downstream petrochemical integration. Countries such as Saudi Arabia, UAE, and Qatar are driving demand for high-reliability, custom-engineered centrifugal compressors for gas lift, gas injection, and massive LNG production facilities. The market is highly sensitive to global oil and gas prices, but long-term governmental diversification strategies ensure sustained, large-scale project pipelines.

- Latin America: Market growth is moderate but promising, primarily concentrated in Brazil, Mexico, and Argentina, linked to the exploitation of deep-water oil reserves and the expansion of national gas distribution networks. Political stability and foreign investment influx are key determinants. Demand is focused on robust, proven technology for offshore platforms and refinery modernization projects, often procured through international EPC contractors adhering to global performance standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Stationary Centrifugal Compressor Market.- Siemens Energy

- Atlas Copco

- General Electric (Baker Hughes)

- Mitsubishi Heavy Industries

- MAN Energy Solutions

- Sulzer

- Ingersoll Rand

- Howden Group

- Kobe Steel (Kobelco)

- Hanwha Power Systems

- Elliott Group

- Ebara Corporation

- Kaeser Kompressoren

- Boge Kompressoren

- Fusheng

- Airex Energy

- Gardner Denver

- IHI Corporation

- Aerzen

- Hitachi Industrial Equipment Systems

Frequently Asked Questions

Analyze common user questions about the Stationary Centrifugal Compressor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for stationary centrifugal compressors in the next five years?

The primary driver is the accelerating investment in global natural gas and petrochemical infrastructure, particularly new Liquefied Natural Gas (LNG) facilities and large-scale ethylene/ammonia production plants in the Asia Pacific and Middle East regions. Additionally, the mandated shift toward highly efficient, oil-free compression systems boosts replacement cycles.

How do integrally geared centrifugal compressors compare to traditional multi-stage compressors?

Integrally geared compressors offer superior efficiency, a more compact footprint, and higher speeds achieved through individual pinion gearing for each impeller. This design allows for optimal intercooling and specialized pressure ratios, making them highly favored for medium-flow, high-pressure industrial gas applications compared to the traditional direct-drive multi-stage axial or radial designs.

Which end-user segment currently holds the largest market share for these compressors?

The Oil and Gas segment, encompassing upstream gas processing, midstream transmission, and downstream refining/petrochemical production, holds the dominant market share. This dominance is driven by the sheer volume and critical nature of gas handling and compression required throughout the hydrocarbon value chain.

What role does digitalization play in the maintenance of stationary centrifugal compressors?

Digitalization, powered by IIoT and AI, enables advanced predictive maintenance strategies. By continuously monitoring vibration, temperature, and pressure data, digital systems predict component failure before it occurs, drastically reducing unplanned downtime and optimizing maintenance intervals, thereby lowering the overall total cost of ownership (TCO).

Are centrifugal compressors being adapted for emerging energy applications like hydrogen?

Yes, centrifugal compressors are undergoing significant adaptation, focusing on specialized materials and sealing technologies, to handle the unique properties of hydrogen (low density, high diffusivity). They are crucial for high-pressure compression required in hydrogen liquefaction, transportation, and storage infrastructure development, representing a key future growth segment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager