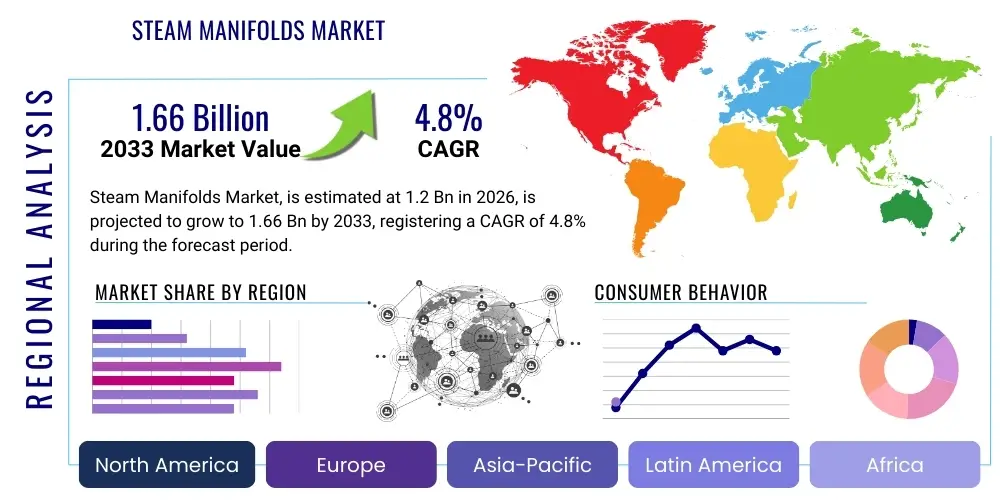

Steam Manifolds Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441318 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Steam Manifolds Market Size

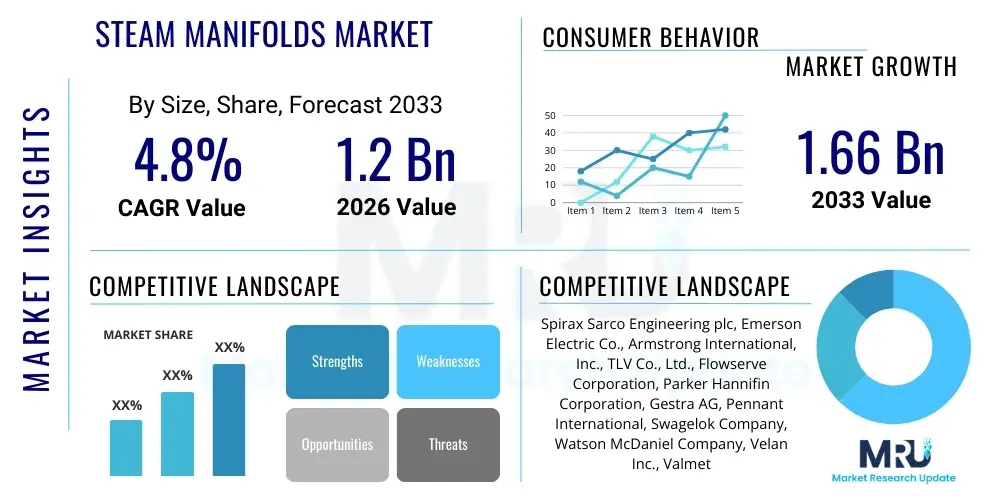

The Steam Manifolds Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.66 Billion by the end of the forecast period in 2033.

Steam Manifolds Market introduction

Steam manifolds are essential components in industrial steam distribution systems, designed to efficiently collect and distribute steam from a single main source to multiple process lines, often incorporating necessary accessories such as isolation valves, drain valves, and steam traps. These devices ensure reliable segregation and control of steam supply across various stages of a manufacturing operation, maximizing energy efficiency and minimizing system downtime. The primary function involves centralized management of steam flow, which is critical in maintaining optimal pressure and temperature stability across diverse applications, ranging from sterilization in pharmaceuticals to heating large vessels in chemical processing plants. The robust design and modularity of modern steam manifolds facilitate easier installation, maintenance, and system expansion, positioning them as fundamental assets in facilities relying heavily on thermal energy transfer.

The major applications of steam manifolds span several heavy industries, including petrochemicals, food and beverage processing, pharmaceuticals, power generation, and textiles. In these sectors, reliable steam delivery is paramount for operations such as heating, cooking, curing, drying, and turbine operation. The adoption of advanced stainless steel and carbon steel alloys in manifold construction is driven by the need for corrosion resistance and high-pressure tolerance, aligning with increasingly stringent safety standards and operational demands. Furthermore, the incorporation of intelligent monitoring systems into modern manifolds enhances predictive maintenance capabilities, contributing significantly to operational excellence.

Driving factors for the market include the rapid industrialization across emerging economies, especially in Asia Pacific, leading to new infrastructure development requiring sophisticated steam infrastructure. The global emphasis on energy efficiency and waste heat recovery mandates the use of highly controlled steam distribution systems, further boosting the demand for high-performance steam manifolds. Key benefits derived from utilizing these components include improved process control, reduced energy wastage through better insulation and trapping, enhanced safety due to centralized regulation, and overall lower lifetime maintenance costs for complex steam networks.

Steam Manifolds Market Executive Summary

The Steam Manifolds Market is undergoing significant transformation driven by global efforts towards decarbonization and industrial automation. Business trends indicate a strong shift towards modular and pre-fabricated manifold systems, which reduce installation time and enhance standardization across large industrial complexes. Manufacturers are increasingly integrating diagnostic features, such as pressure and temperature sensors, into manifold designs to support Industry 4.0 initiatives, allowing for real-time performance monitoring and predictive failure analysis. Furthermore, the escalating cost of industrial energy is compelling end-users to invest in premium, high-efficiency manifolds that minimize leakage and optimize steam distribution, thereby improving overall plant profitability and operational sustainability.

Regionally, the Asia Pacific (APAC) market is expected to demonstrate the highest growth trajectory, primarily fueled by massive infrastructural investments in China, India, and Southeast Asian nations in sectors like chemical manufacturing and food processing. North America and Europe, while representing mature markets, are focusing on upgrading aging infrastructure with modern, safety-compliant, and highly efficient stainless steel manifolds, driven by strict environmental regulations and the need to retrofit legacy facilities. The Middle East and Africa (MEA) are also showing promising growth, particularly in the petrochemical and oil and gas refining segments, where reliable high-pressure steam systems are foundational to complex operations.

Segment trends reveal that manifolds categorized by Material Type, specifically Stainless Steel, are gaining dominance due to their superior resistance to corrosion and compatibility with high-purity steam applications, especially in the pharmaceutical and food and beverage industries. By End-User, the Chemical & Petrochemical segment maintains the largest market share owing to the intensive and continuous nature of their thermal processes, demanding robust and scalable steam handling solutions. Meanwhile, the Power Generation sector is expected to exhibit rapid adoption, driven by global capacity expansion in both conventional and combined heat and power (CHP) facilities, where precise steam control is crucial for turbine efficiency and safety.

AI Impact Analysis on Steam Manifolds Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Steam Manifolds Market primarily revolve around how AI can enhance operational efficiency, reduce maintenance overhead, and optimize steam usage in real-time. Common concerns include the complexity and cost of integrating AI-driven predictive maintenance systems (PdM) with existing manifold infrastructure, and the necessity for highly specialized data analytics to interpret performance anomalies within high-pressure, high-temperature environments. Users are actively seeking solutions where machine learning algorithms can analyze historical operational data—such as pressure fluctuations, temperature differentials, and steam trap cycling rates—to anticipate potential failures in seals, valves, or connection points before they lead to catastrophic downtime or significant energy loss. The expectation is that AI will transform steam management from a reactive maintenance activity into a highly precise, proactive, and autonomously managed utility system.

The integration of AI leverages data generated by advanced sensors embedded within or adjacent to steam manifolds, particularly focusing on condition monitoring. This advanced layer of intelligence allows plant operators to move beyond standard SCADA systems towards truly optimized steam networks. AI models can identify subtle patterns indicative of inefficient operation, such as slight increases in condensate build-up or minor valve seat erosion, which are often undetectable by conventional control methods. This shift fundamentally alters the lifecycle management of steam manifolds, extending asset longevity and guaranteeing sustained efficiency, thereby providing a clear competitive advantage to manufacturers and end-users who adopt these smart solutions early. Furthermore, AI contributes significantly to energy conservation goals by ensuring that steam is generated and distributed only precisely when and where it is needed, minimizing standby losses.

- AI-driven predictive maintenance (PdM) detects early signs of valve leakage or steam trap failure in manifolds, minimizing unplanned outages.

- Machine learning algorithms optimize steam distribution routes and pressure settings dynamically, reducing overall energy consumption.

- Automated anomaly detection enhances safety by flagging immediate operational risks associated with excessive pressure or temperature deviations.

- AI supports asset performance management (APM) by providing accurate forecasts of manifold component lifespan under varying load conditions.

- Integration with Digital Twins allows simulation of steam system modifications and testing of control strategies without physical intervention.

DRO & Impact Forces Of Steam Manifolds Market

The dynamics of the Steam Manifolds Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces. A major driver is the accelerating demand for process automation and precise thermal control across capital-intensive industries. Restraints often center around the high initial capital investment required for high-specification, corrosion-resistant manifolds and the technical expertise needed for their seamless integration into legacy industrial systems. Opportunities arise from technological advancements, particularly in smart manifold designs that incorporate IoT sensors, and the increasing global focus on maximizing energy efficiency and reducing carbon footprints, which heavily relies on optimized steam distribution infrastructure.

The primary driving force is the relentless expansion and modernization of global industrial infrastructure, especially within Asia Pacific and specific sectors like chemicals, petrochemicals, and food processing. These industries require reliable, continuous, and precisely controlled steam supply, necessitating high-quality, modular manifold systems that can handle aggressive media and high operating pressures efficiently. Furthermore, regulatory mandates in developed regions (Europe and North America) that emphasize environmental protection and occupational safety standards push manufacturers towards investing in certified, robust, and leakage-proof manifold solutions, replacing outdated, less efficient distribution systems.

Conversely, significant restraints hinder market growth, including the long operational life cycle of traditional steam system components, which often delays replacement decisions unless a catastrophic failure occurs or efficiency improvements become mandatory. Additionally, fluctuations in raw material prices, particularly steel and specialized alloys, introduce volatility into manufacturing costs, potentially impacting the final price of advanced manifold systems. However, these challenges pave the way for major opportunities; specifically, the growing trend of utilizing prefabricated, plug-and-play manifold solutions drastically reduces on-site labor and installation complexity, attracting smaller and medium-sized enterprises (SMEs). Moreover, the development of manifolds designed for superheated and critical steam applications opens avenues in the high-growth power generation and nuclear sectors, representing significant future market potential and solidifying the overall positive impact forces favoring sophisticated steam management solutions.

Segmentation Analysis

The Steam Manifolds Market segmentation provides a granular view of market dynamics based on operational requirements, material properties, and end-user applications. The market is primarily segmented by Type (Header Manifolds, Steam Distribution Manifolds, Condensate Manifolds), Material (Stainless Steel, Carbon Steel, Alloy Steel), End-User Industry (Chemical & Petrochemical, Food & Beverage, Pharmaceutical, Power Generation, Pulp & Paper, Textile), and Pressure Rating (High Pressure, Medium Pressure, Low Pressure). This segmentation highlights the diverse needs across industries, noting that while general industrial applications may rely on Carbon Steel for cost-effectiveness, specialized sectors like pharmaceuticals strictly demand high-grade Stainless Steel manifolds to maintain purity and corrosion resistance. The trend is moving towards customized, application-specific manifolds that integrate isolation and control features directly into the unit.

By analyzing the segments, it is clear that the demand for modular steam distribution manifolds, which efficiently allocate steam to multiple outlets from a central point, dominates the market share. The increasing complexity of industrial processes requires manifolds capable of managing various steam qualities and pressures simultaneously, often within tight spatial constraints. Geographically, segmentation underscores the importance of regional industrial concentration; for instance, areas with high chemical production favor high-pressure and alloy steel manifolds, whereas regions focusing heavily on hygienic processing show higher uptake of stainless steel variants. Understanding these segments is vital for manufacturers to tailor their product offerings and strategic market penetration efforts efficiently.

- By Type:

- Header Manifolds

- Steam Distribution Manifolds

- Condensate Manifolds

- By Material:

- Stainless Steel (304, 316L)

- Carbon Steel

- Alloy Steel

- By End-User Industry:

- Chemical & Petrochemical

- Food & Beverage

- Pharmaceutical & Biotechnology

- Power Generation

- Pulp & Paper

- Textile and Manufacturing

- By Pressure Rating:

- High Pressure (above 600 psi)

- Medium Pressure (150 psi to 600 psi)

- Low Pressure (below 150 psi)

Value Chain Analysis For Steam Manifolds Market

The Value Chain for the Steam Manifolds Market begins with the upstream activities centered on raw material procurement, primarily high-grade stainless steel, carbon steel, and specialized alloy steel required to withstand high temperatures and pressures. Suppliers of these materials, alongside manufacturers of critical components such as isolation valves, pressure gauges, and steam traps, form the initial tier. Manufacturers of steam manifolds focus on design, fabrication (welding, machining, and assembly), and crucial quality assurance processes, including non-destructive testing and hydro testing, ensuring compliance with international safety standards like ASME and PED. Efficiency at this stage is dictated by precision engineering and minimizing material waste, as raw material costs constitute a significant portion of the final product expenditure.

Midstream activities involve sophisticated manufacturing processes, often moving towards modular and standardized designs to cater to faster installation demands. Many leading companies utilize advanced manufacturing techniques, including robotic welding and automated inventory management, to enhance throughput and maintain consistently high product quality. Following fabrication, manifolds are often coated or insulated based on application requirements. The subsequent distribution channel is multifaceted, relying heavily on specialized industrial distributors and system integrators who possess deep technical knowledge about steam systems. These channels provide localized inventory, essential after-sales support, and technical consultation to end-users, ensuring that the selected manifold system is optimally configured for the specific industrial process.

Downstream analysis focuses on installation, commissioning, operation, and maintenance activities at the end-user site, which heavily influence the product's total cost of ownership. Direct sales channels are often employed for large, complex projects, such as new power plants or chemical facilities, where manufacturers provide direct engineering and consultation services. Indirect distribution through specialized resellers dominates the aftermarket and replacement market, catering to standardized product needs. The effectiveness of the value chain is increasingly measured by the lifetime energy efficiency provided by the installed manifold, underscoring the vital role of skilled installation technicians and the quality of integrated components like steam traps, which prevent energy loss and premature system degradation.

Steam Manifolds Market Potential Customers

The primary potential customers for steam manifolds are large-scale industrial facilities that rely extensively on steam as a utility for heating, drying, sterilization, or mechanical power generation. These customers are categorized by industries requiring stringent process control and high thermal efficiency. The largest buying segment is consistently the Chemical and Petrochemical sector, including refineries and producers of bulk chemicals, where steam is integral to reaction processes, distillation, and heat exchange. These buyers prioritize manifolds that offer extreme reliability, materials resistant to corrosive chemicals, and certification for high-pressure and high-temperature environments, often procuring large, custom-engineered header manifolds capable of managing immense flow rates across vast facility layouts.

Another major segment comprises the Food & Beverage and Pharmaceutical industries. In these sectors, steam is critical for sterilization (autoclaving), clean-in-place (CIP) processes, and maintaining sanitary conditions. Customers here place a premium on hygiene, demanding manifolds constructed from high-grade Stainless Steel (316L typically) with smooth internal finishes to prevent microbial growth. They require compliance with health and safety regulations (e.g., FDA, GMP), leading them to procure specialized steam distribution manifolds designed specifically for clean steam applications. The buying decision is heavily influenced by documentation, material traceability, and ease of validation for regulatory audits.

Furthermore, the Power Generation sector, encompassing conventional thermal plants (coal, gas) and nuclear facilities, represents a crucial segment, focusing on high-pressure ratings necessary for turbine operation and auxiliary systems. These customers seek robust, long-lasting manifolds capable of handling superheated steam and managing intricate bypass and isolation requirements. Other significant buyers include textile manufacturers utilizing steam for dyeing and finishing processes, and the Pulp & Paper industry where steam is essential for drying and pressing paper sheets. The common thread among all potential customers is the need for solutions that minimize energy waste, enhance operational safety, and guarantee the highest levels of system uptime.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.66 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Spirax Sarco Engineering plc, Emerson Electric Co., Armstrong International, Inc., TLV Co., Ltd., Flowserve Corporation, Parker Hannifin Corporation, Gestra AG, Pennant International, Swagelok Company, Watson McDaniel Company, Velan Inc., Valmet Oyj, Forbes Marshall, Bestobell Steam, KLINGER Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Steam Manifolds Market Key Technology Landscape

The technological evolution within the Steam Manifolds Market is predominantly focused on improving system reliability, enhancing modularity, and enabling digitalization through integrated sensing capabilities. A crucial technological advancement is the widespread adoption of modular manifold designs, which allows for standardized, interchangeable components. This modularity not only simplifies installation and reduces piping complexity but also facilitates faster maintenance and scalability. Manufacturers are leveraging advanced welding techniques, such as orbital welding, to ensure superior weld integrity and consistency, especially vital for high-purity steam applications found in the pharmaceutical industry where crevice corrosion must be strictly avoided. Furthermore, sophisticated non-destructive testing (NDT) methodologies are now standard practice to certify the structural integrity of manifolds operating under extreme thermal cycling and high-pressure loads.

The integration of Information Technology (IT) and Operational Technology (OT) is transforming steam manifold management. The inclusion of industrial IoT sensors (temperature, pressure, vibration) and smart steam traps directly into the manifold assembly allows for real-time data acquisition regarding steam quality and component performance. This data feeds into centralized plant monitoring systems and cloud-based analytical platforms, enabling operators to achieve precise control and proactive fault diagnosis. Technologies like integrated differential pressure transmitters and flow meters are becoming common features, providing accurate measurements essential for calculating energy consumption and optimizing steam load allocation across various processes, thereby supporting modern energy management mandates and providing the data foundation for AI-driven maintenance scheduling.

Material science remains a fundamental aspect of the technology landscape, with continuous research into specialized alloys that offer higher resistance to erosion, thermal fatigue, and stress corrosion cracking (SCC), particularly important for superheated steam applications in power plants. Moreover, significant advancements are seen in external manifold technologies, specifically insulation and jacketing systems. High-performance, low-emissivity insulation materials are being developed to drastically reduce heat loss from the manifold surface, which directly translates into enhanced system efficiency and reduced operational costs. The overall technological thrust is directed towards creating intelligent, maintenance-friendly, and energy-efficient manifolds that are seamlessly integrated into the broader digital ecosystem of the industrial facility.

Regional Highlights

The global Steam Manifolds Market demonstrates distinct regional patterns influenced by industrial density, regulatory environment, and modernization pace. Asia Pacific (APAC) stands out as the most dominant and rapidly expanding region, primarily due to large-scale investment in manufacturing infrastructure, chemical production, and power generation capacity in economies like China, India, and Southeast Asia. The demand in APAC is driven by new facility construction requiring comprehensive steam distribution networks, coupled with government initiatives promoting industrial automation and energy conservation. This region is characterized by a high volume demand for both standard carbon steel and high-specification stainless steel manifolds.

North America and Europe represent mature markets characterized by stringent environmental regulations and a focus on infrastructure replacement and efficiency upgrades. In these regions, growth is primarily sustained by the need to retrofit aging steam systems with modern, highly efficient, and safety-compliant manifolds, particularly those incorporating IoT capabilities for predictive maintenance. European demand is bolstered by pharmaceutical and food processing sectors prioritizing ultra-clean, corrosion-resistant manifold solutions that adhere to strict sanitary standards. Manufacturers in these areas emphasize long-term reliability and total cost of ownership rather than initial acquisition cost.

Latin America and the Middle East & Africa (MEA) are emerging regions exhibiting considerable potential. MEA growth is intrinsically linked to the expansion of the oil and gas, petrochemical, and desalination sectors, all of which rely heavily on large, high-pressure steam manifold systems. Latin America's market expansion is steady, fueled by investments in the mining, food processing, and chemical industries. These regions often face challenges related to varied infrastructure quality and therefore favor robust, easy-to-install manifold systems that can operate reliably under diverse and often challenging operational conditions.

- Asia Pacific (APAC): Highest growth area driven by rapid industrialization, chemical manufacturing expansion, and energy infrastructure projects, particularly in China and India.

- North America: Focus on modernizing aging industrial base, adoption of smart manifolds, and compliance with stringent energy efficiency and safety standards.

- Europe: Strong demand from the pharmaceutical and food and beverage sectors for high-purity, stainless steel manifolds, supported by advanced regulatory requirements (e.g., PED).

- Middle East & Africa (MEA): Growth tied to significant investments in petrochemical refining, oil and gas processing, and large-scale utility operations demanding high-pressure solutions.

- Latin America: Steady market expansion supported by investments in mining, agricultural processing, and light manufacturing industries requiring reliable thermal utility infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Steam Manifolds Market.- Spirax Sarco Engineering plc

- Emerson Electric Co.

- Armstrong International, Inc.

- TLV Co., Ltd.

- Flowserve Corporation

- Parker Hannifin Corporation

- Gestra AG (Steriflow Valve Inc.)

- Pennant International

- Swagelok Company

- Watson McDaniel Company

- Velan Inc.

- Valmet Oyj

- Forbes Marshall

- Bestobell Steam

- KLINGER Group

- Tyco International (Johnson Controls)

- Weidmüller Interface GmbH & Co. KG

- ARI-Armaturen GmbH

- MIYAWAKI Inc.

- Chromalox, Inc.

Frequently Asked Questions

Analyze common user questions about the Steam Manifolds market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a steam manifold in an industrial setting?

A steam manifold serves as a central distribution hub that collects steam from a main supply line and distributes it reliably and controllably to multiple branch lines or end-use equipment, ensuring stable pressure and temperature throughout the process.

Which material type dominates the Steam Manifolds Market and why?

Stainless Steel manifolds are gaining dominance, particularly in specialized industries like pharmaceuticals and food and beverage, due to their superior corrosion resistance, high tensile strength, and ability to meet stringent hygienic requirements for clean steam applications.

How do smart or IoT-enabled steam manifolds contribute to energy efficiency?

IoT-enabled manifolds use integrated sensors to provide real-time data on pressure, temperature, and steam trap status, allowing predictive maintenance and dynamic flow optimization. This drastically reduces steam leakage and prevents unnecessary energy waste, thereby improving overall plant efficiency.

Which segment is the largest end-user of steam manifolds?

The Chemical and Petrochemical segment holds the largest market share due to the intensive and continuous nature of their operations, requiring extensive, robust, and often custom-engineered steam distribution systems for processes such as reaction heating and distillation.

What is the expected Compound Annual Growth Rate (CAGR) for the Steam Manifolds Market?

The Steam Manifolds Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033, driven largely by industrial expansion in the Asia Pacific region and global modernization efforts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager