Steam Meters Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442314 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Steam Meters Market Size

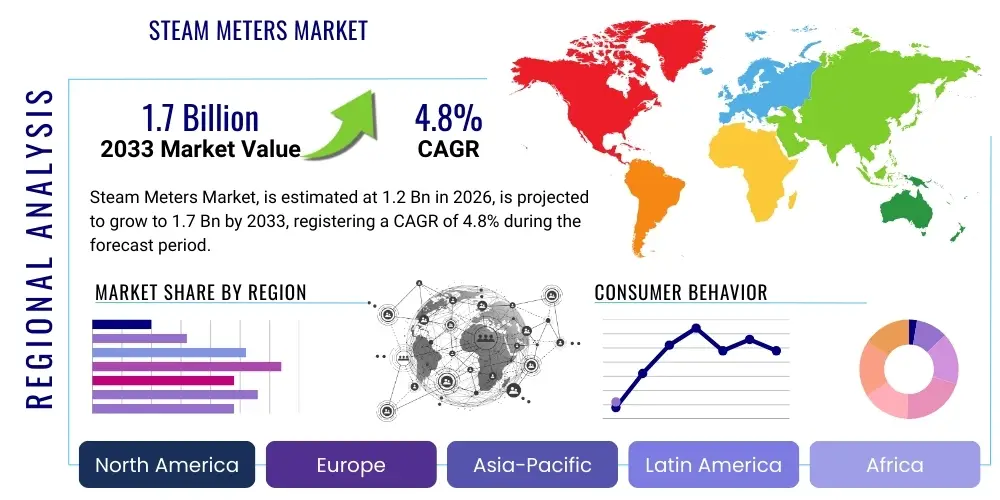

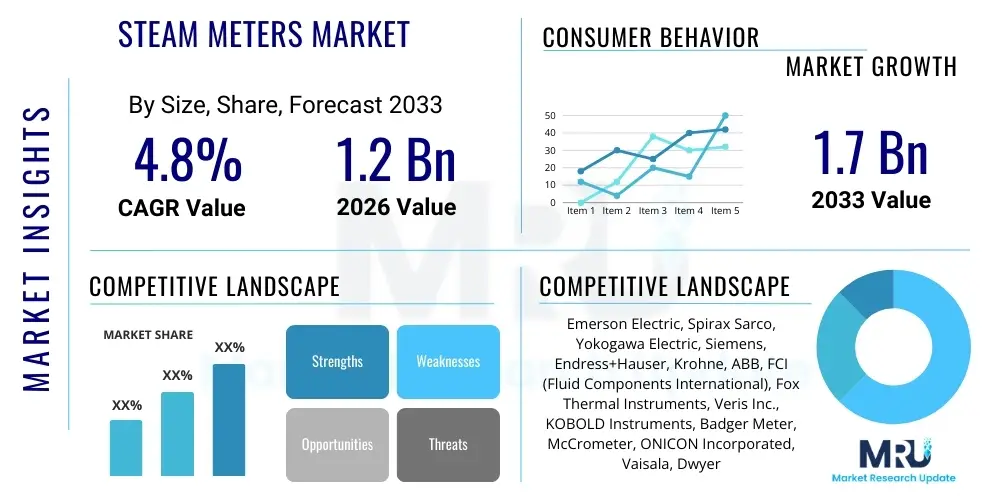

The Steam Meters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.7 Billion by the end of the forecast period in 2033. This consistent growth trajectory is fundamentally driven by the escalating global focus on industrial energy efficiency, stringent regulatory frameworks mandating accurate measurement of energy consumption, and the necessity for precise cost allocation in large industrial and commercial facilities utilizing steam systems.

The valuation reflects the increasing adoption of advanced meter technologies, particularly vortex and Coriolis meters, which offer superior accuracy and reliability compared to traditional differential pressure methods. Investment in modernizing aging industrial infrastructure across developed economies, coupled with rapid industrialization and the establishment of new process manufacturing facilities in emerging markets, are contributing factors supporting this market expansion. Furthermore, the rising prices of natural gas and other fuel sources are amplifying the return on investment for companies implementing high-accuracy steam metering solutions.

Market expansion is also heavily influenced by continuous technological innovation aimed at improving meter performance under harsh industrial conditions, such as high temperatures and varying pressures inherent in steam systems. The integration of IoT capabilities and wireless communication protocols into steam meters is enhancing data accessibility and facilitating seamless integration with enterprise resource planning (ERP) systems and industrial control systems (ICS), thereby maximizing operational efficiency and driving market demand.

Steam Meters Market introduction

Steam meters are highly specialized industrial instruments designed to accurately measure the mass flow rate or volumetric flow rate of steam (both saturated and superheated) within pipelines. These devices are critical components in industrial process control and energy management systems, enabling organizations to monitor consumption, optimize boiler efficiency, ensure equitable cost distribution among internal departments or tenants, and comply with environmental mandates related to energy usage. Key types of steam meters include vortex shedding, differential pressure (utilizing orifice plates or venturi tubes), and Coriolis meters, each offering distinct advantages based on specific application requirements regarding pressure, temperature, and accuracy levels.

Major applications of steam meters span across numerous heavy and light industries where steam is utilized as a primary energy transfer medium or process fluid. These include chemical and petrochemical processing, conventional and nuclear power generation, food and beverage processing for sterilization and heating, pharmaceutical manufacturing, pulp and paper production, and large-scale HVAC systems for district heating. The accurate measurement provided by these instruments directly translates into significant cost savings by identifying leaks, optimizing boiler operations, and preventing energy wastage, making them indispensable assets in modern industrial operations focused on sustainability and economic viability.

The primary driving factors for the Steam Meters Market include the global imperative for achieving energy reduction targets, the increasing complexity of industrial processes requiring real-time measurement capabilities, and legislative requirements that necessitate mandatory monitoring of steam consumption for taxation and auditing purposes. The benefit derived from these meters—namely, enhanced operational safety, optimized fuel consumption, improved process quality control, and accurate fiscal metering—underpins the steady and robust demand for steam metering solutions worldwide.

Steam Meters Market Executive Summary

The Steam Meters Market is characterized by robust growth stemming from the confluence of strict energy efficiency regulations and significant advancements in flow measurement technology. Business trends indicate a strong shift towards intelligent metering solutions integrating Internet of Things (IoT) connectivity, facilitating remote monitoring, predictive maintenance, and seamless data integration with industrial automation platforms. Key market players are prioritizing research and development to enhance accuracy in transient flow conditions and expand the operational envelope for high-pressure, high-temperature superheated steam applications, thereby widening the utility and applicability of these instruments across diverse industrial environments.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by massive investments in infrastructure, rapid industrial expansion, particularly in China and India, and increasing governmental focus on energy conservation policies within manufacturing sectors. North America and Europe, while being mature markets, maintain high demand due to ongoing industrial modernization initiatives, the adoption of advanced fiscal metering standards, and the prevalent utilization of district heating networks, driving replacement cycles for older, less accurate meters with highly reliable modern vortex and Coriolis technologies.

Segmentation trends highlight the dominance of Vortex meters due to their favorable balance of accuracy, cost-effectiveness, and low maintenance requirements, making them the preferred choice for saturated steam applications. However, the Differential Pressure segment maintains a significant share, particularly in legacy systems and where extremely large pipe sizes are involved. Application-wise, the Power Generation and Chemical & Petrochemical sectors remain the largest consumers, given their high dependency on continuous and accurately measured steam flow for core operations, cementing their position as critical demand drivers for high-end, high-performance steam metering solutions.

AI Impact Analysis on Steam Meters Market

User inquiries regarding AI's influence on the Steam Meters Market often revolve around predictive maintenance capabilities, enhanced flow compensation algorithms, and the role of machine learning in optimizing boiler operations and steam network performance. Key user concerns focus on whether AI integration will significantly increase system complexity and initial capital expenditure, alongside questions about data security for highly sensitive energy consumption metrics. Users are actively seeking solutions where AI can process large datasets generated by smart meters to identify anomalies indicative of leaks or inefficient usage in real-time, thereby moving beyond simple measurement towards proactive energy management and predictive diagnostics.

AI is transforming steam metering from a purely measurement function into an integrated system management tool. Machine learning algorithms are being deployed to analyze flow patterns, pressure variations, and temperature fluctuations to dynamically calibrate meter readings, correcting for real-world deviations that traditional linear compensation models often miss. This capability significantly enhances the accuracy of fiscal and custody transfer metering, particularly in challenging environments where steam quality may fluctuate. Furthermore, AI facilitates complex energy modeling, allowing facilities to simulate the impact of changes in production schedules or equipment load on overall steam consumption, ensuring optimal boiler efficiency.

The future trajectory involves leveraging AI for creating "digital twins" of industrial steam networks. These digital representations, fed by real-time data from steam meters and temperature sensors, enable advanced fault detection and isolation, predicting equipment failure (e.g., steam trap malfunction, valve leakages) long before physical symptoms manifest. This shift towards proactive, data-driven maintenance minimizes downtime, reduces operational losses associated with undetected leaks, and extends the lifespan of critical steam infrastructure, driving higher demand for AI-ready smart steam meters.

- AI enables highly accurate, real-time dynamic flow compensation and calibration adjustments.

- Machine Learning algorithms facilitate predictive maintenance by detecting subtle anomalies in steam flow and pressure data.

- Integration of AI improves leak detection and quantification, minimizing energy waste significantly.

- AI optimizes boiler firing rates and steam generation parameters based on predicted industrial load profiles.

- Data analytics driven by AI provide granular insights into departmental energy usage for accurate cost allocation.

DRO & Impact Forces Of Steam Meters Market

The Steam Meters Market is propelled by stringent global energy efficiency regulations and the inherent economic necessity for industries to accurately manage high-cost steam generation. The primary drivers include the mandatory implementation of energy management systems (ISO 50001) and rising fossil fuel costs, which amplify the Return on Investment (ROI) of precise metering. Conversely, the market faces restraints such as the high initial investment required for advanced metering technologies (Coriolis, specialized Vortex) and the technical complexity involved in retrofitting existing, often antiquated, steam systems with modern sensors and communication infrastructure. Significant opportunities lie in the adoption of Industrial IoT (IIoT) platforms for remote diagnostics and the burgeoning demand from developing economies undergoing rapid industrial build-out.

Impact forces currently shaping the market dynamics are heavily skewed towards technological advancements and legislative pressure. The pressure for decarbonization is accelerating the adoption of steam meters in combined heat and power (CHP) facilities and district energy networks, which require extremely reliable fiscal metering. Furthermore, the increasing availability of highly accurate, reliable, and maintenance-free meter types, such as insertion vortex meters designed for easier installation, is lowering the barrier to entry for small to medium enterprises (SMEs). However, the market must continuously contend with the challenge posed by sensor fouling in harsh environments and the necessity for regular professional calibration, which can influence long-term operational costs.

The competitive landscape is defined by continuous innovation in sensor materials and embedded software intelligence. Opportunities for substantial market penetration exist in offering integrated solutions that combine flow measurement, pressure/temperature compensation, and cloud-based data analytics into a single service package. The impact of the global supply chain stability post-2020 has also been a crucial force, influencing the lead times and deployment speeds for large industrial projects, making vendor reliability and local service support critical factors in purchasing decisions. The market remains sensitive to capital expenditure cycles in the Power Generation and Chemical sectors, reflecting the cyclical nature of demand for large-scale instrumentation projects.

Segmentation Analysis

The Steam Meters Market is comprehensively segmented based on the principle of operation (Type), the specific industry utilizing the steam (Application), and the geographic location of deployment (Region). Understanding these segments is crucial for strategic market planning, as technological suitability often dictates segment dominance. For instance, high-accuracy applications like custody transfer heavily favor Coriolis technology, while general process monitoring and energy management typically rely on the cost-effective and robust Vortex shedding principle. The application segments reveal demand elasticity; for example, the Food & Beverage sector demands meters with high repeatability for batch processing, contrasting with the continuous, high-flow demands of the Power Generation industry.

Further granularity in segmentation involves distinguishing between components (sensors, transmitters, display units) and measurement scale (large line size vs. small line size). The growing emphasis on system integration means that transmitters equipped with advanced diagnostics and standard communication protocols (e.g., HART, Modbus, Profibus) are experiencing higher growth than standalone mechanical meters. This integrated approach allows end-users to maximize the value derived from the measured data, aligning with Industry 4.0 paradigms. Regional segmentation underscores the difference between mature infrastructure replacement cycles in North America and Europe and greenfield project installations in Asia Pacific.

The detailed segmentation structure below allows manufacturers, suppliers, and investors to pinpoint high-growth areas and tailor product development and marketing efforts to specific user needs, optimizing resource allocation. The segmentation by type is particularly dynamic, reflecting the ongoing shift away from older, high-maintenance technologies toward digital, low-maintenance, high-accuracy alternatives that minimize pressure drop and operational expenditure over the meter's lifecycle.

- By Type:

- Vortex Flow Meters

- Differential Pressure Flow Meters (Orifice Plate, Venturi, Annubar)

- Coriolis Flow Meters

- Ultrasonic Flow Meters

- Turbine Flow Meters

- By Application:

- Chemical & Petrochemical

- Power Generation (Utility & CHP)

- Food & Beverages

- Pharmaceutical & Healthcare

- Oil & Gas (Upstream & Midstream)

- Pulp & Paper

- HVAC & District Heating

- Textiles & Others

- By End-Use Industry:

- Industrial

- Commercial

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Steam Meters Market

The Steam Meters Market value chain initiates with the procurement and refinement of highly specialized raw materials, primarily high-grade stainless steel, exotic alloys for sensor construction, and advanced semiconductor components for transmitters and digital signal processing units. Upstream activities involve material sourcing and precision manufacturing of meter bodies, sensor elements (e.g., shedder bars for vortex meters, U-tubes for Coriolis), and electronic boards. Suppliers of sensor technologies and embedded software play a crucial role, often forming strategic partnerships with meter manufacturers to ensure compatibility with industrial communication standards and robust performance under extreme operating conditions prevalent in steam systems.

The core manufacturing stage involves the assembly, integration, and meticulous calibration of the meters. Calibration is a critical step, often requiring dedicated high-pressure, high-temperature steam calibration loops to meet stringent industry standards (e.g., ISO, ASME) and ensure accuracy, directly impacting the final product quality and reliability. Distribution channels are typically hybrid, involving direct sales teams for large, complex industrial projects (especially in the power and chemical sectors) and a network of specialized, certified distributors or channel partners for general industrial and commercial installations. These distributors often provide essential local technical support, installation services, and post-sales maintenance, acting as a crucial interface between the manufacturer and the end-user.

Downstream activities center on installation, commissioning, maintenance, and periodic recalibration services. For complex flow metering solutions, technical consultants and system integrators play a vital role in integrating the steam meters into existing plant control systems (DCS/SCADA). The market sees a growing emphasis on indirect revenue generation through long-term service contracts, predictive maintenance agreements, and software licensing for advanced diagnostics and data analytics platforms, ensuring sustained profitability throughout the product lifecycle and reinforcing customer loyalty through continuous operational support.

Steam Meters Market Potential Customers

The potential customer base for steam meters is exceptionally broad, spanning any industry that relies on steam for process heating, sterilization, motive power, or humidification. The primary buyers are large industrial facilities categorized by intensive energy consumption profiles. These end-users, such as power plant operators (utility scale and captive power units), chemical manufacturers, and integrated petrochemical complexes, require high-specification, reliable, and often redundant metering solutions for fiscal accounting, process optimization, and safety compliance. For these critical applications, the purchasing decision prioritizes accuracy, longevity, and certification over initial cost.

Secondary but significant customer segments include the Food & Beverage and Pharmaceutical industries, where steam is integral to sterilization (CIP/SIP) and cooking processes. These sectors demand meters designed for hygienic conditions, often requiring quick-clean designs and materials compliant with FDA regulations. The key motivation for purchasing here is quality control and regulatory adherence, alongside cost monitoring. Additionally, the district heating sector (especially prevalent in Europe and parts of North America) represents a substantial commercial customer base, requiring robust meters for accurate billing and consumption monitoring across large municipal networks, often necessitating high-turndown ratios to handle seasonal load variations.

Finally, the commercial and institutional sectors, including large university campuses, hospitals, military bases, and major commercial complexes, constitute the remaining customer base. These entities use steam primarily for HVAC, domestic hot water, and specific laboratory processes. For this segment, ease of installation, integration with building management systems (BMS), and low maintenance requirements are key purchasing criteria. Consultants and engineering procurement construction (EPC) firms act as influential intermediaries, recommending and specifying steam metering solutions during the design phase of new industrial and commercial projects.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.7 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Emerson Electric, Spirax Sarco, Yokogawa Electric, Siemens, Endress+Hauser, Krohne, ABB, FCI (Fluid Components International), Fox Thermal Instruments, Veris Inc., KOBOLD Instruments, Badger Meter, McCrometer, ONICON Incorporated, Vaisala, Dwyer Instruments, Swagelok, Thermo Fisher Scientific, General Electric (GE), OMEGA Engineering |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Steam Meters Market Key Technology Landscape

The technology landscape for the Steam Meters Market is dominated by the evolution of flow sensing principles towards higher accuracy and maintenance minimization, coupled with robust digital communication capabilities. Vortex shedding technology remains the backbone, with recent innovations focusing on improved noise filtering, wider turndown ratios, and compensation techniques to handle saturated or wet steam conditions more effectively. Manufacturers are incorporating integrated temperature and pressure sensors directly into the meter body, transforming them into multivariable instruments capable of calculating compensated mass flow without external inputs, simplifying installation and reducing potential measurement errors.

Coriolis meters, traditionally high-cost, are witnessing increasing adoption in high-value custody transfer and critical process control applications due to their exceptional accuracy and immunity to steam density variations. Technological advancements in Coriolis designs are aimed at developing smaller, lighter meters with reduced pressure drop, making them more viable for retrofitting standard pipeline sizes. Furthermore, the development of sophisticated signal processing algorithms is allowing ultrasonic flow meters to enter the steam market, overcoming historical limitations related to acoustic impedance mismatch and high temperatures, offering a non-intrusive measurement option with minimal pressure loss.

The most significant technological shift is the widespread adoption of smart metering and IIoT readiness. Modern steam meters are equipped with integrated web servers, advanced diagnostics, and secure wireless communication modules (e.g., LoRaWAN, 5G-enabled edge computing) that facilitate seamless integration into cloud-based asset management platforms. This connectivity allows for real-time performance monitoring, remote troubleshooting, and sophisticated data logging, effectively turning the meter into an intelligent sensor that contributes to the holistic optimization of the entire steam generation and distribution network, thereby driving significant operational expenditure savings for end-users.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by extensive industrial infrastructure development, particularly in China, India, and Southeast Asian nations. High energy consumption rates in these rapidly expanding economies necessitate rigorous energy management policies and the mandatory adoption of advanced metering solutions in power plants, steel mills, and chemical industries. Government initiatives promoting energy efficiency and sustainability further fuel the demand for modern steam meters, coupled with foreign direct investment in manufacturing facilities requiring high-precision instrumentation.

- North America: This region holds a mature yet substantial market share, primarily driven by the replacement of aging steam infrastructure and strong regulatory focus on accurate emissions reporting and cost allocation. The robust presence of major industries like Chemical, Oil & Gas, and Power Generation, coupled with high awareness and rapid adoption of cutting-edge technologies (Coriolis and IIoT-enabled meters), ensures continuous high demand for premium, high-accuracy steam metering solutions.

- Europe: Europe is characterized by stringent energy conservation directives, such as the Energy Efficiency Directive (EED), which mandates continuous monitoring of energy consumption. The region’s advanced district heating networks are massive consumers of steam meters for fiscal metering and billing purposes. Strong emphasis on sustainable manufacturing practices, coupled with high fuel costs, makes investment in precise steam measurement instruments an economic imperative, favoring high-end Vortex and Coriolis technologies.

- Latin America (LATAM): Growth in LATAM is steady, fueled by investments in the resource extraction industries (e.g., mining and petrochemicals) and the modernization of existing manufacturing facilities, particularly in Brazil and Mexico. The market is price-sensitive, often favoring reliable, moderately priced solutions like standard Vortex meters, though regulatory improvements are slowly driving up demand for higher accuracy devices in key industrial hubs.

- Middle East and Africa (MEA): This region is heavily influenced by large-scale oil and gas operations and significant capital expenditure in power generation projects and desalination plants. Steam meters are crucial for process optimization and energy accountability in these large, often state-owned, industrial enterprises. The demand focuses on robust, high-pressure, and high-temperature meters that can withstand the harsh climatic conditions and high throughput volumes characteristic of the region’s massive utility infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Steam Meters Market.- Emerson Electric Co.

- Spirax Sarco Engineering plc

- Yokogawa Electric Corporation

- Siemens AG

- Endress+Hauser Group Services AG

- Krohne Group

- ABB Ltd.

- FCI (Fluid Components International)

- Fox Thermal Instruments, Inc.

- Veris Inc.

- KOBOLD Instruments

- Badger Meter, Inc.

- McCrometer, Inc.

- ONICON Incorporated

- Vaisala Oyj

- Dwyer Instruments, LLC

- Swagelok Company

- Thermo Fisher Scientific Inc.

- General Electric (GE)

- OMEGA Engineering Inc.

Frequently Asked Questions

Analyze common user questions about the Steam Meters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most accurate type of steam meter for high-pressure superheated steam?

The Coriolis flow meter is generally considered the most accurate technology for measuring mass flow, including high-pressure superheated steam, due to its direct mass measurement principle, which is minimally affected by changes in density or temperature. However, multivariable vortex meters with integrated pressure and temperature compensation offer a highly accurate and more cost-effective alternative for many industrial applications.

How frequently should industrial steam meters be calibrated?

The ideal calibration frequency depends heavily on the meter type, the severity of the operating environment, and regulatory requirements. Typically, steam meters should undergo calibration checks every 12 to 24 months, especially those used for fiscal or custody transfer applications. Predictive maintenance algorithms leveraging IIoT data can help optimize this schedule, shifting from time-based to condition-based calibration.

What are the key benefits of using smart steam meters with IIoT connectivity?

Smart steam meters integrated with IIoT offer benefits including real-time performance monitoring, remote diagnostics and troubleshooting, enhanced data logging, and seamless integration with industrial control systems (DCS/SCADA). This connectivity enables predictive maintenance, reduces operational downtime, and provides granular data necessary for advanced energy optimization and leakage detection programs.

Is it possible to measure wet or saturated steam accurately with vortex flow meters?

Modern vortex flow meters are significantly improved and, when equipped with sophisticated multivariable compensation features (measuring temperature and pressure), they can accurately measure saturated steam. However, excessive moisture content (very wet steam) can introduce errors. For optimal accuracy in wet steam conditions, careful selection of the meter's sensing mechanism and proper steam conditioning upstream are essential.

Which industries are the primary drivers of demand for steam meters?

The primary drivers of demand are high-energy consuming sectors: Power Generation (for efficiency monitoring and cost distribution), Chemical and Petrochemical (for process control and accounting), and the Food & Beverage industry (for sterilization and heating process verification). These sectors require continuous, highly reliable measurement for operational safety, cost control, and compliance.

The subsequent detailed analysis further explores the technological nuances and strategic market positioning of key players within the global Steam Meters Market.

Detailed Market Dynamics and Competitive Landscape

The intense competition within the Steam Meters Market is not merely based on price but increasingly on the technological capabilities embedded within the instruments. Leading manufacturers are investing heavily in miniaturization, robustness of sensor materials, and the development of proprietary algorithms to improve measurement accuracy under non-ideal, fluctuating steam conditions. This focus on enhanced performance is crucial because even minor inaccuracies in steam measurement can lead to substantial financial losses over time, given the high cost of steam generation. Furthermore, the push towards standardized digital communication protocols, such as OPC UA, is allowing seamless integration of meters from various vendors into unified plant management systems, driving competitive differentiation through software and integration services rather than hardware alone.

Market penetration strategies often involve strategic alliances with system integrators and engineering procurement construction (EPC) firms, particularly for large greenfield industrial projects in emerging markets. These partnerships ensure that high-end steam metering solutions are specified early in the design phase, locking in long-term maintenance and service contracts. Another critical dynamic is the regulatory arbitrage observed across different regions; while European directives emphasize energy monitoring universally, markets like North America often focus on custody transfer and high-accuracy fiscal metering for transactions involving steam sales between utilities and industrial consumers, necessitating specialized, certified meter models.

The substitution threat remains relatively low for core steam metering applications, as steam is an indispensable utility in heavy industry. However, the internal competition among different meter technologies is fierce. Vortex meters continue to dominate the volume market due to their simplicity and cost-benefit ratio, but Coriolis technology is steadily eroding the market share in applications where accuracy justifies the higher capital outlay. The evolution of insertion-type meters (both Vortex and DP) represents a disruptive trend, as they significantly reduce installation costs and downtime compared to traditional full-bore meters, opening up new opportunities in existing pipeline retrofits across all industrial segments.

Industrial Automation and Digitization Influence

The convergence of industrial automation (Industry 4.0) with flow measurement is redefining the utility of steam meters. Previously isolated measurement instruments are now becoming intelligent data nodes within a connected industrial ecosystem. This shift is primarily driven by the need for actionable intelligence—moving beyond simple flow rate indication to using data for energy optimization, proactive fault detection, and detailed energy accounting across complex facility networks. The influence of digitization mandates that new steam meters must not only be accurate but also possess robust onboard data processing capabilities (edge computing) and secure connectivity features to minimize latency and ensure data integrity.

The adoption of standardized fieldbuses and industrial Ethernet protocols (e.g., PROFINET, Ethernet/IP) is critical for this integration, facilitating real-time data exchange with distributed control systems (DCS) and supervisory control and data acquisition (SCADA) systems. This high level of integration allows operators to perform advanced control loops, such as dynamic adjustment of boiler parameters in response to instantaneous shifts in steam demand detected by the meters. Consequently, manufacturers are prioritizing the development of transmitters with standardized communication interfaces and comprehensive diagnostic functions that simplify setup and compliance with industrial network requirements.

Moreover, the integration of augmented reality (AR) tools for maintenance and calibration, utilizing the data streamed from smart steam meters, is starting to gain traction, particularly in geographically dispersed or hard-to-access steam networks. This trend reduces the requirement for highly specialized technicians to be constantly on-site, lowering operational expenditure for end-users. The continuous advancement in sensor diagnostics means that modern meters can self-check their operational health, flagging issues such as sensor degradation or fouling well in advance, contributing significantly to overall plant uptime and reliability, thereby enhancing the value proposition of digitized steam measurement solutions.

Future Technology Outlook and Innovation Trajectory

The future technology outlook for the Steam Meters Market centers on achieving absolute non-intrusiveness, increasing operational envelopes, and expanding the application of advanced materials science. Research efforts are heavily concentrated on improving non-contact measurement techniques, such as refined ultrasonic and thermal mass flow principles, to create meters that cause zero pressure drop and require no pipeline modification. While thermal mass flow is generally suited for low-pressure gas applications, innovation is aiming to adapt similar concepts for high-temperature steam environments, leveraging advanced coatings and sensor isolation techniques.

Another major innovation trajectory involves leveraging quantum sensing technology, although still nascent, which promises unprecedented levels of accuracy and stability, potentially challenging the dominance of traditional Coriolis technology in high-end fiscal metering applications. Furthermore, there is a sustained push towards enhancing the material resistance of wetted parts to corrosion and erosion, common issues in industrial steam systems, particularly those using treated boiler feedwater. The use of advanced ceramics and specialized polymers in sensor construction is being explored to extend meter lifespan in aggressive operating conditions.

Crucially, the development of self-diagnosing and self-calibrating meters is anticipated to be a game-changer. These intelligent systems would utilize internal reference standards and machine learning algorithms to continuously monitor and adjust calibration factors, minimizing the need for physical removal and external calibration. This capability aligns perfectly with the demands of critical industries (e.g., nuclear power, pharmaceuticals) where process interruptions for maintenance are extremely costly, guaranteeing long-term, high-integrity measurement performance and further propelling the market towards high-value, service-oriented offerings.

Regulatory and Environmental Factors

Global regulatory bodies, driven by the urgency of climate change mitigation and energy scarcity, are increasingly mandating precise energy consumption measurement, which directly boosts the demand for highly accurate steam meters. Standards such as ISO 50001 (Energy Management System) require organizations to measure, monitor, and continuously improve their energy performance, making the installation of certified steam meters a prerequisite for compliance and certification. These regulations establish a baseline demand for high-quality instrumentation across virtually all industrial sectors globally.

Environmental regulations targeting carbon emissions and greenhouse gas reduction also significantly impact the market. Since steam generation is inherently fuel-intensive, accurate metering allows companies to quantify and report their energy usage accurately, which is often tied to carbon taxation or cap-and-trade schemes. Companies that can demonstrate optimized steam usage, verifiable through accurate metering data, gain a competitive advantage and avoid potential regulatory fines, thereby justifying the investment in premium metering technology.

Furthermore, regional legislation concerning worker safety, particularly related to high-pressure steam lines, drives the demand for meters with advanced diagnostic features that monitor for potential leaks or system failures. Meters that provide real-time status and early warnings about process anomalies contribute to a safer operational environment. This regulatory landscape ensures that the market for steam meters is not solely dependent on economic cycles but is supported by mandatory compliance requirements, stabilizing long-term demand.

Market Challenges and Mitigation Strategies

One of the persistent technical challenges in the Steam Meters Market is the accurate measurement of wet steam, where two-phase flow (water droplets and vapor) can severely compromise the accuracy of most meter types, particularly vortex meters. Mitigation strategies involve designing improved separation and conditioning elements upstream of the meter and utilizing advanced signal processing algorithms that can differentiate between flow turbulence and noise caused by droplets. For highly demanding applications, high-end Coriolis meters remain the preferred solution despite their cost, due to their inherent ability to measure mass flow irrespective of phase changes.

Another commercial challenge is the high upfront capital expenditure required, particularly for large-scale industrial metering projects. Manufacturers are mitigating this restraint by offering modular meter designs, which allow for phased investment, and flexible purchasing models, including Metering-as-a-Service (MaaS) subscriptions. MaaS allows customers to access advanced metering technology and associated data analytics without the immediate large investment, shifting the cost from CapEx to OpEx, which is attractive to facility managers focused on immediate cost reduction and quick ROI demonstration.

Lastly, the lack of standardized installation practices and the requirement for highly skilled technicians to install and commission steam meters in complex industrial environments pose logistical challenges. Market leaders are addressing this by focusing on user-friendly meter designs (e.g., factory-calibrated meters requiring minimal field adjustment), extensive training programs for service technicians, and the use of AR-guided installation procedures to standardize deployment quality globally, ensuring reliable performance post-installation.

Economic and Pricing Analysis

The pricing structure within the Steam Meters Market is highly stratified, reflecting the diversity of technologies and application requirements. Differential Pressure meters (Orifice Plate assemblies) generally represent the lower end of the cost spectrum, appealing to price-sensitive buyers or those in older facilities where simplicity is prioritized. Vortex meters occupy the mid-range, offering an optimal balance of cost, accuracy, and operational robustness, making them the segment volume leader in general industrial applications.

Coriolis meters dominate the premium segment. Their high cost is justified by unparalleled accuracy, low maintenance, and direct mass flow measurement, positioning them as the standard for fiscal metering and critical process control where measurement errors translate into massive financial consequences (e.g., energy custody transfer). Pricing power in the premium segment is maintained by manufacturers holding superior intellectual property in sensor design and calibration technology.

The overall market pricing is subject to volatility in raw material costs (especially specialized metals) and the ongoing cost deflation pressure in electronic components due to mass production scale. However, the service component—including installation, commissioning, software licensing for IIoT platforms, and long-term maintenance contracts—is becoming an increasingly significant part of the overall cost structure, providing manufacturers with stable recurring revenue streams and bolstering the overall economic stability of the market value chain beyond initial hardware sales.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager