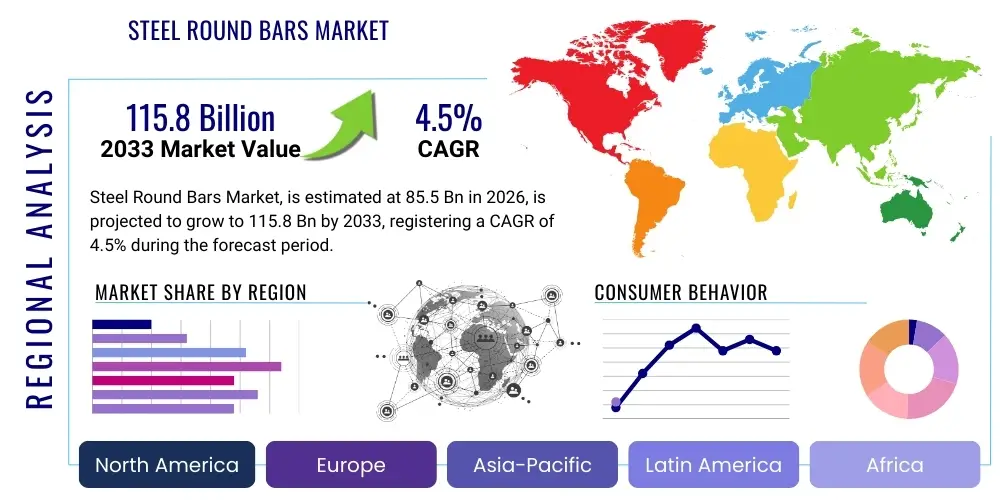

Steel Round Bars Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442467 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Steel Round Bars Market Size

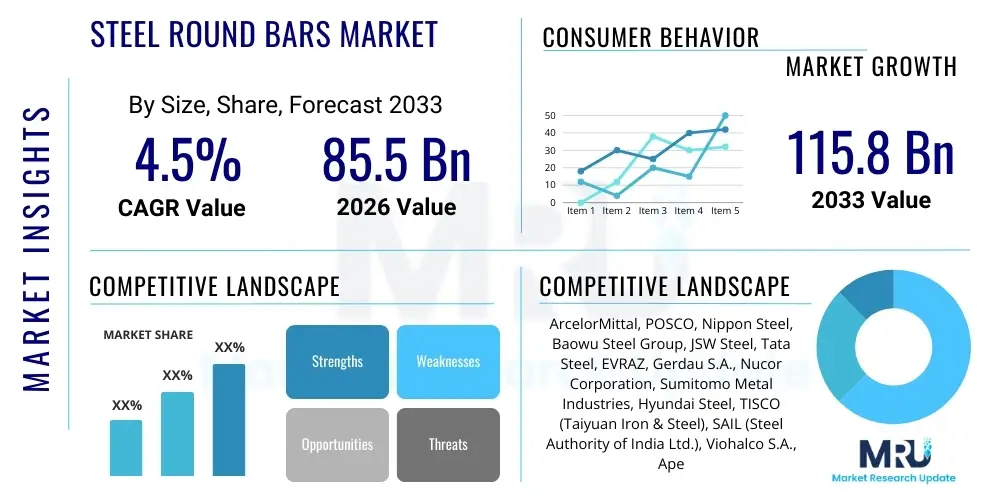

The Steel Round Bars Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 85.5 Billion in 2026 and is projected to reach USD 115.8 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by robust infrastructure development initiatives globally, particularly in emerging economies, alongside sustained demand from critical sectors such as automotive manufacturing, machinery production, and large-scale construction projects. The market expansion is closely tied to advancements in steel manufacturing technologies, allowing for the production of high-strength, lightweight, and durable round bars that meet stringent international quality standards required for specialized applications.

Steel Round Bars Market introduction

The Steel Round Bars Market encompasses the manufacturing, distribution, and utilization of long, cylindrical metal bars made primarily from various steel alloys, designed for use as critical structural components, raw materials for forging, or specialized components in diverse industrial applications. These bars, characterized by their circular cross-section, range significantly in diameter and material composition, including carbon steel, alloy steel, and stainless steel, catering to specific requirements for strength, corrosion resistance, and heat tolerance. Major applications span structural reinforcement in construction, axles and shafts in the automotive and machinery sectors, and feed material for the fabrication of bolts, nuts, and precision tools. The inherent benefits of steel round bars, such as superior tensile strength, excellent weldability, and reliability under stress, position them as indispensable materials across heavy industry. Key driving factors include escalating urbanization rates, significant capital investments in renewable energy infrastructure, the global resurgence of the automotive production industry focusing on lighter materials, and technological upgrades in steel production processes that enhance quality and reduce manufacturing costs, ensuring sustained market impetus.

Steel Round Bars Market Executive Summary

The Steel Round Bars Market is experiencing dynamic shifts, underpinned by strong business trends centered on supply chain resilience, advanced material science integration, and consolidation among major global producers aiming for economies of scale and improved cost structures. Innovation in low-carbon steel production and specialized heat treatments to enhance mechanical properties represent critical commercial differentiators. Regionally, the Asia Pacific (APAC) market maintains undeniable dominance, driven by massive infrastructure spending in China and India, although North America and Europe demonstrate robust demand, particularly for high-grade and specialized alloy steel round bars used in aerospace and precision engineering. Segment trends reveal that carbon steel remains the largest segment by volume due to its widespread use in construction and general manufacturing, while stainless steel is witnessing the highest growth rate, propelled by increasing applications requiring superior corrosion resistance in chemical processing and maritime environments. Furthermore, a growing preference for smaller diameter bars (under 50mm) in high-volume automotive and fabrication industries highlights the market's trajectory towards precision and application-specific material tailoring, necessitating flexible and technologically advanced rolling mill capabilities across the supply chain.

AI Impact Analysis on Steel Round Bars Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can optimize the notoriously complex and energy-intensive production of steel round bars, specifically focusing on quality control, predictive maintenance, and raw material utilization efficiency. Key themes center on the expectation that AI can drastically reduce defects during the rolling and cooling processes, automate intricate scheduling for highly variable product mix demands, and enhance energy management in electric arc furnaces (EAFs) and basic oxygen furnaces (BOFs). Concerns often revolve around the high initial capital expenditure required for integrating AI systems into legacy steel mills, the need for specialized data infrastructure, and workforce skill gaps in managing and interpreting complex AI-driven optimization models. Users anticipate that AI will fundamentally transform quality assurance from reactive testing to proactive, real-time adjustments, ultimately leading to higher yield rates and reduced environmental footprints, positioning early adopters for a significant competitive advantage in precision manufacturing.

- AI optimizes furnace operations by predicting thermal variances, reducing energy consumption by up to 10-15%.

- Machine Vision systems utilize AI for real-time defect detection during the hot rolling process, improving surface quality consistency.

- Predictive maintenance algorithms analyze sensor data from rolling mills to forecast equipment failure, minimizing unplanned downtime and maximizing throughput.

- AI enhances supply chain logistics by optimizing raw material procurement (e.g., scrap metal sorting) and finished goods inventory management, responding quickly to demand fluctuations.

- Advanced simulation models powered by AI allow for the optimization of steel alloy composition and cooling parameters, ensuring specified mechanical properties are met efficiently.

DRO & Impact Forces Of Steel Round Bars Market

The Steel Round Bars Market dynamics are fundamentally shaped by strong drivers such as escalating global construction activities and industrial expansion, coupled with significant restraints including volatility in raw material (iron ore and scrap steel) prices and rigorous environmental regulations governing steel production emissions. Opportunities are abundant in the high-growth sectors demanding specialized alloys, such as aerospace, defense, and oil & gas, alongside innovation in sustainable manufacturing processes, particularly green steel initiatives. These internal and external factors exert significant influence, classified as impact forces, defining the strategic pathways for market participants. The collective impact forces necessitate continuous technological investment to overcome operational inefficiencies and regulatory hurdles, while simultaneously capitalizing on the pervasive need for high-performance structural materials globally, making market resilience contingent on adaptation and scale.

The primary drivers propelling the market growth include rapid urbanization, which translates into sustained demand for residential and commercial infrastructure, requiring massive volumes of steel reinforcement and structural components. Furthermore, government investments worldwide in large-scale infrastructure projects—including high-speed rail networks, bridge construction, and port expansion—provide a solid, long-term foundation for market stability. The automotive sector's shift towards electric vehicles (EVs) and hybrid models, which still require high-strength steel round bars for critical chassis and powertrain components, despite weight reduction efforts, contributes significantly to specialized demand. Technological drivers, such as advancements in continuous casting and high-speed rolling technologies, also lower production costs and improve material quality, making steel round bars more economically competitive against substitute materials.

Conversely, the market faces significant restraints. Foremost among these is the cyclical nature of the steel industry, heavily influenced by global economic downturns and geopolitical instability, which can dramatically suppress demand from end-use sectors like construction and manufacturing. Price volatility of primary inputs, particularly iron ore, metallurgical coal, and energy, creates intense margin pressure on steel producers, complicating long-term planning. Moreover, the industry is highly energy-intensive and faces increasing regulatory scrutiny regarding carbon emissions, leading to substantial compliance costs and the need for expensive capital upgrades. The global overcapacity of standard steel production, particularly in Asian markets, also acts as a restraint, leading to depressed pricing for commodity-grade round bars and intense competitive pressure. Opportunities, however, lie in addressing these restraints through innovation, focusing on the production of high-value, specialized alloy round bars for niches where material substitution is difficult, and adopting green technologies to meet sustainability goals, thereby opening new markets and enhancing corporate reputation.

Segmentation Analysis

The Steel Round Bars Market is intricately segmented based on material type, application, and diameter, allowing manufacturers to tailor products to specific performance requirements and industry standards. Material segmentation—including Carbon Steel, Alloy Steel, Stainless Steel, and Tool Steel—reflects varying needs for strength, hardness, corrosion resistance, and heat treatment capability across different industrial uses. Application segmentation, spanning Construction, Automotive, Machinery & Equipment, Fabrication, and Oil & Gas, dictates volume requirements and material specifications, with construction demanding large volumes of commodity-grade bars, while sectors like aerospace require highly specialized alloys. Diameter segmentation (Below 10mm, 10mm-50mm, Above 50mm) highlights the diversity in processing and end-product function, where smaller diameters typically feed high-precision fabrication and fasteners, and larger diameters are integral to heavy machinery and structural foundations. This granular segmentation is crucial for strategic market positioning, enabling producers to focus on high-margin specialty segments or leverage scale in high-volume commodity segments.

- By Material Type:

- Carbon Steel Round Bars

- Alloy Steel Round Bars

- Stainless Steel Round Bars

- Tool Steel Round Bars

- By Application:

- Construction & Infrastructure

- Automotive & Transportation

- Machinery & Equipment Manufacturing

- Oil & Gas Exploration

- Fabrication & General Engineering

- Aerospace & Defense

- By Diameter:

- Below 10mm

- 10mm to 50mm

- Above 50mm

- By End-Use Industry:

- Heavy Engineering

- Energy & Power

- Consumer Goods

- By Production Process:

- Hot Rolled

- Cold Finished (Drawn, Turned, Ground)

Value Chain Analysis For Steel Round Bars Market

The value chain for the Steel Round Bars Market begins with upstream activities involving the extraction and processing of raw materials, primarily iron ore, coking coal, and scrap metal, which are essential inputs for steel making. This stage is highly capital-intensive and heavily influenced by global commodity pricing and geopolitical factors affecting resource supply chains. Midstream activities center on steel production—utilizing processes like Basic Oxygen Furnace (BOF) or Electric Arc Furnace (EAF)—followed by continuous casting and hot rolling into billets and subsequently into the final round bar shape. Advanced technological capabilities in rolling mills, including precision sizing and heat treatment processes, are critical for quality and cost efficiency in this stage. Downstream activities involve distribution channels, where manufacturers either sell directly to large industrial consumers (e.g., major construction firms or automotive OEMs) or utilize indirect channels via stockists, service centers, and specialized distributors who provide cutting, polishing, and just-in-time delivery services to smaller fabricators and secondary manufacturers. The efficiency of the downstream network, particularly in logistics and inventory management, significantly affects market responsiveness and customer satisfaction. The shift towards specialized and high-grade bars often favors direct sales models to maintain strict quality control and technical consulting, while commodity grades rely heavily on broad, efficient indirect distribution networks.

Steel Round Bars Market Potential Customers

Potential customers for the Steel Round Bars Market span a wide spectrum of industrial and manufacturing sectors, primarily defined by their reliance on durable, high-strength metal components for structural integrity and mechanical function. The most significant end-users are large-scale construction companies and civil engineering firms that utilize these bars for reinforcement in concrete structures (rebar, though specific to round bars, includes materials used in structural foundations) and pre-engineered buildings, prioritizing high volume and structural integrity. Secondly, Original Equipment Manufacturers (OEMs) in the automotive industry and heavy machinery sector (e.g., agricultural equipment, earthmovers, printing presses) are crucial buyers, requiring round bars for precision components such as transmission shafts, gears, and hydraulic cylinders, often demanding specialized alloy grades and tighter dimensional tolerances. Furthermore, the oil and gas industry purchases high-corrosion-resistant alloy bars for drilling equipment, offshore platforms, and pipeline infrastructure, where extreme environmental conditions necessitate premium materials. Finally, numerous fabrication and general engineering workshops constitute a vast client base, relying on distributors for diverse stock profiles used in manufacturing fasteners, tools, and bespoke metallic components, indicating a market structure reliant on both high-volume direct sales and a robust, versatile distribution ecosystem catering to specific project requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 85.5 Billion |

| Market Forecast in 2033 | USD 115.8 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ArcelorMittal, POSCO, Nippon Steel, Baowu Steel Group, JSW Steel, Tata Steel, EVRAZ, Gerdau S.A., Nucor Corporation, Sumitomo Metal Industries, Hyundai Steel, TISCO (Taiyuan Iron & Steel), SAIL (Steel Authority of India Ltd.), Viohalco S.A., Aperam, SSAB, Daido Steel, Shandong Iron and Steel Group, Tsingshan Holding Group, Commercial Metals Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Steel Round Bars Market Key Technology Landscape

The manufacturing process for steel round bars is continually being optimized through the adoption of sophisticated technological solutions focused on enhancing metallurgical properties, achieving closer tolerances, and improving energy efficiency. Key technological advancements include the deployment of advanced continuous casting methods, which minimize material waste and improve the structural homogeneity of the steel billets used as feedstock. Furthermore, high-speed, multi-stand rolling mills equipped with computerized numerical controls (CNC) and laser measurement systems ensure highly precise dimensional accuracy and superior surface finish, particularly crucial for cold-finished bars used in critical applications like automotive shafts and precision tooling. The evolution of thermomechanical rolling (TMR) techniques allows manufacturers to achieve high strength and ductility simultaneously without resorting to complex secondary heat treatments, resulting in significant energy savings and reduced processing time. Digital transformation, leveraging sensors and data analytics integrated via Industry 4.0 principles, is also becoming paramount, facilitating predictive quality control and optimizing the entire production line from melting to final cooling, ensuring stringent quality specifications are met consistently across various product grades and diameters.

Regional Highlights

The Asia Pacific (APAC) region dominates the global Steel Round Bars Market, primarily fueled by extensive state-sponsored infrastructure development programs and robust residential and commercial construction booms, particularly in China, India, and Southeast Asian nations. The region not only accounts for the largest consumption volume but also hosts the highest concentration of large-scale steel production facilities, benefiting from significant cost advantages due to economies of scale and often less stringent environmental regulations compared to Western counterparts. This strong domestic and export capacity ensures APAC remains the global pricing benchmark setter, heavily influencing market trends and competitive dynamics worldwide. Future growth in APAC is expected to diversify, shifting towards higher-grade, specialized steel bars as manufacturing sectors, notably automotive and heavy machinery production, mature and demand superior material performance and reliability.

North America and Europe represent mature markets characterized by stable, yet slower, volume growth, prioritizing high-quality, cold-finished, and specialized alloy steel round bars. Demand in these regions is less dependent on commodity construction steel and is instead driven by the highly technical requirements of the aerospace, defense, energy, and precision machinery industries. Strict quality certifications and traceability requirements necessitate advanced production techniques and localized supply chains. The European market, in particular, is witnessing a significant push toward "Green Steel," utilizing hydrogen and carbon capture technologies to reduce the environmental impact of steel production, creating a premium market for sustainably produced round bars. Market players in these regions focus heavily on technological differentiation, premium pricing strategies, and securing long-term contracts with niche, high-value end-users, compensating for lower overall volume growth with higher profit margins per unit.

Latin America and the Middle East & Africa (MEA) are emerging regions showing promising growth potential. Latin American demand is cyclical, tied closely to mining investments, oil & gas exploration activities, and localized infrastructure projects, demanding substantial quantities of carbon and low-alloy steel bars. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, exhibits robust demand driven by massive investments in diversification projects, including smart cities (like NEOM in Saudi Arabia) and massive oil and gas infrastructure upgrades. The reliance on steel imports is gradually being mitigated by regional capacity expansion, backed by government mandates to localize heavy industries. These regions often serve as crucial export destinations for major Asian and European steel producers but are increasingly developing their own competitive production hubs focused on meeting regional specification standards and fostering regional supply chain resilience.

- Asia Pacific (APAC): Dominates market share due to unprecedented infrastructure and construction spending; focused on volume production of both commodity and high-grade bars; China and India are the primary consumption hubs.

- North America: High demand for specialized alloy and stainless steel bars; growth linked to automotive (trucking/heavy equipment) and defense sectors; emphasis on supply chain reliability and quality standards.

- Europe: Strong focus on high-precision, cold-finished bars; driving global initiatives in "Green Steel" production; demand concentrated in machinery manufacturing and high-end automotive industries.

- Latin America: Market stability tied to commodity cycles (mining and oil & gas); gradual infrastructure modernization drives demand for foundational steel materials; high sensitivity to international trade policies.

- Middle East & Africa (MEA): Growth spurred by large-scale national vision projects (e.g., Saudi Vision 2030); significant investment in oil & gas processing facilities requiring corrosion-resistant materials; increasing regional steel production capacity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Steel Round Bars Market. These companies are actively engaged in optimizing production processes, expanding capacity, and integrating advanced technologies to maintain competitive positioning across global supply chains.- ArcelorMittal

- POSCO

- Nippon Steel Corporation

- Baowu Steel Group Co., Ltd.

- JSW Steel Ltd.

- Tata Steel Limited

- EVRAZ plc

- Gerdau S.A.

- Nucor Corporation

- Sumitomo Metal Industries (now part of Nippon Steel)

- Hyundai Steel Company

- TISCO (Taiyuan Iron & Steel)

- SAIL (Steel Authority of India Ltd.)

- Viohalco S.A.

- Aperam S.A.

- SSAB AB

- Daido Steel Co., Ltd.

- Shandong Iron and Steel Group

- Commercial Metals Company (CMC)

- Outokumpu Oyj

Frequently Asked Questions

What is the primary factor driving the demand for alloy steel round bars?

The primary factor driving demand for alloy steel round bars is the increasing technical complexity and performance requirements in end-use sectors, such as the aerospace, automotive, and heavy machinery industries. These sectors necessitate materials with superior mechanical properties, including enhanced strength-to-weight ratios, high fatigue resistance, and excellent performance under extreme temperatures or corrosive conditions, which standard carbon steel cannot adequately provide.

How does the production process impact the final application of steel round bars?

The production process significantly impacts the properties and application. Hot-rolled steel round bars are typically lower cost, have looser dimensional tolerances, and are primarily used in high-volume, general structural applications like construction. Conversely, cold-finished bars (either drawn, turned, or ground) undergo secondary processing to achieve tighter tolerances, superior surface finish, and improved mechanical properties, making them indispensable for precision components such as hydraulic piston rods, motor shafts, and fasteners.

Which geographical region exhibits the highest growth potential in the next five years?

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth potential, largely due to sustained government investment in large-scale infrastructure and urbanization projects in developing economies like India and Southeast Asia. While growth rates in mature markets are stable, the sheer volume and continuous expansion of industrial capacity across APAC ensure its dominance and robust market expansion throughout the forecast period.

What are the key sustainability challenges facing the steel round bar market?

The major sustainability challenge is decarbonization, as steel production, especially via the Basic Oxygen Furnace (BOF) route, is highly carbon-intensive. Manufacturers face immense pressure from regulators and investors to transition towards cleaner production methods, such as utilizing Electric Arc Furnaces (EAFs) powered by renewable energy or pioneering green steel technologies based on hydrogen reduction, which require substantial capital investment and technological adaptation.

How does raw material price volatility affect steel round bar manufacturers?

Raw material price volatility, particularly for iron ore, scrap metal, and energy, exerts significant pressure on manufacturing margins. Since raw materials account for a substantial portion of the total production cost, sharp price increases can necessitate rapid price adjustments for finished goods or erode profitability, forcing manufacturers to implement sophisticated risk hedging strategies and improve operational efficiency to mitigate market instability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Hot-Rolled Steel Round Bars Market Statistics 2025 Analysis By Application (Construction, Production Equipment, General Application, Others), By Type (Stainless Steel Bars, Carbon Steel Bars), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Cold-Rolled Steel Round Bars Market Statistics 2025 Analysis By Application (Construction, Production Equipment, General Application, Others), By Type (Stainless Steel Bars, Carbon Steel Bars), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager