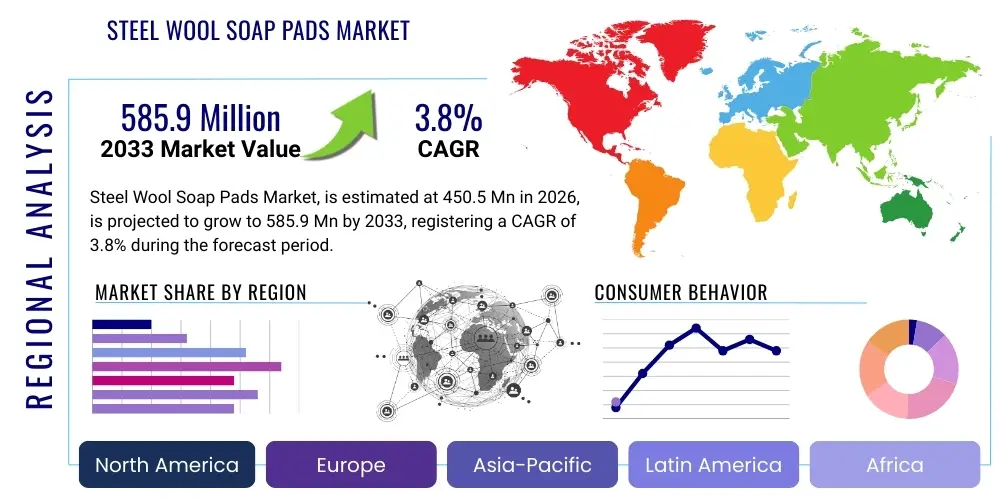

Steel Wool Soap Pads Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442223 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Steel Wool Soap Pads Market Size

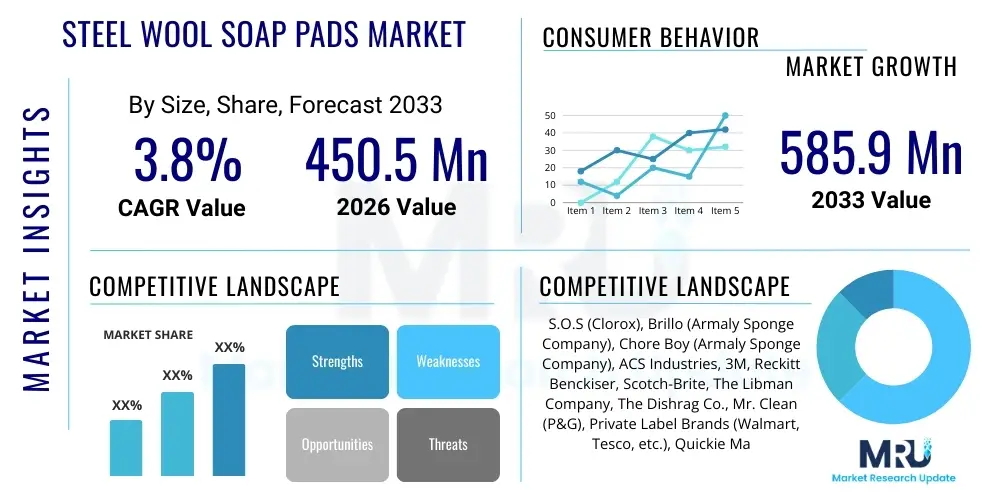

The Steel Wool Soap Pads Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 585.9 Million by the end of the forecast period in 2033.

Steel Wool Soap Pads Market introduction

The Steel Wool Soap Pads Market encompasses the production, distribution, and sales of abrasive cleaning tools composed of fine steel wool filaments infused with a detergent or soap formulation. These ubiquitous household and industrial cleaning aids are specifically designed for heavy-duty scrubbing, tackling stubborn grime, baked-on food residue, and rust from hard surfaces, primarily cookware, ovens, and general kitchen fixtures. The historical reliability of steel wool pads in delivering superior abrasive cleaning compared to non-scratch alternatives solidifies their continued relevance in deep cleaning applications, despite rising competition from synthetic materials and specialized chemical cleaners.

Steel wool soap pads offer several distinct benefits, including superior abrasive power necessary for challenging tasks like oven rack cleaning and removing deeply embedded stains from metallic surfaces. The integrated soap component, often biodegradable or formulated for grease cutting, provides convenience by eliminating the need for separate cleaning agents. Major applications span residential kitchens, commercial food service establishments, janitorial services, and industrial maintenance sectors, where effective, cost-efficient heavy-duty scrubbing is paramount. The market is primarily driven by consistent demand in residential cleaning, coupled with stringent hygiene standards in the HORECA (Hotel, Restaurant, and Catering) segment, necessitating robust cleaning solutions for professional-grade equipment.

Driving factors propelling market expansion include the sustained growth of the global population, which correlates directly with household formation and the associated demand for essential cleaning products. Furthermore, the longevity and effectiveness of steel wool pads, particularly in developing economies where high-end abrasive tools might be less accessible or cost-prohibitive, ensure steady market traction. Manufacturers are increasingly focusing on improving soap formulations to include gentler ingredients or specialized components like rust inhibitors, thereby attempting to broaden the product's appeal and address environmental concerns related to traditional steel wool disposal and packaging materials.

Steel Wool Soap Pads Market Executive Summary

The Steel Wool Soap Pads Market is characterized by moderate growth, underpinned by consistent residential usage and robust demand from professional cleaning sectors. Key business trends indicate a strong focus on product innovation, particularly the integration of eco-friendly packaging and enhanced soap formulations that offer better stain removal while minimizing scratching on surfaces. Competition remains intense, dominated by established multinational consumer goods corporations that leverage extensive distribution networks and brand recognition to maintain market share. Strategic mergers and acquisitions are less frequent in this mature segment, but targeted investments in automation of manufacturing processes are visible to optimize cost structures and maintain price competitiveness against private label alternatives.

Regionally, North America and Europe represent mature markets experiencing stable, albeit slow, growth driven primarily by replacement demand and minor product premiumization efforts. Conversely, the Asia Pacific region, fueled by rapid urbanization, expanding middle-class income, and increasing awareness of household hygiene standards, is emerging as the fastest-growing market segment. Developing nations in APAC present substantial opportunities for market penetration, as the adoption rate of basic, yet highly effective, cleaning solutions like steel wool soap pads continues to accelerate across residential and burgeoning commercial cleaning services. The Middle East and Africa also show promising growth due to infrastructural expansion and increased construction activity requiring heavy-duty cleaning solutions.

Segmentation trends highlight the dominance of the residential segment due to sheer volume, although the commercial and institutional segment provides higher value and often demands larger, industrial-grade packaging formats. In terms of material, traditional steel wool remains the primary choice, but there is a slow, steady increase in demand for hybrid or specialized metallic wool alternatives, particularly those marketed as ‘rust-resistant’ or designed for specific surface types. Distribution is heavily skewed towards hypermarkets and supermarkets, yet the burgeoning penetration of e-commerce platforms is significantly reshaping consumer purchasing patterns, offering specialized bulk options and niche cleaning kits directly to consumers and small businesses, necessitating a responsive omnichannel strategy from leading manufacturers.

AI Impact Analysis on Steel Wool Soap Pads Market

Common user questions regarding AI's influence on the Steel Wool Soap Pads Market often center on manufacturing efficiency, supply chain predictability, and customer personalization. Consumers and industry stakeholders inquire whether AI can optimize the extremely fine filament manufacturing processes, reduce material waste (steel wool and soap), and predict inventory needs for geographically diverse markets. Key themes highlight the expectation that while the core product—a simple abrasive pad—will not be revolutionized by AI, the underlying business operations supporting its production and distribution will undergo significant transformation. Concerns often revolve around the initial capital investment required for AI integration in traditional manufacturing environments and the potential displacement of low-skill labor.

In manufacturing, AI and machine learning algorithms are increasingly being deployed to monitor the quality of steel wool production, ensuring uniformity in filament thickness and density, which are critical for performance consistency. Predictive maintenance, driven by AI analysis of sensor data from machinery, minimizes downtime and extends the operational life of highly specialized cutting and forming equipment. Furthermore, AI-powered systems optimize soap pad impregnation processes, adjusting detergent mixture ratios and absorption rates in real-time based on environmental factors, ensuring precise material usage and maintaining high product quality standards across large production batches.

On the commercial front, AI significantly enhances market forecasting and supply chain management for steel wool soap pads, a staple item often purchased impulsively or based on seasonal cleaning cycles. Machine learning models analyze historical sales data, promotional effectiveness, and external variables (like housing starts or consumer confidence indices) to provide highly accurate demand predictions. This capability allows manufacturers and retailers to optimize stock levels, prevent both stockouts and excess inventory, thereby reducing working capital requirements and minimizing logistics costs, ensuring these bulky, low-margin products are efficiently distributed globally.

- AI optimizes steel wool filament quality control and density consistency in production.

- Machine learning algorithms enhance demand forecasting, particularly for seasonal deep cleaning periods.

- AI-driven supply chain management reduces logistics costs and optimizes inventory distribution across retail channels.

- Predictive maintenance minimizes operational downtime of high-speed manufacturing equipment.

- AI analysis of consumer reviews informs future product development, guiding improvements in soap formulation and pad longevity.

- Automated warehousing and robotics (AI-integrated) speed up order fulfillment for e-commerce distribution.

DRO & Impact Forces Of Steel Wool Soap Pads Market

The Steel Wool Soap Pads Market is driven by the persistent consumer requirement for effective, low-cost solutions for heavy-duty cleaning tasks, particularly those involving hard-to-remove baked-on grime and grease, which chemical cleaners alone often fail to fully eradicate. Restraints include the environmental concerns associated with the disposal of metallic materials and the subsequent rust and degradation in landfills, alongside rising competition from advanced synthetic abrasive pads, non-scratch scrubbers, and specialized enzyme-based cleaning sprays that promise less abrasive alternatives. Opportunities are largely concentrated in the expansion of e-commerce channels, providing direct access to bulk purchasers, and the development of value-added products, such as pads infused with specialized antibacterial agents or sustainable, plant-derived soaps, appealing to the environmentally conscious consumer base.

Impact forces governing the market dynamics include supplier power, which is moderate due to the commodity nature of raw steel wool but influenced by fluctuating global steel prices. Buyer power is high, especially at the retail level (hypermarkets and major discount chains), which exert significant pressure on pricing and profit margins, promoting private label competition. The threat of substitutes is significant, driven by continuous innovation in kitchen cleaning technology, including steam cleaners and highly effective chemical formulations. However, the high abrasive efficacy of steel wool for specific tasks maintains a protective barrier against complete substitution. The threat of new entrants is low due to the substantial capital investment required for specialized manufacturing equipment and the difficulty of displacing established brands in retail distribution.

Socio-economic factors also exert considerable influence; urbanization and smaller living spaces often necessitate quick, effective cleaning tools, favoring the convenience of pre-soaped pads. Conversely, consumer education regarding surface preservation (e.g., non-stick cookware) acts as a restraint, leading some consumers to avoid steel wool entirely. Regulatory changes, particularly concerning detergent ingredients and packaging plastics, mandate continuous adaptation and investment in compliance, affecting operational costs. Successful market players must navigate these competing forces by focusing on cost leadership through operational efficiency while simultaneously investing selectively in product enhancements that mitigate environmental concerns and broaden application safety.

Segmentation Analysis

The Steel Wool Soap Pads Market is primarily segmented based on the type of material used, the key application areas (end-use), and the distribution channel through which the product reaches the consumer. Understanding these segments is crucial for manufacturers to tailor product characteristics, pricing strategies, and marketing campaigns to specific buyer needs. The market’s segmentation highlights the dual nature of demand: high-volume residential usage requires convenience and competitive pricing, while industrial applications necessitate durability and specialized formulations designed for heavy, continuous use in commercial environments. Furthermore, the segmentation by distribution channel reflects the ongoing shift in consumer purchasing habits, emphasizing the growing importance of online retail.

Application segmentation reveals that general kitchen cleaning, specifically focusing on hard-to-clean metallic surfaces like stainless steel pots and pans, accounts for the largest share of market revenue. However, niche applications, such as rust removal in automotive maintenance or industrial cleaning of machinery parts, represent specialized high-value segments that often require pads with different abrasive grades or specific rust-inhibiting soap additives. Material segmentation typically differentiates between conventional steel wool, often made from mild steel, and specialized alternatives like stainless steel wool pads, which offer superior rust resistance and durability, justifying a higher price point in professional settings or areas with high moisture.

Geographically, the segmentation confirms the maturity of North American and Western European markets, where volume stability relies heavily on demographic consistency and replacement purchasing cycles. Contrastingly, the segmentation shows dynamic growth in emerging markets, driven by rising disposable incomes and expanding retail infrastructures. This geographical differential requires tailored logistical strategies; established markets prioritize supply chain efficiency and promotional pricing, while emerging markets require investment in retail penetration and consumer awareness campaigns to drive initial product adoption.

- By Material Type:

- Standard Steel Wool

- Stainless Steel Wool

- Copper/Metallic Blend Pads

- By Application:

- Residential Cleaning (Kitchen, Bathroom)

- Commercial & Institutional (HORECA, Janitorial Services)

- Industrial Cleaning (Machinery, Maintenance)

- By Distribution Channel:

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Retail/E-commerce

- Specialty Stores/Wholesalers

Value Chain Analysis For Steel Wool Soap Pads Market

The value chain for the Steel Wool Soap Pads Market begins with the upstream segment, primarily involving the procurement and processing of raw materials. This includes low-carbon steel wire for manufacturing the wool filaments and various chemical inputs such as surfactants, alkalizing agents, perfumes, and dyes for the soap formulations. Steel processing involves drawing wire to extremely fine tolerances and then cutting or shredding it into the specific grade of steel wool required. Due to the commodity nature of steel inputs, raw material cost fluctuations significantly impact the downstream profitability of manufacturers. Key upstream risks include volatility in global steel commodity markets and maintaining consistent quality standards for the fine-gauge steel wire essential for effective scrubbing action.

The midstream stage is dominated by manufacturing and assembly. Manufacturers combine the processed steel wool with the specially formulated soap, often involving automated machinery for blending, compression, and final packaging. Efficiency in this stage is critical, as steel wool soap pads are generally low-cost, high-volume items, demanding high throughput and minimal waste to maintain competitive pricing. Direct manufacturing involves integrated facilities that handle both steel wool production and soap pad assembly, while some firms specialize only in assembly, sourcing pre-cut steel wool. This stage is heavily influenced by capital expenditure in automated equipment and compliance with safety and environmental regulations concerning chemical handling.

The downstream segment encompasses distribution channels, marketing, and sales. The distribution network is bifurcated into direct sales to large commercial customers (like cleaning service firms or industrial kitchens) and indirect sales through retail channels. Indirect channels, including massive retailers (Walmart, Tesco, Carrefour) and fast-growing e-commerce platforms (Amazon, Alibaba), require robust logistics and supply chain partnerships. E-commerce has fundamentally altered the distribution landscape, allowing smaller brands and specialized pads to reach consumers directly, bypassing traditional wholesale bottlenecks. Effective marketing, focusing on the heavy-duty cleaning superiority and convenience of the pre-soaped pad, is essential for maintaining brand presence in crowded retail shelves.

Steel Wool Soap Pads Market Potential Customers

The primary cohort of potential customers for Steel Wool Soap Pads is diverse, spanning both the business-to-consumer (B2C) and business-to-business (B2B) sectors, all united by the need for abrasive, effective cleaning solutions. In the B2C segment, the dominant end-users are households, particularly individuals responsible for routine kitchen maintenance and deep cleaning tasks, who rely on the product to efficiently remove stubborn, baked-on messes from conventional pots, pans, and oven interiors. This consumer base values cost-effectiveness, convenience (due to the embedded soap), and the proven efficacy of the abrasive material, typically purchasing the product in multi-packs during routine grocery trips.

The B2B segment constitutes highly valuable customers, including commercial food service operators, such as restaurants, cafes, and large institutional kitchens (hospitals, schools). These establishments utilize steel wool soap pads frequently for cleaning professional-grade, heavy-duty stainless steel cookware and complex equipment where hygiene standards are non-negotiable and efficiency is paramount. Furthermore, janitorial and facility management companies form a significant customer group, purchasing pads in bulk for cleaning industrial surfaces, maintenance, and removing rust or grime during renovation and upkeep projects. These professional buyers prioritize durability, standardization, and bulk pricing options.

A growing, specialized customer segment includes industrial maintenance professionals and automotive repair shops. In these environments, steel wool pads (often those with specialized coatings or stainless steel variants) are utilized for tasks ranging from surface preparation for painting, light sanding, and polishing metallic parts, to removing corrosion before component treatment. Manufacturers increasingly target these niche industrial buyers by offering specialized grades and large, durable formats, moving beyond the traditional household cleaning focus. Successful market penetration strategies involve customizing packaging and marketing messages to address the specific durability and performance requirements of each distinct customer segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 585.9 Million |

| Growth Rate | 3.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | S.O.S (Clorox), Brillo (Armaly Sponge Company), Chore Boy (Armaly Sponge Company), ACS Industries, 3M, Reckitt Benckiser, Scotch-Brite, The Libman Company, The Dishrag Co., Mr. Clean (P&G), Private Label Brands (Walmart, Tesco, etc.), Quickie Manufacturing, O-Cedar (Freudenberg Household Products), Continental Commercial Products, Crown Chemical, EZ Brite, Tuffy Products, Sponge Outlet, Fuller Brush Company, Ecolab. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Steel Wool Soap Pads Market Key Technology Landscape

While the core function of steel wool soap pads is inherently mechanical and requires minimal advanced technology in the final use, the manufacturing process relies heavily on specialized mechanical engineering and chemical formulation technologies to ensure product consistency, efficiency, and cost leadership. A crucial element is the technology used for wire drawing and filament cutting. Highly precise machinery is necessary to produce steel wool filaments with uniform thickness (micron gauge) and consistent curl. Variations in filament gauge directly affect the abrasive performance and the potential for scratching delicate surfaces. Manufacturers continuously invest in computer numerical control (CNC) machines to ensure tight tolerances, minimizing material waste and optimizing the structural integrity of the final pad.

The second major technological area involves chemical formulation and impregnation technology. The soap component must be uniformly distributed and effectively retained within the steel wool structure until activated by water, necessitating specialized blending and compression equipment. Modern advancements focus on encapsulating or integrating sophisticated surfactants and degreasers, often utilizing slow-release matrix technologies to prolong the effective lifespan of the soap during use. Furthermore, manufacturers are exploring advanced corrosion inhibitors integrated into the steel wool itself or the soap formulation, particularly in response to consumer complaints about premature rusting of unused or partially used pads, thereby boosting perceived product value and shelf life.

Automation and process optimization represent the third critical technological pillar. High-speed automated assembly lines are essential for cost-effective production in this low-margin, high-volume industry. This includes robotic arms for material handling, automated weighing and quality checks, and sophisticated packaging machinery that ensures accurate count and durable, moisture-resistant sealing. The integration of sensors and data analytics allows real-time monitoring of production throughput and material flow, leading to iterative improvements in overall equipment effectiveness (OEE). This technological focus is less about product invention and more about supply chain resilience and achieving substantial economies of scale to compete effectively with regional and private label manufacturers.

Regional Highlights

North America maintains a dominant position in terms of market value, characterized by high consumer awareness of established brands like S.O.S and Brillo. The market here is mature, driven primarily by household replacement purchases and a strong commercial cleaning sector adherence to proven, effective tools. Technological advancements focus on premium product offerings, such as stainless steel variants or environmentally certified soap formulations, commanding slightly higher price points. The region benefits from highly organized retail distribution networks and significant promotional spending by major market players.

Europe represents another mature and highly competitive market, characterized by stringent environmental regulations concerning detergent chemicals and packaging materials. This regulatory environment is driving manufacturers to innovate in sustainability, focusing on biodegradable surfactants and reduced plastic usage. Western European countries exhibit high per capita consumption, while Eastern Europe offers moderate growth opportunities as consumer spending and modern retail infrastructure continue to expand, leading to greater penetration of branded steel wool soap pads versus basic homemade alternatives.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by massive demographic shifts, rapid urbanization, and increasing household incomes. The burgeoning middle class in countries like China, India, and Southeast Asian nations is driving higher standards of domestic hygiene and the adoption of convenient cleaning aids. Market penetration rates are rapidly accelerating, offering significant expansion potential for global brands. However, manufacturers must contend with fragmented distribution networks and strong competition from local, low-cost manufacturers, necessitating regionally tailored pricing and packaging strategies.

- North America: Stable and mature, high brand loyalty, focus on premium and convenience products, strong commercial cleaning demand.

- Europe: Driven by strict sustainability regulations, high adoption rates, emphasis on eco-friendly soap formulations and minimal packaging.

- Asia Pacific (APAC): Highest growth potential due to urbanization and rising incomes, increasing adoption in residential and commercial sectors, fragmented competitive landscape.

- Latin America (LATAM): Moderate growth tied to economic stability, volume demand from rapidly developing cities, price sensitivity is high among consumers.

- Middle East and Africa (MEA): Emerging market, growth driven by commercial construction and hospitality sector expansion, focused sourcing of bulk and industrial quantities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Steel Wool Soap Pads Market.- S.O.S (A brand of The Clorox Company)

- Brillo (A brand of Armaly Sponge Company)

- Chore Boy (A brand of Armaly Sponge Company)

- ACS Industries Inc.

- 3M Company

- Reckitt Benckiser Group plc

- Scotch-Brite (A brand of 3M)

- The Libman Company

- The Dishrag Co.

- Mr. Clean (A brand of Procter & Gamble)

- Quickie Manufacturing Corp.

- O-Cedar (A brand of Freudenberg Household Products)

- Continental Commercial Products

- Crown Chemical Inc.

- EZ Brite Co.

- Tuffy Products

- Sponge Outlet Inc.

- Fuller Brush Company

- Ecolab Inc.

- Dawn (P&G, specifically associated partnerships)

Frequently Asked Questions

Analyze common user questions about the Steel Wool Soap Pads market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected CAGR for the Steel Wool Soap Pads Market?

The Steel Wool Soap Pads Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 3.8% between 2026 and 2033, driven by sustained residential consumption and commercial sector cleaning requirements.

Which geographical region exhibits the fastest growth in the Steel Wool Soap Pads market?

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market, primarily due to rapid urbanization, increasing disposable incomes, and heightened consumer focus on household cleanliness and hygiene standards.

What are the main competitive restraints affecting the market growth?

Key restraints include environmental concerns regarding the disposal and rusting of metallic pads, alongside increasing competition from technologically advanced synthetic abrasive materials and specialized, non-scratch chemical cleaning alternatives.

How is technology impacting the manufacturing of steel wool soap pads?

Technology primarily impacts manufacturing through precision engineering (for uniform steel wool filament production), advanced chemical formulation and impregnation techniques, and high-speed automation to reduce costs and maintain consistent quality.

Which application segment holds the largest market share for steel wool soap pads?

The Residential Cleaning segment holds the largest market share due to the high volume of household usage for heavy-duty scrubbing of kitchen items like pots, pans, and oven components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager