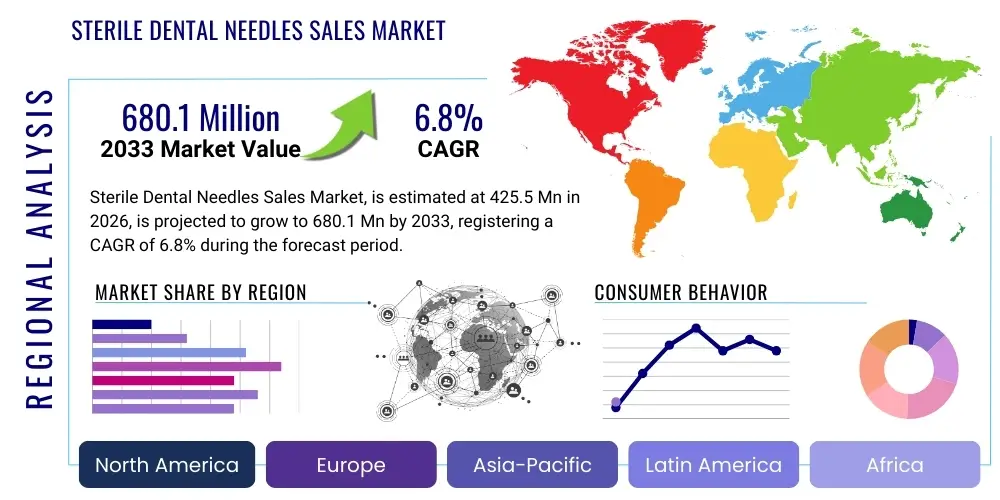

Sterile Dental Needles Sales Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441740 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Sterile Dental Needles Sales Market Size

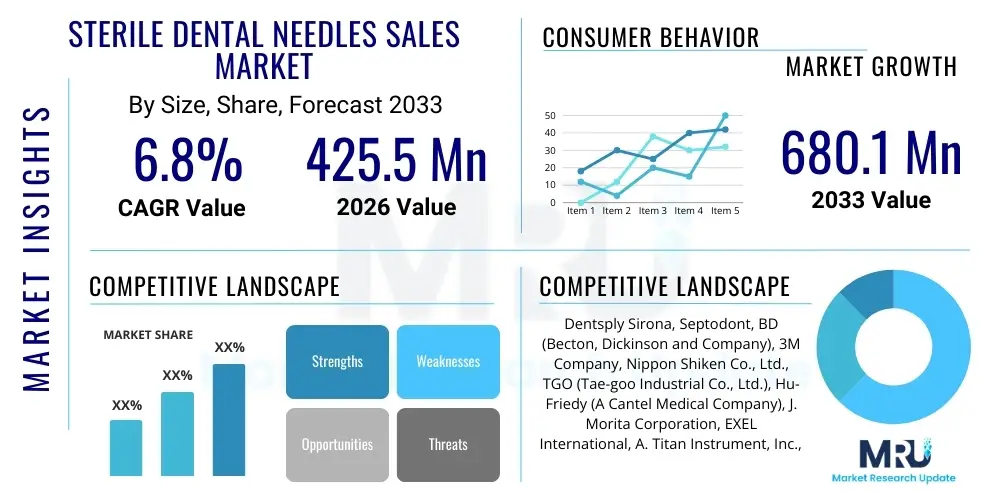

The Sterile Dental Needles Sales Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at 425.5 Million USD in 2026 and is projected to reach 680.1 Million USD by the end of the forecast period in 2033.

Sterile Dental Needles Sales Market introduction

The Sterile Dental Needles Sales Market encompasses the manufacturing and distribution of specialized hypodermic needles used by dental professionals for local anesthesia administration, primarily targeting nerve blocks and infiltration techniques. These needles are critical components in almost every invasive dental procedure, ensuring patient comfort and compliance during treatments ranging from simple fillings and extractions to complex root canals and implantology. The design and quality of these needles, focusing on sharpness, flexibility, and reduced deflection, directly influence the efficacy of the anesthesia delivery and minimize tissue trauma, positioning them as indispensable tools in modern dentistry, ensuring optimal clinical outcomes and minimizing procedural complications.

Product descriptions typically categorize needles based on their gauge size (e.g., 25G, 27G, 30G, 33G), reflecting the internal diameter and flow rate, and their length (short, long, or ultra-short), which are meticulously tailored for specific injection sites and anatomical structures within the oral cavity. Major applications span across restorative dentistry, general dentistry, specialized oral surgery, periodontics, and endodontics, where effective pain management is non-negotiable for successful treatment execution. The core benefits derived from high-quality sterile needles include enhanced patient safety through reduced risk of contamination, optimized procedural efficiency for the practitioner due to reliable performance, and superior pain management outcomes leading to reduced patient anxiety and higher satisfaction rates.

Driving factors for this robust market include the escalating global prevalence of dental diseases requiring interventional treatment, increased awareness and resulting patient demand for pain-free and minimally invasive dental procedures, and significant growth in the geriatric population worldwide, which frequently requires complex and prolonged dental care necessitating effective local anesthesia. Furthermore, stringent regulatory guidelines across developed nations mandate the exclusive use of single-use, sterile disposable instruments to aggressively prevent cross-contamination risks associated with blood-borne pathogens, thereby consistently propelling the sales volume of sterile dental needles globally. Continuous technological advancements focused on ultra-sharp bevels, effective siliconization of the cannula, and ergonomic hub designs further solidify the market expansion trajectory and premiumization of products.

Sterile Dental Needles Sales Market Executive Summary

The Sterile Dental Needles Sales Market exhibits steady and sustainable growth, underpinned by favorable demographic trends such as global population aging and corresponding increases in dental health expenditure. Current business trends indicate a decisive shift toward the adoption of higher-gauge, ultra-thin needles, specifically 30G and 33G, as a direct response to the industry-wide objective of minimizing patient pain and injection discomfort. Concurrent innovation in the market involves the integration of safety-engineered features, such as passive shielding mechanisms and self-aspirating hubs, driven by stricter occupational safety regulations aimed at mitigating accidental needlestick injuries (NSIs). Strategic maneuvers by leading manufacturers involve increasing focus on supply chain resilience and global compliance standards to ensure market access and maintain product reliability in diverse geographic regions.

From a regional perspective, North America commands the dominant market share, reflecting its established and sophisticated healthcare infrastructure, high average patient spending on dental treatments, and the early, mandated adoption of advanced disposable dental technologies, including safety syringes. Conversely, the Asia Pacific (APAC) region is strategically positioned to demonstrate the most accelerated growth rate, primarily fueled by massive infrastructure investments in dental specialty centers, significant expansion of government oral health programs, and rapidly increasing disposable incomes across emerging economies like China and India, making professional dental care more accessible to larger populations. European markets maintain stability, characterized by rigorous quality control enforced by the MDR and a high concentration of specialized dental practices demanding premium, precision-engineered needles.

Analysis of segment trends reveals that the standard plastic hub, stainless steel cannula combination remains the backbone of the market due to its proven efficacy and cost-efficiency, though specialized polymer-based products are gaining traction in niche applications. The 27G and 30G gauge sizes collectively dominate the revenue segmentation, effectively balancing the structural integrity required for effective nerve blocks with the patient comfort provided by reduced diameter. Furthermore, the End-User segmentation confirms that independent dental clinics and large private practices constitute the overwhelming majority of procurement volume, confirming the decentralized nature of anesthetic delivery in modern dentistry, requiring manufacturers to maintain extensive distribution networks targeted at small-to-medium enterprises.

AI Impact Analysis on Sterile Dental Needles Sales Market

Common user questions regarding AI integration often explore its role in optimizing precision dentistry, specifically how automated systems might utilize sterile needles. Users frequently inquire if AI-powered CBCT analysis can precisely predict nerve location, thereby reducing the necessary needle length or gauge variability. Furthermore, there is significant interest in how AI could be deployed in quality assurance during high-volume manufacturing to identify microscopic flaws in needle bevels or cannula surfaces that human inspection might miss, thereby enhancing the overall sterility and reliability of the final product. The overarching theme is that AI will introduce a level of diagnostic and procedural precision that mandates corresponding improvements in the quality and specialization of the physical anesthetic delivery tool, the sterile dental needle.

The indirect yet transformative impact of Artificial Intelligence on the sterile dental needles market primarily stems from its integration into advanced digital dentistry workflows. AI algorithms, embedded in sophisticated dental imaging software, are capable of processing complex three-dimensional scans (e.g., Cone-Beam Computed Tomography or CBCT) to generate ultra-precise anatomical maps of the patient’s maxillofacial region, highlighting the exact trajectory required for local anesthetic administration. This precision guidance ensures the practitioner selects the exact optimal needle—in terms of gauge and length—for the specific target site, minimizing deflection and reducing the risk of vital structure damage. This enhanced planning phase directly promotes the demand for a standardized, high-specification inventory of needles, tailored for maximum accuracy.

Moreover, AI is playing an increasing role in manufacturing efficiency and quality control, which indirectly influences the market supply and quality perception. Machine learning models analyze production line data to predict potential equipment failures or quality deviations in real-time, ensuring that millions of needles manufactured annually meet the stringent sharpness and sterility requirements without variation. While true robotic dental injections are still emerging, AI-enabled guidance systems ensure that when a needle is used, the injection technique is optimized for success, potentially reducing the total number of needles consumed per patient session (by minimizing missed blocks). This technological evolution shifts the market focus from merely high volume to high precision, rewarding manufacturers who can deliver consistently high-quality, ultra-reliable products compatible with guided procedural protocols.

- AI-driven pre-operative mapping (via CBCT) determines optimal needle length and gauge with sub-millimeter precision, reducing error rates.

- Predictive algorithms in inventory management optimize needle stock levels for clinics, preventing shortages and reducing obsolescence.

- AI-based vision systems significantly improve manufacturing quality control, detecting micro-defects in needle bevels essential for atraumatic injection.

- The use of AI-guided injection technology will increase demand for premium, low-deflection needles suitable for precision delivery.

- AI facilitates customized patient protocols, potentially leading to greater adoption of specialized and niche needle products (e.g., extra-short, ultra-thin).

DRO & Impact Forces Of Sterile Dental Needles Sales Market

The Sterile Dental Needles Sales Market is fundamentally driven by the consistently high utilization rate of local anesthesia in restorative and surgical dentistry globally, fueled by mandatory pain management requirements. The non-negotiable need for single-use, sterile devices due to strict global infection control regulations is the primary structural driver, ensuring recurring demand. Restraints on market growth primarily stem from intense price competition, especially in the large-volume commodity segments, coupled with the persistent occupational hazard of accidental needlestick injuries (NSIs), which necessitates significant investment in costly safety-engineered devices that may not be affordable in all markets. Significant opportunities reside in the rapid expansion and modernization of dental clinics across the fast-growing economies in the Asia Pacific region and continued development of ultra-comfort, low-pain needle designs which command a price premium.

Key drivers include the substantial global increase in elective cosmetic dental procedures and complex implantology treatments, both of which require robust anesthetic protocols. Furthermore, demographic shifts, particularly the global aging population, necessitate more frequent and comprehensive restorative dental work, sustaining the high volume of needle consumption. Regulatory bodies globally, driven by World Health Organization (WHO) safety guidelines, increasingly enforce policies promoting or mandating the switch from conventional needles to safety-engineered versions, which significantly impacts product development and accelerates market penetration for these higher-value items. The increasing integration of dental services within general healthcare systems also stabilizes and guarantees demand.

Major market restraints, aside from pricing pressures, include the inherent challenges associated with distributing sterile, low-margin medical consumables across complex global logistics chains, making inventory management and stockout prevention a continuous challenge. While niche, the long-term potential of emerging needle-free drug delivery technologies poses an indirect threat that manufacturers must monitor, especially for routine surface procedures. Impact forces dictate that manufacturers must strategically balance the trade-off between incorporating advanced safety features, which increase production costs, and meeting the demand for affordable, high-volume products required by public health services and large Dental Service Organizations (DSOs). Successful companies will differentiate through superior quality control and robust intellectual property protection surrounding innovative bevel geometries and anti-deflection materials.

Segmentation Analysis

The segmentation analysis of the Sterile Dental Needles Sales Market is crucial for understanding the diversity of clinical needs and guiding manufacturing strategies. Product segmentation is most commonly based on Needle Gauge (the inverse measure of the needle's diameter), which fundamentally dictates the injection rate and pain perception, and Needle Length, which must correspond precisely to the depth required for the targeted nerve block or infiltration. These primary segments influence pricing, procurement decisions, and regional usage patterns, as clinical practices in North America might favor thinner gauges (30G) for routine infiltration, while those in other regions might stick to the more robust 27G for deep blocks.

A secondary, yet increasingly important segmentation criterion is the presence of Safety Features. Conventional needles are being systematically replaced by safety-engineered variants, particularly in regulated markets, creating distinct segments based on the sophistication and activation mechanism (active vs. passive) of the protective sheath. End-User segmentation remains critical, distinguishing between high-volume, cost-sensitive institutional buyers (hospitals, schools) and smaller, quality-focused private practices. Geographic segmentation reflects variations in regulatory compliance, clinical technique preferences, and ability to afford premium products, with North America leading in safety needle adoption and APAC dominating volume growth of standard products.

- By Gauge Size:

- 25 Gauge (G): Used for high-volume delivery, offering rigidity.

- 27 Gauge (G): Standard gauge for deep blocks and general procedures, balancing strength and comfort.

- 30 Gauge (G): Preferred for infiltration anesthesia, optimizing patient comfort.

- 33 Gauge (G) and Finer: Used for ultra-sensitive patients and specialized procedures, maximizing pain reduction.

- Other Gauges (e.g., 23G, 29G): Used in niche surgical applications.

- By Length:

- Short (Less than 20 mm): Ideal for maxillary infiltration and pediatric use.

- Long (20 mm and above): Essential for mandibular nerve blocks (e.g., Inferior Alveolar Nerve Block).

- By Safety Feature:

- Conventional Needles (Non-Safety)

- Safety-Engineered Needles (Retractable or Sheathed)

- By Hub Material:

- Plastic Hub (Polypropylene or ABS)

- Metal Hub (Less Common, primarily for specialized delivery systems)

- By End-User:

- Dental Clinics and Private Practices (Highest Volume)

- Hospitals and Ambulatory Surgical Centers (ASCs)

- Academic and Research Institutes (Training and Research)

- By Sales Channel:

- Direct Sales (Institutional procurement)

- Distributors and Wholesalers (Primary channel for private clinics)

- E-commerce Platforms (Growing channel for small inventory top-ups)

Value Chain Analysis For Sterile Dental Needles Sales Market

The upstream segment of the sterile dental needles value chain is characterized by the procurement and precision processing of high-purity raw materials. Key inputs include medical-grade stainless steel tubing (often 304 or 316 grade) for the cannula, which must possess superior hardness and minimal impurities to ensure consistent sharpness and prevent breakage. Specialized polymers, such as medical-grade polypropylene or polyethylene, are sourced for the injection-molded plastic hubs and protective caps. Upstream analysis focuses heavily on supplier qualification, material cost containment, and ensuring the sourced materials meet strict biocompatibility standards. Volatility in global commodity prices, particularly for metals, poses a continuous risk to manufacturing margins, requiring proactive hedging and robust supplier contracts.

The core manufacturing process constitutes the midstream segment, encompassing highly automated, cleanroom operations. This involves precision cutting and electrochemical grinding of the cannula tips to achieve multi-bevel geometries (tri-bevel or quad-bevel) and subsequent siliconization to minimize insertion friction. Cannula welding or bonding to the plastic hub is performed under microscopic quality control. The final, critical stage is sterilization, typically utilizing Ethylene Oxide (EtO) or controlled gamma irradiation, followed by aseptic packaging in tamper-evident blister packs. Midstream optimization focuses intensely on minimizing waste, increasing automation to reduce labor costs, and maintaining rigorous ISO 13485 compliance to guarantee sterility and integrity, which are paramount to product reliability and market acceptance.

Downstream distribution manages the pathway from the manufacturer to the end-user. The majority of sterile dental needles are sold through indirect channels, relying on specialized dental distributors and wholesalers who manage regional warehousing, just-in-time delivery to thousands of small clinics, and local sales support. Direct sales channels are typically reserved for engaging with large institutional buyers, national health services, or major Dental Service Organizations (DSOs) where bulk purchase agreements and customized logistical solutions are negotiated. The rapid growth of B2B e-commerce platforms is disrupting this downstream segment, offering smaller clinics the ability to bypass traditional wholesalers for routine purchases, demanding manufacturers develop strategies for direct-to-consumer digital interaction while maintaining competitive wholesale pricing structures.

Sterile Dental Needles Sales Market Potential Customers

The core potential customer base for sterile dental needles comprises all licensed practicing dental professionals worldwide who routinely administer local anesthesia, constituting a high-volume, recurring demand segment. General Dentists (GPs) are the largest end-user category by sheer volume, conducting the bulk of routine fillings, extractions, and basic restorative procedures. They prioritize cost-effective, reliable, and standardized needle sizes (like 27G and 30G long and short). Specialized dental practitioners, including oral surgeons (OMFS), periodontists, and endodontists, represent a critical segment that demands high-precision, low-deflection needles, often in specialized gauges or lengths, prioritizing technical performance and patient safety over marginal cost savings due to the complexity and high cost of their procedures.

The institutional sector forms the second major customer bloc, encompassing public and private hospitals, major ambulatory surgical centers (ASCs) with dental departments, and federal health clinics. Procurement decisions within this sector are heavily centralized, driven by rigorous tender processes, Group Purchasing Organization (GPO) contracts, and strict infection control policies. These customers often mandate the use of safety-engineered needles to comply with occupational health regulations and minimize institutional liability related to needlestick injuries. Therefore, manufacturers targeting this segment must offer products with certifications and proven NSI prevention track records, along with established bulk pricing structures.

An emerging, rapidly consolidating customer segment includes Dental Service Organizations (DSOs), which aggregate purchasing power across numerous geographically dispersed dental clinics. DSOs negotiate directly with manufacturers or large distributors, demanding standardized product quality, robust logistics support across their network, and significant volume discounts. Additionally, academic institutions—dental schools and specialized training centers—are consistent buyers, utilizing standard needles for student training and often pioneering the adoption of new, ultra-high-precision products for research and complex teaching procedures. Manufacturers must tailor sales efforts to address the unique blend of cost sensitivity, volume requirements, and technology demands across these varied customer types.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | 425.5 Million USD |

| Market Forecast in 2033 | 680.1 Million USD |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dentsply Sirona, Septodont, BD (Becton, Dickinson and Company), 3M Company, Nippon Shiken Co., Ltd., TGO (Tae-goo Industrial Co., Ltd.), Hu-Friedy (A Cantel Medical Company), J. Morita Corporation, EXEL International, A. Titan Instrument, Inc., Integra LifeSciences Holdings Corporation, Terumo Corporation, Henry Schein, Inc., Keystone Dental, Inc., Runyes Medical Instrument Co., Ltd., Premier Dental Products Company, Shinhung Co., Ltd., Zirc Company, ASAHI Intecc Co., Ltd., Ultradent Products, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sterile Dental Needles Sales Market Key Technology Landscape

The technological evolution in the Sterile Dental Needles market is a testament to precision engineering focused entirely on improving the patient experience and enhancing practitioner safety. The most significant technological advancements revolve around needle tip manufacturing, moving beyond simple bevels to complex multi-bevel geometries—such as tri-bevel and penta-bevel designs—achieved through proprietary electrochemical etching and micro-grinding processes. This sophisticated tip design drastically reduces the insertion force required to penetrate tissue and minimizes the painful tearing of the mucosa, thus directly addressing patient anxiety associated with injections. Complementary technology includes advanced siliconization of the cannula, employing highly controlled processes to apply a thin, uniform layer of medical-grade lubricant that ensures exceptionally smooth tissue passage and reduces friction along the entire shaft, critical for long nerve block needles.

Safety technology represents the most commercially relevant area of innovation, particularly in highly regulated markets. Key advancements include passive safety mechanisms where a protective sheath automatically deploys over the needle tip immediately upon withdrawal from the patient’s tissue, without requiring any manual activation from the clinician. Active safety systems, which require a deliberate manual engagement of a locking or retracting feature, also form a major part of the landscape. These safety features are incorporated into the hub design using precision plastics and complex spring mechanisms. This shift towards mandatory safety devices is driving substantial R&D expenditure and requires seamless integration of mechanisms without compromising the needle’s core performance characteristics or ergonomic profile during use.

Material science optimization is another vital element, particularly concerning the stainless steel cannula. While 304/316 stainless steel remains the standard, manufacturers are investing in specialized surface treatments and proprietary metal alloys to increase the tensile strength of ultra-thin gauges (like 33G), preventing bending or deflection during injection—a common complication that leads to patient discomfort and inaccurate anesthetic delivery. Furthermore, the plastic hubs utilize ergonomic, finger-grip friendly designs and clear, standardized color coding (aligned with ISO standards) to ensure quick and accurate gauge identification by the clinician, minimizing procedural errors. Technological success is measured by the ability to mass-produce these high-precision, zero-defect sterile instruments efficiently and cost-effectively.

Regional Highlights

North America maintains its influential position as the largest revenue generator in the Sterile Dental Needles Sales Market, a leadership role sustained by several compounding factors. The region benefits from exceptionally high per capita expenditure on dental care, a culture of early adoption of advanced disposable medical technologies, and the institutional prevalence of large Dental Service Organizations (DSOs) that standardize purchasing across vast clinic networks. Crucially, the regulatory environment in the U.S. and Canada, particularly strict occupational safety standards, has rapidly accelerated the conversion from conventional to high-cost, safety-engineered dental needles. This regulatory mandate ensures consistent investment in premium product segments and maintains high average selling prices (ASPs) compared to global competitors.

Europe constitutes a mature, high-value market characterized by stability and stringent emphasis on product quality and environmental sustainability. European demand is driven by comprehensive dental insurance coverage and a high density of specialized dental practitioners who prioritize precision-manufactured needles complying with the rigorous standards set forth by the EU Medical Device Regulation (MDR). Key markets like Germany, the UK, and France show strong demand for ultra-sharp, ergonomically designed instruments. European manufacturers often lead in sustainability efforts, exploring recyclable plastics for hubs and minimizing packaging materials, catering to a consumer base that is increasingly sensitive to the environmental footprint of medical consumables.

The Asia Pacific (APAC) region is indisputably the engine of future market growth, expected to record the highest CAGR over the forecast period. This rapid expansion is underpinned by demographic growth, substantial government-led public health initiatives to improve oral health access, and massive infrastructure development in both urban and semi-urban settings, leading to the proliferation of new dental clinics. While price sensitivity is high, particularly in mass-market segments, the growth of dental tourism in countries like Thailand and India drives demand for international-standard, high-quality products. Manufacturers are strategically relocating or expanding production capacity within APAC to mitigate logistics costs and leverage local distribution networks to capture this expansive, high-volume market. Latin America and MEA, while smaller, represent long-term potential markets driven by improving economic indicators and expanding private health insurance penetration.

- North America: Dominant market share due to stringent safety regulations (mandating safety needles), high private dental expenditure, and advanced technological integration in clinical practice.

- Europe: Stable growth, high demand for quality, driven by comprehensive healthcare systems, strict MDR compliance, and focus on sustainable manufacturing practices.

- Asia Pacific (APAC): Highest CAGR projected, attributed to explosive growth in dental service points, rising middle-class income, and rapid urbanization driving demand for modern dental treatments.

- Latin America (LATAM): Emerging market growth supported by increasing aesthetic dentistry procedures and expanding access to professional care through private clinics and regional health reforms.

- Middle East and Africa (MEA): Growth concentrated in affluent GCC countries investing heavily in specialized medical infrastructure and adopting high-end safety devices for international-standard facilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sterile Dental Needles Sales Market.- Dentsply Sirona

- Septodont

- BD (Becton, Dickinson and Company)

- 3M Company

- Nippon Shiken Co., Ltd.

- TGO (Tae-goo Industrial Co., Ltd.)

- Hu-Friedy (A Cantel Medical Company)

- J. Morita Corporation

- EXEL International

- A. Titan Instrument, Inc.

- Integra LifeSciences Holdings Corporation

- Terumo Corporation

- Henry Schein, Inc.

- Keystone Dental, Inc.

- Runyes Medical Instrument Co., Ltd.

- Premier Dental Products Company

- Shinhung Co., Ltd.

- Zirc Company

- ASAHI Intecc Co., Ltd.

- Ultradent Products, Inc.

Frequently Asked Questions

Analyze common user questions about the Sterile Dental Needles Sales market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for sterile dental needles globally?

The increasing global prevalence of dental diseases requiring surgical intervention and restorative procedures, coupled with mandatory regulatory requirements for single-use, sterile devices to prevent cross-contamination, is the core market driver.

How are advancements in needle gauge impacting patient comfort?

Technological focus is shifting towards ultra-thin needles, particularly 30G and 33G, featuring superior sharpness and advanced bevel designs. These finer gauges significantly reduce the pain and trauma experienced during infiltration and injection, improving patient compliance.

Which geographic region demonstrates the highest growth potential in the sterile dental needles market?

The Asia Pacific (APAC) region is projected to experience the fastest market growth, primarily due to expanding healthcare infrastructure, rising disposable incomes facilitating greater access to private dental care, and the burgeoning trend of dental tourism.

What are safety-engineered dental needles and why are they important?

Safety-engineered needles incorporate protective mechanisms, such as retractable sheaths or locking features, designed to cover the needle immediately after use. They are crucial for reducing the risk of accidental needlestick injuries (NSIs), thereby protecting dental staff and minimizing healthcare liabilities.

How does the Value Chain structure influence pricing in this market?

Pricing is heavily influenced by upstream stainless steel costs and midstream sterilization expenses. Downstream distribution, relying mostly on wholesalers for high-volume sales, creates pressure to maintain low unit costs while covering extensive logistics and inventory management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager