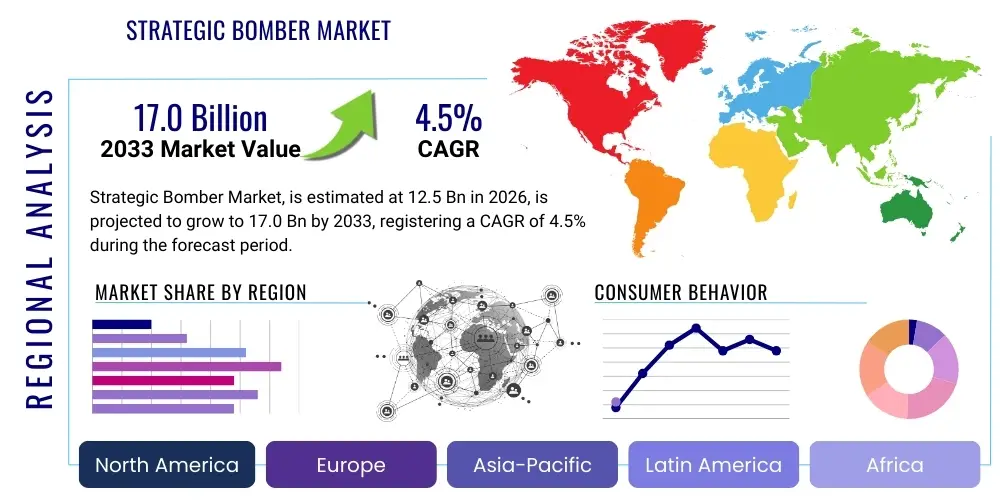

Strategic Bomber Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442505 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Strategic Bomber Market Size

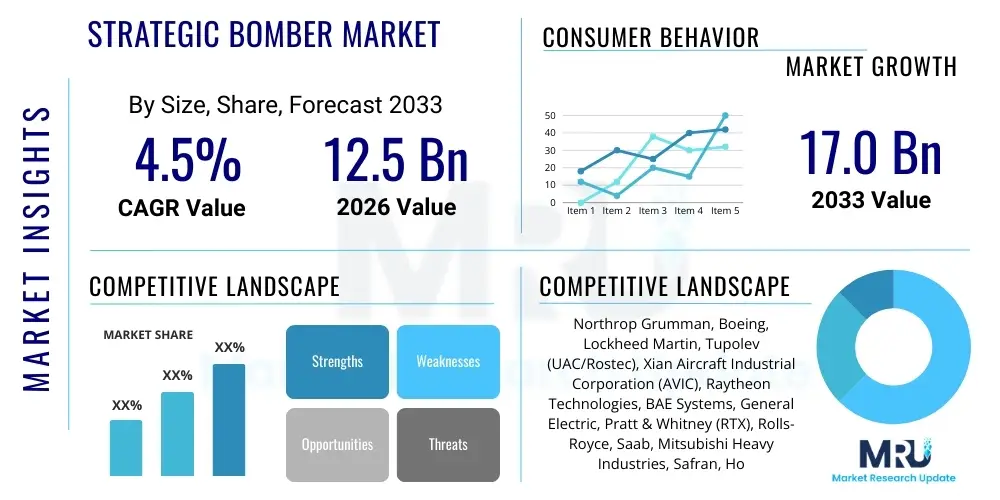

The Strategic Bomber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $12.5 Billion in 2026 and is projected to reach $17.0 Billion by the end of the forecast period in 2033.

Strategic Bomber Market introduction

The Strategic Bomber Market encompasses the design, production, modernization, maintenance, and support systems associated with long-range military aircraft designed primarily for carrying large payloads of air-to-surface ordnance, including nuclear weapons. These platforms constitute a critical leg of the nuclear triad for major global powers, offering unparalleled projection of force, flexibility, and conventional deep strike capabilities against heavily defended targets. The demand for new generation platforms, characterized by advanced stealth features, sophisticated electronic warfare suites, and enhanced connectivity, is the primary market catalyst, driven by escalating geopolitical competition and the necessity for global reach deterrents that can penetrate advanced integrated air defense systems (IADS). Modern strategic bombers are transitioning from dedicated nuclear delivery vehicles to versatile, multi-role platforms capable of intelligence, surveillance, and reconnaissance (ISR) and command and control (C2) functions, significantly expanding their operational utility beyond traditional roles.

The product portfolio within this highly specialized market includes heavy payload, high-altitude aircraft such as the Northrop Grumman B-21 Raider, the Russian Tu-160M, and the Chinese H-20 (expected), alongside ongoing life extension programs for existing fleets like the U.S. B-52 and Russian Tu-95. Major applications involve nuclear deterrence missions, long-range conventional precision strike operations, maritime surveillance, and persistent air presence in contested theaters. The operational effectiveness of strategic bombers relies heavily on complex subsystems, including advanced turbofan or turbojet engines optimized for range, sophisticated synthetic aperture radar (SAR) systems, and specialized materials science for low observability (stealth). The immense complexity and strategic importance of these assets ensure continuous high-level investment from sovereign governments, positioning the market as exceptionally capital-intensive and concentrated among a few global defense primes.

Key market drivers include the accelerating obsolescence of legacy fleets, necessitating costly replacement programs; heightened regional security tensions, particularly in the Indo-Pacific and Eastern Europe; and the continuous pursuit of technological superiority in the aerial domain. The benefit these aircraft provide—the ability to hold distant targets at risk without forward basing—makes them indispensable tools of national power projection. Furthermore, the development cycle of a new strategic bomber often spans decades, creating massive, long-term procurement contracts that stabilize market growth predictions despite relatively low annual production volumes compared to tactical fighter markets. The integration of artificial intelligence (AI) for enhanced mission autonomy and electronic countermeasures (ECM) is rapidly becoming a mandatory requirement for new entrants.

Strategic Bomber Market Executive Summary

The Strategic Bomber Market is experiencing a major transformation characterized by substantial governmental investment in fifth and sixth-generation low-observable platforms, signaling a clear shift away from legacy aircraft designed during the Cold War era. Business trends reflect intense competition among a small cohort of defense primes, primarily based in the United States, Russia, and China, focusing heavily on secure digital infrastructure, advanced materials engineering, and modular open system architectures (MOSA) to facilitate easier upgrades and reduce through-life costs. The current market dynamic is defined by multi-billion dollar programs such as the B-21 Raider in the U.S. and corresponding modernization efforts in competitor nations, indicating a concentrated effort to maintain technological parity and strategic advantage. Defense budgets globally are increasingly prioritizing deep-strike capability, viewing it as essential for deterring peer and near-peer adversaries across vast geographical distances.

Regional trends are overwhelmingly dominated by North America and Asia Pacific. North America, driven by the colossal U.S. Department of Defense procurement budgets, remains the epicenter of high-value R&D and manufacturing, specifically for stealth bombers like the B-21. Asia Pacific is rapidly emerging as the principal growth region, fueled by China's assertive military modernization—specifically the development and deployment of the H-20—and the increasing defense expenditures of allied nations seeking reassurance or offsetting capabilities. Europe and Russia continue significant modernization and life-extension programs (e.g., Tu-160M), although the scale of investment is generally lower than that observed in the US and China. Geopolitical instability in Eastern Europe and the South China Sea acts as a powerful accelerant for regional defense spending focused on strategic assets, ensuring persistent demand for both new platforms and advanced weapon integration services.

Segment trends highlight the dominance of the Platform Segment, specifically the Heavy Bomber sub-segment, which commands the largest market share due to the high unit cost of these aircraft. However, the Supporting Systems and Maintenance, Repair, and Overhaul (MRO) segments are projected to exhibit the fastest growth CAGR, driven by the operational necessity of maintaining stealth coatings, complex sensor arrays, and ensuring the readiness of sophisticated propulsion systems. The Weapons Integration segment is also experiencing growth as nations invest in advanced stand-off and hypersonic missile systems designed specifically to be carried by these strategic platforms. Furthermore, the development of unmanned strategic platforms, though nascent, represents a disruptive segmented opportunity in the long term, potentially offering lower operational costs and reduced risk to aircrew, which could redefine the traditional concept of the strategic bomber.

AI Impact Analysis on Strategic Bomber Market

User queries regarding the impact of AI on the Strategic Bomber Market frequently center on themes of mission autonomy, data fusion, crew workload reduction, and predictive maintenance capabilities. Key concerns revolve around the ethical deployment of lethal autonomous weapon systems (LAWS), the security vulnerabilities of AI-driven combat management systems, and the ability of current infrastructure to support the massive computational demands of real-time AI processing in contested environments. Users are intensely focused on how AI will enhance the survivability and mission success rates of extremely expensive, high-value assets like strategic bombers. There is significant anticipation regarding AI's role in dynamically rerouting missions based on real-time threat detection, optimizing fuel consumption profiles during long-duration flights, and automating the launch sequencing of diverse ordnance types, thereby maximizing the aircraft's effectiveness and minimizing human reaction time delays.

The consensus expectation is that AI integration will shift the operational paradigm of strategic bombing from human-intensive planning to system-assisted decision making, particularly in areas requiring rapid processing of multispectral sensor data. Specifically, Generative Engine Optimization (GEO) suggests that content related to AI-driven "cognitive electronic warfare" and "AI-enhanced crew collaboration" resonates strongly with search intent, indicating a user focus on practical, mission-critical applications rather than purely theoretical applications. AI is seen as crucial for overcoming the limitations imposed by sophisticated adversary integrated air defense systems (IADS), providing the strategic bomber with the necessary cognitive edge to navigate complex threat landscapes and execute strike missions with enhanced precision and stealth profile management. The integration of AI tools for rapid intelligence analysis gathered mid-flight is also a high-priority area for users researching future bomber capabilities.

Moreover, AI algorithms are fundamentally changing the logistics and maintenance life cycle of these complex machines. Predictive maintenance (PdM) powered by machine learning analyzes operational data, vibration signatures, and material degradation indicators to anticipate component failures long before they occur, drastically improving fleet readiness rates—a critical metric for strategic deterrent forces. The sheer size and complexity of systems, particularly stealth coatings and sensor arrays, make traditional manual inspection processes prohibitively time-consuming. AI-driven diagnostic tools reduce downtime and optimize supply chain requirements for highly specialized parts, ensuring that the strategic bomber fleet remains operationally viable over its extended service life, sometimes exceeding 50 years, as is the case with the modernized B-52 fleet.

- AI-Enhanced Mission Planning and Dynamic Retasking: Optimization of ingress/egress routes based on real-time threat intelligence and weather data, significantly improving survivability.

- Cognitive Electronic Warfare (EW): AI algorithms detecting, classifying, and autonomously deploying optimal jamming or deception techniques against hostile radar and communication systems.

- Predictive Maintenance (PdM): Machine learning models analyzing sensor data to forecast system failures, maximizing operational readiness and reducing unexpected ground time.

- Sensor Data Fusion: Real-time amalgamation of diverse sensor inputs (radar, infrared, SIGINT) into a single, cohesive operational picture for the flight crew, improving situational awareness.

- Autonomous Copilot/Weapon Release Systems: AI assisting in managing non-critical flight tasks and automating complex weapon targeting and release sequences under human supervision.

- Manned-Unmanned Teaming (MUM-T): AI coordinating flight paths, sensor data sharing, and engagement priorities between the strategic bomber and accompanying unmanned aerial vehicles (UAVs or UCAVs).

DRO & Impact Forces Of Strategic Bomber Market

The Strategic Bomber Market is uniquely shaped by a complex interplay of political drivers, immense technological constraints, and high capital barriers to entry, resulting in significant impact forces. Key drivers include the resurfacing of great power competition, exemplified by the military modernization efforts in Russia and China, which necessitates a responsive recapitalization of long-range strike capabilities in Western nations. This geopolitical imperative mandates investment in platforms that can reliably penetrate modern air defenses and project force across intercontinental distances. Opportunities predominantly lie in the development and integration of advanced technologies such as hypersonic weapons compatibility, sophisticated stealth materials, and next-generation connectivity (JADC2 or equivalent), allowing these bombers to serve as networked command nodes rather than merely bomb trucks. The opportunity space also includes lucrative, multi-decade MRO and upgrade contracts for sustaining the legacy and new fleets, providing continuous revenue streams for defense contractors.

Conversely, significant restraints hinder market fluidity. The most substantial restraint is the extraordinarily high unit cost of new-generation strategic bombers (e.g., B-21 estimated at over $700 million per unit), leading to substantial budgetary pressures and intense scrutiny from legislative bodies, which often results in program delays or reduced procurement numbers. Furthermore, the development cycle is extremely protracted, involving immense technical risk, which limits competition to a handful of firms with decades of requisite experience and infrastructure. Another critical restraint is the ongoing debate regarding the overall strategic relevance of manned bombers versus the accelerating capability of long-range, survivable intercontinental ballistic missiles (ICBMs) and cruise missiles; while bombers offer flexibility, their vulnerability relative to missiles is a persistent policy discussion.

The impact forces are high, primarily driven by governmental policy and technological breakthroughs. Political decisions, such as nuclear treaty agreements or regional defense pacts, can instantaneously shift procurement priorities. Technological advancements in adversarial anti-access/area denial (A2/AD) capabilities, such as advanced surface-to-air missile (SAM) systems or sophisticated radar networks, directly force innovation in bomber design, particularly in low observability and electronic countermeasures, thereby accelerating the R&D segment. The long-term, quasi-monopolistic nature of the market ensures that once contracts are secured, the impact force on the economy and defense industrial base is profound and stable, generating highly specialized employment and driving advancements in adjacent aerospace technologies.

Segmentation Analysis

The Strategic Bomber Market is segmented based on the type of platform, operational capability, and the services required for lifecycle support. Given the market's concentration among specific military powers, segmentation effectively organizes the differing phases of the aircraft's existence, from initial acquisition to decades of sustained operation. Understanding these segments is crucial for defense contractors aiming to capitalize on specific modernization requirements, focusing either on the highly lucrative but sporadic platform acquisition phase or the steady, high-margin MRO and subsystem upgrade services that follow. The distinction between heavy and medium bombers reflects differing strategic doctrines regarding range, payload, and basing requirements, while the Service segment highlights the immense value derived from maintaining these highly complex assets through their extended operational lives, often requiring specialized labor and classified procedures.

- By Platform Type

- Heavy Bombers (Intercontinental range, high payload capacity, e.g., B-21, Tu-160)

- Medium Bombers (Long range, lower payload, often transitional or multi-role, e.g., potential future platforms)

- Unmanned Strategic Platforms (Future development, potentially highly autonomous strike vehicles)

- By Operational Capability

- Manned Strategic Bombers

- Optionally Manned Strategic Bombers (OSB)

- By Technology

- Stealth/Low Observable Platforms

- Non-Stealth/Conventional Platforms (Modernized legacy fleets)

- By System Component

- Airframe and Structure

- Propulsion Systems (High-Bypass Turbofans, Turbojets)

- Avionics and Navigation Systems

- Sensor and Electronic Warfare (EW) Suites

- Weapon Integration Systems (Rotary Launchers, Internal Bays)

- By Service Type

- Acquisition and Manufacturing

- Modernization and Upgrades (Avionics, Stealth Coatings)

- Maintenance, Repair, and Overhaul (MRO)

- Training and Simulation Services

Value Chain Analysis For Strategic Bomber Market

The Strategic Bomber Market's value chain is exceptionally deep, complex, and highly regulated due to the national security implications of the product. The upstream segment is dominated by specialized raw material suppliers and component manufacturers who provide highly technical inputs, including high-strength, lightweight alloys (e.g., titanium, carbon composites), radar-absorbent materials (RAM) crucial for stealth, and bespoke electronics required for flight control and sensor systems. These suppliers must adhere to stringent quality control standards and often operate under classified agreements, limiting their market participation to a small group of approved vendors. Integration and system design, which represent the core value-add, are handled by the prime defense contractors who possess the unique integration capabilities and necessary intellectual property for constructing the overall strategic platform.

The midstream phase involves the final assembly, integration of complex subsystems (like propulsion and mission computers), and extensive flight testing. This phase requires massive, specialized manufacturing facilities and significant governmental oversight to manage technical risk and production schedules. Unlike commercial aerospace, the direct distribution channel dominates, where the product is delivered almost exclusively from the prime contractor directly to the sovereign military end-user (e.g., the U.S. Air Force, Russian Aerospace Forces). Indirect channels, such as Foreign Military Sales (FMS), are highly restricted and rare, usually occurring only among the closest allied nations and only after exhaustive political approval processes, which further concentrates the market structure and limits global access.

Downstream activities are characterized by long-term, high-value support services. This includes comprehensive technical data packages, lifetime MRO contracts, and continuous software updates. The profitability in the downstream segment is substantial because the operational life of a strategic bomber can exceed fifty years, demanding continuous technological insertion to maintain relevance against evolving threats. Furthermore, crew training and high-fidelity simulation systems constitute another vital downstream element, ensuring operators are proficient in handling the sophisticated weapon systems and managing complex, multi-domain operations. This long-tail service requirement ensures revenue stability for the prime contractors long after the initial procurement is complete.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $12.5 Billion |

| Market Forecast in 2033 | $17.0 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Northrop Grumman, Boeing, Lockheed Martin, Tupolev (UAC/Rostec), Xian Aircraft Industrial Corporation (AVIC), Raytheon Technologies, BAE Systems, General Electric, Pratt & Whitney (RTX), Rolls-Royce, Saab, Mitsubishi Heavy Industries, Safran, Honeywell Aerospace, Elbit Systems, Leonardo S.p.A, L3Harris Technologies, Dassault Aviation, Spirit AeroSystems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Strategic Bomber Market Key Technology Landscape

The core technological landscape of the Strategic Bomber Market is defined by the pursuit of low observability and extreme operational range, necessitating breakthroughs in materials science, propulsion, and digital integration. Stealth technology remains paramount, utilizing advanced radar-absorbent materials (RAM) and precision-engineered airframe shapes to minimize radar cross-section (RCS) across multiple frequency bands. The application of computational fluid dynamics (CFD) and advanced manufacturing techniques, such as additive manufacturing (3D printing) for complex structural components, allows for the creation of intricate internal weapon bays and seamless control surfaces that further reduce detectability. Furthermore, managing the heat signature through sophisticated exhaust cooling and internal temperature regulation is critical, pushing the boundaries of infrared stealth technology to ensure survivability in high-threat environments.

Propulsion technology is another critical differentiator, focusing on achieving high thrust-to-weight ratios while maximizing fuel efficiency for intercontinental reach. Modern strategic bombers rely on highly efficient, often derivatives of commercial, high-bypass turbofan engines that are specially modified for military use, emphasizing durability, low maintenance, and acoustic signature reduction. The integration of advanced engine control units (ECUs) utilizes prognostic health monitoring (PHM) to provide real-time diagnostics, optimizing engine performance throughout the mission. Future generations are expected to incorporate adaptive engine technology, capable of switching between high-thrust mode for combat maneuverability and high-efficiency mode for cruising, further extending unrefueled combat radius—a vital capability for penetrating deep into adversary territory.

Beyond the airframe and engines, the digital backbone of a strategic bomber is arguably the most complex system. Key technologies include highly integrated modular avionics (IMA) that support sensor fusion, allowing the crew to process vast amounts of data from multiple sources (e.g., AESA radar, electronic surveillance measures, data links) seamlessly. Advanced connectivity systems, crucial for operating within the Joint All-Domain Command and Control (JADC2) architecture, enable secure, high-bandwidth communication and collaborative targeting with surface, sea, and space assets. The sophisticated electronic warfare (EW) suite, often integrated deep within the aircraft's architecture, utilizes machine learning to rapidly identify and counter emerging threats, ensuring the bomber's ability to operate successfully in electromagnetically contested environments, making it a truly multi-domain asset.

Strategic Bomber Market Potential Customers

The Strategic Bomber Market is unique in that its customer base is extremely narrow, highly concentrated, and strictly sovereign in nature, fundamentally driven by nations that possess or aspire to possess nuclear deterrent capability and global power projection capacity. The primary and most substantial customers are the P5 nations (permanent members of the UN Security Council): the United States, Russia, and China, which are currently the only nations actively operating or developing strategic bombers. The U.S. Air Force, with its B-21 program, represents the single largest existing and future customer, driving billions in research, development, and procurement spending. Similarly, the Russian Aerospace Forces continue to invest heavily in the modernization of its Tu-160M and Tu-95 fleets, demonstrating a commitment to maintaining its strategic deterrence posture through these platforms.

China's People's Liberation Army Air Force (PLAAF) is rapidly expanding its long-range capabilities through the anticipated deployment of the H-20 stealth bomber, solidifying its position as the primary growth customer in the Asia Pacific region. This program is aimed at extending China's operational reach into the second island chain and beyond, directly responding to geopolitical tensions in the region. These three nations dominate the current and foreseeable demand landscape due to the immense industrial capacity, technological sophistication, and financial investment required to field such assets, creating a near-monopoly on the demand side of the market.

Secondary or potential future customers are highly theoretical but would likely include major NATO allies or established defense partners, such as the UK or France, should they opt for a collaborative strategic deep-strike platform, though such programs would typically require significant geopolitical shifts and collaborative manufacturing agreements. Other nations with burgeoning defense budgets and long-term strategic ambitions, like India, could eventually constitute a highly specialized, though small, potential customer base, provided they can overcome the monumental political and technological barriers inherent in acquiring or developing strategic bomber technology. For the near to mid-term forecast period (2026-2033), the market remains overwhelmingly centered on the modernization and recapitalization programs of the US, Russia, and China.

Regional Highlights

- North America: North America, primarily the United States, is the undisputed leader in the Strategic Bomber Market both in terms of expenditure and technological advancement. The U.S. remains focused on the continuous development and impending procurement phase of the B-21 Raider, a program projected to involve the acquisition of at least 100 aircraft, representing the single most significant defense procurement project globally in this category. The region benefits from an unparalleled industrial base, deep institutional knowledge in stealth technology, and massive defense R&D budgets allocated specifically to maintaining the effectiveness of the nuclear triad. The region's stability in funding ensures that North America will command the largest market share throughout the forecast period, driving innovation across airframe, sensor, and AI integration segments.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market, largely driven by China's aggressive military modernization efforts. China's development of the Xian H-20 stealth bomber is a key strategic priority, aiming to achieve true long-range strike capability across the Pacific theater. This military buildup by China creates significant cascading defense spending across allied nations in the region, such as Australia and Japan, although these nations primarily focus on advanced tactical aircraft and stand-off weapons rather than independent bomber development. The increasing security competition over territorial disputes and trade routes accelerates regional defense budgets, making APAC a crucial hub for strategic platform demand and associated MRO services.

- Europe: The European market, predominantly encompassing Russia's efforts, focuses heavily on sustaining and modernizing its existing fleet. Russia's ongoing modernization of the Tu-160 (Tu-160M) and Tu-95 fleets, coupled with early-stage development of the next-generation PAK DA bomber, ensures steady, high-value investment. Western European countries generally rely on their dedicated fighter fleets (like the Eurofighter Typhoon and Rafale) and NATO alliances for strategic deterrence, limiting independent bomber procurement. However, the resurgence of geopolitical tensions in Eastern Europe ensures that Russia's commitment to strategic airpower remains high, sustaining specialized R&D within its domestic aerospace industry, which is closely tied to the broader Rostec and UAC corporate structure.

- Latin America, Middle East, and Africa (LAMEA): LAMEA holds a negligible share of the strategic bomber market. Nations in these regions lack the geopolitical requirement, industrial capacity, and immense budgetary resources needed to acquire or operate strategic bombers. Market activity is strictly limited to peripheral sales or consultation services related to defense planning, with no current or anticipated indigenous development or procurement programs for platforms of this scale or sophistication during the forecast period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Strategic Bomber Market.- Northrop Grumman Corporation

- The Boeing Company

- Lockheed Martin Corporation

- United Aircraft Corporation (UAC) / Tupolev Design Bureau (Rostec)

- Aviation Industry Corporation of China (AVIC) / Xian Aircraft Industrial Corporation

- Raytheon Technologies Corporation (RTX)

- BAE Systems Plc

- General Electric Company (GE Aviation)

- Pratt & Whitney (A division of RTX)

- Rolls-Royce Holdings Plc

- Safran S.A.

- Honeywell International Inc.

- L3Harris Technologies, Inc.

- Meggitt PLC (Parker Hannifin Aerospace)

- Thales Group

- Leonardo S.p.A

- Elbit Systems Ltd.

- Mitsubishi Heavy Industries (MHI)

- Dassault Aviation S.A.

- Spirit AeroSystems Holdings, Inc.

Frequently Asked Questions

Analyze common user questions about the Strategic Bomber market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a strategic bomber and a tactical bomber?

The primary distinction is range, payload capacity, and mission profile. Strategic bombers, such as the B-21 or Tu-160, are designed for intercontinental range (thousands of miles), capable of carrying massive payloads including nuclear warheads, and executing deep strike missions against highly defended targets globally. Tactical bombers and fighter-bombers (e.g., F-15E, F-35) are designed for shorter ranges, closer air support, and regional strikes using smaller, predominantly conventional payloads.

Which current strategic bomber program holds the most market significance?

The Northrop Grumman B-21 Raider program for the U.S. Air Force is the most significant program currently shaping the market. Its substantial projected procurement volume (over 100 units), integration of sixth-generation stealth and network capabilities, and multi-role mission profile represent the peak of investment and technological direction in the strategic aerospace domain globally.

How do high development costs affect the strategic bomber market?

High development costs, often reaching tens of billions of dollars per program, drastically restrict market entry, ensuring the market remains highly concentrated among sovereign governments with immense budgetary resources (US, Russia, China). This leads to extremely long development cycles and intensive political oversight, limiting annual production rates and increasing dependency on long-term MRO and upgrade contracts for revenue stability.

What is the role of stealth technology in modern strategic bombers?

Stealth technology is foundational to the survivability of modern strategic bombers. It involves shaping the airframe and using radar-absorbent materials (RAM) to minimize radar cross-section (RCS) and thermal signature. This low observability capability is essential for penetrating sophisticated enemy integrated air defense systems (IADS) and ensuring mission success when projecting power into contested environments.

What technological advancements are driving the Strategic Bomber Market growth?

Market growth is driven by the integration of advanced digital technologies, including Artificial Intelligence (AI) for mission autonomy and predictive maintenance, advanced sensor fusion systems (AESA radar), and the imperative for hypersonic weapon carriage capability. These innovations ensure the new platforms maintain relevance against rapidly evolving adversary anti-access/area denial (A2/AD) capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager