Stress Relief Gummies Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442807 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Stress Relief Gummies Market Size

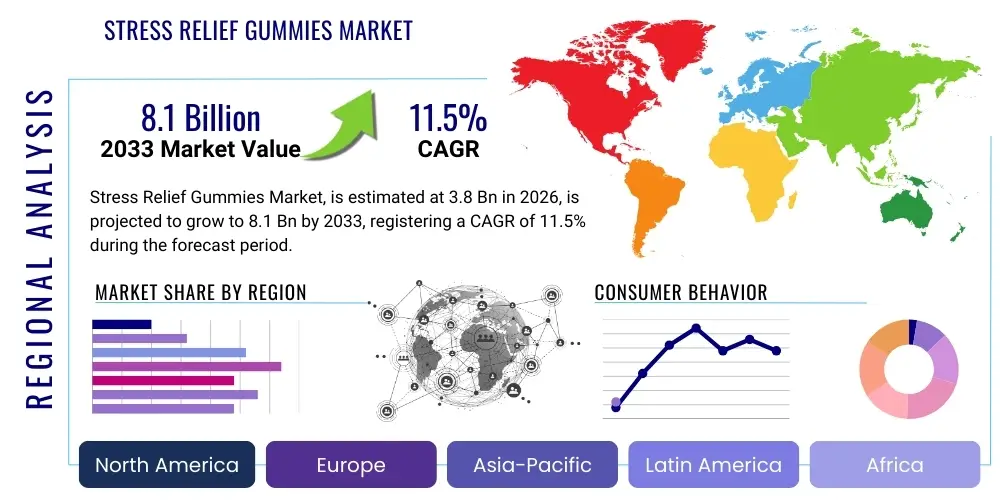

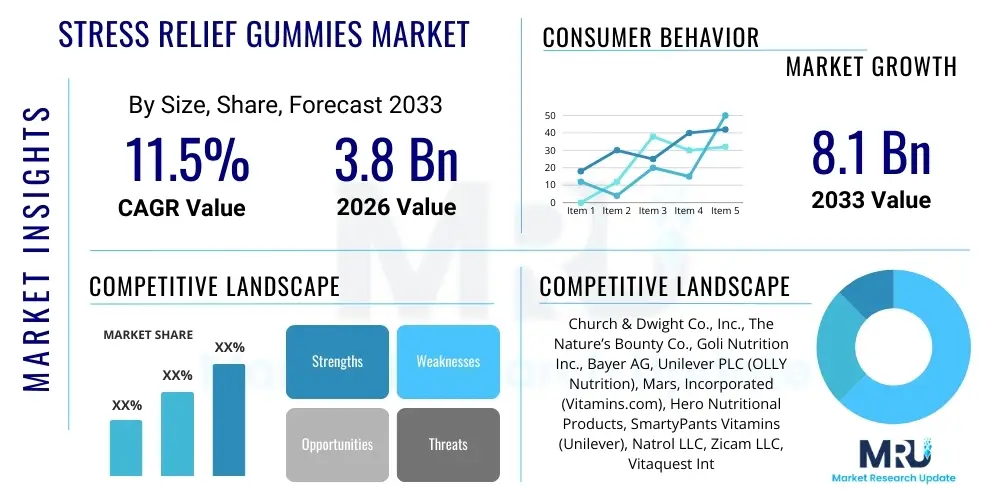

The Stress Relief Gummies Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 3.8 Billion in 2026 and is projected to reach USD 8.1 Billion by the end of the forecast period in 2033.

Stress Relief Gummies Market introduction

The Stress Relief Gummies Market encompasses the development, manufacturing, and distribution of chewable dietary supplements specifically formulated with active ingredients designed to mitigate symptoms of stress, anxiety, and support relaxation. These products leverage convenient dosage forms to deliver adaptogens, vitamins, and calming compounds, addressing the escalating prevalence of mental wellness concerns globally. Key ingredients frequently utilized include Ashwagandha, L-Theanine, CBD (where legal), Melatonin, and various B vitamins, all recognized for their anxiolytic or mood-stabilizing properties. The shift from traditional pill or capsule formats to palatable gummy forms has significantly boosted consumer adoption, particularly among demographics seeking simpler, more enjoyable methods of supplement intake.

The primary applications of these gummies revolve around daily maintenance of emotional balance, improving sleep quality disrupted by stress, and providing a discreet, accessible method for momentary tension relief. As modern lifestyles intensify pressure points, consumers are actively seeking preventative wellness solutions, positioning stress relief gummies as a core component of self-care routines. The market expansion is intrinsically linked to rising consumer awareness regarding mental health issues and a proactive approach toward holistic well-being. Furthermore, the stigma surrounding mental health support is gradually receding, fostering an environment conducive to the acceptance of functional foods and supplements that offer tangible mental benefits.

Major benefits driving the market include ease of use, superior compliance due to appealing flavors, and the perceived natural efficacy of botanical ingredients. Driving factors are multifaceted, including the global increase in diagnosed stress and anxiety disorders, heightened digital connectivity leading to chronic overstimulation, and the continuous innovation in ingredient formulation that enhances bioavailability and taste masking. Manufacturers are focusing heavily on developing ‘clean label’ products, free from artificial colors and high-fructose corn syrup, catering to the health-conscious consumer who demands both efficacy and purity in their nutritional supplements.

Stress Relief Gummies Market Executive Summary

The Stress Relief Gummies Market is characterized by robust growth, primarily propelled by favorable consumer sentiment toward functional, enjoyable delivery formats and the escalating global stress epidemic. Current business trends indicate a strong move towards ingredient diversification, with companies increasingly blending traditional adaptogens like Rhodiola and Bacopa Monnieri with modern compounds such as magnesium L-threonate for targeted cognitive and stress support. Furthermore, the competitive landscape is shifting towards specialized branding aimed at niche demographics, such as products optimized for students, high-performance professionals, or post-menopausal women, ensuring formulations address specific stressor types. Strategic acquisitions and vertical integration, particularly in the sourcing of high-quality botanical extracts, are defining the operational resilience of market leaders, securing supply chains against volatility.

Regional trends highlight North America and Europe as the dominant markets, attributed to high disposable incomes, mature regulatory frameworks supporting supplement sales, and advanced consumer education regarding proactive mental health management. North America, in particular, leads in innovation, especially regarding CBD-infused gummies, driving premium pricing and rapid product turnover. Conversely, the Asia Pacific (APAC) region is demonstrating the fastest growth trajectory, spurred by rapid urbanization, increased adoption of Western supplement trends, and the large-scale integration of traditional Chinese and Ayurvedic medicinal practices into modern dietary supplements. Infrastructure improvements in APAC retail and e-commerce platforms are enabling greater market penetration for international brands, although localization of ingredient sourcing and flavor profiles remains a key strategic challenge.

Segment trends confirm that the Ingredient Type category is dominated by Ashwagandha and L-Theanine due to their established clinical efficacy and favorable regulatory status across major geographies. The Distribution Channel segment is witnessing significant channel cannibalization, with Direct-to-Consumer (D2C) online sales exhibiting superior growth rates compared to traditional brick-and-mortar retail. This shift is driven by the consumer demand for transparency, detailed product information, and subscription convenience. From an End-User perspective, the Adult segment (25-55 years) remains the largest purchasing group, yet the rapid uptake in the Geriatric population, seeking non-pharmaceutical sleep and mood support, is creating substantial future growth pockets. Innovation in sugar-free and vegan formulations is crucial for maintaining market share across all segments, reflecting broader health and dietary consciousness.

AI Impact Analysis on Stress Relief Gummies Market

User inquiries concerning AI's role in the Stress Relief Gummies market frequently center on three core areas: the acceleration of R&D for novel, efficacious formulations; the enhancement of supply chain transparency and resilience; and the capability for hyper-personalized consumer recommendations. Users are keenly interested in how machine learning can predict the synergistic effects of adaptogenic compounds, thereby reducing the time and cost associated with clinical trials for new product stacks. A major user concern is regulatory ambiguity, questioning whether AI-driven formulation and labeling practices will withstand stringent governmental oversight, particularly regarding claims substantiation. Users also anticipate that AI will drive down costs through optimized manufacturing processes, ultimately making high-quality stress relief products more accessible to the mass market. The summary theme is a high expectation for AI to usher in an era of precision nutrition in the stress relief space, moving beyond generalized supplementation toward highly customized solutions.

AI's primary influence will be exerted in the product development lifecycle. By utilizing deep learning algorithms, manufacturers can analyze vast datasets of phytochemical properties, biological pathways related to stress response (e.g., HPA axis modulation), and existing consumer feedback on ingredient combinations. This predictive modeling capability allows companies to rapidly prototype gummy formulations that maximize efficacy and minimize side effects, significantly cutting down on traditional trial-and-error processes. Furthermore, AI can model the stability of temperature-sensitive ingredients—a major challenge in gummy manufacturing—ensuring active compound integrity throughout the product’s shelf life, thus improving product quality and consumer trust.

Beyond formulation, AI is revolutionizing market strategy and operational efficiency. In marketing, generative AI tools are enabling the creation of tailored advertising copy and educational content that resonates deeply with specific consumer segments suffering from distinct types of stress (e.g., performance anxiety vs. sleep-related stress), leading to higher conversion rates. Operationally, predictive analytics optimize inventory management for volatile botanical raw materials, forecasting demand fluctuations with greater accuracy. This proactive approach minimizes waste, reduces stockouts, and stabilizes production costs, allowing companies to maintain competitive pricing strategies in a crowded marketplace while enhancing supply chain visibility from farm to final product.

- AI accelerates new ingredient discovery and compound synergy prediction, optimizing efficacy.

- Machine learning models ensure precise ingredient dosing and stability under various storage conditions.

- Predictive supply chain analytics enhance sourcing resilience for botanical raw materials.

- Generative AI tools enable hyper-personalized marketing and content creation targeting specific stress profiles.

- AI-driven quality control systems automate inspection, ensuring manufacturing compliance and product safety.

DRO & Impact Forces Of Stress Relief Gummies Market

The Stress Relief Gummies market dynamics are governed by a robust interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces. Key drivers include the overwhelming global increase in chronic stress and anxiety, accelerated by socio-economic uncertainty and perpetual digital screen time, fundamentally expanding the target consumer base. The inherent convenience, palatability, and discreet nature of the gummy format also serve as a powerful driver, significantly lowering the barrier to entry for individuals new to dietary supplementation. Conversely, major restraints involve the pervasive regulatory inconsistencies across international borders, particularly concerning novel ingredients like CBD, which impede market harmonization and restrict global scaling efforts. The perception of gummies as less ‘serious’ or overly sugary compared to capsules also acts as a subtle restraint among traditional supplement users.

Significant opportunities are emerging through technological advancements and evolving consumer demands. The strongest opportunity lies in the development of scientifically validated, condition-specific formulations, moving beyond generic stress relief to target specific physiological manifestations such as adrenal fatigue or cortisol imbalance. The move toward 'Clean Label' sourcing and the commercialization of certified organic and Non-GMO products represent a strong market growth vector. Furthermore, the integration of personalized health diagnostics, potentially linking stress biomarker data with customized gummy subscriptions, represents a high-potential future market segment, offering differentiated value propositions and fostering customer loyalty through enhanced efficacy.

The primary impact forces shaping the market are competitive intensity and shifting consumer preference for natural solutions. Intense competition among established pharmaceutical companies entering the nutraceutical space and agile D2C startups drives rapid product innovation and aggressive marketing expenditures, potentially leading to market saturation in key categories. The influence of social media and wellness influencers has become a critical impact force, rapidly driving consumer education and shaping purchasing decisions based on perceived product authenticity and ingredient transparency. Regulatory changes, particularly standardization efforts related to dosage and allowable health claims, constitute a profound external impact force that dictates market entry strategies and product viability, ensuring that only compliant and credible formulations thrive in the long term.

Segmentation Analysis

The Stress Relief Gummies Market is meticulously segmented across several critical dimensions, enabling manufacturers and marketers to precisely target consumer groups and tailor product development efforts. These dimensions include Ingredient Type, which is the foundational element defining product efficacy; Source, differentiating between natural botanicals and synthetic compounds; Distribution Channel, reflecting diverse purchasing behaviors; and End-User, categorizing consumers based on age and lifestyle needs. This detailed segmentation is crucial for understanding regional market maturity and predicting future growth patterns, as different consumer cohorts exhibit distinct preferences regarding taste, dosage format, and ingredient origins. For instance, younger consumers often prioritize vegan and innovative flavor profiles, while older demographics may focus more heavily on scientifically backed ingredients and sugar content.

The fastest-growing segment is currently defined by ingredients that offer holistic, multi-faceted benefits, moving away from single-compound formulations. Combination products utilizing adaptogens like Ashwagandha alongside sleep aids like Melatonin or cognitive enhancers such as L-Theanine are experiencing exponential demand, addressing the interconnected nature of stress, sleep, and cognitive function. The rise of e-commerce as the preferred distribution method has decentralized purchasing power, allowing smaller, specialized brands to compete effectively against large corporate entities through focused digital marketing and transparent D2C interactions. This trend necessitates that traditional retailers adapt quickly by enhancing their online presence and offering exclusive or bundled product selections to retain market relevance.

Geographically, segmentation highlights the dominance of developed markets but signals the long-term potential of emerging economies. Product differentiation based on ethical sourcing and sustainability claims is becoming a key purchase driver, influencing the Source segment, where certified organic and sustainably harvested botanical extracts command a significant price premium. Continuous innovation in the delivery format, such as integrating liquid centers or controlled-release matrices within the gummy itself, further refines the market segmentation, appealing to sophisticated consumers seeking incremental technological improvements in their daily supplementation regime. Analyzing these segments rigorously provides the framework for strategic market entry and sustained competitive advantage within the dynamic stress relief landscape.

- By Ingredient Type:

- Ashwagandha

- L-Theanine

- Melatonin

- CBD (Cannabidiol)

- Magnesium

- B Vitamins (B6, B12)

- Other Botanical Blends (Chamomile, Lavender, Rhodiola)

- By Source:

- Natural

- Synthetic

- By Flavor Profile:

- Berry (Strawberry, Raspberry)

- Citrus (Orange, Lemon)

- Tropical (Mango, Pineapple)

- Mint and Others

- By Formulations (Dietary Attributes):

- Sugar-Free

- Vegan/Vegetarian

- Gluten-Free

- Organic

- By Distribution Channel:

- Store-Based Retail:

- Pharmacies & Drug Stores

- Supermarkets & Hypermarkets

- Specialty Stores

- Non-Store Based (Online):

- E-commerce Platforms (Amazon, Alibaba)

- Direct-to-Consumer (D2C) Websites

- By End-User:

- Adults (18-55)

- Geriatric Population (55+)

- Pediatric Population (Limited Usage)

Value Chain Analysis For Stress Relief Gummies Market

The value chain for the Stress Relief Gummies Market begins with the highly specialized Upstream Analysis stage, focused on sourcing and processing critical raw materials. This stage is complex due to the requirement for high-purity, standardized botanical extracts (e.g., Ashwagandha KSM-66, or high-potency L-Theanine) and pharmaceutical-grade excipients like gelatin, pectin, or binding agents. Quality control at this juncture is paramount, as the efficacy of the final product is directly dependent on the active compound concentration and stability of the raw ingredients. Strong relationships with certified growers and extractors are necessary to ensure supply chain integrity, trace origin, and compliance with ethical sourcing standards, particularly for globally sourced adaptogens which can face supply volatility and contamination risks.

The central phase involves manufacturing and processing, where the transformation of raw materials into the final gummy format occurs. This stage utilizes advanced technology, including specialized depositors and high-volume drying tunnels, necessary for creating a product that balances therapeutic efficacy with appealing texture and flavor. A critical component is the formulation stability, ensuring that active ingredients do not degrade when exposed to the heat and moisture inherent in the gummy-making process; techniques like microencapsulation are frequently employed here. Rigorous internal quality assurance protocols, often exceeding minimum regulatory requirements, are essential to verify dose accuracy, microbiological safety, and compliance with nutritional labeling claims before products move to the downstream segment.

The Downstream Analysis focuses on distribution and market access, involving both direct and indirect channels. Indirect distribution relies heavily on established partnerships with major pharmacy chains, mass market retailers, and large-scale e-commerce marketplaces (e.g., Amazon), requiring robust logistics and warehousing capabilities. Direct distribution (D2C) via company-owned websites is increasingly vital, offering higher profit margins, direct consumer data capture, and full control over branding and customer experience. Successful downstream operations require sophisticated digital marketing strategies, streamlined last-mile delivery, and effective inventory allocation across diverse sales platforms. The final layer involves comprehensive post-sale customer support and data feedback loops, which inform future product iteration and formulation strategy, closing the value chain cycle.

Stress Relief Gummies Market Potential Customers

Potential customers for the Stress Relief Gummies Market are broadly characterized by their exposure to modern lifestyle stressors and a proactive desire to manage mental wellness through non-prescription, convenient methods. The core demographic includes working professionals, particularly Millennials and Generation Z, who face intense workplace pressure, digital burnout, and seek immediate, accessible forms of relief without resorting to prescription medication. These individuals are typically tech-savvy, heavily influenced by wellness trends seen on social media, and prioritize efficacy alongside ethical and clean product attributes such as vegan certification and natural sweeteners. They value the ease of incorporating gummies into hectic daily schedules, often viewing them as a preventative health measure rather than a reactive treatment.

A secondary, rapidly expanding segment consists of individuals experiencing age-related sleep disturbances or generalized anxiety, predominantly the Geriatric population (55+). This demographic often seeks alternatives to traditional sleep aids and pharmaceuticals due to concerns over side effects and dependency. For this segment, formulations must focus on gentleness, clear scientific substantiation, and compatibility with other medications. The market penetration into this group is often facilitated through recommendations from healthcare providers or specialized retail pharmacies, emphasizing the need for robust clinical evidence to gain their trust. Customizations like lower sugar content and easily digestible formats are crucial for securing market share within this cautious but growing consumer group.

Furthermore, specialized subsets of potential customers include new parents struggling with balancing responsibilities, students facing academic pressure, and shift workers battling circadian rhythm disruption. These groups require targeted formulations; for instance, students might prioritize cognitive support alongside stress relief (L-Theanine blends), whereas shift workers require immediate, effective sleep induction (Melatonin-based formulations). Companies that successfully segment their marketing and product lines to address these specific occupational and life-stage stressors—offering "Focus & Calm" or "Night Shift Recovery" products—will unlock substantial niche market potential. The continuous expansion of stress awareness ensures a perpetually replenishing supply of new customers entering the functional food supplement market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 8.1 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Church & Dwight Co., Inc., The Nature’s Bounty Co., Goli Nutrition Inc., Bayer AG, Unilever PLC (OLLY Nutrition), Mars, Incorporated (Vitamins.com), Hero Nutritional Products, SmartyPants Vitamins (Unilever), Natrol LLC, Zicam LLC, Vitaquest International, LLC, Beemster Candy B.V., Herb Pharm, LLC, Webber Naturals, Nature Made, New Age USANA Health Sciences, Nordic Naturals, Garden of Life (Nestlé Health Science) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Stress Relief Gummies Market Key Technology Landscape

The technological landscape of the Stress Relief Gummies market is driven by innovations aimed at solving fundamental formulation challenges: maintaining ingredient efficacy, achieving pleasant organoleptic properties, and ensuring long-term shelf stability without excessive reliance on artificial preservatives. A paramount technology in this domain is Microencapsulation, a process used to shield sensitive active ingredients, such as L-Theanine or certain B vitamins, from degradation caused by heat, moisture, and acidic environments during the cooking and curing phases of gummy production. This technology is critical for both preserving potency and masking the often-bitter taste associated with high concentrations of adaptogens, thereby significantly enhancing consumer acceptance and bioavailability upon ingestion. Furthermore, advancements in specialized Pectin formulations allow manufacturers to create vegan gummies that possess a desirable, stable chew texture comparable to traditional gelatin-based products, catering to the rapidly expanding segment of plant-based consumers.

Manufacturing process technology is also evolving rapidly. High-speed, precision deposition systems now utilize advanced sensors and automation to ensure accurate, consistent dosing of active compounds in every single gummy. This is essential for meeting regulatory requirements and ensuring consumer safety, moving away from older, less reliable batch mixing methods. Furthermore, the implementation of Clean-In-Place (CIP) and highly aseptic processing environments minimizes the risk of microbial contamination, crucial given the high moisture and sugar content of gummies. Research and development labs are increasingly leveraging Rapid Prototyping and sensory analysis software to quickly iterate on flavor profiles and textures, integrating artificial intelligence to predict consumer acceptance of new fruit and botanical flavor pairings, thereby speeding up time-to-market for novel products.

In terms of ingredient technology, the focus is on optimizing delivery systems to maximize the body's absorption rate. Liposomal encapsulation technology is gaining traction, particularly for lipid-soluble components like CBD or certain vitamins, enhancing their solubility and transport across the intestinal barrier. Another key area is the refinement of sweetening agents; manufacturers are utilizing high-intensity natural sweeteners (e.g., stevia glycosides, monk fruit extract) and polyols to drastically reduce the reliance on refined sugar without compromising flavor. This innovation addresses a major consumer restraint—the concern over excessive sugar intake—while maintaining the palatable format that defines the market, allowing the production of effective, health-aligned, and consumer-friendly stress relief supplements.

Regional Highlights

The regional analysis of the Stress Relief Gummies Market reveals distinct consumption patterns, regulatory environments, and growth trajectories across the globe. North America, encompassing the United States and Canada, currently holds the largest market share due to its established supplement culture, high consumer awareness regarding mental wellness, and substantial disposable income facilitating premium product purchases. The region is a hotbed for innovation, specifically in D2C subscription models and the incorporation of regulated novel ingredients like hemp-derived CBD and specialized amino acids. The competitive landscape in North America is highly fragmented yet mature, requiring continuous product differentiation based on organic certification, clinical efficacy, and unique flavor delivery. Robust e-commerce infrastructure further supports rapid market access and expansion for both incumbent and startup brands.

Europe represents the second-largest market, characterized by highly stringent regulatory requirements, particularly concerning health claims and ingredient safety as mandated by the European Food Safety Authority (EFSA). This high barrier to entry necessitates meticulous formulation validation and clear, substantiated labeling, fostering a consumer base that prioritizes scientific backing over aggressive marketing claims. While regulatory complexities can slow down product launch cycles, they also instill a higher level of consumer confidence in products that successfully enter the market. Key growth areas within Europe include Germany, the UK, and France, driven by rising consumer interest in botanicals like Valerian root and Ashwagandha, often integrated into evening relaxation and sleep-support gummies.

The Asia Pacific (APAC) region is projected to register the fastest growth rate during the forecast period. This acceleration is fueled by increasing urbanization, rising disposable income, and a demographic shift toward adopting preventative health measures, moving away from reactive healthcare models. Countries like China, India, and Australia are seeing strong demand, though cultural acceptance of traditional supplements and local regulatory differences heavily influence market entry strategies. Success in APAC often relies on adapting formulations to local tastes and leveraging established distribution channels that cater to both modern and traditional medicine consumers. The Middle East and Africa (MEA) region remains nascent but offers potential in urban centers, driven by expatriate populations and growing exposure to global health trends, though market penetration is often constrained by supply chain logistics and cultural considerations regarding certain ingredients.

- North America: Dominant market share; driven by high acceptance of functional foods, advanced e-commerce penetration, and robust innovation in CBD and adaptogen blending.

- Europe: Characterized by stringent EFSA regulations; growth focused on scientifically validated, clean-label formulations and natural sleep aids.

- Asia Pacific (APAC): Highest CAGR; growth driven by urbanization, rising health expenditure, and increasing acceptance of Western-style supplements blended with local traditional herbs.

- Latin America (LATAM): Emerging market; characterized by price sensitivity and growing awareness, primarily focused on basic vitamin and mineral support gummies.

- Middle East & Africa (MEA): Nascent growth potential; confined primarily to urban areas; demand often focused on premium, imported brands.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Stress Relief Gummies Market.- Church & Dwight Co., Inc. (Zicam LLC)

- The Nature’s Bounty Co. (Nature's Bounty, Solgar)

- Goli Nutrition Inc.

- Bayer AG (One A Day)

- Unilever PLC (OLLY Nutrition)

- Mars, Incorporated (Vitamins.com)

- Hero Nutritional Products

- SmartyPants Vitamins (Unilever)

- Natrol LLC

- Vitaquest International, LLC

- Beemster Candy B.V.

- Herb Pharm, LLC

- Webber Naturals

- Nature Made (Pharmavite LLC)

- New Age USANA Health Sciences

- Nordic Naturals

- Garden of Life (Nestlé Health Science)

- Pure Encapsulations

- Vital Proteins (Nestlé Health Science)

Frequently Asked Questions

Analyze common user questions about the Stress Relief Gummies market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary ingredient driving efficacy in stress relief gummies?

The ingredient driving the most significant market interest and sales volume is Ashwagandha (specifically root extracts like KSM-66), valued for its adaptogenic properties in modulating cortisol levels and reducing perceived stress. L-Theanine is also highly effective for non-drowsy relaxation.

Are stress relief gummies considered regulated medications?

No, stress relief gummies are classified as dietary supplements or functional foods, not regulated medications. They are regulated by entities like the FDA (in the US) under guidelines for food ingredients and supplements, meaning they are not intended to diagnose, treat, or cure medical conditions.

What are the key trends affecting the formulation of stress relief gummies?

Key formulation trends include the shift towards vegan/pectin-based formulations, significant reduction or elimination of added sugars (using alternatives like monk fruit or allulose), and the creation of multi-functional blends that combine stress relief with specific benefits like immune support or cognitive enhancement.

Which distribution channel offers the fastest growth opportunity for these products?

The Direct-to-Consumer (D2C) online channel, including brand websites and dedicated e-commerce platforms, presents the fastest growth opportunity. This channel facilitates immediate consumer interaction, personalized subscription services, and greater control over brand storytelling and educational content.

What are the main consumer concerns regarding stress relief gummies?

Major consumer concerns revolve around sugar content, potential lack of efficacy compared to traditional pills, and transparency regarding sourcing and clinical backing of active ingredients. Consumers increasingly demand third-party testing verification to confirm purity and potency claims.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager