Strip Parquet Floors Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440998 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Strip Parquet Floors Market Size

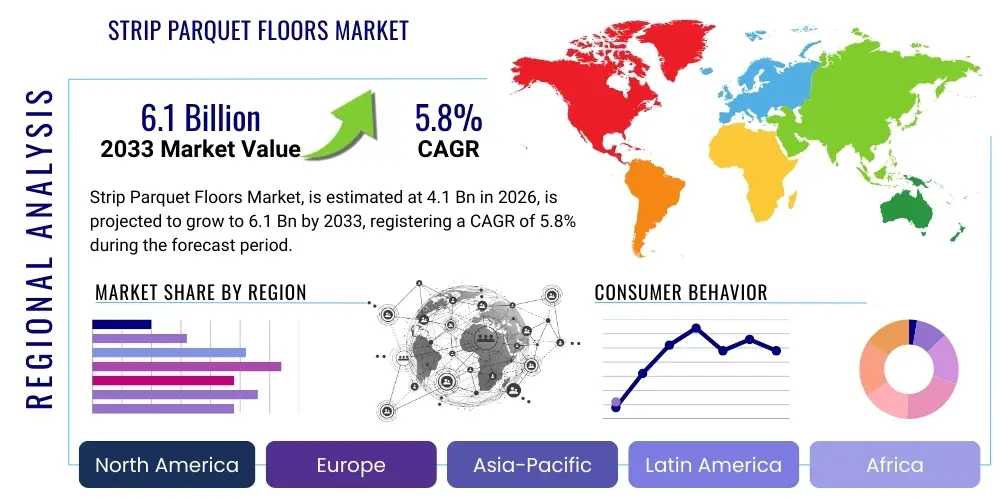

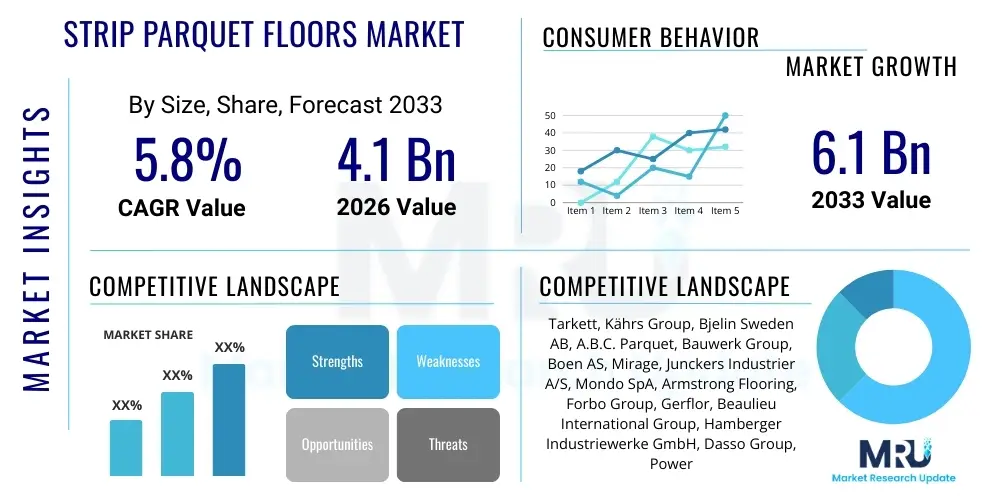

The Strip Parquet Floors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033. This growth trajectory is significantly influenced by the increasing focus on aesthetically pleasing and durable flooring solutions within both residential and commercial construction sectors globally. The resurgence in popularity of natural wood materials, driven by sustainability trends and a demand for high-end interior finishes, further bolsters this market expansion.

The valuation reflects robust demand stemming from reconstruction and renovation activities, particularly in mature economies like North America and Europe, where homeowners are investing heavily in quality, long-lasting flooring. Furthermore, emerging markets, especially in Asia Pacific, are experiencing rapid urbanization and burgeoning middle-class populations, translating into higher uptake of premium, engineered wood flooring options, of which strip parquet is a key component. The shift towards engineered strip parquet, offering superior stability and installation ease compared to traditional solid wood, is a major factor contributing to the positive financial outlook.

Strip Parquet Floors Market introduction

The Strip Parquet Floors Market encompasses the production, distribution, and installation of flooring composed of small, narrow wooden strips assembled together to create geometric patterns, most commonly utilizing tongue-and-groove systems for secure fitting. These flooring types offer a classic, timeless aesthetic while providing excellent durability and thermal insulation properties. Major applications span residential buildings (apartments, houses), commercial spaces (offices, retail stores), hospitality sectors (hotels, resorts), and specialized facilities like museums and galleries, where premium, natural finishes are prioritized. Key benefits include longevity, repairability through sanding, inherent warmth, and the ability to significantly increase property value. The primary driving factors include rising disposable incomes leading to higher investment in home interiors, technological advancements in wood engineering enhancing moisture resistance and stability, and stringent environmental regulations promoting sustainable sourcing of hardwood, making certified strip parquet highly desirable.

Strip parquet flooring is generally categorized based on its construction: solid strip parquet, which is entirely hardwood, and engineered strip parquet, which features a veneer of hardwood glued over multiple layers of plywood or HDF. The engineered variant is rapidly gaining market share due to its stability in environments with fluctuating humidity and temperature, making it suitable for modern construction methods, including those utilizing underfloor heating systems. The aesthetic versatility of strip parquet, allowing for various wood species (oak, maple, walnut) and finishes (lacquer, oil), ensures its adaptability across diverse architectural styles, from traditional European interiors to sleek, contemporary designs. The market is also heavily influenced by trends in interior design, specifically the current global preference for natural, tactile materials that promote wellness and biophilic design principles within indoor environments.

Strip Parquet Floors Market Executive Summary

The Strip Parquet Floors Market is characterized by steady expansion, driven primarily by upscale residential construction and commercial refurbishment projects focused on sustainable, high-quality finishes. Business trends indicate a strong move toward engineered wood solutions that mitigate the vulnerability of solid wood to environmental changes, improving product longevity and reducing installation complexities. This shift also encourages innovation in locking mechanisms and protective coatings, offering enhanced scratch and moisture resistance. Regionally, Europe remains the dominant market due owing to its deep-rooted history of wood flooring usage and stringent quality standards, while Asia Pacific presents the fastest growth opportunities driven by burgeoning real estate development and increasing consumer affluence seeking luxury western interior aesthetics. Segment trends show that oak remains the preferred wood species due to its availability and aesthetic neutrality, though exotic woods are gaining traction in niche, high-end applications. Furthermore, the residential sector holds the largest market share, though the commercial sector’s demand for durable, low-maintenance finishes is accelerating quickly, especially within the hospitality and corporate office segments.

AI Impact Analysis on Strip Parquet Floors Market

Common user questions regarding AI's influence on the Strip Parquet Floors Market center around efficiency, customization, and predictive maintenance. Users frequently inquire about how AI can optimize timber selection and grading to minimize waste, whether AI-driven design tools can automate complex pattern creation for personalized installation, and if machine learning can predict floor wear and scheduling maintenance needs. Furthermore, there is significant interest in how AI can enhance supply chain transparency regarding sustainable sourcing and track the authenticity of wood species. These inquiries collectively highlight user expectations for AI to deliver greater operational precision, highly personalized product offerings, and enhanced sustainability verification within the traditionally manual and resource-intensive flooring industry, ultimately leading to higher quality and reduced costs for consumers and manufacturers alike.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming the manufacturing and logistics aspects of the strip parquet flooring industry. In manufacturing, AI algorithms are being deployed to analyze high-resolution scans of raw timber, optimizing cutting patterns to maximize material yield and consistently grade wood strips based on color, knot density, and grain uniformity—tasks traditionally reliant on human expertise, which often introduced variability. This predictive analytics capability leads to substantial reductions in raw material waste and ensures a higher consistency in the final product batch, directly addressing consumer demand for flawless installations. Moreover, AI systems are instrumental in monitoring and adjusting complex curing and finishing processes, such as UV curing or oil penetration, based on real-time environmental factors, thereby enhancing the durability and quality of the surface treatment.

Beyond production, AI plays a crucial role in enhancing customer experience and supply chain resilience. Virtual Reality (VR) and Augmented Reality (AR) tools, often powered by AI algorithms, allow potential customers to visualize complex strip parquet patterns, such as herringbone or chevron, directly within their own spaces, facilitating purchase decisions and reducing returns due to visualization mismatches. On the supply chain side, ML models analyze global timber sourcing data, predicting potential bottlenecks due to climate events or geopolitical instability, and suggesting alternative, verified sustainable suppliers, thereby safeguarding production schedules and reinforcing compliance with ethical sourcing mandates. This advanced predictive capability positions manufacturers to react dynamically to fluctuating market conditions and maintain competitive pricing and lead times.

- AI-driven optimization of raw material cutting patterns to minimize wood waste.

- Machine Learning algorithms for automatic, consistent grading of wood strips (color, grain, knots).

- Predictive maintenance schedules for manufacturing machinery, reducing downtime and operational costs.

- AI-powered visual tools (AR/VR) for customer visualization of floor patterns and finishes in real-time.

- Enhanced supply chain transparency and traceability using ML for sustainable sourcing verification.

- Optimization of energy usage in drying kilns and finishing lines through real-time process control.

- Automated quality control checks post-finishing to detect micro-defects invisible to the human eye.

DRO & Impact Forces Of Strip Parquet Floors Market

The dynamics of the Strip Parquet Floors Market are governed by a robust interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces. Key drivers include the global trend towards premiumization in residential interiors and the verifiable longevity and investment value offered by natural wood flooring. Restraints primarily revolve around the high initial cost of acquisition and installation compared to alternatives like laminate or vinyl, alongside the susceptibility of natural wood to significant moisture fluctuations if not properly installed or maintained. Opportunities are vast, centered on technological leaps in engineered parquet stability and the massive untapped potential in green building certifications requiring sustainably sourced interior materials. The overall impact forces are high, primarily driven by fluctuating raw material prices (hardwood commodity cycles) and increasing regulatory pressures related to forestry and sustainable logging practices (Impact Force). These factors necessitate strategic supply chain management and continuous product innovation to maintain market competitiveness and capture growth potential.

Detailed analysis reveals that the desire for high aesthetic value in luxury residential projects, particularly the traditional elegance associated with strip parquet, acts as a powerful demand driver. The easy availability of various species and finishes allows for extensive customization, satisfying niche market demands. However, the requirement for highly skilled labor for complex pattern installations, especially solid strip parquet, constitutes a significant restraint, often delaying projects and increasing overall costs. Furthermore, consumer perception regarding the maintenance intensity of real wood, despite modern finishes reducing the burden, remains a psychological barrier in some markets. The greatest opportunity lies in targeting the burgeoning institutional sector, such as high-traffic public areas and academic institutions, where the long-term cost-efficiency of durable, refinishable parquet floors outweighs the initial capital expenditure. Leveraging advancements in surface coatings, such as ceramic-reinforced lacquers, provides an immediate market opportunity to counter the traditional moisture vulnerability restraint.

The market faces significant impact from macroeconomic variables, chiefly interest rate changes that affect the housing market and construction financing, directly influencing flooring demand. Environmental impact forces are also critical; increasing scrutiny on deforestation and the push for Forest Stewardship Council (FSC) certification pressure manufacturers to secure sustainable wood supply chains, often requiring investments in traceable logging and processing infrastructure. Failure to comply with these environmental standards poses a major reputation risk and market access constraint, particularly in European markets. Thus, the successful navigation of this market requires firms to balance the premium positioning of their products with demonstrable commitment to ecological responsibility and supply chain robustness, mitigating the impact of external commodity price volatility.

Segmentation Analysis

The Strip Parquet Floors Market is comprehensively segmented across several crucial dimensions, including Construction Type, Wood Species, Application (End-User), and Distribution Channel, allowing for precise targeting and strategic market analysis. Construction type distinguishes between traditional Solid Strip Parquet and the increasingly popular Engineered Strip Parquet, reflecting differing performance characteristics and installation requirements. Segmentation by wood species reveals consumer preferences, with Oak dominating due to its durability and accessibility, followed by Maple, Walnut, and exotic hardwoods used for specialized, high-design installations. The application segmentation clearly delineates the demand drivers across Residential and Commercial sectors, acknowledging their distinct needs regarding wear resistance and volume requirements. Finally, distribution channels—Direct Sales, Retail Stores, and Online Platforms—show the evolving landscape of product accessibility and procurement methods, critical for developing targeted sales strategies and managing logistics.

- Construction Type

- Solid Strip Parquet

- Engineered Strip Parquet

- Wood Species

- Oak

- Maple

- Walnut

- Ash

- Exotic Woods (e.g., Teak, Merbau)

- Application

- Residential

- Commercial (Office, Retail, Hospitality, Institutional)

- Distribution Channel

- Direct Sales (Contractors, Architects)

- Retail Stores (Home Improvement, Specialized Flooring)

- Online Platforms

Value Chain Analysis For Strip Parquet Floors Market

The value chain for the Strip Parquet Floors Market begins with upstream activities involving sustainable forestry and raw timber procurement, where certification (e.g., FSC, PEFC) is increasingly paramount for market acceptance. This is followed by primary processing (sawmilling and drying), a critical stage that determines the quality and stability of the wood planks. Midstream activities encompass the precise manufacturing processes, including the lamination of engineered core layers, the milling of the tongue-and-groove profile, and the application of sophisticated surface finishes (oil, lacquer, UV curing). Downstream segments focus on logistics, distribution, and installation services. Distribution channels are bifurcated into direct sales, catering primarily to large commercial projects and professional contractors, and indirect channels, utilizing specialized retail showrooms and increasingly, e-commerce platforms to reach the residential consumer. The efficiency of this value chain is heavily dependent on minimizing material waste during milling and ensuring secure, moisture-controlled storage during transit.

Upstream stability is constantly challenged by global resource availability and climate change, necessitating strong, long-term relationships between parquet manufacturers and certified sustainable logging operators. Manufacturers who own or control their own timber resources (vertical integration) often gain a competitive advantage regarding cost control and quality consistency. In the midstream, technological investments in precision machinery, such as Computer Numerical Control (CNC) milling equipment, are essential for achieving the tight tolerances required for seamless strip parquet installation. Furthermore, the development of proprietary, high-durability surface coatings adds significant value at the manufacturing stage, differentiating premium products from mass-market offerings.

The downstream sector is characterized by intense competition among installers and distributors. Direct channels allow manufacturers greater margin control and immediate feedback on product performance but require extensive sales infrastructure. Indirect channels, particularly specialized flooring retailers, provide crucial advisory and aesthetic consultation services to consumers, adding value through expert guidance on wood species suitability and pattern selection. The final stage—installation—is perhaps the most critical for perceived product quality. Manufacturers increasingly offer certified installer training programs, recognizing that poor installation can negate the quality inherent in the product, thus maintaining control and quality assurance throughout the entire customer journey.

Strip Parquet Floors Market Potential Customers

The primary consumers and end-users of strip parquet floors fall into two broad, yet distinct, categories: the high-end residential market and various segments within the commercial and institutional sectors. Within the residential space, potential customers are typically affluent homeowners, custom builders, and interior designers who prioritize high durability, natural aesthetics, and long-term asset value in renovation or new construction projects. These buyers often seek out customized, exotic wood species or specific historic patterns like herringbone or chevron, demanding premium installation services. The key drivers for this segment are aesthetic appeal, environmental certification, and perceived quality investment.

Conversely, the commercial sector’s potential customers include developers of luxury hotels, corporate headquarters, high-end retail boutiques, and cultural institutions (museums, theaters). These entities require flooring solutions that offer exceptional wear resistance, minimal maintenance requirements, and compliance with strict fire and safety codes, alongside sophisticated design. For this segment, the total cost of ownership over a 20-30 year lifespan, factoring in refinishing capabilities, is often more critical than the initial outlay. Facility managers and general contractors are key decision-makers, valuing bulk supply capability and adherence to demanding project timelines and specifications. Both segments share a growing demand for products that demonstrably contribute to indoor air quality and sustainable building accreditation systems like LEED or BREEAM.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tarkett, Kährs Group, Bjelin Sweden AB, A.B.C. Parquet, Bauwerk Group, Boen AS, Mirage, Junckers Industrier A/S, Mondo SpA, Armstrong Flooring, Forbo Group, Gerflor, Beaulieu International Group, Hamberger Industriewerke GmbH, Dasso Group, Power Dekor Group, Woodpecker Flooring, Hakwood, Haro Sports Flooring, Lägler GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Strip Parquet Floors Market Key Technology Landscape

The technology landscape in the Strip Parquet Floors Market is rapidly evolving, focusing on enhancing product stability, ease of installation, and surface performance. A major technological advancement is the widespread adoption of multi-layer engineered construction, which utilizes High-Density Fiberboard (HDF) or cross-ply plywood cores to counteract the natural expansion and contraction of solid wood, significantly reducing installation risks and making parquet suitable for underfloor heating systems. Furthermore, milling technology has progressed to include sophisticated 5G or similar click-lock mechanisms, replacing traditional glue-down methods in many applications. These locking systems enable faster, cleaner, and more robust floating installations, appealing directly to the do-it-yourself (DIY) market and reducing labor costs for professionals. The precision in milling required for these locking profiles is achieved through advanced laser-guided and CNC manufacturing processes, minimizing gaps and ensuring a seamless, high-quality finished floor surface.

Surface finishing technology constitutes another critical area of innovation. Manufacturers are increasingly utilizing UV-cured acrylic and polyurethane lacquers, often reinforced with micro-ceramic or aluminum oxide particles, to achieve exceptional scratch resistance and durability exceeding traditional solvent-based finishes. These advanced finishes not only extend the lifespan of the floor but also facilitate easier maintenance, addressing a key consumer concern regarding natural wood. Moreover, the environmental imperative has driven the development of low-Volatile Organic Compound (VOC) and formaldehyde-free adhesives and finishes, aligning product offerings with stringent health and safety regulations prevalent in Europe and North America. The optimization of wood drying kilns using sensor technology and predictive algorithms also ensures precise moisture content control, a vital factor for producing high-stability parquet strips that resist warping post-installation.

Digitalization also plays a role in streamlining the entire product lifecycle. Scanning technology and photogrammetry are used to capture the natural variation and texture of the wood veneer, allowing manufacturers to create highly realistic digital twins of their products. This aids in marketing through high-fidelity visualization tools and assists in quality control by automating the identification of flaws. Looking ahead, the integration of smart sensors into high-end commercial parquet installations is being explored. These sensors could monitor floor traffic, temperature gradients, and minor structural shifts, feeding data back into a Building Management System (BMS) to proactively schedule cleaning or maintenance, optimizing the performance and lifespan of the flooring in high-stress environments like airports or large retail centers.

Regional Highlights

The global Strip Parquet Floors Market exhibits diverse regional dynamics, heavily influenced by local construction traditions, economic maturity, and environmental regulations.

- Europe: Europe represents the largest and most mature market for strip parquet, driven by a deeply ingrained cultural preference for high-quality, long-lasting wood flooring and robust renovation cycles in countries like Germany, France, and Scandinavia. Strict environmental standards (E.g., EUTR) ensure high demand for sustainably sourced and certified parquet products. Innovation in engineered flooring and sophisticated click systems originated here, maintaining Europe’s position as a technological leader.

- North America: This region shows significant growth, particularly in the premium residential segment. The demand is heavily skewed towards engineered strip parquet due to the prevalence of slab construction and the use of forced-air heating/cooling systems, which necessitate greater dimensional stability. The rise in custom home building and high-end multifamily developments fuels this segment, with Oak and Maple being the dominant wood species preferences.

- Asia Pacific (APAC): APAC is the fastest-growing market, propelled by rapid urbanization, massive infrastructure development, and increasing disposable incomes in key economies like China, India, and Southeast Asian nations. While the market initially focused on solid parquet, the shift to engineered products is accelerating to meet large-scale project demands quickly. Local manufacturers are rapidly adopting European manufacturing standards to compete in the luxury segment.

- Latin America: Growth is steady but constrained by economic volatility. The market focuses primarily on domestically sourced tropical hardwoods for solid strip parquet, though engineered solutions from international suppliers are gaining traction in affluent urban centers like São Paulo and Mexico City, largely catering to new office buildings and luxury residential towers.

- Middle East and Africa (MEA): This region offers niche opportunities, mainly in the high-end hospitality and luxury retail sectors of the Gulf Cooperation Council (GCC) nations. Due to extreme climatic conditions, demand is almost exclusively for highly stable, engineered strip parquet, often imported and requiring specialized installation techniques to manage humidity and temperature variations effectively.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Strip Parquet Floors Market.- Tarkett

- Kährs Group

- Bjelin Sweden AB

- A.B.C. Parquet

- Bauwerk Group

- Boen AS

- Mirage

- Junckers Industrier A/S

- Mondo SpA

- Armstrong Flooring

- Forbo Group

- Gerflor

- Beaulieu International Group

- Hamberger Industriewerke GmbH

- Dasso Group

- Power Dekor Group

- Woodpecker Flooring

- Hakwood

- Haro Sports Flooring

- Lägler GmbH

Frequently Asked Questions

Analyze common user questions about the Strip Parquet Floors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between solid and engineered strip parquet?

Solid strip parquet is constructed entirely of hardwood, offering maximum refinish capability but requiring skilled installation and being more susceptible to moisture changes. Engineered strip parquet features a hardwood veneer over a stable core (plywood or HDF), providing superior dimensional stability, easier installation, and suitability for basements and underfloor heating systems.

Is strip parquet flooring a sustainable choice compared to other flooring materials?

Yes, modern strip parquet, especially when sourced from manufacturers with Forest Stewardship Council (FSC) or Programme for the Endorsement of Forest Certification (PEFC) accreditation, is highly sustainable. Its longevity (often 50+ years) and the ability to be refinished multiple times minimize replacement waste, making it environmentally friendly over its lifecycle.

How do technological advancements like click systems affect the installation of strip parquet?

Click-lock systems, common in engineered strip parquet, significantly simplify installation by allowing planks to be clicked together without adhesive, enabling faster, cleaner, and less labor-intensive floating installations. This technology reduces overall project time and cost, making professional-quality installation more accessible.

Which regional market holds the highest growth potential for strip parquet floors?

The Asia Pacific (APAC) region is projected to exhibit the highest growth rate due to rapid urbanization, increasing middle-class affluence, and the booming construction sector, particularly in high-rise residential and commercial developments demanding premium, high-durability interior finishes.

What is the expected long-term impact of fluctuating timber prices on the market?

Fluctuating timber prices introduce cost volatility and potential margin compression for manufacturers, acting as a major impact force. Companies focused on engineered parquet, which uses less premium solid wood per unit, are better positioned to mitigate these effects compared to those relying heavily on 100% solid strip products.

The Strip Parquet Floors Market's long-term viability is intrinsically linked to advancements in materials science, particularly in developing durable, environmentally conscious finishes and more stable core constructions. Continued consumer preference for natural, aesthetic, and durable flooring in both high-end residential and commercial spaces will sustain demand. The adoption of digital tools for design and installation, coupled with sophisticated supply chain management ensuring sustainable sourcing, will be crucial differentiators for market leaders. The competitive landscape is slowly shifting towards integrated solutions providers offering not just the product, but also certified installation and long-term maintenance contracts, securing customer loyalty and ensuring product longevity. Moreover, geopolitical stability and global trade agreements regarding timber sourcing will significantly influence the operational costs and overall pricing strategy within the coming forecast period. Manufacturers investing in localized production facilities closer to high-demand construction hubs, thereby minimizing complex logistical chains and tariffs, are likely to achieve higher operational efficiency and capture greater market share in fragmented regional landscapes. The future of strip parquet lies in balancing the timeless appeal of natural wood with the technological demands for stability, ease of use, and ecological integrity.

Further analysis of the regulatory environment suggests that impending European Union directives targeting embodied carbon in building materials will strongly favor manufacturers who can provide comprehensive environmental product declarations (EPDs) for their strip parquet offerings. This regulatory push will accelerate the phase-out of chemically intensive finishes and adhesives, prompting innovation towards bio-based and non-toxic alternatives. The North American market is similarly influenced by green building trends, where certifications like LEED prioritize materials with low environmental impact and verifiable sustainable origins, creating a premium segment where certified strip parquet commands higher prices. This trend reinforces the necessity for rigorous tracking systems throughout the value chain, from forest management to final installation, necessitating investment in digital traceability solutions. For emerging markets, while cost remains a key consideration, growing consumer awareness about health and air quality is increasing the demand for products with low VOC emissions, moving strip parquet manufacturers away from cheaper, less environmentally compliant materials.

From a product perspective, the future market landscape will see increased diversification in aesthetic offerings. While traditional patterns like herringbone remain popular, advancements in CNC technology enable manufacturers to produce custom, complex geometric patterns at industrial scale, previously only achievable through bespoke craftsmanship. This democratization of high-design parquet will open new revenue streams in the mid-to-high segment. Furthermore, the convergence of flooring and smart home technology presents an untapped opportunity; embedding minimal sensory capabilities (e.g., temperature or moisture monitoring) directly into engineered parquet boards could offer added value, particularly for large commercial clients concerned with preventative maintenance and insurance liability. The strategic importance of establishing robust after-sales service networks, including professional sanding and refinishing support, cannot be overstated, as the longevity of strip parquet is a core component of its value proposition against competing single-use flooring materials.

The competitive differentiation amongst key players is increasingly reliant on vertical integration and technological superiority. Companies that control the entire process, from sustainable forest logging to final product finishing and distribution, are better equipped to manage input costs and maintain consistent quality, offering a more reliable value proposition to large-scale contractors and developers. The ability to rapidly customize product specifications, such as veneer thickness, core material, and proprietary locking mechanisms, for diverse international projects is becoming essential for securing large commercial tenders. Smaller, specialized firms, conversely, thrive by focusing on niche, solid-wood patterns and exotic species, serving the ultra-luxury residential market where craftsmanship and unique aesthetics outweigh production volume. The ongoing global shortage of skilled construction labor reinforces the market demand for easily installed engineered products, potentially leading to the development of modular strip parquet systems designed for rapid deployment, further optimizing installation efficiency and reducing overall project timelines for mass-market residential construction. This dual market focus—high-tech ease-of-use versus high-craft customization—will define strategic positioning in the coming years.

Market penetration into the renovation and remodeling sector, especially in developed economies with aging housing stock, offers significant, consistent demand. Homeowners seeking durable upgrades that maximize resale value often select strip parquet due to its classic appeal and proven longevity. Marketing strategies must therefore emphasize the long-term investment return and the emotional value of natural materials, rather than focusing solely on the initial purchase price. The interplay between interior design trends, which currently favor light woods and matte finishes, drives immediate product innovation, requiring manufacturers to maintain flexible production lines capable of rapidly adapting to changes in popular stains, oils, and lacquers. The challenge for the industry remains managing the perception of fragility associated with real wood, which is best addressed through robust product warranties and consumer education regarding proper care and maintenance specific to modern, high-performance finishes. Effective digital content marketing, utilizing high-quality visuals and educational resources (AEO content), is instrumental in building consumer confidence and driving sales through both online and traditional retail channels.

In summary, the Strip Parquet Floors Market is characterized by resilient demand fueled by demographic shifts toward premium interior finishes and regulatory pressure favoring sustainable materials. While facing constraints from cost and specialized installation requirements, the opportunities presented by engineered technology and geographical expansion into APAC solidify a positive growth outlook. Strategic success requires manufacturers to prioritize supply chain transparency, integrate advanced manufacturing technologies (including AI for quality control), and tailor their product lines to meet the divergent needs of the high-volume commercial sector and the high-design residential segment. The overall market narrative is shifting from merely selling a product to providing a long-term, sustainable, and aesthetically superior flooring solution, necessitating continuous innovation across the entire value chain.

The regulatory landscape is poised to have a defining impact on market access and competitiveness. Specifically, the European Union's ambitious Circular Economy Action Plan encourages the adoption of products designed for longevity and easy repairability, positioning refinishable strip parquet favorably against short-life cycle materials like certain vinyl and laminates. Compliance with evolving standards related to formaldehyde emissions (e.g., CARB Phase 2, TSCA Title VI) mandates significant investment in material substitution and testing protocols, creating barriers to entry for manufacturers unwilling to adopt stringent quality controls. Companies that proactively lead in adopting these high environmental standards gain a reputation for quality and responsibility, appealing directly to the increasingly conscious consumer base in developed economies. This focus on sustainability is not merely a compliance issue but a fundamental driver of premium pricing and brand loyalty.

Furthermore, distribution optimization is crucial for market efficiency. The rise of e-commerce necessitates robust logistics capabilities for handling bulky, heavy flooring materials, often requiring specialized third-party carriers. Manufacturers are increasingly utilizing digital inventory management systems to provide accurate, real-time lead times, a critical factor for contractors and consumers planning construction projects. The synergy between online visualization tools and physical showroom presence (omnichannel retail strategy) ensures customers can experience the tactile quality of the wood while benefiting from the convenience of digital procurement. This shift requires traditional manufacturers to invest heavily in digital infrastructure and data analytics to track consumer behavior and forecast regional demand accurately, moving beyond reliance on traditional sales agent networks alone. The integration of advanced Enterprise Resource Planning (ERP) systems aids in managing the complex variations in product specifications (species, grade, finish, locking system) that characterize the strip parquet offering.

The role of architectural and design (A&D) communities remains pivotal. Architects and interior designers are significant influencers in material specification for high-value projects. Manufacturers must maintain strong engagement programs, providing continuous education on new product lines, technical performance data (e.g., fire ratings, slip resistance), and environmental certifications. Continuing Professional Development (CPD) courses focused on the correct specification and installation of engineered parquet over modern substrates (like radiant heat floors) ensure that the product is appropriately integrated into complex building designs. Strategic partnerships with prominent global design firms can effectively showcase strip parquet in high-visibility projects, setting trends and establishing new benchmarks for interior aesthetics. This targeted approach ensures that strip parquet remains relevant and preferred in the upper echelons of modern construction and design. The success of market penetration in the burgeoning institutional sector, such as healthcare and educational facilities, depends entirely on meeting the stringent technical specifications and regulatory compliance demands driven by these professional end-users.

The global outlook for raw materials emphasizes a growing reliance on sustainably managed temperate forests, predominantly in North America and Europe, which supply the most preferred species like Oak. Exotic wood sourcing, while aesthetically desirable, faces increasing regulatory hurdles and ethical scrutiny, pushing manufacturers to explore technologically enhanced alternatives, such as thermo-treated domestic species that mimic the hardness and color of exotic woods. Thermowood technology, involving heat and steam treatment, improves the dimensional stability and fungal resistance of standard softwoods and temperate hardwoods, creating a more sustainable and geographically diversified material input pool for engineered strip parquet cores and veneers. This innovation directly addresses both the sustainability constraints and the high cost associated with traditional exotic hardwood supply chains. Continuous investment in research and development dedicated to these alternative treatment methods is essential for maintaining competitive material costs and securing long-term supply resilience in the face of environmental resource limitations.

Furthermore, consumer education initiatives focusing on the maintenance and long-term value proposition of strip parquet are paramount for continued growth. Addressing the common misconception that wood floors are overly difficult to maintain requires highlighting the ease of care for modern, highly durable finishes. Providing clear, accessible information (via digital channels) on routine cleaning, protective measures, and the multi-cycle refinishing process reinforces the value proposition of strip parquet as a durable investment, contrasting sharply with the limited lifespan of many synthetic alternatives. This educational effort, integrated into marketing and point-of-sale materials, transforms the consumer perception of wood flooring from a high-maintenance luxury item to a practical, long-term asset, further solidifying the market position against competing flooring types.

The consolidation trend observed among large flooring manufacturers, where companies acquire specialized parquet producers, suggests a strategic effort to capture market share and diversify product portfolios globally. These mergers and acquisitions often lead to streamlined manufacturing processes, shared technological advancements, and enhanced distribution networks, which benefit the end consumer through standardized quality and improved availability. For smaller, innovative parquet manufacturers, this creates opportunities for strategic partnerships or lucrative exits. The pressure for consolidation is particularly strong in the engineered segment, where economies of scale in raw material procurement and complex manufacturing processes yield significant competitive advantages. Overall, the Strip Parquet Floors Market is maturing while simultaneously undergoing substantial technological transformation, positioned for sustained, quality-driven growth predicated on sustainability and innovation.

Finally, the long-term forecast suggests that market differentiation will hinge less on basic wood species and more on surface aesthetics and specialized performance characteristics. Customization features, such as unique texturing (hand-scraped, wire-brushed), non-traditional color staining (e.g., bleached or gray tones), and hyper-matte oil finishes, will dictate consumer preference in the high-end segment. Performance specifications, including enhanced acoustic insulation properties necessary for multi-story buildings, and specialized formulations for resistance against high-impact sports use (in athletic facilities), are expanding the application scope of engineered strip parquet into niche, high-value commercial markets. Manufacturers successfully integrating these aesthetic and functional enhancements, supported by verifiable performance data, are best positioned to dominate the premium tiers of the market throughout the forecast period, leveraging the intrinsic beauty and inherent durability of wood to meet the complex demands of modern construction.

The continuous focus on maximizing yield from raw timber resources through AI-driven cutting optimization will become a standard industry practice, directly influencing cost structure and environmental metrics. Furthermore, the development of bio-composite core materials for engineered parquet, potentially incorporating recycled or rapidly renewable resources, presents a significant opportunity to further decouple the market's reliance on primary wood consumption, addressing long-term resource scarcity concerns. This technological evolution towards resource-efficient, high-performance hybrid flooring solutions will ensure the continued competitiveness of strip parquet against synthetic alternatives, reinforcing its status as a premium, sustainable, and high-value flooring option globally.

Strategic deployment of capital expenditure towards automation in the finishing lines is also crucial. Automated sanding and coating processes ensure uniformity and speed, which are essential for fulfilling high-volume orders without compromising the exquisite quality expected of natural wood products. Specifically, robotic application of finishing layers, often utilizing UV light curing, drastically reduces the curing time and minimizes human error, resulting in a more durable and consistently high-quality surface finish. This emphasis on manufacturing precision is what differentiates market leaders and secures long-term contracts in demanding commercial sectors, where product failure or inconsistency is not tolerated. The intersection of traditional wood craftsmanship and modern industrial automation defines the current competitive edge in the strip parquet sector, ensuring scalability while preserving the inherent natural beauty of the product.

Another area for substantial growth is the restoration and maintenance market. Given the inherent value and long lifespan of strip parquet, the demand for specialized services—including dustless sanding technologies and non-toxic refinishing solutions—is substantial and growing. Manufacturers that offer or partner with certified maintenance professionals can secure additional revenue streams and reinforce the floor's value proposition. Lägler GmbH, noted in the key players list, is prominent not for producing the floor itself, but for specializing in the high-quality sanding machinery necessary for parquet maintenance, highlighting the importance of the extended service ecosystem around the product. Providing comprehensive care kits and localized maintenance support differentiates brands and ensures that consumers fully realize the decades-long lifespan benefits of their investment.

The impact of trade tariffs and geopolitical instability on the global movement of hardwood timber continues to pose risks. Diversifying sourcing geographically and species-wise, while maintaining stringent sustainability checks, is a key mitigation strategy. For instance, manufacturers relying heavily on specific European oak sources may seek viable alternatives from North American species or expand the use of thermal modification techniques on locally sourced woods to achieve similar performance attributes. This strategic resilience against external shocks to the supply chain is critical for maintaining stable pricing and reliable delivery schedules, especially important in large-scale construction projects where delays are costly. The ongoing complexity in global logistics underscores the increasing value of manufacturers with established, redundant supply infrastructures.

Finally, addressing the acoustic performance of flooring is a non-negotiable requirement, particularly in multi-family and commercial constructions. Manufacturers are continuously innovating engineered strip parquet designs by integrating specialized acoustic underlayment materials (e.g., cork, high-density foam) directly into the plank structure or developing specialized installation techniques to minimize impact sound transmission. Compliance with increasingly strict building codes regarding sound mitigation, especially in urban areas, provides a competitive advantage for products engineered specifically for superior acoustic dampening, further expanding the applicability of strip parquet beyond traditional residential use into high-density living environments and corporate offices. This focus on performance metrics beyond pure aesthetics is key to securing future commercial market share.

The Strip Parquet Floors Market is mature yet highly adaptive, constantly incorporating technological and material innovations to meet the evolving demands of both high-end consumers and stringent commercial specifications. The market’s sustained growth hinges on its ability to offer a superior, long-term, and increasingly sustainable flooring solution, leveraging the timeless appeal of natural wood with the stability and performance guarantees of modern engineering.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager