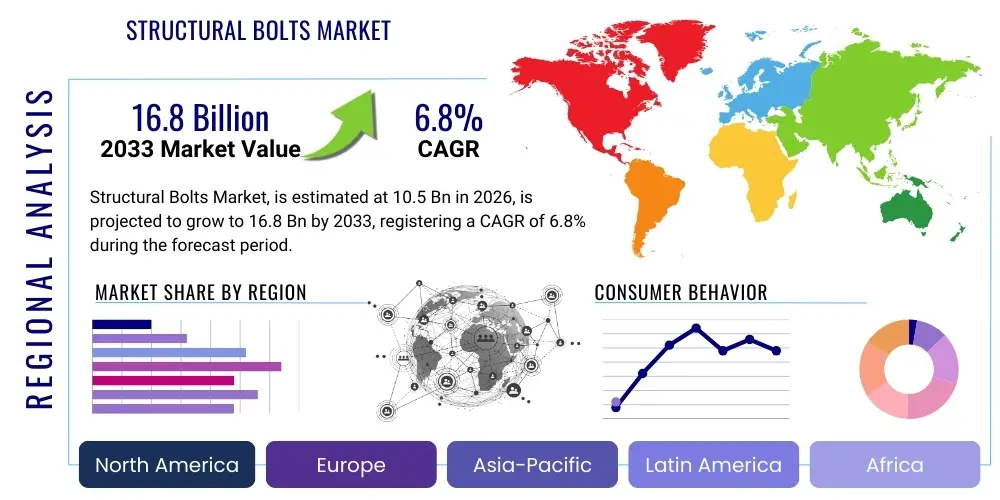

Structural Bolts Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441595 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Structural Bolts Market Size

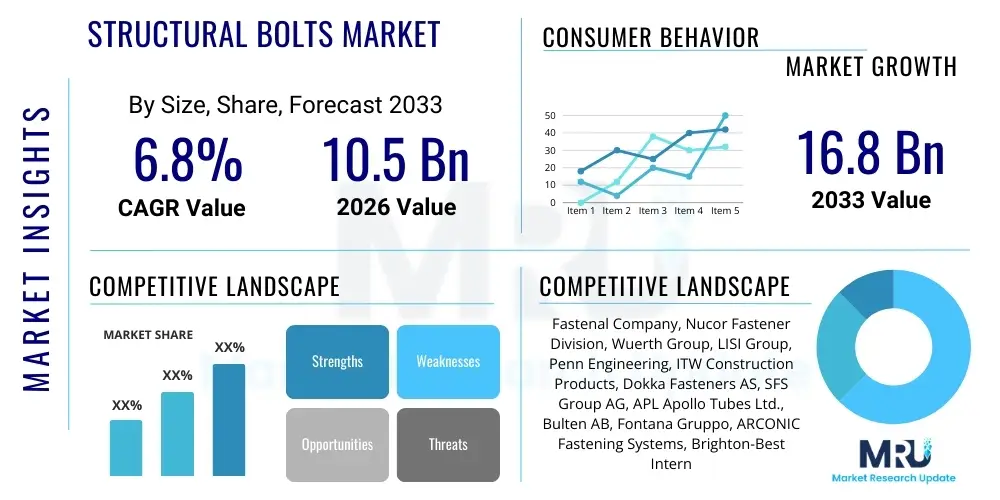

The Structural Bolts Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 10.5 billion in 2026 and is projected to reach USD 16.8 billion by the end of the forecast period in 2033.

Structural Bolts Market introduction

Structural bolts are highly engineered fastening components specifically designed for heavy-duty load-bearing connections in structural applications, primarily within the construction, infrastructure, and heavy engineering sectors. These bolts are manufactured to meet stringent specifications, such as ASTM standards (A325, A490, F1852, F2280), ensuring they possess superior tensile strength, shear resistance, and durability necessary to withstand dynamic loads, fatigue, and environmental stressors inherent in major structural assemblies like bridges, high-rise buildings, and industrial plants. The primary product variations include heavy hex structural bolts, tension control (TC) bolts, and specialized anchor bolts, differentiated by their material composition, typically high-strength alloy steel, and surface treatments like hot-dip galvanizing for corrosion resistance. The rigorous quality control associated with these products is paramount, given their direct impact on the safety and longevity of critical infrastructure projects globally.

The major applications for structural bolts span across several critical industries. In civil engineering, they are indispensable for joining steel framework in bridges, tunnels, and elevated highways, where consistency and reliability under extreme stress are non-negotiable. Within commercial and residential construction, these fasteners secure the primary structural steel frames of skyscrapers, stadiums, and manufacturing facilities. Furthermore, the energy sector, encompassing wind turbine towers, oil and gas platforms, and power generation facilities, relies heavily on high-tensile structural bolting systems to maintain operational integrity in harsh environments. The increasing complexity and scale of modern construction projects, coupled with stricter regulatory requirements concerning structural stability and seismic resilience, continue to drive the demand for high-performance structural bolts that offer consistent preload and exceptional fatigue life.

The market is currently being driven by rapid global urbanization and substantial public and private sector investment in infrastructure renewal programs, particularly in emerging economies of the Asia Pacific region. Key benefits offered by structural bolting solutions include superior resistance to loosening compared to conventional fastening methods, ease of installation using specialized tools, and verifiable compliance with international safety codes. However, market growth is also highly correlated with commodity pricing for raw materials like steel and fluctuating construction cycles. Technological advancements in coatings, such as zinc-aluminum flake systems, and innovations in installation technology, including smart bolting systems for real-time tension monitoring, are further enhancing product appeal and operational efficiency on large-scale construction sites, securing the market's trajectory through the forecast period.

Structural Bolts Market Executive Summary

The Structural Bolts Market is characterized by robust growth, primarily fueled by global infrastructure spending and the ongoing transition toward pre-engineered steel structures which inherently require high-strength fastening solutions. Current business trends indicate a strong emphasis on supply chain resilience, necessitated by volatility in steel prices and geopolitical trade disruptions. Leading manufacturers are focusing on backward integration to secure raw material access and are investing heavily in automated manufacturing processes to improve production consistency and volume capacity. Furthermore, there is a discernible shift towards specialized, value-added products, such as tension-control bolts and sophisticated corrosion-resistant coatings, responding to the demand for minimized maintenance and extended lifespan in critical applications like coastal structures and chemical processing plants. Mergers and acquisitions remain a key strategy for market players to consolidate regional presence and acquire niche technological expertise, driving competitive intensity.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine for the structural bolts market, propelled by massive infrastructure development projects, including high-speed rail networks, urban mass transit systems, and massive industrial park expansions, particularly in China, India, and Southeast Asian nations. North America and Europe, while representing mature markets, exhibit stable demand driven by repair, renovation, and replacement (RR&R) of aging infrastructure, coupled with stringent quality requirements that favor premium, certified structural fastening systems. Regulatory frameworks in these mature markets, such as those governed by AISC (American Institute of Steel Construction) and Eurocodes, establish high barriers to entry for uncertified products, thus ensuring market dominance for established players. The Middle East and Africa (MEA) region shows significant cyclical growth tied to large-scale construction booms in the energy and hospitality sectors.

Segment trends highlight the dominance of High-Strength Steel Bolts (A325 and A490 equivalents) based on material, attributed to their widespread use across most heavy construction applications. By product type, the demand for Tension Control (TC) bolts is experiencing the fastest acceleration. TC bolts offer advantages in installation speed and verification of proper tensioning, which is crucial for safety and efficiency in large-scale field work, making them increasingly preferred over traditional heavy hex assemblies, despite a higher unit cost. The end-use segment continues to be led by the Construction and Infrastructure sectors, which collectively account for the vast majority of consumption. However, the specialized application in the Renewable Energy sector, specifically wind and solar utility installations, is projecting above-average growth rates as global energy transition initiatives gain momentum, requiring exceptionally durable fasteners capable of handling cyclical loading and vibration.

AI Impact Analysis on Structural Bolts Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the structural bolts market typically revolve around optimizing manufacturing efficiency, enhancing quality control, and streamlining supply chain logistics. Users frequently ask: "How can AI reduce material waste in bolt manufacturing?" or "Will AI-driven inspection systems replace manual quality assurance for structural fasteners?" and "Can predictive AI modeling improve forecasting for volatile steel procurement?" These questions underscore a primary industry concern: maintaining high standards of product integrity and traceability while simultaneously achieving cost efficiencies in a fiercely competitive, commodity-driven market. There is significant interest in AI's role in digital twinning of manufacturing plants, simulating stress tests, and optimizing machine parameters to ensure zero-defect production of safety-critical fasteners.

The key themes emerging from this user analysis suggest that the adoption of AI is not focused on the structural bolt product itself, but rather on the processes surrounding its production, distribution, and application. Expectations center on leveraging AI for sophisticated Non-Destructive Testing (NDT) image analysis, moving beyond simple automation toward predictive maintenance of manufacturing equipment to minimize downtime, which is crucial given the high capital expenditure associated with cold heading and threading machinery. Furthermore, the integration of smart sensors into structural installations, analyzed by AI algorithms, is anticipated to revolutionize the maintenance and inspection cycle, moving from scheduled inspections to condition-based monitoring, thus impacting the replacement cycle demand for structural bolts.

The structural bolts industry views AI as an essential tool for achieving higher compliance levels and reducing long-term liability. By utilizing machine learning algorithms to analyze large datasets derived from material batches, heat treatment processes, and final physical testing, manufacturers can establish tighter tolerances and more reliable product consistency than traditional statistical process control allows. This adoption is expected to create a competitive advantage for producers who can offer 'smart' or 'digitally-certified' batches, guaranteeing performance parameters backed by verifiable AI-driven analytics, thereby solidifying trust with major infrastructure developers and governmental procurement agencies focused on mitigating structural failure risks.

- AI-driven Predictive Maintenance: Minimizing downtime on cold heading and forging machinery, ensuring consistent production flow.

- Enhanced Quality Assurance: Utilizing machine vision and deep learning for rapid, precise, and non-subjective defect detection in fasteners.

- Supply Chain Optimization: ML algorithms predicting demand fluctuations and optimizing inventory levels for high-cost raw materials like alloy steel.

- Design Optimization: AI tools assisting in the virtual simulation of bolt performance under extreme loading conditions and fatigue cycles.

- Process Parameter Tuning: Real-time adjustment of heat treatment and surface coating processes to maximize material strength and corrosion resistance.

- Smart Bolting Systems: Integration of low-power sensors and AI analytics for remote monitoring of bolt tension and structural health post-installation.

DRO & Impact Forces Of Structural Bolts Market

The structural bolts market is influenced by a powerful combination of drivers, restraints, opportunities, and external impact forces. A primary driver is the accelerating pace of global urbanization, particularly in developing economies, which necessitates massive investment in new residential, commercial, and industrial infrastructure, all reliant on steel frame construction. Concurrently, government-led initiatives across mature economies focusing on the repair, maintenance, and upgrade of aging civil infrastructure, such as highways, railways, and utilities, provide a stable, recurring demand base. Furthermore, the increasing adoption of highly precise, prefabricated steel structures in construction mandates the use of certified structural bolts for rapid, reliable assembly, driving technical specification requirements higher and favoring specialized product segments like tension-control bolts. These factors collectively create a strong, cyclical positive pressure on market expansion.

Conversely, significant restraints hinder market growth and profitability. The most critical constraint is the volatile price fluctuation and supply chain instability associated with core raw materials, predominantly steel and various metal alloys, which directly impacts manufacturing costs and profit margins. Structural bolts, being a commodity-like product sensitive to price competition, struggle to absorb large material cost increases without losing competitive edge. Additionally, the market faces stringent regulatory and quality control standards (ASTM, ISO, European norms). While these standards ensure safety, compliance requires costly certifications, rigorous testing, and specialized manufacturing equipment, creating high barriers to entry and limiting the proliferation of smaller, uncertified producers, thus restricting market dynamism and keeping production concentrated among a few global giants.

Opportunities for market players lie predominantly in technological innovation and geographic diversification. The opportunity to develop and commercialize advanced materials and coatings, such as high-performance zinc flake coatings or duplex stainless steel grades, offers premium pricing potential by enhancing corrosion resistance and extending the lifespan of fasteners in extreme environments. Furthermore, integrating Industry 4.0 technologies—including AI for quality control and IoT for smart installation monitoring—allows manufacturers to differentiate their offerings as sophisticated, value-added components rather than simple commodities. The impact forces acting on this market include macroeconomic factors like global GDP growth, which correlates directly with construction spending, and environmental regulations which are pressuring manufacturers to adopt sustainable manufacturing practices, potentially increasing short-term production costs but opening up long-term opportunities for 'green' certified fasteners.

Segmentation Analysis

The Structural Bolts Market is meticulously segmented based on material, product type, coating type, application, and end-use sector, providing a granular view of demand dynamics across various construction and engineering disciplines. Understanding these segments is crucial for market participants to tailor their manufacturing capabilities and sales strategies, as the requirements for a structural bolt used in a seismic zone skyscraper differ significantly from those used in a non-critical agricultural structure. The core segmentation revolves around differentiating high-strength fasteners designed for specific load requirements and environmental exposure, ensuring compliance with diverse national and international safety standards.

Segmentation by material, primarily focusing on carbon steel, alloy steel, and stainless steel, reflects the required tensile strength and corrosion resistance needed for the end application. Alloy steel bolts, typically meeting ASTM A490 specifications, cater to the highest strength requirements in critical load-bearing assemblies. Product type segmentation, which includes Heavy Hex Bolts and Tension Control (TC) Bolts, highlights differences in installation methodology and quality verification. TC bolts, which utilize a shear-off spline mechanism for verifiable installation tension, are rapidly gaining share due to their efficiency and reliability in large infrastructure projects where installation verification is a time-consuming and critical factor.

The market’s end-use segmentation reveals the primary consumption centers. The Infrastructure sector, encompassing bridges, highways, and utility towers, remains the largest consumer, driven by ongoing governmental expenditure. However, the renewable energy sector, particularly onshore and offshore wind farms, is emerging as a high-growth segment, demanding specialized fasteners capable of withstanding extreme vibration, high fatigue cycles, and harsh marine or remote environmental conditions. Strategic focus on these specialized, higher-margin applications is key for manufacturers looking to mitigate the cyclical risks associated with general commercial construction.

- By Material Type:

- Carbon Steel Structural Bolts (ASTM A307)

- Alloy Steel Structural Bolts (ASTM A325, ASTM A490)

- Stainless Steel Structural Bolts (304, 316 Grades)

- Specialized Nickel-Alloy Bolts

- By Product Type:

- Heavy Hex Structural Bolts (Non-TC)

- Tension Control (TC) Bolts (Twist-off type)

- Anchor Structural Bolts

- Custom Engineered Fasteners

- By Coating Type:

- Hot-Dip Galvanized (HDG) Bolts

- Zinc Plated Bolts

- Mechanical Galvanized Bolts

- Zinc-Aluminum Flake Coating Bolts

- Plain/Black Oxide Finish

- By Application:

- Steel Frame Construction

- Bridge and Highway Construction

- Pre-engineered Metal Buildings (PEMB)

- Tower and Transmission Structures

- Heavy Machinery and Equipment Assembly

- By End-Use Sector:

- Construction (Commercial, Residential)

- Infrastructure (Roads, Railways, Ports)

- Energy (Oil & Gas, Conventional Power)

- Renewable Energy (Wind, Solar Utility)

- Mining and Industrial Manufacturing

Value Chain Analysis For Structural Bolts Market

The value chain for the Structural Bolts Market begins with the upstream activities centered on raw material procurement, primarily high-strength steel rod or wire, sourced from specialized steel mills. This stage is critical as the quality, composition, and consistency of the input material directly dictate the final mechanical properties of the structural bolt. Key activities include alloying, heat treatment, and drawing the steel to the required diameter and tensile specification. Manufacturers often engage in long-term supply agreements with certified steel producers to ensure material traceability and price stability, given the substantial cost component of raw steel in the final product. Efficiency in this upstream segment relies heavily on managing commodity price volatility and minimizing material waste during the initial forming stages.

The core manufacturing process involves cold heading, threading, and heat treatment, where the raw steel is transformed into the final structural bolt product. This mid-stream segment requires significant capital investment in specialized machinery, including multi-station cold formers and precise induction or vacuum furnaces for heat treating, which impart the required strength (e.g., A325 or A490 grade). Following production, bolts are typically finished with corrosion-resistant coatings, such as hot-dip galvanizing or specialized zinc flake coatings, before undergoing stringent quality assurance tests and certification processes to meet industry standards. Distribution channels then take over, differentiating between direct sales to large construction companies and indirect sales through specialized industrial distributors and wholesalers who maintain local inventories and cater to smaller projects and maintenance needs.

Downstream activities involve the end-use applications in construction, infrastructure, and heavy engineering. The selection and procurement of structural bolts are often dictated by engineering specifications provided by structural consulting firms and approved by regulatory bodies. Direct sales channels are preferred for massive infrastructure projects, allowing manufacturers to offer technical support and direct quality control oversight. Indirect channels, through regional distributors, play a crucial role in providing logistical efficiency and just-in-time delivery to multiple, dispersed construction sites. The profitability of the downstream market is highly dependent on factors like project timelines, labor costs, and the availability of specialized installation equipment, such as calibrated torque wrenches and tension calibrators, emphasizing the importance of integrated product-service solutions offered by key market players.

Structural Bolts Market Potential Customers

Potential customers for structural bolts are defined by sectors requiring certified, high-strength fastening solutions for permanent, load-bearing connections. The most significant customer base resides within the Construction industry, specifically companies specializing in large commercial buildings, high-rise towers, and institutional facilities that rely on structural steel frameworks. These buyers prioritize product certification (e.g., adherence to ASTM standards), reliable supply volume, and batch traceability, often requiring extensive documentation for regulatory compliance and safety auditing purposes. Furthermore, the relationships with steel fabricators and erectors are paramount, as they are the direct implementers who specify and purchase the bolts based on the structural engineer’s drawings and project schedule demands.

The Infrastructure development segment represents another pillar of demand, encompassing governmental agencies and private contractors involved in monumental civil engineering projects. This includes organizations responsible for constructing and maintaining bridges, elevated road systems, ports, and rail infrastructure. For these customers, long-term durability, resistance to fatigue, and exceptional corrosion resistance (often necessitating hot-dip galvanizing or specialized coatings) are critical purchasing factors due to the expected 50-100 year lifespan of the assets. Procurement in this area is often subject to strict public tenders and competitive bidding processes where life-cycle cost analysis often outweighs initial unit price, favoring high-quality, premium fasteners.

Beyond traditional construction, the Energy sector serves as a high-value customer segment. This includes major utility companies, EPC (Engineering, Procurement, and Construction) firms focused on oil and gas installations, and, increasingly, developers of renewable energy projects. Wind farm developers, for instance, are substantial buyers of specialized, large-diameter structural bolts for tower assembly, requiring fasteners capable of enduring high cyclical loads and extreme weather. These buyers require partners capable of providing technical design assistance, bespoke fastening solutions, and global logistics support, given the remote and highly specialized nature of these installations, positioning them as ideal targets for manufacturers offering customized, integrated bolting packages.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 10.5 Billion |

| Market Forecast in 2033 | USD 16.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fastenal Company, Nucor Fastener Division, Wuerth Group, LISI Group, Penn Engineering, ITW Construction Products, Dokka Fasteners AS, SFS Group AG, APL Apollo Tubes Ltd., Bulten AB, Fontana Gruppo, ARCONIC Fastening Systems, Brighton-Best International, Infasco, SWF Industrial Fasteners, Kamax Holding GmbH & Co. KG, Birmingham Fastener, Precision Fasteners Ltd., Gem-Year Industrial Co., Ltd., Tong Ming Enterprise Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Structural Bolts Market Key Technology Landscape

The key technology landscape in the Structural Bolts Market is dominated by advancements in manufacturing precision, material science, and digital integration. Manufacturing technology emphasizes the use of advanced multi-station cold forging machines, which allow for high-speed, high-volume production of fasteners with near-net-shape geometry, minimizing material wastage and improving grain structure integrity. Precision heat treatment processes, particularly controlled atmosphere and vacuum heat treatment, are essential for achieving the specific mechanical properties required by high-strength standards like ASTM A490. Furthermore, specialized threading techniques, such as rolling after heat treatment (where permitted by standards), are employed to enhance the fatigue life of the bolt threads, a critical factor in dynamic structural applications like bridges and machinery.

Material science innovation centers on developing high-performance alloy steels that offer enhanced strength-to-weight ratios and superior low-temperature toughness, vital for applications in arctic environments or deep-sea oil rigs. Significant investment is also directed toward advanced corrosion protection technologies. This includes sophisticated surface treatments beyond traditional hot-dip galvanizing, such as mechanically plated zinc finishes and multilayered zinc-aluminum flake coatings (like Geomet or Dacromet), which provide excellent sacrificial and barrier protection without inducing hydrogen embrittlement, a significant risk associated with conventional plating on high-strength steels. These material and coating technologies are crucial differentiators, allowing manufacturers to address increasingly severe operating environments.

More recently, the landscape has seen the emergence of digital and smart fastening technologies. This includes the development of Tension Control (TC) bolts with highly precise shear-off splines for verifiable preload, and the introduction of smart bolts embedded with miniature sensors (strain gauges or piezoelectric elements). These smart fasteners, although niche and higher cost, enable real-time monitoring of tension and structural loads, which is invaluable for predictive maintenance programs in critical infrastructure like wind turbines and power plants. This integration of IoT and sensors into mechanical components transforms the structural bolt from a static component into a dynamic data point, driving efficiency and safety throughout the asset lifecycle, aligning the industry with broader Industry 4.0 trends in construction technology.

Regional Highlights

The Structural Bolts Market demonstrates distinct regional dynamics heavily influenced by local infrastructure policies, economic maturity, and construction practices. The Asia Pacific (APAC) region is indisputably the fastest-growing market, largely driven by countries like China and India, which are undertaking unprecedented urban development and infrastructure expansion, including massive investments in railway networks, industrial corridors, and public housing. The high volume of consumption, sometimes tolerating slightly lower quality standards in non-critical applications, dictates a strong price competition environment. However, increasing adoption of international standards in newly developed metropolitan areas is creating a dual market structure favoring certified fasteners.

North America (NA) represents a market defined by high standards and replacement demand. The U.S. and Canada benefit from continuous investment in the repair and rehabilitation of decades-old bridges, highways, and utility infrastructure, which mandates the use of highly certified, premium structural bolts (A325, A490, and specialty corrosion-resistant materials). The market here is less about new, sprawling construction and more focused on durability, traceability, and compliance with stringent state and federal procurement regulations, ensuring stable, high-value demand for domestic and international manufacturers that maintain approved supplier status.

Europe mirrors the maturity of North America, characterized by strong regulatory oversight, particularly adherence to Eurocodes and CE marking requirements. The European demand is stable, primarily driven by complex commercial construction, industrial plant upgrades, and significant renewable energy projects, especially offshore wind farms which require highly specialized, marine-grade fasteners. Western European nations, such as Germany and the UK, prioritize innovation in installation technology and corrosion protection. The Middle East and Africa (MEA) market experiences highly cyclical demand linked to oil price stability and the execution of mega-projects, such as new city developments and major industrial complexes, requiring large, sporadic bulk orders of structural fasteners.

- Asia Pacific (APAC): Dominant in volume and growth rate; driven by massive urbanization, infrastructure projects (e.g., Belt and Road Initiative), and rapid industrialization in emerging economies like India and Indonesia.

- North America: Stable, high-value market focused on replacement and rehabilitation of aging infrastructure; stringent regulatory compliance (AISC, ASTM) dictates demand for premium, certified fasteners.

- Europe: Focus on highly specified, corrosion-resistant bolts due to high standards and major renewable energy investments (offshore wind); adherence to European technical assessments (ETA) is mandatory.

- Latin America (LATAM): Growth tied to resource extraction (mining) and local infrastructure modernization; high variability in quality standards across different national markets.

- Middle East and Africa (MEA): Demand is project-driven, highly sensitive to geopolitical stability and energy sector investments; significant use of specialized fasteners for oil & gas and large public works in the GCC region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Structural Bolts Market.- Fastenal Company

- Nucor Fastener Division

- Wuerth Group

- LISI Group

- Penn Engineering

- ITW Construction Products

- Dokka Fasteners AS

- SFS Group AG

- APL Apollo Tubes Ltd.

- Bulten AB

- Fontana Gruppo

- ARCONIC Fastening Systems

- Brighton-Best International

- Infasco

- SWF Industrial Fasteners

- Kamax Holding GmbH & Co. KG

- Birmingham Fastener

- Precision Fasteners Ltd.

- Gem-Year Industrial Co., Ltd.

- Tong Ming Enterprise Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Structural Bolts market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for high-strength structural bolts?

The primary driver is the accelerating global investment in infrastructure renewal and new construction, particularly high-rise commercial buildings and complex transportation systems, which require reliable, certified, high-tensile steel connections for safety and longevity.

How do Tension Control (TC) bolts differ from standard heavy hex structural bolts?

TC bolts feature a shear-off spline at the end that twists off when the predetermined tension (preload) is achieved during installation, offering a faster and verifiable method of quality assurance compared to standard heavy hex bolts which require precise torque wrench calibration and manual tension monitoring.

Which geographical region exhibits the highest growth potential in the structural bolts market?

The Asia Pacific (APAC) region, spearheaded by large-scale infrastructure and industrial construction in countries like China and India, is projected to maintain the highest compound annual growth rate due to ongoing urbanization and expansive development projects.

What regulatory standards are most critical for structural bolt manufacturers?

Adherence to standards established by organizations such as ASTM International (e.g., A325, A490, F1852) in North America, and compliance with the European technical assessment guidelines (Eurocodes/CE Marking) are critical for ensuring product performance, safety, and market acceptance globally.

How does the volatility of raw material prices impact the market dynamics of structural bolts?

As steel constitutes the major component cost, fluctuating steel prices lead to unstable manufacturing margins and pricing pressure. This volatility forces manufacturers to focus on securing long-term supply agreements and optimizing production processes to maintain competitive pricing in the commodity-sensitive market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager