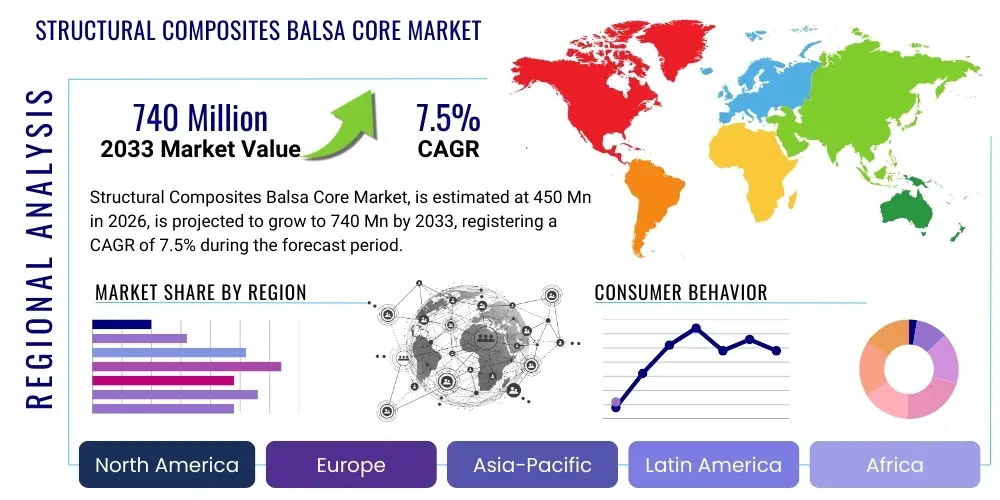

Structural Composites Balsa Core Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443167 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Structural Composites Balsa Core Market Size

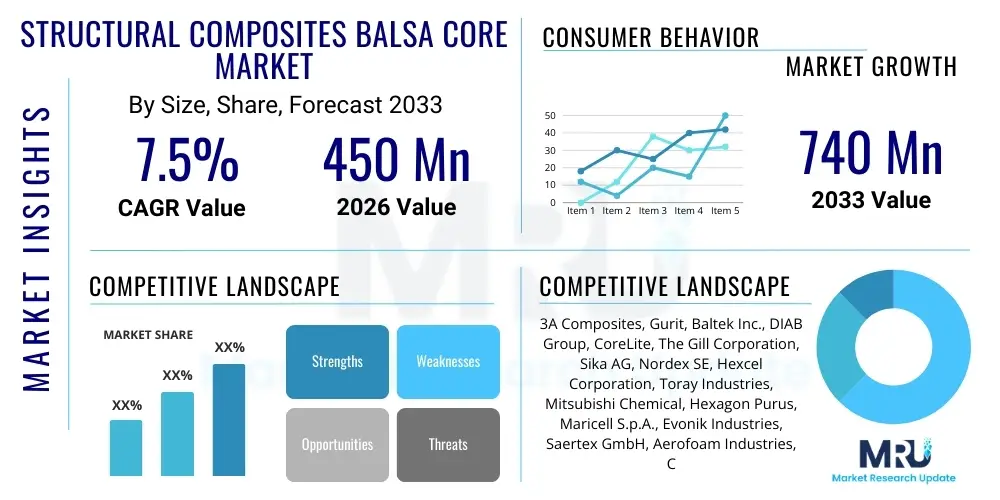

The Structural Composites Balsa Core Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 740 Million by the end of the forecast period in 2033. This robust expansion is primarily driven by the escalating demand from the renewable energy sector, particularly wind turbine blade manufacturing, where the material's exceptional strength-to-weight ratio is critical for achieving efficiency and scale.

The calculation of market size reflects the increasing adoption of balsa core materials over synthetic alternatives in applications requiring high performance and low density. Geographical expansion into emerging economies, coupled with favorable governmental policies promoting sustainable infrastructure, further solidifies the growth trajectory. The valuation methodology incorporates revenue generated from both processed end-grain balsa products and associated material kits supplied to key industrial sectors.

Forecasting projections are influenced by material availability, advancements in bonding agents, and the cyclical nature of key end-user industries like aerospace and marine construction. Despite occasional supply chain volatility stemming from the primary balsa cultivation regions in Ecuador, strategic sourcing and diversification efforts by major manufacturers are expected to mitigate long-term risks, ensuring stable market expansion through 2033. The focus on lightweighting across transportation and infrastructure sectors provides a sustained foundational demand.

Structural Composites Balsa Core Market introduction

The Structural Composites Balsa Core Market centers around engineered materials derived from balsa wood (Ochroma pyramidale), specifically utilized as the lightweight core layer in sandwich composite structures. Balsa core material, known for its low density, high shear strength, and excellent insulating properties, is structurally optimized for applications where minimizing weight without compromising stiffness or integrity is paramount. The primary product form is end-grain balsa wood, which ensures superior compressive and shear performance when laminated between stiff skins of fiber-reinforced polymers (FRPs) such as fiberglass or carbon fiber. This configuration creates sandwich panels widely used in high-performance structural applications.

Major applications of balsa core materials span across several demanding industries. The wind energy sector remains the dominant consumer, leveraging balsa's properties for the fabrication of massive, load-bearing rotor blades where weight reduction directly impacts turbine efficiency and longevity. The marine industry employs balsa cores extensively in boat hulls, decks, and superstructures to achieve hydrodynamically efficient, lightweight vessels. Furthermore, aerospace components, civil infrastructure elements like bridge decks, and high-speed rail transportation all utilize balsa composites for achieving energy efficiency and enhanced structural performance.

The market is fundamentally driven by the inherent benefits of balsa as a core material, which include its natural renewability and carbon neutrality, appealing to industries prioritizing sustainability. Its excellent fatigue resistance and dimensional stability under varying temperatures further enhance its appeal over synthetic foams in demanding environments. Key driving factors include global regulatory mandates for reduced emissions in transportation, the exponential growth of the global wind farm capacity, and continuous innovation in composite manufacturing techniques that optimize balsa integration, making it a preferred material for high-stress, weight-sensitive structural applications.

Structural Composites Balsa Core Market Executive Summary

The Structural Composites Balsa Core Market is positioned for significant growth, underpinned by robust business trends emphasizing sustainability and material performance efficiency. Leading manufacturers are investing heavily in Ecuador and other balsa cultivation regions to secure reliable supply chains and enhance processing efficiencies, moving towards fully traceable and certified sustainable sourcing. A critical business trend involves the development of pre-kitted balsa core solutions, customized with precision for large-scale composite projects, reducing waste and simplifying the lamination process for end-users in the wind and marine industries. Strategic mergers and acquisitions among core suppliers and composite material providers are reshaping the competitive landscape, aiming to offer integrated composite solutions rather than standalone core materials.

Regionally, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by massive investments in wind power capacity, particularly in China and India, alongside burgeoning naval shipbuilding activities. Europe continues to be a mature but strong market, driven by stringent energy efficiency standards and advanced manufacturing capabilities in Germany and Spain, focusing heavily on offshore wind applications. North America is experiencing steady demand, primarily from the upgrade and maintenance of existing infrastructure and the marine leisure sector, alongside nascent applications in electric vehicle battery enclosures requiring high strength-to-weight ratios.

Segment trends highlight the enduring dominance of the wind energy sector in terms of volume consumption, although the marine segment remains crucial for high-margin, specialized balsa products. By product type, end-grain balsa dominates due to its superior mechanical performance in shear loading environments inherent to rotor blades. The market is also witnessing a trend towards combining balsa with hybrid cores (e.g., balsa/PET foam combinations) to optimize cost-performance balance for mid-range applications. The focus across all segments is on material processing innovations that minimize resin uptake, thus further enhancing the lightweighting advantage of the balsa core structure.

AI Impact Analysis on Structural Composites Balsa Core Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on the Structural Composites Balsa Core Market reveals primary concerns centered on supply chain stability, manufacturing precision, and quality control automation. Users are particularly interested in how AI can address the inherent variability of a natural product like balsa wood, asking questions such as "Can AI predict balsa wood yield and density variations?" and "How is machine learning improving defect detection in balsa processing?" The central theme revolves around leveraging predictive analytics to stabilize the raw material supply chain originating mostly from remote regions and using computer vision systems to ensure consistent grading and dimensional accuracy during core preparation, thus standardizing the input material for high-stakes structural applications. Expectations are high regarding AI's potential to optimize lamination processes and reduce material waste.

The integration of AI technologies is fundamentally transforming the manufacturing and deployment stages of balsa core composites. In the upstream supply chain, machine learning algorithms are being utilized to analyze historical yield data, weather patterns, and soil conditions to optimize the cultivation and harvesting schedules of balsa plantations, aiming to ensure a more predictable and consistent supply volume. This predictive capability minimizes price volatility and enhances inventory management for composite manufacturers globally. Furthermore, AI-driven demand forecasting allows core suppliers to align production schedules precisely with the fluctuating needs of the massive wind energy sector, which is prone to large, infrequent orders.

Downstream, in the composite manufacturing process, AI applications focus heavily on quality assurance and process optimization. High-speed, high-resolution cameras powered by computer vision and deep learning models are now deployed to automatically inspect balsa core sheets for knots, density anomalies, and dimensional defects far faster and more accurately than traditional manual inspection. AI also plays a role in optimizing the resin infusion process in Vacuum Assisted Resin Transfer Molding (VARTM) used for large structures, predicting optimal vacuum levels and resin flow rates based on balsa core morphology, thereby ensuring complete saturation and minimizing structural voids. This level of precision is crucial for structural integrity in highly demanding applications like 100-meter-plus wind turbine blades.

- AI-driven predictive analytics optimize balsa harvesting and raw material inventory management, reducing supply chain volatility.

- Machine learning algorithms enhance demand forecasting, aligning core production with cyclical wind energy projects.

- Computer vision systems enable automated, high-speed inspection of balsa core quality, detecting density variations and defects with high precision.

- Predictive maintenance models for core processing machinery reduce downtime and improve operational efficiency.

- AI optimizes composite lamination processes (e.g., VARTM), ensuring precise resin uptake and maximizing structural performance in final parts.

- Data analytics derived from sensor feedback during usage (e.g., in turbine blades) informs future core material specifications and design improvements.

DRO & Impact Forces Of Structural Composites Balsa Core Market

The Structural Composites Balsa Core Market is highly influenced by a dynamic interplay of drivers, restraints, and opportunities, collectively shaping its trajectory and competitive intensity. The primary driver remains the unprecedented global commitment to renewable energy, specifically wind power, necessitating increasingly longer and lighter rotor blades that inherently rely on materials offering high stiffness-to-weight ratios like balsa. Simultaneously, the material’s intrinsic sustainability credentials—being a rapidly renewable resource that sequesters carbon—align perfectly with corporate ESG (Environmental, Social, and Governance) mandates, providing a significant competitive advantage over petrochemical-derived foam cores. These core strengths push manufacturers toward greater capacity and process optimization.

However, the market faces significant restraints, chiefly concerning the supply chain vulnerability and price volatility of raw balsa wood. Since high-quality, high-density balsa primarily originates from specific equatorial regions, primarily Ecuador, geopolitical instability, unexpected weather events, and land-use competition can drastically affect availability and pricing. Furthermore, balsa core faces intense competition from high-performance synthetic foams such as PET (polyethylene terephthalate) and PVC (polyvinyl chloride) foams, which offer superior consistency, often lower cost (when considering long-term supply agreements), and moisture resistance in certain marine environments. These restraints compel manufacturers to maintain diversified core material portfolios.

Opportunities for market growth are abundant, particularly in emerging composite applications within the transportation sector. The electrification of mobility (EVs) presents a compelling avenue, where balsa cores can be integrated into battery enclosures, chassis components, and interior panels to offset the weight added by large battery packs, thus extending vehicle range. Furthermore, advancements in bio-based resin systems and surface treatments that enhance the moisture resistance of balsa core open doors for broader application in harsh environments and infrastructure projects. The combination of sustainable material attributes and technical performance positions balsa core for substantial long-term expansion, particularly in high-growth, innovation-led composite sectors.

Segmentation Analysis

The Structural Composites Balsa Core Market is comprehensively segmented based on product type, end-use application, and processing method, allowing for a detailed analysis of specific market niches and growth drivers. Understanding these segments is crucial for strategic planning, as different applications require specific density ranges and core configurations of balsa material. The segmentation reflects the specialized requirements of high-performance industries where material choice directly impacts the final structural integrity and functional lifespan of the composite structure.

The segmentation by type, specifically between end-grain and cross-cut configurations, dictates the material's mechanical properties, with end-grain preferred for high-shear load applications due to its maximized compressive strength. The application segmentation, dominated by the wind energy sector, showcases the vast volume requirement of this industry compared to the bespoke, high-value demands of the aerospace or specialized marine sectors. Furthermore, the market differentiates based on whether the balsa core is sold as raw sheets, scored sheets (for contouring), or fully kitted and prefabricated sets, reflecting different levels of value addition and integration into the composite manufacturing supply chain.

- By Type:

- End-Grain Balsa

- Cross-Cut Balsa

- Balsa Laminates/Hybrids

- By Application:

- Wind Energy (Rotor Blades, Nacelles)

- Marine (Hulls, Decks, Superstructures)

- Aerospace and Defense (Secondary Structures, Interior Panels)

- Transportation (Rail, Automotive Components, Electric Vehicle Enclosures)

- Construction and Infrastructure (Bridge Decks, Architectural Panels)

- By Processing Method:

- Scored/Contourable Balsa

- Unscored Balsa Sheets

- Pre-kitted Balsa Cores

Value Chain Analysis For Structural Composites Balsa Core Market

The value chain for the Structural Composites Balsa Core Market is highly centralized upstream, starting with the cultivation and harvesting of Ochroma pyramidale (balsa wood), primarily concentrated in Ecuador. Upstream activities involve plantation management, specialized harvesting (due to the balsa's rapid growth cycle), and initial drying processes. High capital investment is required for securing and managing vast tracts of agricultural land suitable for balsa cultivation, along with establishing efficient logistics for moving the raw timber to primary processing centers. Key upstream factors influencing the market include sustainable sourcing certifications (like FSC) and regulatory compliance regarding land use, which directly impact the raw material cost and availability for downstream processors.

The midstream segment involves specialized processing, where raw balsa logs are sliced, kiln-dried, and then engineered into core materials, predominantly utilizing end-grain orientation for maximizing structural performance. This phase includes precision CNC cutting, scoring (for contouring capability), and assembly into large core sheets or tailored kits. Distribution channels are typically a mix of direct sales to major high-volume users, such as wind turbine manufacturers (Nordex, Vestas), and indirect distribution through specialized composite material distributors who service smaller marine, aerospace, and general industrial fabricators. The indirect route is crucial for reaching smaller, highly specialized composite workshops worldwide.

Downstream analysis focuses on the end-use applications, where composite manufacturers laminate the balsa core between composite skins (fiberglass, carbon fiber) using various processes like vacuum infusion or prepreg layup to form final structural components. Direct sales channels are dominant when core suppliers are deeply integrated with Tier 1 component manufacturers in the wind and aerospace sectors, providing JIT (Just-In-Time) customized kits. Indirect channels serve MRO (Maintenance, Repair, and Overhaul) operations and localized boat builders. The value generated downstream is heavily dependent on the performance of the final composite part, making quality assurance and technical support from the core manufacturer a critical component of the value proposition.

Structural Composites Balsa Core Market Potential Customers

The primary end-users and buyers of structural composites balsa core materials are large-scale industrial manufacturers focused on creating high-performance, lightweight structural components. The wind energy sector stands out as the single largest buyer segment, comprising global turbine manufacturers and their blade subcontractors who require consistent, large-volume supplies of end-grain balsa for multi-megawatt rotor blades. These customers demand highly customized core kits that are pre-cut and often pre-fitted with specialized structural inserts, minimizing complexity on the factory floor and accelerating production cycles.

Another major customer base resides within the marine industry, spanning commercial shipbuilding (ferries, high-speed vessels) and the leisure marine sector (yachts, powerboats). These customers prioritize balsa core for its excellent resistance to fatigue and thermal cycling, which is critical for components constantly exposed to variable loads and harsh environments. While their volume requirements are typically lower than the wind sector, their demand for premium, highly durable balsa grades often results in high-value sales. The third significant customer segment includes transportation manufacturers, particularly those developing advanced rail cars, specialized truck bodies, and components for electric vehicles, seeking balsa to meet strict weight reduction targets necessary for efficiency gains.

Potential customers also include aerospace component manufacturers, although balsa use in commercial aircraft is generally limited to secondary structures and interiors due to stringent fire regulations; however, its application in specialized defense and drone systems remains viable. Finally, civil infrastructure contractors utilize balsa core in niche applications such as pedestrian bridge panels or architectural cladding where sustainability, rapid construction, and high rigidity are required. These diverse customer groups emphasize different core properties—volume and consistency for wind, durability for marine, and lightweighting for transportation—dictating specialized product offerings from market suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 740 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3A Composites, Gurit, Baltek Inc., DIAB Group, CoreLite, The Gill Corporation, Sika AG, Nordex SE, Hexcel Corporation, Toray Industries, Mitsubishi Chemical, Hexagon Purus, Maricell S.p.A., Evonik Industries, Saertex GmbH, Aerofoam Industries, CMP Composites, Polyumac, Vencorex, Sino Composites |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Structural Composites Balsa Core Market Key Technology Landscape

The technology landscape governing the Structural Composites Balsa Core Market is primarily focused on enhancing material consistency, optimizing processing efficiency, and integrating balsa effectively into advanced composite manufacturing systems. A key technological advancement involves highly precise Computer Numerical Control (CNC) cutting and scoring equipment. This technology allows processors to create complex, contourable core kits with minimal waste and extremely tight tolerances, essential for the intricate curvature demands of modern wind turbine blades and complex marine structures. The use of advanced adhesive systems and jointing techniques is also critical, ensuring seamless continuity and mechanical integrity across large balsa core assemblies, often combining smaller planks into massive, structurally sound panels.

Another crucial technological area involves sophisticated drying and treatment processes applied to the raw balsa wood. Technology here focuses on minimizing moisture content variability and preventing microbial degradation without compromising the natural cell structure that provides the material's strength. This includes optimized kiln drying cycles monitored by sensors and the use of proprietary surface treatments to enhance compatibility with various resin systems, particularly polyester, epoxy, and vinyl ester resins commonly used in composite layup. These treatments are essential to prevent resin absorption from increasing component weight unnecessarily and to improve the overall durability of the finished product, especially against water ingress.

The convergence of Industry 4.0 principles, including high-speed automation and sophisticated sensor networks, is defining the future technology roadmap. Manufacturers are implementing systems for automated optical sorting and grading based on density, a technology critical for ensuring that only the most suitable balsa core planks are used for demanding structural parts. Furthermore, the development of hybrid core technologies, which integrate balsa with synthetic foams (e.g., PET) through co-extrusion or specialized bonding methods, represents an innovation aimed at balancing the natural core’s performance with the cost and consistency advantages of synthetic materials, offering tailored solutions for diverse structural requirements in high-volume applications.

Regional Highlights

- Asia Pacific (APAC): The APAC region is the fastest-growing market for balsa core, driven primarily by China’s aggressive expansion of its wind energy capacity, both onshore and offshore. Countries like India, South Korea, and Japan are also increasing investment in marine and transportation infrastructure, boosting demand. The market here is characterized by high volume consumption and intense price competition, necessitating robust local processing and kitting operations by global core suppliers to meet the massive supply needs of regional composite giants.

- Europe: Europe represents a mature but technologically advanced market, dominating in offshore wind energy innovation and high-end marine construction. Demand is stable, characterized by strict material quality requirements and a strong focus on certified sustainable sourcing (FSC). Germany, Spain, and Denmark are key consumers, driving demand for specialized, high-density balsa grades used in increasingly complex, large rotor blades requiring superior fatigue resistance.

- North America: The North American market is experiencing steady growth, supported by government incentives for renewable energy and a strong, active leisure marine sector. Demand is spread across wind farm expansion and the refurbishing of aging infrastructure. The region also acts as a hub for aerospace material research and development, occasionally testing balsa core applications for novel lightweight structures, emphasizing quality and domestic supply chain resilience.

- Latin America (LATAM): LATAM is crucial upstream, as it is the primary source of raw balsa wood (Ecuador). While processing capacity exists, internal consumption is lower compared to exports. The market dynamic is focused on managing resource sustainability, establishing ethical labor practices, and increasing initial processing capabilities within source countries to capture more value before export.

- Middle East and Africa (MEA): This region is a nascent market with growing potential, tied mainly to developing infrastructure projects and regional naval expansion. Currently, consumption is moderate, relying on imports, but future growth is anticipated from localized renewable energy projects seeking robust, cost-effective composite materials for extreme climate durability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Structural Composites Balsa Core Market.- 3A Composites

- Gurit

- Baltek Inc.

- DIAB Group

- CoreLite

- The Gill Corporation

- Sika AG

- Nordex SE

- Hexcel Corporation

- Toray Industries

- Mitsubishi Chemical

- Hexagon Purus

- Maricell S.p.A.

- Evonik Industries

- Saertex GmbH

- Aerofoam Industries

- CMP Composites

- Polyumac

- Vencorex

- Sino Composites

Frequently Asked Questions

Analyze common user questions about the Structural Composites Balsa Core market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the increasing demand for balsa core materials?

The primary driver is the rapid expansion of the global wind energy sector, which relies heavily on balsa core’s exceptional strength-to-weight ratio for manufacturing longer, more efficient rotor blades while meeting strict lightweighting and sustainability requirements.

How does balsa core compare to synthetic foam cores like PET or PVC in structural applications?

Balsa core generally offers superior shear and compressive strength per unit weight and is naturally sustainable. Synthetic foams offer greater consistency, better moisture resistance, and often lower, more stable pricing, leading to hybrid solutions combining the benefits of both materials in many structural composites.

What regions dominate the supply and consumption of structural balsa core?

Latin America, specifically Ecuador, dominates the raw material supply chain. Consumption is highest in Asia Pacific (driven by manufacturing volume) and Europe (driven by high-performance wind and marine applications).

What are the main risks associated with the balsa core supply chain?

The main risks include price volatility and potential supply shortages due to the geographical concentration of balsa cultivation, along with environmental risks and geopolitical instability in primary sourcing regions, necessitating stringent risk mitigation and sustainable sourcing strategies.

How is technology improving the quality and usability of balsa core materials?

Key technologies involve advanced CNC precision cutting for customized kitting, specialized chemical treatments to enhance moisture resistance and resin compatibility, and AI-driven quality inspection systems to ensure consistent density and structural integrity across batches.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager