Studio Monitor Speaker Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441958 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Studio Monitor Speaker Market Size

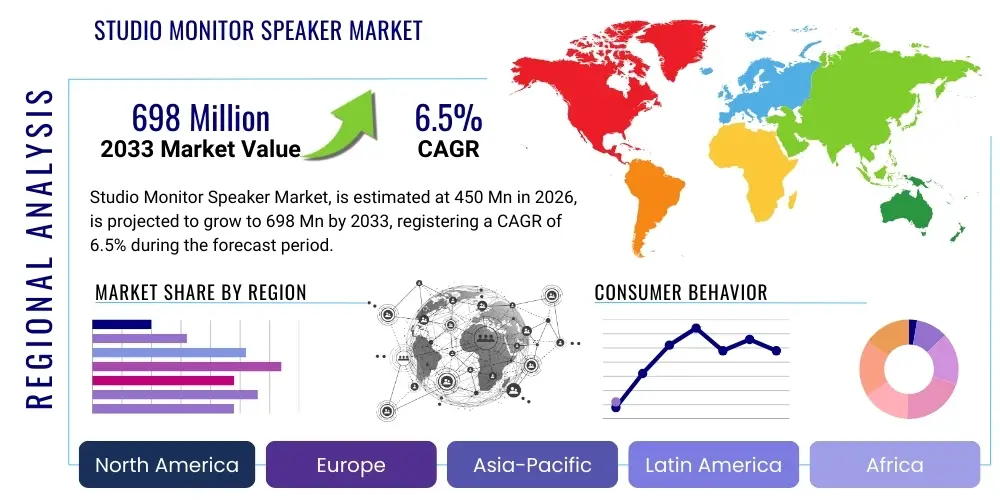

The Studio Monitor Speaker Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 698 Million by the end of the forecast period in 2033.

Studio Monitor Speaker Market introduction

The Studio Monitor Speaker Market encompasses specialized audio playback systems designed explicitly for critical listening applications within professional audio engineering, music production, broadcasting, and acoustic design. These devices are fundamentally engineered to achieve sonic transparency, characterized by an exceptionally flat frequency response, minimal harmonic distortion, and precise phase coherence across the entire operational spectrum. This design philosophy ensures that engineers and producers receive an uncolored, reliable representation of the audio source material, making them indispensable tools for accurate mixing, mastering, and quality control during the production pipeline. Unlike consumer speakers, studio monitors prioritize analytical precision over auditory pleasingness, serving as the sonic foundation for professional content creation globally.

The application spectrum for studio monitors is broad, extending from high-budget commercial recording facilities and intricate film post-production suites to rapidly proliferating project and home studios. Key functional benefits derived from utilizing high-quality monitors include superior resolution of micro-dynamics and subtle spatial cues, enhanced temporal accuracy (transient response), and dependable performance under high-SPL (Sound Pressure Level) demands often encountered during extended mixing sessions. The market is witnessing a notable transition, wherein once-exclusive high-fidelity features, such as bi-amplification and advanced acoustic porting, are now standard in affordable near-field models, catering directly to the massive influx of independent content creators.

Driving forces behind the market's current expansion include the continued global proliferation of digital media consumption, necessitating a continuous supply of professionally mastered content across streaming platforms. Furthermore, the relentless evolution of digital audio workstation (DAW) software and interface technology has lowered the barrier to entry for prospective producers, creating a robust, expanding consumer base interested in upgrading from budget headphones to dedicated monitoring systems. The incorporation of advanced digital technologies, specifically DSP for active equalization and room correction, further cements the monitor's role as a sophisticated piece of audio technology capable of adapting to diverse and acoustically challenging environments, thereby fueling demand across all market segments.

Studio Monitor Speaker Market Executive Summary

The Studio Monitor Speaker Market is experiencing dynamic growth driven by a fundamental shift toward decentralized content production, leveraging compact, high-performance active monitors. Current business trends indicate intense competition focused on integrating advanced Digital Signal Processing (DSP) capabilities to address room acoustic limitations, a key pain point for the burgeoning home studio segment. Manufacturers are increasingly utilizing strategic pricing models to capture market share among prosumers while maintaining premium pricing and high margins for flagship models targeting established commercial facilities. The market structure favors companies that can efficiently deliver precision drivers and sophisticated electronic components, particularly Class D amplifiers, within competitive supply chain frameworks.

Geographically, market dominance remains concentrated in North America and Europe, regions characterized by mature music and broadcast industries, significant investment in high-fidelity infrastructure, and strong purchasing power for premium brands. However, the future growth engine is unequivocally the Asia Pacific (APAC) region. Exponential growth in digital platforms, coupled with government initiatives supporting creative industries in countries like China, South Korea, and India, is rapidly accelerating demand for affordable, reliable monitoring solutions. Manufacturers are thus dedicating substantial resources to expanding distribution networks and localized marketing efforts across major APAC urban centers to capitalize on this regional boom.

Analysis of segment trends highlights the near-field active monitor (specifically 5-inch to 6.5-inch driver models) as the primary revenue generator due to its optimal size for project studios. The shift from passive to active systems is nearly complete in the prosumer space, streamlining user experience and system integration. Technologically, DSP-enabled monitors represent the most significant opportunity for differentiation, promising professional-grade accuracy in non-professional acoustic settings. Concurrently, the small but high-value segment of networked audio (AoIP) monitors is gaining traction among high-end commercial studios seeking modularity and remote management capabilities, signaling a trend towards fully integrated digital audio ecosystems.

AI Impact Analysis on Studio Monitor Speaker Market

User inquiries concerning AI's integration into the Studio Monitor Speaker domain primarily revolve around the efficiency gains provided by automated acoustic calibration and intelligent mixing assistance. Users often query whether AI can truly replace the necessity of human critical listening or if the monitor simply becomes a more sophisticated output device for AI algorithms. The key insight derived is that AI is not a threat to the fundamental requirement for accurate monitoring, but rather an enhancement of it. AI tools, such as neural network-driven mastering assistants and intelligent room measurement software, rely absolutely on an uncompromised, reference-grade monitor to audit the resulting sonic profile. If the monitor itself is inaccurate, the AI's output verification becomes flawed, underscoring the enduring necessity for high-transparency transducers.

Furthermore, AI significantly impacts the design and calibration phase of the monitor itself. Machine learning is increasingly being applied to driver design simulations and quality control processes, predicting material stress, optimizing acoustic loads, and ensuring ultra-tight tolerance matching between pairs of monitors. This application translates directly into higher production consistency and superior acoustic performance, even in mass-produced units. The impact of AI is therefore twofold: optimizing the monitor internally for manufacturing excellence, and externally, optimizing the monitor's performance relative to the acoustically hostile environment it is placed within, thereby enhancing user accessibility to professional results.

The expectation is that future studio monitors will feature increasingly sophisticated, built-in AI algorithms that learn user preferences and room characteristics over time, offering dynamically tailored acoustic compensation. This continuous adaptation moves beyond static room correction, providing a fluid reference point that compensates for changes in furniture placement, temperature, and even listening fatigue. This integration elevates the monitor from a passive transducer to an active, intelligent partner in the audio production workflow, commanding higher perceived value and justifying investment in premium models featuring these advanced computational capabilities.

- AI-driven room correction algorithms automatically compensate for acoustic anomalies introduced by the listening environment, significantly enhancing the monitor's performance regardless of room size or treatment quality, minimizing setup time.

- Integration of machine learning models for predictive maintenance, anticipating potential speaker component failure (e.g., thermal stress on voice coils) before critical sessions, ensuring operational continuity.

- AI tools assist in automated frequency balancing during mixing and mastering processes, making the flat, uncolored response of studio monitors even more critical for auditing and verifying the resulting spectral balance and perceived sonic integrity.

- Development of smart monitors that dynamically adjust equalization, phase, and bass management based on continuous environmental sensing or user feedback regarding tonal consistency and transient preservation.

- Optimization of manufacturing processes and quality control using AI vision systems and acoustic analysis to ensure precise component assembly, ultra-low tolerance variability in speaker drivers, and efficient material utilization.

DRO & Impact Forces Of Studio Monitor Speaker Market

The core drivers sustaining market momentum include the democratization of professional music and audio production, primarily facilitated by the affordability of digital audio workstations (DAWs) and high-quality audio interfaces. This shift has exponentially increased the number of potential buyers—from hobbyists to semi-professionals—requiring accurate monitoring tools to meet the rising expectation for broadcast-quality audio content on streaming platforms. Furthermore, continuous product innovation, particularly in the realm of active monitors with integrated amplification and DSP, offers enhanced convenience and performance, effectively driving the replacement cycle for older, passive systems. The principal impact force derived from these drivers is the mass market penetration of high-fidelity audio production tools, pushing market volume significantly upward.

Key restraining factors predominantly relate to the acoustic prerequisites for optimal monitor performance and intense market saturation in the mid-to-low price tiers. Studio monitors are highly sensitive to room reflections and standing waves; consequently, the high cost and complexity associated with professional acoustic treatment deter many home studio users from maximizing their monitor investment. This creates a psychological barrier to high-end purchasing. Moreover, the entry-level segment is characterized by aggressive pricing strategies from Asian mass-market manufacturers, compressing profit margins for global heritage brands. These restraints create an impact force centered on the need for technological solutions (like DSP correction) that mitigate environmental variables, thereby decoupling monitor performance from expensive physical room treatment, allowing manufacturers to retain margin and value.

Opportunities for strategic growth are substantial, particularly in addressing the digital workflow requirements of contemporary studios. The shift towards Audio over IP (AoIP) protocols like Dante and AVB presents a lucrative niche for high-end monitors offering seamless network integration, simplifying large-scale studio installation and reducing latency and cabling clutter. Additionally, expanding the product portfolio into specialized areas, such as immersive audio monitoring systems (Dolby Atmos, 360 Reality Audio), caters to forward-looking production houses adopting these new formats. Finally, the untapped potential in emerging APAC and LATAM markets, driven by their digital transformation and relatively low installed base of professional gear, offers fertile ground for establishing long-term market leadership through robust distribution and localized product offerings. These opportunities direct the impact forces towards specialization, digital integration, and geographical expansion.

Segmentation Analysis

Market segmentation for Studio Monitor Speakers provides a vital framework for understanding diverse user needs and technological preferences. The core delineation rests on the Type segmentation, separating Active (self-powered) monitors from Passive (requiring external amplification) monitors. Active monitors, with integrated bi-amplification and tailored electronic crossovers, represent the overwhelming majority of modern sales, prized for their acoustic consistency and simplified setup, particularly among the prosumer base. Passive monitors, while still used in some legacy or highly customized commercial setups, hold a diminishing share, primarily catering to engineers who prefer specific outboard power amplifiers.

Driver Size segmentation is crucial as it directly correlates with application and acoustic output characteristics. Near-field monitors, typically in the 5-inch to 8-inch range, are the standard for personal and project studios, optimized for short listening distances where acoustic flaws are less pronounced. Larger driver sizes (above 8 inches), including mid-field and main monitors, require larger rooms and are exclusively used in commercial facilities due to their ability to deliver higher SPL and deeper bass extension, necessitating significant investment in room treatment. This size-based distinction informs production volume and price point strategies across the manufacturer portfolio.

Furthermore, technology segmentation is rapidly gaining importance, differentiating analog-only devices from advanced DSP-enabled systems. Monitors incorporating sophisticated DSP for features such as phase alignment, dynamic response shaping, and automated room correction systems command higher prices and represent the cutting edge of the market, effectively addressing the performance degradation caused by non-ideal acoustic environments. This technological advancement allows for premium positioning and targets professional users demanding uncompromising accuracy, regardless of their physical workspace limitations.

- By Type:

- Active (Powered) Studio Monitors: Dominant market segment due to integration of amplifiers and acoustic optimization.

- Passive (Unpowered) Studio Monitors: Niche market catering to high-end custom setups with specific amplifier requirements.

- By Driver Size:

- Under 5-inch: Ultra-compact monitoring and specialized secondary reference (e.g., mix cubes).

- 5-inch to 6-inch: Primary choice for home and project studios, offering optimal balance and compact footprint.

- 6-inch to 8-inch: High-power near-field/small mid-field usage, suitable for larger project rooms.

- Above 8-inch (Mid-field and Main Monitors): Reserved for large commercial studios requiring high SPL and deep bass.

- By Application/End-User:

- Professional Recording Studios (Commercial): Require reliability, high-SPL, and networking capabilities.

- Project/Home Studios (Prosumer): Demand affordability, compact size, and user-friendly setup.

- Broadcast and Post-Production Facilities: Prioritize pristine signal chain and accurate dialogue reproduction.

- Educational Institutions and Gaming Audio Centers: Focus on durability and cost-effective monitoring for training and spatial audio rendering.

- By Technology:

- Analog Monitors: Traditional design utilizing passive or analog electronic crossovers.

- DSP Enabled Monitors (Room Correction, Digital Crossovers): High-growth segment offering automated acoustic optimization.

- Networked Audio Monitors (Dante, AVB): Premium segment focused on large-scale, digitally integrated installations.

Value Chain Analysis For Studio Monitor Speaker Market

The upstream segment of the Studio Monitor Speaker value chain is defined by the high technical specification requirements of core components, leading to substantial investment in research and proprietary manufacturing processes. This includes the sourcing of specialized magnetic assemblies (e.g., Neodymium), cone materials (such as woven Kevlar or advanced polypropylenes optimized for low mass and high rigidity), and high-precision electronic components for Class D amplification modules and complex DSP chips. The industry's reliance on specialized suppliers for custom drivers and proprietary waveguide technology means that control over intellectual property and supply security is paramount. Leading manufacturers often maintain tight vertical integration for driver assembly to ensure minimal variance and acoustic consistency, a critical factor for professional endorsement and premium product positioning.

The manufacturing and assembly phase involves intricate processes, including precision cabinet construction to control internal standing waves and port tuning for optimized low-frequency response. For active monitors, the assembly includes matching the amplifier modules and crossover circuitry precisely to the drivers, often necessitating sophisticated anechoic chamber testing and calibration. Quality control (QC) is highly stringent, involving detailed acoustic measurements for every unit to guarantee the specified frequency response flatness and phase coherence. Failure to maintain tight QC results in paired monitors having acoustic differences, rendering them unsuitable for critical stereo mixing, thus eroding brand reputation.

Downstream distribution channels are bifurcated based on the target customer. For the Prosumer segment, high-volume online retailers and music instrument stores dominate, leveraging strong e-commerce logistics and customer reviews to drive sales. For the Professional segment (commercial studios, broadcast), direct sales or specialized pro audio dealers provide crucial technical consulting, system integration services, and after-sales support, justifying higher margins. Effective marketing leverages industry endorsements, particularly from Grammy-winning producers and reputable sound engineers, as credibility is the ultimate currency in this specialized market. The logistical complexity involves handling sensitive, calibrated electronic equipment, requiring careful packaging and transport protocols to prevent damage that could compromise acoustic performance.

Studio Monitor Speaker Market Potential Customers

The core clientele of the Studio Monitor Speaker Market includes established commercial recording facilities, which serve as the benchmark for high-end demand. These customers require full-range systems, often encompassing main monitors (flush-mounted), mid-field monitors for general mixing, and secondary near-field pairs for reference checking. Their purchase cycle is often capital expenditure-driven and highly reliant on maintaining technological parity with industry standards (e.g., adopting immersive audio setups), prioritizing longevity, high SPL capability, and factory-calibration guarantees from marquee brands like Genelec and Neumann.

The largest volume purchaser base is the Prosumer segment, consisting of freelance audio engineers, podcasters, independent musicians, YouTubers, and amateur producers operating from home studios. This group demands affordability, ease of integration (USB/Bluetooth connectivity, built-in EQ), and aesthetically pleasing designs suitable for small workspaces. Their purchasing decisions are primarily influenced by online community recommendations, product reviews, and educational content demonstrating workflow integration. Manufacturers like KRK, JBL, and PreSonus effectively target this segment with feature-rich, competitively priced 5-inch and 6.5-inch active monitor pairs.

Beyond traditional audio production, significant potential customers exist in niche industrial and educational applications. This includes tertiary education institutions running audio engineering diplomas and degrees, requiring durable, reliable systems for student labs. Furthermore, corporate communication centers, virtual reality (VR) developers, and high-fidelity gaming audio designers increasingly rely on accurate studio monitors for precise sound design and spatialization, recognizing that consumer headphones often mask critical production flaws. This diversification of end-users beyond music reinforces the stability of the overall market demand structure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 698 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Genelec, Yamaha, KRK Systems (Gibson Brands), JBL Professional (Harman International), Adam Audio, Neumann, Focal, Mackie, PreSonus, Dynaudio, Kali Audio, Avantone Pro, Behringer, Tannoy, M-Audio, EVE Audio, Fluid Audio, Unity Audio, Quested Monitoring Systems, ATC Loudspeaker Technology |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Studio Monitor Speaker Market Key Technology Landscape

The contemporary technical landscape of the Studio Monitor Speaker Market is defined by continuous refinement aimed at reducing acoustic distortion and enhancing system integration. A primary advancement is the proliferation of high-performance Class D amplification modules, which have largely superseded traditional linear amplifiers, particularly in active designs. Class D technology offers significantly improved thermal efficiency and reduced size and weight, allowing manufacturers to integrate powerful bi-amplification (separate amplifiers for woofer and tweeter) within compact enclosures without compromising reliability. This power efficiency is critical for modern near-field monitors, maximizing acoustic output potential while minimizing the physical footprint necessary for home studios.

Driver technology remains a central differentiator. Manufacturers invest heavily in researching specialized materials to achieve a near-perfect piston motion across the driver’s frequency band. For tweeters, technologies such as the Air Motion Transformer (AMT), popularized by Adam Audio, or Beryllium domes, offer exceptional transient response and reduced breakup compared to conventional dome materials. Woofers often utilize advanced composites like Kevlar or polypropylene, coupled with optimized magnetic motor structures (Neodymium being preferred for its power-to-weight ratio), to ensure high excursion linearity and minimal compression, crucial for accurate bass reproduction down to the low frequencies required for mastering.

Furthermore, digital integration via DSP is transforming the functional capability of studio monitors. DSP enables precise, phase-optimized digital crossover networks that are far superior to passive component crossovers, resulting in smoother frequency transitions between drivers. More importantly, DSP facilitates integrated acoustic measurement and room correction, such as boundary EQ and advanced parametric EQ adjustments. This technology allows users to mitigate common acoustic problems—like bass build-up near walls or reflective surfaces—using software rather than expensive physical room treatment. This focus on "acoustic intelligence" is the most potent technological trend, making professional monitoring accuracy accessible to a broader user base and significantly influencing product development cycles for all major market players.

Technology points summary:

- DSP-Based Room Correction: Utilizes proprietary algorithms to measure environmental acoustic anomalies and apply corrective EQ and phase adjustments, optimizing the frequency response at the listening position in non-ideal rooms.

- Advanced Driver Materials and Geometry: Implementation of rigid, lightweight cone materials (e.g., Kevlar, Carbon Fiber, Beryllium) and specialized tweeter designs (AMT/Ribbon) to achieve superior transient fidelity and minimize distortion.

- Class D Amplification: High-efficiency, integrated amplification providing powerful, cool-running solutions for bi-amplified and tri-amplified active monitor configurations.

- Optimized Waveguide Technology: Precision-engineered front baffles and waveguides to control sound dispersion, widen the sweet spot, and improve stereo imaging consistency, reducing listener fatigue.

- Networked Audio Protocols (AoIP): Integration of Dante, AES67, or AVB connectivity for high-channel count digital signal transmission, robust system synchronization, and centralized remote management in large broadcast and post-production studios.

- Boundary Control Filters: Built-in analog or digital switches/EQs allowing users to manually compensate for acoustic issues arising from monitor placement (e.g., bookshelf placement, proximity to walls).

- Coaxial Driver Design: Implementing tweeter and woofer on the same axis to ensure true point-source sound radiation, leading to improved phase alignment and consistent off-axis response.

Regional Highlights

- North America: Maintains market leadership due to the immense scale of its professional audio industry, driven by major music production centers, film post-production hubs (Los Angeles, Vancouver), and a high consumer propensity to invest in high-quality prosumer gear. The region is characterized by early adoption of immersive audio formats (Dolby Atmos) and strong demand for monitors featuring networked audio and advanced DSP.

- Europe: A highly competitive and mature market, dominated by countries like the UK, Germany, and Scandinavia, which have long histories of audio innovation and broadcasting. Demand is stable, with a strong preference for monitors manufactured by established European brands (Genelec, Adam Audio, Neumann). The focus is on quality, longevity, and adherence to professional broadcast standards.

- Asia Pacific (APAC): The fastest-growing region, fueled by rising digital media consumption, expanding mobile gaming industries, and significant government support for creative and broadcast sectors in China, India, and Southeast Asia. The market is primarily driven by the demand for affordable and mid-range active monitors, particularly in the 5-inch category, catering to the huge base of aspiring producers and online content creators.

- Latin America (LATAM): Exhibits strong potential, with key growth centered in Mexico and Brazil. The market is increasingly professionalizing, moving away from low-cost imports toward recognizable global brands. Price sensitivity requires localized distribution strategies focused on value and entry-level products, though demand for mid-range active monitors is steadily increasing.

- Middle East and Africa (MEA): Growth is primarily concentrated in the GCC nations (UAE, Qatar, Saudi Arabia), where substantial infrastructure investments in modern broadcast facilities, entertainment venues, and media cities necessitate high-end monitoring systems. The demand here tends toward professional, high-reliability products for large-scale fixed installations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Studio Monitor Speaker Market.- Genelec Oy (Finland)

- Yamaha Corporation (Japan)

- KRK Systems (Gibson Brands) (USA)

- JBL Professional (Harman International / Samsung) (USA)

- Adam Audio GmbH (Germany)

- Neumann GmbH (Sennheiser Group) (Germany)

- Focal-JMlab (France)

- Mackie (LOUD Audio LLC) (USA)

- PreSonus Audio Electronics (USA)

- Dynaudio A/S (Denmark)

- Kali Audio (USA)

- Avantone Pro (USA)

- Behringer (Music Tribe) (Germany/China)

- Tannoy (TC Group) (UK)

- M-Audio (InMusic Brands) (USA)

- EVE Audio GmbH (Germany)

- Fluid Audio (USA)

- Unity Audio Ltd. (UK)

- Quested Monitoring Systems (UK)

- ATC Loudspeaker Technology Ltd. (UK)

Frequently Asked Questions

Analyze common user questions about the Studio Monitor Speaker market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a studio monitor and a conventional Hi-Fi speaker?

Studio monitors are designed for accuracy and neutrality, aiming for a flat frequency response to allow engineers to precisely hear flaws and make objective mixing decisions. Hi-Fi speakers are usually tailored with boosted bass or highs to provide an aesthetically pleasing, consumer-oriented sound.

Should I choose active or passive studio monitors?

Active (powered) monitors are strongly recommended for most users today. They feature integrated amplifiers and optimized electronic crossovers perfectly matched to the drivers, ensuring acoustic synergy, superior consistency, and often incorporating essential DSP functions like room correction.

How does DSP technology benefit studio monitors?

DSP (Digital Signal Processing) enables advanced features such as linear phase digital crossovers and automated room correction systems. This technology measures and compensates for acoustic distortions caused by the listening environment, resulting in a significantly flatter and more reliable frequency response at the mixing position.

Which driver size is recommended for a typical home studio environment?

For typical near-field listening in untreated or small home studios, 5-inch or 6.5-inch driver models are generally optimal. They offer sufficient bass response for mixing without exciting excessive low-frequency standing waves that often plague small, acoustically constrained spaces.

Is the Studio Monitor Speaker Market growing due to professional or home studios?

While professional studios drive innovation and high-end sales, the overwhelming volume and growth of the market stem from the rapid expansion of the Prosumer and Home Studio segment. The ease of access to digital production tools has made accurate monitoring an essential requirement for millions of independent content creators globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager