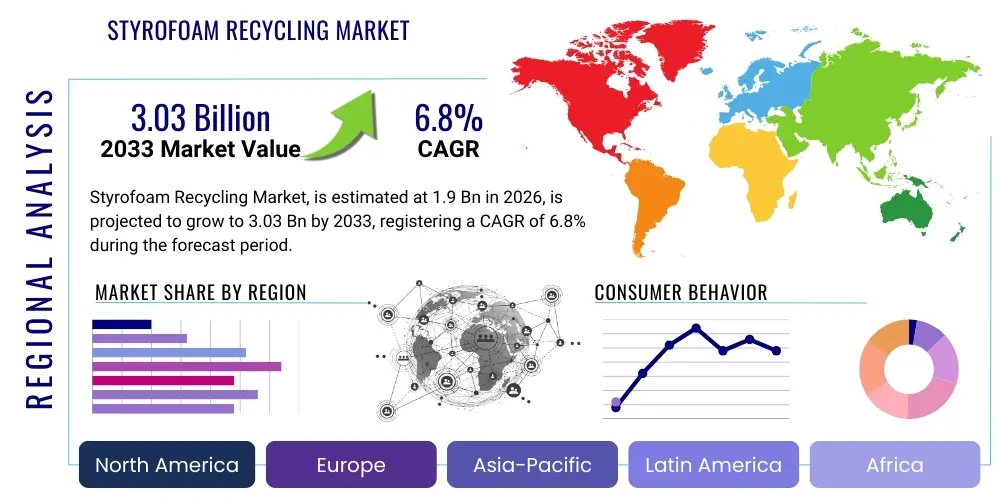

Styrofoam Recycling Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441135 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Styrofoam Recycling Market Size

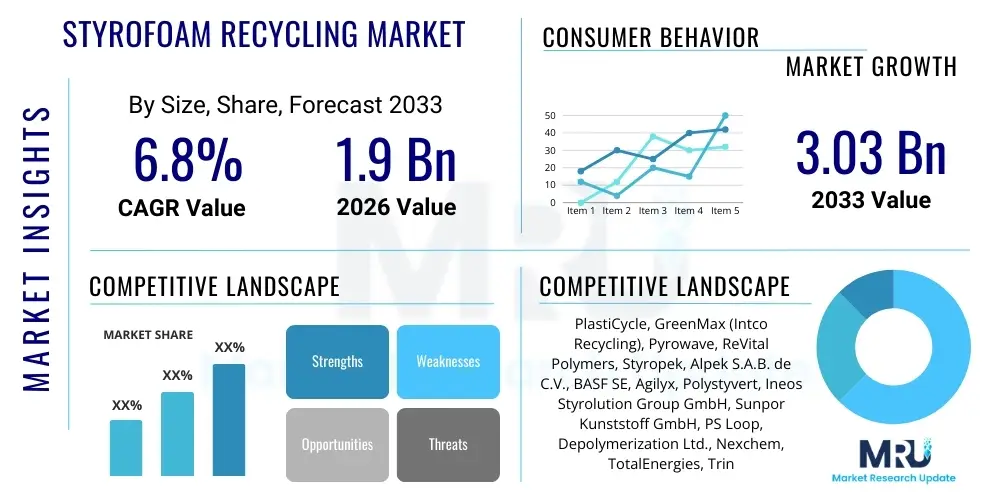

The Styrofoam Recycling Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.9 Billion in 2026 and is projected to reach USD 3.03 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily underpinned by escalating regulatory pressures concerning plastic waste management, coupled with increasing corporate mandates for sustainable sourcing and closed-loop material cycles across industrialized nations.

Styrofoam Recycling Market introduction

The Styrofoam Recycling Market centers on the processing of Expanded Polystyrene (EPS), a ubiquitous, lightweight plastic foam known for its excellent thermal insulation and shock absorption properties. While crucial for applications ranging from protective packaging to construction materials, EPS presents significant end-of-life challenges due to its low density, high volume, and historically low recycling rate. This market encompasses diverse technologies—including mechanical recycling (densification), thermal decomposition (pyrolysis), and chemical dissolution—designed to transform waste EPS back into reusable feedstocks or intermediate chemical compounds, thereby preventing landfill accumulation and reducing reliance on virgin petroleum resources.

The primary driver accelerating market adoption is the global push toward a circular economy, necessitated by stringent environmental legislation, particularly in the European Union and parts of North America. Furthermore, increasing consumer awareness and subsequent demand for eco-friendly products compel major industries, such as electronics, construction, and food packaging, to integrate recycled EPS (rEPS) into their supply chains. The benefits derived from effective Styrofoam recycling are manifold: they include reduced greenhouse gas emissions associated with new polymer production, significant savings in landfill disposal costs, and the creation of secondary material markets, fostering economic resilience within the waste management sector.

Major applications driving demand for recycled Styrofoam materials include high-value construction components like insulation boards and structural filling, due to EPS’s unparalleled thermal efficiency. Furthermore, the material is increasingly reintroduced into primary packaging manufacturing and utilized in lightweight aggregates for concrete mixtures. The overall market dynamic is characterized by intense technological innovation focused on overcoming inherent logistical hurdles associated with collecting and transporting low-density foam, ensuring that high-purity recycled polymers can effectively displace virgin materials without compromising performance specifications.

Styrofoam Recycling Market Executive Summary

The Styrofoam Recycling Market is undergoing a significant transformative phase, marked by substantial investments in advanced chemical recycling infrastructure and a shift toward high-efficiency densification technologies. Current business trends indicate a strong move toward vertical integration, where major chemical producers and polymer manufacturers acquire or form strategic partnerships with waste management firms to secure consistent, high-quality feedstock supply. Regionally, the Asia Pacific (APAC) market, spearheaded by China and Japan, dominates consumption and processing capacity, driven by high manufacturing output and proactive national recycling targets. North America and Europe, however, lead in technological innovation, particularly in sophisticated sorting and chemical dissolution methods that offer higher recovery purity compared to traditional mechanical means.

Segment trends highlight the growing importance of chemical recycling processes, such as depolymerization and pyrolysis, which allow for the recovery of styrene monomer, a crucial building block for new polystyrene production. This segment is experiencing faster growth than conventional mechanical recycling because it addresses the contamination issues that limit the quality and application scope of mechanically recycled EPS. Simultaneously, the Post-Consumer segment is expanding rapidly, fuelled by municipal solid waste management initiatives and extended producer responsibility (EPR) schemes that mandate manufacturers bear responsibility for the end-of-life treatment of their products.

Overall, the market landscape is defined by the critical need to improve collection logistics—the most substantial bottleneck—and to achieve economies of scale necessary to make recycled EPS cost-competitive with virgin materials. Market profitability hinges on the successful commercial scaling of advanced recycling facilities and the development of robust end-markets for the resulting recycled products. The regulatory environment acts as a primary catalyst, ensuring sustained momentum and commitment from industry stakeholders toward achieving established circularity goals across key industrialized economies.

AI Impact Analysis on Styrofoam Recycling Market

User queries regarding the impact of Artificial Intelligence (AI) on the Styrofoam Recycling Market primarily revolve around optimizing operational efficiency, enhancing material sorting accuracy, and predicting waste stream availability. Users frequently inquire how AI can address the critical challenge of contamination in mixed plastic streams, specifically focusing on whether machine learning algorithms can reliably distinguish between different grades of polystyrene and other packaging materials. There is significant expectation that AI-powered vision systems, integrated with Near-Infrared (NIR) spectroscopy, will dramatically improve the purity of recycled feedstock, thereby increasing the economic viability of the entire recycling process and overcoming existing limitations in conventional sorting infrastructure.

Beyond sorting, common concerns address the application of AI in supply chain logistics. Users are keen to understand how predictive analytics can be used to model waste generation patterns, optimize collection routes for low-density, high-volume EPS waste, and manage inventory at compaction centers. Furthermore, market stakeholders are exploring AI’s role in process control within advanced recycling facilities, such as monitoring temperature and reaction parameters in pyrolysis units to maximize monomer yield and minimize energy consumption. The core theme underpinning these inquiries is the desire to leverage AI for higher material recovery rates, lower operating costs, and greater overall system resilience in a complex waste management landscape.

The implementation of AI promises to transition the Styrofoam recycling sector from a largely linear, labor-intensive model to a highly efficient, automated, and data-driven circular operation. By providing real-time quality assurance and optimizing plant throughput, AI technologies are expected to accelerate the commercial deployment of advanced chemical recycling facilities, which are highly sensitive to feedstock consistency. This integration is vital for the market's future, as it bridges the gap between the complex challenge of post-consumer EPS collection and the stringent quality requirements of high-performance polymer manufacturers.

- AI-driven optical sorting enhances the identification and separation of contaminants, significantly improving EPS purity levels.

- Machine Learning algorithms optimize collection routes and material flow planning, reducing transportation costs associated with high-volume, low-density waste.

- Predictive maintenance analytics monitor recycling equipment (e.g., densifiers, extruders, reactors) to minimize downtime and maximize operational efficiency.

- AI models forecast regional waste generation trends, aiding recyclers in securing predictable feedstock volumes and managing inventory effectively.

- Deep learning applied to chemical recycling processes optimizes reaction conditions (temperature, pressure) for maximum monomer yield and energy efficiency.

DRO & Impact Forces Of Styrofoam Recycling Market

The Styrofoam Recycling Market is profoundly shaped by a confluence of accelerating drivers, persistent operational restraints, and substantial innovation-driven opportunities, creating powerful impact forces that determine its growth trajectory. The primary driver is the global mandate for sustainable waste management, particularly restrictive regulations imposed on single-use plastics and packaging, such as directives from the European Commission and national bans on EPS packaging in various jurisdictions. These legislative actions, coupled with rapidly rising landfill taxes and the associated environmental costs of disposal, incentivize businesses and municipalities to seek viable, cost-effective recycling solutions. Conversely, the market faces significant restraints, chiefly rooted in collection logistics; the extremely low bulk density of EPS makes its transportation inherently expensive and inefficient, often negating the economic viability of recycling unless robust regional densification infrastructure is in place. Furthermore, the inherent susceptibility of EPS to contamination, especially in post-consumer streams, complicates processing and degrades the quality of the final recycled product.

Despite these challenges, substantial opportunities are emerging, predominantly driven by breakthroughs in chemical recycling technologies like pyrolysis and dissolution. These advanced methods can handle contaminated feedstock and yield high-purity, virgin-equivalent monomers, drastically expanding the potential end-markets for recycled materials and positioning them favorably against virgin polymers. The increasing commitment from major multinational corporations—particularly consumer electronics and e-commerce giants—to incorporate 30-50% recycled content into their packaging strategies creates guaranteed demand for rEPS. The overall impact forces are strongly positive, pushing the market toward technological sophistication and greater integration into the petrochemical value chain. The demand side pull, driven by sustainability pledges, often outweighs the friction caused by logistical restraints, compelling continuous capital expenditure in innovative solutions.

The market's evolution is highly dependent on overcoming the current supply chain fragmentation, particularly the initial steps of collection and sorting. Successful market expansion relies on collaborative models—involving producers, waste handlers, and specialized recyclers—to streamline the flow of material. The ongoing technological refinement in densification equipment, which significantly reduces volume (up to 90:1 ratios), is crucial for mitigating transportation costs, turning a major restraint into a manageable operational challenge. Ultimately, the successful deployment of large-scale chemical recycling facilities is expected to be the most potent force reshaping the market structure, elevating recycling from a niche waste management activity to a core component of sustainable polymer production.

Segmentation Analysis

The Styrofoam Recycling Market is systematically analyzed based on process type, source, and final application, reflecting the diverse pathways through which Expanded Polystyrene (EPS) is managed and reintroduced into the economy. Segmentation by process is critical as it defines the purity, scale, and end-use potential of the recycled material, with chemical recycling (pyrolysis, dissolution) rapidly gaining traction due to its ability to handle complex waste streams and produce high-quality monomers. Segmentation by source differentiates between easier-to-process Post-Industrial waste and highly contaminated, yet vastly larger, Post-Consumer waste streams. Analyzing these segments provides market participants with essential insights into investment priorities, logistical requirements, and target end-markets.

- By Process Type:

- Mechanical Recycling (Densification, Extrusion)

- Chemical Recycling (Pyrolysis, Depolymerization, Dissolution)

- Thermal Recycling (Waste-to-Energy, Limited Recovery)

- By Source:

- Post-Consumer Waste (Municipal Solid Waste, Institutional Streams)

- Post-Industrial Waste (Manufacturing Scraps, Off-cuts)

- By Application:

- Construction (Insulation, Lightweight Fill)

- Packaging (Protective Packaging, Food Containers)

- Consumer Goods (Hangers, Office Supplies)

- Others (Landscaping, Drainage Aggregate)

Value Chain Analysis For Styrofoam Recycling Market

The value chain for Styrofoam recycling is complex and multi-layered, beginning with the upstream analysis involving the sourcing and collection of EPS waste. Upstream activities are dominated by collection networks that gather material from municipal recycling programs (post-consumer) and industrial sites (post-industrial). Since EPS is 98% air, the initial stage requires significant logistical effort and capital investment in densification or compaction equipment to reduce volume prior to transport to centralized processing hubs. Key stakeholders in this phase include municipal waste authorities, specialized materials recovery facilities (MRFs), and dedicated collection service providers. The efficiency of this upstream segment is the most crucial determinant of overall market profitability.

The midstream component involves the actual recycling and processing operations. This stage utilizes the key technologies of mechanical, chemical, or thermal recycling to transform the compressed EPS into a reusable material. Mechanical recycling involves shredding, washing, pelletizing, and extrusion to create recycled polystyrene pellets (rPS). Chemical recycling, which is gaining prominence, involves sophisticated reactors to break down the polymer into its chemical constituents (styrene monomer or oil), often requiring significant technical expertise and high purity standards. The success of midstream operations depends heavily on the integration of advanced sorting and cleaning technologies to maintain feedstock quality.

The downstream analysis focuses on the distribution and end-use of the recycled products. Finished materials—whether rPS pellets or recovered styrene monomer—are marketed to converters and manufacturers. Distribution channels include direct sales to large polymer users (e.g., construction materials producers or packaging companies) and indirect sales through resin distributors. The market requires robust quality control and certification processes to ensure that rEPS products meet the stringent performance requirements of end-users. Strong partnerships between recyclers and major brand owners seeking sustainable packaging mandates are essential for driving consistent downstream demand, thus completing the closed-loop cycle and validating the market's long-term sustainability.

Styrofoam Recycling Market Potential Customers

The potential customer base for recycled Styrofoam materials is expansive, encompassing all major industries that historically utilize virgin Expanded Polystyrene (EPS) for packaging and insulation purposes, along with emerging sectors committed to sustainable sourcing. Primary end-users include the vast construction industry, which relies heavily on high-performance insulation boards, geofoam for civil engineering projects, and lightweight aggregates for concrete mixtures, making them the largest volume consumers of rEPS. These buyers prioritize materials that maintain crucial thermal resistance and structural integrity while offering a clear sustainability narrative for green building certification.

Another major segment consists of Consumer Goods and Electronics manufacturers, particularly those in the e-commerce sector. These companies require large quantities of protective packaging (molded blocks, custom inserts) to secure fragile products during transit. Driven by aggressive corporate sustainability pledges and consumer demand for eco-friendly packaging, these buyers actively seek suppliers offering rEPS derived from post-consumer waste streams to meet recycled content targets and reduce their overall carbon footprint. The ability to supply a stable volume of high-quality, lightweight rEPS is key to serving this segment effectively.

Furthermore, chemical and polymer producers represent crucial potential customers, particularly those involved in the polystyrene manufacturing value chain. These entities are the key buyers of the output from chemical recycling processes, specifically recovered styrene monomer. By integrating this monomer back into their production cycles, they reduce reliance on crude oil-derived inputs. This group demands high-purity inputs and drives investment in advanced recycling techniques. Governmental agencies and municipal solid waste entities also act as indirect customers, driving demand through policy implementation and investment in public infrastructure that utilizes recycled content.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.9 Billion |

| Market Forecast in 2033 | USD 3.03 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | PlastiCycle, GreenMax (Intco Recycling), Pyrowave, ReVital Polymers, Styropek, Alpek S.A.B. de C.V., BASF SE, Agilyx, Polystyvert, Ineos Styrolution Group GmbH, Sunpor Kunststoff GmbH, PS Loop, Depolymerization Ltd., Nexchem, TotalEnergies, Trinseo, Erema Group GmbH, Heger GmbH, T&T Industry Group, StyroRec. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Styrofoam Recycling Market Key Technology Landscape

The technological landscape of the Styrofoam Recycling Market is characterized by a dynamic interplay between established mechanical methods and rapidly evolving advanced chemical processes aimed at maximizing resource efficiency and material quality. The most prevalent technology remains mechanical recycling, which primarily relies on high-pressure densifiers and compactors (such as hot-melt or cold-press machines) to significantly reduce the volume of EPS waste, making it economical to transport. Once densified, the material is typically melted, filtered, and pelletized into rPS pellets suitable for basic applications like composite lumber or non-food contact packaging. This method is cost-effective for relatively clean, consistent feedstock, but the resulting polymer often exhibits degraded properties due to thermal stress and residual contaminants, limiting its use in high-performance applications.

In contrast, chemical recycling technologies represent the cutting edge of the market, offering solutions to the contamination and degradation challenges inherent in mechanical processes. Pyrolysis involves heating the EPS waste in an oxygen-free environment to break it down into pyrolysis oil or monomers, which can then be refined and reused. This process is highly versatile and can manage mixed or heavily contaminated feedstock, delivering oil suitable for petrochemical cracking or pure styrene monomer. Another key innovation is dissolution recycling, exemplified by processes that use specialized solvents to dissolve the polystyrene, separating the polymer chain from contaminants and inert fillers. The purified polymer is then precipitated out of the solvent, resulting in a virgin-equivalent material suitable for high-end applications, including food-grade contact.

Furthermore, advancements in pre-processing technology are vital for the scalability of all recycling routes. Automated sorting systems incorporating Near-Infrared (NIR) spectroscopy and Artificial Intelligence (AI) vision systems are deployed at MRFs to efficiently identify and separate different types of plastics, ensuring a cleaner input stream for recyclers. Furthermore, specialized degasification and extrusion machinery is continuously being improved to remove trapped residual gases and moisture, mitigating potential quality issues during pellet production. The industry’s focus is clear: transitioning from basic volume reduction to high-value resource recovery by investing heavily in chemical and intelligent pre-sorting technologies.

Regional Highlights

Regional dynamics play a crucial role in shaping the Styrofoam Recycling Market, influenced by varying regulatory stringency, population density, and industrial base.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market, largely driven by its status as a global manufacturing hub, producing immense volumes of industrial and packaging EPS waste. Countries like China, Japan, and South Korea have implemented comprehensive recycling infrastructure and ambitious national circular economy goals, often focusing on high-volume mechanical recycling and rapid adoption of chemical recycling methods to secure feedstock for their expansive petrochemical industries.

- Europe: Europe exhibits leadership in regulatory frameworks (e.g., the EU Waste Framework Directive and targets for plastic packaging recycling). This region is characterized by high operational costs but strong governmental and corporate commitment to closed-loop systems, driving innovation in dissolution and advanced chemical recycling technologies to meet stringent recycled content mandates. Germany, the UK, and the Netherlands are key contributors, focusing on high-quality post-consumer rEPS.

- North America: North America presents a highly decentralized market where growth is spurred by individual state-level regulations and significant private sector investments. While facing geographical challenges in collection, the U.S. and Canada are major centers for technological deployment, particularly in integrating AI-powered sorting systems and scaling up pyrolysis facilities, often backed by commitments from major retail and food service companies.

- Latin America (LATAM): The LATAM region is an emerging market characterized by foundational regulatory development and rapidly growing urbanization. Mexico and Brazil are primary areas of growth, with the market focusing on establishing basic collection infrastructure and mechanical recycling capacity to manage increasing municipal waste volumes.

- Middle East and Africa (MEA): Growth in MEA is still nascent but accelerating, tied primarily to large-scale construction projects and localized waste management modernization efforts in GCC countries. The focus here is on leveraging recycling to reduce landfill reliance and establish localized, integrated waste-to-resource value chains.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Styrofoam Recycling Market.- PlastiCycle

- GreenMax (Intco Recycling)

- Pyrowave

- ReVital Polymers

- Styropek

- Alpek S.A.B. de C.V.

- BASF SE

- Agilyx

- Polystyvert

- Ineos Styrolution Group GmbH

- Sunpor Kunststoff GmbH

- PS Loop

- Depolymerization Ltd.

- Nexchem

- TotalEnergies

- Trinseo

- Erema Group GmbH

- Heger GmbH

- T&T Industry Group

- StyroRec

Frequently Asked Questions

Analyze common user questions about the Styrofoam Recycling market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary methods used for recycling Styrofoam?

The primary methods are Mechanical Recycling (densification and pelletizing), which is cost-effective but yields lower purity, and Chemical Recycling (pyrolysis and dissolution), which breaks the polymer down into high-purity monomers, suitable for new polymer production.

Is Styrofoam recycling economically viable today, considering its low density?

Economic viability is heavily dependent on pre-processing, particularly densification technologies that reduce volume (making transport feasible), and supportive regulatory environments (like high landfill taxes) that incentivize recycling over disposal. Advanced chemical recycling is enhancing viability by creating high-value outputs.

What is the main bottleneck limiting the growth of the Styrofoam recycling market?

The main bottleneck is the inefficient and high-cost logistics associated with collecting and transporting low-density, high-volume post-consumer Expanded Polystyrene (EPS) waste, requiring significant investment in decentralized densification infrastructure.

How are new technologies, like chemical recycling, changing the market landscape?

Chemical recycling (depolymerization) is transformative because it enables the processing of contaminated EPS waste and produces virgin-equivalent styrene monomer, which can be used for high-end, food-grade applications, significantly expanding end-market opportunities and increasing recovery value.

Which geographical region holds the largest market share for Styrofoam recycling?

The Asia Pacific (APAC) region currently holds the largest market share, driven by extensive manufacturing activity, high volumes of industrial waste, and stringent governmental policies in countries such as China and Japan promoting materials circularity and waste minimization goals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager