Submersible Dewatering Pumps Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442932 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Submersible Dewatering Pumps Market Size

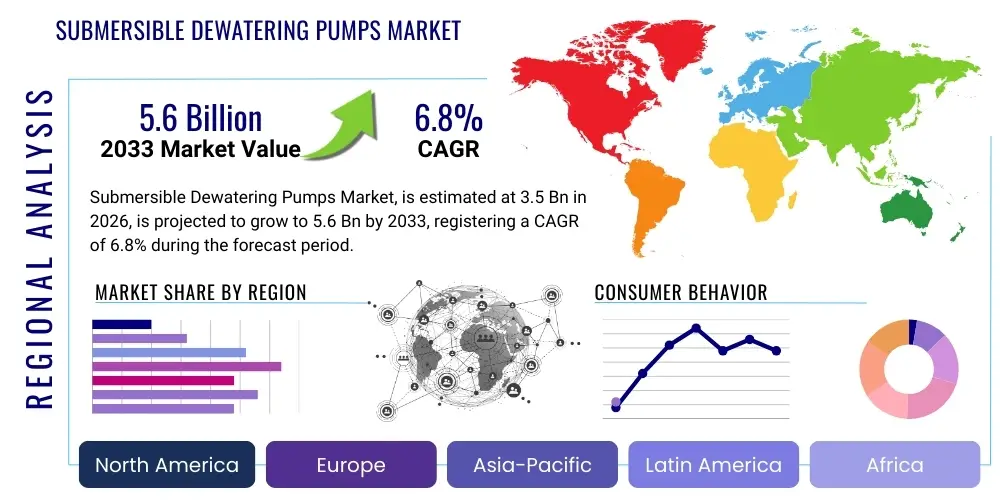

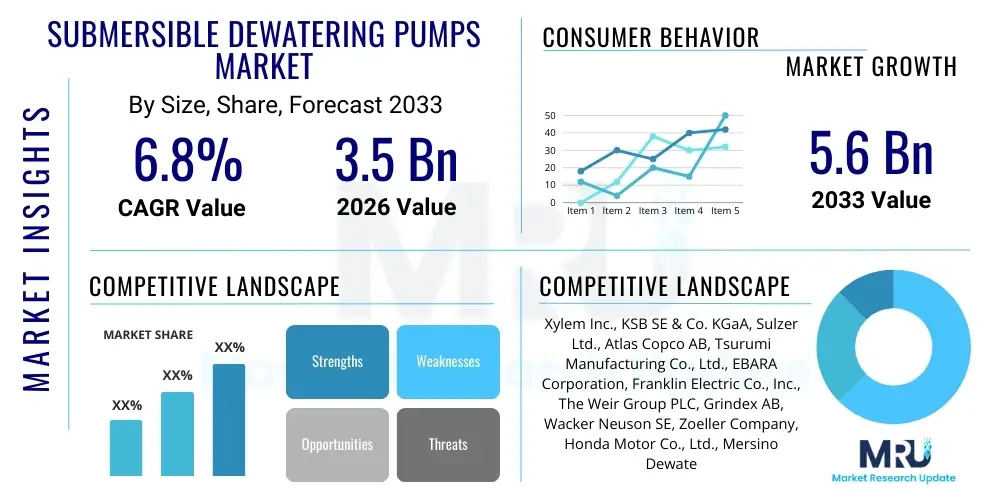

The Submersible Dewatering Pumps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by escalating global infrastructure development, burgeoning construction activities, and the critical need for efficient water management in resource-intensive sectors like mining and municipal utilities. The inherent operational advantages of submersible pumps, such as their ability to handle varying levels of solids and their highly compact design for deployment in confined spaces, further solidify this growth trajectory, making them indispensable tools in challenging environments worldwide.

Submersible Dewatering Pumps Market introduction

The Submersible Dewatering Pumps Market encompasses specialized centrifugal pumps designed to operate entirely underwater, efficiently removing unwanted liquid, often containing abrasive solids, sludge, or slurry, from construction sites, mines, trenches, and municipal facilities. These pumps are crucial for maintaining dry working conditions, preventing flooding, and managing effluent streams, thereby ensuring operational continuity and safety across multiple industries. Key products range from portable, light-duty units used in temporary construction pits to heavy-duty, high-head pumps utilized in deep mining shafts and large-scale tunneling projects. The primary benefit of these pumps lies in their cooling mechanism, as surrounding liquid dissipates motor heat, enabling continuous operation and improved energy efficiency compared to dry-mounted alternatives.

Major applications of submersible dewatering pumps span heavy construction (foundation work, tunneling, bridge building), infrastructure projects (water treatment plants, sewage systems), mining (quarry drainage, slurry handling), and disaster relief operations (flood mitigation). The global driving factors propelling this market include massive governmental spending on public infrastructure, especially in developing economies of Asia Pacific, coupled with the increasing global incidence of extreme weather events necessitating reliable dewatering solutions. Furthermore, advancements in material science, leading to the development of corrosion-resistant and wear-resistant components, are extending pump life cycles and enhancing performance in harsh, abrasive media.

The operational efficiency and reliability of modern submersible dewatering pumps are significantly improved through integration of smart technologies. Features such as integrated sensors for temperature and vibration monitoring, coupled with variable speed drives (VSDs), allow these pumps to adjust their performance dynamically based on the inflow rate and head requirements. This technological evolution reduces energy consumption, minimizes downtime due to unexpected failures, and lowers overall operational costs, providing substantial economic benefits to end-users across construction and industrial sectors. The market is highly competitive, characterized by continuous innovation aimed at improving power-to-weight ratios and overall portability.

Submersible Dewatering Pumps Market Executive Summary

The Submersible Dewatering Pumps Market is experiencing a transformative phase driven by global infrastructural resurgence and stringent environmental regulations concerning water discharge. Business trends indicate a strong shift towards rental services, particularly for high-capacity and specialized pump models, offering capital expenditure relief and operational flexibility to construction and mining firms. Technological advancements, focusing on high-efficiency motors (IE3/IE4 standards), lightweight materials, and IoT integration for remote monitoring, are defining competitive advantages among key manufacturers. The increasing focus on sustainability also drives demand for electric-powered pumps over traditional diesel units, aligning with global decarbonization efforts, especially in urban environments where noise and emission restrictions are tightening.

Regionally, the Asia Pacific (APAC) market dominates the global landscape, fueled by rapid urbanization, extensive road and rail network expansion, and significant investments in water management infrastructure in countries like China, India, and Southeast Asian nations. North America and Europe maintain stable growth, primarily driven by maintenance, repair, and replacement cycles, alongside adoption of advanced, high-specification smart pumps compliant with stringent safety and environmental standards. Segments trends highlight the dominance of electrically driven pumps due to environmental mandates and cost efficiency, while the medium capacity segment remains the largest volume contributor, serving the vast construction and municipal utility sectors. Furthermore, the mining sector's demand for high-head, abrasion-resistant pumps provides a consistent, high-value revenue stream, pushing innovation in impeller design and material composition.

In essence, the market outlook is overwhelmingly positive, characterized by resilience against economic fluctuations due to the necessity of dewatering services across essential industries. Strategic imperatives for market participants include geographical expansion into high-growth APAC regions, diversification of product portfolios to include smart, connected pump systems, and optimization of supply chain logistics to manage global material cost volatility. The synergy between infrastructure spending and technological innovation is expected to sustain the 6.8% CAGR through 2033, underscoring the indispensable role of these pumps in modern industrial operations.

AI Impact Analysis on Submersible Dewatering Pumps Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Submersible Dewatering Pumps Market primarily focus on achieving predictive maintenance capabilities, optimizing energy consumption in real-time, and integrating pumps within broader autonomous industrial environments. Key themes revolve around how AI can analyze historical operational data (vibration, temperature, current draw) to forecast potential component failures, thereby minimizing unplanned downtime, which is a significant cost factor in dewatering applications. Users are also keenly interested in AI's role in dynamically adjusting pump speed and flow rate based on fluctuating water ingress rates, ensuring maximum efficiency and energy savings, especially crucial for large-scale, continuous operations like deep mines or municipal drainage systems. Furthermore, the integration of AI-driven diagnostics into smart pump control panels is expected to simplify troubleshooting and reduce the reliance on specialized on-site personnel.

- AI enables predictive maintenance by analyzing sensor data (e.g., vibration, bearing temperature, motor current) to anticipate failures, maximizing uptime.

- Optimization algorithms driven by AI dynamically adjust Variable Frequency Drives (VFDs) to match dewatering requirements, leading to significant energy cost reductions.

- Machine learning models enhance fault diagnosis accuracy and speed, reducing repair times and minimizing operational disruptions.

- AI facilitates autonomous dewatering cycles by integrating pump controls with site water level monitoring and external environmental data.

- Improved inventory management through AI forecasting of component wear and spare parts necessity, streamlining supply chains for maintenance operations.

- AI-powered remote monitoring platforms provide detailed operational analytics and efficiency reports, optimizing fleet management for large rental companies.

DRO & Impact Forces Of Submersible Dewatering Pumps Market

The market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively constituting the market's Impact Forces. Major Drivers include robust global infrastructure spending, particularly on transportation, utilities, and housing projects, which necessitates extensive foundation dewatering and trench water management. The second critical driver is the continuous expansion of the global mining industry, requiring high-head, highly reliable pumps for deep shaft dewatering and slurry handling. Moreover, the increasing frequency and severity of natural disasters, specifically flash floods and tropical storms attributed to climate change, significantly boost demand for emergency and robust dewatering equipment, especially in municipal response and recovery phases. These drivers create an unavoidable, persistent demand base for submersible pump technology globally.

Conversely, significant Restraints impede market acceleration. The primary restraint involves the high initial capital investment required for heavy-duty submersible pumps, particularly those incorporating advanced materials and smart technology, which can deter smaller contractors or municipal bodies with restrictive budgets. Operational restraints include the susceptibility of pumps to rapid wear and tear when handling highly abrasive media (e.g., sand, silt, sludge), leading to higher maintenance costs and shorter component lifecycles. Furthermore, the fluctuating costs of raw materials, such as copper for motor windings and specialized alloys for impellers and housings, introduce price volatility, impacting overall profitability and final product pricing for end-users.

Opportunities for growth are concentrated in technological advancements and geographic expansion. The development and integration of IoT-enabled "smart pumps" that offer real-time diagnostics and energy optimization represent a major opportunity to capture high-value contracts focusing on total cost of ownership reduction. Geographically, untapped potential remains high in emerging economies across Africa and Southeast Asia, where rapid industrialization and inadequate existing water infrastructure necessitate urgent and large-scale dewatering solutions. Finally, the shift toward sustainable and energy-efficient pumping solutions, driven by tightening environmental regulations, provides manufacturers with a strong pathway for innovation in electric motor technology and material engineering, thereby creating differentiation and premium pricing potential.

Segmentation Analysis

The Submersible Dewatering Pumps Market is meticulously segmented based on Type, Capacity, Application, and geographic region, reflecting the diverse operational requirements across different industries. Understanding these segments is crucial for strategic positioning and product development, as demands vary significantly, ranging from highly portable units for urban utility repairs to massive, fixed installations for deep mining operations. The segmentation analysis provides granular insight into high-growth areas, particularly where technological integration intersects with critical application needs, such as in the medium capacity segment where adoption of VFDs and smart monitoring is rapidly increasing to serve large-scale construction sites and municipal wastewater management projects efficiently.

- By Type:

- Electric Submersible Pumps

- Hydraulic Submersible Pumps

- Diesel/Engine-Driven Submersible Pumps

- By Capacity:

- Low Capacity (Up to 10 HP)

- Medium Capacity (10 HP to 50 HP)

- High Capacity (Above 50 HP)

- By Application:

- Construction (Infrastructure, Residential, Commercial)

- Mining (Surface Mining, Underground Mining, Quarrying)

- Municipal & Utility (Wastewater Treatment, Sewage, Flood Control)

- Industrial (Power Generation, Oil & Gas, Manufacturing)

- By End-User:

- Contractors & Rental Companies

- Government & Municipal Authorities

- Industrial Operators

Value Chain Analysis For Submersible Dewatering Pumps Market

The value chain for the Submersible Dewatering Pumps Market begins with Upstream activities, focused on the procurement of critical raw materials and specialized components. Key upstream suppliers provide high-grade materials such as corrosion-resistant stainless steel, specialized alloys for impellers (e.g., high-chromium white iron), copper for motor windings, and advanced polymers for seals and coatings. The efficiency and reliability of the final product are heavily dependent on the quality and consistent supply of these materials. Strategic partnerships with reliable upstream suppliers are vital to mitigate risks associated with material price volatility and ensure compliance with demanding industrial standards regarding durability and resistance to abrasion and corrosion, which are essential factors in pump longevity.

The Midstream phase involves core manufacturing, assembly, and quality control. Leading manufacturers utilize advanced CNC machining, precision casting, and automated winding techniques to produce motors and pump ends with high mechanical and volumetric efficiency. This phase also includes the integration of electronic components, such as sensors, control panels, and VFDs, increasingly focusing on modular design for easier maintenance and repair. Downstream activities encompass distribution channels, which are bifurcated into direct sales and indirect sales. Direct channels typically handle high-value, customized, or large-scale project tenders, providing direct manufacturer support and after-sales service. Indirect channels, including authorized dealers, specialized industrial distributors, and, crucially, large equipment rental companies, handle the majority of standard, high-volume sales and temporary operational needs.

The critical role of the distribution channel is evidenced by the prominence of the equipment rental market. Rental companies often act as major purchasers, providing pumps to construction and mining sites on a short-term basis, reducing CAPEX for end-users while generating consistent demand for high-quality, durable equipment. Service and maintenance—including preventative maintenance agreements, parts supply, and repair services—form the final, highly profitable stage of the value chain. This stage is becoming increasingly technologically advanced, utilizing IoT data streams for condition monitoring and proactive servicing. Manufacturers who effectively leverage both direct sales for strategic projects and indirect channels, especially rental partners, maintain a stronger market presence and better adaptability to fluctuating industry demands.

Submersible Dewatering Pumps Market Potential Customers

The primary End-Users and Buyers of submersible dewatering pumps are highly diversified across industries where water accumulation poses a threat to operational continuity, safety, or progress. Construction contractors represent the largest customer base, constantly requiring pumps for foundation dewatering, utility trench clearance, bridge construction, and tunneling projects, where continuous water removal is non-negotiable for safety and adherence to schedules. Their demand spans across portable, medium-capacity pumps for everyday use to high-head pumps for deep excavations. The cyclical nature of construction necessitates strong partnerships with equipment rental companies, who in turn become major purchasers of pump fleets to service project-based needs.

The second major segment comprises the mining and quarrying industry, demanding robust, high-capacity, and extremely durable pumps capable of handling large volumes of abrasive slurry and operating at significant depths (high head requirements). These customers prioritize pumps built with specialized metallurgy to withstand highly corrosive and erosive environments, viewing pump reliability as crucial to avoiding catastrophic operational failures in deep underground mines. Demand from municipal authorities and utility operators is consistently stable, driven by the essential requirement for managing stormwater run-off, sewage system maintenance, and critical flood control infrastructure, often requiring permanent, reliable installations focused on energy efficiency and low long-term maintenance costs.

Furthermore, industrial operators across sectors like power generation (cooling water management), oil & gas (pipeline trenching and site remediation), and manufacturing (effluent control) constitute significant potential customers. These buyers often require tailored solutions that comply with specific regulatory standards for effluent discharge and possess advanced monitoring capabilities. The decision-making process for these customers is heavily influenced by the pump's Total Cost of Ownership (TCO), including energy consumption, expected component lifespan, ease of maintenance, and the availability of responsive, localized service support from the manufacturer or distributor.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Xylem Inc., KSB SE & Co. KGaA, Sulzer Ltd., Atlas Copco AB, Tsurumi Manufacturing Co., Ltd., EBARA Corporation, Franklin Electric Co., Inc., The Weir Group PLC, Grindex AB, Wacker Neuson SE, Zoeller Company, Honda Motor Co., Ltd., Mersino Dewatering, Toyo Pumps, Ltd., Gorman-Rupp Company, Wuhan Zhongyuan Submersible Pump Co., Ltd., SPP Pumps Ltd., Ruhrpumpen Inc., Davey Water Products Pty Ltd., BJM Pumps. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Submersible Dewatering Pumps Market Key Technology Landscape

The technological landscape of the Submersible Dewatering Pumps market is rapidly evolving, driven primarily by the need for enhanced energy efficiency, increased durability in harsh environments, and the integration of sophisticated monitoring systems. A crucial advancement is the widespread adoption of Variable Frequency Drives (VFDs) and high-efficiency motors, particularly IE3 and IE4 compliant designs. VFDs allow pumps to operate across a range of speeds, dynamically adjusting flow rates and head to match actual demand, which dramatically reduces energy consumption during periods of variable inflow, a common scenario in construction and municipal dewatering. Furthermore, the motors themselves are increasingly featuring optimized cooling jacket designs to ensure sustained high performance when partially submerged or operating in highly viscous liquids, preventing thermal overload and extending operational life, which is critical for continuous-duty applications.

Material science innovation constitutes another foundational technological pillar. Manufacturers are continuously developing and utilizing advanced composite materials, specialized ceramics, and highly resistant alloys for impellers, wear plates, and internal components. These materials, such as high-chrome cast iron and polyurethane linings, provide superior resistance to abrasive solids and corrosive chemicals commonly found in mine tailings and contaminated site water, significantly extending the Mean Time Between Failures (MTBF). This focus on wear resistance directly impacts the total cost of ownership (TCO) for end-users, making advanced material technology a key differentiator in competitive tenders, especially within the demanding mining and heavy industrial sectors where uptime is paramount.

The most significant modern trend is the transition to "Smart Pumping Systems" facilitated by the Internet of Things (IoT) and integrated sensor technology. Modern submersible pumps are equipped with sensors that continuously monitor critical parameters, including bearing temperature, motor vibration levels, moisture ingress in the seal chambers, and power consumption. This data is transmitted wirelessly to centralized cloud platforms, enabling remote diagnostics, real-time performance tracking, and the execution of predictive maintenance protocols. This connectivity allows users to manage vast fleets of pumps across multiple locations from a single interface, optimizing resource allocation, reducing the need for costly manual inspections, and ensuring the pump operates strictly within its optimal performance envelope, thereby mitigating potential mechanical stress and enhancing overall system reliability.

Regional Highlights

- Asia Pacific (APAC): Dominance and Rapid Growth Engine – APAC holds the largest market share and is projected to exhibit the highest CAGR due to unprecedented levels of investment in infrastructure development, including urbanization projects, smart city initiatives, and expansion of transportation networks (rail, metro, roads). Countries like China, India, and Indonesia are witnessing massive construction booms, generating continuous demand for dewatering solutions. Furthermore, increasing reliance on resource extraction in Australia and Southeast Asia fuels the need for high-capacity, heavy-duty pumps for mining applications.

- North America: Technological Maturity and Replacement Demand – The North American market is characterized by maturity, stable growth, and a strong emphasis on regulatory compliance (e.g., environmental discharge standards). Demand is primarily driven by the replacement of aging equipment, maintenance of extensive municipal water infrastructure, and highly sophisticated construction techniques. This region shows high adoption rates for advanced, smart pump systems featuring VFDs and IoT connectivity to optimize energy use and adhere to strict environmental performance criteria.

- Europe: Strict Environmental Mandates and Energy Efficiency Focus – European growth is stable, underpinned by strict environmental regulations mandating highly efficient, low-emission pumping solutions, driving the uptake of electric and hydraulic models over diesel variants. The region is a leader in technology adoption, particularly in integrating pumps into automated wastewater management systems and prioritizing sustainability in construction projects. Germany, the UK, and the Nordic countries contribute significantly through sophisticated municipal and industrial applications, focusing heavily on TCO and life-cycle performance.

- Latin America (LATAM): Resource Extraction and Infrastructure Catch-Up – Growth in LATAM is closely linked to the volatility of global commodity prices, as the region hosts substantial mining operations (copper, iron ore) in countries like Chile, Brazil, and Peru. These sectors create consistent demand for heavy-duty submersible slurry and dewatering pumps. Simultaneously, ongoing public works projects aimed at modernizing aging municipal infrastructure contribute to market expansion, albeit often challenged by economic instability and capital constraints.

- Middle East and Africa (MEA): Oil & Gas and Water Scarcity Management – The MEA region presents a complex demand profile. High-value projects in the oil and gas sector (pipeline laying, refining construction) drive temporary, high-demand spikes for dewatering solutions. Concurrently, rapid urbanization in the Gulf Cooperation Council (GCC) countries and critical water management projects across Africa generate steady demand. The market here prioritizes robust pumps capable of operating in extreme heat and handling saline or highly corrosive water sources prevalent in the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Submersible Dewatering Pumps Market.- Xylem Inc.

- KSB SE & Co. KGaA

- Sulzer Ltd.

- Atlas Copco AB

- Tsurumi Manufacturing Co., Ltd.

- EBARA Corporation

- Franklin Electric Co., Inc.

- The Weir Group PLC

- Grindex AB

- Wacker Neuson SE

- Zoeller Company

- Honda Motor Co., Ltd.

- Mersino Dewatering

- Toyo Pumps, Ltd.

- Gorman-Rupp Company

- Wuhan Zhongyuan Submersible Pump Co., Ltd.

- SPP Pumps Ltd.

- Ruhrpumpen Inc.

- Davey Water Products Pty Ltd.

- BJM Pumps

Frequently Asked Questions

Analyze common user questions about the Submersible Dewatering Pumps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Submersible Dewatering Pumps Market?

The primary driver is the accelerating global investment in infrastructure, particularly large-scale construction, road networks, and municipal water management projects, coupled with the critical need for efficient water control in the expanding mining sector worldwide.

Which application segment holds the largest share in the Submersible Dewatering Pumps Market?

The Construction application segment dominates the market share due to continuous and mandatory requirements for dewatering foundations, trenches, and tunnels to ensure safe and efficient working environments for both civil and commercial projects.

How do smart pumping systems impact the operational efficiency of submersible dewatering pumps?

Smart pumping systems, enabled by IoT and VFDs, significantly improve operational efficiency by allowing real-time monitoring of performance parameters, facilitating predictive maintenance to minimize downtime, and dynamically optimizing energy consumption based on fluid inflow rates.

What are the key technological advancements shaping the future of dewatering pumps?

Key technological advancements include the integration of high-efficiency IE4 motors, advanced material science for superior abrasion and corrosion resistance (extending lifespan), and the widespread adoption of AI-driven diagnostics for remote fleet management and predictive failure analysis.

Why is the Asia Pacific region projected to exhibit the highest growth rate?

APAC's high growth rate is attributed to rapid urbanization, massive government expenditures on essential infrastructure and transportation projects, and significant mining and industrial expansion in countries such as China, India, and Indonesia, fueling extensive demand for dewatering equipment.

The detailed market analysis confirms that the Submersible Dewatering Pumps Market is a highly resilient sector, sustained by essential industrial activities globally. The transition toward smart, energy-efficient pumping solutions, alongside increasing infrastructure spending in developing economies, guarantees consistent growth. Manufacturers are focusing on durability through advanced materials and intelligence through digital integration to meet the stringent demands of modern construction, mining, and municipal environments. This convergence of technological sophistication and robust foundational demand solidifies the positive forecast for the industry.

Further market insight indicates that strategic partnerships with specialized rental agencies are increasingly crucial, especially in mature markets like North America and Europe, where projects often demand temporary, high-specification equipment without long-term capital commitment. This business model allows end-users to access the latest pump technologies, including those incorporating advanced sensor arrays and AI diagnostics, without bearing the full acquisition cost, thereby stimulating overall market absorption of innovative products. The competitive landscape is therefore not just about product performance but also about robust distribution, maintenance networks, and flexible financing/rental options, demanding a comprehensive commercial strategy from leading players.

Specific attention is being paid to high-head applications within the deep mining segment. As mines go deeper, the hydraulic requirements become exponentially more demanding, necessitating specialized multi-stage submersible pumps that can handle massive static heads and maintain operational integrity under extreme pressure. Research and development in this niche focuses on hydraulic design optimization, improving pump-end efficiency to reduce the required motor size, and developing modular components that simplify underground installation and maintenance procedures. This high-value segment provides significant revenue opportunities for manufacturers capable of meeting these demanding engineering specifications consistently, often requiring customized solutions rather than standard off-the-shelf units.

In the municipal sector, the focus remains firmly on pumps designed for wastewater and sewage handling. Unlike clean water dewatering, these applications require non-clogging impeller designs (such as vortex or channel impellers) and robust mechanical seals capable of handling high levels of abrasive solids and fibrous material. Energy consumption is a paramount concern for municipal operators due to continuous 24/7 operation; consequently, technologies like premium efficiency motors and VFD integration are non-negotiable standards. The necessity for reliable, low-maintenance pumps in public utility systems ensures sustained, recession-proof demand for specialized wastewater submersible pumps across all key global regions, supporting the market's fundamental stability.

The regulatory environment, particularly in Europe and parts of North America, exerts a considerable influence on product development. Regulations concerning noise emission, especially for pumps used in urban construction or residential proximity, push manufacturers towards quieter electric and hydraulic models. Similarly, directives on waste disposal and water quality management necessitate pumps that can operate reliably within closed-loop systems or handle treated effluent effectively without contamination risk. Compliance with these evolving environmental and operational standards acts as a continuous impetus for innovation, ensuring that market offerings consistently meet or exceed current best practices for sustainability and operational safety, further differentiating compliant, high-quality products from lower-cost alternatives.

Looking ahead, the long-term strategic advantage will belong to firms that successfully leverage data analytics derived from their IoT-enabled pump fleets. Analyzing usage patterns, failure modes, and energy consumption across thousands of deployed units allows manufacturers to iterate on designs rapidly, optimize scheduled maintenance intervals, and provide proactive, value-added services to their customers. This shift from simply selling hardware to offering integrated dewatering solutions, characterized by uptime guarantees and optimized energy performance, is redefining the competitive dynamics and driving merger and acquisition activity focused on acquiring software and sensor technology expertise.

The construction sector's demand for portability and ease of deployment continues to drive innovation in materials science focused on weight reduction. Developing lightweight, high-strength composite materials allows for the production of medium-capacity pumps that are easily handled and repositioned on dynamic construction sites, improving worker safety and productivity. While traditional heavy-duty units remain necessary for permanent industrial installations, the high-volume, quick-turnaround construction market increasingly favors pumps that blend robust performance with superior mobility. This emphasis on ergonomic design and rapid installation further expands the market reach, particularly appealing to smaller contracting firms and specialized rental service providers.

Furthermore, global climate adaptation strategies are increasingly impacting market demand. With many regions facing exacerbated drought conditions or, conversely, increased intensity of rainfall and flooding, submersible dewatering pumps are essential components of water resilience infrastructure. This includes both temporary emergency response capabilities and permanent installations within flood mitigation schemes. Governments and municipal bodies are allocating substantial budgets toward strengthening these water management systems, positioning dewatering pumps as critical climate change adaptation technology, thereby securing a long-term, structurally sound demand stream irrespective of traditional economic cycles.

In summary, the Submersible Dewatering Pumps Market is mature yet dynamic, characterized by stable base demand from construction and mining, amplified by technological innovation focusing on efficiency and connectivity, and underpinned by non-negotiable requirements related to safety and climate change adaptation. Successful market penetration necessitates a comprehensive understanding of regional infrastructure cycles, material science advancements, and the effective integration of digital technologies throughout the product lifecycle and service delivery model.

The segment of hydraulic submersible pumps, while smaller than electric, maintains importance in specific heavy-duty environments, particularly those with explosion risk (e.g., oil & gas, certain mining environments) or where hydraulic power is readily available on site. Hydraulic pumps offer advantages such as high power density and the ability to run dry without immediate motor damage, which electric pumps often cannot sustain without sophisticated internal protection. Manufacturers specializing in this segment focus on developing highly robust, low-maintenance hydraulic systems that can withstand extreme external conditions, ensuring reliability where electrical power access is limited or hazardous.

Conversely, the high-capacity segment (above 50 HP) primarily serves large, continuous operations such as major dams, deep mines, and extensive municipal flood pumping stations. Buyers in this segment are highly sensitive to energy consumption and total system integration. They require customized engineering solutions that maximize the pump's hydraulic efficiency (Head vs. Flow curve) and minimize required maintenance windows. Investment decisions here often involve detailed TCO models and long-term service contracts, favoring established global suppliers with proven reliability and extensive field support capabilities. This segment, though lower in volume, contributes significantly to overall market value due to the high unit cost and complexity of the equipment.

Finally, the competitive strategy across the entire segmentation spectrum increasingly centers on lifecycle management. Companies are leveraging their installed base data to offer tailored maintenance programs, predictive component replacement schedules, and upgrade packages that improve the efficiency of older units. This approach not only generates recurring service revenue but also strengthens customer loyalty, creating barriers to entry for new competitors. The capability to provide comprehensive dewatering solutions, combining hardware, monitoring software, and service expertise, is now the benchmark for market leadership in this essential industrial equipment sector, requiring significant investment in both R&D and field service networks globally.

The strategic differentiation for electric submersible pumps often revolves around motor cooling and sealing technology. Effective motor cooling is crucial for maintaining high efficiency when pumps are operating in low-water conditions or handling high-temperature fluids. Manufacturers utilize advanced oil-filled or water-jacket cooling systems to manage heat dissipation, ensuring the pump can operate continuously without performance degradation or premature motor failure. Similarly, mechanical seal technology, often featuring dual or triple seal arrangements with advanced material faces (like silicon carbide), is vital for preventing water ingress into the motor housing, which is the most common cause of submersible pump failure. Continuous innovation in these areas is non-negotiable for maintaining competitive edge in the dominant electric segment.

Furthermore, the segmentation by capacity directly influences material selection and robustness. Low-capacity pumps are often designed for maximum portability, utilizing lighter materials such as aluminum housings and thermoplastic components, primarily catering to utility, small construction, and residential markets. Medium and high-capacity pumps, conversely, must prioritize wear resistance and strength, leading to the use of heavy-duty cast iron, ductile iron, and specialized hardened steel alloys. This capacity-based differentiation in material science dictates the manufacturing complexity and, consequently, the price point, demonstrating a clear relationship between required performance characteristics and unit cost within the various market segments.

The rental market, defined under the End-User segmentation (Contractors & Rental Companies), serves as a critical barometer for market health and technological adoption. Rental firms demand pumps that are exceptionally durable, easy to service, and highly versatile to meet the varying requirements of their diverse client base. They prefer modular designs where pump ends can be quickly replaced or serviced in the field, minimizing their off-rent time. Manufacturers who succeed in this channel must provide robust, standardized, and easily maintainable products with readily available spare parts, as the TCO for a rental company is measured heavily by durability and speed of service, driving a specific set of design imperatives.

Finally, the growing environmental consciousness is creating a niche market for specialized pumps designed for handling contaminated water, including leachate from landfills or heavily polluted industrial effluent. These applications require specific materials highly resistant to chemical corrosion and explosion-proof (Ex-rated) features for handling volatile liquids. Though a smaller volume segment, this area commands premium pricing due to the complexity of the engineering, strict regulatory compliance requirements, and the necessity for extreme operational reliability in hazardous environments, representing a high-margin opportunity for specialized manufacturers focusing on environmental remediation solutions.

The segmentation based on geographical region further reveals differentiated market requirements. For instance, in seismic zones or areas prone to ground shifting, specialized pump casings and flexible discharge systems are required to absorb movement without compromising sealing integrity. Manufacturers catering to these regions must integrate higher safety margins and ruggedized components into their designs. Conversely, in regions with extremely low labor costs, the demand might lean toward less complex, easier-to-repair mechanical systems rather than highly integrated, technologically sophisticated smart systems that require specialized technicians, showcasing how local economic factors influence preferred product characteristics across different segments globally.

Addressing the segmentation of the Value Chain, the distribution network optimization remains a competitive battleground. With the global scale of infrastructure projects, logistics efficiency in delivering heavy, large-scale pumps to remote mining or construction sites is paramount. Leading companies are investing heavily in localized assembly and stocking facilities, particularly in high-growth regions like APAC, to minimize transportation costs and lead times. Furthermore, the role of certified service centers, providing genuine spare parts and factory-trained technicians, is a non-price competitive advantage that secures long-term customer relationships, proving that post-sale support is as crucial as initial product quality in securing market share.

The technology landscape is continually shaped by regulatory pressure to reduce noise pollution, particularly in urban environments. This requirement has spurred innovations in pump housing designs that incorporate noise dampening materials and motor technologies optimized for quieter operation. For contractors working on municipal projects, compliance with noise ordinances is mandatory, making low-noise performance a key purchasing criterion alongside efficiency and durability. Manufacturers are therefore required to invest in acoustical engineering, adding complexity and specific design costs, but yielding a clear market advantage in noise-sensitive applications, demonstrating how external regulatory factors directly influence core technological development and product segmentation within the dewatering market.

Ultimately, the synthesis of segmentation, value chain, and technological trends reveals a market undergoing subtle yet persistent evolution. While the core function of removing water remains unchanged, the methods—driven by AI, efficiency demands, and material science—are rapidly advancing. The market rewards holistic solutions providers who can deliver high reliability across diverse applications, optimize the total cost of ownership through smart systems, and maintain flexibility through robust global distribution and rental networks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager