Sulphuric Acid Resistant Chemical Pump Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443028 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Sulphuric Acid Resistant Chemical Pump Market Size

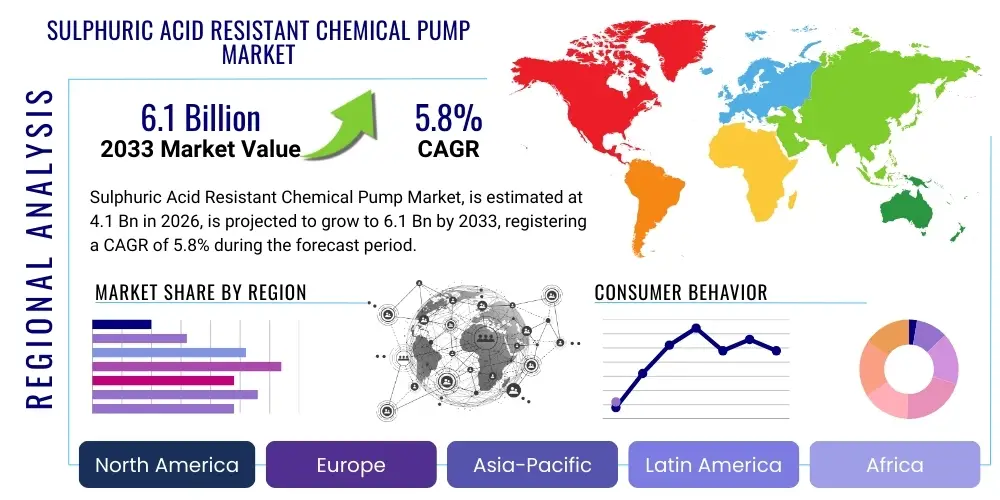

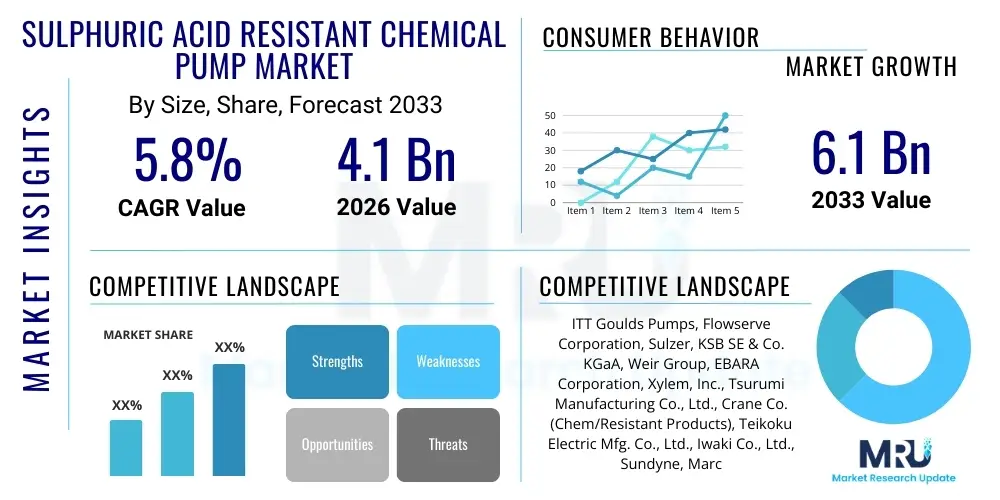

The Sulphuric Acid Resistant Chemical Pump Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033.

The robust growth trajectory of this specialized market is fundamentally driven by the continuous expansion of core industrial sectors globally, particularly phosphate fertilizer production, metallurgical processing, and petroleum refining, all of which rely heavily on concentrated sulphuric acid as a critical intermediary. The demand for highly durable and chemically inert pumping solutions is paramount, given the corrosive nature, high temperature, and varying concentrations of the acid being handled. This necessity translates into consistent capital expenditure for advanced pumping systems that promise extended operational lifespan and minimize environmental and safety risks associated with catastrophic equipment failure. Furthermore, the stringent enforcement of occupational health and safety regulations, alongside rigorous environmental protection mandates across developed and emerging economies, compels end-users to invest in premium pumps constructed from specialized alloys or non-metallic polymers, thereby escalating the overall market valuation.

Market expansion is also significantly influenced by the technology shift toward magnetically coupled pumps, often referred to as sealless pumps, which eliminate traditional mechanical seals—the most common points of leakage and failure in conventional centrifugal pumps. For highly hazardous and corrosive fluids like sulphuric acid, sealless technology offers unparalleled safety, reduced maintenance costs, and zero emissions, aligning perfectly with modern industrial requirements for environmental stewardship and operational efficiency. Although the initial investment for these specialized pumps is higher than standard models, the total cost of ownership (TCO) is lower due to reduced downtime and minimal maintenance requirements in demanding chemical processes. This long-term cost-effectiveness, coupled with ongoing infrastructural investments in chemical processing plants across Asia Pacific and the Middle East, cements the market's positive growth outlook through 2033.

Sulphuric Acid Resistant Chemical Pump Market introduction

The Sulphuric Acid Resistant Chemical Pump Market encompasses specialized fluid handling equipment engineered to safely and efficiently transfer sulphuric acid (H₂SO₄) across various concentrations and temperatures encountered in industrial processes. These pumps are critical components in industries such as fertilizer manufacturing (especially phosphoric acid production), mining and metallurgy (leaching operations), chemical synthesis, and wastewater treatment, where the highly corrosive nature of the acid necessitates the use of exotic materials like high-nickel alloys (e.g., Alloy 20, Hastelloy C), corrosion-resistant plastics (e.g., PTFE, PVDF, UHMW-PE), and specialized ceramics or composite linings. Product descriptions typically revolve around centrifugal pumps (both sealed and sealless magnetic drive types) and positive displacement pumps (such as progressive cavity or gear pumps) designed explicitly for high reliability under severe operating conditions, adhering strictly to international standards like ANSI or ISO for chemical process pumps to ensure dimensional interchangeability and performance consistency.

The major applications driving the market include the production train for phosphate fertilizers, which requires moving vast quantities of H₂SO₄, and the demanding environment of smelters and refineries where the acid is often produced as a byproduct of sulfurous gas scrubbing. Benefits derived from utilizing these specialized pumps are centered on enhanced operational safety, prevention of acid leaks (which pose significant danger to personnel and infrastructure), and substantial reduction in unscheduled downtime due to component failure. Moreover, these high-integrity pumps contribute directly to environmental compliance by mitigating the risk of hazardous chemical spills. Driving factors for market adoption include robust industrial capacity expansion, especially in emerging markets with growing agricultural and industrial output, combined with the increasing global emphasis on safety protocols, necessitating the replacement of older, less reliable equipment with state-of-the-art corrosion-resistant technology.

Sulphuric Acid Resistant Chemical Pump Market Executive Summary

The Sulphuric Acid Resistant Chemical Pump Market demonstrates strong resilience and consistent growth, propelled primarily by indispensable demand from the chemical and fertilizer sectors. Key business trends indicate a definitive shift toward sealless magnetic drive pump technology, driven by stringent safety regulations and the operational advantages of zero leakage, minimizing maintenance expenditures and environmental hazards associated with mechanical seals. Manufacturers are focusing heavily on material science innovation, developing advanced non-metallic materials and specialized fluoropolymers that offer superior chemical resistance and thermal stability, presenting cost-effective alternatives to expensive nickel-based alloys for specific acid concentrations. Furthermore, the integration of Internet of Things (IoT) sensors and remote monitoring capabilities into pumping systems is emerging as a critical competitive differentiator, enabling predictive maintenance schedules and optimizing pump longevity and efficiency across high-risk applications, thereby maximizing asset utilization for end-users.

Regionally, the Asia Pacific (APAC) region stands out as the primary growth engine, fueled by massive investments in fertilizer production to meet escalating food demand and rapid industrialization in countries like China, India, and Southeast Asian nations, where the construction of new chemical processing facilities necessitates significant procurement of new pumping infrastructure. North America and Europe, while exhibiting slower growth in terms of new construction, maintain high market values driven by continuous demand for equipment replacement, technological upgrades to comply with stricter environmental mandates (e.g., REACH), and the utilization of advanced pumps in highly specialized niche applications such as high-purity chemical manufacturing. Segment trends highlight that Centrifugal pumps dominate the market share due to their high flow capacity, suitability for continuous duty cycles, and material versatility, although Positive Displacement pumps retain essential status in applications requiring high pressure or precise dosing accuracy, particularly in chemical processing or specialized wastewater treatment involving concentrated acid injection.

AI Impact Analysis on Sulphuric Acid Resistant Chemical Pump Market

User inquiries regarding AI's influence in the chemical pump sector commonly focus on how smart systems can enhance pump reliability, mitigate risks associated with corrosive failure, and streamline operational management. The central themes reveal expectations around AI-driven predictive maintenance models capable of anticipating material degradation before failure, optimizing pump operational parameters (such as flow rate adjustments based on acid concentration changes), and automating component inventory management. Users are concerned about the complexity and cost of integrating AI tools with legacy pump infrastructure and the need for standardized data protocols across disparate pump manufacturers. Expectations also include AI assisting in the initial selection process, guiding engineers to the most suitable material and pump type (e.g., metallic vs. non-metallic, sealed vs. sealless) based on specific chemical profiles, temperature fluctuations, and operational duties, reducing human error and improving capital expenditure efficiency in highly specialized procurement.

Artificial Intelligence algorithms, specifically machine learning models trained on vast datasets of historical performance, vibration analysis, temperature readings, and pressure trends, are fundamentally transforming how critical assets like sulphuric acid pumps are managed. By analyzing complex multivariate data streams in real-time, AI can detect subtle anomalies indicative of seal failure, bearing wear, or corrosion creep far earlier than traditional condition monitoring techniques. This shift from reactive or scheduled maintenance to highly accurate predictive maintenance minimizes the incidence of catastrophic failures, which, given the hazardous nature of sulphuric acid, translates directly into enhanced worker safety and massive reductions in clean-up costs and environmental fines. Furthermore, AI systems are increasingly utilized in process optimization, modulating pump speed and flow to ensure energy efficiency while maintaining optimal chemical reaction conditions downstream, leading to significant operational savings for large-scale chemical producers and refiners.

The deployment of AI-enabled systems also addresses challenges in supply chain resilience by forecasting maintenance needs with greater accuracy, allowing procurement teams to manage the inventory of expensive, long-lead-time components—such as specialized impellers made from exotic alloys—more effectively. This capability is crucial in avoiding bottlenecks caused by sudden, unexpected equipment failures. Beyond maintenance, advanced AI platforms are assisting in modeling fluid dynamics within the pump, optimizing internal geometries to reduce turbulence and cavitation, thereby extending the life of corrosion-prone internal parts and improving hydraulic efficiency. This data-centric approach is establishing a new paradigm for asset integrity management, transitioning sulphuric acid pump ownership from a burdensome maintenance task to a finely tuned, technologically optimized operation, substantially increasing the reliability quotient necessary for continuous process industries.

- AI enables predictive maintenance by analyzing vibration and thermal signatures, preempting catastrophic failures.

- Optimized pump selection through machine learning models based on specific acid concentration and temperature profiles.

- Real-time performance monitoring and automated adjustment of operating parameters for energy efficiency.

- Enhanced inventory management for expensive, specialized pump components (e.g., Hastelloy parts).

- Improved safety compliance by minimizing human intervention in high-risk chemical environments.

- Utilization of generative AI for rapid design prototyping of complex non-metallic pump geometries.

DRO & Impact Forces Of Sulphuric Acid Resistant Chemical Pump Market

The Sulphuric Acid Resistant Chemical Pump Market is shaped by a complex interplay of positive momentum (Drivers), operational challenges (Restraints), future pathways (Opportunities), and overarching industry pressures (Impact Forces). The market’s primary driving force stems from the non-discretionary global requirement for sulfuric acid in key industrial processes, particularly in the production of phosphate fertilizers vital for global food security, ensuring continuous demand for replacement and new installation of reliable pumps. Furthermore, escalating regulatory scrutiny concerning industrial chemical safety and environmental protection mandates the adoption of higher-integrity equipment, favoring premium, leakage-preventing designs like sealless magnetic drive pumps, which directly elevates the average selling price and market value. Alongside this, significant infrastructure expansion in developing economies, targeting chemical, mining, and metallurgical sectors, provides substantial avenues for market penetration and volume growth throughout the forecast period.

However, the market faces significant restraints, chiefly related to the high capital investment required for specialized corrosion-resistant materials. The materials necessary for handling highly concentrated or high-temperature sulphuric acid—such as expensive nickel-based alloys or advanced, thick-walled fluoropolymers—result in substantial upfront costs, which can deter smaller industrial operators or those in price-sensitive regions. The technical complexity involved in the design, manufacturing, and maintenance of these pumps, especially concerning the precise tolerance required for magnetic couplings or composite lining applications, demands highly skilled labor, adding to operational expenses. Furthermore, the volatility in the prices of critical raw materials, particularly nickel and specialized polymers, poses a challenge to stable pricing and margins for pump manufacturers, creating uncertainty in long-term supply agreements and procurement strategies across the industry.

Despite these challenges, substantial opportunities exist, particularly through technological innovation centered on advanced composite materials and plastics. The development of non-metallic materials like fiber-reinforced polymers or specialized PFA/PVDF linings that can withstand moderately concentrated H₂SO₄ at elevated temperatures offers a cost-effective, durable alternative to prohibitively expensive metallic alloys, widening the accessible market. A significant growth avenue lies in the expansion of digitalization and condition monitoring; integrating smart sensors, IoT platforms, and AI-based diagnostics into existing and new pump installations allows companies to offer comprehensive predictive maintenance packages, generating recurring revenue streams and enhancing customer loyalty through maximized uptime. Finally, opportunities are emerging in niche high-ppurity applications, such as semiconductor manufacturing, where extremely high integrity and non-contaminating pump construction are mandatory, requiring highly specialized inert material solutions.

Impact forces acting on the market are dominated by stringent regulatory frameworks, including chemical substance controls (e.g., REACH in Europe) and emissions standards, which directly influence pump design toward zero-leakage solutions. Macroeconomic shifts, such as fluctuating global commodity prices, particularly for phosphates and sulfur, indirectly impact the market by affecting the profitability and investment capacity of fertilizer producers, the market's largest end-user group. Technological obsolescence is also a significant impact force, where older pump models are steadily being replaced by technologically superior magnetic drive or canned motor designs due to inherent safety advantages and lower life-cycle costs. Global trade tariffs and supply chain vulnerabilities, particularly concerning exotic metals sourced globally, represent an external impact force that manufacturers must continuously manage to ensure stable production timelines and delivery schedules for specialized pumping equipment.

Segmentation Analysis

The Sulphuric Acid Resistant Chemical Pump Market is broadly segmented based on the critical characteristics that dictate suitability for harsh chemical environments, including the core material of construction, the operational pumping mechanism, the specific flow rate capacity, and the primary industrial application. Understanding these segments is crucial for market participants to tailor their offerings effectively and address the precise technical requirements demanded by varying acid concentrations and process temperatures. The segmentation highlights the trade-offs between metallic and non-metallic solutions—where metals offer high mechanical strength and temperature resistance but are vulnerable to specific acid concentrations, while non-metals excel in corrosion immunity but may have lower pressure or temperature limits. This multi-faceted segmentation structure allows for granular analysis of demand patterns, indicating high growth areas such as sealless magnetic drive non-metallic pumps for mid-concentration acid handling and high-alloy centrifugal pumps for highly concentrated, high-temperature applications common in primary chemical production.

A deep dive into the segmentation by Type reveals the dominance of Centrifugal Pumps, which are favored for their simplicity, continuous flow capability, and ability to handle large volumes of fluid required in fertilizer production and large-scale chemical transfer. Within this type, the shift toward Magnetic Drive (Sealless) technology is the most pronounced trend, commanding increasing market share due to unparalleled safety features. Conversely, the segmentation by Material is rapidly diversifying beyond traditional stainless steels into specialized alloys (like Duplex and Super Duplex Stainless Steels, and Nickel-Chromium-Molybdenum alloys) and advanced plastics, where materials such as Polypropylene (PP), Polyvinylidene Fluoride (PVDF), and Polytetrafluoroethylene (PTFE) are increasingly specified for applications where corrosion resistance is the primary concern, such as in processes involving dilute acid or high-purity requirements. This material diversity ensures that specific resistance profiles can be matched to the exact chemical duty, optimizing both performance and total cost of ownership across the diverse industrial landscape reliant on sulfuric acid pumping.

The segmentation by Application provides the clearest indicator of market volume and critical demand centers. The Fertilizer sector, dominated by phosphate and sulfate production, remains the single largest consumer of these specialized pumps, followed closely by General Chemical Manufacturing, which includes numerous processes requiring acid catalysis or neutralization. Furthermore, the segmentation by Flow Rate (categorized typically into Low, Medium, and High) influences the design complexity and material choice; high-flow applications generally mandate robust, metallic centrifugal pumps, while low-flow, high-precision dosing applications often utilize positive displacement technologies with highly inert plastic components. This comprehensive segmentation framework assists manufacturers in prioritizing R&D efforts towards high-demand, high-growth segments, such as developing larger capacity sealless pumps or creating more durable non-metallic components suitable for increasingly challenging operating environments prevalent across global industry.

- By Type:

- Centrifugal Pumps

- Positive Displacement Pumps (Gear, Piston, Diaphragm)

- Magnetic Drive (Sealless) Pumps

- Vertical Sump Pumps

- By Material:

- Metallic Alloys (Hastelloy, Alloy 20, Duplex Steel, Titanium)

- Non-Metallic/Polymer (PTFE, PVDF, UHMW-PE, PFA/FEP Lined)

- Ceramic/Graphite Composite

- By Application:

- Fertilizer Production (Phosphate and Nitrogen-based)

- Chemical Manufacturing

- Mining and Metallurgy (Hydrometallurgy/Leaching)

- Petrochemical Refining

- Wastewater Treatment and Neutralization

- By Flow Rate:

- Low Flow (Up to 50 m³/h)

- Medium Flow (50 m³/h to 300 m³/h)

- High Flow (Above 300 m³/h)

Value Chain Analysis For Sulphuric Acid Resistant Chemical Pump Market

The value chain for the Sulphuric Acid Resistant Chemical Pump Market begins with upstream activities centered on the sourcing and refinement of specialized raw materials. This phase is characterized by the high dependence on global suppliers for exotic metals (nickel, chromium, molybdenum used in Hastelloy and Alloy 20) and high-performance polymers (fluoropolymers like PTFE and PFA). The price volatility and geopolitical factors affecting the supply of these niche materials significantly impact the final manufacturing cost. Manufacturing involves specialized foundries and fabrication facilities capable of precision casting, welding, and machining these materials, followed by assembly of complex components, including impellers, casings, shafts, and magnetic couplings. Quality control and rigorous testing, particularly hydrostatic testing and performance verification under simulated corrosive conditions, are critical steps to ensure the pump meets strict industry standards and safety specifications required for handling hazardous chemicals.

The downstream segment focuses heavily on sophisticated distribution channels and post-sale services. Due to the highly technical nature of the product, direct sales through dedicated engineering teams are common, especially for large industrial projects requiring customized pump solutions tailored to specific process parameters (e.g., concentrated hot acid transfer in a specific plant configuration). Indirect distribution channels involve specialized distributors or agents who possess deep technical expertise in chemical processing equipment, offering local inventory, installation support, and authorized repair services. The critical differentiator in the downstream segment is the provision of lifecycle services, including spare parts availability (especially for quick-wear components like seals or specialized liners) and comprehensive maintenance contracts, which are vital for chemical plants aiming to maximize uptime and regulatory compliance, ensuring a reliable revenue stream for manufacturers.

The relationship between manufacturers and end-users is characterized by long-term partnerships due to the high integration of these pumps into critical infrastructure. Direct channels are preferred for high-value contracts, allowing manufacturers to maintain tight control over product specification and installation quality, ensuring that the selected material and pump design is optimal for the exact acid duty. Indirect channels, while offering broader market reach and local responsiveness, require rigorous training and certification of distributors to maintain the technical integrity of the product and service offerings. The emphasis across the entire value chain remains on safety, reliability, and material science innovation, as any failure along the chain—from material defects upstream to improper installation downstream—can lead to catastrophic operational and environmental consequences when dealing with highly corrosive fluids like concentrated sulfuric acid, making technical expertise a primary competitive element.

Sulphuric Acid Resistant Chemical Pump Market Potential Customers

Potential customers for Sulphuric Acid Resistant Chemical Pumps are concentrated within capital-intensive heavy industries that rely on sulphuric acid as a fundamental processing agent. The largest group of buyers includes multinational and national fertilizer producers (such as Mosaic, Nutrien, and large state-owned chemical enterprises) engaged in the production of phosphate fertilizers, where massive quantities of concentrated acid are circulated continuously. These entities represent the highest volume demand, driving purchases of large, high-flow centrifugal pumps, often selecting high-alloy metallic or specialized lined pumps for extreme duty cycles. Additionally, mining and metallurgical operations, particularly those involved in hydrometallurgical leaching processes for copper, zinc, and nickel extraction, are significant purchasers, requiring robust pumps capable of handling not only corrosive acid but often abrasive slurries containing acid, necessitating heavy-duty construction materials and specific mechanical seals or sealless designs.

Beyond the primary industries, a substantial customer base exists within the broader Chemical Manufacturing sector, encompassing producers of pigments, detergents, explosives, and various organic and inorganic chemicals. These customers frequently require smaller, more precise pumping solutions, such as positive displacement pumps or low-flow magnetic drive centrifugal pumps, often prioritizing non-metallic construction (PTFE/PVDF) to maintain high purity or handle varied acid concentrations in batch processing environments. Furthermore, industrial wastewater treatment facilities, which utilize sulphuric acid for pH adjustment and neutralization of alkaline effluents prior to discharge, represent a steady, geographically diverse market for medium-sized, reliable dosing and transfer pumps. Regulatory compliance and the need for precision injection systems are key purchasing criteria for this segment.

In essence, the end-user landscape is defined by organizations prioritizing safety, operational continuity, and compliance with stringent environmental regulations when handling hazardous chemicals. Purchasing decisions are typically made by engineering, procurement, and operations teams who evaluate suppliers based on proven reliability records, material certification, and the provision of long-term technical support. These customers are highly sensitive to pump failure, viewing equipment investment as a critical element of risk mitigation rather than merely a component cost, thereby favoring established suppliers offering documented longevity and specialized expertise in acid handling applications over lower-cost alternatives lacking verifiable technical pedigree in corrosion resistance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ITT Goulds Pumps, Flowserve Corporation, Sulzer, KSB SE & Co. KGaA, Weir Group, EBARA Corporation, Xylem, Inc., Tsurumi Manufacturing Co., Ltd., Crane Co. (Chem/Resistant Products), Teikoku Electric Mfg. Co., Ltd., Iwaki Co., Ltd., Sundyne, March Manufacturing Inc., Griswold Pump Company, Finish Thompson Inc., Roto Pumps Limited, Verder Group, Ruhrpumpen Group, Wenzhou Lianyi Pump Co., Ltd., PSG Dover (Wilden/Neptune). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sulphuric Acid Resistant Chemical Pump Market Key Technology Landscape

The technological landscape of the Sulphuric Acid Resistant Chemical Pump Market is dominated by advancements in material science and mechanical design focused on leak prevention and extended service life under extreme corrosive conditions. The paramount technology shift is the pervasive adoption of magnetic drive (mag-drive) sealless pumps. Mag-drive pumps utilize powerful magnets to transmit power from the motor to the impeller, eliminating the need for a dynamic mechanical seal that is typically the weakest point in conventional pumps when handling aggressive fluids like sulfuric acid. This design innovation inherently offers zero leakage, drastically improving worker safety and environmental compliance. Further technological refinement involves optimizing the design of internal non-metallic containment shells, often utilizing PFA or thick PVDF, to ensure full chemical isolation and high-pressure integrity, allowing these sealless designs to compete effectively with traditional metallic sealed pumps even in moderate-to-high flow applications prevalent in fertilizer plants.

Material innovation represents the second crucial technological pillar. Historically, handling high-concentration (above 90%) and hot sulfuric acid relied almost exclusively on expensive nickel alloys such as Alloy 20 or Hastelloy C. However, ongoing R&D focuses on developing advanced non-metallic composite materials, including fiber-reinforced polymers (FRP) with engineered resin barriers and specialized linings (e.g., Ultra-High Molecular Weight Polyethylene – UHMW-PE), which offer exceptional resistance to medium-concentration acid (up to 70%) at ambient or slightly elevated temperatures at a significantly lower material cost. Furthermore, there is continued technological focus on improving the metallurgy of duplex and super duplex stainless steels, enhancing their pitting and crevice corrosion resistance specifically for mildly aggressive sulfuric acid environments, providing a balance between cost, mechanical strength, and corrosion immunity for lower-risk applications within refining or wastewater treatment processes.

Lastly, digitalization and integration of smart technology are fundamentally redefining the operational lifecycle of these pumps. Modern sulfuric acid pumps are increasingly equipped with integrated sensors for real-time vibration analysis, temperature monitoring (especially critical for bearing health in mag-drive pumps), and pressure measurement. This sensor data feeds into IoT platforms and cloud-based analytics systems, facilitating sophisticated condition monitoring. The use of diagnostic tools and AI-driven platforms allows operators to implement predictive maintenance models, analyzing slight shifts in operational data to preemptively identify material degradation or imminent mechanical failure, maximizing pump utilization and minimizing exposure to hazardous substances. This integration of digital monitoring not only boosts efficiency but is rapidly becoming a standard expectation for high-integrity chemical transfer equipment, marking a critical evolutionary step in pump technology deployment.

Regional Highlights

- Asia Pacific (APAC): APAC is the fastest-growing and largest regional market, driven primarily by massive investments in infrastructure development, rapid industrialization, and, most crucially, the overwhelming demand for phosphate and nitrogen fertilizers to support the region’s expansive agricultural sector. Countries like China, India, and Indonesia are witnessing significant capital expenditure on new chemical processing facilities and mining operations (especially in copper and nickel leaching, which uses H₂SO₄ extensively), directly translating into high-volume pump procurement for both new installations and capacity upgrades. Regulatory standards concerning safety are gradually tightening, encouraging the adoption of advanced sealless pumps over conventional, failure-prone sealed units, further stimulating market value growth.

- North America: North America represents a mature yet high-value market characterized by stringent environmental safety regulations (e.g., EPA standards) that necessitate the use of premium, reliable, and often magnetically coupled pumps to ensure zero emissions. The demand is heavily skewed toward replacement and technological upgrading of existing pump fleets in chemical production, refining, and specialized manufacturing (e.g., high-purity chemicals for electronics). Innovation adoption is high here, with early uptake of IoT and AI-enabled condition monitoring systems for predictive maintenance strategies being a key regional trend focused on maximizing asset longevity and minimizing regulatory risk.

- Europe: Similar to North America, the European market is defined by replacement cycles and adherence to exceptionally strict safety and chemical management regulations (such as REACH). The region sees strong demand for pumps made from specialized alloys and highly engineered non-metallic materials, particularly for specialized chemical synthesis and pharmaceutical intermediate production where acid handling must meet the highest standards of purity and containment. Growth is steady, fueled by technological advancement and the continuous need to upgrade equipment in aging facilities to meet escalating environmental compliance benchmarks and occupational safety requirements.

- Middle East and Africa (MEA): This region is experiencing significant market growth, particularly in the Middle East, driven by the expansion of the oil and gas sector (requiring acid for refining processes) and large-scale fertilizer production facilities, capitalizing on regional gas reserves and phosphate deposits. Investments in large-scale desalination and independent power projects also contribute, as some operations require acid dosing for water conditioning. African market growth, though patchy, is centered primarily around large mining operations (copper, gold, platinum) where hydrometallurgical processing necessitates extensive use of specialized, robust pumps designed to withstand harsh operating conditions, often in remote locations where reliability is paramount.

- Latin America: Market demand is highly concentrated in countries with significant mining sectors, notably Chile and Peru, which are major global copper producers utilizing vast amounts of sulfuric acid for leaching. The market dynamic is closely tied to global commodity prices, affecting investment decisions in new mining infrastructure. The industrial base also includes chemical and petrochemical plants in countries like Brazil and Mexico. Price sensitivity is often higher than in North America or Europe, leading to a balanced demand between high-alloy metallic pumps for critical processes and more cost-effective non-metallic or composite-lined pumps for general transfer applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sulphuric Acid Resistant Chemical Pump Market.- ITT Goulds Pumps

- Flowserve Corporation

- Sulzer

- KSB SE & Co. KGaA

- Weir Group

- EBARA Corporation

- Xylem, Inc.

- Tsurumi Manufacturing Co., Ltd.

- Crane Co. (Chem/Resistant Products)

- Teikoku Electric Mfg. Co., Ltd.

- Iwaki Co., Ltd.

- Sundyne

- March Manufacturing Inc.

- Griswold Pump Company

- Finish Thompson Inc.

- Roto Pumps Limited

- Verder Group

- Ruhrpumpen Group

- Wenzhou Lianyi Pump Co., Ltd.

- PSG Dover (Wilden/Neptune)

- AxFlow Holding AB

- CECO Environmental

- Sealed Air Corporation

- Met-Pro Corporation

- Shanghai East Pump (Group) Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Sulphuric Acid Resistant Chemical Pump market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the best materials for handling high-concentration sulphuric acid?

For high concentrations (above 90%) and elevated temperatures, the optimal materials are typically specialized high-nickel alloys such as Alloy 20, Hastelloy C-276, and sometimes high-silicon cast irons. Non-metallic options like PFA-lined pumps or specific high-density polymers can be suitable for lower temperatures or specific acid concentration ranges, but exotic metallic alloys offer superior mechanical and thermal resistance for critical hot acid applications, ensuring longevity and safety under severe duty.

Why are sealless magnetic drive pumps preferred over traditional sealed pumps for sulphuric acid applications?

Sealless magnetic drive pumps are preferred because they eliminate the dynamic mechanical seal, which is the primary failure point leading to hazardous acid leakage and pump downtime. Mag-drive pumps offer containment security, zero emissions, and significantly reduced maintenance requirements, aligning with strict environmental and safety regulations, thereby reducing the total life-cycle cost despite a higher initial investment compared to traditional sealed centrifugal pumps.

How does the concentration and temperature of sulphuric acid affect pump selection?

Concentration and temperature are the two most critical factors determining material choice. Highly concentrated acid (98%) at high temperatures necessitates expensive metallic alloys (e.g., Hastelloy). Dilute acid (below 50%) is highly corrosive and often requires advanced non-metallic materials like PTFE or PVDF lining. The selection process must precisely match the pump's construction material to the specific chemical operating window to prevent rapid catastrophic corrosion and ensure operational integrity and safety.

Which industrial sector drives the highest demand for Sulphuric Acid Resistant Chemical Pumps?

The Fertilizer Production sector, specifically the manufacturing of phosphate fertilizers, is the primary driver of demand. This process involves the continuous, high-volume transfer of sulfuric acid to produce phosphoric acid, necessitating large fleets of highly robust and corrosion-resistant centrifugal pumps. The global expansion of agricultural requirements ensures this sector maintains its position as the largest and most critical end-user base for these specialized pumps worldwide.

What impact does IoT technology have on the Sulphuric Acid Resistant Pump Market?

IoT technology, integrating smart sensors and connected diagnostic tools, enables real-time condition monitoring of pumps by tracking vibration, temperature, and pressure. This digital integration facilitates predictive maintenance, allowing operators to anticipate component failure due to corrosion or mechanical wear long before it occurs. This capability significantly improves pump uptime, reduces maintenance costs, enhances safety by minimizing unplanned human exposure to acid spills, and is becoming standard for high-value chemical processing assets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager