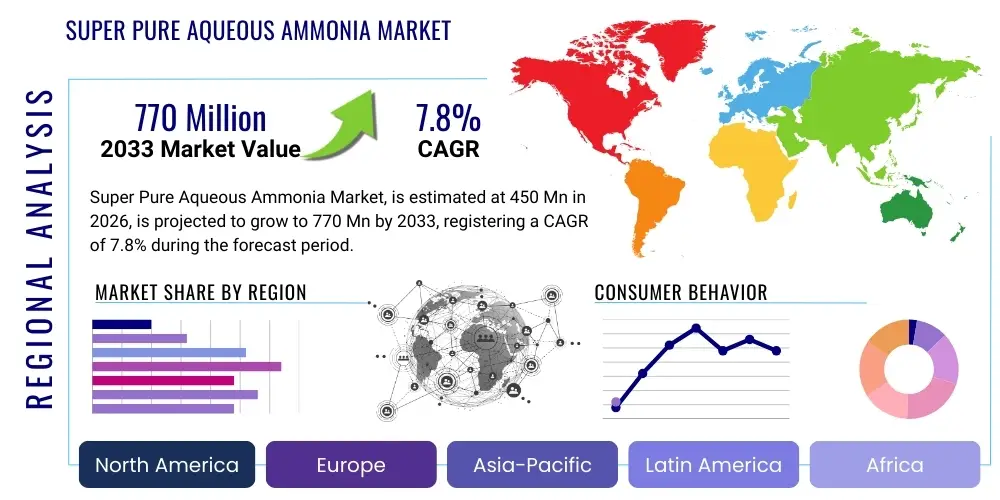

Super Pure Aqueous Ammonia Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443564 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Super Pure Aqueous Ammonia Market Size

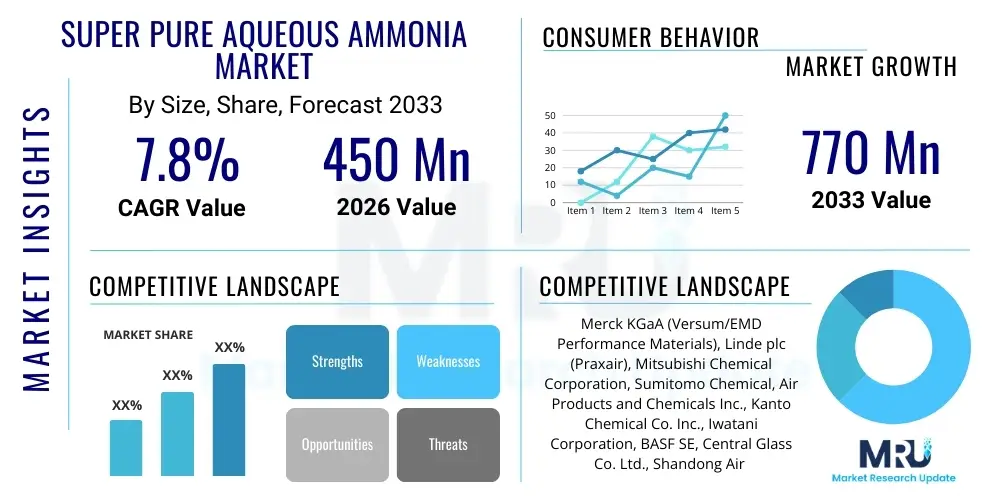

The Super Pure Aqueous Ammonia Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 770 Million by the end of the forecast period in 2033.

Super Pure Aqueous Ammonia Market introduction

The Super Pure Aqueous Ammonia (SPAA), often referred to as Ultra-High Purity Ammonium Hydroxide (NH4OH), is a specialized chemical critical to the high-technology sectors, primarily semiconductor manufacturing, advanced flat panel displays (FPDs), and high-efficiency solar cells. Its defining characteristic is the extremely low concentration of metallic ions, particulates, and organic impurities, often measured in parts per trillion (ppt) or parts per billion (ppb). This level of purity is non-negotiable in processes where even trace contamination can lead to catastrophic device failure or yield reduction, such as the etching, cleaning, and preparation of silicon wafers or display substrates. The product is typically sold in concentrations ranging from 20% to 30%, with 29% being a standard concentration for electronic grades.

Major applications of SPAA are concentrated in the microelectronics industry, where it is indispensable for wet chemical processing. In semiconductor fabrication, SPAA is a key component in Standard Clean 1 (SC-1) solutions, used for removing organic residues and particle contamination from silicon wafer surfaces without damaging the underlying structure. The ability of SPAA to complex and remove specific trace metals while maintaining surface integrity is paramount to achieving high yields in advanced nodes (e.g., 7nm, 5nm, and below). Furthermore, its use extends to Chemical Mechanical Planarization (CMP) processes and epitaxy steps, cementing its role as a foundational material in digital technology manufacturing.

The primary benefits driving the market include enhanced semiconductor device performance, superior manufacturing yields, and improved reliability of electronic components. As chip architectures become more complex and feature sizes shrink, the demand for higher purity levels of all wet chemicals, including SPAA, escalates. Driving factors encompass the global expansion of 5G technology adoption, the surge in data center construction necessitating advanced logic and memory chips, and increasing investments in domestic semiconductor manufacturing capabilities across regions like North America, Europe, and Asia Pacific. These macroscopic technological shifts directly translate into increased consumption and heightened quality requirements for Super Pure Aqueous Ammonia.

Super Pure Aqueous Ammonia Market Executive Summary

The Super Pure Aqueous Ammonia market is characterized by stringent quality control, high barriers to entry, and strong correlation with the global semiconductor fabrication capacity utilization rates. Business trends indicate a movement towards regional supply chain resilience, driven by geopolitical concerns and lessons learned from pandemic-related disruptions. Major chemical producers are strategically investing in capacity expansions, particularly in Asia Pacific, which remains the dominant manufacturing hub for microelectronics. There is a noticeable trend towards just-in-time delivery systems and bulk supply mechanisms for high-volume customers, requiring sophisticated logistics and storage capabilities to maintain product integrity and purity throughout the supply chain. Furthermore, innovation is focused on enhancing purification techniques to meet the upcoming G5 and G4 purity standards, pushing the detection limits of trace impurities even lower.

Regionally, Asia Pacific (APAC), led by Taiwan, South Korea, China, and Japan, commands the largest market share due to the concentration of leading semiconductor foundries (Fabs) and integrated device manufacturers (IDMs). This region dictates market pricing and technological requirements. North America and Europe are exhibiting significant growth, fueled by governmental initiatives, such as the US CHIPS Act and the EU Chips Act, aimed at revitalizing domestic semiconductor production. These regions are prioritizing local sourcing of essential high-purity chemicals like SPAA to reduce dependence on overseas suppliers and strengthen their technological sovereignty. Emerging markets in Southeast Asia are also showing promising potential as chip assembly and testing (OSAT) facilities expand.

Segmentation trends highlight the dominance of the Semiconductor Grade (G5 and G4) segments, driven by advanced logic and memory chip production. The 29% concentration variant remains the standard for most wet cleaning processes, though variations are used based on specific etch chemistry requirements. The Memory (DRAM and NAND) sector represents a critical end-use segment, exhibiting high demand volatility but massive volume consumption. Conversely, segments relating to advanced displays (OLED, QLED) are showing robust, steady growth as consumer electronics evolve towards higher resolution and brightness. The shift towards green electronics and sustainable manufacturing is also subtly influencing demand, pushing manufacturers to ensure environmentally responsible sourcing and waste management practices related to SPAA production and use.

AI Impact Analysis on Super Pure Aqueous Ammonia Market

Common user questions regarding AI's impact on the Super Pure Aqueous Ammonia market typically revolve around how artificial intelligence and machine learning (ML) optimize semiconductor fabrication processes, subsequently affecting the demand and quality requirements for SPAA. Users frequently ask if AI-driven process control minimizes chemical usage, what role AI plays in defect detection and yield management, and how AI can improve the efficiency and quality control of SPAA production itself. Key themes identified include the expectation that AI integration will demand tighter chemical purity tolerances to support higher chip yields, the concern over potential demand stabilization if process optimization significantly reduces chemical waste, and the need for suppliers to offer 'smart' chemical logistics integrated with AI-driven Fab management systems. Essentially, AI is viewed as an accelerator for quality expectations and an optimizer for consumption efficiency.

The implementation of AI and Big Data analytics in semiconductor Fabs allows for unprecedented levels of process monitoring and optimization. By analyzing vast datasets generated during wafer processing, AI algorithms can predict potential contamination events, optimize etching times, and fine-tune cleaning protocols. This heightened level of precision means that any input material variability, including the purity of SPAA, becomes an even more critical variable. Consequently, AI-driven manufacturing environments necessitate exceptionally consistent and ultra-pure chemical inputs, raising the effective purity floor for market acceptance. Suppliers who can leverage AI internally to achieve superior batch-to-batch consistency in SPAA will gain a competitive advantage.

Furthermore, AI-powered predictive maintenance and supply chain management systems are beginning to influence how SPAA is distributed and consumed. AI can forecast demand fluctuations more accurately, minimizing storage requirements and ensuring that the high-purity chemical is delivered just in time, thereby mitigating the risk of degradation during storage. While AI-optimization might lead to a slight reduction in chemical wastage per wafer processed, the overwhelming growth in overall global wafer starts, driven by AI processing demands (such as massive GPU clusters), outweighs this efficiency gain, leading to a net increase in the total volume demand for SPAA, albeit at significantly elevated purity standards.

- AI drives demand for tighter purity specifications (G5+ standards).

- Predictive analytics optimize chemical consumption and inventory management in Fabs.

- AI integration in fabrication necessitates superior batch-to-batch consistency from SPAA suppliers.

- Machine learning enhances quality control and defect prediction in semiconductor wet processes, elevating the value proposition of ultra-pure chemicals.

- Increased demand for AI-related hardware (GPUs, specialized chips) directly boosts total volume demand for SPAA.

DRO & Impact Forces Of Super Pure Aqueous Ammonia Market

The Super Pure Aqueous Ammonia market is heavily influenced by a delicate balance of strong drivers originating from the global digitalization trend, restraints centered on high production costs and regulatory hurdles, and significant opportunities arising from emerging technologies and regionalization strategies. The primary driving force is the relentless scaling down of semiconductor feature sizes (Moore's Law), which dictates the need for purer chemicals to prevent device defects. Restraints include the extremely high capital expenditure required for ultra-purification facilities and stringent environmental regulations governing ammonia handling and wastewater management. Opportunities are abundant in next-generation chip architectures, such as Gate-All-Around (GAA) FETs, and the burgeoning market for advanced packaging, both of which require specialized cleaning chemistries utilizing SPAA. These forces collectively create a high-stakes, technology-intensive market environment.

Drivers: The explosive growth in end-user applications like cloud computing, artificial intelligence, electric vehicles (EVs), and IoT devices generates exponential demand for integrated circuits (ICs), directly correlating with the need for high-quality wafer processing chemicals. Specifically, the introduction of extreme ultraviolet (EUV) lithography requires cleaner surfaces than ever before, cementing the role of high-purity cleaning agents. Government subsidies and initiatives aimed at establishing domestic semiconductor supply chains (e.g., in the US, Europe, and India) are powerful exogenous drivers stimulating regional demand and investment in localized SPAA production facilities. Furthermore, the constant introduction of new memory technologies, such as HBM (High Bandwidth Memory) and advanced 3D NAND structures, requires complex, multi-step etching and cleaning sequences, increasing the required volume and purity level of aqueous ammonia consumed per wafer.

Restraints: The most significant restraint is the technological complexity and associated cost of achieving and maintaining G5 (parts per trillion) purity standards. This requires specialized infrastructure, including cleanroom environments, expensive filtration systems, and continuous, rigorous analytical monitoring, resulting in high operational expenses that limit the number of viable market entrants. Supply chain logistics pose another restraint, as SPAA must be transported and stored in specialized, non-contaminating containers (typically high-density polyethylene or PFA-lined) under strictly controlled temperatures, adding substantially to the final delivered cost. Finally, the volatile nature of ammonia pricing and energy costs, crucial inputs for the manufacturing process, can introduce margin instability for producers.

Opportunities: Key opportunities lie in the development of materials for next-generation semiconductor devices, particularly in compound semiconductors (e.g., GaN, SiC) used in power electronics and 5G infrastructure, where cleaning protocols are still evolving and demanding ultra-pure reagents. The transition to advanced packaging techniques (3D stacking, chiplets) requires new, highly selective cleaning chemistries to manage diverse material interfaces, creating demand for customized SPAA solutions and delivery methods. Moreover, strategic alliances and partnerships between major SPAA suppliers and leading global foundries present opportunities for collaborative research and development to align purification technologies with future device roadmaps (e.g., 2nm and 1nm node technologies). Investment in closed-loop systems and sustainable manufacturing processes offers a significant long-term opportunity to address environmental concerns and enhance resource efficiency.

- Drivers:

- Continuous semiconductor node shrinkage (scaling down to 5nm and below).

- Rapid expansion of high-growth segments: 5G, AI, Data Centers, and advanced displays (OLED/QLED).

- Increased global capital expenditure in new semiconductor fabrication plants (Fabs).

- Restraints:

- Extremely high investment required for G5-grade purification and analytical infrastructure.

- Strict environmental, health, and safety (EHS) regulations related to ammonia handling and disposal.

- Complexity and cost associated with maintaining chemical integrity during specialized transportation and storage.

- Opportunities:

- Demand generation from emerging technologies like GaN/SiC power electronics and micro-LED displays.

- Development of customized, highly selective cleaning chemistries for advanced packaging (e.g., chiplets).

- Regionalization of supply chains driven by government incentives and geopolitical necessity.

- Impact Forces:

- Technological Obsolescence Risk: Low-purity producers face imminent obsolescence as purity requirements accelerate.

- Supply Chain Rigidity: The specialized nature of logistics creates dependence on a few certified suppliers.

- Pricing Power: Highly specialized suppliers maintain significant pricing power due to high barriers to entry and non-substitutability in critical processes.

Segmentation Analysis

The Super Pure Aqueous Ammonia market is primarily segmented based on the purity grade, concentration level, and the specific application or end-use sector. Purity grade is the most critical differentiator, reflecting the stringent quality standards demanded by advanced microelectronics. These grades typically follow established industry standards (e.g., SEMI standards, often categorized as G1 through G5 or specific electronic grades like EL or UP-SS). Segmentation by concentration typically involves 29% and 20% solutions, which are optimized for different wet processing chemistries. Understanding these segments is crucial for suppliers tailoring their production capabilities and distribution strategies to meet precise customer specifications, especially concerning trace metal contaminants, which must be managed individually.

The segmentation by end-use application provides clear insight into demand drivers and stability. The Semiconductor segment consistently dominates, further subdivided into Logic, Memory (DRAM/NAND), and Foundry services, each requiring specific procurement volumes and purity profiles. Advanced displays, particularly the manufacturing of high-resolution OLED and flexible screens, form the second largest growth segment, necessitating highly consistent chemical quality for uniform panel production. The diversification into LED/micro-LED manufacturing, while currently smaller, represents a high-growth niche due to the complex etching requirements of these gallium-based materials. Market players must continuously align their product portfolio purity levels—and certified analytical capabilities—with the fastest-growing end-use subsegments, particularly those driving the lowest feature sizes in semiconductor logic production.

Geographically, market segmentation is heavily skewed towards regions with concentrated semiconductor manufacturing infrastructure, creating regional monopolies or oligopolies for domestic supply. The trend toward regional autonomy means that segmentation by geography is becoming increasingly important for strategic capacity planning. Producers must adhere to local regulatory and logistics requirements, which vary significantly between jurisdictions like the US, EU, and key APAC nations. Furthermore, the segmentation by distribution channel—direct supply to large Fabs versus distribution through specialty chemical agents—also influences pricing and market access, especially for newer entrants or smaller foundries seeking specialized volumes.

- By Purity Grade:

- G5 Grade (Parts per trillion - ppt)

- G4 Grade (High-end parts per billion - ppb)

- G3 Grade (Standard electronic grade)

- By Concentration:

- 29% Aqueous Ammonia

- 20% Aqueous Ammonia

- Other Concentrations (Customized blending)

- By Application:

- Semiconductors

- Logic Devices (CPUs, GPUs)

- Memory Devices (DRAM, NAND Flash)

- Foundry Services

- Power Devices (SiC, GaN)

- Flat Panel Displays (FPDs)

- OLED Manufacturing

- LCD/LED Manufacturing

- LED/Micro-LED Manufacturing

- Solar Cells (Photovoltaics)

- By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Value Chain Analysis For Super Pure Aqueous Ammonia Market

The value chain for Super Pure Aqueous Ammonia is characterized by intense specialization and a sequential process that dramatically increases the value of the product at each stage, transforming commodity-grade ammonia into a mission-critical electronic chemical. The upstream segment involves the production of commodity anhydrous ammonia, which relies heavily on petrochemical feedstock (natural gas or petroleum) and large-scale synthesis plants (Haber-Bosch process). The quality and consistency of this primary input are fundamental, but the true value addition occurs in the middle segment: the ultra-purification process. This stage requires proprietary technology, highly specialized facilities (Class 100 cleanrooms), and advanced analytical capabilities (e.g., ICP-MS) to reduce metal and particulate contamination to ppt levels. Because purification is capital-intensive and technologically demanding, only a limited number of global players control this crucial phase.

The distribution channel is highly specialized, differentiating between direct and indirect supply. Large, integrated device manufacturers (IDMs) and major foundries typically negotiate direct supply contracts with major SPAA producers, often requiring dedicated production lines and specialized bulk delivery systems (e.g., ISO tanks or specialized drums) that maintain purity during transit. This direct model allows for better supply chain integration, quality audits, and forecasting alignment. Indirect distribution involves specialty chemical distributors and regional agents who serve smaller fabs, R&D facilities, or customers requiring smaller volumes or customized blends. These distributors must possess certified handling and storage facilities to prevent degradation, absorbing additional logistical costs but providing crucial market access to diverse customer bases.

The downstream analysis centers on the end-user application, primarily semiconductor fabrication facilities (Fabs). Once the SPAA is received, it is fed into complex wet bench stations, typically as part of a formulated mixture (such as SC-1) for wafer cleaning. The successful use of SPAA directly impacts the end-user's yield rates, making the purity of the chemical a critical performance metric. Post-usage, the management of spent aqueous ammonia—which is classified as hazardous waste—involves costly and environmentally stringent wastewater treatment processes or specialized recycling programs. This strong linkage means suppliers are often required to provide expertise not just on the chemical quality, but also on process integration, safety protocols, and sustainability solutions, making the supply relationship highly collaborative and long-term.

Super Pure Aqueous Ammonia Market Potential Customers

Potential customers for Super Pure Aqueous Ammonia are concentrated within highly technical, capital-intensive manufacturing sectors that rely on pristine surface preparation and etching processes for high-value components. The primary and largest customer base consists of semiconductor manufacturers, specifically global foundries (like TSMC, Samsung Foundry, UMC, GlobalFoundries) and major integrated device manufacturers (IDMs) such as Intel, SK Hynix, and Micron, which produce logic, memory (DRAM and NAND), and microprocessors. These entities consume SPAA in massive quantities, requiring G4 or G5 grade purity for their advanced node processes.

The second major group of customers includes manufacturers of advanced flat panel displays. Companies specializing in high-end displays, particularly those focused on OLED technology for smartphones, televisions, and tablets (e.g., Samsung Display, LG Display, BOE), utilize SPAA extensively for cleaning and etching glass or flexible substrates. The quality requirements in this sector are also rigorous, though often slightly less demanding than the most advanced semiconductor grades, focusing instead on consistent batch quality across extremely large volumes.

Additionally, emerging customers include producers of Compound Semiconductors (used in 5G radio frequency components and power devices like electric vehicle inverters), and specialized manufacturers of high-efficiency solar cells (photovoltaics). While these segments consume lower volumes than the core semiconductor industry, their rapid growth and stringent quality demands for specific materials (e.g., removal of residues from GaN or SiC substrates) position them as high-potential growth customers for customized SPAA formulations. Research laboratories, cleanroom chemical blenders, and specialized defense contractors also form niche markets requiring small volumes of the highest purity material.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 770 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA (Versum/EMD Performance Materials), Linde plc (Praxair), Mitsubishi Chemical Corporation, Sumitomo Chemical, Air Products and Chemicals Inc., Kanto Chemical Co. Inc., Iwatani Corporation, BASF SE, Central Glass Co. Ltd., Shandong Air Separation Group, Zhejiang Kaisn Fluorochemical Co., Columbus Chemical Industries, Taiyo Nippon Sanso Corporation, Soulbrain Co. Ltd., SK Materials, J.T. Baker (Avantor), PCC SE, Honeywell International Inc., Solvay S.A., Moses Lake Industries (TAMA Chemicals) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Super Pure Aqueous Ammonia Market Key Technology Landscape

The technological landscape of the Super Pure Aqueous Ammonia market is defined by advanced purification methods and sophisticated analytical testing capabilities, both of which are constantly being pushed to meet lower impurity thresholds (G5 and G4+ grades). Primary purification technologies employed include proprietary multi-stage distillation, ion exchange chromatography, and specialized membrane filtration (ultrafiltration and nanofiltration). Multi-stage distillation is essential for removing non-volatile residues and gross impurities, leveraging precise temperature and pressure control. However, achieving parts-per-trillion levels of metal ions requires subsequent polishing steps, often involving advanced ion exchange resins tailored to selectively bind specific critical metal contaminants like sodium, iron, and potassium. The integration of continuous real-time monitoring systems is increasingly critical to ensure process stability and immediate detection of contamination events.

A critical, often proprietary, aspect of the technology landscape is the material science associated with storage and delivery. To prevent leaching of impurities from the container walls into the ultra-pure chemical, advanced materials such as high-purity, linear low-density polyethylene (LLDPE), and fluoropolymer linings (PFA/PTFE) are mandatory for storage tanks, piping, and drums. Innovation is focused on developing container materials with even lower extractable trace elements and superior chemical resistance, particularly as Fabs increasingly require bulk delivery systems to maximize efficiency. The entire technological ecosystem, from production facility to point-of-use equipment in the Fab, must be designed to maintain the integrity of the ppt-level purity achieved during manufacturing, requiring specialized welding techniques and cleanroom practices.

The convergence of purification technology and analytical verification technology is another key trend. As purity standards approach the detection limits of current instrumentation, advanced analytical methods such as Inductively Coupled Plasma Mass Spectrometry (ICP-MS) and Glow Discharge Mass Spectrometry (GDMS) are indispensable. Suppliers are investing heavily in customized, high-sensitivity analytical laboratories capable of reliably measuring impurities in the sub-ppt range. This high-end analytical capability serves as a significant technological barrier to entry and is a critical competitive differentiator, as customers require certified proof that the chemical meets their G5 requirements. Future technological advancements are expected in leveraging machine learning to predict and preempt contamination events in the purification train, further optimizing yield and consistency.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of the global Super Pure Aqueous Ammonia market, driven by the massive concentration of semiconductor manufacturing, particularly in Taiwan (TSMC), South Korea (Samsung, SK Hynix), Japan (leading material suppliers), and Mainland China (rapidly expanding domestic capacity). The region accounts for the majority of global consumption, fueled by intensive production of logic chips, advanced memory (DRAM/NAND), and high-resolution FPDs. Market dynamics are characterized by fierce competition among regional suppliers, aggressive governmental support for local material sourcing, and the earliest adoption of G5 and G4+ purity specifications due to the presence of cutting-edge fabrication facilities. Growth in China is particularly significant, driven by the push for self-sufficiency in electronic chemicals.

- North America: This region is experiencing a resurgence in demand, primarily due to large-scale investments stimulated by the CHIPS and Science Act. The focus here is on building advanced new fabrication plants (e.g., in Arizona, Ohio, New York) requiring reliable, localized, and ultra-high-purity supply chains. While the overall volume consumption remains lower than APAC, the growth rate is robust, driven by technology leadership and high-purity demands for R&D and specialized defense applications. Suppliers are prioritizing vertical integration and high-tech manufacturing capacity within the US to meet geopolitical supply security requirements.

- Europe: The European market, though smaller in scale, is critical due to established automotive and industrial electronics manufacturers and recent legislative efforts (EU Chips Act) aimed at boosting domestic production capacity, particularly in Germany and France. The demand for SPAA in Europe is heavily concentrated in sophisticated automotive chip production, power electronics (SiC/GaN), and research institutions. The region emphasizes sustainability in chemical manufacturing, pushing suppliers to adopt cleaner production methods and enhance resource efficiency in their European facilities.

- Latin America, Middle East, and Africa (MEA): These regions represent nascent or smaller markets for Super Pure Aqueous Ammonia, with demand primarily stemming from localized solar panel manufacturing and smaller electronic assembly plants. Growth opportunities exist as semiconductor final assembly, test, and packaging (OSAT) operations expand, potentially requiring localized chemical support. However, current high-purity chemical demand is largely satisfied through imports from APAC and North America, necessitating complex cold chain logistics to maintain quality standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Super Pure Aqueous Ammonia Market.- Merck KGaA (Versum/EMD Performance Materials)

- Linde plc (Praxair)

- Mitsubishi Chemical Corporation

- Sumitomo Chemical

- Air Products and Chemicals Inc.

- Kanto Chemical Co. Inc.

- Iwatani Corporation

- BASF SE

- Central Glass Co. Ltd.

- Shandong Air Separation Group

- Zhejiang Kaisn Fluorochemical Co.

- Columbus Chemical Industries

- Taiyo Nippon Sanso Corporation

- Soulbrain Co. Ltd.

- SK Materials

- J.T. Baker (Avantor)

- PCC SE

- Honeywell International Inc.

- Solvay S.A.

- Moses Lake Industries (TAMA Chemicals)

Frequently Asked Questions

Analyze common user questions about the Super Pure Aqueous Ammonia market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Super Pure Aqueous Ammonia (SPAA) and why is its purity level critical in manufacturing?

SPAA, or Ultra-High Purity Ammonium Hydroxide, is an essential electronic-grade chemical used primarily for cleaning and etching in microelectronics. Its critical purity, often measured in parts per trillion (ppt), is necessary because trace metal contaminants can cause electrical shorts, device failure, and drastically reduce manufacturing yields in advanced semiconductor nodes (e.g., 5nm logic chips).

Which purity grades of Aqueous Ammonia are most in demand by semiconductor manufacturers?

Semiconductor manufacturers producing cutting-edge devices overwhelmingly demand G5 Grade (ppt level) and high-end G4 Grade (ppb level) SPAA. The industry trend is moving towards G5 purity as feature sizes shrink and fabrication processes become more sensitive to micro-contamination, driving the need for continuous purification technology upgrades.

How do geopolitical factors impact the supply chain for Super Pure Aqueous Ammonia?

Geopolitical tensions and trade regulations significantly affect the SPAA supply chain by promoting regionalization. Countries are investing heavily in local manufacturing capacity (e.g., US CHIPS Act, EU Chips Act) to secure domestic supplies of this critical material, reducing reliance on the currently dominant Asia Pacific supply network and increasing logistical complexity for global suppliers.

What are the key technological challenges for SPAA suppliers?

The primary technological challenges include the need to continuously reduce impurity levels below current detection limits, developing contamination-free storage and transportation systems (PFA-lined containers), and investing in extremely high-cost, certified analytical capabilities (ICP-MS) required to verify parts-per-trillion purity for G5 chemicals.

Which end-use application drives the highest demand volume for SPAA?

The Semiconductor industry, specifically the manufacturing of memory devices (DRAM and NAND Flash) and advanced logic chips, drives the highest overall demand volume for Super Pure Aqueous Ammonia. These high-volume processes require constant replenishment of wet chemicals for cleaning and etching silicon wafers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager