Superalloy Honeycomb Seals Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443151 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Superalloy Honeycomb Seals Market Size

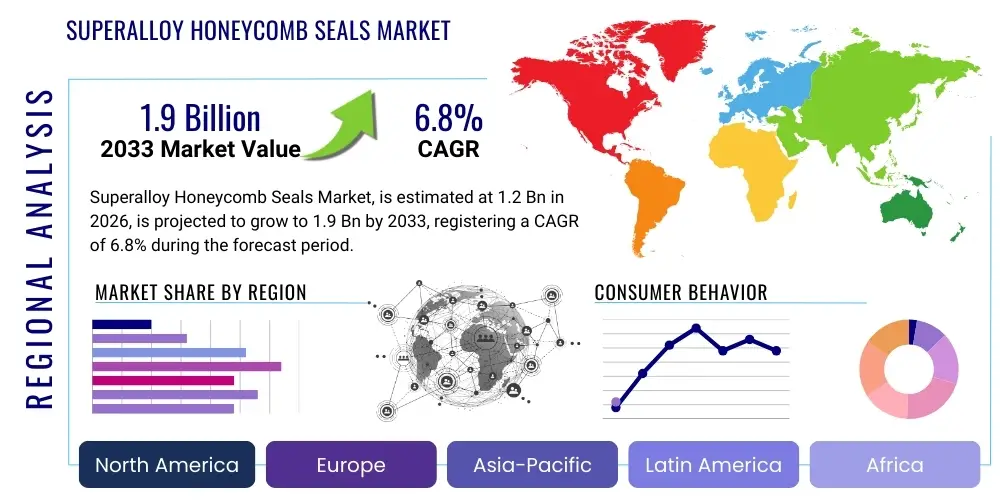

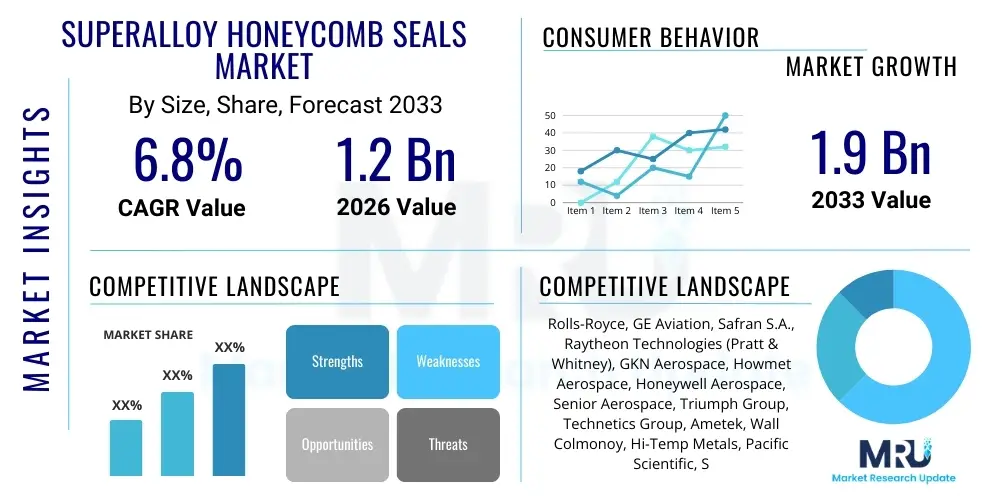

The Superalloy Honeycomb Seals Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.9 Billion by the end of the forecast period in 2033.

Superalloy Honeycomb Seals Market introduction

The Superalloy Honeycomb Seals Market encompasses specialized sealing solutions crafted from high-performance superalloys, primarily utilized in high-speed rotating machinery like gas turbines and jet engines. These seals are critical components designed to minimize leakage between stationary and rotating parts, drastically improving thermal efficiency and reducing fuel consumption in aerospace and power generation applications. Superalloys, typically nickel-based, cobalt-based, or iron-based materials, are selected due to their exceptional strength, superior oxidation resistance, and maintained structural integrity at extreme temperatures, often exceeding 1000°C. The unique honeycomb structure, characterized by a thin foil matrix, provides excellent abradability—allowing the seal to deform safely when momentarily contacted by the rotating component (blade tip)—thereby maintaining a minimal clearance gap during operational transients and ensuring maximum efficiency throughout the flight or operational cycle. This intricate balance of stiffness and flexibility is fundamental to modern high-thrust, high-bypass ratio engine designs, driving the necessity for continuous innovation in material science and manufacturing processes related to these seals. The primary function of these seals is directly linked to the overall performance envelope of advanced propulsion systems, making them indispensable in environments where reliability and efficiency are paramount.

The principal applications for superalloy honeycomb seals reside overwhelmingly within the aerospace and defense sector, where they are integral to commercial aircraft engines, military jet engines, and rocket propulsion systems. Beyond aviation, the power generation industry constitutes a significant application area, employing these seals in industrial gas turbines (IGTs) used for electrical utility generation and in various steam turbine configurations requiring high-temperature sealing capabilities. These seals play a crucial role in preventing hot gas ingestion and ensuring effective cooling airflow management within complex turbine architectures. The inherent benefits derived from utilizing superalloy honeycomb seals are multifold, including substantial improvements in fuel efficiency due to reduced parasitic leakage, extended component lifespan resulting from lower thermal stress and vibration dampening, and enhanced operational safety through robust material performance under demanding conditions. Furthermore, the push towards achieving net-zero emissions targets in the aviation industry places increased pressure on manufacturers to integrate components that maximize thermodynamic efficiency, directly fueling the demand for advanced sealing technologies that can operate effectively under ever-increasing pressure and temperature ratios within the turbine core.

The market expansion is robustly driven by several macro and microeconomic factors. Globally, the surging demand for new commercial aircraft, particularly in the Asia Pacific region driven by rising air travel and fleet modernization programs, forms the core driving factor. Simultaneously, continuous technological advancements in engine design, necessitating components capable of handling hotter combustion environments (Ultra High Bypass Ratio engines), mandate the use of next-generation superalloy materials and sophisticated honeycomb structures. The stringent regulatory environment emphasizing reduced emissions and improved efficiency further accelerates the adoption of premium sealing solutions. The maintenance, repair, and overhaul (MRO) segment also contributes substantially to market volume, as these seals are consumable items requiring periodic replacement during major engine overhauls. Overall, the combination of cyclical growth in aerospace manufacturing and the imperative for efficiency improvements in power generation provides a strong foundational demand structure for the Superalloy Honeycomb Seals Market, ensuring sustained growth throughout the projected forecast period and solidifying its position as a critical enabling technology for advanced turbomachinery. The long-term trajectory is intrinsically linked to global energy transition efforts and the technological evolution of propulsion systems.

Superalloy Honeycomb Seals Market Executive Summary

The Superalloy Honeycomb Seals Market is currently characterized by intense technological competition focused on material science, coating optimization, and additive manufacturing integration. Major business trends include strategic vertical integration among key aerospace original equipment manufacturers (OEMs) to secure supply chains and proprietary material specifications, alongside increasing collaboration between specialized seal manufacturers and material suppliers to develop next-generation thermal barrier coatings (TBCs) capable of withstand extreme thermal cycles and chemical degradation. Market consolidation remains a pervasive theme, driven by the necessity for significant capital investment in highly specialized manufacturing equipment, particularly for thin-foil forming, high-vacuum brazing, and diffusion bonding techniques. Furthermore, there is a discernible shift in service models, with OEMs increasingly offering long-term maintenance contracts that encompass predictable replacement cycles for honeycomb seals, ensuring sustained revenue streams in the aftermarket segment. The drive towards digitalization in manufacturing, integrating Industry 4.0 principles, is also enabling better quality control and geometric complexity in seal design, critical for achieving tighter engine clearances and maximizing aerodynamic performance across diverse operational envelopes, simultaneously enhancing component traceability.

Regionally, the market exhibits strong dichotomy between established aerospace hubs and rapidly emerging manufacturing centers. North America and Europe currently dominate the market share, attributed to the presence of major engine manufacturers such as General Electric, Rolls-Royce, and Safran, coupled with robust defense spending and established MRO infrastructure. These regions are primary centers for research and development (R&D) concerning new superalloy formulations, specifically high-entropy alloys and advanced single-crystal materials designed for unparalleled high-temperature creep resistance and longevity. Conversely, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled primarily by the burgeoning commercial aviation sector in China and India, significant investments in indigenous defense aircraft programs, and expanding industrial gas turbine installations for energy security initiatives, necessitating regional production capability ramp-up. Latin America, the Middle East, and Africa (LAMEA) represent niche but growing markets, primarily focused on MRO activities related to existing commercial aircraft fleets and the expansion of oil and gas infrastructure which utilizes high-efficiency turbines requiring these sophisticated seals for critical processes.

Segmentation trends highlight the increasing prominence of Nickel-based Superalloys due to their exceptional temperature tolerance and widespread adoption in the latest generation of jet engines (e.g., Leap, GTF, Trent XWB series). Within the application segments, the Aero Engines category holds the dominant share, underscoring the high value and stringent performance requirements mandated by the aerospace industry, which prioritizes performance optimization over cost considerations. However, the Industrial Gas Turbines (IGT) segment is demonstrating above-average growth, driven by global transitions toward cleaner natural gas power generation and the corresponding need for highly efficient turbine operation to meet grid stability requirements. The End-User analysis confirms Aerospace & Defense as the foundational demand generator, but the Power Generation sector's stability and cyclical investment patterns provide a reliable secondary market, particularly for larger seals utilized in high-megawatt installations. Future segment growth will likely be concentrated in specialized high-temperature cobalt-based alloys designed for niche hypersonic or military applications, requiring materials that can maintain structural integrity under extreme dynamic thermal loads encountered during transient maneuvering or high-Mach flight profiles.

AI Impact Analysis on Superalloy Honeycomb Seals Market

User queries regarding AI's impact on the Superalloy Honeycomb Seals Market predominantly focus on three key themes: material discovery acceleration, optimization of manufacturing processes (particularly additive manufacturing and brazing), and the integration of predictive maintenance systems. Users are keen to understand how AI-driven simulations can predict long-term seal degradation under complex operational profiles, thereby improving component lifespan estimates and optimizing replacement schedules. The adoption of digital twin technology, powered by AI, allows manufacturers to simulate the interaction between the rapidly rotating blade tip and the abradable honeycomb structure under various engine start-up and transient conditions, leading to significantly optimized clearance designs before physical prototyping even begins. There is also significant interest in AI's role in correlating non-destructive testing (NDT) data, such as ultrasonic or X-ray inspections, with final material properties to ensure flawless quality control in mission-critical aerospace components, reducing the reliance on manual inspection and minimizing human error in complex manufacturing sequences.

The application of Machine Learning (ML) is particularly transformative in the materials science aspect. Traditional superalloy development relies on time-consuming trial-and-error alloying and testing; however, AI can analyze vast metallurgical databases and thermodynamic calculations to swiftly propose novel alloy compositions that meet specific high-temperature criteria for honeycomb structures. This drastically reduces the time needed to qualify materials for extreme environments. Furthermore, in manufacturing processes like thin foil welding and brazing, ML algorithms monitor real-time sensor data—including temperature uniformity, pressure profiles, and power inputs—to autonomously adjust parameters, ensuring micro-structure consistency and optimizing the bonding strength, which is critical for the durability of the final seal assembly under cyclic stress and thermal fatigue experienced during engine operation.

The overarching expectation is that AI will move the industry from traditional, empirically-driven design methodologies towards highly iterative, data-driven optimization, reducing lead times for developing seals capable of withstanding next-generation engine requirements, particularly those pushing operational temperature limits beyond current conventional material capabilities. This transition promises to enhance both product quality and supply chain responsiveness within a highly specialized, capital-intensive sector, ultimately supporting the global aerospace industry's goal of developing ultra-high-efficiency engines with minimized carbon footprints. AI-enabled digital thread continuity, linking design specifications to manufacturing execution and in-service performance data, ensures continuous feedback loops for product refinement and defect prevention.

- Accelerated Material Informatics: AI and Machine Learning (ML) algorithms analyze vast datasets of superalloy compositions and performance characteristics (creep, fatigue, oxidation resistance) to rapidly identify optimal material chemistries for high-temperature honeycomb applications, dramatically shortening R&D cycles by predicting performance outcomes.

- Enhanced Generative Design: AI tools utilize generative design techniques to optimize the complex geometrical structure of the honeycomb matrix, ensuring maximal abradability and sealing efficiency while minimizing material usage and weight, crucial for thrust-to-weight ratio improvements in advanced turbomachinery.

- Predictive Quality Control: Integration of ML models with sensor data during manufacturing (e.g., laser welding, diffusion bonding) allows for real-time monitoring and anomaly detection, predicting potential defects in the micro-structure of the seal before final assembly, significantly reducing scrap rates and improving component reliability.

- Optimized Manufacturing Parameters: AI determines the ideal process parameters (temperature, pressure, duration) for complex manufacturing steps like brazing or thermal spraying, ensuring maximum joint strength and coating uniformity for extended operational life and reducing reliance on traditional statistical process control methods.

- Predictive Maintenance Integration: AI analyzes engine telemetry data (vibration, temperature profiles, pressure drops) transmitted via IoT sensors to predict the remaining useful life (RUL) of installed honeycomb seals, enabling condition-based maintenance strategies rather than fixed calendar replacements, thereby maximizing asset utilization and minimizing unnecessary maintenance downtime.

DRO & Impact Forces Of Superalloy Honeycomb Seals Market

The dynamics of the Superalloy Honeycomb Seals Market are shaped by a complex interplay of strong demand drivers rooted in global aerospace growth and stringent efficiency requirements, juxtaposed against significant technological and supply chain restraints. Key drivers include the massive global aircraft order backlogs, especially for fuel-efficient narrow-body aircraft, which require continuous seal replacement and upgrade cycles both in initial engine build and in long-term MRO activities. Furthermore, regulatory pressures worldwide, particularly the ICAO’s Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), mandate the adoption of components that maximize engine efficiency, directly favoring high-performance sealing solutions. Opportunities primarily arise from the increasing adoption of Additive Manufacturing (AM), which promises to revolutionize the production of geometrically intricate seal structures, and the expansion into niche markets such as high-temperature seals for hydrogen-powered turbines or hypersonic vehicle applications, demanding novel material solutions capable of handling unique combustion environments. However, the market faces considerable restraints, including the highly regulated nature of aerospace materials, the exceptionally high capital expenditure required for specialized production facilities compliant with aerospace standards, and the chronic volatility and scarcity associated with key superalloy elements like Nickel, Cobalt, and Chromium, which are subject to geopolitical supply risks.

The impact forces influencing the market are multifaceted, combining internal industry pressure with external regulatory and economic influences. Technological advancement acts as a crucial accelerating force; the continuous quest for higher thrust and lower fuel burn necessitates seals capable of withstanding temperatures previously considered impossible, thereby pushing R&D investment into advanced thin-foil materials and ceramic coatings. Supply chain resilience, particularly the sourcing of specialized thin superalloy foils and high-purity raw powders, presents a significant constraining force; any disruption in this niche supply segment severely impacts global engine production schedules and maintenance capacity. Furthermore, geopolitical stability plays a defining role, as defense spending and international trade agreements directly influence military and commercial aerospace manufacturing activities, respectively, impacting demand for military-grade superalloy seals. The overarching macroeconomic climate also influences airline profitability and capital expenditure on new fleets, providing a cyclical impact on initial equipment (OE) seal demand, while the MRO market provides a stabilizing, counter-cyclical revenue stream, buffering against sudden economic downturns affecting new aircraft purchases.

The market faces inherent structural rigidity due to high barriers to entry; qualifying a new material or seal design for flight certification is an expensive, multi-year process involving rigorous testing and data submission to regulatory bodies, limiting the ability of new entrants to rapidly capture market share. This high inertia ensures that incumbent suppliers with established OEM relationships retain a dominant position through proprietary intellectual property and certified manufacturing processes. Conversely, the environmental imperative—the global commitment to reduce aviation's carbon footprint—is a powerful enabling force. It compels OEMs and suppliers to invest heavily in sealing technologies that minimize leakage and maximize overall engine efficiency, positioning superalloy honeycomb seals as essential components in meeting future sustainability targets and reducing operational greenhouse gas emissions. Thus, the market is constantly balancing the constraints of material science limitations and regulatory oversight against the irresistible pull of commercial and environmental efficiency demands, shaping strategic investment decisions and long-term partnership formations.

Segmentation Analysis

The Superalloy Honeycomb Seals Market is systematically segmented based on material composition, application, and end-user industry, reflecting the specialized requirements of high-performance turbomachinery. Understanding these segments is crucial for market participants seeking to align their technological strengths with specific demand pockets and to optimize their production methodologies for specific alloy requirements. The material segmentation primarily differentiates between nickel, cobalt, and iron-based alloys, where performance specifications like maximum operating temperature, resistance to thermal cycling fatigue, and resistance to specific corrosive environments dictate material selection. For instance, nickel-based alloys dominate commercial aerospace due to their superior combination of strength and temperature resistance. Application segmentation delineates demand between the core sectors of aero engines and industrial gas turbines, highlighting the distinct volume, value proposition, and component lifespan expectations each sector offers. The end-user analysis confirms the foundational importance of the Aerospace & Defense sector while recognizing the steady, high-power requirements of the Power Generation industry, particularly in large utility-scale gas turbine installations. This structural segmentation allows for precise market sizing and forecasting, enabling stakeholders to focus R&D efforts on the most lucrative and technically challenging areas, such as high-temperature nickel superalloys tailored for Ultra-High Bypass Ratio (UHBR) commercial engines demanding tighter clearances and reduced weight.

- By Material:

- Nickel-based Superalloys (e.g., Inconel 625, Waspaloy)

- Cobalt-based Superalloys (e.g., L-605, Haynes 188)

- Iron-based Superalloys (Used primarily in less severe industrial applications)

- Others (e.g., advanced High-Entropy Alloys, refractory metal alloys being explored for extreme environments)

- By Application:

- Aero Engines (Commercial Turbofans, Military Jets, Rotorcraft Turboshafts)

- Industrial Gas Turbines (IGTs for electrical utility generation)

- Steam Turbines (Used for lower-temperature sealing applications in power generation)

- Auxiliary Power Units (APUs) and Others (e.g., small turbochargers, specialized rotating equipment)

- By End-User:

- Aerospace & Defense (OEM for new engines, MRO for existing fleets)

- Power Generation (Utility-scale power plants, Independent Power Producers)

- Oil & Gas (Pipeline Compressors, Offshore Platforms using high-performance turbines)

Value Chain Analysis For Superalloy Honeycomb Seals Market

The value chain for the Superalloy Honeycomb Seals Market is intricate and highly specialized, beginning with the critical upstream supply of raw superalloy materials. Upstream activities involve mining, refining, and alloying complex metals such as Nickel, Cobalt, Molybdenum, and Chromium, which are then processed into highly specific metallurgical forms, including thin foils (often rolled down to micron thicknesses) and specialized powder feedstock suitable for additive manufacturing or traditional sheet metal fabrication. A critical bottleneck in this upstream phase is the stringent quality control required for aerospace-grade superalloys, ensuring consistency in grain structure, minimal contaminants, and precise chemical composition, which often involves dedicated vacuum induction melting (VIM) and vacuum arc remelting (VAR) processes. Suppliers in this segment, though few and often highly specialized metallurgical companies, wield significant pricing power due to the scarcity of high-purity materials and the substantial barriers to entry regarding compliance and material certification, such as adherence to SAE AMS standards. The midstream involves the core manufacturing process, encompassing thin-foil forming, precision cutting, machining, complex high-vacuum furnace brazing, laser welding, and the application of specialized coatings (e.g., ceramic or metallic abradable coatings), an activity dominated by specialized component suppliers who possess proprietary tooling and expertise in handling highly reactive superalloy materials.

The distribution channel in this market is predominantly direct, reflecting the high-value, bespoke nature of the product, where intellectual property and strict adherence to geometric tolerances are critical. Direct distribution is mandated for Original Equipment Manufacturers (OEMs) like GE Aviation or Rolls-Royce, who require seals manufactured precisely to their proprietary design specifications and material certifications, often involving 'build-to-print' contracts. The seals are shipped directly from the component supplier to the engine assembly lines (OE market) or directly to authorized Maintenance, Repair, and Overhaul (MRO) facilities globally (Aftermarket). This direct relationship facilitates immediate feedback on component performance and quality issues. Indirect distribution is negligible but may exist through certified third-party aerospace parts distributors that manage inventories of common, non-proprietary seal designs or specific MRO kits for smaller fleet operators or industrial clients. The emphasis on direct channels ensures traceability, minimizes risks associated with counterfeit parts, and facilitates necessary technical support during installation and service life. The direct relationship reinforces the necessity for component suppliers to maintain AS9100 quality certifications and strong, transparent, long-term partnerships with the major engine builders.

Downstream analysis focuses on the end-users: primarily the global aerospace industry (airlines, defense forces, helicopter operators) and power generation companies. For airlines and defense users, the seals are incorporated into propulsion systems, and their performance directly impacts operating costs (fuel burn, maintenance frequency) and mission readiness. The utilization phase, which is downstream, generates a substantial aftermarket revenue stream, as seals are periodically replaced during engine life cycles (MRO). The efficiency benefits provided by these seals represent the ultimate value proposition captured by the downstream users—reduced operational costs, lower emissions profile, and improved asset utilization. This constant cycle of use, degradation, and replacement anchors the demand for both OE and aftermarket segments, creating a stable, though cyclical, market structure. The inherent challenges involve balancing the upstream material pricing volatility and long lead times with the downstream demand sensitivity (airline profitability and power grid requirements), defining the operational risk profile for all participants within this highly interdependent value chain segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rolls-Royce, GE Aviation, Safran S.A., Raytheon Technologies (Pratt & Whitney), GKN Aerospace, Howmet Aerospace, Honeywell Aerospace, Senior Aerospace, Triumph Group, Technetics Group, Ametek, Wall Colmonoy, Hi-Temp Metals, Pacific Scientific, Saint-Gobain, Parker Hannifin, Meggitt (Parker Aerospace), MTU Aero Engines, Chromalloy, StandardAero. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Superalloy Honeycomb Seals Market Potential Customers

The primary customer base for Superalloy Honeycomb Seals consists of global aerospace engine Original Equipment Manufacturers (OEMs), maintenance, repair, and overhaul (MRO) service providers, and major utility companies operating industrial gas and steam turbines. Aerospace OEMs, such as GE Aviation, Pratt & Whitney, Rolls-Royce, and Safran, represent the largest and most technically demanding segment, purchasing seals for initial engine build (Original Equipment) and relying on long-term supplier partnerships to ensure product consistency and rapid technological adaptation to new engine designs, such as the new generation of geared turbofans and ultra-high bypass ratio engines. These customers prioritize superior performance metrics, verified by extensive full-scale engine testing and compliance with stringent Federal Aviation Administration (FAA) and European Union Aviation Safety Agency (EASA) standards. The complexity and mission-critical nature of the component dictate that these customers have high expectations regarding material traceability, quality assurance protocols, and manufacturing process control, often requiring the implementation of proprietary design features to maximize engine efficiency and longevity.

The MRO segment serves as a crucial, consistent revenue source, as operational engines require periodic overhaul and component replacement, typically every few thousand flight hours or upon reaching specific usage limits. Airlines, defense organizations, and independent MRO shops globally purchase replacement honeycomb seals, seeking competitive pricing, rapid availability, and guaranteed airworthiness certifications (e.g., PMA or DER parts). This customer group is often more price-sensitive than the OEMs, especially for aging fleets, but remains equally demanding regarding quality and compliance, driving the aftermarket toward certified third-party providers capable of producing seals that meet or exceed OEM specifications. The demand in the MRO segment is closely cyclical, tracking global flight hours and engine fleet utilization rates, providing a reliable long-term market that naturally offsets some of the short-term volatility inherent in new aircraft delivery schedules, thus stabilizing overall market revenue streams.

Beyond aviation, major power generation utility providers and large industrial operators, particularly in the oil and gas sector, constitute another significant customer base. These customers utilize industrial gas turbines for electricity generation, grid stabilization, or high-capacity pipeline compression, where efficiency and extended uptime are paramount. For these industrial applications, the seals must often withstand extended operational periods under constant high thermal load and potential exposure to contaminants, necessitating seals optimized for longevity and resistance to sulfidation or specific industrial corrosion mechanisms, rather than purely weight-saving metrics relevant to aerospace. Companies operating combined cycle power plants are increasingly adopting advanced turbine technologies, such as H-class and J-class turbines, solidifying their status as growing consumers of high-performance superalloy sealing solutions, demonstrating a clear willingness to invest in superior components that promise substantial long-term operational efficiency gains and reduced maintenance intervals due to increased component reliability.

Superalloy Honeycomb Seals Market Key Technology Landscape

The technological landscape of the Superalloy Honeycomb Seals Market is defined by continuous innovation in material science, advanced manufacturing techniques, and coating technologies aimed at improving high-temperature resistance and abradability characteristics. A major area of focus is the development and commercialization of next-generation superalloys, including advanced nickel-based alloys with enhanced thermal stability, improved microstructural homogeneity, and increased creep resistance, necessary for modern engines operating at increasingly higher turbine entry temperatures to maximize thermodynamic efficiency. Techniques such as the careful control of trace elements and specialized heat treatment regimes are employed to optimize the material properties. Furthermore, the handling and processing of ultra-thin superalloy foils (often less than 75 microns thick) require specialized high-precision rolling mills, high-speed slitting, and complex forming equipment, which represents a significant technological barrier to entry, demanding substantial capital investment and proprietary manufacturing know-how to ensure material integrity and geometric precision without induced stress cracking.

Manufacturing advancements, particularly in the realm of Additive Manufacturing (AM) or 3D printing, are rapidly transforming the production possibilities for honeycomb seals. Selective Laser Melting (SLM) and Electron Beam Melting (EBM) are being actively explored to produce complex, highly customized honeycomb geometries that are impossible or cost-prohibitive using traditional brazing and welding methods. AM allows for the creation of seals with tailored internal lattice structures, anisotropic properties, and integrated cooling channels, pushing the boundaries of aerodynamic and thermal management within the engine core, leading to designs that dramatically reduce leakage paths. While challenges related to surface finish requirements, ensuring full density, and achieving full material qualification remain ongoing R&D areas, AM promises to reduce material waste, shorten product development lead times, and facilitate rapid prototyping of new designs. Concurrently, traditional methods rely heavily on sophisticated high-vacuum furnace brazing and specialized laser welding techniques to join the multiple layers of foil elements precisely, requiring rigorous process control, often under inert atmospheres, to maintain structural integrity and prevent thermal distortion of the delicate assemblies.

Coating technology is another critical differentiator that directly impacts the lifespan and efficiency of the overall sealing system. The performance of a honeycomb seal is highly dependent on the abradable coating applied to the opposing surface of the rotating component (e.g., blade tip or rotor). These coatings, often complex ceramic or metal matrix composite materials applied via thermal spray techniques, are designed to erode minimally upon contact with the seal, protecting the expensive, high-value rotating components while the honeycomb structure absorbs the impact energy. Innovations include the development of porous abradable seal designs and specialized thermal barrier coatings (TBCs) that are applied directly to the casing adjacent to the seal, enhancing the seal's tolerance to extreme thermal gradients, minimizing heat transfer into the engine casing structure, and protecting against foreign object damage (FOD). The nascent integration of advanced fiber optic or capacitive sensor technology directly into the seals for health monitoring represents a future technological trajectory, allowing for real-time clearance measurement and proactive maintenance intervention, ultimately driving towards the fully connected, predictive maintenance system of the future turbofan engine.

Regional Highlights

Global demand for superalloy honeycomb seals is geographically concentrated around major aerospace and power generation manufacturing hubs, with significant growth potential identified in rapidly industrializing regions where energy infrastructure and air travel are expanding rapidly.

- North America: Dominates the global market share, largely due to the presence of key aerospace OEMs (GE Aviation, Pratt & Whitney) and a vast, technologically advanced MRO network. Robust government spending on complex defense aerospace programs (e.g., military transport, tactical fighters), coupled with continuous R&D investment in high-temperature materials and advanced manufacturing, ensures that the U.S. remains the primary technological and production leader.

- Europe: A leading hub for commercial aircraft and engine manufacturing (Rolls-Royce, Safran, MTU Aero Engines), driving strong demand for OE components tailored for the A320neo and A350 families. European players focus heavily on compliance with strict environmental regulations (EASA, EU Green Deal), spurring innovation in highly efficient sealing technologies tailored for minimizing engine noise and reducing CO2 emissions.

- Asia Pacific (APAC): Expected to exhibit the highest CAGR through the forecast period. This growth is primarily driven by exponential growth in commercial air traffic, massive fleet expansion and modernization programs in emerging economies like China and India, and increasing regional self-sufficiency in defense production capabilities. Substantial investments in large-scale industrial gas turbines for rapidly expanding energy grids also fuel market demand, particularly for high-durability seals.

- Latin America (LATAM): Primarily an MRO-driven market, serving extensive existing commercial airline fleets and regional aviation operators. Demand is stable but highly dependent on regional economic stability, commodity prices (which impact fleet capitalization), and the pace of commercial aircraft modernization efforts across major carriers.

- Middle East and Africa (MEA): Characterized by major regional airlines (Emirates, Qatar Airways) with large, technologically advanced fleets, leading to substantial high-value MRO demand. Significant investment in oil and gas infrastructure, particularly large-scale pipeline compressor turbines and liquefaction plants, also generates specialized demand for high-reliability industrial seals suitable for harsh, high-temperature environmental conditions prevalent in the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Superalloy Honeycomb Seals Market.- Rolls-Royce

- GE Aviation

- Safran S.A.

- Raytheon Technologies (Pratt & Whitney)

- GKN Aerospace

- Howmet Aerospace

- Honeywell Aerospace

- Senior Aerospace

- Triumph Group

- Technetics Group

- Ametek

- Wall Colmonoy

- Hi-Temp Metals

- Pacific Scientific

- Saint-Gobain

- Parker Hannifin

- Meggitt (Parker Aerospace)

- MTU Aero Engines

- Chromalloy

- StandardAero

Frequently Asked Questions

Analyze common user questions about the Superalloy Honeycomb Seals market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Superalloy Honeycomb Seal in an aircraft engine?

The primary function is to minimize the leakage of hot, high-pressure gases between the rotating blades and the stationary casing (labyrinth seal) or stator components within a gas turbine engine. This reduction in parasitic air loss directly enhances the engine's thermal efficiency and reduces specific fuel consumption (SFC), critical metrics for modern aviation and power generation.

Why are superalloys, specifically nickel-based materials, preferred for these sealing applications?

Superalloys are essential due to their unique properties, including exceptional strength, creep resistance, and oxidation resistance at operating temperatures that often exceed 1000°C. Nickel-based alloys, such as Inconel, are favored for their structural integrity under extreme heat and corrosive environments encountered in the hot section of the engine, ensuring component reliability under high stress.

How does the abradability of a honeycomb seal contribute to engine efficiency?

Abradability is the characteristic that allows the seal to safely erode or deform when the rotating blade tips momentarily contact the honeycomb structure during operational transients (e.g., rapid acceleration or maneuvering). This controlled deformation establishes the tightest possible clearance gap without damaging the rotating components, maximizing aerodynamic performance and minimizing efficiency losses throughout the operational envelope.

What role does Additive Manufacturing (AM) play in the future of honeycomb seal production?

AM holds significant promise for generating highly complex internal geometries and customized shapes that improve sealing efficiency and reduce weight, features difficult to achieve with traditional foil brazing. It facilitates rapid prototyping and the creation of seals with integrated cooling features, potentially lowering material waste and speeding up the certification process for new designs tailored to extreme operating conditions.

Which end-user segment drives the highest demand and technological requirements?

The Aerospace & Defense end-user segment drives the highest demand value and sets the most stringent technological requirements. The critical need for high thrust-to-weight ratios, extreme temperature tolerance, and uncompromising safety standards in commercial and military aircraft engines necessitates continuous innovation in seal material science, precision manufacturing, and quality control.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager