Supply Chain and Logistics for B2B Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442738 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Supply Chain and Logistics for B2B Market Size

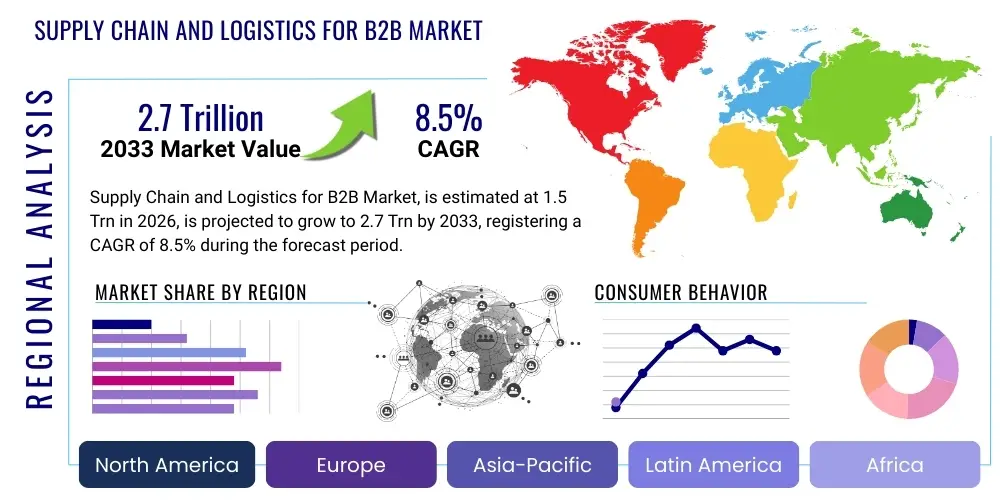

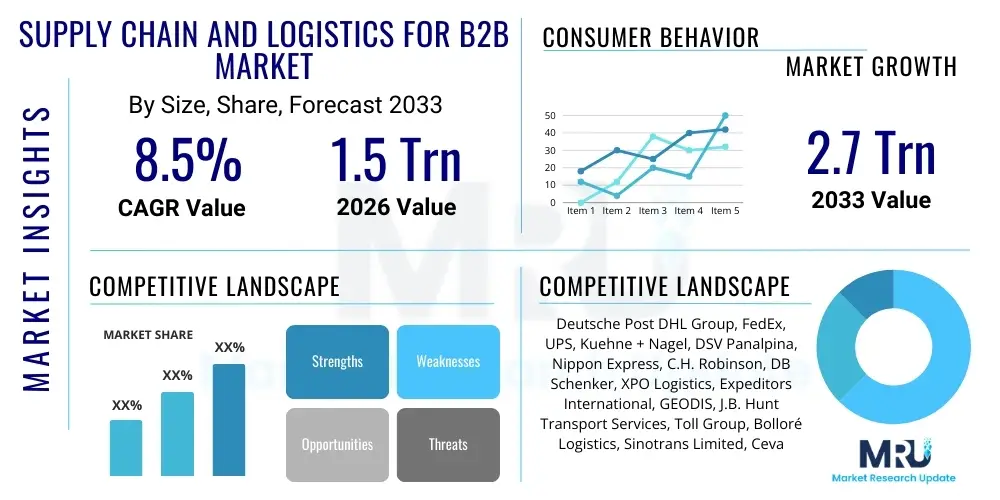

The Supply Chain and Logistics for B2B Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.5 Trillion in 2026 and is projected to reach USD 2.7 Trillion by the end of the forecast period in 2033.

Supply Chain and Logistics for B2B Market introduction

The Supply Chain and Logistics for B2B Market encompasses the comprehensive planning, execution, and control of physical goods, information flows, and associated financial transactions between businesses globally. This critical sector involves services such as freight forwarding, warehousing, inventory management, multimodal transportation, last-mile delivery optimization for commercial clients, and reverse logistics. Driven primarily by the accelerating pace of global trade, the proliferation of specialized e-commerce platforms catering to commercial entities, and the pervasive requirement for enhanced operational efficiencies, the B2B logistics sector is undergoing radical transformation. The fundamental benefits offered include significant reductions in operational expenditure, minimization of inventory holding costs, rapid fulfillment cycle times, and the establishment of robust, resilient supply networks capable of mitigating geopolitical and demand volatility risks. Key driving factors involve the adoption of advanced digital platforms, the integration of IoT devices for real-time visibility, and the increasing outsourcing of complex logistical processes to expert Third-Party Logistics (3PL) providers.

B2B logistics fundamentally differs from B2C primarily in transaction volume, complexity, and specialized handling requirements. B2B transactions typically involve higher unit volumes, less frequent shipments, highly structured delivery windows, and specialized compliance or contractual stipulations. Products often require tailored temperature controls, specific hazardous materials handling protocols, or complex cross-border documentation. The market is shifting from purely transactional interactions to strategic partnerships where logistics providers act as crucial extensions of the customer's operational framework, necessitating deep systems integration and collaborative forecasting. This strategic integration is pivotal for industries such as automotive, high-tech manufacturing, and pharmaceuticals, where precise, just-in-time (JIT) delivery is mandatory to sustain assembly lines and operational flow.

Furthermore, the market's evolution is heavily influenced by the imperative for sustainability and ethical sourcing. Modern B2B logistics solutions are increasingly incorporating green warehousing practices, optimizing transport routes to minimize carbon emissions, and utilizing electric or alternative-fuel vehicle fleets. Regulatory pressures, coupled with corporate sustainability mandates, are transforming procurement decisions, pushing companies toward logistics partners who can demonstrate verifiable commitments to environmental and social governance (ESG). The integration of blockchain technology is also emerging as a pivotal factor, ensuring immutable records for tracking origin, verifying compliance, and enhancing overall supply chain transparency, which is crucial for high-value or regulated goods.

Supply Chain and Logistics for B2B Market Executive Summary

The B2B Supply Chain and Logistics Market is characterized by vigorous growth, fueled by globalized supply chains and the widespread digitization of trade processes. Key business trends indicate a strong move toward hyper-automation, with enterprises investing heavily in robotic process automation (RPA) within warehouses and autonomous vehicles for specific segments of transportation. There is a concerted effort among major market participants to expand their digital ecosystem offerings, moving beyond traditional transport services to provide end-to-end supply chain visibility platforms. Geopolitical instability and trade protectionism have significantly influenced business strategies, leading to greater adoption of 'China Plus One' strategies and regionalized supply hubs, thereby diversifying logistical risks and increasing demand for regional specialized carriers. Furthermore, the persistent challenge of labor shortages, particularly for skilled warehouse operators and truck drivers, continues to drive innovation in autonomous systems and advanced materials handling equipment.

Regional trends reveal that Asia Pacific (APAC) remains the fastest-growing market, driven by robust manufacturing output in countries like China, India, and Vietnam, coupled with massive government investment in infrastructure development (e.g., ports, railways, and smart city logistics corridors). North America and Europe, while mature, are characterized by high technological penetration, focusing on optimizing existing infrastructure through data analytics and predictive maintenance. European trends are heavily influenced by stringent EU regulations regarding cross-border compliance and sustainability standards, compelling logistics providers to accelerate their adoption of cleaner transport solutions and unified digital customs interfaces. Latin America and the Middle East & Africa (MEA) are experiencing rapid expansion, propelled by increased intra-regional trade and significant foreign direct investment aimed at developing multimodal transportation networks and modern cold chain capabilities, particularly in the pharmaceutical and perishable goods sectors.

Segmentation trends highlight the increasing dominance of specialized logistics services, particularly those supporting temperature-controlled environments (cold chain logistics) and complex reverse logistics operations critical for the high-tech and automotive industries. Technology-wise, Transportation Management Systems (TMS) and Warehouse Management Systems (WMS) integrated with AI capabilities are seeing the highest adoption rates, moving from transactional tools to predictive optimization engines. By application, the E-commerce & Retail segment, specifically B2B e-procurement platforms, shows accelerated demand for rapid, accurate fulfillment solutions that mimic the speed and transparency of B2C services but scaled for commercial requirements. Finally, the move towards integrated logistics, combining various services under a single contract (4PL models), is gaining traction as businesses seek streamlined management and centralized accountability for highly fragmented global supply chains.

AI Impact Analysis on Supply Chain and Logistics for B2B Market

Common user questions regarding AI’s impact on B2B logistics often revolve around its potential for job displacement, the required investment in data infrastructure, the accuracy of predictive demand forecasting under volatile conditions, and the practical implementation of autonomous fleet management. Users frequently inquire about how AI can move beyond simple automation to truly optimize complex, multi-echelon networks, specifically asking how quickly return on investment (ROI) can be achieved from machine learning models applied to dynamic pricing and inventory routing. The key themes summarized are centered on the transition from reactive supply chains to proactive, self-optimizing networks, leveraging AI for superior risk mitigation, forecasting precision, dynamic capacity allocation, and achieving the elusive goal of hyper-personalized service delivery even in the highly standardized B2B environment.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally redefining operational paradigms within the B2B supply chain, transforming logistics from a cost center into a strategic differentiator. AI algorithms are proving indispensable in handling the massive datasets generated by modern IoT sensors and enterprise resource planning (ERP) systems, allowing for granular analysis of performance metrics, identification of latent bottlenecks, and optimization of complex routing problems in real-time. For instance, predictive maintenance powered by ML minimizes unexpected asset downtime, maximizing the utilization of high-value transport assets such as container ships or specialized delivery vehicles. This shift towards predictive analytics enables logistics providers to anticipate demand fluctuations with far greater accuracy than traditional statistical models, significantly reducing the bullwhip effect and optimizing safety stock levels for B2B manufacturers and distributors.

Furthermore, AI is crucial in enhancing the robustness and resilience of supply chains in the face of increasing external shocks. By simulating various scenarios—such as port closures, major weather events, or sudden geopolitical trade tariffs—AI platforms can instantaneously recommend optimal diversion routes, reallocate inventory across distribution centers, and adjust pricing strategies dynamically to absorb cost pressures. This capability moves beyond simple data reporting, providing actionable, prescriptive insights that drastically improve decision-making speed. For B2B customers, this means higher service reliability, greater adherence to delivery windows, and minimized exposure to stock-outs or surplus inventory accumulation, leading to stronger commercial relationships and reduced contractual penalties.

AI also serves as the backbone for next-generation customer service interactions in B2B logistics. AI-powered chatbots and virtual assistants handle a high volume of routine queries concerning shipment tracking, customs documentation checks, and invoice verification, freeing up human logistics specialists to focus on high-complexity problem resolution and strategic account management. Moreover, computer vision, a sub-field of AI, is revolutionizing warehousing operations by ensuring accurate quality control, identifying damaged goods instantly, and guiding autonomous mobile robots (AMRs) for efficient goods placement and retrieval. This deep integration of AI across the operational and administrative layers guarantees sustained competitive advantage for organizations that successfully navigate the data standardization and integration challenges required for effective AI deployment.

- Enhanced Predictive Demand Forecasting and Inventory Optimization via Machine Learning models.

- Real-time Route Optimization and Dynamic Pricing driven by instantaneous data processing.

- Autonomous Logistics implementation, including optimized utilization of Autonomous Mobile Robots (AMRs) and drone delivery in controlled B2B environments.

- Improved Risk Management and Supply Chain Resilience through scenario simulation and prescriptive analytics.

- Automated Quality Control and Damage Detection in warehousing using Computer Vision technology.

- Streamlined Customs Compliance and Documentation through Natural Language Processing (NLP) solutions.

DRO & Impact Forces Of Supply Chain and Logistics for B2B Market

The Supply Chain and Logistics for B2B Market is defined by a dynamic interplay of factors: Drivers (D) compelling growth, Restraints (R) hindering expansion, Opportunities (O) presenting avenues for innovation, and the underlying Impact Forces shaping strategic decisions. The dominant driver is the continued globalization of trade and the accelerated rise of specialized B2B e-commerce platforms requiring complex, scaled fulfillment capabilities. Major restraints include inadequate physical and digital infrastructure in emerging markets, coupled with chronic worldwide shortages of skilled logistics labor (e.g., truck drivers and maritime personnel). Significant opportunities lie in the widespread adoption of digital twin technology for network simulation and optimization, alongside leveraging sustainable logistics practices (green supply chains) as a competitive differentiator. These elements collectively form impact forces that necessitate continuous capital investment in technology and human capital development to ensure resilient, high-performance logistical operations.

Key drivers center around technological mandates and shifting economic geography. The necessity for real-time visibility across the entire value chain, driven by client demand for transparency, pushes adoption of IoT and cloud-based WMS/TMS solutions. Additionally, the proliferation of flexible manufacturing models, such as mass customization, requires logistical partners capable of handling smaller, more frequent, and highly differentiated shipments, moving away from bulk standardized transport. The expansion of Free Trade Agreements (FTAs) globally simplifies cross-border movement, stimulating higher volumes of international B2B transactions. Conversely, high initial capital expenditure required for sophisticated automation technologies (e.g., automated storage and retrieval systems or autonomous guided vehicles) presents a substantial restraint, particularly for small to medium-sized logistics providers. Furthermore, regulatory complexity regarding data security and cross-border data transfer, such as GDPR compliance in Europe, imposes operational hurdles and compliance costs that impact service delivery timelines.

Opportunities are predominantly concentrated in disruptive technological integration and sustainability initiatives. The development and commercial viability of advanced analytics tools, coupled with geospatial data integration, offer novel pathways for reducing empty miles and optimizing load factors, directly impacting profitability and environmental footprint. The burgeoning cold chain market, especially for biopharma and specialized foodstuffs, offers a high-margin opportunity requiring specialized infrastructure investment. The impact forces acting on the market are profound: increased shareholder scrutiny on ESG performance mandates sustainable sourcing and transport, while the ongoing geopolitical realignment forces companies to adopt diversified sourcing strategies, prioritizing risk management over pure cost minimization. The necessity of creating 'phygital' (physical and digital) supply chain models that seamlessly blend physical asset management with advanced digital decision-making tools represents the core competitive arena for the foreseeable future.

Segmentation Analysis

The Supply Chain and Logistics for B2B market is meticulously segmented based on the type of service offered, the technology integrated, the specific industry vertical served, and the transportation mode utilized. This segmentation allows market participants to tailor highly specialized solutions, recognizing the disparate logistical requirements across sectors such as healthcare (requiring cold chain and regulatory compliance), automotive (demanding JIT delivery), and heavy manufacturing (focused on breakbulk and specialized freight). Analysis by service type highlights the dominance of integrated logistics and value-added services, demonstrating the market's shift toward comprehensive, managed solutions rather than standalone transportation. Technological segmentation reveals rapid adoption of sophisticated platform solutions necessary for real-time global coordination and transparent asset tracking, while regional fragmentation underscores localized infrastructure challenges and regulatory frameworks.

Segmentation by Service Type emphasizes the complexity of modern B2B interactions. Freight forwarding, although a foundational element, is increasingly packaged with ancillary services like customs brokerage, specialized packaging, and complex documentation handling. The high growth observed in specialized services, such as reverse logistics and aftermarket services, reflects the increasing circular economy trends and the need for efficient product returns and repair cycles in high-value B2B components. Furthermore, the mode of transportation dictates the speed, cost, and reliability parameters, with intermodal transport solutions gaining prominence for balancing efficiency and environmental impact. The integration of sea, rail, and road freight is optimized through centralized control towers managed by 4PL providers, which enhances route flexibility and minimizes potential single-mode bottlenecks.

From an end-user perspective, the segmentation is crucial as each industry vertical imposes unique demands on the logistics framework. The pharmaceutical industry, for example, demands stringent compliance with Good Distribution Practice (GDP) guidelines and requires highly validated cold chain infrastructure, often involving complex monitoring systems. Conversely, the high-tech manufacturing sector relies heavily on air freight for time-critical components and necessitates secure, trackable transport for valuable intellectual property embedded in components. Successful market penetration therefore requires logistics providers to build deep domain expertise, offering solutions that are not merely generic transport offerings but are instead compliant, industry-specific operational frameworks that directly support the core business processes of the client.

- By Service Type:

- Transportation (Freight Forwarding, Intermodal, Road, Rail, Air, Ocean)

- Warehousing and Distribution (Inventory Management, Cross-docking, Cold Storage)

- Value-Added Services (Packaging, Labeling, Assembly, Kitting)

- Customs and Trade Compliance

- Reverse Logistics and Aftermarket Services

- By Industry Vertical:

- Manufacturing (Automotive, Heavy Machinery)

- Retail and E-commerce (B2B Fulfillment)

- Healthcare and Pharmaceuticals (Cold Chain)

- Chemical and Energy

- Food and Beverage

- By Technology Adoption:

- Transportation Management Systems (TMS)

- Warehouse Management Systems (WMS)

- IoT and Telematics

- Blockchain Technology

- Robotics and Automation

- By Deployment Model:

- On-premise

- Cloud-based

Value Chain Analysis For Supply Chain and Logistics for B2B Market

The value chain for the Supply Chain and Logistics for B2B Market is a highly complex, interconnected network spanning multiple tiers, from raw material sourcing (upstream analysis) to final product delivery and post-sales support (downstream analysis). Upstream activities involve strategic procurement of transportation assets (trucks, ships, specialized containers), investment in critical infrastructure (warehouses, sorting hubs), and the acquisition of core digital platforms (WMS, TMS). Key challenges upstream include managing volatile fuel costs and securing high-quality, specialized labor. Logistics providers must optimize these procurement functions to maintain competitive pricing structures and operational readiness, often entering into long-term strategic partnerships with technology vendors and equipment manufacturers.

Midstream, the core value-creation activities revolve around operational efficiency: resource scheduling, multi-modal transportation execution, and centralized inventory management. The distribution channel structure is highly fragmented, encompassing both direct channels (owned fleet and warehousing) and indirect channels (reliance on vast networks of sub-contracted carriers, regional 3PLs, and specialized freight brokers). The shift toward indirect channels is driven by the necessity for flexible, scalable capacity that can rapidly adapt to fluctuating demand without incurring massive fixed costs. Effective synchronization across these disparate distribution channels, facilitated by advanced digital control towers, is the defining factor in maximizing midstream profitability and service quality.

Downstream analysis focuses on value delivery to the end-user/buyer, emphasizing last-mile B2B delivery, installation, and reverse logistics management. Success downstream is measured by delivery accuracy, cycle time compression, and the quality of customer service surrounding exceptions management. Modern B2B transactions require sophisticated Proof of Delivery (POD) systems and integrated payment processing. The most innovative logistics firms are enhancing their downstream value by offering tailored consultancy services, helping B2B clients optimize their internal receiving processes, thereby creating deeper, more entrenched customer relationships that secure long-term contracts and high retention rates. This continuous feedback loop from downstream operations informs upstream strategic investments in technology and capacity.

Supply Chain and Logistics for B2B Market Potential Customers

The potential customers for Supply Chain and Logistics services within the B2B sphere are exceptionally diverse, spanning nearly every major industrial and commercial sector globally. The primary end-users or buyers are large multinational manufacturers (especially automotive, aerospace, and electronics), mass-market retail conglomerates utilizing dedicated fulfillment networks for B2B sales, and specialized sectors like healthcare (pharmaceuticals and medical devices) and chemicals/energy. These customers share a fundamental need for reliability, scalability, and compliance, but their specific logistical demands—ranging from just-in-time sequencing in automotive assembly to cold chain validation in biopharma—require highly customized service offerings.

Manufacturing enterprises represent a cornerstone segment, utilizing B2B logistics services for sourcing raw materials, managing intra-facility transfers, and distributing finished goods to commercial clients or regional distribution hubs. The automotive sector, for example, demands complex supply chain choreography where millions of distinct parts must arrive precisely on schedule, often from dozens of different global suppliers. Similarly, electronics manufacturers require secure, fast transport for high-value components susceptible to obsolescence, emphasizing the need for robust security protocols and expedited air freight services, making them lucrative clients for providers specializing in high-security logistics.

The rapidly evolving B2B e-commerce sector is also generating substantial demand, blurring the lines between traditional commercial distribution and online retail fulfillment. Companies purchasing industrial supplies, office equipment, or specialized components online expect B2C-like speed and transparency, driving demand for advanced WMS/TMS integration and efficient consolidation services. Healthcare is a high-growth customer segment, where the stringent regulatory environment and the absolute necessity of maintaining product integrity (e.g., vaccine transport) translate into a requirement for certified, audited cold chain solutions and highly specialized risk management protocols, making them premium customers for providers capable of meeting exacting global standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Trillion |

| Market Forecast in 2033 | USD 2.7 Trillion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deutsche Post DHL Group, FedEx, UPS, Kuehne + Nagel, DSV Panalpina, Nippon Express, C.H. Robinson, DB Schenker, XPO Logistics, Expeditors International, GEODIS, J.B. Hunt Transport Services, Toll Group, Bolloré Logistics, Sinotrans Limited, Ceva Logistics, Yusen Logistics, Landstar System, Ryder System, Maersk Logistics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Supply Chain and Logistics for B2B Market Key Technology Landscape

The Supply Chain and Logistics for B2B market is defined by a rapid technological transition, moving away from legacy, siloed IT systems toward integrated, cloud-native platforms that facilitate end-to-end visibility and real-time decision-making. The core technological infrastructure relies heavily on sophisticated Transportation Management Systems (TMS) and Warehouse Management Systems (WMS), which are increasingly augmented by Artificial Intelligence (AI) and Machine Learning (ML) capabilities for predictive scheduling, demand sensing, and dynamic resource allocation. Furthermore, the proliferation of the Internet of Things (IoT) sensors is critical for collecting granular data on asset location, temperature, humidity, and security status, providing the necessary data foundation for advanced analytics and enhanced service level agreement (SLA) compliance.

A major focus within the technology landscape is on physical automation and efficiency maximization. Robotics, including Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs), are transforming warehouse and fulfillment center operations, drastically improving throughput and accuracy while mitigating the dependency on human labor for repetitive tasks. Complementary to this, blockchain technology is gaining traction, particularly for highly regulated or valuable B2B commodities, as it provides an immutable ledger for tracking provenance, ownership transfer, and verifying compliance documentation, thus building trust and transparency among multi-party supply chain stakeholders, especially in complex cross-border transactions where data integrity is paramount.

The effective use of data visualization tools and digital twins is establishing a new standard for strategic logistics planning. Digital twins allow logistics operators to create virtual replicas of their physical networks—from individual warehouses to global distribution routes—enabling simulation of various operational changes (e.g., opening a new hub, changing a transport mode, or reacting to a sudden customs delay) before committing resources in the physical world. This predictive simulation capacity is essential for modern B2B logistics providers who promise highly resilient and agile services. Furthermore, the ongoing migration to cloud-based solutions ensures scalability, lowers infrastructure maintenance costs, and facilitates seamless integration between disparate systems used by different partners in the B2B supply chain ecosystem.

Regional Highlights

Global demand for B2B logistics services exhibits significant regional variation, driven by localized economic development, infrastructure maturity, and regulatory environments. Geographic proximity to major manufacturing hubs and consumption markets dictates regional market size, while technological absorption rates determine service sophistication.

- North America: The market is mature, characterized by high adoption of advanced supply chain technologies such as AI-driven TMS and extensive automation in large-scale distribution centers. Growth is primarily driven by the expansion of B2B e-commerce platforms and the high demands placed on cold chain logistics, particularly in the US. The emphasis is on domestic optimization, intermodal efficiency (rail/road), and integrating advanced last-mile solutions for commercial addresses. Regulatory harmonization between the US, Canada, and Mexico (USMCA) facilitates cross-border trade, demanding seamless logistical operations that leverage modern technology for border clearance and tracking.

- Europe: This region is defined by strong regulatory pressure for sustainability and complex cross-border compliance within the EU single market. The drive for green logistics, including mandated low-emission zones and increased utilization of rail and short-sea shipping, dictates investment priorities. Central and Eastern Europe are emerging as critical logistics hubs due to lower operational costs and strategic positioning relative to Western European consumer markets and Asian import routes. Demand is high for 4PL services that can navigate the intricate web of different national tax systems, labor laws, and regulatory frameworks efficiently.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, fueled by China's industrial output, India's burgeoning domestic consumption, and the manufacturing shift into Southeast Asian nations (Vietnam, Indonesia). Massive infrastructure investments (e.g., Belt and Road Initiative logistics corridors) are enhancing multimodal connectivity. The region is highly fragmented, requiring specialized expertise in fragmented delivery networks and varied technological maturity. Technological leapfrogging is common, with many players bypassing older IT systems directly into advanced cloud-based and mobile-centric logistics solutions to handle high volumes of trade.

- Latin America (LATAM): Growth is driven by increased stability in certain economies and rising intra-regional trade, although hampered by challenging infrastructure and customs bureaucracy. There is a strong need for improved cold chain infrastructure, particularly in agricultural exports and pharmaceuticals. Logistics providers focus on improving visibility and security due to higher risks associated with cargo theft in certain corridors. Investment is concentrated in developing metropolitan logistics parks and integrating mobile tracking technologies to overcome infrastructural limitations.

- Middle East and Africa (MEA): This region serves as a crucial transit corridor between Asia, Europe, and Africa. Significant government investment in smart ports (e.g., Dubai, Saudi Arabia) and logistics free zones is driving market expansion. The African market, while nascent, shows high potential, focusing on mobile technology for supply chain coordination and rapid development of e-commerce fulfillment centers. Energy and chemical logistics remain primary drivers, requiring highly specialized, secure, and compliant transport solutions, especially for hazardous materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Supply Chain and Logistics for B2B Market.- Deutsche Post DHL Group

- FedEx

- UPS

- Kuehne + Nagel

- DSV Panalpina

- Nippon Express

- C.H. Robinson

- DB Schenker

- XPO Logistics

- Expeditors International

- GEODIS

- J.B. Hunt Transport Services

- Toll Group

- Bolloré Logistics

- Sinotrans Limited

- Ceva Logistics

- Yusen Logistics

- Landstar System

- Ryder System

- Maersk Logistics

Frequently Asked Questions

Analyze common user questions about the Supply Chain and Logistics for B2B market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between B2B and B2C logistics?

B2B logistics handles larger shipment volumes, less frequent deliveries, and often involves specialized handling, contractual obligations, and strict compliance requirements. B2C logistics focuses on high frequency, low volume, and speed to the individual consumer, utilizing smaller packages and different final-mile strategies.

How is digital transformation impacting B2B supply chain resilience?

Digital transformation, through the adoption of IoT, AI, and cloud-based TMS/WMS, significantly enhances resilience by providing real-time visibility, predictive risk modeling, and the ability to dynamically reroute and reallocate resources during disruptions, thereby minimizing delays and mitigating external shocks.

Which industry vertical is driving the highest growth in specialized B2B logistics?

The Healthcare and Pharmaceutical vertical, particularly the cold chain segment, is driving exceptionally high growth due to stringent regulatory demands (GDP compliance) and the complexity of transporting high-value, temperature-sensitive biopharmaceuticals, necessitating continuous monitoring and validated infrastructure.

What role does automation play in mitigating B2B logistics labor shortages?

Automation, utilizing Autonomous Mobile Robots (AMRs) and Automated Storage and Retrieval Systems (AS/RS), significantly reduces dependency on manual labor for repetitive tasks like picking, packing, and sorting within B2B warehouses, allowing the existing workforce to focus on high-value, complex operational management and specialized handling.

What are the main opportunities for 3PL providers in the B2B market?

Major opportunities for 3PL providers lie in offering integrated 4PL models, specializing in high-growth areas like reverse logistics and cold chain, and leveraging advanced data analytics to provide consultative services that optimize the client's entire supply network rather than just executing transport functions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager