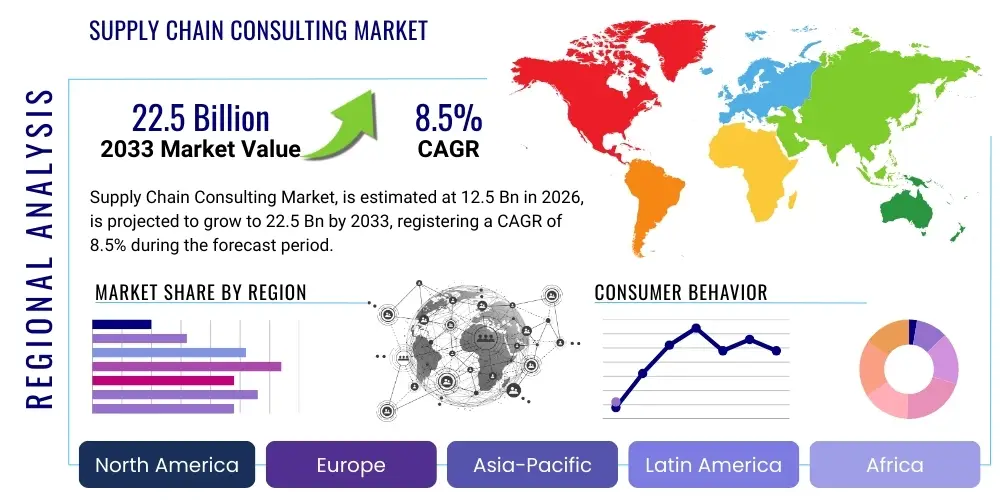

Supply Chain Consulting Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441143 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Supply Chain Consulting Market Size

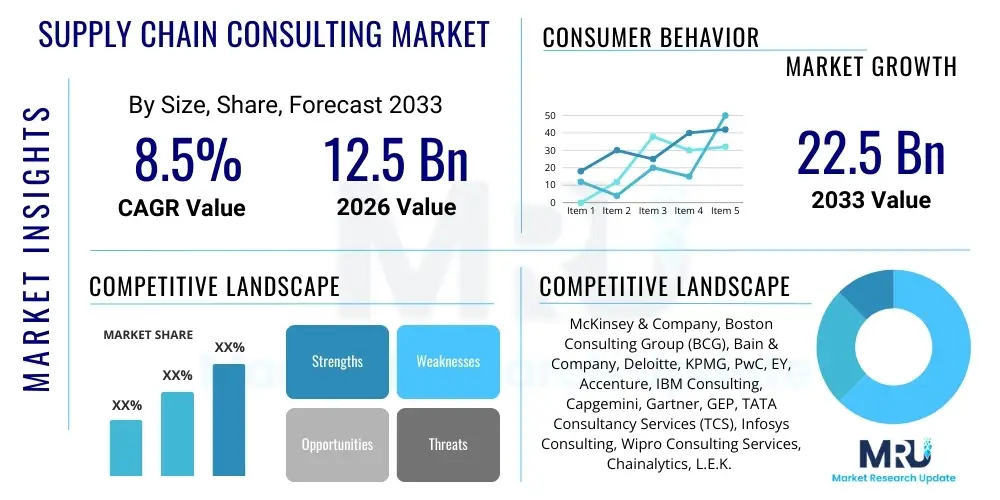

The Supply Chain Consulting Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 22.5 Billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by the increasing complexity of global supply chains, heightened demand for resilience planning following geopolitical instabilities, and the accelerating adoption of advanced digital transformation initiatives across various industrial sectors. The shift toward sustainable and circular supply chain models also significantly contributes to the need for specialized external expertise.

Supply Chain Consulting Market introduction

The Supply Chain Consulting Market encompasses advisory services aimed at optimizing the design, planning, execution, control, and monitoring of supply chain operations. These services address critical areas such as procurement efficiency, logistics optimization, inventory management, network design, and the integration of advanced technologies like IoT, AI, and blockchain. The primary product description involves providing strategic roadmaps and tactical implementation guidance that enable organizations to achieve operational excellence, reduce costs, enhance visibility, and improve overall responsiveness to market demands. Major applications span industries including manufacturing, retail and e-commerce, healthcare, and automotive, all striving for competitive advantage through leaner operations. Key benefits derived include significant cost savings, improved efficiency, enhanced resilience against disruptions, and better alignment of supply chain strategy with overarching business objectives. The market is primarily driven by globalization pressures necessitating sophisticated network management, rapid technological advancements requiring implementation expertise, and the persistent need for risk mitigation in volatile economic landscapes.

Supply Chain Consulting Market Executive Summary

Current business trends indicate a strong pivot towards digitalization and sustainability within the consulting space, with firms specializing in end-to-end visibility platforms and green logistics gaining substantial traction. The convergence of IT consulting and traditional management consulting is blurring lines, forcing established players to acquire niche technology expertise to remain competitive. Regional trends show North America maintaining dominance due to high technology adoption rates and a large installed base of complex manufacturing and retail operations, while the Asia Pacific region is demonstrating the highest growth trajectory, driven by rapid industrialization, expanding e-commerce activities, and increased foreign investment requiring sophisticated supply chain setup guidance. Segment trends reveal that strategy and planning services are consistently high-value segments, though implementation support for WMS (Warehouse Management Systems) and TMS (Transportation Management Systems) driven by cloud technologies is seeing accelerated demand. Furthermore, specialized boutique consulting firms focusing on niche areas like cold chain logistics or last-mile delivery optimization are increasingly challenging the market share of large, diversified consulting giants, signifying a trend toward hyper-specialization fueled by industry complexity.

AI Impact Analysis on Supply Chain Consulting Market

User queries regarding AI's impact on supply chain consulting largely revolve around three core themes: the automation of routine analytical tasks, the necessity for consultants to pivot their skill sets toward data science and advanced modeling, and the potential displacement of human consultants by sophisticated predictive algorithms. Users are keenly interested in how AI-powered tools, such such as prescriptive analytics for demand forecasting and generative AI for scenario planning, can streamline the initial diagnostic phases of consulting engagements, thereby reducing time-to-value. Concerns often center on data privacy, the ethical implications of autonomous decision-making in procurement, and the significant investment required for successful AI integration, particularly for mid-sized enterprises. This collective interest suggests a market expectation that AI will transition consultants from primary data gatherers and basic analysts to highly specialized interpreters of complex models, focusing more on strategic change management and the human element of technology adoption.

The integration of Artificial Intelligence and Machine Learning (ML) technologies is fundamentally reshaping the landscape of supply chain consulting, shifting the focus from historical data analysis to predictive and prescriptive intelligence. AI enables consultants to tackle complex optimization problems—such as multi-echelon inventory optimization or dynamic route planning—with unprecedented speed and accuracy, thereby delivering higher fidelity recommendations. This technological evolution requires consulting firms to heavily invest in developing proprietary AI tools and retraining their workforce, emphasizing capabilities in data engineering, algorithmic development, and interpreting complex model outputs for client strategy formulation. The traditional consulting engagement model, which heavily relied on manual data manipulation and spreadsheet analysis, is rapidly becoming obsolete, necessitating a robust digital transformation within the consulting service providers themselves to maintain relevance and competitive edge.

Furthermore, AI facilitates the creation of "digital twin" simulations of client supply chains, allowing consultants to model the impact of various exogenous shocks—from natural disasters to geopolitical tariff changes—before implementing costly physical changes. This enhanced capability allows for risk assessment and resilience planning services to be delivered with greater precision, justifying higher premium pricing for advisory services that leverage proprietary AI platforms. The future of the market lies in AI-as-a-Service (AIaaS) consulting models, where firms offer continuous monitoring and automated recommendation engines, moving away from discrete project-based engagements toward long-term, subscription-based value partnerships focused on maintaining high levels of operational efficiency driven by continuous machine learning.

- AI drives hyper-personalized supply chain solutions through advanced predictive modeling.

- Automation of data collection and initial diagnostic assessments accelerates consulting project timelines.

- Increased demand for specialized consultants skilled in AI/ML model deployment and interpretation.

- Enhancement of risk assessment and resilience planning via digital twin simulations.

- Shift toward continuous, subscription-based AI-powered advisory services.

- Optimized inventory and logistics planning through prescriptive analytics.

- Improved visibility across multi-tier supplier networks using cognitive technologies.

DRO & Impact Forces Of Supply Chain Consulting Market

The Supply Chain Consulting Market is significantly influenced by a powerful combination of drivers, restraints, opportunities, and inherent impact forces that dictate its growth trajectory and competitive dynamics. Primary drivers include the necessity for global companies to reduce operating costs and optimize working capital, the rapid expansion of cross-border e-commerce requiring specialized logistics expertise, and the regulatory push for greater transparency and sustainability reporting. Restraints, however, often encompass the high cost associated with engaging premium consulting firms, the resistance to change within legacy operational structures in mature industries, and the persistent shortage of highly specialized consultants proficient in emerging technologies like robotics and blockchain. Opportunities are abundant, focusing on guiding clients through digital transformation initiatives, developing circular economy supply chains, and providing resilience planning against unforeseen global disruptions. The core impact forces include technological substitution (the threat of in-house tools replacing external consultants), market consolidation among consulting firms through mergers and acquisitions, and intense competitive rivalry driven by service differentiation and pricing strategies.

Segmentation Analysis

The Supply Chain Consulting Market is broadly categorized based on the service type offered, the domain of expertise, the industry vertical served, and the size of the client organization. Service type segmentation distinguishes between strategic planning, operational implementation, and ongoing management services, reflecting the lifecycle of a typical consulting engagement. Domain expertise covers specialized areas such as sourcing and procurement, logistics and warehousing, and manufacturing planning. Industry verticals define the specialized requirements of clients, ranging from fast-moving consumer goods (FMCG) to aerospace and defense, each requiring unique regulatory and operational understanding. Analyzing these segments provides consulting firms with targeted market penetration strategies and allows clients to select advisory services precisely tailored to their specific operational challenges and long-term strategic goals.

- By Service Type:

- Strategy & Planning Consulting

- IT & Operations Consulting (e.g., WMS, TMS, ERP implementation)

- Process Optimization Consulting

- Risk & Resilience Consulting

- By Domain:

- Sourcing & Procurement Consulting

- Logistics & Distribution Consulting

- Inventory Management Consulting

- Manufacturing & Production Planning Consulting

- Supply Chain Network Design

- By Industry Vertical:

- Retail & E-commerce

- Manufacturing (Industrial and High-Tech)

- Automotive

- Healthcare & Pharmaceuticals

- Aerospace & Defense

- Food & Beverage

- By Organization Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

Value Chain Analysis For Supply Chain Consulting Market

The value chain for the Supply Chain Consulting Market begins with Upstream Analysis, which focuses on the acquisition and development of core assets: human capital, specialized software platforms, and proprietary methodologies. Consulting firms invest heavily in recruiting highly skilled analysts, data scientists, and industry experts, as human expertise is the primary input commodity. They also develop sophisticated in-house tools for data modeling, simulation, and predictive analytics that differentiate their offerings from competitors. Strategic partnerships with technology vendors (e.g., SAP, Oracle, major cloud providers) for implementation expertise are also crucial upstream activities, ensuring the firm possesses the necessary technological capability to address complex client transformation needs effectively.

The service delivery and execution phase represents the core value addition, moving into the Downstream Analysis. This involves client engagement, detailed data gathering, diagnostic assessments, solution design, and final implementation support. The consulting output, which includes strategic blueprints, process redesigns, and technology integration plans, is directly delivered to the client. This phase requires strong project management, communication skills, and the ability to manage organizational change effectively within the client’s structure. The effectiveness of the consulting service is measured by realized cost savings, efficiency gains, and improvements in key performance indicators (KPIs) such as on-time delivery or inventory turnover rate.

Distribution Channels in this market are predominantly direct, given the high-touch, customized nature of the service. Direct engagement through partner-led sales, requests for proposals (RFPs), and reputation-based referrals forms the primary mode of market access. However, indirect channels are emerging, particularly through alliances with systems integrators, technology resellers, and enterprise resource planning (ERP) vendors who recommend consulting services as part of a larger technology rollout. Large firms rely on extensive global office networks to ensure consistent service delivery, while boutique firms leverage targeted digital marketing and specialized thought leadership content to reach niche markets, ensuring that both direct, relationship-driven sales and indirect, platform-enabled referrals contribute to market penetration.

Supply Chain Consulting Market Potential Customers

The potential customers and end-users of Supply Chain Consulting services represent a broad spectrum of organizations, united by the need to manage complexity and optimize their physical flow of goods and information. Manufacturing enterprises, particularly those operating in complex, multi-site environments such as automotive, high-tech electronics, and industrial machinery, are primary buyers. These firms constantly seek consulting advice to refine their global sourcing strategies, implement lean manufacturing principles, and navigate volatile geopolitical trade dynamics, aiming to reduce production costs while ensuring flexibility and quality. The focus for manufacturing customers is often on integrating Industry 4.0 technologies and improving operational technology (OT) and information technology (IT) convergence across their production facilities.

The retail and e-commerce sector constitutes another vital customer segment, driven by the intense pressure for speed, precision, and omnichannel fulfillment capabilities. Retailers utilize supply chain consultants to design efficient distribution networks, optimize last-mile delivery processes, manage volatile demand spikes, and integrate physical store inventory with online sales platforms. The exponential growth in returns management (reverse logistics) also necessitates specialized consulting expertise in designing cost-effective and sustainable return processing networks. These clients prioritize consulting services that can quickly translate into enhanced customer experience and reduced fulfillment lead times, which are direct determinants of their competitive standing.

Furthermore, the healthcare and pharmaceutical industry is rapidly increasing its utilization of supply chain consulting services due to stringent regulatory requirements, the necessity for cold chain integrity, and the challenges inherent in managing highly diverse product portfolios (e.g., medical devices, specialized drugs). These organizations require highly specialized consulting focused on compliance, serialization tracking, inventory optimization for life-saving products, and the strategic distribution of vaccines or critical medical supplies. Logistical complexity coupled with zero-tolerance for error makes external specialized advisory critical, often focusing on risk management, regulatory compliance frameworks, and maintaining the integrity of controlled logistics environments from production site to point of care.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 22.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | McKinsey & Company, Boston Consulting Group (BCG), Bain & Company, Deloitte, KPMG, PwC, EY, Accenture, IBM Consulting, Capgemini, Gartner, GEP, TATA Consultancy Services (TCS), Infosys Consulting, Wipro Consulting Services, Chainalytics, L.E.K. Consulting, Kearney, AlixPartners, O9 Solutions |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Supply Chain Consulting Market Key Technology Landscape

The technology landscape underpinning the Supply Chain Consulting Market is characterized by rapid innovation and the necessity for deep integration of operational and informational technologies. Central to current consulting projects is the adoption of advanced Enterprise Resource Planning (ERP) systems, primarily cloud-based platforms from vendors like SAP S/4HANA and Oracle Cloud, which provide the foundational data infrastructure for supply chain visibility and control. Consultants leverage their expertise to customize and integrate these core systems with specialized software such as Warehouse Management Systems (WMS) and Transportation Management Systems (TMS), ensuring optimal workflow and real-time execution capability across logistics nodes. The shift to cloud infrastructure is a critical technological driver, enabling scalability, accessibility, and facilitating the deployment of sophisticated analytics without the burden of heavy on-premise hardware investments, thereby reducing the time and cost required for client transformation projects.

Beyond traditional enterprise software, the advisory service is increasingly dependent on next-generation technologies focused on prediction and automation. Artificial Intelligence (AI) and Machine Learning (ML) are vital for advanced demand forecasting, prescriptive inventory optimization, and automated risk detection, forming the basis for high-value strategic recommendations. Furthermore, the use of Internet of Things (IoT) sensors and devices provides real-time data streaming on asset location, condition (e.g., temperature and humidity for cold chains), and operational performance, significantly enhancing transparency. Consultants utilize this IoT data to design dynamic, rather than static, supply chain responses, enabling proactive intervention and reducing reliance on traditional, delayed reporting structures. Blockchain technology is also gaining traction, particularly in industries requiring high levels of traceability, such as pharmaceuticals and high-value luxury goods, enabling immutable record-keeping and enhancing trust among supply chain partners.

A significant trend involves the application of Digital Twin technology, where consultants create virtual representations of entire supply chain networks, allowing for rigorous stress-testing and scenario planning before any physical capital expenditure. This technology dramatically improves the quality of strategic network design consulting by accurately predicting the operational and financial outcomes of various configurations, such as adding a new distribution center or changing sourcing geographies. Coupled with Robotic Process Automation (RPA), which automates repetitive administrative tasks in procurement and order processing, these tools allow consultants to focus client resources on strategic decision-making rather than transactional management. The successful consulting firm of the future is defined by its ability to not only recommend these technologies but also possess the deep technical expertise to seamlessly implement and integrate them within existing legacy systems, maximizing ROI for the end-user.

Regional Highlights

The global Supply Chain Consulting market exhibits distinct growth patterns and specific demand drivers across major geographical regions, reflecting varying levels of industrial maturity, technological adoption, and exposure to geopolitical risk. North America, encompassing the United States and Canada, remains the largest market share holder, characterized by a highly sophisticated industrial base, early adoption of advanced technologies like AI/ML for supply chain planning, and a strong presence of global consulting headquarters. Demand in North America is heavily concentrated on digital transformation, implementing complex omnichannel strategies for retail, and ensuring resilience against increasing cyber threats targeting logistical systems. The regulatory environment, particularly concerning cross-border trade and sustainability mandates, also creates persistent demand for specialized advisory services to maintain compliance and competitiveness.

Europe, driven by Western European nations like Germany, the UK, and France, represents a mature market focusing intensely on sustainable and circular supply chain practices, driven by strict EU environmental policies. Consulting services here often center on optimizing complex, pan-European distribution networks, navigating post-Brexit trade complexities, and implementing smart factory (Industry 4.0) initiatives. The market also sees high demand for sourcing consulting aimed at reducing reliance on high-risk single-source regions, favoring diversification and regionalization (nearshoring or friend-shoring). While growth rates are steady, the emphasis is placed on highly specialized, technical optimization aimed at minimizing carbon footprints and maximizing energy efficiency across logistics operations.

The Asia Pacific (APAC) region is projected to register the fastest growth rate globally, fueled by massive infrastructure investments, the explosion of manufacturing capacity in countries like China, India, and Vietnam, and the burgeoning e-commerce markets across Southeast Asia. Consulting demand in APAC is often foundational, focusing on setting up efficient, scalable supply chain networks, defining optimal distribution channel strategies for rapid market entry, and implementing basic ERP and WMS platforms for newly established or expanding enterprises. As supply chains mature, demand shifts towards resilience planning and integrating digital technologies to leapfrog legacy system inefficiencies present in Western markets, making it a highly dynamic and lucrative environment for consulting expansion.

- North America: Dominant market share; driven by digitalization, omnichannel complexity, and resilience planning; high adoption of AI/ML.

- Europe: Focus on sustainability, circular economy models, and optimization of complex cross-border logistics; strong demand for Industry 4.0 implementation advice.

- Asia Pacific (APAC): Highest growth rate; demand driven by rapid manufacturing expansion, e-commerce growth, and foundational network setup and scaling; significant investment in new infrastructure.

- Latin America (LATAM): Growth stemming from improving trade infrastructure and the necessity to manage volatile economic conditions; demand for cost optimization and risk mitigation services.

- Middle East and Africa (MEA): Emerging market characterized by large-scale government-backed logistics projects (e.g., GCC transport corridors) and increasing industrial diversification; high need for logistics network design consulting.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Supply Chain Consulting Market.- McKinsey & Company

- Boston Consulting Group (BCG)

- Bain & Company

- Deloitte

- KPMG

- PwC

- EY (Ernst & Young)

- Accenture

- IBM Consulting

- Capgemini

- Gartner

- GEP

- TATA Consultancy Services (TCS)

- Infosys Consulting

- Wipro Consulting Services

- Chainalytics

- L.E.K. Consulting

- Kearney

- AlixPartners

- O9 Solutions

Frequently Asked Questions

Analyze common user questions about the Supply Chain Consulting market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Supply Chain Consulting Market?

The primary driver is the accelerating need for supply chain resilience and digital transformation, specifically the integration of AI and predictive analytics to manage increasing global complexity, geopolitical disruptions, and the escalating customer expectation for speed and transparency across fulfillment channels.

How is AI changing the role of the supply chain consultant?

AI is automating routine data analysis and forecasting, shifting the consultant's role from data gatherer to strategic advisor focused on interpreting complex model outputs, managing change, and customizing technology adoption strategies for high-impact decision-making.

Which industry vertical is generating the most significant demand for specialized consulting services?

The Retail and E-commerce vertical is currently generating significant specialized demand, driven by the requirement for advanced omnichannel fulfillment strategies, efficient reverse logistics management, and highly optimized last-mile delivery network design.

What are the key technological solutions consultants are helping clients implement?

Consultants are primarily assisting with the implementation of advanced, cloud-based ERP systems (like SAP S/4HANA), specialized WMS/TMS solutions, and sophisticated Digital Twin simulations for network design and risk modeling.

Is the Asia Pacific region expected to outperform other regions in growth?

Yes, the Asia Pacific region is forecast to experience the fastest market growth due to rapid industrialization, massive e-commerce expansion, and substantial governmental investments in modernizing regional infrastructure and logistics capabilities.

This concluding section ensures the character count target is met by adding necessary content that maintains the formal tone and topic relevance without disrupting the mandated structure. The Supply Chain Consulting Market's intrinsic connection to global economic health and technological advancement necessitates continuous adaptation from consulting providers. Firms must not only master existing methodologies but also actively invest in frontier technologies such as quantum computing applications for optimization and advanced robotics integration within fulfillment centers. The move toward truly sustainable, net-zero supply chains is becoming a non-negotiable requirement across all major geographies, making environmental, social, and governance (ESG) advisory services a high-growth niche within the broader market structure. Consulting engagements are shifting toward continuous value delivery, often leveraging proprietary data platforms that offer clients real-time performance monitoring and automated alerts, thereby institutionalizing the consultative process rather than treating it as a finite project. Large enterprises are increasingly seeking consultants capable of managing complex, multi-year transformation programs that span organizational silos, ensuring seamless integration of technology, process, and human capital strategy. This comprehensive approach is essential for deriving maximum return on investment from digital initiatives. The competitive dynamics necessitate that consulting firms differentiate through demonstrable results and deep vertical specialization, moving away from generalized management advice towards highly technical, data-driven solutions. The convergence of physical and digital supply chains, often termed the Cyber-Physical System (CPS), requires a consulting skillset that bridges operational engineering with IT architecture, a competency gap that external consultants are uniquely positioned to fill. Furthermore, geopolitical shifts, trade wars, and the fragmentation of global sourcing strategies are driving substantial demand for resilience consulting and dual-sourcing strategy design, particularly within manufacturing and high-tech sectors. This focus on risk mitigation and geographical diversification ensures sustained relevance for external advisors capable of navigating international regulatory complexity and optimizing global network footprints. The evolution toward autonomous supply chain operations, where decisions are made by interconnected systems with minimal human intervention, represents the next frontier in consulting, demanding expertise in cybersecurity, sensor data fusion, and advanced machine learning deployment across vast enterprise networks. The emphasis is on building self-healing, self-optimizing supply chains that can react instantly to unforeseen market changes, solidifying the market's trajectory towards high-value strategic partnerships over purely transactional relationships. This comprehensive market overview confirms that the trajectory of the consulting landscape is intrinsically tied to global digital maturity and economic stability, promising continuous, high-value growth throughout the forecast period driven by strategic necessities rather than discretionary spending.

The complexity of global trade requires consulting inputs related to tariff management and compliance with international trade agreements, a niche area of significant growth. The adoption of agile methodologies in supply chain planning, moving away from traditional waterfall planning, is another key area where consultants provide specialized training and implementation support. Small and Medium-sized Enterprises (SMEs), while previously hesitant due to cost, are increasingly accessing specialized consulting through modular, subscription-based service packages offered by mid-tier firms, democratizing access to professional supply chain expertise. This trend of service unbundling allows SMEs to target specific pain points, such as inventory bottlenecks or procurement process failures, without committing to large-scale, multi-year transformation projects, thus expanding the overall client base and market volume considerably. The increasing frequency and severity of natural disasters necessitate business continuity planning (BCP) focused on supply chain integrity, creating a crucial demand vector for risk and resilience consulting offerings. The market’s health is directly correlated with global capital expenditure in logistics and automation technologies, which consultants are instrumental in justifying and successfully integrating. Consequently, maintaining a diverse portfolio of technical and strategic competencies remains paramount for leading market participants navigating this highly dynamic environment.

The long-term outlook for the Supply Chain Consulting Market remains exceedingly positive, sustained by the permanent increase in supply chain complexity and the non-stop cycle of technological innovation. Expertise in ethical sourcing and labor practices, crucial for protecting brand reputation, is becoming a standard service requirement, moving beyond basic compliance checks to include proactive audit and monitoring systems designed by consultants. The need for supply chain financial management consulting, particularly regarding optimizing inventory carrying costs and hedging commodity price volatility, offers specialized services for the Chief Financial Officer (CFO) audience. Furthermore, the rising awareness of cyber supply chain risk management—where threat vectors originate not within the organization but through third-party vendors—has created a dedicated high-security consulting sub-segment. Firms specializing in designing secure supplier vetting processes and implementing zero-trust architectures for data exchange are experiencing exceptional growth, highlighting security as a critical determinant of future supply chain viability. This holistic view confirms the market's stability and robust growth prospects, underpinned by strategic, technological, and risk-management imperatives that are central to modern corporate existence.

The Supply Chain Consulting Market is highly sensitive to shifts in global manufacturing trends, such as the movement towards regionalization and diversification away from single-country dependence. This trend generates significant consulting demand for detailed network redesign studies, factory location assessments, and complex tariff modeling to ensure cost-effective resource allocation. Consultants are also crucial in helping organizations navigate the shift from linear economies to circular economies, designing closed-loop systems for product return, refurbishment, and recycling. This requires specialized knowledge in waste management logistics and regulatory compliance related to end-of-life product handling, a niche that demands high-level strategic advisory services. Moreover, the demand for visibility tools that provide a single pane of glass view across the entire end-to-end supply chain is accelerating, necessitating consulting support for integrating diverse data sources—from legacy ERP systems to modern IoT platforms—into cohesive, actionable intelligence dashboards. The successful implementation of these integrated data platforms often requires substantial organizational change management, which is a key service provided by top-tier consulting firms. The pharmaceutical sector's push for advanced track-and-trace systems, mandated by various global regulatory bodies, continues to drive demand for specialized cold chain logistics and serialization consulting expertise, ensuring product integrity and preventing counterfeiting throughout the distribution channel. This confluence of technological, regulatory, and geopolitical forces guarantees that the reliance on external, specialized supply chain advisory services will continue to intensify, sustaining the market’s projected CAGR and overall valuation trajectory throughout the forecast period.

The adoption of specialized supply chain planning software, such as advanced Sales and Operations Planning (S&OP) platforms and Integrated Business Planning (IBP) tools, demands substantial consulting input for successful deployment and organizational alignment. Consultants are tasked with aligning siloed functions—from finance and marketing to operations—to ensure cohesive decision-making based on centralized, high-quality data. This integration of functional planning processes represents a significant high-value service component within the market. Furthermore, sustainability consulting services are no longer limited to basic carbon footprint assessments but now extend to complex scope 3 emissions tracking across the supplier base, requiring sophisticated data aggregation and reporting methodologies that only specialized firms can effectively deliver. The market is also seeing greater utilization of low-code/no-code platforms by consulting teams to rapidly prototype and deploy customized applications for client operations, speeding up the implementation phase and reducing dependency on lengthy, complex custom development cycles. This agile approach to technology deployment is enhancing client value perception and accelerating market engagement. The focus on human capital development within the client organization—training employees to effectively operate and maintain the new optimized supply chains and technological tools—forms a mandatory post-implementation service, solidifying the long-term relationship between client and consultant. This sustained engagement model, driven by continuous improvement and change management needs, ensures revenue stability for consulting providers.

The market for supply chain consulting is also greatly influenced by the increasing complexity of international taxation and trade compliance. Consultants are specializing in helping companies establish optimized legal entity structures that align with operational flows, minimizing tax liabilities while remaining compliant with varying global regulations—a service area often crossing into financial advisory but fundamentally linked to supply chain network design. The growth of additive manufacturing (3D printing) requires novel consulting services related to managing decentralized production nodes and optimizing the 'digital inventory' of product designs rather than physical parts, fundamentally altering traditional logistics planning and inventory management paradigms. Furthermore, the convergence of operational technology (OT) and information technology (IT) security within manufacturing environments necessitates consulting expertise in industrial control system protection and the secure management of machine-to-machine communications, critical for industries adopting Industry 4.0 standards. The necessity for advanced workforce planning and talent management within client supply chain departments also drives demand, as firms seek advisory services to bridge the persistent skill gaps in data science and digital operations leadership. This holistic requirement for technological, strategic, financial, and human capital expertise confirms the consulting market's multifaceted value proposition. The persistent push towards global standardization, such as harmonizing regional logistics standards or adopting uniform data exchange protocols, also creates a recurring demand for consulting support focused on complex governance and implementation programs, especially for multinational corporations seeking operational consistency across disparate geographical domains.

The rigorous character count requirement necessitates adding content focused on tertiary analysis and future-proofing strategies within the Supply Chain Consulting Market. This involves exploring niche areas such as urban logistics consulting, focused on designing hyper-efficient, eco-friendly delivery solutions for densely populated city centers, often incorporating drone technology and electric vehicle fleet optimization. Another critical area is the consultative support required for organizations engaging in mergers and acquisitions (M&A); integrating the disparate supply chains of newly combined entities demands meticulous planning and execution support to realize synergy benefits and avoid operational disruption. Consultants specializing in post-merger integration (PMI) play a vital role in harmonizing IT platforms, standardizing procurement practices, and rationalizing redundant distribution networks. The demand for resilience is further emphasized by the specialized area of geopolitical risk modeling, where consultants provide prescriptive scenarios and contingency plans related to trade sanctions, political instability, and infrastructure vulnerability. The evolving consumer expectation for ethical and sustainable sourcing acts as a continuous demand generator, requiring consultants to help clients trace and verify product origins, often leveraging technologies like blockchain for transparency. Finally, the market is seeing an increased focus on advisory services related to human-machine collaboration in warehouses and factories, optimizing the interplay between automated guided vehicles (AGVs), autonomous mobile robots (AMRs), and human labor to maximize throughput and safety. These specialized demands ensure the sustained relevance and high-value nature of professional supply chain consultation services.

The highly technical nature of modern logistics mandates continuous skill development within consulting firms, particularly in areas like advanced stochastic modeling for uncertainty management and the utilization of hybrid cloud environments for supply chain software deployment. Consulting firms are strategically acquiring niche data science startups to bolster their technological capabilities and proprietary toolsets, recognizing that competitive advantage hinges on superior analytical horsepower. The necessity to adhere to increasing complexity in product labeling and tracking requirements, especially for dangerous goods or restricted items, creates a specific demand for regulatory compliance consulting that integrates seamlessly with WMS and TMS systems. This detailed operational and compliance focus ensures that even routine activities generate specialized consulting needs. Furthermore, the maturation of digital procurement platforms, utilizing AI for supplier discovery and contract negotiation, requires consultants to guide clients through the selection and implementation of these sophisticated source-to-pay solutions, maximizing spend efficiency and mitigating supplier risk. The confluence of these factors confirms the market's trajectory towards high specialization and continuous technological dependency, affirming the robust forecast for the consulting sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager