Surface Measurement Equipment and Tools Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442597 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Surface Measurement Equipment and Tools Market Size

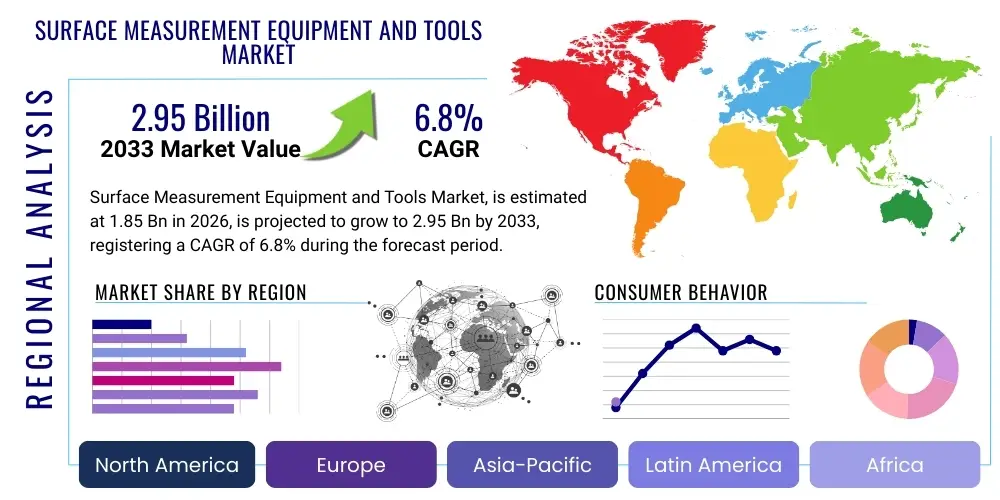

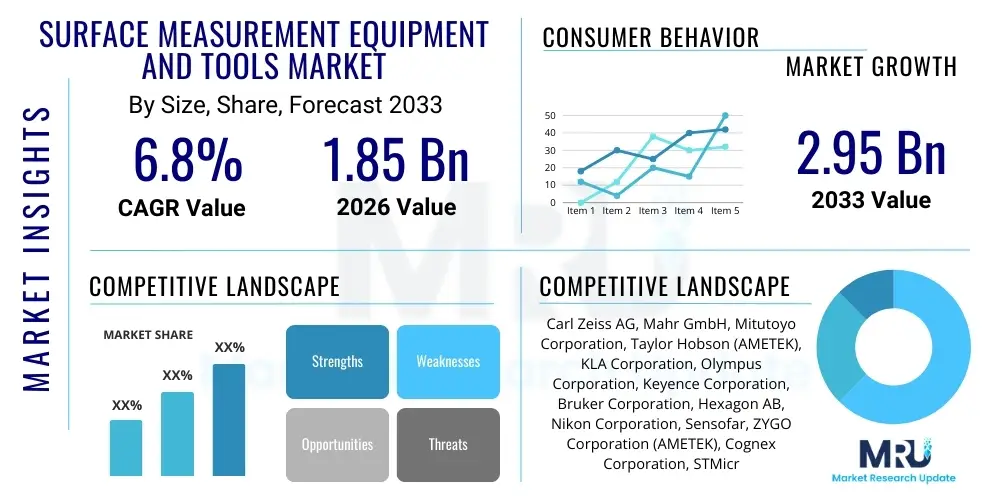

The Surface Measurement Equipment and Tools Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.85 billion in 2026 and is projected to reach USD 2.95 billion by the end of the forecast period in 2033.

Surface Measurement Equipment and Tools Market introduction

The Surface Measurement Equipment and Tools Market encompasses a diverse range of precision instruments designed to quantify and analyze the topographical characteristics of material surfaces. These characteristics include roughness, waviness, contour, texture, and three-dimensional form. Key products within this market span from contact measurement devices such as stylus profilometers to advanced non-contact optical systems like confocal microscopes, white light interferometers, and coordinate measuring machines (CMMs) equipped with surface scanning capabilities. The primary objective of these tools is to ensure product quality, optimize manufacturing processes, and validate adherence to stringent industry standards in various high-precision sectors.

Major applications of surface measurement technology are pervasive across critical industries, including quality control in automotive manufacturing (engine components, body panels), aerospace (turbine blades, structural integrity checks), electronics (semiconductor wafer analysis, micro-electromechanical systems (MEMS)), and medical devices (implants, surgical tools). These measurements are crucial for determining functionality, lifespan, and aesthetic qualities of finished products. For example, roughness directly impacts friction, wear resistance, and lubrication properties, making precise control essential for performance-critical applications.

The market benefits significantly from the global drive toward miniaturization, precision engineering, and Industry 4.0 adoption. Driving factors include increasing regulatory pressure for product reliability, the complexity of modern materials requiring nanometer-scale analysis, and the continuous innovation in sensor technology that enables faster, more accurate, and non-destructive testing. The adoption of automated inspection systems integrated with manufacturing lines further accelerates market growth by improving throughput and reducing human error in critical inspection processes.

Surface Measurement Equipment and Tools Market Executive Summary

The Surface Measurement Equipment and Tools Market demonstrates robust growth driven primarily by increasing automation in manufacturing and the growing demand for ultra-precise components across electronics and aerospace sectors. Business trends show a strong shift from traditional contact methods to advanced non-contact optical techniques, facilitated by superior speed and the ability to measure fragile or complex geometries without damage. Key vendors are focusing on developing hybrid systems that combine multiple measurement technologies (e.g., combining CMMs with laser scanning) to offer comprehensive metrology solutions. Furthermore, the integration of advanced software, artificial intelligence (AI) for defect classification, and cloud connectivity aligns the market with broader Industry 4.0 paradigms, enhancing data management and predictive maintenance capabilities.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, largely due to massive investments in electronics manufacturing, automotive production expansion in countries like China and India, and the establishment of sophisticated semiconductor fabrication plants. North America and Europe, while mature, remain dominant in terms of technological innovation and high-end instrument adoption, particularly in R&D-intensive fields such as aerospace and medical technology. European markets are characterized by stringent quality standards and a strong focus on precision engineering, driving demand for high-accuracy profilometers and interferometers.

Segment trends reveal that the Optical Measurement Technology segment is projected to hold the largest market share due to its non-destructive nature and high throughput capabilities, specifically white light interferometry and confocal microscopy. Among end-users, the Automotive sector remains the largest consumer, requiring surface analysis for engine components, bearings, and brake systems to ensure operational efficiency and safety. However, the Semiconductor and Electronics segment is expected to exhibit the highest CAGR, driven by the need for increasingly finer surface inspection of microchips and integrated circuits required for 5G and IoT infrastructure development.

AI Impact Analysis on Surface Measurement Equipment and Tools Market

Common user questions regarding AI's impact on the Surface Measurement Equipment and Tools Market often revolve around how artificial intelligence can enhance measurement speed, accuracy, and autonomy. Users are keen to understand if AI can automate the complex process of surface data analysis, specifically in distinguishing between critical defects and tolerable surface variations, and how it handles high-volume, heterogeneous data generated by 3D scanners. Concerns also frequently surface about the reliability and explainability of AI algorithms used in crucial quality control decisions, alongside the required training data volume needed to implement effective machine learning models for defect recognition and classification. The underlying expectation is that AI will transform surface metrology from a manual inspection process into an intelligent, self-optimizing quality control system.

The integration of AI, particularly machine learning (ML) and computer vision, is fundamentally reshaping the capabilities of surface measurement equipment. AI algorithms are now deployed to perform rapid image processing and defect detection on surfaces, significantly improving the efficiency of high-throughput inspection systems. This shift allows manufacturers to move away from statistical sampling towards 100% inline inspection. For instance, ML models can be trained on vast datasets of acceptable and defective surfaces, enabling automated classification that surpasses human perceptual limitations, particularly when dealing with complex textures or subtle deviations on large volumes of parts.

Furthermore, AI is instrumental in optimizing measurement processes by intelligently adjusting equipment parameters, such as scanning speed, resolution, and illumination angles, based on the material and required tolerance. This capability not only reduces setup time but also ensures optimal data acquisition quality. The ability of AI to interpret large, complex 3D topography data generated by non-contact sensors is accelerating R&D cycles and improving predictive maintenance models for the measurement equipment itself, signaling a clear trajectory towards fully autonomous metrology systems integrated within smart factories.

- Enhanced Defect Classification: AI algorithms provide automated, high-speed identification and categorization of surface anomalies (scratches, porosity, contamination).

- Optimized Measurement Parameters: Machine learning models autonomously adjust measurement settings (e.g., focus, intensity, scan path) for optimal data collection efficiency.

- Predictive Quality Control: AI enables real-time analysis correlating surface data with manufacturing parameters to predict potential quality issues before they occur.

- Increased Throughput: Automation of data processing and reporting drastically reduces inspection cycle times, supporting 100% inline quality checks.

- Reduced Operator Dependence: AI simplifies complex analysis workflows, lowering the skill requirement for frontline personnel operating advanced equipment.

- Development of Smart Metrology Systems: Facilitates integration with Industrial IoT (IIoT) platforms for centralized data management and remote diagnostics.

DRO & Impact Forces Of Surface Measurement Equipment and Tools Market

The Surface Measurement Equipment and Tools Market is subject to significant dynamic forces shaping its trajectory. Key drivers include the relentless global push towards high-precision manufacturing, especially in sectors like aerospace, semiconductor, and medical device manufacturing, where component failure tolerance is extremely low. The escalating demand for three-dimensional (3D) surface measurement over traditional two-dimensional (2D) methods, driven by the complexity of modern geometries and additive manufacturing techniques, substantially boosts the adoption of advanced systems like 3D optical profilers and advanced CMMs. Furthermore, regulatory mandates and standardization efforts (e.g., ISO standards for surface texture) compel industries worldwide to invest in certified and reliable measurement solutions.

Conversely, the market faces several restraining factors. The initial capital investment required for acquiring high-end surface measurement equipment, particularly advanced non-contact instruments, is substantial, posing a significant barrier for small and medium-sized enterprises (SMEs). Moreover, the operation and interpretation of complex metrology data often require highly specialized technical expertise, leading to a shortage of skilled personnel. Economic uncertainty and geopolitical instability can also lead to temporary slowdowns in capital expenditure across major manufacturing hubs, impacting equipment procurement cycles. The integration challenges of new measurement systems into existing legacy manufacturing environments further limit rapid adoption in some traditional industries.

Significant opportunities exist, particularly in the rapid commercialization of micro- and nano-level manufacturing processes, requiring ultra-high resolution surface analysis for materials such as thin films and specialized coatings. The growing trend of adopting inline metrology—moving measurement tools directly onto the production floor for real-time feedback—presents a major avenue for market expansion. Furthermore, emerging markets in Southeast Asia and Latin America represent untapped growth potential as these regions modernize their manufacturing infrastructures. The development of portable and handheld surface measurement devices, leveraging advancements in miniaturized optics and sensors, offers new applications in field diagnostics and quality assurance beyond the controlled laboratory environment.

Segmentation Analysis

The Surface Measurement Equipment and Tools Market is meticulously segmented based on technology, measurement type, end-user industry, and application, allowing for a detailed understanding of market dynamics and targeted strategic planning. The analysis reveals that technological advancements are the primary differentiator, with non-contact methods rapidly gaining dominance over traditional contact methods due to speed, precision, and versatility. Market segmentation provides critical insights into purchasing behaviors, highlighting high-growth areas such as non-contact optical techniques (interferometry) and end-use sectors like semiconductors, which mandate the highest levels of surface quality inspection for integrated circuits and wafers.

Segmentation by measurement type distinguishes between two-dimensional (2D) measurements, typically focused on profile or roughness along a single line, and three-dimensional (3D) measurements, which provide comprehensive topographical mapping. The increasing complexity of components manufactured via additive manufacturing and CNC machining necessitates 3D solutions, driving this segment's growth significantly. Analyzing the market through the lens of end-user industry, the automotive and aerospace sectors command the largest share, owing to strict quality requirements for safety-critical components, while the electronics industry exhibits the most rapid expansion rate driven by technological scaling and miniaturization trends.

Understanding these segments is essential for manufacturers to tailor their product offerings, focusing on specialized solutions such as high-resolution atomic force microscopes (AFM) for nanotechnology applications or rugged, high-throughput confocal microscopes for production line integration. Furthermore, the application segmentation—covering quality control, research and development (R&D), failure analysis, and calibration—helps market participants align their sales and distribution strategies with the specific needs and budget cycles of different functional departments within customer organizations.

- By Technology:

- Contact Measurement (Stylus Profilometers, CMM-based Tactile Probes)

- Non-Contact Measurement (Optical Profilometers, White Light Interferometers, Confocal Microscopy, Atomic Force Microscopy (AFM), Laser Scanning)

- By Measurement Type:

- 2D Surface Measurement

- 3D Surface Measurement

- By End-User Industry:

- Automotive

- Aerospace and Defense

- Semiconductor and Electronics

- Medical Devices

- Precision Engineering and Machining

- Optics and Photonics

- Research and Academia

- By Application:

- Quality Control and Inspection (QC)

- Research and Development (R&D)

- Failure Analysis

- Calibration and Standardization

Value Chain Analysis For Surface Measurement Equipment and Tools Market

The value chain for the Surface Measurement Equipment and Tools Market begins with upstream activities focused on core technological development and raw material sourcing. This segment involves specialized manufacturers of high-precision optical components (lenses, mirrors, lasers), high-resolution sensors (CCD/CMOS cameras, photo detectors), and complex mechanical stages required for nanometer-level positioning accuracy. Research institutions and technology developers play a crucial role in the initial innovation phase, providing proprietary algorithms for image processing and surface reconstruction. The viability and competitiveness of the final product are heavily dependent on the quality and cost-effectiveness of these upstream supplied components, particularly the high-resolution optics essential for non-contact systems.

The midstream stage centers on the Original Equipment Manufacturers (OEMs) who integrate these components, design the software interface, and assemble the final measurement systems (e.g., CMMs, interferometers, profilometers). This stage involves extensive calibration, rigorous testing, and compliance with international metrology standards (ISO, ASME). OEMs invest heavily in R&D to enhance speed, automation, and user-friendliness, often collaborating directly with key industrial end-users to tailor solutions to specific application requirements, such as inline measurement for high-volume production or ultra-precision analysis for semiconductor lithography masks.

Downstream activities include distribution, sales, installation, training, and crucially, long-term maintenance and calibration services. Distribution channels are typically a mix of direct sales teams for major accounts (aerospace, Tier 1 automotive suppliers) and specialized, technically proficient distributors for smaller regional customers or niche market entry. Given the complexity and high cost of the equipment, aftermarket services, including calibration traceable to national standards and timely software updates, represent a significant revenue stream and a vital component of customer retention, ensuring the continued accuracy and performance of the installed base.

Surface Measurement Equipment and Tools Market Potential Customers

Potential customers for Surface Measurement Equipment and Tools are highly diversified, encompassing any manufacturing or research entity requiring verification of geometric and surface integrity down to the micro and nano scales. The largest customer base resides within the manufacturing sector, particularly in high-reliability segments. Automotive manufacturers and their Tier 1 suppliers are continuous buyers, using these tools for inspecting engine components, transmission gears, braking surfaces, and newly developed electric vehicle (EV) battery components where surface contact and wear minimization are paramount. The aerospace and defense industry represents a critical, high-value customer group, requiring certified equipment for inspecting turbine blades, structural welds, and complex composite materials to ensure flight safety and long operational life.

The semiconductor and electronics industry constitutes a rapidly growing and technically demanding customer segment. Companies involved in wafer fabrication, microchip packaging, and MEMS production utilize advanced surface metrology (especially AFM and white light interferometry) to monitor critical dimensions, film thickness, and defect density on surfaces at the nanoscale. These customers require the fastest, most precise non-contact solutions available to maintain high yield rates in their fabrication processes. Similarly, the medical device industry, producing orthopedic implants, drug delivery systems, and surgical instruments, relies heavily on surface measurement to ensure biocompatibility and regulatory compliance, making them essential recurring buyers.

Furthermore, academic and industrial research laboratories globally are core potential customers, utilizing cutting-edge surface measurement tools for materials science research, nanotechnology development, and the creation of new functional surfaces (e.g., anti-reflective coatings, self-cleaning materials). These R&D buyers often seek the highest resolution, multi-functional systems that can adapt to evolving research requirements. The overall buyer profile is characterized by a strong emphasis on precision, compliance, and return on investment through optimized manufacturing yield and reduced failure rates.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.95 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Carl Zeiss AG, Mahr GmbH, Mitutoyo Corporation, Taylor Hobson (AMETEK), KLA Corporation, Olympus Corporation, Keyence Corporation, Bruker Corporation, Hexagon AB, Nikon Corporation, Sensofar, ZYGO Corporation (AMETEK), Cognex Corporation, STMicroelectronics, and Jenoptik AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Surface Measurement Equipment and Tools Market Key Technology Landscape

The technological landscape of the Surface Measurement Equipment and Tools Market is characterized by a rapid migration towards non-contact, high-speed, and high-resolution methods, displacing older tactile systems in many mainstream industrial applications. White Light Interferometry (WLI) remains a cornerstone technology, offering vertical resolution down to sub-nanometers and capable of measuring the surface texture and form of materials ranging from highly reflective optics to rough machined components. Advancements in WLI focus on improving measurement speed and enhancing resistance to environmental vibrations, making them more suitable for inline factory floor applications rather than strictly laboratory settings. This technology is crucial in semiconductor and precision optics manufacturing where feature sizes are shrinking and stringent quality controls are necessary.

Confocal Microscopy has also seen significant improvements, particularly in its capacity for measuring steep slopes and highly complex geometries that pose challenges for other optical methods. The adoption of focus variation techniques, often combined with confocal technology, allows for fast 3D topographical reconstruction across large areas. Furthermore, Laser Scanning Microscopy (LSM) and structured light scanning are increasingly used for large-area inspection and geometry measurement, offering a balance between speed and precision. The technological evolution is heavily influenced by the integration of advanced data processing algorithms, enabling real-time filtering of noise and accurate differentiation between surface roughness and underlying form errors.

At the extreme end of resolution, Atomic Force Microscopy (AFM) continues to be indispensable for scientific research and semiconductor R&D, providing true atomic-scale resolution, though its application remains primarily limited to laboratory environments due to lower measurement speed and small field of view. The most significant technological trend involves the development of hybrid metrology systems, which merge multiple sensors (e.g., combining a laser scanner for overall form with an interferometric sensor for local roughness) within a single platform. This convergence provides comprehensive surface and form data simultaneously, drastically reducing inspection time and optimizing the overall metrology workflow, catering directly to the demands of modern complex manufacturing environments.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the most dynamic and fastest-growing region in the Surface Measurement Equipment and Tools Market. This growth is intrinsically linked to the region’s status as a global manufacturing powerhouse, particularly in automotive, electronics, and semiconductor production, notably in countries like China, South Korea, Japan, and Taiwan. The massive governmental investments in developing local high-tech manufacturing ecosystems and the expansion of consumer electronics production create an unprecedented demand for high-throughput, automated surface inspection systems to ensure quality and competitiveness. Furthermore, the rapid scaling of 5G and IoT infrastructure drives the need for advanced surface measurement in high-density integrated circuit manufacturing and micro-electromechanical systems (MEMS).

- North America: North America holds a substantial market share, driven primarily by technological leadership, high R&D spending, and stringent quality control standards in the aerospace and medical device industries. The region is characterized by early adoption of cutting-edge technologies, such as advanced 3D optical profilers and integrated metrology solutions aligned with Industry 4.0 principles. The demand here is less focused on volume and more on ultra-precision and complex material analysis, catering to specialized applications like additive manufacturing quality assurance and advanced materials research within corporate and governmental laboratories.

- Europe: The European market is mature and highly concentrated in countries known for precision engineering, such such as Germany, Switzerland, and Italy. The automotive sector, particularly the luxury and performance vehicle segment, alongside the thriving machinery and industrial automation industries, drives steady demand for high-accuracy CMMs and profilometers. Europe places significant emphasis on regulatory compliance and metrology standardization, necessitating continuous upgrades and investment in certified calibration services, which further sustains market momentum. Focus is increasingly placed on efficient, energy-saving manufacturing processes requiring highly reliable surface integrity checks.

- Latin America (LATAM): LATAM represents an emerging market characterized by increasing industrialization, particularly in Brazil and Mexico, which serve as key automotive manufacturing hubs and export centers. While penetration rates for advanced equipment are lower compared to developed regions, modernization efforts and foreign direct investment (FDI) in local manufacturing facilities are fueling demand for basic and mid-range surface measurement tools. Market growth is closely tied to economic stability and the success of local efforts to integrate into global supply chains requiring adherence to international quality standards.

- Middle East and Africa (MEA): The MEA market is relatively small but shows potential, primarily driven by investments in oil and gas infrastructure, aerospace maintenance facilities, and diversification efforts in countries like Saudi Arabia and the UAE. Surface measurement tools are essential for monitoring corrosion, wear, and structural integrity in critical energy sector assets. Future growth will be dependent on planned diversification programs into high-tech manufacturing and the expansion of healthcare and localized production capabilities within the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Surface Measurement Equipment and Tools Market.- Carl Zeiss AG

- Mahr GmbH

- Mitutoyo Corporation

- Taylor Hobson (AMETEK)

- KLA Corporation

- Olympus Corporation

- Keyence Corporation

- Bruker Corporation

- Hexagon AB

- Nikon Corporation

- Sensofar

- ZYGO Corporation (AMETEK)

- Cognex Corporation

- STMicroelectronics

- Jenoptik AG

- Tesa (Hexagon Manufacturing Intelligence)

- Fuji Film Corporation

- Alicona Imaging GmbH

- Gage-Chek Inc.

- Solartron Metrology (AMETEK)

Frequently Asked Questions

Analyze common user questions about the Surface Measurement Equipment and Tools market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between contact and non-contact surface measurement technologies?

Contact measurement, primarily using stylus profilometers, physically touches the surface to measure roughness and profile, offering high vertical resolution but risking surface damage or wear. Non-contact technologies, such as white light interferometers and confocal microscopes, use light and optics to measure surface topography remotely, providing faster throughput and the ability to measure delicate materials or complex 3D forms without physical interaction, making them increasingly preferred for high-volume, critical applications.

Which end-user industry drives the highest demand for surface measurement equipment?

The Automotive industry currently accounts for the largest share of the Surface Measurement Equipment Market, driven by the need for precise inspection of critical safety and performance components like engine parts, bearings, gears, and brake systems. However, the Semiconductor and Electronics segment is the fastest growing due to stringent requirements for nanometer-scale inspection of wafers, microchips, and thin films necessary for advanced computing and mobile technologies.

How is Industry 4.0 influencing the surface measurement market?

Industry 4.0 is transitioning surface metrology towards smart, integrated, and automated solutions. This involves the implementation of inline measurement systems for 100% inspection, real-time data connectivity, cloud-based data analytics, and the integration of AI/Machine Learning for rapid defect classification and process optimization. This shift enhances manufacturing efficiency and facilitates predictive quality control across the production line.

What are the key technical challenges facing the adoption of advanced surface measurement tools?

Key challenges include managing the substantial initial capital expenditure required for high-resolution optical systems, addressing the shortage of specialized technicians required to operate and interpret complex 3D measurement data, and ensuring reliable measurement accuracy in harsh factory environments characterized by vibration and temperature fluctuations, which often require extensive environmental isolation solutions.

What role does 3D measurement technology play in the market growth?

The shift from 2D to 3D measurement is a major growth driver. Modern manufacturing, including additive manufacturing (3D printing) and multi-axis CNC machining, produces complex geometries that require comprehensive topographical analysis beyond simple profile checks. 3D technologies like optical profilometry and structured light scanning provide full-surface mapping, essential for validating form, texture, and volume characteristics simultaneously, enhancing product quality validation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager