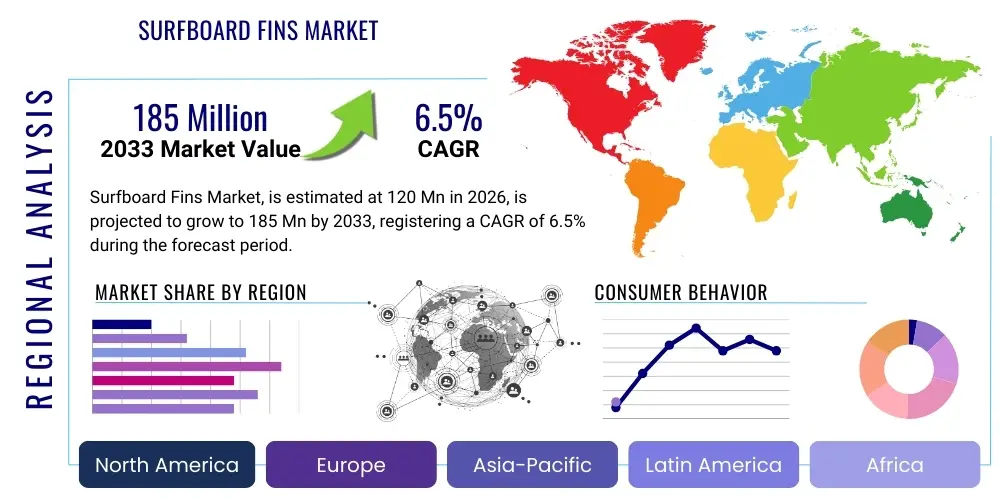

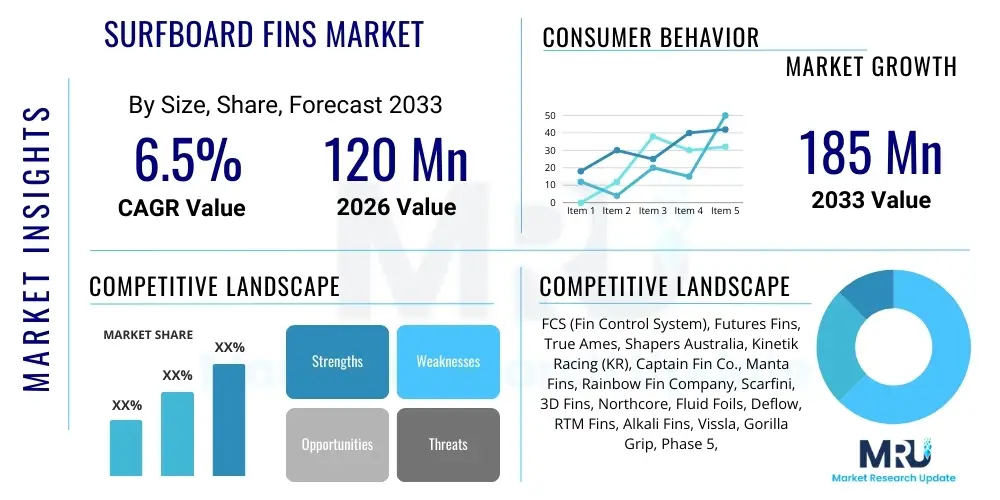

Surfboard Fins Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443220 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Surfboard Fins Market Size

The Surfboard Fins Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 120 Million in 2026 and is projected to reach USD 185 Million by the end of the forecast period in 2033.

Surfboard Fins Market introduction

The Surfboard Fins Market encompasses the global trade and utilization of components attached to the underside of surfboards, pivotal for controlling direction, stability, and speed. These essential accessories transform the performance characteristics of a surfboard, allowing riders to tailor their equipment to specific wave types, riding styles, and personal preferences. The core products range from single fins used on longboards to the thruster (three-fin) setups dominating modern shortboarding, alongside quad (four-fin) and five-fin options. Innovations in design, such as foil adjustments, rake modifications, and sophisticated composite materials, continually drive product evolution, catering to both amateur enthusiasts and professional athletes seeking marginal performance gains. The market's stability is inherently tied to the global participation rates in surfing and related watersports, which have shown steady growth, particularly in regions with extensive coastlines and favorable surfing conditions, positioning the industry for sustained moderate expansion over the forecast horizon. The functional importance of fins—acting as the rudder and keel of the surfboard—solidifies their status as a non-negotiable accessory, thereby ensuring constant demand regardless of short-term economic fluctuations in the broader sporting goods sector. Manufacturers are increasingly differentiating their products through proprietary fin systems, material science breakthroughs, and endorsements from professional surfers, focusing on specific performance metrics like drive, pivot, and hold, which resonate deeply with the core consumer base.

Surfboard fins serve critical applications across recreational surfing, professional competitive surfing, and surf training institutions. The primary benefit of these accessories lies in their ability to provide the necessary hydrodynamics for board maneuverability; they dictate factors such as pivot, drive, and hold, essential for executing complex maneuvers on a wave face. Improved fin systems, such as FCS (Fin Control System) and Futures, allow for quick interchangeability, enabling surfers to rapidly adapt their setup to changing wave conditions, which is a major convenience benefit fueling consumer spending on multiple fin sets and increasing the average annual expenditure per surfer. Driving factors influencing market expansion include the increasing global adoption of surfing as a mainstream water sport, significant growth in surf tourism, and sustained technological advancements in material science, leading to lighter, stronger, and more responsive fin constructions. Furthermore, the rise of niche surfing segments, such as foil surfing and tow-in surfing, introduces specialized fin designs and expands the total addressable market, necessitating continuous R&D investment from leading market players. The confluence of these factors creates a fertile ground for both established manufacturers and innovative startups focused on performance enhancement and durability across all price points.

Surfboard Fins Market Executive Summary

The Surfboard Fins Market is characterized by robust competition driven by continuous innovation in material technology and proprietary system design. Key business trends include the increasing consumer preference for lightweight, high-performance composite materials, such as sophisticated carbon fiber and fiberglass combinations, over traditional molded plastic or basic materials, particularly among high-spending enthusiasts. Manufacturers are strategically focusing on developing environmentally sustainable fins using recycled ocean plastics or bio-resins, aligning with growing consumer environmental consciousness and creating a differentiated product offering that commands premium pricing. Furthermore, the licensing and patenting of interchangeable fin systems, notably the FCS II and Futures systems, represent significant structural barriers to entry and strong competitive advantages for the market leaders, ensuring control over the vast majority of the high-performance segment. Strategic mergers, acquisitions, and partnerships aimed at expanding global distribution networks, particularly into emerging surf markets in Asia Pacific and Latin America, are becoming commonplace to solidify global market presence and capture regional market share efficiently, often targeting local manufacturing capabilities to reduce logistical costs and improve market responsiveness. The direct-to-consumer (D2C) sales model, leveraging advanced e-commerce platforms and social media influence, is gaining substantial traction, allowing niche fin designers to reach specialized segments without reliance on traditional, localized surf shops, thereby significantly reshaping the established retail landscape and distribution dynamics.

Regionally, North America and Europe remain the dominant markets in terms of overall revenue due to high surfing participation rates, deeply established surf culture, and significant disposable income dedicated to premium sporting goods and accessories. These regions maintain high average selling prices (ASPs) due to the strong demand for premium composite fins. However, the Asia Pacific region, specifically including dynamic markets such as Australia, Indonesia, and Japan, is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) over the forecast period. This rapid growth is primarily fueled by accelerated urbanization, increased accessibility to coastal leisure activities, and substantial government and private sector investment in surf tourism infrastructure, alongside a rapidly growing local surfing population. Within segmentation, the Thruster (3-fin) configuration continues to hold the largest market share by volume and revenue, reflecting its inherent versatility and dominance in modern high-performance shortboarding, which accounts for the largest segment of the board market. Conversely, the Quad (4-fin) and Specialty Fin segments are experiencing the fastest growth rates, driven by experienced surfers diversifying their equipment quivers to optimize performance for specific board types (e.g., retro boards, fish shapes) and unique wave conditions. Material trends indicate a strong, steady shift towards sophisticated, high-end composite materials, which command superior profit margins, although durable molded polymer fins maintain a critically important role in the high-volume, entry-level, and rental markets worldwide. This dynamic segmentation underscores a mature yet highly specialized market environment where constant product diversification, robust intellectual property protection, and highly targeted marketing strategies are essential for sustained commercial success and maintaining market leadership against emerging competitors.

AI Impact Analysis on Surfboard Fins Market

User queries regarding AI’s impact on the Surfboard Fins Market predominantly revolve around three interconnected core themes: hyper-customization, manufacturing efficiency, and predictive performance validation. Consumers frequently express interest in whether AI systems can instantaneously generate the optimal fin geometry, including precise foil, rake, and flex characteristics, specifically tailored for their individual biometric data (weight, stance), preferred riding style (power, speed, or flow), and the highly localized hydrodynamics of their typical wave break conditions (customization). They also inquire intensely about the potential for AI-driven generative design to create entirely novel, unconventional fin shapes that surpass the intuitive limitations of human industrial designers, potentially leading to unprecedented hydrodynamic efficiencies (manufacturing/design innovation). A common and pragmatic concern is how AI can be utilized to integrate and analyze real-time performance data streams originating from sensors embedded in surfboards and fins, providing personalized, actionable recommendations for fin adjustments, thereby elevating the surfing experience and potentially streamlining inventory management for specialized retailers based on localized, data-driven performance metrics and regional demand patterns. These thematic concerns universally highlight an overarching expectation that AI will move fin design beyond traditional, time-consuming trial-and-error methodologies, making the selection and design process significantly more personalized, scientifically accurate, and resource-efficient, ultimately leading to demonstrably superior hydrodynamics and a substantial reduction in material waste inherent in the physical prototyping phases, although consumer concerns regarding the eventual cost implications of such advanced technologies remain a significant factor for mass market adoption.

The incorporation of sophisticated Artificial Intelligence methodologies, particularly machine learning and generative adversarial networks (GANs), is poised to fundamentally revolutionize the design, prototyping, and manufacturing workflow within the highly technical surfboard fins sector. This transition involves a strategic shift from reliance on empirical testing and designer intuition to a system heavily reliant on predictive computational modeling. AI algorithms can be rigorously trained on massive, proprietary datasets encompassing detailed computational fluid dynamics (CFD) simulations, complex real-world surfing telemetry (e.g., speed, rail angle of attack, G-forces absorbed during maneuvers), and comprehensive material stress-testing properties to rapidly predict the precise optimal fin foil, rake, sweep, and complex flex characteristics required to meet specific, predetermined performance criteria. This advanced predictive capability drastically reduces the necessity for expensive, iterative, and time-consuming physical prototyping cycles, thereby significantly accelerating the crucial product development lifecycle from concept to market deployment. Furthermore, AI-driven generative design software can systematically explore thousands of complex aerodynamic and hydrodynamic variations—often resulting in organic or lattice structures—that human designers, bound by traditional manufacturing constraints or subjective biases, might otherwise overlook. This capacity for radical exploration potentially unlocks unprecedented levels of performance efficiency in fin architecture, establishing new benchmarks for drive and release. This critical shift toward a data-informed, digitally validated design methodology is essential for maintaining a definitive competitive edge in the highly specialized, high-performance segment, where even marginal gains translate directly into decisive competitive advantages for professional athletes and serious enthusiasts, effectively validating and sustaining the premium pricing strategies for AI-optimized products in the consumer market.

- AI-driven Generative Design: Utilized extensively for optimizing complex fin geometry (foil, rake, sweep, flex) based on advanced fluid dynamics simulations, leading to structurally efficient and hydrodynamically superior designs that may be unattainable through conventional human-led processes.

- Predictive Performance Modeling: Employment of machine learning models to correlate comprehensive rider metrics, real-time ocean wave conditions, board parameters, and specific fin characteristics to accurately forecast and recommend optimal performance configurations for individual surfers and specific locations.

- Automated Quality Control and Inspection: Deployment of high-resolution computer vision and machine learning systems within manufacturing processes to ensure micron-level precision in alignment, detect sub-surface material defects (e.g., voids in resin transfer), and guarantee consistent material integrity across all high-volume, mass-produced fin sets, improving reliability.

- Personalized Recommendation Engines: E-commerce and specialized retail platforms utilizing AI to analyze detailed user profiles, historical surfing performance data, board type inventory, and real-time local wave forecast data to provide the most suitable, dynamically optimized fin system recommendations, significantly enhancing the customer purchasing journey.

- Supply Chain Optimization and Logistics: AI algorithms forecasting highly granular demand for specific fin types and materials based on complex variables such as seasonal weather patterns, regional surf contest schedules, and long-range surf forecasts, allowing manufacturers to significantly improve inventory management, reduce warehousing costs, and ensure timely product availability in diverse global markets.

DRO & Impact Forces Of Surfboard Fins Market

The market dynamics of the Surfboard Fins Market are primarily governed by a strong interplay between potent drivers centered on robust global participation growth and sophisticated product innovation, delicately balanced against inherent restraints related to the high cost of specialized composite materials and the intrinsic niche characteristics of the specialized equipment market. The paramount drivers include the substantial and sustained global growth in surfing participation, significantly fueled by better access to entry-level equipment, the professionalization of instructional methodologies, and the sport’s elevated inclusion in major international athletic events such as the Olympics, collectively expanding the total addressable consumer base across numerous demographics. This driving force is further compounded by rapid, continuous advancements in material science, particularly the successful utilization of exceptionally lightweight and durable composites such as high-modulus carbon fiber and premium epoxy resins. These material breakthroughs allow manufacturers to offer demonstrably superior performance characteristics, translating into tangible benefits for the surfer and subsequently driving strong replacement and upgrade demand among experienced surfers who routinely update their equipment quivers to maintain competitive performance. Opportunities for substantial market expansion are emerging rapidly, particularly in the development and commercialization of sophisticated smart fins equipped with embedded sensors for real-time performance tracking and detailed telemetry, which links physical hardware with advanced software ecosystems to create fully integrated surfing solutions. Furthermore, strategic geographical expansion into new, high-potential markets, especially across rapidly developing coastal regions of Southeast Asia and certain coastal areas of Africa, presents significant untapped potential as global tourism and local disposable incomes continue their upward trajectory.

Conversely, several significant structural and economic restraints inhibit a more explosive, large-scale growth trajectory within this specialized accessories market. The prohibitively high manufacturing and retail cost associated with premium materials and complex interchangeable fin systems often presents a substantial financial barrier to entry, particularly challenging for consumers in developing economies or for the vast segment of casual surfers unwilling to invest substantial discretionary sums into non-essential accessories. A parallel and persistent challenge is the pervasive threat of counterfeiting and the widespread proliferation of low-quality, generic fin clones, which are easily distributed through unregulated online marketplaces. This widespread presence of unauthorized products poses a continuous, debilitating threat to established, reputable brands, actively diluting market value, eroding consumer trust in proprietary fin systems, and ultimately undermining legitimate profit margins. Additionally, the inherent seasonality of surfing in many major consumption regions globally and the unavoidable reliance on highly favorable weather and specific ocean conditions introduce a high degree of intrinsic market volatility. This condition makes accurate long-term inventory planning and resource allocation significantly challenging for manufacturers, necessitating flexible and highly responsive supply chain management systems to mitigate risk effectively. These structural restraints require continuous investment in brand protection, quality assurance, and consumer education.

The primary impact forces critically shaping the operational landscape of the Surfboard Fins Market operate on multiple competitive, economic, and social levels, significantly influencing both the structure of the supply chain and consumer adoption patterns globally. The overwhelming market dominance of a few highly standardized, proprietary fin systems, most notably FCS and Futures, acts as a high structural and technological barrier to entry for any new or emerging competitors, often requiring costly licensing agreements or significant, independent R&D investment to develop an equivalent, globally adopted standard technology. This intense competitive pressure, while fostering incremental innovation within the existing proprietary framework, inherently limits the potential for truly disruptive change in the fundamental mounting technology. Economically, the market demonstrates high sensitivity to the global price fluctuations of key raw materials, including high-grade petroleum-derived resins, specialized epoxies, and advanced carbon fibers, which directly and rapidly impacts manufacturing costs and, consequently, end-user pricing strategies, creating margin pressure. Socially, the rapidly growing global trend toward stringent sustainability dictates that manufacturers must invest substantially in adopting greener production methods, exploring closed-loop recycling processes, and utilizing bio-resins or other recyclable materials. While extremely beneficial for brand equity and alignment with conscious consumer values, these sustainability initiatives often introduce significantly higher initial production costs. Ultimately, the market success is driven intensely by the highly discerning, performance-focused consumer, whose expectations demand that all product performance claims must be rigorously verifiable and whose brand loyalty is meticulously earned through the consistent delivery of superior, high-quality products, making advanced marketing, detailed performance data transparency, and strategic professional athlete collaboration absolutely pivotal in influencing final purchasing decisions and driving profitable volume.

Segmentation Analysis

The Surfboard Fins Market is intricately segmented based on material composition, fin configuration, the established distribution channel, and the specific end-user application, reflecting the highly specialized nature of the sport and the vastly diverse needs of the global surfing community. Material segmentation is profoundly crucial, clearly distinguishing between high-performance composite fins (incorporating advanced fiberglass, premium carbon fiber, and sophisticated honeycomb cores) overwhelmingly preferred by advanced and professional surfers seeking maximum performance, and the more cost-effective molded fins (typically utilizing nylon, plastic, or basic polymers) predominantly used by beginners, large surf schools, and commercial rental operations where durability and low cost are paramount. Fin Configuration segmentation highlights the enduring, dominant position of the versatile Thruster (3-fin) setup, reflecting its widespread use, alongside the rapid growth in demand for specialized Quad (4-fin) and Single fin designs that are precisely tailored for specific board types (e.g., retro designs, longboards) and unique wave riding objectives (e.g., fast down-the-line surfing). Comprehensive analysis across these nuanced segments provides manufacturers with crucial, actionable insights into consumer behavior, allowing for highly targeted product development cycles and optimized, region-specific pricing strategies across different tiers of the market, ensuring that product offerings accurately match both the demanding performance expectations and the varying budgetary constraints of diverse consumer groups globally. The ongoing differentiation within the highest-performance category, particularly the relentless development of customized foil technologies and varying engineered flex patterns, continues to be a primary driver fueling premium market growth and R&D spending.

Distribution channel analysis reveals a critical and increasingly dynamic balance between traditional, established brick-and-mortar surf shops and rapidly expanding, globally accessible e-commerce platforms. While specialized surf retailers remain absolutely vital for providing indispensable expert advice, allowing for hands-on product inspection, and serving as essential community hubs—especially critical for the sale of high-end, complex fin systems—online sales channels offer significantly greater geographical reach, unparalleled inventory diversity, and highly competitive pricing structures, making them particularly appealing to the younger, globally dispersed, and digitally native consumer segment. The crucial end-user segment distinguishes clearly between recreational surfers, who collectively form the largest overall volume base for standard and mid-range fins, and the highly influential professional/competitive surfers, who, while significantly smaller in numerical count, drive the overwhelming demand for the most technologically advanced and highest-margin products, often functioning as indispensable early adopters and critical brand ambassadors whose demonstrated preferences exert substantial influence on the broader aspirational market. Understanding the complex interplay between these various segmentation layers is absolutely fundamental for achieving effective market penetration and sustained profitability. For example, high-volume molded fins are typically distributed through general sporting goods retailers and large, transactional online marketplaces, whereas highly specialized, high-tolerance carbon fiber fins are often strategically sold through certified, exclusive dealers or directly via manufacturer websites to meticulously maintain margin control, ensure technical guidance, and strictly protect premium brand integrity. This highly nuanced and dynamic approach to market segmentation is essential for maximizing global market coverage and optimizing strategic resource allocation across geographically diverse territories.

- By Material Type:

- Fiberglass (Standard and High-Density)

- Carbon Fiber Composites (High-Modulus, Ultra-lightweight)

- Molded Composites (Nylon/Plastic, High-Durability Polymers)

- Sustainable Materials (Bio-resins, Recycled Plastics, Bamboo)

- Others (e.g., Wood Core, Hybrid Structures)

- By Fin Configuration:

- Thruster (3-Fin) - Dominant performance segment

- Quad (4-Fin) - High-speed and small wave specialty

- Single Fin - Traditional and longboard market core

- Twin Fin (2-Fin) - Retro and fish board specialty

- Specialty/Others (e.g., Five-Fin Sets, Keel Fins, Side Bites)

- By Fin System:

- FCS (Fin Control System) - Standard and Tool-less (FCS II)

- Futures Fins - Patented base tab system

- US Box - Longboard standard

- Glass-on Fins - Permanent installations (niche/custom)

- Other Proprietary Systems (e.g., specific SUP/Niche boxes)

- By End-User:

- Recreational Surfers (Largest volume segment)

- Professional/Competitive Surfers (Highest value segment)

- Surf Schools/Rental Operations (Durability focused)

- Enthusiasts/Advanced Surfers

- By Distribution Channel:

- Offline Channels (Specialty Surf Stores, Major Sporting Goods Retailers)

- Online Channels (E-commerce Platforms, Direct-to-Consumer Brand Websites)

Value Chain Analysis For Surfboard Fins Market

The complex value chain for the Surfboard Fins Market initiates with the highly specialized upstream procurement of essential raw materials, primarily consisting of high-grade chemical resins (epoxy, polyester), specialized lightweight core materials (honeycomb, high-density foam), and critical high-tensile fibers (fiberglass mats, various weaves of carbon fiber). Maintaining stringent efficiency in this upstream segment is critically dependent on securing robust, long-term strategic relationships with highly specialized chemical and composite suppliers globally to reliably guarantee consistently high material quality, achieve optimal cost stability, and adhere rigorously to sustainable sourcing practices, particularly given the inherent volatility in global commodity prices for petrochemical derivatives used extensively in resin production. The manufacturing stage, forming the core operational segment, involves a series of complex, precision-demanding processes such as sophisticated Resin Transfer Molding (RTM) for consistent shape production, high-precision Computer Numerical Control (CNC) machining for complex foil finishing, and intricate, skilled hand-layup processes reserved for the most premium, customized fins. This stage necessitates significant upfront capital investment in specialized tooling, advanced automated equipment, and the continuous employment of a highly skilled, specialized labor force trained in composite fabrication. Ensuring robust intellectual property protection for proprietary hydrodynamic foils, unique flex patterns, and patented fin base designs is absolutely critical at this high-value stage, alongside implementing rigorous quality control and certification processes to comprehensively validate all performance and durability claims, directly translating into essential consumer trust and overall brand value. The high degree of specialization in materials and advanced manufacturing techniques significantly differentiates this accessory supply chain from the generalized production methods found in the broader sporting goods sector.

The crucial downstream segment strategically focuses on highly effective distribution, compelling marketing, and final sales execution, successfully linking manufacturers to the geographically diverse and highly specialized end-user base. Distribution channels are structurally bifurcated into critical direct and indirect routes. Direct distribution involves manufacturers leveraging their own branded e-commerce platforms or dedicated flagship stores, a strategy that facilitates optimal margin capture, allows for essential direct customer feedback integration crucial for rapidly iterating product designs, and maintains stringent brand control. Conversely, indirect distribution relies heavily on established global networks: specialty surf shops, which provide indispensable expert advice, serve as vital community hubs, and are crucial for premium product sales; large, multi-channel sporting goods chains for achieving high-volume sales of molded fins; and major third-party global e-commerce retailers like Amazon, offering broad market access. Specialty surf shops are considered indispensable for the successful sales of high-end, complex fin sets, as the performance-focused consumer frequently requires detailed, experienced guidance on selecting the exact correct fin setup suitable for their specific board type, weight, and prevailing local wave conditions. The ultimate effectiveness of the entire downstream value chain is highly contingent upon logistical efficiency in managing global inventories of a massive number of highly varied product SKUs, coupled with the execution of highly targeted marketing campaigns strategically featuring professional surfer endorsements to significantly influence consumer purchasing behavior and preference.

Key value addition throughout the entire chain occurs predominantly through continuous research and development (R&D), robust brand building, and exemplary post-sale customer support and warranty services. Continuous and intensive research into advanced hydrodynamic performance modeling, breakthroughs in composite material technology, and the precise engineering of flex and flow dynamics is essential for creating genuine high-value products that can successfully justify and command premium pricing in a highly competitive market. Robust brand equity, meticulously achieved through the consistent delivery of superior product quality, transparent performance data, and strategic, high-profile athlete sponsorships, effectively builds the necessary long-term loyalty and emotional connection within this passionate, niche consumer market. The operational relationship between manufacturers and key specialty surf shop retailers is symbiotic and mutually beneficial; retailers offer crucial front-line visibility, provide essential educational resources to the consumer, and act as the final, most influential point before purchase commitment. However, the relentless rise of powerful online intermediaries necessitates continuous, sophisticated channel management strategies to actively prevent catastrophic price erosion and ensure that channel conflict is minimized to protect retailer margins and relationships. Overall, successful, profitable value chain management imperatively requires a high degree of vertical integration of specialized material knowledge and seamless horizontal coordination across extremely diverse global sales, distribution, and marketing channels, consistently prioritizing speed to market for innovative, verifiable performance-enhancing accessories while maintaining strict quality control standards at every touchpoint from raw material sourcing to final consumer use.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 120 Million |

| Market Forecast in 2033 | USD 185 Million |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FCS (Fin Control System), Futures Fins, True Ames, Shapers Australia, Kinetik Racing (KR), Captain Fin Co., Manta Fins, Rainbow Fin Company, Scarfini, 3D Fins, Northcore, Fluid Foils, Deflow, RTM Fins, Alkali Fins, Vissla, Gorilla Grip, Phase 5, O’Brien, G&S Fins |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Surfboard Fins Market Key Technology Landscape

The technological landscape of the Surfboard Fins Market is fundamentally defined by continuous, rapid advancements in highly specialized material composition and precision manufacturing processes, all strategically aimed at meticulously controlling the fin's flex characteristics, overall weight profile, and structural durability under extreme hydrodynamic load. Resin Transfer Molding (RTM) remains a crucial, foundational manufacturing technique, offering exceptional consistency and reliable repeatability for high-volume production of fins, particularly those incorporating advanced hollow-core or sophisticated foam-core structures. This ensures the achievement of an optimal strength-to-weight ratio, which is critically important for all high-performance surfing applications. However, the true cutting edge of the technology is defined by the complex, sophisticated integration of multiple composite layers, often involving varying weaves, orientations, and thicknesses of high-tensile carbon fiber and premium fiberglass, strategically combined with specialized internal cores (such as lightweight honeycomb or natural cork materials). These materials are meticulously positioned to engineer highly specific, progressive flex patterns. This engineered flex—where the fin absorbs energy and recoils predictably during a turn—is paramount, as it directly dictates the energy projection (or "drive") the surfer receives to accelerate out of a maneuver. Intensive research and development efforts are currently focused on developing advanced lightweight resin matrices that successfully maintain crucial stiffness at the fin base (essential for immediate board response and minimal energy loss) while allowing for controlled, progressive flex toward the fin tip (crucial for speed generation, controlled release from the water, and mitigating spin-outs). Intellectual property rights surrounding proprietary foil geometries—which meticulously govern the critical water flow, lift, and drag characteristics of the fin—are fiercely protected technological assets, representing a substantial, sustained competitive advantage for all global market leaders.

Furthermore, the technology related to the fin mounting systems themselves constitutes a massive, indispensable part of the market’s ongoing innovation cycle and installed base. Highly successful proprietary systems, most notably the FCS II (Fin Control System) and the pervasive Futures Fins technology, have successfully established dominant, universally accepted industry standards, characterized by their ease of tool-less installation (in the case of FCS II) or superior, robust integration that minimizes problematic drag and maximizes the critically important connection integrity between the fin base and the surfboard’s hydrodynamic surface. Ongoing technological evolution in these standardized systems is predominantly focused on substantially increasing the shear strength and reliability of the connection under the most extreme loading conditions (e.g., aerial landings, massive wave forces) and meticulously ensuring essential backward compatibility across various generations of board designs where technically feasible. Beyond the physical mounting hardware, a significant and rapidly emerging trend involves the specialized integration of ‘smart’ technologies. This innovation entails embedding miniature, resilient sensors (including highly sensitive accelerometers, reliable gyroscopes, and pressure gauges) directly within the body of the fins or the accompanying fin boxes. These integrated sensors are designed to accurately capture and record real-time, highly granular performance data—such as speed, precise angle of attack, and detailed pressure distribution—which can then be transmitted wirelessly via low-energy Bluetooth protocols to a linked mobile device or smart watch for immediate or post-session analysis. This data not only proves invaluable for helping recreational surfers refine and optimize their riding technique but also provides indispensable, quantitative performance feedback to fin designers, effectively closing the crucial design loop and facilitating rapid, data-driven product iteration, marking a significant, structural convergence of IoT (Internet of Things) protocols and highly specialized water sporting equipment design, positioning the industry for a digital transformation.

The development of sustainable technology is also playing an increasingly vital and mandated role in shaping the current and future market offerings. Growing consumer environmental consciousness and increasing regulatory pressure compel manufacturers to intensively explore and commercialize bio-based resins derived from renewable plant sources, recycled and repurposed plastics often salvaged from critical ocean cleanup initiatives, and renewable, lightweight core materials like specialized composite woods (e.g., certified bamboo, sustainably harvested light hardwoods) to substantially reduce the overall environmental footprint associated with fin production and disposal. The primary technological challenge inherent in this sustainable shift is consistently achieving performance parity or, ideally, technical superiority compared to traditional, long-established petroleum-based composites while rigorously maintaining cost competitiveness in a price-sensitive market segment. Advanced computational fluid dynamics (CFD) software platforms and highly sophisticated finite element analysis (FEA) tools are now routinely and widely employed in the initial design and validation phases. These powerful computational tools allow designers to accurately simulate and analyze hundreds of hours of complex water flow, nuanced lift, and precise drag characteristics virtually, often simulating extreme use cases before any commitment is made to manufacturing expensive physical prototypes. This simulation-first, data-validated approach dramatically reduces research and development costs, significantly shortens the critical time-to-market for hydrodynamically superior, novel products, and solidifies the indispensable role of digital engineering excellence within the core manufacturing technology stack of all leading global surfboard fin brands, thereby driving the continuous need for sophisticated software licensing and the continuous recruitment of highly specialized engineering talent across the entire industry value chain.

Regional Highlights

The global distribution of the Surfboard Fins Market revenue is profoundly influenced by established regional surfing traditions, consistent coastal accessibility, favorable year-round climate conditions, and the underlying economic capacity of populations to consistently support high-cost leisure and sports activities. North America, specifically the U.S. West Coast (California) and the highly influential Hawaiian islands, maintains a commanding market share, not only in consumption but also in innovation. This dominance is directly attributable to a deeply entrenched, highly commercialized, and globally influential surf culture, significant ongoing R&D activity leading directly to continuous product innovation, and the crucial presence of major global brand headquarters (e.g., FCS, Futures) that dictate industry standards. The region exhibits exceptionally high consumer demand for premium, technologically sophisticated fins and generally sets the global trends in high-performance accessories, acting as a critical launch market. Europe, anchored by strong, dedicated surfing markets in key coastal nations such as France, Spain (Basque Country), Portugal, and the U.K., represents another major consumption hub. This market is characterized by a strong mix of year-round dedicated local surfers and a vibrant, economically significant surf tourism industry, driving consistent demand for a comprehensive range of products, spanning both advanced performance-grade and highly durable, all-condition entry-level fins. These mature markets focus heavily on brand loyalty and specialized distribution through established regional surf retailer networks.

Conversely, the Asia Pacific (APAC) region is definitively forecasted to be the fastest-growing market over the entire projection period, poised for substantial expansion. This accelerated, structural growth is primarily driven by expanding middle-class populations across key coastal nations like Australia (a mature market with exceptionally high per capita expenditure on surfing gear), Indonesia (which benefits immensely from its status as a global surf tourism magnet and increasing local participation), and Japan (whose market was significantly galvanized by the 2020 Olympic inclusion of surfing and possesses a long-established, dedicated coastal lifestyle culture). Critical factors driving this regional surge include extensive infrastructure development, rapidly increasing investment in high-end surf tourism resorts and related amenities, and the marked improvement in the local availability and distribution channels for high-quality, international-standard equipment. Latin America, particularly high-population countries like Brazil, Mexico, and Chile, presents a massive, untapped growth potential. This market is characterized by a passionate, very large population of local surfers who are increasingly gaining necessary economic access to global brands and sophisticated, professional-grade equipment through rapidly expanding e-commerce platforms and significantly improved local retail distribution networks, leading to a strong shift away from local, generic producers toward international proprietary brands. The Middle East and Africa (MEA) region, while still representing a smaller, more niche market, shows consistent growth potential, primarily focused on emerging surf tourism destinations (e.g., Morocco, South Africa) and localized participation, often relying almost exclusively on efficient importation of specialized accessories.

- North America (U.S. and Canada): Market leader by revenue, defined by deeply rooted surf culture, high average consumer spending, and the concentration of key innovative manufacturers, driving trends primarily in premium and high-performance carbon composite fins.

- Europe (France, Spain, Portugal, U.K.): Strong, mature consumption market sustained by consistent year-round surfing conditions and established surf tourism; favors a balance between cutting-edge performance-grade and highly durable, reliable all-condition fins suitable for varying Atlantic conditions.

- Asia Pacific (Australia, Indonesia, Japan, Philippines): Expected to achieve the highest CAGR, propelled by rapid regional economic expansion, significant tourism growth, and sharply increasing local surfing participation rates; simultaneously functions as a critical manufacturing hub and a rapidly expanding consumer market.

- Latin America (Brazil, Mexico, Chile): Emerging high-growth market characterized by large coastal populations, strong local passion for the sport, and rapidly improving economic access to sophisticated, professional-grade surfing equipment through formalized distribution channels.

- Middle East and Africa (MEA): Growing niche market focused on key coastal nations with viable surfing breaks and developing surf tourism sectors; demand is typically met via focused imports of both durable entry-level and specialized high-end accessories.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Surfboard Fins Market.- FCS (Fin Control System)

- Futures Fins

- True Ames

- Shapers Australia

- Kinetik Racing (KR)

- Captain Fin Co.

- Manta Fins

- Rainbow Fin Company

- Scarfini

- 3D Fins

- Northcore

- Fluid Foils

- Deflow

- RTM Fins

- Alkali Fins

- Vissla

- Gorilla Grip

- Phase 5

- O’Brien

- G&S Fins

Frequently Asked Questions

Analyze common user questions about the Surfboard Fins market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Surfboard Fins Market between 2026 and 2033?

The Surfboard Fins Market is projected to experience a robust Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period spanning from 2026 to 2033, primarily driven by increasing global surfing participation and continuous advancements in composite material technology and system design.

Which surfboard fin configuration currently holds the largest market share globally and why?

The Thruster (3-fin) configuration currently commands the largest market share by both volume and revenue due to its superior versatility, hydrodynamic balance, and its dominance as the standard setup for the vast majority of modern high-performance shortboards utilized by recreational and competitive surfers worldwide.

How is advanced technological innovation fundamentally affecting surfboard fin design and manufacturing?

Technological innovation is heavily concentrated on integrating advanced composites like precision-engineered carbon fiber and specialized honeycomb cores to optimally control fin flex patterns and minimize weight. Emerging R&D trends also critically include the utilization of Artificial Intelligence (AI) for sophisticated generative design and the incorporation of embedded sensors for real-time performance data tracking (the development of ‘smart fins’).

Which geographical region is anticipated to exhibit the fastest market expansion rate in the coming years?

The Asia Pacific (APAC) region, significantly encompassing dynamic markets such as Indonesia, Japan, and Australia, is strongly anticipated to show the fastest market growth, fueled by rapid regional urbanization, massive investment in surf tourism infrastructure, and rapidly rising local consumer disposable incomes dedicated to specialized water sports equipment.

What are the primary structural restraints currently impacting the Surfboard Fins Market expansion and profitability?

Key structural restraints include the relatively high manufacturing and material costs associated with premium, high-performance composites (such as high-modulus carbon fiber) and the pervasive, market-diluting presence of low-cost, unauthorized fin clones and counterfeit products, which pose significant challenges to both brand differentiation and price stability across distribution channels.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager