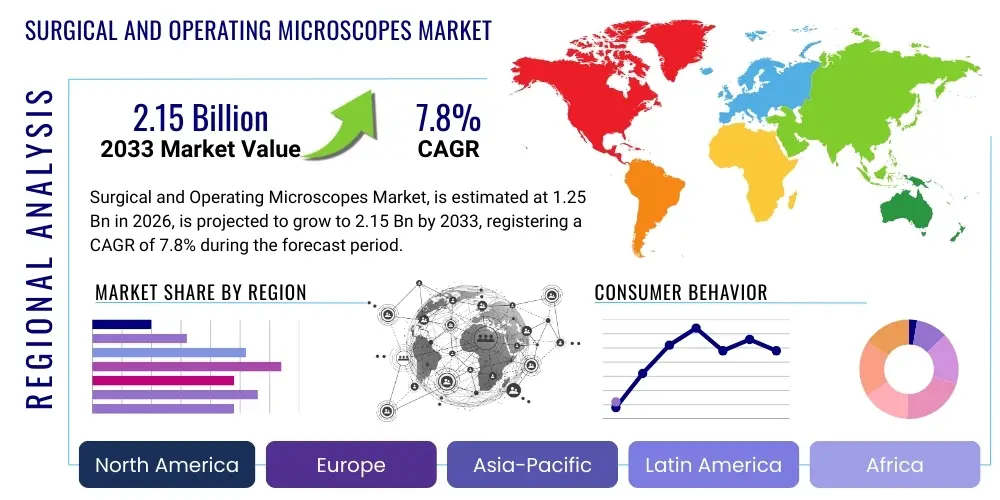

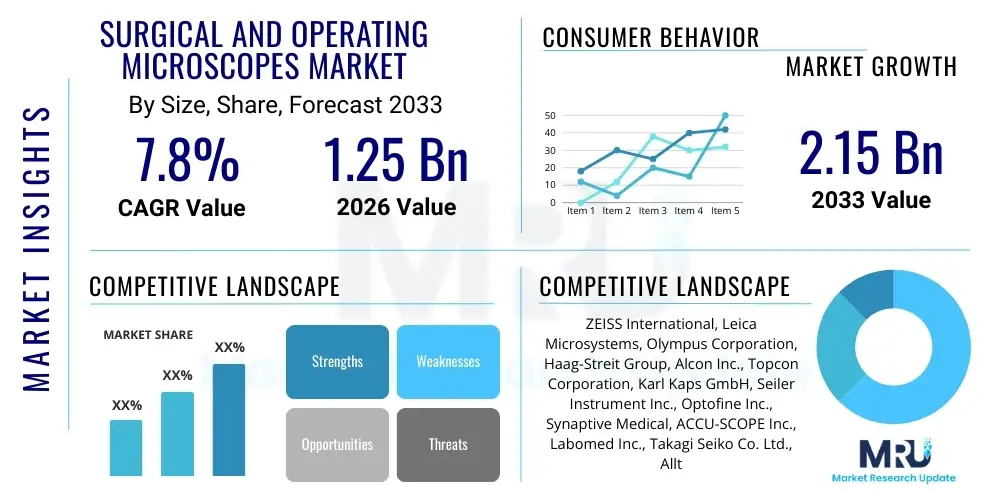

Surgical and Operating Microscopes Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442762 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Surgical and Operating Microscopes Market Size

The Surgical and Operating Microscopes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.25 billion in 2026 and is projected to reach USD 2.15 billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global incidence of chronic neurological, ophthalmological, and cardiovascular conditions necessitating highly precise surgical interventions. Furthermore, the persistent push toward minimally invasive surgical techniques, which inherently rely on superior visualization provided by advanced microscopes, is catalyzing market penetration across various clinical specialties, particularly in developed economies that possess established healthcare infrastructure capable of adopting high-capital medical equipment.

Surgical and Operating Microscopes Market introduction

The Surgical and Operating Microscopes Market encompasses high-precision optical instruments engineered to provide surgeons with stereoscopic, high-magnification, and illuminated visualization of the surgical field during intricate procedures. These advanced devices are critical for enhancing dexterity and precision, particularly in neurosurgery, ophthalmology, otolaryngology (ENT), plastic and reconstructive surgery, and specialized orthopedic procedures. The fundamental product description involves complex optical trains, often featuring apochromatic lenses, advanced illumination systems (LED or Xenon), motorized components for focusing and zooming, and increasingly, integrated digital documentation and imaging capabilities (4K/8K cameras). Major applications include retinal surgery, complex spinal procedures, cranial tumor resection, and delicate microvascular anastomosis, where visualization accuracy directly correlates with patient outcome and procedural success rates. The primary benefit of these systems is the minimization of tissue trauma and improvement in surgical efficacy, leading to faster recovery times and reduced post-operative complications. Driving factors contributing to market growth include the global aging demographic, which increases the prevalence of age-related diseases requiring microsurgery, coupled with significant technological evolution such as the integration of Augmented Reality (AR) navigation and robotic control systems into microscopy platforms, making complex procedures safer and more accessible.

Surgical microscopes are segmented based on their configuration, including floor-standing, table-mounted, and ceiling-mounted systems, catering to diverse operating room layouts and specialized clinical requirements. The adoption rate is significantly influenced by healthcare spending, regulatory approvals for new surgical modalities, and the training available for specialized surgeons capable of utilizing these high-end tools effectively. The transition toward digital microscopy is a defining trend, moving away from purely optical systems to networked platforms that allow for real-time consultation, remote monitoring, and enhanced surgical planning through digital overlays. This digital transformation not only improves operational efficiency within hospitals but also future-proofs the investment by accommodating forthcoming technological updates and AI-driven enhancements in image processing and surgical guidance. The complexity of these systems necessitates robust service agreements and specialized training programs, forming a crucial component of the overall market ecosystem and influencing procurement decisions by major hospital networks globally.

Surgical and Operating Microscopes Market Executive Summary

The Surgical and Operating Microscopes Market is poised for accelerated growth, characterized by significant business trends focused on technological convergence and strategic partnerships. Key business trends involve the integration of high-definition 4K and 8K visualization modules, fluorescence imaging capabilities for real-time tissue differentiation, and robotic arms to enable highly stable positioning and automated tracking. Major manufacturers are prioritizing modular systems that can be adapted across multiple specialties, offering a cost-effective solution for large hospital groups. Regional trends indicate North America and Europe maintaining dominance due to high healthcare expenditure, established reimbursement frameworks, and early adoption of premium technologies. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by rapid expansion of healthcare infrastructure, increasing medical tourism, and government initiatives aimed at modernizing surgical facilities in emerging economies like China and India. This regional expansion is driving manufacturers to establish localized production and distribution networks to effectively penetrate these burgeoning markets. Furthermore, the rising proliferation of ambulatory surgical centers (ASCs) is creating demand for more compact, yet equally sophisticated, operating microscopes that optimize space and operational throughput.

Segment trends highlight a strong shift toward neurological and ophthalmological applications, which are the highest-revenue generating sectors due to the high complexity and reimbursement rates associated with these procedures. Within product segmentation, advanced integrated systems incorporating intraoperative Optical Coherence Tomography (OCT) are gaining traction, particularly in retinal surgery, offering unparalleled subsurface visualization during delicate maneuvers. The competitive landscape is intensely focused on intellectual property related to proprietary optics and software integration, leading to high investment in R&D aimed at automating tasks like focus adjustment and optical balancing. Financially, major players are consolidating their positions through mergers and acquisitions to acquire specialized technology and expand geographic reach, thereby standardizing advanced microsurgery workflows globally. The overall market resilience is tied to the irreplaceable nature of high-magnification visualization in micro-invasive surgery, ensuring sustained demand regardless of moderate economic volatility. These trends collectively underscore a market moving toward greater connectivity, procedural automation, and enhanced visual fidelity to support the most challenging surgical cases.

AI Impact Analysis on Surgical and Operating Microscopes Market

Analysis of common user questions related to the impact of AI on the Surgical and Operating Microscopes Market reveals key themes centered around precision enhancement, workflow automation, and the future role of the surgeon. Users frequently inquire: "How can AI algorithms interpret microscope images faster than a surgeon?", "What specific safety improvements does AI integration offer in delicate surgeries?", and "Are AI-powered microscopes cost-prohibitive for smaller hospitals?" The overarching expectation is that AI will transform the microscope from a passive visualization tool into an active surgical assistant. Concerns often revolve around regulatory hurdles, data privacy related to image capture, and the potential for 'over-reliance' on algorithmic guidance. Users anticipate AI driving features such as automated tumor margin detection, real-time vascular structure highlighting, and predictive risk assessment during procedures, significantly reducing cognitive load on the surgeon. This integration is expected to standardize outcomes, democratize access to expert-level surgical guidance, and dramatically improve the efficiency of teaching complex micro-surgical techniques in academic settings.

The core influence of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is concentrated on augmenting the interpretation of complex, high-resolution optical data generated by surgical microscopes. AI is utilized for sophisticated image processing tasks, including noise reduction, automated focusing, and dynamic field stabilization, which are crucial when dealing with micro-movements during long surgeries. Furthermore, deep learning models are being trained on vast datasets of surgical images and videos to recognize anatomical structures and pathological tissues (e.g., differentiating healthy brain tissue from glioma margins) in real-time, providing surgeons with immediate, color-coded visual feedback superimposed onto the live image feed (Augmented Reality overlay). This capability shifts the operational paradigm from purely visual observation to intelligent, data-driven intraoperative guidance, leading to potentially more complete resections and minimized damage to critical adjacent structures. The adoption of AI is therefore viewed as a critical differentiator for manufacturers seeking to lead the next generation of precision medical devices, necessitating strong computational hardware integrated directly into the microscope chassis.

- AI enables real-time tumor margin detection via integrated fluorescence imaging analysis.

- Automated focusing and tracking algorithms maintain optimal clarity despite patient movement.

- Machine Learning models facilitate surgical skill assessment and objective training protocols.

- Predictive analytics use intraoperative data to warn surgeons of potential complications or anatomical risks.

- Augmented Reality (AR) overlays guided by AI superimpose pre-operative planning data (e.g., MRI/CT scans) onto the live microscopic view.

- Enhancement of digital image quality (denoising, contrast optimization) for improved visualization.

DRO & Impact Forces Of Surgical and Operating Microscopes Market

The Surgical and Operating Microscopes Market dynamics are governed by a robust interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces. A primary driver is the accelerating shift towards Minimally Invasive Surgery (MIS) across specialties, which requires enhanced magnification and illumination systems to compensate for limited access and visibility. This is compounded by the rising prevalence of chronic diseases globally, particularly age-related conditions like cataracts, glaucoma, and neurological disorders. Simultaneously, advancements in imaging technology, such as the introduction of 4K/8K resolution and specialized modalities like Near-Infrared Fluorescence (NIRF) imaging, significantly enhance diagnostic and therapeutic capabilities, pushing healthcare providers to upgrade existing equipment. The high capital expenditure required for sophisticated microscope systems, coupled with stringent regulatory approval processes (especially in markets like the US and EU) that extend time-to-market for innovative products, acts as a significant restraint. Furthermore, the need for highly specialized surgeon training to proficiently operate these complex, integrated systems can slow down widespread adoption, particularly in resource-constrained settings.

The significant opportunities within the market are predominantly located in untapped emerging economies, where healthcare infrastructure is rapidly developing, creating new procurement cycles for advanced medical devices. The convergence of microscopy with robotic surgery platforms represents a major technological opportunity, allowing for unprecedented precision and integration into sophisticated operating room ecosystems. Furthermore, the growth of Ambulatory Surgical Centers (ASCs) necessitates the development of more compact, modular, and cost-efficient microscope solutions tailored for high-throughput environments. The key impact forces shaping this market include continuous technological obsolescence due to rapid innovation cycles, forcing hospitals to frequently reassess their capital investments. Global economic stability plays a role, as high-end microscopes are capital goods sensitive to healthcare budget cuts. Moreover, the growing focus on standardization of surgical outcomes and quality metrics globally is pushing manufacturers to develop systems that offer objective, reproducible performance data, often facilitated by integrated digital recording and AI analysis capabilities.

Segmentation Analysis

The Surgical and Operating Microscopes Market is systematically segmented across several critical dimensions, allowing for detailed analysis of market dynamics, purchasing trends, and technological adoption rates across different medical fields and end-user facilities. Primary segmentation revolves around the Type of Product, where categorization distinguishes between high-end systems (integrated, motorized, ceiling-mounted) and more portable or basic models. Application segmentation is crucial, identifying the primary surgical specialties driving demand, with Neurology, Ophthalmology, and ENT consistently dominating due to the necessity of micro-level precision in these fields. Furthermore, segmentation by End-User provides insight into procurement power and feature preferences, differentiating between large hospital groups, Ambulatory Surgical Centers (ASCs), and specialized clinics or research institutions. The evolution of these segments is marked by manufacturers increasingly developing application-specific optics and specialized ergonomic features to meet the unique demands of each surgical discipline, such as enhanced working distance for orthopedic surgery versus superior depth perception required in neurosurgery.

A growing secondary segmentation involves the Visualization Type, differentiating between traditional Optical Microscopy, which provides direct visualization, and Digital Microscopy, which relies on high-resolution cameras and monitors, often integrating 3D visualization capabilities. This digital segment is expected to show superior growth due to its compatibility with surgical networking, tele-mentoring, and AI integration. The market also segments by magnification power and illumination source (e.g., LED versus Xenon), directly impacting the suitability of the microscope for specific procedures and influencing overall system cost. Detailed analysis of these segments is paramount for strategic planning, revealing that while hospitals remain the largest volume purchasers, the rapidly expanding ASC sector is becoming a key driver for mid-range, flexible, and high-quality systems, prioritizing efficiency and ease of use in a non-academic setting. This complex segmentation highlights a mature market characterized by highly specialized product offerings aimed at maximizing procedural precision and workflow efficiency across the diverse landscape of modern surgical practice.

- By Type:

- Fixed/Mounted Microscopes (Ceiling, Wall, Floor Stand)

- Portable/Benchtop Microscopes

- By Application:

- Ophthalmology (Retinal Surgery, Cataract Procedures)

- Neurosurgery and Spine Surgery

- Otolaryngology (ENT)

- Plastic and Reconstructive Surgery

- Dentistry (Endodontics, Periodontics)

- Oncology

- Gynecology and Urology

- By End User:

- Hospitals and Clinics

- Ambulatory Surgical Centers (ASCs)

- Academic and Research Institutes

Value Chain Analysis For Surgical and Operating Microscopes Market

The value chain for the Surgical and Operating Microscopes Market is characterized by a high degree of vertical integration among key players and critical reliance on specialized component suppliers. The upstream analysis focuses on the sourcing of highly precise raw materials, particularly advanced optical glass, high-tolerance mechanical components (for motorized control systems), sophisticated electronic sensors (for integrated cameras), and proprietary software components. Manufacturers must maintain stringent quality control over these input materials, as the slightest impurity or mechanical imperfection can compromise the optical fidelity required for microsurgery. The core manufacturing phase involves specialized assembly processes for apochromatic objective lenses, complex illumination systems (often fiber-optic based), and the integration of digital imaging hardware. This phase is capital-intensive and requires highly skilled technicians, often resulting in high barriers to entry for new market participants. Competitive advantage is frequently established through proprietary optical design and patented integration of digital features, ensuring superior performance and ergonomic efficiency.

The downstream analysis primarily concerns distribution, sales, installation, and post-sales servicing. Distribution channels are predominantly direct, especially for high-end, complex systems sold to major hospital networks, requiring specialized sales representatives with deep clinical knowledge to manage complex procurement cycles and provide customized operating room integration solutions. Indirect channels, involving authorized dealers and distributors, are more common for entry-level or portable systems, particularly in geographically distant or emerging markets. Due to the high investment and technical complexity, post-sales support, including preventative maintenance, software updates, and specialized repair services, constitutes a significant and high-margin segment of the value chain. Successful market players prioritize robust service contracts and maintain large global service networks to ensure minimal downtime in critical surgical settings. The relationship between the manufacturer and the end-user is highly consultative, ensuring the system is correctly configured for specific surgical needs, thereby influencing long-term brand loyalty and future upgrade cycles.

Surgical and Operating Microscopes Market Potential Customers

The primary consumers and end-users of surgical and operating microscopes are institutions requiring high-precision visualization capabilities for diagnostic and therapeutic surgical procedures. Large multi-specialty hospitals, particularly those affiliated with university medical centers, represent the largest segment of potential customers. These institutions require a diverse portfolio of microscopes—ranging from top-tier, fully integrated neurosurgical units to specialized ophthalmology systems—to support their high-volume, complex surgical schedules and training programs. Their procurement decisions are driven by technological capability, system reliability, integration with Electronic Health Records (EHRs), and the availability of comprehensive service agreements. These academic centers are often early adopters of new technologies, such as AR-enabled microscopes and 4K imaging systems, due to their involvement in clinical research and surgical innovation.

The rapidly expanding sector of Ambulatory Surgical Centers (ASCs) constitutes a crucial and fast-growing customer base. ASCs typically focus on specialized, less complex, and higher-volume outpatient procedures, such as cataract surgery or routine ENT operations. For this customer group, procurement priorities shift towards systems that offer excellent optical quality alongside features optimizing workflow efficiency, such as faster setup times, smaller footprints, and lower overall maintenance costs compared to hospital-grade, fully integrated ceiling-mounted systems. Furthermore, specialized private clinics, particularly in dentistry (endodontics and implantology) and plastic surgery, also represent significant buyers, often opting for dedicated, benchtop or floor-stand models tailored specifically for their singular surgical requirements. Government procurement agencies and international health organizations also purchase robust, often portable, systems for deployment in military hospitals or global health initiatives in remote locations, focusing on durability and ease of maintenance in challenging environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 2.15 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ZEISS International, Leica Microsystems, Olympus Corporation, Haag-Streit Group, Alcon Inc., Topcon Corporation, Karl Kaps GmbH, Seiler Instrument Inc., Optofine Inc., Synaptive Medical, ACCU-SCOPE Inc., Labomed Inc., Takagi Seiko Co. Ltd., Alltion (Wuzhou) Co. Ltd., Dino-Lite Medical, Suzhou Kangli Optical Instrument Co. Ltd., B. Braun Melsungen AG, Welch Allyn (Hill-Rom), Global Surgical Corporation, Rudolf Riester GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Surgical and Operating Microscopes Market Key Technology Landscape

The contemporary technological landscape of the Surgical and Operating Microscopes Market is defined by a rigorous pursuit of enhanced visualization, superior ergonomic design, and seamless digital integration. A pivotal advancement is the widespread adoption of ultra-high-definition imaging, specifically 4K and increasingly 8K resolution cameras and displays, which provide unparalleled image clarity and color fidelity crucial for microvascular and neurological procedures where minor color variations signify physiological changes. Coupled with this is the continuous refinement of apochromatic optics, which minimizes chromatic aberration and ensures crisp, true-color magnification across the entire zoom range, offering surgeons a distortion-free field of view. Furthermore, modern microscopes are integrating advanced illumination techniques, such as Near-Infrared Fluorescence (NIRF) imaging (e.g., using Indocyanine Green or 5-ALA) which allows for real-time differentiation of blood flow, tissue viability, or malignant margins, significantly enhancing diagnostic accuracy and guiding surgical resection boundaries.

Another dominant technological trend involves the sophisticated motorization and robotic control systems built into the microscope platforms. These features enable motorized movement along multiple axes, automatic balancing mechanisms to counteract surgical tool weight, and programmed positioning capabilities, minimizing physical strain on the surgeon and ensuring stable, repeatable setup. The incorporation of digital workflows is crucial; this includes integrated image and video capture, storage on hospital servers, and network connectivity, facilitating educational activities and clinical documentation. More recently, the introduction of heads-up display (HUD) visualization, where the surgeon operates while viewing a 3D digital image on a large monitor rather than through eyepieces, offers improved ergonomics and allows the entire operating team to view the exact surgical field, enhancing coordination and training capabilities. Haptic feedback mechanisms and augmented reality overlays, driven by AI processing of pre-operative and intra-operative data, are further transforming these devices into intelligent, interactive surgical guidance tools, promising higher procedural success rates and reduced surgical time.

The emphasis on modularity and adaptability is also a crucial technological element. Manufacturers are designing platforms that allow for easy addition of supplementary modules, such as specialized endoscopes, intraoperative Optical Coherence Tomography (OCT) systems for subsurface imaging (critical in retinal surgery), and various laser delivery systems. This modular approach extends the lifespan of the core investment and allows hospitals to customize the microscope for specific departmental needs without purchasing entirely new units. Moreover, advanced ergonomic designs, including customizable magnification ratios, optimized working distances, and features reducing ocular strain, are being prioritized to accommodate lengthy and complex surgical procedures, thereby improving surgeon comfort and sustained focus. These technological advancements collectively position the surgical microscope not merely as an optical tool, but as the central, networked visualization hub of the modern, integrated operating room, capable of processing and presenting multi-modal data in real time.

Regional Highlights

The global Surgical and Operating Microscopes Market exhibits diverse characteristics across major geographical regions, influenced by healthcare expenditure, technological adoption, and regulatory frameworks. North America, encompassing the United States and Canada, currently holds the largest market share and remains the principal hub for technological innovation and high-value system adoption. This dominance is attributed to high per capita healthcare spending, advanced medical infrastructure, favorable reimbursement policies for complex microsurgical procedures, and the presence of leading research institutions and manufacturers. The US market is characterized by a high demand for fully integrated, AI-enabled, and 4K-capable surgical microscopes, driven particularly by the large volume of neurosurgical and ophthalmological procedures conducted annually. Stringent FDA regulations, while increasing development hurdles, simultaneously ensure the highest standards of product quality and safety, reinforcing confidence in advanced technologies.

Europe represents the second-largest market, marked by robust governmental healthcare systems and a strong focus on quality manufacturing standards, particularly in Germany, Switzerland, and the UK. The European market is characterized by a balanced adoption of high-end integrated systems and more cost-efficient, specialized models. The implementation of the Medical Device Regulation (MDR) has intensified the regulatory landscape, affecting time-to-market for new devices but ensuring adherence to high clinical safety profiles. Demand is high for systems with advanced ergonomics and modularity to suit diverse hospital settings across the Eurozone. Central and Eastern European countries are gradually increasing their adoption rates as healthcare modernization projects continue, driven often by public tenders and structural funds aimed at upgrading operating theatre technology.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) over the forecast period. This rapid growth is propelled by improving economic conditions, significant public and private investments in healthcare infrastructure expansion, and a burgeoning medical tourism sector, particularly in countries like China, India, and South Korea. While price sensitivity remains a factor in certain sub-regions, the increasing prevalence of lifestyle diseases and the expanding elderly population are generating immense demand for sophisticated surgical equipment. Manufacturers are focusing on establishing local partnerships and optimizing supply chains to cater to this diverse region, where the market spans from major metropolitan centers demanding cutting-edge technology to rural areas requiring durable, easy-to-maintain, and cost-effective solutions. Latin America and the Middle East & Africa (MEA) represent nascent markets with substantial potential, primarily driven by investments in high-tech medical facilities in oil-rich MEA nations and localized expansion of specialty surgical centers in Brazil and Mexico, though these regions remain sensitive to import duties and fluctuating exchange rates.

- North America: Market leader, high adoption of AI/4K systems, strong reimbursement framework, focus on specialized neuro and ophthalmic applications.

- Europe: Second largest market, emphasis on high manufacturing standards (MDR compliance), strong demand for ergonomic and modular systems, particularly in Germany and France.

- Asia Pacific (APAC): Highest projected CAGR, driven by infrastructure development, increasing medical tourism, and rising population health awareness in China and India.

- Latin America (LATAM): Growth driven by private healthcare investments and expansion of specialized surgical facilities, though constrained by economic instability.

- Middle East & Africa (MEA): Growing investment in premium healthcare services, particularly in the UAE and Saudi Arabia, increasing demand for state-of-the-art integrated OR solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Surgical and Operating Microscopes Market.- ZEISS International

- Leica Microsystems (Part of Danaher Corporation)

- Olympus Corporation

- Haag-Streit Group

- Alcon Inc.

- Topcon Corporation

- Karl Kaps GmbH & Co. KG

- Seiler Instrument Inc.

- Optofine Inc.

- Synaptive Medical

- ACCU-SCOPE Inc.

- Labomed Inc.

- Takagi Seiko Co. Ltd.

- Alltion (Wuzhou) Co. Ltd.

- Dino-Lite Medical

- Suzhou Kangli Optical Instrument Co. Ltd.

- B. Braun Melsungen AG

- Welch Allyn (Part of Hill-Rom)

- Global Surgical Corporation

- Rudolf Riester GmbH

Frequently Asked Questions

Analyze common user questions about the Surgical and Operating Microscopes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Surgical and Operating Microscopes Market?

The market is primarily driven by the increasing global prevalence of chronic diseases requiring micro-invasive intervention, the subsequent rising demand for Minimally Invasive Surgery (MIS), and continuous technological integration of features like 4K imaging, fluorescence visualization, and AI-powered surgical guidance systems.

How is Artificial Intelligence (AI) being utilized in modern surgical microscopes?

AI is employed for real-time image analysis, providing automated tissue differentiation (e.g., tumor margin detection), dynamic focusing adjustments, and Augmented Reality (AR) overlays that superimpose crucial pre-operative data onto the live surgical view, significantly enhancing accuracy and decision-making.

Which surgical application segment holds the largest market share?

The Ophthalmology and Neurosurgery segments collectively hold the largest market share due to the highly intricate nature of procedures in these specialties, demanding superior magnification, illumination, and specialized optical designs that are essential for successful patient outcomes.

What is the key technological challenge facing market manufacturers?

A key challenge is managing the high cost and complexity of integrating advanced digital components (4K/8K sensors, sophisticated processors for AI) while simultaneously maintaining robust optical quality and adhering to stringent global regulatory standards (e.g., FDA and MDR) which extends the product development cycle.

What role do Ambulatory Surgical Centers (ASCs) play in market expansion?

ASCs are crucial growth drivers, increasingly demanding compact, cost-efficient, and highly efficient surgical microscope systems tailored for high-throughput outpatient procedures. This segment drives innovation in modular and ergonomically optimized benchtop models.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager