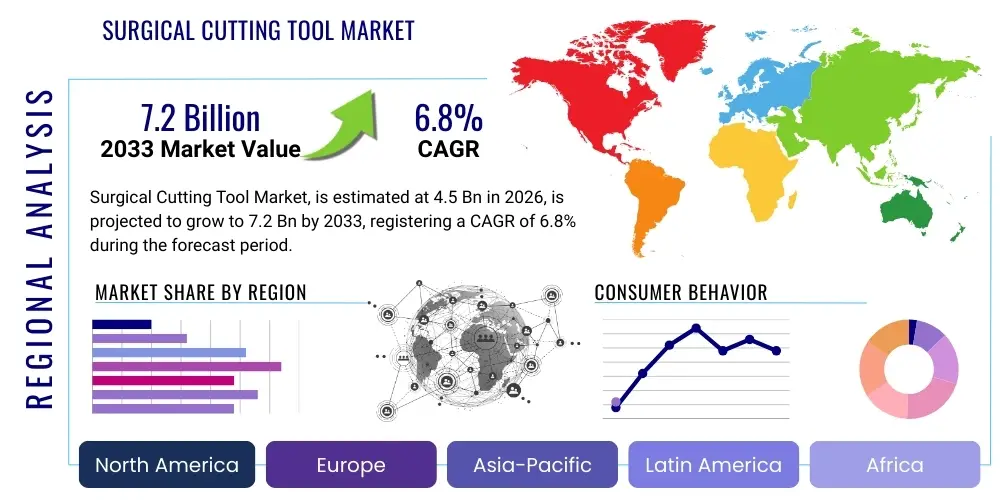

Surgical Cutting Tool Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443334 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Surgical Cutting Tool Market Size

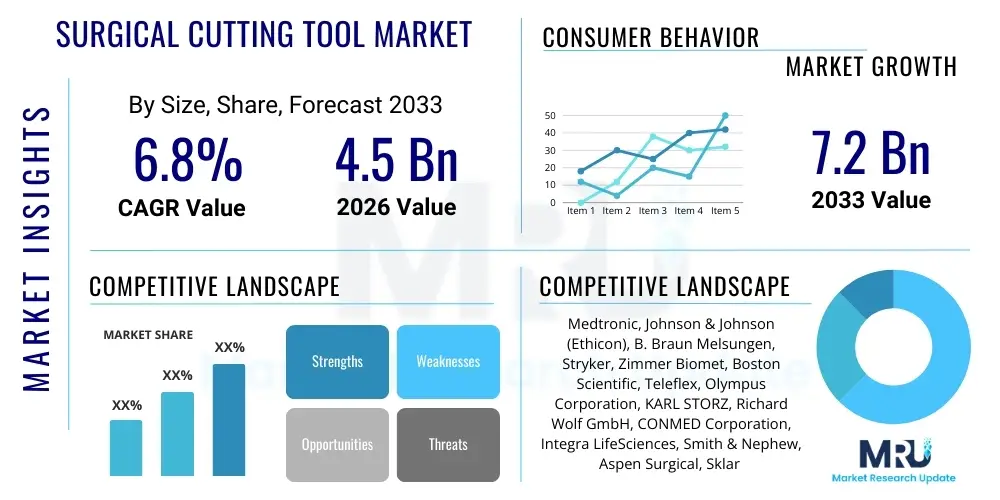

The Surgical Cutting Tool Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Surgical Cutting Tool Market introduction

The Surgical Cutting Tool Market encompasses a wide range of medical instruments essential for incising, dissecting, drilling, scraping, or removing biological tissues during operative procedures. These instruments, which include scalpels, scissors, saws, trocars, and specialized blades, are critical for ensuring precision, minimizing trauma, and optimizing patient outcomes across various surgical specialties. The market scope covers both reusable and single-use instruments, with an increasing emphasis on high-precision, ergonomically designed tools that facilitate minimally invasive surgical (MIS) techniques. Modern surgical cutting tools are often manufactured using advanced materials such as surgical-grade stainless steel, titanium, and specialized polymers to enhance durability, sharpness, and compatibility with sterilization protocols.

Major applications driving the demand for these tools include general surgery, orthopedic procedures, neurosurgery, cardiovascular interventions, and gynecology. The rapid adoption of robotic surgery systems and computer-assisted navigation tools is further necessitating the development of highly sophisticated, integrated cutting tools that can interface seamlessly with robotic arms. These technological advancements aim to improve visualization and dexterity for surgeons, especially in complex or confined anatomical spaces, contributing significantly to market expansion and product innovation.

Key market driving factors include the escalating global prevalence of chronic diseases requiring surgical intervention, the rapid demographic shift towards an aging population globally (which necessitates more surgical procedures), and continuous investment in healthcare infrastructure, particularly in emerging economies. Furthermore, stringent regulatory standards pertaining to surgical site infections (SSIs) are pushing healthcare providers toward adopting high-quality, often single-use, cutting instruments, thereby sustaining the market growth trajectory.

Surgical Cutting Tool Market Executive Summary

The Surgical Cutting Tool Market is characterized by robust growth driven primarily by technological convergence and the shift toward specialized surgical techniques. Business trends indicate a strong move away from traditional reusable instruments towards advanced disposable tools, which mitigate risks associated with cross-contamination and simplify operational logistics for healthcare facilities. There is significant competitive intensity focused on developing tools optimized for minimally invasive procedures (MIPs) and robotic platforms, where precision and material integrity are paramount. Strategic partnerships between established medical device manufacturers and robotics companies are becoming increasingly common to integrate advanced cutting capabilities directly into robotic ecosystems, positioning precision tooling as a high-value segment.

Regionally, North America maintains the largest market share due to its sophisticated healthcare spending, rapid adoption of advanced surgical technologies, and established infrastructure for complex procedures. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This accelerated growth in APAC is attributed to rapidly improving healthcare access, increasing disposable income leading to higher demand for specialized treatments, and governmental initiatives focused on modernizing hospital facilities and medical equipment procurement. Europe remains a steady market, influenced heavily by rigorous regulatory frameworks like the Medical Device Regulation (MDR), which drives innovation toward higher quality and documentation standards.

Segment trends highlight the dominance of General Surgery applications, although Orthopedics is experiencing exceptional growth driven by the rising volume of joint replacement and trauma procedures. By product type, blades and scalpels constitute the foundational market share, yet powered cutting tools (drills and saws used extensively in orthopedic and neurological surgery) are showcasing faster growth rates due to their integration into high-efficiency surgical systems. End-user analysis reveals that hospitals remain the primary consumers, but Ambulatory Surgical Centers (ASCs) are rapidly increasing their market penetration as the focus shifts toward cost-effective, high-throughput outpatient surgeries, demanding specialized, efficient cutting tools tailored for short-stay procedures.

AI Impact Analysis on Surgical Cutting Tool Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the surgical cutting tool market primarily revolve around automation, enhanced precision, and the development of 'smart' instruments. Users seek to understand how AI influences tool design for robotic surgery, whether AI can predict tool failure or wear, and the role of machine learning in optimizing cutting trajectories and minimizing tissue damage during complex procedures. Key themes emerging from these questions include concerns about data privacy, the required skill integration for surgeons using AI-enabled tools, and the cost justification for adopting highly sophisticated, algorithm-driven instrumentation.

The implementation of AI and Machine Learning (ML) is fundamentally altering the requirements for surgical cutting tools, moving them from passive instruments to active, data-generating components within a larger surgical ecosystem. AI algorithms are increasingly being utilized in pre-operative planning and real-time guidance systems, which necessitate cutting tools capable of providing highly accurate positional feedback. Furthermore, AI contributes to the development of instruments with adaptive capabilities; for example, smart electrocautery tools that automatically adjust power output based on real-time tissue impedance recognition to ensure optimal cutting and coagulation while reducing thermal injury risk. This integration demands tool manufacturers prioritize embedded sensors and robust data communication capabilities in their product lines.

Looking forward, predictive maintenance driven by AI will become crucial, particularly for expensive reusable powered cutting tools (like surgical drills and saws). ML models trained on usage data can predict optimal replacement times for blades or motors, thus preventing intraoperative failures and maximizing equipment lifespan. While AI does not directly replace the physical tool, it significantly enhances the functionality, reliability, and precision of the entire cutting process, driving demand for tools certified for use within these high-tech robotic and navigation environments, thereby cementing the future direction of product development toward intelligent, connected surgical systems.

- AI optimizes tool trajectory and positioning in robotic surgery systems, enhancing precision.

- Machine learning algorithms assist in real-time tissue recognition, optimizing cutting depth and power output.

- Predictive analytics enables proactive maintenance, reducing failure rates for powered cutting tools.

- Integration of smart sensors in cutting instruments provides crucial real-time feedback data to surgeons and AI guidance systems.

- AI drives innovation in ergonomic design based on analysis of surgeon movement and instrument strain data.

DRO & Impact Forces Of Surgical Cutting Tool Market

The Surgical Cutting Tool Market is propelled by the increasing global geriatric population, which correlates directly with a higher incidence of age-related and chronic conditions demanding surgical treatments. Technological drivers, notably the continuous refinement of minimally invasive surgery (MIS) techniques and the widespread adoption of robotic platforms, necessitate specialized, high-precision instruments designed for confined operative fields. These specialized tools often command higher prices, contributing positively to market value expansion. Furthermore, enhanced awareness and stringent healthcare mandates concerning patient safety and infection control favor the use of single-use, disposable cutting tools, acting as a strong driver for volume growth, despite persistent economic pressures in global healthcare systems.

However, the market faces significant restraints, primarily stemming from the high cost associated with advanced robotic-assisted cutting tools and the rigorous, time-consuming regulatory approval processes, particularly in highly regulated regions like North America and Europe. Device manufacturers must navigate complex certification requirements, which increases the time-to-market and R&D costs. Additionally, pricing pressure from Group Purchasing Organizations (GPOs) and hospital systems seeking cost efficiencies, coupled with challenges related to the effective sterilization and maintenance of reusable instruments, poses ongoing limitations to market expansion and profitability margins, compelling companies to focus on materials science and streamlined manufacturing processes to manage costs.

Opportunities for growth are abundant in emerging economies, where healthcare infrastructure development is accelerating, creating significant unmet needs for standard and specialized surgical equipment. The adoption of advanced biomaterials, such as specialized ceramics and polymers, offers new avenues for improving tool sharpness, durability, and biocompatibility, particularly in niche specialties like micro-surgery and ophthalmology. The continuous shift towards outpatient settings, such as Ambulatory Surgical Centers (ASCs), provides an excellent opportunity for manufacturers to develop standardized, high-volume procedure kits that bundle necessary cutting instruments, offering both convenience and cost savings to these burgeoning healthcare facilities, thereby securing long-term market resilience and diversification.

Segmentation Analysis

The Surgical Cutting Tool Market is comprehensively segmented based on product type, application, and end-use, allowing for detailed analysis of demand drivers and competitive landscapes across specialized surgical domains. Product segmentation is crucial, distinguishing between manual instruments (scalpels, scissors, chisels) and powered instruments (saws, drills, shavers), which have vastly different usage profiles and technological requirements. Application segmentation reveals the major clinical areas driving demand, with general surgery and orthopedics being dominant, while specialized areas like neurosurgery demand exceptional precision and material quality. The end-use segmentation highlights shifts in procurement patterns, particularly the growing influence of Ambulatory Surgical Centers (ASCs) versus traditional hospitals.

- Product Type: Manual Surgical Cutting Tools (Scalpels, Surgical Blades, Scissors, Trocars, Curettes, Chisels & Osteotomes, Forceps/Clamps), Powered Surgical Cutting Tools (Drills, Saws, Micro-debriders, Shavers).

- Application: General Surgery, Orthopedic Surgery, Neurosurgery, Cardiovascular Surgery, Gynecology, Urology, Plastic and Reconstructive Surgery, Ophthalmic Surgery.

- End-Use: Hospitals, Ambulatory Surgical Centers (ASCs), Specialty Clinics.

Value Chain Analysis For Surgical Cutting Tool Market

The value chain for the Surgical Cutting Tool Market begins with upstream activities focused on the sourcing and processing of high-grade raw materials, primarily medical-grade stainless steel (300 and 400 series), titanium alloys, specialty ceramics, and high-performance polymers. Manufacturers are heavily dependent on reliable suppliers capable of meeting stringent quality controls for material purity and composition, as these factors directly impact instrument durability, sharpness retention, and patient safety. Research and Development (R&D) and design innovation represent a critical high-value activity, where manufacturers invest heavily in CAD/CAM technologies, material testing, and clinical validation to ensure compliance with global regulatory standards like FDA approval and European MDR certification. Manufacturing processes, including precision machining, forging, etching, and specialized coatings (e.g., anti-reflective or antimicrobial), define product differentiation.

The downstream segment of the value chain involves complex distribution and sales strategies. Due to the critical nature of surgical tools, distribution requires specialized logistics that ensure sterility and timely delivery to end-users. Distribution channels are generally bifurcated: direct sales channels handle high-value, specialized instruments (especially those associated with robotic systems or custom implants) and maintain direct contact with key opinion leaders and surgical departments; while indirect channels, involving distributors, wholesalers, and Group Purchasing Organizations (GPOs), handle the high-volume, standardized reusable and disposable tools. GPOs play a substantial role, often negotiating large-volume contracts that exert significant pricing pressure on manufacturers, necessitating efficient supply chain management.

Market access is heavily influenced by the effectiveness of the distribution network and the capability of manufacturers to provide comprehensive after-sales support, including sterilization guidance, maintenance contracts for powered tools, and surgeon training programs. The relationship between manufacturers, GPOs, and end-users (hospitals and ASCs) is paramount for success. Strategic alignment with major GPOs allows manufacturers to secure access to large networks of healthcare facilities, while investing in robust digital platforms for inventory management and reordering enhances end-user convenience and reduces logistical friction, ensuring continuous supply of these essential surgical consumables.

Surgical Cutting Tool Market Potential Customers

The primary consumers of surgical cutting tools are healthcare institutions where operative procedures are performed. This category is dominated by large, multi-specialty hospitals, including public, private, and university-affiliated teaching hospitals. These facilities represent the largest procurement segment due to their capacity to handle a high volume of complex, high-acuity surgeries, such as cardiac, orthopedic trauma, and neurosurgical interventions, which require the most diverse and advanced inventory of specialized cutting instruments, often including expensive powered tools and dedicated robotic accessories. Procurement decisions in these large entities are typically managed by centralized purchasing departments or GPOs, focusing on standardization, bulk discounts, and long-term contracts.

A rapidly growing segment of potential customers includes Ambulatory Surgical Centers (ASCs) and specialized outpatient clinics. ASCs are increasingly favored for elective, less-complex procedures (like basic orthopedic repairs, cataract surgery, and minor general surgery) due to their lower operational costs and enhanced patient convenience compared to traditional inpatient hospital settings. This segment drives demand for high-volume, cost-effective, and often disposable cutting kits tailored specifically for specific, high-frequency procedures. Manufacturers are adjusting their product offerings to meet the unique needs of ASCs, emphasizing sterile, single-use solutions that minimize the need for complex internal sterilization processing.

Furthermore, specialized clinics, particularly those focusing on dentistry, ophthalmology, and plastic and reconstructive surgery, represent niche, yet critical, customer segments. These clinics often require highly specialized micro-cutting tools and instruments made from specific materials to ensure maximum precision and minimize scarring or tissue damage. While smaller in procurement volume individually, the cumulative demand from specialty clinics contributes significantly to the demand for highly specialized, often customized, cutting instrument lines, emphasizing the importance of quality over sheer volume in this specific end-user category.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, Johnson & Johnson (Ethicon), B. Braun Melsungen, Stryker, Zimmer Biomet, Boston Scientific, Teleflex, Olympus Corporation, KARL STORZ, Richard Wolf GmbH, CONMED Corporation, Integra LifeSciences, Smith & Nephew, Aspen Surgical, Sklar Instruments, Millennium Surgical, GPC Medical, CooperSurgical, C. R. Bard (BD), Cook Medical |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Surgical Cutting Tool Market Key Technology Landscape

The technological landscape of the Surgical Cutting Tool Market is rapidly evolving, driven by the demand for enhanced precision, better ergonomic design, and integration with advanced surgical platforms. A fundamental technological trend involves the use of advanced materials science. Manufacturers are increasingly utilizing specialized high-carbon stainless steels, medical-grade titanium alloys, and ceramic coatings (such as titanium nitride and diamond-like carbon) to improve the edge retention, durability, and corrosion resistance of cutting surfaces. These material innovations are crucial for ensuring instruments can withstand rigorous modern sterilization techniques (e.g., autoclaving) while maintaining micro-sharp edges essential for delicate tissue dissection, thereby improving instrument lifespan and surgical efficacy.

The rise of minimally invasive surgery (MIS) and robotic surgery mandates the miniaturization and sophisticated design of cutting instruments. Key technology here includes articulating instruments and endoscopic scissors/shears that can be manipulated through small port incisions. These tools incorporate complex internal mechanisms and specialized grips that transmit the surgeon's movements precisely, often involving advanced articulation and locking mechanisms. For robotic systems, the cutting tools require specialized chip integration for recognition by the robotic console and robust connectivity, allowing for real-time feedback and energy delivery (as seen in advanced vessel sealing and cutting instruments).

Furthermore, energy-based cutting technologies, such as ultrasonic scalpels (harmonic technology) and advanced electrocautery devices, are increasingly replacing traditional cold steel cutting methods in many procedures. Ultrasonic devices cut and coagulate simultaneously by utilizing high-frequency vibrations, minimizing blood loss and reducing thermal spread to adjacent tissues. Manufacturers are focused on developing handheld units that are lighter, more ergonomic, and offer multi-functionality (e.g., cutting, grasping, and dissecting) within a single tip, representing a significant technological advantage and an area of intense research and development investment aimed at safer and faster surgical outcomes across high-volume procedures.

Regional Highlights

- North America: Dominates the global market share due to high healthcare expenditure, established reimbursement policies, and early adoption of cutting-edge surgical technologies, particularly robotic systems. The presence of major industry leaders and a high volume of complex orthopedic and cardiovascular procedures solidify its leading position. The US remains the single largest market globally, characterized by stringent quality standards and high demand for single-use advanced cutting tools.

- Europe: Represents a mature market characterized by universal healthcare coverage and a focus on cost efficiency. Growth is steady, driven by an aging population and high standards of medical care. The implementation of the EU Medical Device Regulation (MDR) has intensified the demand for high-quality, well-documented devices, influencing product development toward stricter compliance and superior manufacturing processes across countries like Germany, France, and the UK.

- Asia Pacific (APAC): Projected to be the fastest-growing region, fueled by massive investments in healthcare infrastructure, increasing medical tourism, and a rapidly expanding patient pool in countries such as China, India, and South Korea. Rising surgical volumes, coupled with improving economic conditions, facilitate greater access to advanced instruments, creating substantial market opportunities for both domestic and international manufacturers targeting high-growth urban centers.

- Latin America (LATAM): Exhibits moderate growth, primarily driven by expanding private healthcare sectors in Brazil and Mexico. Market penetration is often challenging due to economic volatility and reliance on imported advanced technology, but government efforts to modernize public hospital systems are opening new tender-based procurement avenues for standard surgical instruments.

- Middle East and Africa (MEA): Growth is localized, concentrated primarily in the Gulf Cooperation Council (GCC) countries (Saudi Arabia, UAE) due to high per capita healthcare spending and significant government investments in specialty hospitals. Demand is high for advanced, often imported, cutting tools necessary for complex procedures, while the African sub-region focuses mainly on essential, cost-effective surgical instruments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Surgical Cutting Tool Market.- Medtronic

- Johnson & Johnson (Ethicon)

- B. Braun Melsungen

- Stryker

- Zimmer Biomet

- Boston Scientific

- Teleflex

- Olympus Corporation

- KARL STORZ

- Richard Wolf GmbH

- CONMED Corporation

- Integra LifeSciences

- Smith & Nephew

- Aspen Surgical

- Sklar Instruments

- Millennium Surgical

- GPC Medical

- CooperSurgical

- C. R. Bard (BD)

- Cook Medical

Frequently Asked Questions

Analyze common user questions about the Surgical Cutting Tool market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for specialized surgical cutting tools?

The predominant factor is the rapid expansion and increasing complexity of Minimally Invasive Surgery (MIS) and robotic procedures. These sophisticated techniques necessitate ultra-precise, miniaturized, and durable cutting instruments capable of operating effectively through small incisions, thus driving innovation and market value.

Are disposable or reusable surgical cutting tools dominating the market?

While reusable tools hold significant installed base, the disposable (single-use) segment is experiencing faster growth. This shift is driven by heightened awareness of infection control, the high cost and complexity of ensuring proper sterilization of reusable instruments, and logistical benefits for Ambulatory Surgical Centers (ASCs).

How is technological advancement impacting the material composition of cutting instruments?

Technological advancement is leading to increased utilization of advanced materials such as surgical-grade titanium, specialized ceramics, and diamond-like carbon (DLC) coatings. These materials enhance sharpness, corrosion resistance, and longevity, particularly for instruments used in powered systems and harsh sterilization cycles.

Which geographical region offers the highest growth potential for surgical cutting tool manufacturers?

The Asia Pacific (APAC) region, specifically emerging economies like China and India, offers the highest growth potential. This is due to rapidly improving healthcare infrastructure, increasing accessibility to advanced surgical care, and a substantial, underserved patient population.

What is the role of regulatory bodies in shaping the surgical cutting tool market?

Regulatory bodies, such as the FDA and those enforcing the EU MDR, play a critical role by enforcing stringent quality, safety, and documentation standards. This pushes manufacturers to invest heavily in R&D and clinical validation, increasing market entry barriers but ultimately driving the development of safer, higher-quality instruments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager