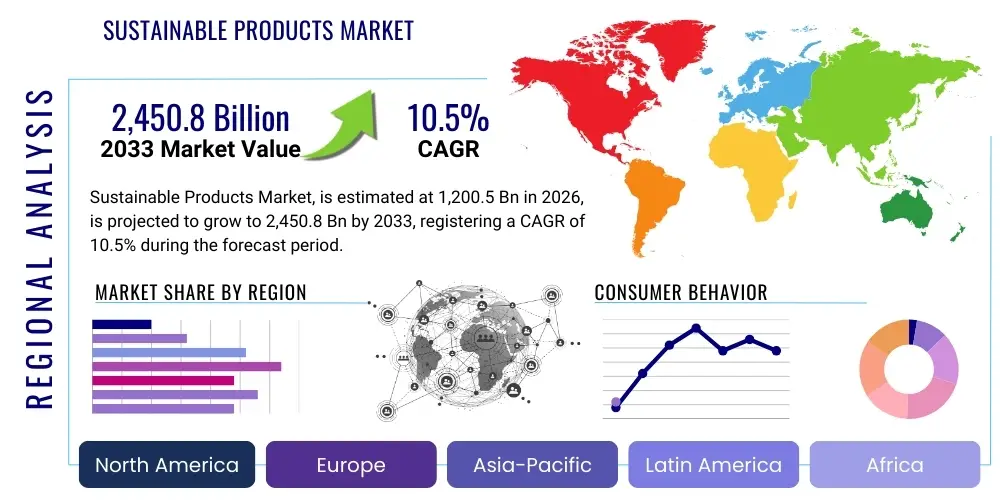

Sustainable Products Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442874 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Sustainable Products Market Size

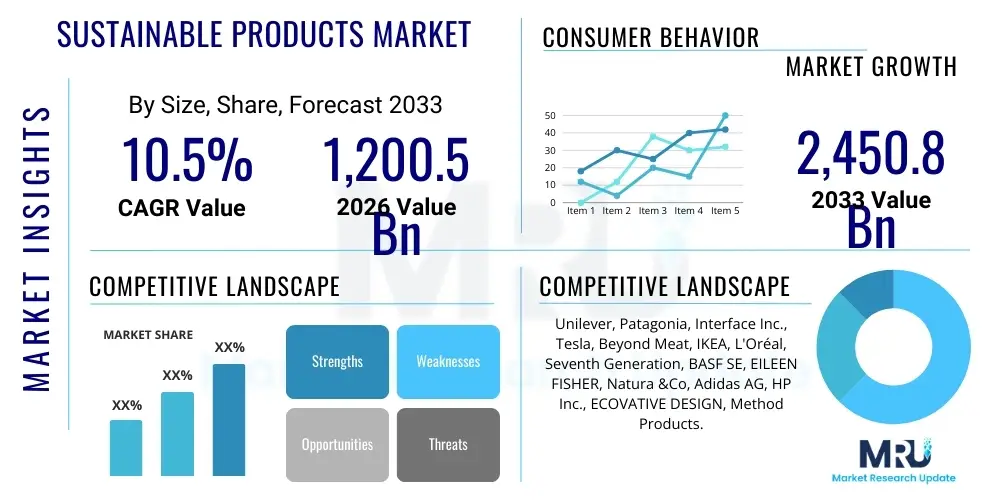

The Sustainable Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% (Include CAGR 10.5% Word with % Value) between 2026 and 2033. The market is estimated at $1,200.5 Billion USD in 2026 and is projected to reach $2,450.8 Billion USD by the end of the forecast period in 2033.

Sustainable Products Market introduction

The Sustainable Products Market encompasses a wide array of goods and services designed, produced, and consumed with minimized negative environmental and social impacts throughout their lifecycle. This includes products that utilize renewable resources, employ energy-efficient manufacturing processes, minimize waste, and promote ethical labor practices. The core objective of sustainable products is to balance economic viability with ecological stewardship and social equity. This market segment is increasingly characterized by stringent certification standards, robust traceability requirements, and a shift towards circular economy models, moving beyond simple end-of-life recycling to design products for longevity and reuse. Key categories span consumer packaged goods, sustainable fashion, green building materials, eco-friendly electronics, and clean energy solutions.

Major applications of sustainable products are observed across crucial industrial and consumer sectors. In the food and beverage industry, sustainable products include organic, fair-trade certified, and locally sourced items, addressing concerns related to agricultural runoff and carbon footprints. Within the automotive and transportation sector, the focus is on electric vehicles (EVs) and low-emission components. Furthermore, the construction industry relies heavily on sustainable building materials, such as low-VOC paints and recycled content aggregates, to achieve green building certifications like LEED. The broad applicability underscores the market's foundational role in achieving global sustainability targets outlined by frameworks such as the United Nations Sustainable Development Goals (SDGs).

The market’s substantial growth is driven primarily by escalating consumer awareness and preference for environmentally responsible alternatives, coupled with strengthening governmental regulations mandating sustainable practices. Benefits include reduced operational risks, enhanced brand reputation, compliance with international trade standards, and lower long-term resource costs through efficiency gains. The driving factors involve increased public scrutiny of corporate environmental, social, and governance (ESG) performance, rapid technological advancements enabling cost-effective sustainable production, and investment surges into renewable infrastructure and resource management technologies.

Sustainable Products Market Executive Summary

The Sustainable Products Market is undergoing rapid transformation, fueled by a confluence of evolving business trends, assertive regulatory action, and shifting consumer demographics. Business trends highlight a pervasive integration of circular economy principles, where businesses prioritize product-as-a-service models, material recapture, and waste minimization across their entire value chain. Furthermore, there is a pronounced move towards radical supply chain transparency, often leveraging blockchain technology, to authenticate ethical sourcing and carbon neutrality claims. Strategic alliances between major corporations and innovative sustainable startups are becoming common, accelerating the pace of product innovation and market penetration, specifically in areas like bioplastics and sustainable packaging solutions.

Regionally, Europe stands as the regulatory leader, with initiatives such as the European Green Deal and mandatory corporate sustainability reporting setting a high global benchmark for sustainable production and consumption, making it a critical hub for high-value sustainable goods. Asia Pacific (APAC) is projected to exhibit the fastest growth rate, driven by urbanization, expanding middle-class income, and governmental initiatives in countries like China and India to combat severe environmental pollution and transition to green energy infrastructure. North America is characterized by robust consumer demand, particularly among Millennials and Gen Z, coupled with increasing investments in sustainable food systems and electric mobility, solidifying its position as a major consumption market.

In terms of segmentation trends, the sustainable packaging segment, driven by global pressure to reduce plastic waste, remains highly dynamic, focusing on compostable and biodegradable materials. The ethical apparel and textile segment is experiencing significant expansion as consumers demand traceability and fair labor conditions. Furthermore, the clean energy technology segment, specifically solar photovoltaic (PV) and sustainable battery storage solutions, dominates in terms of market value and capital investment. These segments are collectively pushing market boundaries by integrating advanced materials science and leveraging digital platforms for better resource management and consumer engagement.

AI Impact Analysis on Sustainable Products Market

User inquiries regarding AI's influence on the Sustainable Products Market frequently focus on how artificial intelligence can move sustainability beyond compliance into genuine competitive advantage. Key themes include the use of AI for optimizing complex, multi-national sustainable supply chains; the ability of machine learning to predict and minimize material waste in manufacturing processes; and the validation of environmental claims to combat greenwashing. Consumers and industry stakeholders are keen to understand how AI tools can provide real-time metrics on carbon emissions and resource depletion associated with specific products, enhancing credibility and facilitating informed decision-making. The overarching expectation is that AI will automate sustainability reporting, personalize eco-friendly product recommendations, and dramatically improve the efficiency of circular systems, moving the market toward true resource decoupling.

AI’s potential lies in its ability to handle and analyze vast datasets related to ecological impact and material flows, which traditional methods struggle to process effectively. For instance, predictive maintenance models powered by AI extend the lifespan of machinery, thus reducing replacement and material consumption. Furthermore, in agriculture, AI-driven precision farming minimizes the use of water, fertilizers, and pesticides, leading directly to the creation of more sustainable food products. This technological integration is transforming the operational backbone of sustainability, providing the granular data necessary for comprehensive lifecycle assessment (LCA).

The application of generative AI tools is also emerging in sustainable product design, allowing designers to rapidly iterate through material combinations and structural optimizations that minimize environmental impact while maintaining product functionality. By simulating the environmental footprint of thousands of design variations before physical prototyping, AI drastically cuts the material and energy expenditure associated with product development. This sophisticated integration ensures that sustainability is engineered into the product from the conceptual stage rather than being an additive measure, driving systemic efficiencies necessary for high-volume sustainable production across various sectors, including textiles and consumer electronics.

- AI-driven supply chain transparency and traceability, verifying ethical sourcing and mitigating risk.

- Predictive modeling for waste reduction in manufacturing and optimized resource allocation.

- Enhanced product life cycle assessment (LCA) through automated data collection and analysis.

- Optimization of energy consumption in smart buildings and manufacturing facilities.

- Personalized consumer recommendations for sustainable products based on behavioral data and carbon impact scores.

- Facilitation of circular economy loops through efficient sorting, recycling, and material recovery systems.

DRO & Impact Forces Of Sustainable Products Market

The dynamics of the Sustainable Products Market are significantly shaped by powerful driving forces, specific market restraints, compelling opportunities, and their cumulative impact. Primary drivers include overwhelming consumer pressure, especially from younger generations who prioritize environmental stewardship over traditional brand loyalty, coupled with increasingly punitive governmental regulations targeting carbon emissions and single-use plastics. Restraints primarily revolve around the initial higher production costs associated with sustainable materials and ethical labor, creating a price barrier for mass adoption, as well as the pervasive threat of 'greenwashing,' which erodes consumer trust and requires greater regulatory oversight and third-party verification. Opportunities emerge from material science innovation, particularly in biodegradable and bio-based polymers, and the untapped potential in developing markets seeking resilient, localized supply chains.

Impact forces stemming from these elements are profound and structural. The increasing regulatory burden acts as an accelerating impact force, coercing companies to internalize external environmental costs and invest heavily in sustainable innovation to maintain market access, particularly in advanced economies. The opportunity provided by digital transformation and industrial IoT enables precise tracking of sustainability metrics, mitigating the restraint posed by greenwashing and allowing brands to authenticate their claims effectively. Furthermore, the sustained investment in renewable energy infrastructure worldwide reduces the energy intensity of sustainable product manufacturing, gradually lowering production costs and addressing the key restraint related to pricing parity with conventional goods. This complex interplay of forces ensures sustainability is transitioning from a niche requirement to a core business mandate.

Ultimately, the overarching impact force is the global commitment to climate goals, which transcends individual market drivers. This commitment forces cross-sector collaboration and massive public-private investments in foundational technologies necessary for deep decarbonization and resource efficiency. The market is thus propelled by a dual mandate: satisfying conscious consumer demand while simultaneously adhering to legally binding national and international environmental standards. Companies that successfully navigate the restraints related to cost and transparency while capitalizing on innovation opportunities will secure long-term market leadership and superior resilience against future environmental and regulatory shocks.

Segmentation Analysis

The Sustainable Products Market is diverse, segmented primarily based on the type of product, the intended end-user, and the specific distribution channel utilized. This detailed segmentation allows for a granular understanding of consumer behavior and industrial purchasing patterns across different sectors. Key product categories include non-durable consumer goods such as sustainable food and personal care items, and durable goods like eco-friendly electronics and furniture. The market complexity is further defined by the varying certification standards applied to each segment, ranging from Fair Trade and Organic certifications for food to stringent ISO standards for sustainable manufacturing processes in industrial applications. Understanding these segments is crucial for strategic market entry and product localization.

Segmentation by end-user distinguishes between the large, volume-driven consumer market (B2C) and the specialized, often regulatory-driven business market (B2B). The B2B segment, covering sustainable sourcing by corporations, government procurement, and institutional buying (e.g., hospitals, educational facilities), often involves large-scale contracts focused on reducing the operational carbon footprint through sustainable energy solutions and green IT. Conversely, the B2C segment is highly influenced by branding, packaging sustainability, and digital engagement, often relying on direct-to-consumer (D2C) channels that highlight product origin and ethical narratives. The divergence in purchasing criteria—cost-efficiency and compliance in B2B versus emotional appeal and ethical alignment in B2C—dictates the marketing and product development strategies employed within each segment.

The increasing relevance of specific material types, such as recycled content, bio-based materials, and waste-derived materials, further refines the market segmentation. For instance, the transition in the packaging sector towards compostable polymers represents a sub-segment driven entirely by material innovation and regulatory pressure on plastic waste. Similarly, the sustainable fashion segment is bifurcated based on material sources, differentiating between recycled textiles and innovative materials like mushroom leather or organic cotton. This granular level of analysis confirms that material science breakthroughs are fundamental catalysts for the emergence of new, high-growth sustainable product sub-segments across the global market landscape.

- By Product Type:

- Sustainable Food & Beverages (Organic, Fair Trade, Plant-Based)

- Sustainable Personal Care & Cosmetics (Natural Ingredients, Zero Waste)

- Sustainable Apparel & Textiles (Recycled Fibers, Organic Cotton, Ethical Sourcing)

- Sustainable Home Goods & Cleaning Products (Biodegradable, Non-Toxic)

- Sustainable Building & Construction Materials (Low-VOC, Recycled Content)

- Sustainable Packaging (Compostable, Recyclable, Bio-based)

- Sustainable Electronics & Technology (Energy Efficient, Circular Design)

- By End-User:

- Business-to-Consumer (B2C)

- Business-to-Business (B2B)

- Government and Institutions

- By Distribution Channel:

- Online Retail (E-commerce Platforms, D2C Websites)

- Offline Retail (Supermarkets, Specialty Stores, Department Stores)

- Direct Sales (B2B Supply Chains)

Value Chain Analysis For Sustainable Products Market

The value chain for the Sustainable Products Market begins with Upstream Analysis, which focuses critically on the sourcing of raw materials. Unlike conventional markets, the upstream segment here emphasizes certified sustainable and recycled inputs, ethical labor practices, and regenerative agricultural methods. This includes securing certifications for materials like organic cotton, responsibly managed forestry products (FSC certified), and recycled plastics (post-consumer resin - PCR). The inherent complexity and cost associated with verifying the sustainability claims at the raw material stage necessitate rigorous auditing, often supported by blockchain technology, to maintain supply chain integrity. Failures at this foundational stage can significantly jeopardize the final product's sustainable accreditation.

The midstream process involves sustainable manufacturing and logistics. Manufacturing must adhere to strict environmental standards, minimizing water and energy usage, reducing hazardous waste, and aiming for net-zero carbon operations. This includes investing in resource-efficient machinery and renewable energy sources for production facilities. Downstream Analysis encompasses the distribution channel, which is crucial for reducing the final product's carbon footprint. The distribution network involves optimizing supply chain logistics to minimize transportation emissions (e.g., using low-carbon shipping, localized manufacturing) and choosing appropriate sales channels—Direct and Indirect. Direct distribution through company-owned retail or D2C e-commerce platforms provides greater control over the presentation of the sustainability narrative and customer data collection, facilitating personalized engagement and loyalty programs.

Indirect distribution, primarily through large-scale supermarkets, third-party marketplaces, and department stores, relies heavily on transparent communication and effective merchandising to convey the product's sustainable attributes amidst competing conventional options. Crucially, the end-of-life stage, often considered part of the downstream process in sustainable value chains, is paramount. This includes establishing take-back programs, facilitating product repairability, and ensuring robust recycling infrastructure. A successful sustainable value chain is not linear but circular, requiring constant feedback loops between consumers, manufacturers, and raw material suppliers to maximize resource efficiency and minimize leakage into landfills.

Sustainable Products Market Potential Customers

The primary End-Users/Buyers of sustainable products span three major demographics: conscious consumers, proactive corporate procurement departments, and increasingly, mandated public sector organizations. Conscious consumers, particularly Millennials and Generation Z, represent a high-growth segment. These individuals are driven by alignment with personal values, prioritize transparency regarding environmental and social impacts, and are often willing to pay a premium for certified ethical and eco-friendly goods. They are heavy users of digital platforms for research and favor brands that authentically communicate their sustainability efforts, making them essential targets for D2C brands.

Corporate procurement departments within major B2B entities constitute another massive potential customer base. Driven by Environmental, Social, and Governance (ESG) mandates and investor pressure, these organizations are shifting purchasing towards sustainable alternatives for operational necessities, including IT equipment, facility management products, and logistics services. For large corporations, adopting sustainable products is not just an ethical choice but a strategic imperative to de-risk their supply chains, comply with reporting regulations, and enhance their overall corporate sustainability performance rating, thereby attracting sustainable finance and investment.

Finally, governmental bodies and public institutions, through green procurement policies, are significant buyers, especially in sectors like infrastructure, public transportation, and office supplies. Many nations and regional blocs, such as the EU and various state governments in North America, have established legal requirements mandating that public spending prioritize goods with verifiable lower environmental footprints. This segment offers stability and scale for sustainable product providers, as these contracts are typically large and long-term, further stabilizing the market and driving innovation toward meeting highly specific institutional sustainability metrics and compliance standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1,200.5 Billion USD |

| Market Forecast in 2033 | $2,450.8 Billion USD |

| Growth Rate | CAGR 10.5% ( Include CAGR 10.5% Word with % Value ) |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Unilever, Patagonia, Interface Inc., Tesla, Beyond Meat, IKEA, L'Oréal, Seventh Generation, BASF SE, EILEEN FISHER, Natura &Co, Adidas AG, HP Inc., ECOVATIVE DESIGN, Method Products. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sustainable Products Market Key Technology Landscape

The evolution of the Sustainable Products Market is inextricably linked to breakthroughs in material science, digital traceability, and resource efficiency technologies. Key among these is the development and scaling of bio-based and biodegradable materials, which directly address the global plastic waste crisis. Advancements in industrial biotechnology allow for the production of sustainable materials, such as polyhydroxyalkanoates (PHAs) derived from microbial fermentation, offering alternatives to fossil fuel-based polymers. Furthermore, technologies focusing on carbon capture and utilization (CCU) are transforming industrial emissions into usable products, providing a pathway toward circular production and a net-zero manufacturing footprint. These material innovations are critical because they enable sustainable product design without compromising performance or scaling capacity.

Digital technologies play a pivotal role in creating transparency and optimizing resource flows. The integration of Internet of Things (IoT) sensors and Artificial Intelligence (AI) in supply chain management facilitates real-time tracking of resource consumption, waste generation, and energy use across geographically dispersed operations. This data-driven approach is essential for accurate lifecycle assessment (LCA) and for building trust with consumers regarding the authenticity of sustainability claims. Furthermore, blockchain technology is increasingly adopted to create immutable records of ethical sourcing and material provenance, combating counterfeiting and ensuring compliance with stringent fair trade and environmental standards from the raw material supplier to the final point of sale.

Another crucial technological area is the advancement in resource recovery and circularity systems. High-efficiency sorting and recycling technologies, including advanced optical and robotic sorting machines, are significantly improving the quality and volume of recovered materials, feeding them back into the production loop. This is complemented by new chemical recycling processes capable of breaking down complex plastics into their molecular building blocks, enabling high-quality reuse that mechanical recycling often cannot achieve. These resource-focused technologies are the operational backbone necessary to transition the sustainable market from a linear model of production to a fully regenerative circular economy, maximizing the value retention of materials indefinitely.

Regional Highlights

The Sustainable Products Market exhibits distinct dynamics across key geographical regions, each contributing uniquely to global growth through regulatory frameworks, technological adoption, and consumer behavior. Europe, led by the European Union, remains the global regulatory benchmark. Initiatives like the EU Green Deal, Ecodesign requirements, and mandatory corporate sustainability reporting accelerate the transition away from resource-intensive products. This regulatory pressure fosters intense innovation, particularly in sustainable energy, circular economy models, and eco-friendly packaging, positioning Europe as a leading market for high-value sustainable solutions and premium ethical goods.

Asia Pacific (APAC) is forecast to be the fastest-growing region, driven by large populations, rapid industrialization, and escalating concerns over air and water quality. Governments in countries such as China, Japan, and South Korea are heavily investing in renewable energy infrastructure, green building projects, and electric vehicle production, creating massive demand for sustainable components and materials. While regulatory compliance can be uneven, the sheer scale of manufacturing in APAC makes the region crucial for scaling up sustainable production processes and developing cost-effective, sustainable alternatives for the global market.

North America, particularly the United States, is characterized by strong, consumer-led demand, especially for sustainable food, apparel, and personal care items. This market is highly dynamic, fueled by private sector initiatives, venture capital investment in green technology, and state-level policy innovations (e.g., California’s environmental standards). The market’s sustainability focus is often driven by corporate ESG goals and direct consumer engagement through branding and digital marketing, resulting in rapid adoption cycles for innovative sustainable products and services.

- Europe: Regulatory leadership; high consumer awareness; dominance in circular economy implementation; strong focus on energy transition and sustainable textiles.

- Asia Pacific (APAC): Highest growth rate; vast manufacturing capacity; significant government investment in green infrastructure; rising middle-class demand for sustainable consumables.

- North America: Strongest consumer-driven market (especially US); high VC investment in green technology; focus on sustainable food systems, electric mobility, and ethical sourcing.

- Latin America (LATAM): Growth driven by sustainable agriculture (organic farming, certified timber) and bio-based resource exploitation; regulatory focus on biodiversity protection.

- Middle East and Africa (MEA): Emerging market driven by large-scale governmental sustainability projects (e.g., NEOM in Saudi Arabia); increasing energy efficiency mandates and water management solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sustainable Products Market.- Unilever

- Patagonia

- Interface Inc.

- Tesla

- Beyond Meat

- IKEA

- L'Oréal

- Seventh Generation

- BASF SE

- EILEEN FISHER

- Natura &Co

- Adidas AG

- HP Inc.

- ECOVATIVE DESIGN

- Method Products

- Nestlé S.A.

- Puma SE

- Danone S.A.

- P&G (Procter & Gamble)

- Kimberly-Clark Corporation

Frequently Asked Questions

Analyze common user questions about the Sustainable Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Sustainable Products Market?

The Sustainable Products Market is projected to grow robustly at a CAGR of 10.5% between 2026 and 2033. This substantial growth is primarily driven by escalating global consumer demand for ethical goods and increasingly stringent environmental regulations, particularly across European and Asian markets, accelerating the shift towards eco-friendly alternatives across all sectors.

Which technologies are driving innovation in sustainable product development?

Key technological drivers include advanced material science innovations, such as bio-based polymers (e.g., PHAs) and recycled content integration, coupled with digital technologies like AI and blockchain. AI optimizes manufacturing resource use and logistics, while blockchain ensures radical transparency and traceability for ethical sourcing claims, effectively combating greenwashing concerns.

What are the main restraints hindering the mass adoption of sustainable products?

The primary restraints include the relatively higher initial production costs of sustainable materials and ethical manufacturing processes compared to conventional goods, creating a price premium that limits mass-market accessibility. Additionally, the lack of standardized global certifications and the prevalence of misleading 'greenwashing' claims continue to erode consumer trust, necessitating rigorous verification standards.

How is the circular economy concept impacting the Sustainable Products Market?

The circular economy is fundamentally reshaping the market by requiring products to be designed for longevity, repairability, and end-of-life material recovery, moving away from the linear "take-make-dispose" model. This shift drives innovation in product-as-a-service models and compels manufacturers to establish infrastructure for material take-back and recycling, enhancing resource efficiency and minimizing waste across the entire value chain.

Which geographical region holds the strongest potential for immediate sustainable product market growth?

While Europe leads in regulatory framework maturity, the Asia Pacific (APAC) region is projected to register the fastest market growth. This acceleration is fueled by massive government investments in green infrastructure, rapid urbanization, and a growing consumer base demanding solutions for severe localized environmental challenges, creating significant opportunities for scaling sustainable manufacturing and consumption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager