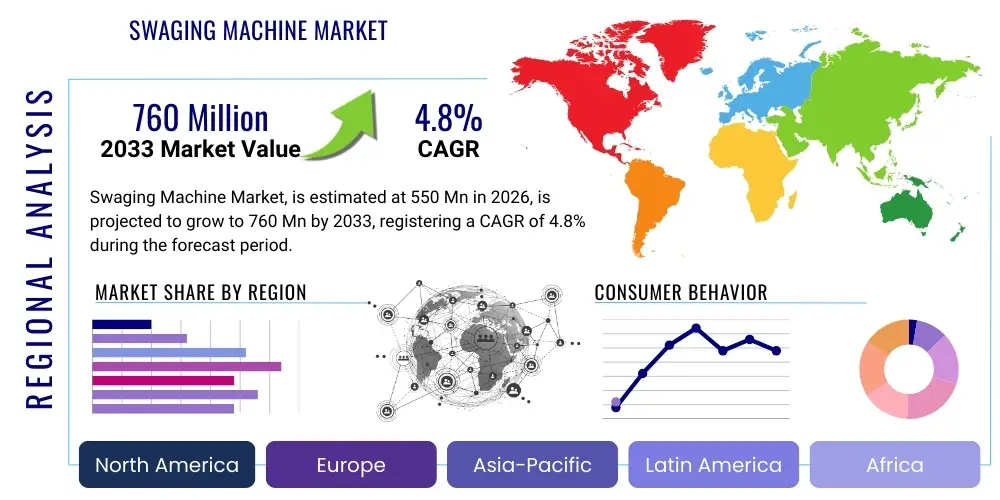

Swaging Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442326 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Swaging Machine Market Size

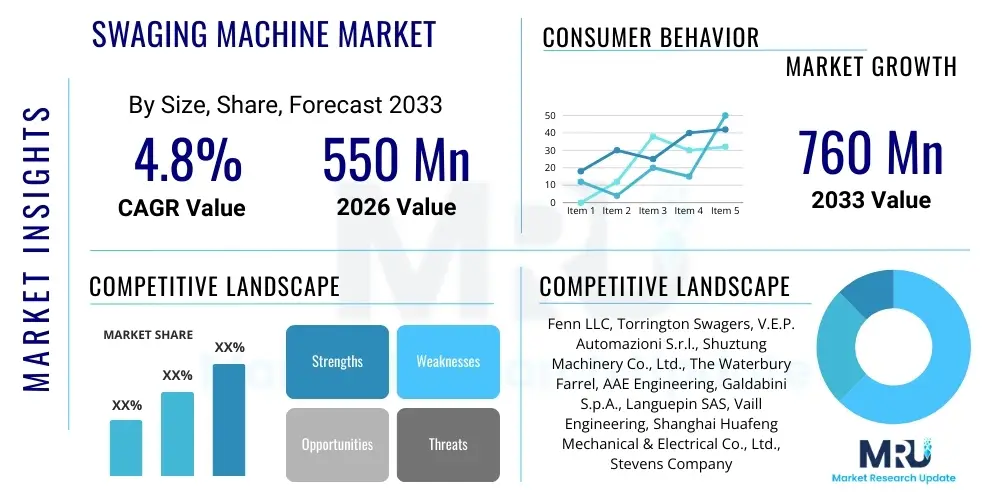

The Swaging Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. This robust growth is underpinned by increasing demand for precision components, particularly within the automotive, aerospace, and medical device sectors, which require superior material consistency and structural integrity achievable through the swaging process. The market is estimated at USD 550 Million in 2026, driven by continuous industrial modernization and the adoption of high-performance manufacturing techniques globally. The inherent efficiency of swaging—reducing the diameter of materials such as tubes, rods, or wires without significant material loss—positions it as a critical technology in modern metalworking operations, contributing significantly to its established valuation.

Market expansion is particularly noticeable in developing economies where rapid infrastructural and manufacturing build-out necessitates reliable component fabrication solutions. Furthermore, the shift towards automated and computer numerically controlled (CNC) swaging machines, offering higher repeatability and tighter tolerances, is contributing to the overall market valuation growth. These advanced machines reduce labor costs and waste, making swaging a more economically viable solution compared to alternative forming methods for high-volume production lines. The integration of advanced diagnostics and remote monitoring capabilities further enhances the appeal of new swaging equipment, supporting its projected market size.

Based on these pervasive industrial drivers and technological advancements, the Swaging Machine Market is projected to reach USD 760 Million by the end of the forecast period in 2033. This projection reflects an anticipated sustained investment in high-precision manufacturing processes, especially in sectors focused on lightweighting materials (such as aluminum and specialized alloys) crucial for energy efficiency and performance enhancement. The increasing complexity of component geometries demanded by next-generation technologies, including electric vehicle batteries and sophisticated medical instruments, cements the necessity and future financial growth trajectory of the swaging equipment sector.

Swaging Machine Market introduction

The Swaging Machine Market encompasses the manufacturing, distribution, and utilization of specialized machinery designed to reduce, taper, or form the diameter of tubes, rods, or wires by hammering or compressing the material within a die set. This cold-forming process improves the material's mechanical properties, enhancing surface finish, hardness, and tensile strength, which is vital for applications requiring high durability and precision. Products range from basic manual machines to highly sophisticated CNC-controlled rotary and fixed-die systems, catering to diverse production scales and material specifications across multiple industrial landscapes.

Major applications of swaging machines are concentrated in industries where component reliability is non-negotiable. In the automotive industry, swaging is extensively used for manufacturing steering columns, driveshafts, exhaust components, and fluid lines, ensuring leak-proof and durable connections. The aerospace sector leverages swaging for producing precision structural tubing and control rods, necessitating stringent tolerance adherence. Furthermore, the medical sector relies on micro-swaging for creating critical components like surgical instruments, catheters, and needles, where miniaturization and structural integrity are paramount. The inherent benefits of the swaging process include superior material grain structure preservation, minimal material waste, and the ability to achieve complex profiles efficiently.

Driving factors propelling the market include the global trend toward lightweighting in transportation to meet fuel efficiency standards, which requires precise forming of high-strength, thin-walled materials. The growth of the electric vehicle (EV) market demands new types of high-tolerance conductive components, often formed using swaging. Additionally, the rapid expansion of automated manufacturing facilities and the continuous need for complex, highly customized medical implants globally are sustaining high demand for advanced swaging technology. These machines offer unparalleled control over material deformation, making them indispensable for modern, high-specification manufacturing environments.

Swaging Machine Market Executive Summary

The Swaging Machine Market is witnessing a decisive shift towards automation and digitalization, driven by global mandates for increased production efficiency and reduced manufacturing variance. Key business trends include the rising prominence of CNC rotary swaging technology, which allows for dynamic adjustments and complex profile creation with minimal downtime. Manufacturers are increasingly integrating Industry 4.0 principles, embedding sensors and connectivity features into new machines to facilitate predictive maintenance, remote diagnostics, and seamless integration with broader enterprise resource planning (ERP) systems. This focus on intelligent manufacturing is crucial for maintaining competitiveness in regions with high labor costs and stringent quality requirements.

Regionally, Asia Pacific (APAC) stands as the dominant market shareholder, primarily fueled by massive expansion in the automotive, construction, and electronics manufacturing sectors in countries like China, India, and South Korea. North America and Europe, while mature markets, emphasize technological innovation, focusing investments on high-precision swaging for aerospace, defense, and specialized medical applications, where the cost of equipment is justified by the extremely high value and critical nature of the output components. Latin America and the Middle East & Africa (MEA) are emerging as high-growth regions, driven by localized infrastructure projects and the establishment of independent automotive supply chains, necessitating initial investments in robust metal-forming equipment.

Segment trends reveal that the Automatic/CNC operation segment is experiencing the fastest Compound Annual Growth Rate (CAGR), reflecting the industrial move away from manual operations to achieve superior consistency and throughput. Regarding application, the Automotive segment remains the largest consumer due to high volume requirements for fluid transmission and structural components, while the Medical segment exhibits the highest growth potential due to increasing global healthcare expenditure and the trend toward minimally invasive devices requiring micro-precision tubing. Furthermore, there is a distinct trend towards hydraulic swaging solutions for high-force applications and noise reduction, complementing traditional mechanical systems.

AI Impact Analysis on Swaging Machine Market

Common user questions regarding AI’s impact on the Swaging Machine Market frequently revolve around how artificial intelligence can enhance process precision, minimize material waste, and improve operational longevity. Users inquire about the practicality and cost-effectiveness of retrofitting existing analog machines with AI-driven monitoring systems, and they express concerns regarding data security, proprietary process knowledge protection, and the necessary skill evolution for machine operators. The prevailing expectations center on AI providing predictive failure analysis for critical components like dies and spindles, optimizing setup parameters for novel materials, and utilizing machine vision to ensure instantaneous, non-destructive quality checks of finished components, thereby eliminating human error in quality assurance cycles and driving throughput efficiency.

The integration of AI algorithms facilitates advanced process optimization far beyond traditional statistical process control (SPC). Machine learning models analyze thousands of data points related to vibration, temperature, acoustic emissions, and motor load during the swaging cycle. By correlating these variables with eventual product quality and material characteristics, AI systems can automatically adjust feed rates, die closure pressure, and cycle time in real-time. This dynamic adjustment capability is particularly crucial when processing high-strength or exotic alloys, ensuring optimal material flow and minimizing the risk of defects like internal fracturing or surface imperfections. Such intelligent control dramatically increases the yield rate, especially in high-cost, zero-defect environments like aerospace manufacturing.

Furthermore, AI significantly enhances the maintenance lifecycle of swaging equipment. Traditional maintenance is often reactive or time-based, leading to unexpected failures or premature component replacement. AI-driven predictive maintenance utilizes deep learning models to forecast remaining useful life (RUL) of critical components, such as die sets and spindle bearings, based on anomaly detection in operational data. This transition to condition-based monitoring minimizes unplanned downtime, extends the life of expensive tooling, and allows maintenance schedules to be optimized for minimal disruption to production schedules. The implementation of AI is therefore viewed not just as an efficiency booster but as a strategic asset for maximizing operational uptime and reducing total cost of ownership (TCO) for swaging machinery.

- AI enables real-time, adaptive process parameter control, optimizing material flow and reducing forming defects.

- Machine learning models drive predictive maintenance programs, forecasting component failure and minimizing unplanned downtime (RUL analysis).

- AI-powered vision systems facilitate instantaneous, high-precision quality inspection, ensuring zero-defect output compliance.

- Data analytics platforms optimize tooling design and material selection by analyzing historical performance data across different swaging operations.

- Autonomous scheduling and load balancing algorithms improve overall factory floor efficiency and machine utilization rates.

DRO & Impact Forces Of Swaging Machine Market

The dynamics of the Swaging Machine Market are complex, dictated by a confluence of strong industrial drivers, significant capital restraints, and technological opportunities shaping long-term adoption. The primary drivers stem from the global necessity for lightweight, high-performance components across automotive and aerospace industries, necessitating precision cold forming methods that maintain structural integrity while reducing weight. Restraints primarily involve the substantial initial capital investment required for high-precision CNC swaging machinery and tooling, coupled with the need for highly specialized, skilled labor to operate and maintain these complex systems. Opportunities lie in the exploitation of emerging industrial regions, the processing of next-generation materials like superalloys and advanced composites, and the aggressive pursuit of full automation integration through IoT and AI technologies.

Key impact forces governing the market include intensified competition among leading manufacturers who are constantly vying to introduce higher speed, higher force, and more energy-efficient machines. Regulatory pressures, particularly those related to safety standards and environmental impact (e.g., noise reduction and lubrication management), force manufacturers to continually innovate machine design. Furthermore, the cyclical nature of end-user industries, such particularly the automotive and general manufacturing sectors, exerts a strong influence on capital expenditure cycles for new machinery purchases. Geopolitical stability and global trade policies also significantly impact cross-border supply chains for both the machines themselves and the raw materials they process, acting as potent external forces.

The most compelling opportunity lies in expanding the capabilities of swaging beyond traditional metal forming. Research into hydroforming swaging, which uses fluid pressure alongside mechanical force, offers the potential for creating even more complex and precise internal geometries, opening doors to new applications in micro-robotics and advanced heat exchange systems. Market players are strategically positioning themselves to offer modular, reconfigurable swaging cells that can be quickly adapted to different component specifications, appealing to smaller-scale manufacturers and research facilities. Addressing the high skill barrier through simplified, AI-assisted interfaces and advanced simulation software remains a critical internal opportunity for sustained market penetration.

Segmentation Analysis

The Swaging Machine Market is comprehensively segmented based on machine type, operational capability, the specific end-user application, and the geometry of the material processed. Analyzing these segments provides a nuanced understanding of market maturity, technological adoption rates, and regional demand dynamics. The segmentation by Type, specifically distinguishing between Rotary and Fixed Die systems, reflects differences in complexity, output speed, and the precision required for the final product. Operational segmentation (Manual, Semi-Automatic, Automatic/CNC) directly mirrors the industrial shift toward high-volume, repeatable manufacturing processes demanding minimal human intervention and maximum consistency, driven largely by cost-efficiency measures in developed economies. Application-based segmentation highlights the sectors driving demand, confirming the dominance of the Automotive industry while recognizing the high-growth trajectory of specialized fields like Medical devices and Aerospace components. This granular view is essential for strategic planning and resource allocation for equipment manufacturers and suppliers.

- By Type:

- Rotary Swaging Machines

- Fixed Die Swaging Machines (often used for tube end forming)

- Hydraulic Swaging Machines

- By Operation:

- Manual

- Semi-Automatic

- Automatic/CNC

- By Application:

- Automotive Industry (e.g., driveshafts, steering components)

- Aerospace & Defense (e.g., structural tubing, flight control rods)

- Medical Devices (e.g., needles, catheters, surgical instruments)

- Construction & Infrastructure

- Electrical & Electronics (e.g., terminals, connection pins)

- By End-Use Product Geometry:

- Tube Swaging

- Rod Swaging

- Wire Swaging

Value Chain Analysis For Swaging Machine Market

The value chain for the Swaging Machine Market begins with the Upstream Analysis, which involves the procurement of highly specialized raw materials, predominantly high-grade steel alloys, precision bearings, hydraulic components, and advanced electronic control systems (PLCs, CNC units). Manufacturers of swaging equipment rely heavily on reliable, high-quality suppliers for these components, as the performance and longevity of swaging machines are directly dependent on the mechanical resilience and precision of their core parts, such as the spindle and die housing. Specialized tooling manufacturers form a crucial part of the upstream segment, providing the customized dies essential for unique customer requirements, thus maintaining a co-dependent relationship with the machine builders.

The midstream process involves the complex assembly, integration, calibration, and testing of the swaging equipment. Swaging machine manufacturers focus on integrating cutting-edge technologies, including advanced CNC controls, simulation software, and increasingly, AI-driven monitoring systems, ensuring the machines meet stringent industry tolerances, particularly for aerospace and medical applications. Distribution channels are varied: Direct sales models are often employed for large, custom-built CNC machines, allowing for detailed consultation and installation support, while smaller, standard semi-automatic machines may utilize Indirect channels through specialized industrial equipment distributors, agents, and local technical service providers who handle regional market penetration and after-sales support.

The Downstream Analysis culminates with the end-users—large automotive Tier 1 suppliers, specialized medical device manufacturers, and aerospace component fabricators. The value chain extends beyond the initial sale to encompass comprehensive after-sales services, including maintenance contracts, spare parts supply (especially consumable dies and tooling), operator training, and technological upgrades. Customer retention is heavily reliant on the quality and responsiveness of these downstream services, as machine downtime in high-volume production environments is prohibitively expensive. This emphasis on service transforms the machine sale into a long-term partnership focused on maximizing operational efficiency for the client.

Swaging Machine Market Potential Customers

Potential customers and primary buyers within the Swaging Machine Market are predominantly large-scale manufacturing enterprises requiring high precision and volume production of metal components with reduced diameter or specific formed ends. The largest segment of end-users are the Tier 1 and Tier 2 suppliers within the Automotive Industry, who utilize swaging for mass production of items like steering shaft components, exhaust system pipes, and hydraulic and fuel lines. These customers demand highly reliable, automatic CNC machines capable of integration into existing assembly lines with minimal fluctuation in output quality over millions of cycles. The need for vehicle lightweighting ensures sustained investment from this sector.

The second major cohort includes manufacturers specializing in high-value, low-volume components, most notably in the Aerospace & Defense sector and the Medical Device industry. Aerospace companies require specialized fixed-die swaging equipment for forming high-strength, thin-walled tubing and fittings, where safety and material integrity are paramount, justifying the purchase of custom, high-cost machinery. Medical device manufacturers, particularly those producing catheters, hypodermic needles, and endoscopic instruments, require micro-swaging capabilities for extreme precision in handling ultra-fine materials like nitinol and stainless steel, demanding machines with highly sophisticated micro-adjustment capabilities and cleanroom compatibility.

Other significant potential buyers include electrical component manufacturers utilizing swaging for forming cable terminals and connection pins, as well as general industrial machinery fabricators who use swaging for forming tool handles and structural elements. For all these end-users, the decision to invest in a swaging machine is driven by the need to achieve superior mechanical properties—such as increased fatigue strength and better surface finish—that are difficult or impossible to achieve cost-effectively through alternative machining processes, making them indispensable strategic capital investments for sustained competitive advantage.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 760 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fenn LLC, Torrington Swagers, V.E.P. Automazioni S.r.l., Shuztung Machinery Co., Ltd., The Waterbury Farrel, AAE Engineering, Galdabini S.p.A., Languepin SAS, Vaill Engineering, Shanghai Huafeng Mechanical & Electrical Co., Ltd., Stevens Company, M.T.A. Srl, A & E Engineering, K&H Engineering, Lasco Umformtechnik GmbH, HMP Forging Equipment, RMC Corporation, Zani S.p.A., SACMA Limbiate S.p.A., Jiangsu Jinyun CNC Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Swaging Machine Market Key Technology Landscape

The Swaging Machine Market is characterized by continuous technological evolution aimed at enhancing precision, increasing energy efficiency, and reducing operational noise. A core technology is the integration of advanced Computer Numerical Control (CNC) systems, replacing older hydraulic or pneumatic controls. Modern CNC swagers offer multi-axis control, allowing for complex internal and external profile formation and precise adjustments to stroke depth and cycle speed. This precision is critical for industries requiring components with extremely tight tolerances, such as those used in aviation and advanced fluid dynamics applications. Furthermore, the incorporation of closed-loop feedback systems using high-resolution sensors ensures immediate adjustments, compensating for minor variations in material properties or temperature, guaranteeing superior component consistency across large batches. These innovations make modern swaging viable for high-value applications where rejection rates must be near zero.

Another pivotal technological advancement is the focus on hydrostatic and hydroforming swaging techniques. Unlike traditional mechanical swaging which relies solely on physical die compression, hydrostatic swaging utilizes pressurized fluid to assist in the deformation process. This methodology results in a more uniform material flow and stress distribution, significantly reducing the risk of material cracking or excessive work hardening, particularly beneficial when working with difficult-to-form alloys like titanium or specialty stainless steels. Furthermore, manufacturers are heavily investing in developing modular tooling and quick-change die systems. This technological streamlining drastically reduces machine setup time (a significant restraint in traditional swaging), allowing manufacturers to rapidly switch production between different component geometries, thereby maximizing machine utilization and facilitating smaller, customized batch runs favored by medical and specialized industrial sectors.

In line with Industry 4.0 trends, the latest swaging machines are equipped with sophisticated Internet of Things (IoT) capabilities. This includes embedded connectivity for real-time remote monitoring, data logging, and integration with cloud-based diagnostic platforms. Predictive maintenance algorithms, often leveraging AI and machine learning, analyze operational data streams (vibration, temperature, power consumption) to anticipate potential component failures, thereby optimizing maintenance scheduling and minimizing expensive unplanned downtime. Energy recovery systems, which capture and reuse energy generated during the deceleration phase of the machine cycle, represent a growing technological focus, addressing the market’s need for more sustainable and cost-effective high-force manufacturing solutions, ultimately enhancing the overall technological sophistication and economic feasibility of modern swaging operations.

Regional Highlights

The market dynamics of swaging machines vary significantly across major global regions, influenced by localized manufacturing footprints, regulatory environments, and capital investment rates. Asia Pacific (APAC) holds the largest market share and is expected to maintain the highest growth trajectory, driven primarily by the colossal production volumes required by the automotive and electronics manufacturing hubs in China, India, and Southeast Asia. These regions prioritize the procurement of high-speed, automatic swaging machinery to meet aggressive production schedules and supply global value chains. Government initiatives supporting infrastructure development and domestic manufacturing further stimulate demand for general-purpose swaging equipment in APAC.

North America and Europe represent mature markets characterized by a high demand for technologically advanced, high-precision swaging solutions. In these regions, the primary application drivers are the stringent quality requirements of the aerospace, defense, and specialized medical device industries. European manufacturers often lead innovation in energy-efficient and noise-reduced swaging systems to comply with strict regional environmental and workplace safety regulations. The focus here is less on sheer volume and more on technical capability, material specialization (e.g., lightweight alloys and superalloys), and seamless integration into automated production lines using advanced software interfaces.

Latin America (LATAM) and the Middle East & Africa (MEA) are characterized by lower market maturity but strong emerging potential. Growth in LATAM is closely tied to the resurgence of regional automotive production and infrastructure modernization projects, driving demand for robust, reliable semi-automatic and basic rotary swaging machines. In MEA, particularly the Gulf Cooperation Council (GCC) nations, diversification efforts away from oil economies into general manufacturing, defense, and specialized construction projects are catalyzing initial investments in foundational metal forming equipment, creating new opportunities for manufacturers capable of offering comprehensive technical support and installation services in these developing industrial landscapes.

- Asia Pacific (APAC): Dominant market share; highest growth driven by high-volume automotive, electronics, and construction manufacturing in China and India.

- North America: Focus on high-precision CNC swaging for demanding Aerospace, Defense, and specialized industrial component applications, emphasizing automation integration.

- Europe: Mature market prioritizing technological innovation, regulatory compliance (noise/energy efficiency), and high-specification swaging for automotive and medical sectors.

- Latin America (LATAM): Emerging growth market driven by localized automotive manufacturing resurgence and essential infrastructure development projects.

- Middle East & Africa (MEA): Developing market, with initial investment spurred by economic diversification efforts into specialized manufacturing and localized defense production.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Swaging Machine Market.- Fenn LLC

- Torrington Swagers

- V.E.P. Automazioni S.r.l.

- Shuztung Machinery Co., Ltd.

- The Waterbury Farrel

- AAE Engineering

- Galdabini S.p.A.

- Languepin SAS

- Vaill Engineering

- Shanghai Huafeng Mechanical & Electrical Co., Ltd.

- Stevens Company

- M.T.A. Srl

- A & E Engineering

- K&H Engineering

- Lasco Umformtechnik GmbH

- HMP Forging Equipment

- RMC Corporation

- Zani S.p.A.

- SACMA Limbiate S.p.A.

- Jiangsu Jinyun CNC Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Swaging Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between Rotary Swaging and Fixed Die Swaging?

Rotary swaging utilizes multiple dies revolving around the workpiece, providing uniform, concentric reduction suitable for continuous materials like wires or long rods. Fixed die swaging involves compressing the material end-on using stationary dies, typically used for forming tube ends, fittings, or precise tapers on specific sections, offering high force and structural integrity at the formed point.

Which industrial application drives the highest demand for Swaging Machines globally?

The Automotive Industry consistently generates the highest volume demand for swaging machines. This is due to the extensive requirement for high-tolerance, structurally sound components such as steering columns, fluid transmission lines, and various complex tube assemblies essential for vehicle function and safety standards.

How is CNC technology transforming the efficiency of modern Swaging Machines?

CNC technology enhances efficiency by providing precise, multi-axis control over the swaging process, allowing for automated parameter adjustments, reducing setup time, and ensuring superior component consistency. This automation minimizes reliance on highly skilled operators and enables complex component geometries to be formed with high repeatability, crucial for high-volume manufacturing.

What is the typical lifespan and required maintenance for Swaging Machine tooling (dies)?

The lifespan of swaging dies varies widely based on the material being processed (hardness), the degree of reduction, and operational speed. Dies are consumable tooling, generally made of high-speed steel or carbide. Required maintenance involves regular inspection for cracking or wear, timely replacement, and ensuring optimal lubrication cycles to maximize their operational life and maintain product quality.

What role does Swaging play in the rapidly growing Medical Device manufacturing sector?

Swaging is critical in the Medical Device sector for precision forming and tapering of miniature components, including catheter tips, hypodermic needle shafts, and surgical instrument parts. It ensures the necessary smooth transitions, precise diameters, and enhanced material strength required for minimally invasive and life-critical medical applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager