Sweet Paprika Powder Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440889 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Sweet Paprika Powder Market Size

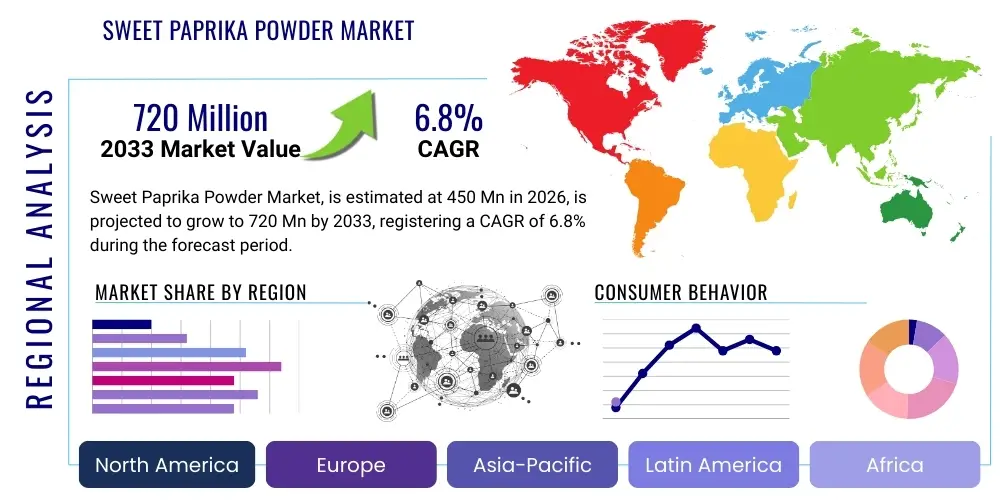

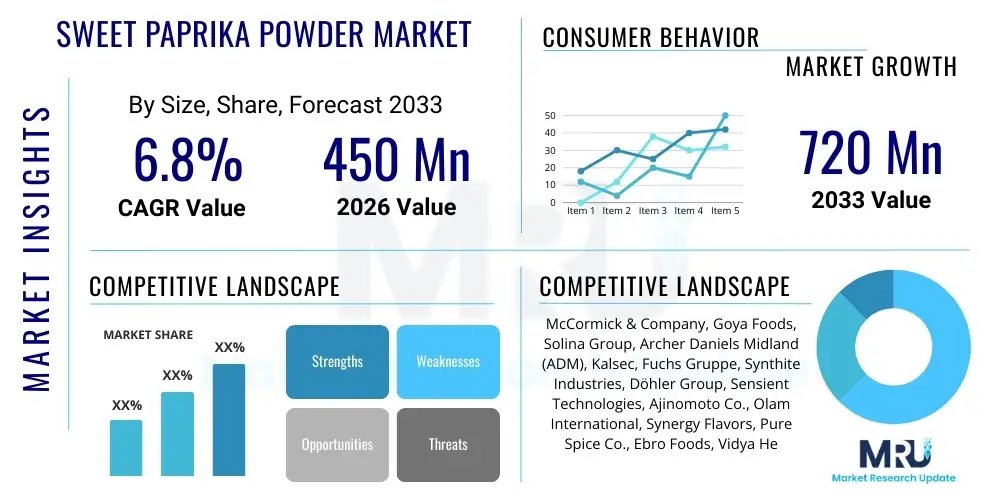

The Sweet Paprika Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 720 Million by the end of the forecast period in 2033.

Sweet Paprika Powder Market introduction

The Sweet Paprika Powder Market encompasses the production, distribution, and utilization of finely ground sweet peppers (Capsicum annuum L.) characterized by their mild flavor and vibrant red color. This spice, often distinguished from hot varieties by its low capsaicin content, serves primarily as a coloring agent and flavor enhancer in global cuisine. Major applications span across the Food and Beverage industry, including meat processing, ready meals, sauces, and snacks, where it provides both aesthetic appeal and a subtle, distinctive taste profile. The inherent properties of sweet paprika, such as its natural colorants (carotenoids) and potential health benefits (antioxidants), further solidify its position as a high-value ingredient.

Product descriptions typically highlight key metrics such as ASTA (American Spice Trade Association) color units, grind size, and geographical origin, with Spanish, Hungarian, and Californian varieties being highly sought after for their specific quality characteristics. The market benefits significantly from the global trend favoring natural food colorants over synthetic alternatives, coupled with rising consumer interest in ethnic and international cuisines that heavily feature paprika. Moreover, the increasing demand from industrialized food production processes, which require consistent, high-quality bulk ingredients, acts as a primary driving factor for market expansion.

Key applications extend beyond basic seasoning; sweet paprika powder is critical in industrial operations for achieving standardized product appearance, particularly in processed meats like sausages and ham, and in seasoning blends for potato chips and extruded snacks. The market structure involves complex supply chains starting from agricultural cultivation in key growing regions, progressing through drying, grinding, sterilization, and final distribution to B2B clients and B2C channels. This sophisticated supply chain, supported by stringent quality and safety standards, is vital for ensuring the consistent quality required by major food manufacturers worldwide.

Sweet Paprika Powder Market Executive Summary

The Sweet Paprika Powder Market is poised for robust growth driven by accelerating demand for clean label ingredients and natural food colorants across established and emerging economies. Business trends indicate a strong focus on supply chain resilience, vertical integration among major spice houses, and the adoption of advanced drying and grinding technologies to preserve color stability and nutritional integrity. Strategic partnerships between large-scale food processors and paprika suppliers are becoming commonplace, aimed at securing consistent, certified organic and non-GMO sources. Furthermore, product innovation is centered on developing high-ASTA varieties and specialty powders tailored for specific applications, such as oil-soluble or water-dispersible formulations, enhancing their utility in complex food matrixes.

Regional trends reveal Asia Pacific (APAC) as the fastest-growing market, primarily fueled by rapid urbanization, Westernization of diets, and significant expansion of the processed food industry, especially in China and India. North America and Europe, while mature, maintain dominant market shares due to high consumption rates in convenience foods and stringent regulatory environments favoring natural ingredients. European demand is heavily influenced by Mediterranean culinary trends and the strong heritage of paprika use in countries like Spain and Hungary. Meanwhile, technological advancements in Middle Eastern and Latin American countries are enabling localized production and reducing reliance on imports, fostering self-sufficiency and driving regional market complexity.

Segment trends highlight the premiumization of the organic sweet paprika powder category, which commands higher prices and appeals to health-conscious consumers and high-end food manufacturers. Application-wise, the Ready Meals and Snacks segments are projected to experience the highest growth, necessitating bulk supply of flavor-consistent, deeply pigmented powder. Distribution channel analysis confirms the continued dominance of the B2B segment, reflecting the industrial scale of application, though online retail is rapidly gaining traction in the B2C space, providing niche producers direct access to consumers seeking gourmet or ethically sourced spices. Controlling quality consistency—specifically the color, flavor, and microbial load—remains the overarching challenge shaping competitive strategy across all segments.

AI Impact Analysis on Sweet Paprika Powder Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Sweet Paprika Powder Market frequently center on efficiency gains in agricultural yield prediction, optimization of processing parameters, and enhancing supply chain transparency to meet traceability demands. Key user concerns revolve around whether AI can reliably predict harvest quality (measured by ASTA color units) before processing, and how machine learning algorithms can minimize waste during drying and grinding, processes critical for maintaining product value. There is significant interest in using AI for advanced quality control, automating the detection of contaminants or adulteration, which is a major regulatory concern. Users also seek clarity on AI's role in consumer trend analysis, specifically in forecasting demand shifts toward specific paprika varieties or applications, enabling producers to better align their crop planning and inventory management strategies, thereby mitigating market volatility and improving operational profitability.

- AI-driven predictive analytics optimizes harvesting schedules to maximize ASTA color and yield.

- Machine Learning models enhance supply chain traceability from farm to factory, improving compliance.

- Automated visual inspection systems (using computer vision) detect impurities and grade powder quality instantly.

- AI optimizes drying and sterilization processes to minimize energy consumption and preserve color stability.

- Natural Language Processing (NLP) tools analyze global culinary trends and consumer reviews to inform product innovation.

- Advanced algorithms forecast regional demand shifts, aiding inventory management and reducing spoilage risk.

DRO & Impact Forces Of Sweet Paprika Powder Market

The Sweet Paprika Powder Market is significantly influenced by a confluence of accelerating drivers (D), structural restraints (R), and latent opportunities (O), creating complex impact forces that shape investment decisions and competitive dynamics. Key drivers include the global shift towards natural food coloring agents, driven by consumer skepticism regarding synthetic additives and tightening regulatory standards in developed markets, which inherently favors natural alternatives like paprika oleoresin and powder. Additionally, the proliferation of globalized cuisines, particularly Mediterranean and Tex-Mex, ensures a continuous and expanding baseline demand for sweet paprika as a fundamental ingredient. However, market growth is constrained by the inherent vulnerability of the primary crop (sweet peppers) to unpredictable climate change, which causes extreme volatility in yield and quality, thereby destabilizing supply and pricing. Furthermore, the risk of adulteration or substitution with cheaper, lower-quality powders poses a consistent threat to brand integrity and requires substantial investment in advanced testing and certification protocols.

Opportunities for market expansion are substantial, primarily focusing on product innovation, such as the development of specialty, high-pigment paprika varieties specifically engineered for applications like pet food and cosmetics, extending the product’s traditional reach. Furthermore, establishing robust, certified organic supply chains offers premium pricing potential and caters to the burgeoning niche of discerning industrial buyers. The principal impact forces affecting the market structure are the rising input costs (energy, labor, water) impacting processing margins, and increasing regulatory scrutiny on food safety, particularly concerning heavy metals and pesticide residues, which compels manufacturers to invest in state-of-the-art cleaning and sterilization technologies. The balance between maintaining a high, consistent ASTA score and ensuring microbial safety often dictates the required capital expenditure and technological sophistication of processing facilities.

The delicate equilibrium between market forces means that companies focused on vertical integration and technological superiority in post-harvest handling are best positioned for long-term growth. Restraints related to high upfront investment in advanced sterilization techniques, such as steam sterilization or gamma irradiation, can deter smaller players. However, these techniques are essential for meeting the stringent import requirements of Europe and North America, effectively acting as high barriers to entry. The increasing consumer awareness regarding sustainable sourcing and ethical labor practices adds another layer of complexity, transforming supply chain transparency from a niche opportunity into a critical requirement for maintaining market access and enhancing brand reputation in competitive global landscapes.

Segmentation Analysis

The Sweet Paprika Powder Market is comprehensively segmented based on its source type (conventional versus organic), its functional application across various industries, and the distribution channels utilized to reach end-users. This segmentation allows for precise market sizing and strategic targeting, recognizing that the demands and pricing sensitivities vary significantly across categories. The Organic segment, while smaller in volume, exhibits significantly higher revenue growth due to strong consumer preference for clean-label, residue-free ingredients, particularly in Western markets. Conversely, the Conventional segment dominates volume, serving the majority of large-scale industrial food manufacturing operations where cost efficiency is paramount alongside quality consistency. Detailed analysis of these segments reveals heterogeneous growth vectors across different geographical regions and end-use sectors, necessitating tailored market penetration strategies.

- By Type:

- Conventional Sweet Paprika Powder

- Organic Sweet Paprika Powder

- By Application:

- Food & Beverage (F&B)

- Snacks and Seasoning Blends

- Sauces & Dressings

- Meat Products and Processed Foods

- Ready Meals and Soups

- Cosmetics and Personal Care

- Pharmaceuticals and Nutraceuticals

- By Distribution Channel:

- Business-to-Business (B2B) Sales (Direct Industrial Supply)

- Business-to-Consumer (B2C) Sales

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail and Specialty Stores

Value Chain Analysis For Sweet Paprika Powder Market

The Sweet Paprika Powder value chain begins upstream with specialized agriculture—the cultivation and harvesting of high-quality sweet pepper varieties, which demands precise climate control, specific soil conditions, and often intensive farming practices. This stage is crucial as the quality of the raw material (measured in ASTA color units) dictates the final product's market value. Upstream activities also include post-harvest drying, which must be carefully managed to prevent microbial growth and maximize color retention, often utilizing modern controlled environment dryers. Suppliers at this stage range from small family farms to large, contract-based agricultural cooperatives, making input procurement a highly fragmented and geographically dependent activity.

The midstream processing phase involves rigorous sorting, cleaning, grinding, and crucially, sterilization (often via steam or heat treatment) to meet global food safety standards. Major spice processors and ingredient manufacturers dominate this stage, utilizing highly specialized machinery to achieve fine, consistent particle sizes and guaranteed microbial specifications. This processing transforms the raw, bulky material into a standardized, high-value powder or oleoresin, ready for industrial use. Efficiency in processing, especially concerning energy consumption and waste reduction, is a key competitive differentiator, influencing the final cost structure significantly.

Downstream analysis focuses on distribution and the end-user markets. Distribution channels are predominantly B2B, where large shipments move directly from processors to industrial clients in the processed food sector (meat packers, snack manufacturers). The indirect channel, serving the retail B2C market, relies on global logistics providers, distributors, and ultimately, modern retail outlets and e-commerce platforms. The trend towards direct sourcing for organic and specialty powders is streamlining the supply chain, though the bulk of the market still relies on a multi-tiered distribution network. End-users, including industrial food giants, prioritize large-volume consistency and certification, while retail consumers focus more on brand reputation, origin, and organic status.

Sweet Paprika Powder Market Potential Customers

Potential customers for Sweet Paprika Powder are highly diversified, encompassing industrial food manufacturers, specialized nutraceutical companies, and the vast retail consumer base. The largest volume buyers reside within the industrial sector, particularly companies involved in meat processing, where paprika acts as a vital colorant and flavor agent in products ranging from sausages and deli meats to marinades and rubs. Furthermore, global snack food giants and ready-meal producers constitute a rapidly expanding customer base, relying on sweet paprika for flavoring and visual appeal in products designed for mass market consumption and requiring consistent quality at high volumes. Their purchasing decisions are heavily weighted by factors such as guaranteed ASTA rating, bulk pricing, and adherence to international food safety certifications, such as GFSI-recognized schemes.

Beyond the core food sector, the cosmetics industry represents a growing niche for high-quality, often organic, sweet paprika extracts and powder, leveraging its natural coloring properties as an alternative to synthetic dyes in lipsticks, blushes, and other personal care products. Similarly, the nutraceutical and pharmaceutical segments utilize paprika's carotenoids (e.g., capsorubin, capsanthin) and high antioxidant content for functional food supplements aimed at eye health and general wellness. These specialized buyers demand superior purity, often necessitating pharmaceutical-grade processing standards and highly detailed compositional analysis, making them a high-margin customer segment for specialized suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 720 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | McCormick & Company, Goya Foods, Solina Group, Archer Daniels Midland (ADM), Kalsec, Fuchs Gruppe, Synthite Industries, Döhler Group, Sensient Technologies, Ajinomoto Co., Olam International, Synergy Flavors, Pure Spice Co., Ebro Foods, Vidya Herbs, Chr. Hansen, Naturex (Givaudan), ABF Ingredients |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sweet Paprika Powder Market Key Technology Landscape

The technological landscape within the Sweet Paprika Powder market is dominated by processes designed to maximize color preservation, extend shelf life, and ensure microbial safety. A foundational technology involves advanced drying systems, such as low-temperature belt dryers or vacuum drying, which minimize thermal degradation of capsorubin and capsanthin—the primary color compounds—thus ensuring high ASTA values in the final product. Furthermore, the use of cryogenic grinding, while more expensive, is increasingly adopted by premium suppliers. This technique uses liquid nitrogen to cool the dried peppers before grinding, preventing the heat generated during the grinding process from causing loss of volatile flavor compounds and color oxidation, resulting in a superior quality powder sought after by high-end food manufacturers and specialty spice blenders.

Sterilization is a critical technological focus, driven by stringent global food safety standards demanding extremely low microbial loads. Key methods include validated steam sterilization, which effectively reduces bacterial pathogens and spores without severely impacting sensory qualities, and increasingly, non-thermal technologies such as high-pressure processing (HPP) or e-beam/gamma irradiation, particularly when exporting to regions with strict import controls like the European Union. These advanced sterilization protocols require significant capital investment but are essential for market access and mitigating the risk of product recalls, positioning them as non-negotiable technologies for major international suppliers.

Beyond processing, traceability and quality assurance technologies are rapidly gaining prominence. Spectrophotometry and High-Performance Liquid Chromatography (HPLC) are standard analytical techniques used to measure ASTA color units and detect potential adulteration or unauthorized additives. Furthermore, the integration of blockchain technology is emerging as a novel way to document the entire supply chain, from seed variety and farm location to processing batch and sterilization records. This enhanced transparency, enabled by digital platforms, addresses the growing industrial and consumer demand for verifiable origin and sustainability credentials, differentiating technologically advanced suppliers in a highly competitive global commodity market.

Regional Highlights

- North America (USA, Canada, Mexico): North America represents a mature, high-value market characterized by robust demand from the processed food industry, particularly in the ready meals and snack sectors. The US is the largest consumer, driven by fast-paced lifestyles and a large Hispanic consumer base heavily utilizing paprika in seasoning blends. Regulatory standards, especially concerning food safety and organic certification, are extremely rigorous, favoring suppliers capable of providing consistent, sterilized products. The region is increasingly adopting paprika oleoresin alongside powder, reflecting the shift towards highly concentrated coloring solutions in industrial applications.

- Europe (Germany, UK, France, Spain, Hungary): Europe holds a dominant position in both consumption and specialized production (e.g., Spanish and Hungarian varieties). Demand is anchored in the region's strong culinary heritage, requiring high-quality, geographically specific paprika. Stringent EU regulations (especially concerning pesticide residues and heavy metals) mandate advanced processing and testing technologies, driving market premiumization. Spain remains a critical global exporter, investing heavily in modern irrigation and processing to maintain its competitive edge in quality.

- Asia Pacific (APAC) (China, India, Japan, Australia): APAC is projected to be the fastest-growing region, propelled by soaring urbanization, the expansion of local and international fast-food chains, and rapidly increasing middle-class disposable incomes leading to higher consumption of processed and convenience foods. While traditionally a minor consumer of sweet paprika, the adoption of Westernized flavor profiles and the immense scale of the regional food manufacturing sector are creating unprecedented demand. China and India are focal points for investment, although supply chain infrastructure remains a challenge compared to North America and Europe.

- Latin America (Brazil, Argentina): Latin America is an important cultivation region, particularly parts of Brazil and Peru, but consumption is focused primarily on domestic and intra-regional markets. Market growth is being supported by improved local processing capabilities and increasing exports to the US. Economic volatility often impacts consumer spending on non-essential, imported food items, but the robust growth of the domestic packaged food industry provides a stable baseline for industrial demand.

- Middle East and Africa (MEA): The MEA region is characterized by fragmented demand, heavily reliant on imports, particularly within the Gulf Cooperation Council (GCC) states due to favorable logistical hubs and high consumer purchasing power. Growth is linked to the development of modern retail infrastructure and the rise of local food processing aimed at reducing reliance on global supply chains. Demand is sensitive to global commodity pricing, but the region shows potential for high-quality, natural coloring agents in the rapidly developing packaged goods sector.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sweet Paprika Powder Market.- McCormick & Company

- Goya Foods

- Solina Group

- Archer Daniels Midland (ADM)

- Kalsec

- Fuchs Gruppe

- Synthite Industries

- Döhler Group

- Sensient Technologies

- Ajinomoto Co.

- Olam International

- Synergy Flavors

- Pure Spice Co.

- Ebro Foods

- Vidya Herbs

- Chr. Hansen

- Naturex (Givaudan)

- ABF Ingredients

Frequently Asked Questions

Analyze common user questions about the Sweet Paprika Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Sweet Paprika Powder Market?

The market growth is primarily driven by the rising global preference for natural food colorants and flavorings over synthetic additives, coupled with the significant expansion of the processed food, snacks, and ready meals industries worldwide. Increased consumer interest in ethnic and Mediterranean cuisines also contributes substantially to sustained demand.

How is the quality of Sweet Paprika Powder typically measured in the industry?

Quality is predominantly measured using the ASTA (American Spice Trade Association) color unit system, which quantifies the intensity of the red pigment (carotenoids). Higher ASTA values indicate superior coloring strength, translating directly into premium pricing and desirability for industrial applications.

Which geographical region holds the largest market share for Sweet Paprika Powder?

Europe currently holds the largest market share, driven by high consumption rates in key countries like Spain and Hungary, established culinary traditions, and a large, mature food processing sector with strict quality demands. North America is also a dominant consumer, while Asia Pacific is the fastest-growing region.

What are the main applications of Sweet Paprika Powder beyond general seasoning?

Beyond seasoning, key industrial applications include its use as a natural red colorant in processed meat products (sausages, cured meats), a functional ingredient in nutraceuticals due to its antioxidant content, and as a natural dye base in the cosmetics and personal care industries, replacing artificial colors.

What impact does climate change have on the Sweet Paprika Powder supply chain?

Climate change poses a significant restraint as extreme weather events (droughts, excess rain) directly impact sweet pepper crop yield and quality (lowering ASTA values). This volatility creates supply unpredictability, leading to price fluctuations and necessitating greater reliance on diversified sourcing strategies and technological adaptation in cultivation.

Why is sterilization technology crucial in the Paprika Powder industry?

Sterilization, typically achieved through steam or irradiation, is crucial for reducing microbial load and meeting stringent food safety regulations, particularly in major importing regions like the EU and North America. It is essential for ensuring product shelf stability and preventing recalls.

Is there a noticeable trend in the market regarding Organic Sweet Paprika Powder?

Yes, the Organic Sweet Paprika Powder segment is exhibiting high growth and strong premiumization. Consumers and industrial buyers are increasingly seeking certified organic ingredients to support clean label initiatives and minimize pesticide residue risks, driving innovation in organic farming and processing methods.

How does the B2B distribution channel compare to B2C in this market?

The B2B channel, involving direct industrial supply to food manufacturers, dominates the market volume due to the massive scale of processed food production. The B2C channel (retail, online) accounts for a smaller volume but is vital for brand presence and caters to the specialty gourmet and household consumer segments.

Which technologies are used to maintain the color integrity of the powder?

Key technologies include controlled, low-temperature drying systems to minimize pigment degradation, and cryogenic grinding, which prevents heat build-up during processing. Advanced packaging materials also play a role by mitigating exposure to light and oxygen, which cause color fading.

What role does traceability play in competitive advantage?

Advanced traceability, often facilitated by technologies like blockchain, offers a significant competitive advantage. It allows suppliers to verify the origin, processing history, and compliance status of their product instantly, meeting the growing industrial demand for supply chain transparency and ethical sourcing mandates.

What is the difference between sweet paprika powder and paprika oleoresin?

Sweet paprika powder is the finely ground dried pepper fruit, used for flavor and color. Paprika oleoresin is a highly concentrated, oil-soluble extract derived from the powder, used primarily for industrial coloring where intense pigment concentration and solubility in fat matrices are required.

Are there major suppliers focusing on vertical integration in this market?

Yes, several major international ingredient suppliers are pursuing vertical integration strategies—controlling everything from the cultivation stage (contract farming) to final processing—to ensure consistent quality, stable supply, and better compliance with strict global standards, thereby mitigating supply chain risks.

What is the primary restraint related to price volatility in the market?

The primary restraint is the dependence of the supply chain on agricultural output, which is highly susceptible to climate fluctuations and pest outbreaks. This instability in raw material supply translates directly into unpredictable and volatile market pricing, impacting the margins of ingredient processors.

How are food manufacturers utilizing paprika powder in the ready meals segment?

In ready meals, paprika powder is used extensively as a key component in seasoning blends for sauces, rice dishes, and stews, providing both a characteristic flavor profile and necessary visual appeal to ensure the final product looks appetizing and meets consumer expectations for color intensity.

What are the emerging opportunities in the pharmaceutical segment for sweet paprika?

Opportunities are emerging due to the high content of carotenoids (antioxidants) found in paprika. This positions it as a valuable source material for nutraceuticals focused on supplements for eye health, immune support, and general antioxidant protection, demanding high-purity, standardized extracts.

How does the growth in Asian processed food consumption affect global paprika demand?

The rapid expansion of the processed food sector in large Asian markets like China and India dramatically increases the global industrial demand for bulk sweet paprika powder. This growth is accelerating the need for high-volume, reliable international suppliers capable of meeting large-scale manufacturing requirements.

What impact does the need for clean labels have on packaging technologies?

The clean label trend mandates high standards of preservation without chemical additives. This drives the adoption of advanced, inert packaging solutions that offer superior barriers against moisture, light, and oxygen, thereby naturally extending the powder’s shelf life and maintaining color and flavor integrity.

Which segments are expected to show the highest CAGR growth?

The Organic segment and the application segment related to Snacks and Ready Meals are anticipated to demonstrate the highest CAGR growth, driven by consumer health trends and convenience demands, respectively, attracting significant investment from major market players.

How does AI contribute to quality control in paprika processing?

AI, specifically through computer vision and machine learning models, can be deployed to automate visual inspection of the powder, identifying foreign material, irregular particle sizes, and color inconsistencies far faster and more accurately than manual methods, enhancing overall product quality assurance.

What is the competitive scenario among the top key players?

Competition is intense, focusing on controlling raw material sourcing (via contracts in Spain, Peru, and China), achieving cost efficiencies through technological processing superiority, and maintaining extensive global distribution networks to service large multinational food and beverage corporations.

Why are some companies investing in advanced analytical testing?

Companies invest heavily in advanced analytical testing (like HPLC) to rigorously ensure quality parameters such as ASTA level, purity, and the absence of contaminants like heavy metals and unauthorized dyes. This investment is crucial for compliance, managing brand reputation, and qualifying for premium industrial contracts.

Does the Sweet Paprika Powder Market face significant substitution threats?

Yes, substitution threats exist primarily from synthetic colorants (though regulatory pressure is reducing their use) and cheaper natural alternatives like certain pepper extracts or turmeric used for coloring. However, paprika's unique flavor profile limits direct flavor substitution.

What is the typical shelf life requirement for industrial buyers?

Industrial buyers typically require a minimum guaranteed shelf life of 12 to 24 months for bulk powder, necessitating highly effective sterilization, controlled moisture content during packaging, and stable storage conditions throughout the supply chain.

How do tariffs and trade policies affect the international paprika trade?

Tariffs and complex trade policies significantly affect the profitability and flow of sweet paprika, a globally traded commodity. Changes in trade agreements between major producing regions (e.g., Spain, China) and consuming blocks (EU, US) can instantly shift sourcing strategies and market pricing dynamics.

Where are the primary global cultivation hubs for sweet paprika peppers?

The primary global cultivation hubs include Spain, Hungary, certain regions in China (Xinjiang), and Peru, each specializing in varieties known for distinct color intensity, flavor profile, and traditional agricultural techniques. Sourcing diversification across these hubs is common for large suppliers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager