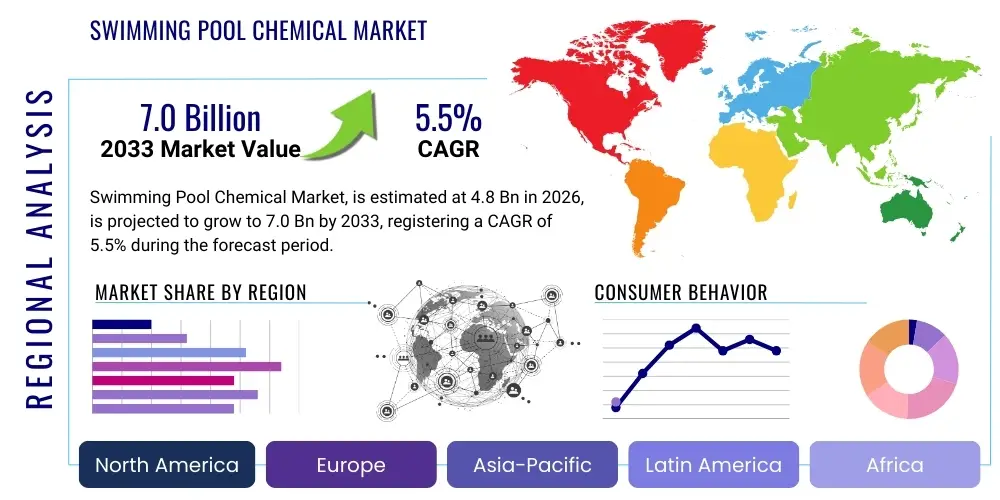

Swimming Pool Chemical Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442141 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Swimming Pool Chemical Market Size

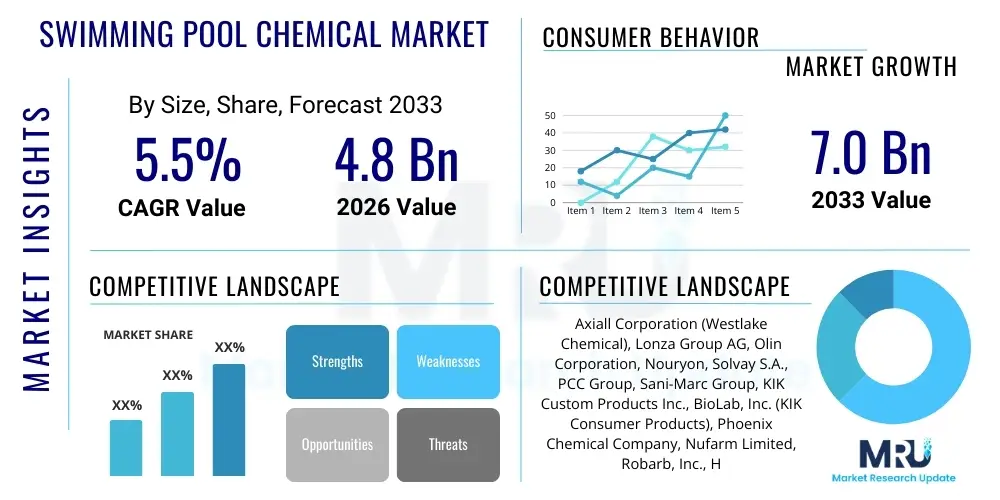

The Swimming Pool Chemical Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.0 Billion by the end of the forecast period in 2033.

Swimming Pool Chemical Market introduction

The Swimming Pool Chemical Market encompasses the entire lifecycle of chemical products designed for water treatment, hygiene, and aesthetic maintenance of pools, spas, and other recreational aquatic environments globally. These indispensable compounds are categorized into primary sanitizers, oxidizers, pH and alkalinity adjusters, and a wide array of specialty chemicals such as algaecides, clarifiers, and metal sequestering agents. The fundamental necessity for these products is driven by public health imperatives, specifically the control and eradication of waterborne pathogens, including bacteria, viruses, and chlorine-resistant microorganisms like Cryptosporidium. Furthermore, proper chemical balance is essential for protecting expensive pool infrastructure, such as liners, pumps, and heating systems, from corrosion or scale buildup, directly contributing to the longevity and operational efficiency of the aquatic facility. The continuous demand cycle inherent in pool maintenance, where chemicals are consumed and must be replenished regularly, provides a stable and predictable revenue stream for market participants, stimulating ongoing investment in supply chain optimization and advanced product formulation.

Product descriptions invariably focus on chlorination derivatives, which remain the dominant force in the sanitizer segment due to their cost-effectiveness and broad-spectrum microbial efficacy. These include stabilized forms (like trichloro-s-triazinetrione or trichlor) that resist breakdown from ultraviolet light, and unstabilized forms (like sodium hypochlorite or liquid chlorine) used primarily in commercial or automated systems. Major applications span from individual residential backyard pools, which constitute a significant decentralized consumer base, to large-scale commercial entities like municipal pools, health clubs, and international hotel chains. The benefits extend beyond sanitation; specialty chemicals, for instance, target specific aesthetic issues—such as cloudiness and staining—which dramatically improve the user experience and perceived quality of the water. Driving factors for this sustained market expansion include the global urbanization trend coupled with increasing disposable incomes in Asia Pacific and Latin America, which fuel the construction of new private and public pools, along with significant post-pandemic investment in home leisure amenities across mature Western economies.

The market trajectory is further bolstered by innovation focused on user safety and environmental sustainability. There is a perceptible shift towards automated chemical dosing systems that rely on sophisticated sensors to maintain precision chemical levels, minimizing human error and reducing overall consumption. The adoption of secondary disinfection methods, such as ozone generation and UV systems, is growing, not as replacements but as supplements that reduce the required primary chemical load and combat chlorine-resistant contaminants. Regulatory bodies worldwide are continuously reviewing and tightening water quality standards, particularly concerning chloramine levels and disinfection byproducts (DBPs), thereby enforcing continuous upgrades in chemical usage and technology among commercial operators. This regulatory push, combined with technological advancements making pool maintenance less labor-intensive, positions the Swimming Pool Chemical Market for consistent and resilient growth throughout the forecast period, addressing both public health and consumer convenience requirements effectively.

Swimming Pool Chemical Market Executive Summary

The global Swimming Pool Chemical Market demonstrates vigorous expansion, chiefly driven by burgeoning residential pool ownership and strict regulatory enforcement of water sanitation standards worldwide. Current business trends illustrate a dual focus: maintaining cost efficiency in the bulk chlorine segment while simultaneously investing heavily in the specialty and non-chlorine alternative markets. Market participants are increasingly consolidating operations through strategic mergers and acquisitions to secure key raw material supply chains and expand their geographical reach, particularly targeting high-growth regions like APAC. This consolidation effort is crucial for achieving resilience against the high price volatility of commodity chemicals such as chlorine and soda ash. Furthermore, the industry is witnessing a significant move towards integrated smart chemical management solutions, connecting sensors, automated feeders, and mobile applications to provide seamless, predictive maintenance, thereby reducing operational expenditure for both commercial and residential users.

From a regional perspective, North America sustains its foundational dominance, supported by a massive existing infrastructure of pools and a sophisticated, well-established professional maintenance service industry that drives high-quality chemical uptake. Conversely, the Asia Pacific region is poised to record the highest growth trajectory, benefiting from substantial economic growth, a tourism boom, and rapid luxury residential development in key economies like India and China, creating vast new demand centers for sanitizers and balancers. European markets, characterized by high regulatory maturity and environmental awareness, lead the demand for sustainable, low-impact chemical formulations and advanced filtration adjuncts. These regional dynamics highlight a market that is mature in its core operations yet highly dynamic in its technological and geographical expansion, requiring tailored distribution and product strategies to meet localized regulatory and consumer demands effectively.

Analysis of segment trends confirms that while the Sanitizers and Oxidizers segment holds the largest revenue share, predominantly led by stabilized chlorine compounds, the fastest anticipated growth belongs to the Specialty Chemicals category. This segment includes complex compounds like phosphate removers, advanced flocculants, and enzymatic cleaners, responding to the growing need for targeted solutions that address aesthetic concerns and reduce the non-sanitizer chemical load. The Residential end-user segment is expanding rapidly, fueled by easy access to DIY products via e-commerce and retail channels, and is generally more price-elastic than the Commercial segment. The Commercial end-user segment, though demanding higher purity and quality assurance, provides stable, large-volume contracts, driving manufacturers to innovate in bulk handling and regulatory documentation. The convergence of strict public health mandates, consumer desire for convenience, and technological integration underscores the strategic shift toward premium, performance-oriented chemical management solutions across all operational scales.

AI Impact Analysis on Swimming Pool Chemical Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) within the Swimming Pool Chemical Market primarily addresses the complexities of achieving and maintaining perfect chemical balance efficiently. Common user queries emphasize the feasibility of AI reducing operational costs, predicting necessary maintenance before issues arise, and optimizing inventory management. Users, particularly commercial operators, seek assurance that AI can handle fluctuating bather loads and environmental changes (e.g., heavy rain, sunlight intensity) to adjust dosing rates autonomously, preventing costly closures or water quality failures. The overarching theme is the transition from reactive maintenance, based on manual testing, to a highly predictive and prescriptive chemical management model, dramatically enhancing reliability and reducing human intervention for routine tasks. Homeowners are increasingly interested in simplified AI-enabled diagnostic tools that provide immediate, expert-level recommendations via mobile devices.

AI's practical application currently manifests in sophisticated sensor fusion algorithms and algorithmic dosing systems. These ML models are trained on vast datasets encompassing historical chemical consumption, local climatic data, and specific pool characteristics (volume, circulation rate) to develop highly accurate predictive models for chemical depletion and need. When integrated with IoT sensors, these systems can identify minute deviations in water parameters, interpret the root cause, and signal the automated feeder to dispense the exact required volume of sanitizer or pH adjuster. This precision not only ensures superior water quality and regulatory compliance but also results in significant reductions in chemical consumption (often 15-25%), generating compelling Return on Investment (ROI) for commercial installations and promoting environmental stewardship by minimizing unnecessary chemical discharge.

Beyond water treatment itself, AI profoundly impacts the chemical supply chain. Manufacturers are leveraging AI-driven forecasting tools to predict demand spikes regionally and seasonally, optimizing production scheduling and logistics for commodity chemicals, which helps mitigate the financial risks associated with raw material price volatility. Furthermore, AI-powered customer service chatbots and diagnostic applications offer first-line support to both residential customers and field technicians, analyzing user-provided data or images to diagnose issues like algae blooms or metal staining, and recommending specific specialty chemical treatments. While adoption requires initial investment in smart infrastructure, the long-term benefits of efficiency, error reduction, and enhanced regulatory compliance position AI as a transformative force, rapidly redefining best practices for chemical management in the aquatic leisure industry.

- AI-driven Predictive Dosing: Optimization of chemical injection based on real-time sensor data, environmental factors, and machine learning models to prevent chemical imbalances.

- Automated Compliance Reporting: Generation of regulatory audit trails and reports documenting historical water quality parameters, chemical usage, and adherence to public health standards.

- Supply Chain Optimization: ML algorithms forecasting seasonal and regional demand for raw materials and finished goods, improving inventory efficiency and mitigating cost risks.

- Sensor Data Diagnostics: Real-time analysis of complex water parameters (pH, ORP, TDS) to detect anomalies and preemptively suggest corrective chemical or mechanical actions.

- Enhanced Consumer Interface: Mobile applications utilizing AI to analyze user input (photos, test strip results) to provide prescriptive chemical treatment advice and automated product ordering.

DRO & Impact Forces Of Swimming Pool Chemical Market

The market dynamics are governed by a robust framework of Drivers, Restraints, and Opportunities (DRO), all acting as significant Impact Forces. A primary driver is the pervasive and growing concern over Recreational Water Illnesses (RWI), which consistently pushes regulatory bodies to mandate stringent water quality standards, directly increasing the demand for reliable, high-efficacy sanitizers and advanced testing chemicals. Coupled with this is the demographic trend of increasing global wealth, particularly in emerging economies, leading to greater investment in private leisure facilities and expansion of the global pool installed base. Technological drivers, such as the miniaturization and cost reduction of smart sensors and automated dosing systems, are simplifying pool maintenance, thereby encouraging greater chemical consumption uniformity and precision across both commercial and residential sectors, solidifying market momentum.

Restraints primarily revolve around operational and regulatory challenges. The high dependency on industrial commodity chemicals subjects the market to dramatic price fluctuations influenced by global energy costs and geopolitical events affecting chlorine and caustic soda production. This volatility impacts manufacturers' profit margins and consumer pricing stability. Furthermore, escalating environmental scrutiny over the release of chlorine disinfection byproducts (DBPs), such as trihalomethanes (THMs), and the toxicity of certain persistent chemicals (like some copper-based algaecides) pressure the industry to invest heavily in reformulation towards greener, less hazardous alternatives, often leading to higher production costs and complexity. Consumer perception of chemicals as inherently harsh also acts as a subtle restraint, driving a niche demand for non-chemical or mineral-based systems that, while growing, do not yet offer the broad-spectrum efficacy of traditional halogenated sanitizers.

Strategic opportunities lie in several key areas. The development and aggressive marketing of advanced specialty chemicals, focusing on preventative maintenance (e.g., enzyme products that break down oils and sunscreen) and water clarity, represents a high-margin opportunity for market players seeking differentiation. The rising trend of automated and IoT-integrated pool management offers a major avenue for growth, enabling companies to move beyond selling bulk commodities towards providing integrated chemical service platforms. Geographically, market penetration in the burgeoning residential markets of Asia Pacific remains a critical opportunity for volume expansion. The cumulative impact forces—specifically regulatory mandates (high positive impact on demand for quality) and raw material supply chain fragility (high negative impact on profitability)—compel sustained innovation in sourcing, formulation, and application technology to ensure market stability and long-term profitable growth for leading stakeholders.

Segmentation Analysis

Segmentation analysis is paramount for understanding the disparate demands and purchasing behaviors within the Swimming Pool Chemical Market. The classification by Chemical Type separates products into fundamental categories: Sanitizers & Oxidizers (the largest and most critical segment for hygiene), Balancers & Adjusters (essential for water chemistry stability and comfort), and Specialty Chemicals (focused on aesthetic and auxiliary treatments). Chlorine derivatives dominate the sanitizer segment, but alternatives like bromine and biguanides address specific application needs, such as high-temperature environments (spas) or specialized medical facilities. The consistent necessity of maintaining pH and alkalinity ensures the stability of the Balancers segment, while the increasing complexity of water issues in modern pools fuels the rapid expansion of the Specialty Chemicals category, including advanced phosphate removers and flocculants designed for superior water clarity and ecosystem health.

Further granularity is achieved through segmenting by End-User, distinctly separating the Residential and Commercial markets. The Residential segment is volume-intensive, driven by seasonal demand and characterized by retail sales, e-commerce, and DIY maintenance approaches. Residential consumers prioritize convenience, simple instructions, and effective multi-purpose products. In contrast, the Commercial segment—encompassing large resorts, water parks, and municipal pools—is value-driven, demanding industrial-grade chemical purity, large-format packaging, strict adherence to industrial safety standards, and guaranteed long-term supply via contractual agreements. Lastly, application segmentation differentiates between general Swimming Pools and specialized Spas and Hot Tubs; the latter, with smaller volumes and significantly higher temperatures, requires specific chemical formulations (e.g., highly stable bromine) to remain effective, ensuring products are tailored precisely to operational requirements across the diverse aquatic industry landscape.

- By Chemical Type:

- Sanitizers & Oxidizers (Chlorine, Bromine, Ozone, Non-Chlorine Shock, Biguanides)

- Balancers & Adjusters (pH Adjusters - Acidic & Basic, Alkalinity Adjusters, Calcium Hardness Increasers)

- Specialty Chemicals (Algaecides - Quaternary Ammonia & Copper Based, Clarifiers, Flocculants, Stain & Scale Removers, Enzyme-based Products, Phosphate Removers)

- By End-User:

- Residential (Individual Homeowners)

- Commercial (Hotels & Resorts, Municipal Pools, Water Parks, Health Clubs, Educational Institutions)

- By Application:

- Swimming Pools (In-ground and Above-ground)

- Spas and Hot Tubs

Value Chain Analysis For Swimming Pool Chemical Market

The Value Chain analysis reveals a structurally integrated process beginning with the upstream segment, dominated by large-scale basic chemical manufacturers who source and process fundamental inputs like brine, natural gas, and mineral ores to produce elemental chlorine, caustic soda, and sulfuric acid. This stage is highly capital-intensive, requiring substantial infrastructure and adherence to stringent environmental and safety regulations. Cost control and supply stability at this raw material phase dictate the competitiveness of the entire downstream market. Subsequently, manufacturers and formulators convert these basic materials into stabilized, packaged pool chemicals through complex industrial processes, involving blending stabilizers (like cyanuric acid), pelletizing, or liquid formulation. Key success factors here include process efficiency, proprietary stabilization technology, and robust quality control to ensure product purity, shelf life, and safe handling for the end consumer.

The downstream flow is governed by sophisticated distribution networks tailored to different end-user needs. The distribution channel is fundamentally divided into direct and indirect sales. Direct channels facilitate bulk delivery and contractual relationships between manufacturers and high-volume commercial users (e.g., water parks or major resort chains), often bypassing traditional retail markups. The indirect channel, which is crucial for reaching the residential market, involves multiple intermediary steps: large distributors supply major retail chains (big-box stores, hardware stores), specialized pool and spa supply stores, and, increasingly, e-commerce fulfillment centers. Professional pool service companies represent a unique intermediary, acting as both expert consultants recommending specific products and high-volume purchasers who apply the chemicals directly, influencing a significant portion of the residential market's chemical choices and usage habits.

E-commerce platforms are exerting an increasing influence on the distribution landscape by offering price transparency and convenience, particularly for staple chemicals and non-hazardous products, posing a challenge to traditional retail margins. However, hazardous or highly regulated chemicals often require specialized logistics and storage, favoring established, professional distribution networks. Efficient logistics, minimizing shipping costs, and ensuring safe transport are crucial factors across all distribution channels. Ultimately, the health of the downstream market relies heavily on the technical proficiency of the final seller—whether a pool store employee or a service technician—to correctly diagnose water issues and recommend the appropriate specialized chemical treatment, linking expertise directly to sales success in a complex product environment.

Swimming Pool Chemical Market Potential Customers

The potential customer base for swimming pool chemicals is vast and highly segmented, fundamentally categorized by their ownership structure and maintenance requirements. Residential pool owners constitute the largest group numerically. These buyers, sensitive to pricing and accessibility, require intuitive, easy-to-use products, often seeking multi-purpose solutions (e.g., "shock and algaecide" combos). Their purchasing behavior is seasonal and heavily influenced by retail merchandising, brand recognition, and digital content providing simplified water chemistry guidance. Post-purchase support, whether via mobile apps or retail consultation, is key to retaining this segment, as they often lack professional expertise in chemical application and troubleshooting.

The Commercial end-user segment represents the highest value per customer, characterized by stringent regulatory oversight and large-volume purchasing. This includes major buyers such as international hotel and resort chains, which prioritize consistent water quality to safeguard their brand reputation and meet insurance liabilities. Municipalities and public aquatic centers require industrial-grade, high-purity chemicals delivered via contractual obligations, often utilizing advanced automation systems managed by certified operators. Their purchasing decisions are driven by total cost of ownership, reliability, product certification, and supplier ability to provide consistent, timely bulk deliveries, making technical support and reliable supply chain execution critical components of the offering.

A third, specialized customer group includes Pool Maintenance and Service Companies, which act as crucial gatekeepers and volume consumers. These professionals purchase chemicals in commercial quantities to service their client portfolios, ranging from dozens to hundreds of residential and smaller commercial pools. They value product consistency, favorable bulk pricing, technical efficacy, and innovative specialty chemicals that enhance their service quality and efficiency. Furthermore, institutional buyers (e.g., educational facilities, government recreational facilities) procure chemicals based on public bidding processes, demanding specific quality certifications and compliance documentation. Successful market penetration requires differentiated product lines and distribution strategies tailored to meet the varying sophistication, scale, and compliance needs of these distinct customer groups.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.0 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Axiall Corporation (Westlake Chemical), Lonza Group AG, Olin Corporation, Nouryon, Solvay S.A., PCC Group, Sani-Marc Group, KIK Custom Products Inc., BioLab, Inc. (KIK Consumer Products), Phoenix Chemical Company, Nufarm Limited, Robarb, Inc., Haviland USA, Natural Chemistry, Arch Water Products (Sigura Water), Allied Universal Corp., PPG Industries, Occidental Petroleum Corporation, Basin Chemical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Swimming Pool Chemical Market Key Technology Landscape

The contemporary technology landscape of the Swimming Pool Chemical Market is defined by the pervasive adoption of Internet of Things (IoT) sensors and data-driven automation, which fundamentally shifts chemical management from manual intervention to continuous, intelligent control. Central to this transformation are advanced sensors that measure critical water parameters—such as ORP (Oxidation Reduction Potential), pH, and free chlorine concentration—with high accuracy and resilience against varying water conditions. These sensors integrate seamlessly with sophisticated control panels and automated peristaltic pumps or solenoid valve feeders. This integration allows for algorithmic control of chemical introduction, ensuring optimal chemical residual is maintained at all times, preventing the under-dosing that leads to hygiene risks or the over-dosing that wastes chemicals and causes corrosion. These systems are essential for commercial pools where bather load fluctuates unpredictably, demanding dynamic chemical response capabilities.

Significant technological advancements are also evident in sanitization alternatives that aim to reduce primary chlorine reliance. Salt chlorine generation systems, which use electrolysis to create chlorine from salt, continue to gain market share due to their convenience and lower handling requirements for hazardous chemicals. Furthermore, secondary disinfection technologies, notably Medium-Pressure Ultraviolet (UV) light and Ozone systems, are being widely adopted, particularly in high-traffic commercial settings. These systems neutralize pathogens (including Cryptosporidium and Giardia) and destroy chloramines (the cause of chemical odors and irritation) highly effectively, allowing operators to run lower free chlorine residuals while maintaining superior water quality, aligning with stringent public health requirements and enhancing swimmer comfort.

Product formulation technology itself is seeing innovation through encapsulation and slow-release matrix designs. These developments extend the efficacy of sanitizers and specialty chemicals, particularly in high-UV environments, reducing the frequency of dosing and improving user safety by minimizing contact with concentrated chemical forms. The convergence of these technologies—smart sensing, automated dosing, alternative sanitization, and advanced formulation—is creating a synergistic effect, enabling professional pool management services to offer highly efficient, reliable, and environmentally conscious solutions, which represents the premium tier of the market offering and dictates future industry standards for water quality management.

Regional Highlights

- North America (Market Leadership and High Penetration of Automation): North America, comprising the US and Canada, remains the largest and most mature market for swimming pool chemicals globally. This dominance is attributed to a vast installed base of both residential and commercial pools, high consumer awareness regarding health and safety, and a highly professionalized pool maintenance service industry. Demand is robust across all segments, but particularly high for stabilized chlorine and advanced specialty chemicals, driven by the desire for crystal-clear water and ease of maintenance. The region leads in the adoption of smart pool technology, including automated chemical controllers and app-based water monitoring systems, positioning it as the primary innovation hub for chemical dosing solutions. Strict state and federal regulations concerning water quality ensure consistent demand for certified, high-purity chemical products, maintaining high average market pricing compared to other regions.

- Europe (Regulatory Focus and Green Chemistry Adoption): The European market is characterized by a strong regulatory emphasis on environmental compliance, notably the Biocidal Products Regulation (BPR) and REACH, which influence product formulation and registration. This stringent environment drives demand towards eco-friendly and non-halogenated alternatives, as well as advanced filtration adjuncts and mineral systems that reduce the chemical footprint. Western Europe, specifically France, Spain, and Germany, boasts significant consumer spending on pool maintenance, with a growing trend towards indoor and covered pools, which necessitates specialized chemicals for managing air quality and reducing volatilization of chloramines. The mature nature of the market means growth is primarily focused on product substitution, efficiency improvements, and sustainable innovation rather than sheer volume increase from new pool construction.

- Asia Pacific (Highest Growth Potential and Urbanization Impact): The APAC region is the undisputed leader in market growth rate, propelled by rapid economic development, urbanization, and a boom in both residential and hospitality construction, particularly in Southeast Asia, China, and India. While the market initially favors cost-effective, unstabilized chlorine derivatives, rising international tourism standards and growing affluence are accelerating the adoption of premium specialty chemicals and modern automated dosing equipment in commercial sectors. The massive, untapped residential market provides a long runway for volume growth. Challenges include diverse regulatory environments and complex distribution logistics across geographically disparate nations, requiring highly localized packaging and marketing strategies for effective penetration.

- Latin America (Tourism Dependency and Climate Influence): The chemical market in Latin America is heavily seasonal and intrinsically linked to the performance of the tourism industry, particularly in tropical and sub-tropical countries. High temperatures and intense sun exposure necessitate substantial consumption of UV-stabilized sanitizers and potent algaecides to combat rapid microbial growth and chemical degradation. Brazil and Mexico represent the largest national markets within the region. Economic instability and fluctuating currency values occasionally constrain the adoption of expensive, high-tech chemical solutions, leading to a strong reliance on cost-efficient, basic chemical treatments. Distribution often faces challenges related to infrastructure and customs complexity, favoring locally established manufacturers or distributors with robust internal logistics capabilities.

- Middle East & Africa (Extreme Climates and Commercial Dominance): The MEA market is dominated by large-scale commercial entities, including luxury resorts and massive residential compounds in the GCC states (UAE, Saudi Arabia, Qatar). The severe climate—characterized by high heat, intense evaporation, and airborne dust—places extraordinary stress on pool water quality, driving immense demand for clarifiers, sequestrants (to manage hardness), and industrial volumes of sanitizers. Water scarcity concerns in this region incentivize the adoption of high-efficiency filtration and chemical control systems that minimize water replacement. The market demands robust, high-performance chemical formulations capable of maintaining stability under extreme operating conditions, providing significant opportunities for premium product suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Swimming Pool Chemical Market.- Axiall Corporation (Westlake Chemical)

- Lonza Group AG

- Olin Corporation

- Nouryon

- Solvay S.A.

- PCC Group

- Sani-Marc Group

- KIK Custom Products Inc.

- BioLab, Inc. (KIK Consumer Products)

- Phoenix Chemical Company

- Nufarm Limited

- Robarb, Inc.

- Haviland USA

- Natural Chemistry

- Arch Water Products (Sigura Water)

- Allied Universal Corp.

- PPG Industries

- Occidental Petroleum Corporation

- Basin Chemical

Frequently Asked Questions

What are the primary drivers of growth in the pool chemical market?

The key drivers include increasing global construction of residential and commercial swimming pools, heightened consumer awareness regarding recreational water illnesses (RWI), stringent public health regulations requiring optimal sanitation, and continuous innovation in smart, automated dosing technologies that simplify pool maintenance.

How is the industry addressing the environmental impact of traditional chlorine chemicals?

The industry is actively shifting towards sustainable alternatives, including advanced mineral purifiers, enzyme-based cleaners, phosphate removers, and utilizing secondary sanitation systems such as UV and ozone to reduce the necessary concentration of chlorine, minimizing byproduct formation and environmental discharge.

Which segment of the swimming pool chemical market is expected to show the fastest growth rate?

The Specialty Chemicals segment, including high-performance algaecides, clarifiers, and enzyme treatments, is projected to exhibit the fastest growth. This is driven by consumer demand for solutions addressing complex water issues like oil, grease, and metal stains, moving beyond basic sanitation requirements.

How do volatile raw material prices affect the market?

Volatile prices for key raw materials like chlorine gas and caustic soda significantly increase manufacturing costs, leading to price volatility for finished pool chemical products. This volatility impacts profitability and encourages manufacturers to pursue vertical integration or diversification of sourcing to stabilize supply chains.

What role does Artificial Intelligence (AI) play in pool chemical management?

AI is crucial in optimizing chemical usage through predictive dosing systems. AI-enabled sensors analyze real-time water quality and environmental factors to calculate precise chemical needs, reducing waste, ensuring consistent water balance, and automating compliance reporting for commercial facilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Swimming Pool Chemical Market Statistics 2025 Analysis By Application (Residential Pool, Commercial Pool), By Type (Beaching Powder, Sodium Hypochlorite, Liquid Chlorine, Trichloroisocyanuric Acid (TCCA), Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Swimming Pool Chemical Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Beaching Powder, Sodium Hypochlorite, Liquid Chlorine, Trichloroisocyanuric Acid (TCCA), Other), By Application (Residential Pool, Commercial Pool), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager