Swimming Pool Treatment Chemicals Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442792 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Swimming Pool Treatment Chemicals Market Size

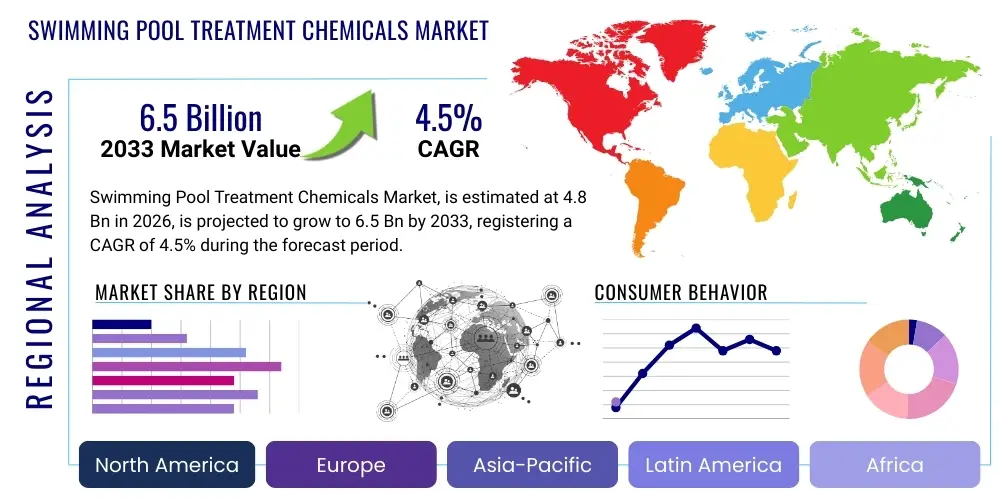

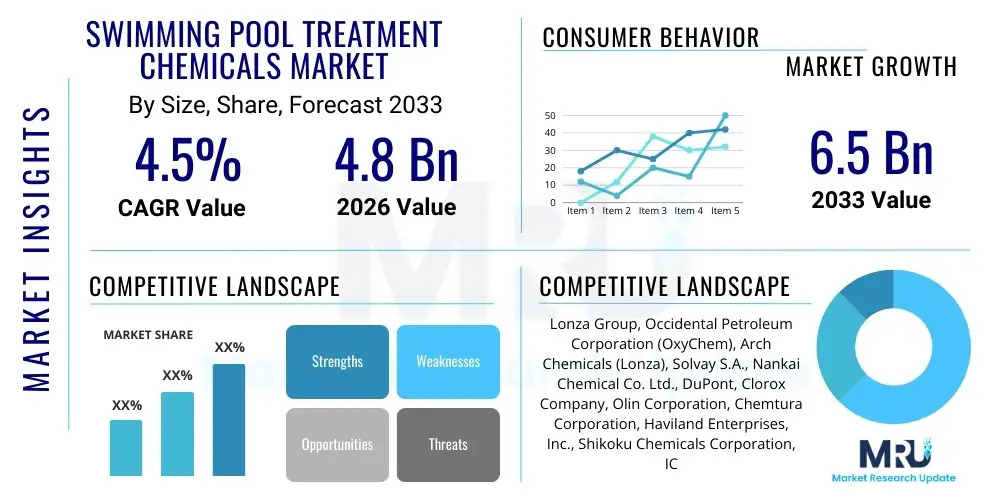

The Swimming Pool Treatment Chemicals Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 6.5 Billion by the end of the forecast period in 2033.

Swimming Pool Treatment Chemicals Market introduction

The Swimming Pool Treatment Chemicals Market encompasses a diverse and essential portfolio of products required globally for maintaining optimal water quality, sanitation, and structural integrity across both commercial and residential aquatic installations. These chemical inputs are fundamental to inhibiting the proliferation of pathogenic microorganisms, including bacteria and viruses, which pose significant health risks in high-bather-load environments. Primary chemical categories include foundational disinfectants, predominantly halogen-based compounds such as sodium hypochlorite, calcium hypochlorite, and stabilized chlorine (Trichlor and Dichlor), alongside their bromine counterparts, which are often favored in higher-temperature spa environments. Beyond sanitation, the market incorporates critical water balancing agents—specifically pH increasers (soda ash) and decreasers (muriatic acid or sodium bisulfate)—essential for controlling corrosive properties and maximizing the efficacy of disinfectants. The necessity for advanced pool chemistry is continually reinforced by public health bodies worldwide, establishing minimum acceptable standards for recreational water safety and compliance.

Major applications for these sophisticated chemical systems extend across a broad spectrum of end-use sectors. Residential pools, constituting a vast and fragmented segment, rely on user-friendly, retail-packaged solutions. In contrast, the commercial segment, which includes luxury hotel chains, municipal sports centers, theme park water features, and high-end fitness facilities, demands bulk quantities of professional-grade chemicals, often coupled with specialized automated dosing equipment to ensure continuous, precise monitoring and application. The benefits derived from the conscientious use of these specialized chemicals are multi-faceted, ranging from the immediate and critical outcome of disease prevention to the long-term protection of costly pool infrastructure, including filtration systems, plaster surfaces, and heating elements, all of which are susceptible to damage from chemically imbalanced water. A well-treated pool guarantees visual clarity, enhances swimmer comfort by minimizing skin and eye irritation, and prolongs the operational life of the entire aquatic system.

Market growth is dynamically influenced by several macro and microeconomic drivers. Climate change trends, resulting in warmer weather and subsequently extended swimming seasons in various geographies, naturally heighten the sustained demand for chemical treatments. Furthermore, the global proliferation of luxury tourism and the increasing rate of new housing starts featuring private pools, particularly in rapidly urbanizing regions of Asia, create continuous fresh demand. Technological drivers include the advancement in integrated pool monitoring systems, which require chemical inputs with defined solubility and purity standards to ensure compatibility with complex electronic feeders. However, the industry faces ongoing challenges related to the safe handling, transportation, and storage of hazardous materials, propelling significant research into safer, less volatile delivery formats and the development of highly concentrated, low-volume formulations that minimize logistical risk while maintaining effectiveness.

Swimming Pool Treatment Chemicals Market Executive Summary

The global market for Swimming Pool Treatment Chemicals demonstrates significant stability, underpinned by its status as an indispensable sector tied directly to public health and recreational safety. The current business environment is witnessing a sustained strategic push towards digitalization and automation in chemical application, driven by commercial operators seeking labor cost reduction and enhanced regulatory compliance accuracy. Manufacturers are responding by focusing investment on liquid chemical concentrates and high-purity formulations compatible with advanced peristaltic pump systems and robotic monitoring devices. Financially, market expansion is threatened by ongoing supply chain instabilities affecting key chemical precursors, particularly those derived from industrial salt processing or energy-intensive electrolysis, leading to persistent price volatility that major producers are attempting to mitigate through long-term sourcing contracts and strategic regional manufacturing hubs to localize production close to high-consumption markets.

Regional dynamics highlight a bifurcation in market maturity and growth vectors. While North America and Western Europe maintain large, established installed bases, characterized by predictable replacement demand and a strong emphasis on professional pool service companies, the highest growth potential resides in the Asia Pacific (APAC) and Latin American markets. The APAC region is capitalizing on massive capital investment in hospitality infrastructure and a rising middle class adopting private pool ownership, necessitating the establishment of robust, localized distribution networks and compliance education. European markets, in contrast, are pioneering the adoption of strict environmental directives, stimulating greater innovation in specialty chemicals, such as metal sequestering agents and specific enzyme treatments, designed to work optimally with reduced levels of primary disinfectants, aligning with sustainability goals.

Segmentation analysis reveals the enduring dominance of disinfectants, though their market share is slowly being eroded by the accelerated adoption of advanced secondary sanitizers (e.g., UV, Ozone). This shift, however, does not eliminate chemical demand; rather, it reallocates it towards essential water balancing agents and specialty chemicals required to stabilize water chemistry in these complex hybrid systems. The liquid chemical form segment is gaining traction, particularly in high-usage commercial facilities, offering superior accuracy and safety in dosing compared to manual application of solid forms. The overarching trend indicates that the market is migrating towards specialized, higher-margin products that address specific water chemistry challenges, moving away from a purely commodity-driven competitive landscape towards one favoring technical service and formulation expertise.

AI Impact Analysis on Swimming Pool Treatment Chemicals Market

Common user questions regarding AI’s pervasive impact on the Swimming Pool Treatment Chemicals Market center heavily on operational efficacy, predictive maintenance capabilities, and the potential for chemical waste reduction. Users are increasingly concerned with how intelligent systems can ensure compliance with rapidly changing local health codes without requiring constant human intervention. Specific inquiries often relate to the ability of AI to model complex variables, asking: "How does AI account for dynamic factors like heavy rainfall or unexpected bather load spikes when calculating chemical needs?" and "Can machine learning algorithms truly predict equipment failure, such as a dosing pump malfunction, before it compromises water safety?" This discourse underscores a strong market appetite for solutions that automate expertise, reduce the risk associated with human error in chemical handling, and provide demonstrable cost savings through hyper-efficient chemical usage and optimized service routing for maintenance providers.

The integration of sophisticated AI and machine learning models fundamentally revolutionizes the utilization and management of chemical treatments within aquatic facilities. AI-driven pool controllers leverage vast datasets collected from high-resolution, multi-spectral sensors—measuring parameters like Oxidation-Reduction Potential (ORP), conductivity, temperature, and Cyanuric Acid (CYA) levels—to generate highly precise predictive dosing models. Unlike simple reactive controllers, these intelligent systems anticipate chemical demand based on predictive load modeling (using historical usage patterns, scheduled events, and real-time weather feeds). This predictive capability ensures that chemical adjustments are made proactively, stabilizing water chemistry within optimal narrow bands, thereby significantly reducing the instances of costly chemical shock treatments and the wasteful consumption associated with managing severe imbalances. This high degree of precision also plays a vital role in reducing the formation of undesirable disinfection byproducts (DBPs), directly addressing consumer health concerns and regulatory pressures.

Moreover, AI extends its critical influence into the logistical and safety aspects of the chemical supply chain. For chemical manufacturers, advanced analytics models are used to forecast localized, granular demand based not just on season but on specific geographical indices and macroeconomic indicators, enabling optimized production batch sizes and strategically positioned safety stock inventories for regulated chemicals. On the maintenance service front, AI algorithms can process operational data from fleets of automated pool systems to predict necessary maintenance interventions—such as anticipating the need for filter backwash or preemptively ordering chemical refills based on calculated consumption rates—leading to streamlined service routes and enhanced profitability for pool management companies. This predictive approach minimizes pool downtime, ensures continuous adherence to safety standards, and significantly reduces the operational exposure of maintenance personnel to hazardous chemical handling events.

- Precise chemical dosing optimization via real-time data analysis, factoring in environmental variables and bather load.

- Predictive maintenance schedules for chemical feeders and testing equipment, reducing unexpected failures and pool closure times.

- Enhanced supply chain forecasting for seasonal chemical demand volatility, optimizing inventory management for hazardous materials.

- Development of autonomous pool monitoring and diagnostics systems reducing human error in complex chemical interactions.

- Personalized chemical recommendations based on complex pool geometry, material composition (e.g., fiberglass vs. concrete), and localized environmental factors.

- Improved regulatory compliance tracking and automated reporting based on continuous water quality data logging and analysis, minimizing legal risks.

DRO & Impact Forces Of Swimming Pool Treatment Chemicals Market

The market's persistent growth is robustly driven by the imperative of public health maintenance, formalized through continuously evolving and increasingly stringent governmental mandates globally concerning recreational water quality. A primary driver is the accelerating urbanization and associated growth in the leisure and wellness sectors, which translates directly into higher numbers of commercial and residential pools, spas, and water features requiring intensive chemical maintenance. The inherent limitations of alternative sanitization methods (such as UV and ozone), which often lack sufficient residual activity necessary to prevent contamination in the pool basin itself, secure the essential and long-term role of chemical disinfectants, sustaining core demand. Furthermore, the development of specialty chemicals that address specific aesthetic challenges, such as controlling scale in hard water regions or preventing metal staining, adds significant value and drives revenue growth beyond basic sanitation commodities, catering to the luxury segment of the market.

However, the sector confronts formidable restraints, notably the pronounced volatility in the procurement costs of essential chemical feedstocks, which are often tied to global energy prices and industrial production schedules. This economic pressure is compounded by the high regulatory burden associated with the manufacturing, classification, transportation, and safe storage of hazardous chemicals, which significantly adds to operational overheads and complexity, particularly for smaller market players. Public and environmental resistance to chlorine and its byproducts, such as chloramines, creates friction, fueling consumer demand for safer, non-halogenated, or biologically derived alternatives, which often carry a higher per-unit cost and necessitate a change in established maintenance protocols, slowing widespread adoption of new chemical solutions, particularly in environmentally conscious regions like Western Europe.

Significant opportunities for market expansion exist in the increasing penetration of smart pool technology, which necessitates a reliable ecosystem of chemical inputs specifically formulated for automated dosing and compatibility with sophisticated sensors. The lucrative aftermarket potential generated by the vast installed base of aging residential pools in developed economies, requiring specialized chemicals for restoration and complex maintenance issues (e.g., remediation of long-standing scale or severe algae infestations), presents a stable, high-margin revenue stream. The primary impact forces shaping competitive strategy are strict governmental oversight relating to safety and discharge standards, coupled with consumer-led demand for environmentally conscious products. This dual pressure forces manufacturers to prioritize R&D in formulating low-residual, high-efficacy chemicals and to invest heavily in supply chain transparency and comprehensive regulatory compliance mechanisms across multiple jurisdictions, often requiring complex global logistics and risk management strategies.

Segmentation Analysis

The Swimming Pool Treatment Chemicals Market is rigorously segmented based on product type, chemical form, end-use application, and geographic region, reflecting the varied technological and maintenance needs of global aquatic environments. The analysis of these segments is crucial for accurate market forecasting and identifying high-growth pockets for strategic investment. Product segmentation highlights disinfectants, oxidizers, balancers, and specialty chemicals, with the disinfectant category maintaining market volume leadership due to its indispensable role in preventing waterborne diseases and ensuring public health compliance. Understanding the distinct requirements of each product type allows manufacturers to optimize production and inventory strategies according to highly seasonal demand cycles.

Chemical form classification distinguishes between solid formulations (tablets, granules, powders), liquid solutions, and gaseous chemicals. Liquid forms are experiencing accelerated adoption, particularly within high-throughput commercial and municipal facilities, owing to their superior compatibility with automated dosing systems, which provide enhanced precision and reduced personnel exposure to hazardous concentrated materials. Conversely, solid forms remain essential for the fragmented residential market, where convenience, ease of storage, and slow-release characteristics are highly valued. This distinction in chemical form often correlates with pricing structures and technical service demands.

End-use application segmentation separates demand into residential, commercial (hotels, resorts, water parks), and municipal/institutional pools. The commercial segment drives innovation in large-volume, high-performance chemistry, seeking solutions that minimize pool downtime and optimize cost-per-bather. The residential market, while lower in volume per unit, provides a stable, recurrent revenue base for retail channels and pool service companies. The ongoing trend within segmentation indicates a pronounced migration from reliance on general commodity disinfectants toward the strategic application of advanced, specialized chemicals designed to manage complex water chemistry imbalances, such as high TDS (Total Dissolved Solids) or aggressive Langelier Saturation Index (LSI) readings, representing a lucrative growth area.

- By Product Type: Disinfectants (Chlorine, Bromine, Non-Halogen Compounds), Algaecides (Quaternary Ammonium Compounds, Copper-Based), pH Adjusters (Acidic/Alkaline), Flocculants & Coagulants, Specialty Chemicals (Enzymes, Sequestering Agents, Water Clarifiers).

- By Chemical Form: Solid (Tablets, Granules, Powders, Sticks), Liquid (Hypochlorites, Acids), Gas (Chlorine Gas).

- By End-Use Application: Residential Pools, Commercial Pools (Hotels, Resorts, Spas, Fitness Centers), Municipal Pools (Public & Institutional Facilities).

Value Chain Analysis For Swimming Pool Treatment Chemicals Market

The value chain for swimming pool treatment chemicals initiates with the upstream sourcing and large-scale manufacturing of core chemical intermediates. This stage is dominated by large, multinational chemical corporations that control the production of raw materials such as industrial salts (for chlorine), various acids (sulfuric, muriatic), and specialized petroleum-derived organic compounds required for stabilizers and algaecides. Upstream activities are capital-intensive and subject to stringent environmental and labor regulations, meaning geopolitical factors, energy costs, and regulatory compliance significantly influence the overall cost structure and stability of supply for the entire market. Efficiency gains at this level are critical for maintaining competitive pricing in commodity chemical segments.

Midstream activities involve the specialized formulation, packaging, and branding of the final consumer or industrial products. Manufacturers carefully convert bulk inputs into stable, user-friendly forms, such as slow-dissolving tablets, highly concentrated liquids, or specific granule sizes, ensuring adherence to strict quality control parameters related to active ingredient concentration and purity. Packaging design is a strategic focus point, involving child-safe, tamper-evident, and chemical-resistant containers to comply with global transportation and safety regulations for hazardous materials. Successful midstream operations require specialized blending and handling equipment that can safely manage corrosive and toxic substances while minimizing environmental discharge.

The downstream segment encompasses the intricate distribution pathways linking manufacturers to the diverse end-user base. Direct channels efficiently handle high-volume sales to municipal and large commercial clients, often involving dedicated logistical fleets specialized in hazardous material transport and offering integrated technical consulting. The indirect channel is reliant on multiple layers: national distributors, regional wholesalers, major pool supply retail chains, and e-commerce platforms. Crucially, professional pool maintenance companies serve as vital secondary distributors, purchasing professional-grade products and providing application services, significantly influencing product selection and consumption patterns within the fragmented residential market. Robust inventory management across the downstream is essential due to the high seasonality and logistical challenges of transporting these regulated substances.

Swimming Pool Treatment Chemicals Market Potential Customers

The potential customer base for swimming pool treatment chemicals is segmented into three primary groups, each possessing unique procurement needs and consumption patterns. Residential pool owners represent a large, widely dispersed customer segment seeking convenience, clarity, and ease of use. These homeowners typically purchase standardized, pre-packaged chemical kits and maintenance supplies through retail channels, including dedicated pool stores, home improvement centers, and online marketplaces. Purchasing decisions are heavily influenced by local water conditions, seasonal requirements, and the advice provided by local pool maintenance service providers. This segment requires products with clear instructions, robust safety packaging, and accessible information on proper application rates.

Commercial pool operators constitute a crucial segment characterized by high-volume demand and stringent operational requirements. This group includes hotels, resorts, health clubs, municipal facilities, and water parks, where maintaining impeccable water quality is a liability and reputational necessity. These customers typically require bulk quantities of high-purity disinfectants and balancers, often sourced via direct contracts with manufacturers or major distributors that can guarantee consistent supply, technical troubleshooting, and certification compliance documentation. Procurement in this sector is driven by optimizing chemical efficiency to reduce labor costs and minimizing pool closure time due to chemical imbalance or regulatory non-compliance, prioritizing reliability and high efficacy over marginal cost savings.

The institutional and service professional segment, encompassing schools, universities, therapeutic centers, and independent pool maintenance firms, acts as a pivotal intermediary and end-user. Institutional buyers often utilize formal tendering processes, prioritizing long-term value, regulatory adherence, and comprehensive safety data sheets (SDS). Professional pool service companies are high-volume purchasers of specialized, often concentrated, products that allow them to efficiently manage multiple client pools. Their purchasing power and influence make them a key strategic target for manufacturers, demanding products that offer consistent quality, predictable performance across various pool types, and bulk packaging options suitable for professional application and transport.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 6.5 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lonza Group, Occidental Petroleum Corporation (OxyChem), Arch Chemicals (Lonza), Solvay S.A., Nankai Chemical Co. Ltd., DuPont, Clorox Company, Olin Corporation, Chemtura Corporation, Haviland Enterprises, Inc., Shikoku Chemicals Corporation, ICL Group, Nippon Soda Co. Ltd., Rekord-Chemie GmbH, PPG Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Swimming Pool Treatment Chemicals Market Key Technology Landscape

The contemporary technology landscape for swimming pool treatment chemicals is centered on innovation that addresses the dual challenges of operational safety and superior water quality consistency. Significant advancements are seen in the formulation of stabilized chemical compounds, particularly for disinfectants, where technologies like controlled-release matrices and advanced binders ensure a prolonged, consistent release profile, even under harsh environmental conditions (such as intense UV exposure or high temperatures). This focus on stability minimizes chemical decay, thereby reducing the overall volume of chemicals required over a season and enhancing the sustainability profile of the product. Furthermore, the development of specialty formulations, such as highly effective phosphate removers and bio-enzymatic water clarifiers, utilizes sophisticated biochemistry to manage organic loads without relying solely on high concentrations of traditional disinfectants, mitigating the formation of irritating byproducts and improving the aesthetic qualities of the water.

Another dominant technological trend is the seamless integration of chemical inputs with digital monitoring and dosing hardware, a key component of the smart pool movement. Modern pool controllers utilize advanced potentiometric and amperometric sensors to generate highly accurate data, which requires chemical inputs of exceptional purity and consistency to maintain sensor reliability and prevent calibration drift. This demand has spurred manufacturers to develop ultra-pure liquid chemical concentrates and specialized buffering agents that ensure instantaneous and homogeneous mixing with the pool water. Furthermore, the technology of chemical delivery systems has evolved, moving towards diaphragm and peristaltic pumps that provide fractional dosing capabilities, essential for AI-driven precision, replacing older, less accurate manual or venturi-based injection methods common in less sophisticated systems, thereby enhancing safety margins.

Crucially, the technology landscape is also defined by safety innovations surrounding chemical handling and storage, addressing ongoing regulatory and consumer concerns. Efforts are being made to develop non-hazardous delivery systems, such as advanced granular products or pre-dosed cartridges, that minimize direct human contact with concentrated chemicals and reduce spillage risk. In the realm of non-chemical primary treatment, the technological interplay between UV sterilizers and ozone generators necessitates complementary chemical innovation. These systems require specialized stabilizer chemicals and balancing agents designed to counteract the localized pH shifts or corrosive effects induced by the alternative sanitization process, ensuring overall system harmony, compliance with public health standards, and prolonging the life of expensive infrastructure components within the pool environment.

Regional Highlights

North America remains the foundational market for swimming pool treatment chemicals, primarily due to the vast concentration of residential pools in the United States, particularly in the high-growth Sun Belt states (Florida, Texas, California). The market here is mature, highly regulated by federal and state bodies, and characterized by a strong consumer preference for convenient, pre-packaged solutions and advanced automation technologies. The extensive infrastructure of professional pool service companies ensures steady, high-volume consumption of professional-grade chemicals. Market growth, while stable, is largely driven by aftermarket chemical replacement sales, pool modernization projects, and new construction starts in favorable climate zones, rather than exponential saturation.

Europe presents a highly fragmented but substantial market, characterized by significant regional differences in pool culture and stringent regulatory regimes, notably the European Union’s REACH regulation governing chemical registration and use. Countries in Southern Europe (Spain, France, Italy) exhibit high pool density and traditional demand for disinfectants and balancers. Conversely, Northern European nations demonstrate a stronger regulatory push towards environmental sustainability, stimulating demand for non-chlorine alternatives, closed-loop water treatment systems, and specialized chemical solutions that minimize discharge impact, forcing manufacturers to innovate formulations that align with stricter environmental mandates.

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate during the forecast period. This explosive expansion is attributed to the confluence of rapid urbanization, significant infrastructure development in commercial tourism (luxury resorts and hotels), and a rapidly expanding affluent consumer base embracing private pool ownership, particularly in China, India, and Southeast Asia. While local regulations are often less standardized than in the West, growing public awareness regarding waterborne illnesses is driving demand for verifiable, high-quality chemical treatments. The market requires localized production and robust cold chain logistics to manage the high temperatures prevalent across the region.

- North America: Dominant market share; characterized by high consumer spending on maintenance, mature distribution channels, and early adoption of automated dosing technology.

- Europe: Focus on sustainability and stringent environmental regulations (REACH); high demand for specialized balancing agents and alternative, low-residual chemical options.

- Asia Pacific (APAC): Fastest-growing region; fueled by booming commercial infrastructure, rising disposable incomes, and increasing regulatory enforcement of water hygiene standards.

- Latin America (LATAM): Growth potential driven by favorable climate conditions and expansion of public leisure facilities, though supply chain stability and economic volatility remain persistent challenges.

- Middle East & Africa (MEA): Steady growth linked to high-end residential and hospitality projects in the Gulf Cooperation Council (GCC) nations, where extreme temperatures necessitate specialized stabilization and UV-resistant chemical treatments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Swimming Pool Treatment Chemicals Market.- Lonza Group

- Occidental Petroleum Corporation (OxyChem)

- Nankai Chemical Co. Ltd.

- Olin Corporation

- Solvay S.A.

- DuPont de Nemours, Inc.

- ICL Group Ltd.

- The Clorox Company

- BioLab, Inc. (KIK Custom Products)

- Pinch-A-Penny Pool Patio & Spa

- Hydra Swimming Pool Chemicals

- Chemtura Corporation (Lanxess)

- Shikoku Chemicals Corporation

- Nippon Soda Co. Ltd.

- Arkema S.A.

- Recreational Water Products (Robarb/HTH)

- Haviland Enterprises, Inc.

- Toray Industries, Inc.

- PPG Industries

- Sinopec Group

Frequently Asked Questions

Analyze common user questions about the Swimming Pool Treatment Chemicals market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for swimming pool treatment chemicals?

The primary driver is the necessity for public health protection and compliance with stringent government regulations regarding water sanitation. Maintaining specific levels of disinfectants, primarily chlorine or bromine, is non-negotiable for preventing waterborne diseases and ensuring swimmer safety, regardless of the pool's size or usage frequency.

How are environmental concerns impacting the formulation of new pool chemicals?

Environmental concerns are pushing manufacturers to develop eco-friendly alternatives, such as stabilized, lower-VOC formulations, enzyme-based cleaners, and phosphate-free algaecides. The goal is to reduce harmful chemical runoff and minimize the formation of regulated disinfection byproducts (DBPs) like trihalomethanes (THMs).

Which geographic region is experiencing the fastest growth in this market?

The Asia Pacific (APAC) region is witnessing the fastest growth due to rapid infrastructure development in commercial tourism (hotels, resorts) and increasing rates of private pool installation among affluent populations in countries like China and India, escalating demand for both basic and specialized chemical treatments.

What role does automation play in the future use of pool chemicals?

Automation, driven by IoT sensors and AI algorithms, is crucial for optimizing chemical usage. Automated dosing systems ensure precise, real-time adjustments to chemical levels, reducing waste, enhancing safety, and promoting the shift toward standardized, high-purity liquid chemicals compatible with these advanced monitoring technologies.

What are the main types of pool chemicals needed for standard maintenance?

Standard pool maintenance requires three main categories of chemicals: disinfectants (like chlorine) for killing pathogens, pH adjusters (acids or bases) for maintaining water balance and swimmer comfort, and specialty chemicals (like algaecides or sequestering agents) for managing specific water quality issues.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Swimming Pool Treatment Chemicals Market Statistics 2025 Analysis By Application (Residential Pool, Commercial Pool), By Type (Bleaching Powder, Sodium Hypochlorite, Liquid Chlorine, Trichloroisocyanuric Acid), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Swimming Pool Treatment Chemicals Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Calcium Hypochlorite, Sodium Hypochlorite, Trichloroisocyanuric Acid (TCCA), Bromine, Others), By Application (Residential Pool, Commercial Pool), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Swimming Pool Treatment Chemicals Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Beaching Powder, Sodium Hypochlorite, Liquid Chlorine, Trichloroisocyanuric Acid (TCCA), Others), By Application (Residential Pool, Commercial Pool), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager