Switches and Dimmers and Receptacles Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442935 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Switches and Dimmers and Receptacles Market Size

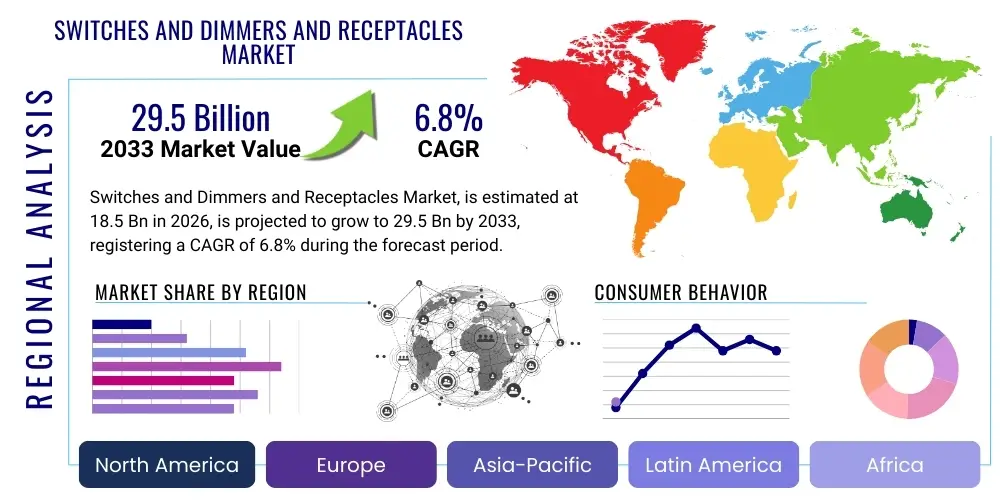

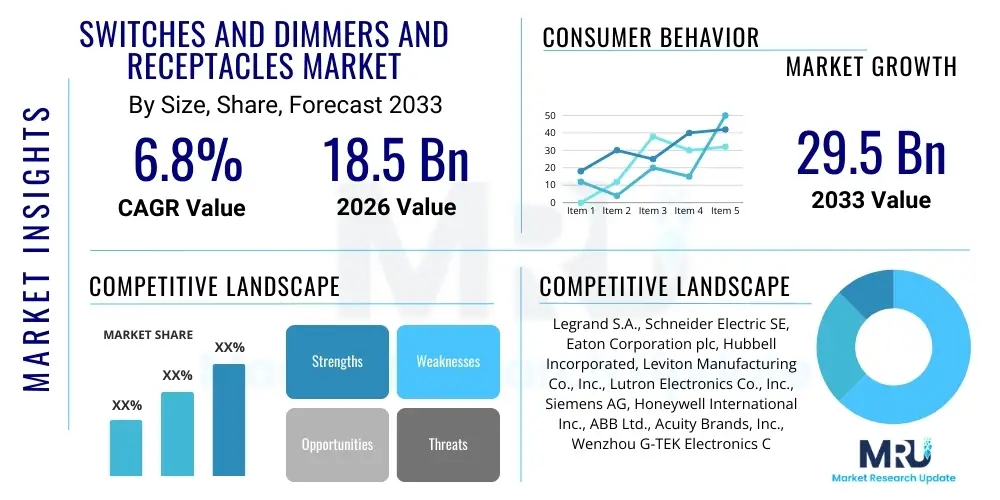

The Switches and Dimmers and Receptacles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 29.5 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by rapid global urbanization, increasing consumer demand for energy-efficient building solutions, and the accelerating integration of smart home technologies. The need for infrastructure modernization in developed economies and significant new construction projects across emerging markets contribute substantially to the consistent demand for high-quality, advanced electrical wiring devices. Furthermore, the shift towards sustainable building practices mandates the adoption of sophisticated control systems, particularly dimmers and smart switches, which allow for precise energy management and enhanced user convenience, solidifying the market's robust expansion outlook over the next decade.

Switches and Dimmers and Receptacles Market introduction

The Switches and Dimmers and Receptacles Market encompasses a diverse range of low-voltage electrical components essential for controlling and distributing power within residential, commercial, and industrial structures. Products include conventional wall switches (toggle, rocker, push-button), advanced lighting dimmers (rotary, slide, and digital/smart), and various receptacle types (standard outlets, USB charging receptacles, GFCI, and AFCI outlets). Major applications span across new construction, retrofitting existing buildings, and specialized industrial facilities, driven by the indispensable role these devices play in ensuring electrical safety, convenience, and functionality. Key benefits derived from modern switches, dimmers, and receptacles include enhanced energy savings through lighting control, improved safety standards compliance, aesthetic integration into interior design, and seamless connectivity within smart building ecosystems. The primary driving factors for market proliferation include increasing infrastructural spending, stringent energy efficiency regulations implemented globally, and the relentless technological evolution leading to the widespread adoption of IoT-enabled and wireless control devices that enhance user interaction and device performance.

Switches and Dimmers and Receptacles Market Executive Summary

The Switches and Dimmers and Receptacles Market is experiencing significant dynamic shifts driven by profound business trends related to digital transformation and sustainability imperatives. Business trends highlight a strong competitive focus on product differentiation through smart features, interoperability standards (like Matter and Thread), and modular design, enabling manufacturers to cater to both high-end smart home segments and cost-conscious conventional construction markets. Regionally, growth momentum is robustly concentrated in the Asia Pacific due to massive urbanization and government initiatives supporting affordable housing and smart city projects, while North America and Europe maintain high revenue shares driven by premium product adoption and stringent building codes requiring advanced safety receptacles (GFCI/AFCI). Segment-wise, the smart dimmers and switches category exhibits the highest growth rate, reflecting the consumer transition toward automated, centralized lighting control. Conversely, the receptacles segment remains foundational, witnessing innovation primarily in integrated features such as USB Type-C charging ports and enhanced tamper-resistance mechanisms. Overall, the market's executive overview points toward a sustained expansion phase characterized by premiumization of control components and rapid integration into the broader Internet of Things framework.

AI Impact Analysis on Switches and Dimmers and Receptacles Market

Common user questions regarding the impact of Artificial Intelligence on the Switches and Dimmers and Receptacles Market center predominantly around how AI optimizes energy usage, enhances predictive maintenance capabilities, and influences the design of user interfaces. Users frequently inquire about the feasibility of AI algorithms managing dynamic lighting levels based on occupancy and ambient light conditions, thereby moving beyond simple scheduling to true adaptive control. A significant concern is the security and data privacy implications of embedding complex processing capabilities within wall-mounted devices, alongside expectations for backward compatibility with existing electrical infrastructure. The key themes summarized from this user analysis reveal a high expectation for AI to transform these traditionally passive components into highly active, data-generating nodes within a smart building network, automating decisions related to comfort, safety, and operational efficiency without requiring manual user intervention.

The transformative influence of AI on the Switches and Dimmers and Receptacles sector is multifaceted, extending beyond mere connectivity to proactive system management. AI algorithms integrated into smart dimmers and switches are essential for learning occupancy patterns, predicting peak usage times, and modulating power delivery to optimize energy consumption in real-time. For instance, sophisticated dimming controls can utilize machine learning to analyze circadian rhythms and dynamically adjust light color temperature and intensity throughout the day, fostering improved health and productivity in commercial and residential settings. This shift necessitates the development of specialized microcontrollers and edge computing capabilities embedded within the physical switch or dimmer, allowing localized AI processing to occur instantaneously without constant cloud dependence, thereby improving latency and resilience.

Furthermore, AI is pivotal in enhancing the functionality and safety of receptacles. Predictive maintenance driven by AI models can monitor the electrical load and temperature fluctuations across multiple receptacles in a commercial installation, identifying potential faults, overheating issues, or circuit anomalies long before they escalate into serious safety hazards or equipment failures. This capability drastically reduces downtime and maintenance costs for facilities managers. The ability of AI to interpret sensory data—such as detecting subtle changes in electrical noise or vibration—from the wiring system allows for an unprecedented level of diagnostic precision, transitioning the maintenance paradigm from reactive repairs to proactive, condition-based interventions, thereby reinforcing the longevity and reliability of the entire electrical infrastructure.

- AI enables predictive energy optimization by learning user habits and environmental factors.

- Machine learning algorithms facilitate advanced, adaptive lighting control based on occupancy, daylight harvesting, and circadian rhythm synchronization.

- AI enhances predictive maintenance by monitoring electrical load signatures and identifying nascent fault conditions in receptacles and wiring systems.

- Embedded AI allows for decentralized, rapid decision-making at the edge, reducing latency in smart home environments.

- AI drives the development of intuitive voice and gesture control interfaces integrated into switch plates.

- It supports personalized user profiles, allowing switches and dimmers to automatically adjust settings based on the recognized user in the room.

DRO & Impact Forces Of Switches and Dimmers and Receptacles Market

The market dynamics of the Switches and Dimmers and Receptacles industry are shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and associated Impact Forces. The primary driver is the accelerating penetration of smart home technology and the consumer preference for centralized control systems, directly correlating with increased demand for high-value smart switches and dimmers. Opportunities abound in the development of modular and platform-agnostic products, enabling seamless integration with diverse IoT ecosystems, alongside significant potential in retrofitting older commercial buildings to meet modern energy efficiency standards. However, restraints such as high initial costs associated with smart electrical infrastructure and persistent issues related to cybersecurity vulnerabilities in connected devices temper this rapid growth. The impact forces are currently skewed toward moderate-to-high technological push, where innovation in wireless protocols and battery efficiency continuously disrupts traditional product lines, necessitating constant R&D investment from market players to maintain relevance and competitiveness.

Key drivers include the global push for green building certifications, such as LEED and BREEAM, which strongly incentivize the installation of sophisticated lighting controls, primarily dimmers and occupancy-sensing switches, to achieve mandated energy performance metrics. Furthermore, governmental safety mandates worldwide—especially concerning the mandatory use of Ground Fault Circuit Interrupters (GFCIs) in wet areas and Arc Fault Circuit Interrupters (AFCIs) in residential wiring—provide a stable, regulatory-driven baseline demand for advanced receptacles, often compelling upgrades even in established markets. These regulations necessitate continuous product innovation to meet increasingly stringent performance specifications and ease of installation, thereby maintaining a steady replacement cycle for safety-critical components within the electrical system infrastructure.

Major restraints to sustained market growth include the fragmentation of wireless communication standards and interoperability challenges, which can confuse end-users and complicate installation for contractors, sometimes leading to hesitancy in adopting advanced smart products. The inherent complexity of sophisticated wiring devices also necessitates specialized installation expertise, which can be scarce in certain developing regions, slowing the penetration rate of premium smart products. Opportunities primarily stem from the emerging markets' vast new construction activities and the untapped potential for advanced power monitoring and metering functionalities integrated directly into receptacles, allowing consumers and businesses granular control over energy consumption down to the appliance level. The development of robust, secure, and unified communication platforms represents a critical pathway for capitalizing on the full potential of interconnected smart switches and dimmers.

Segmentation Analysis

The Switches and Dimmers and Receptacles Market is comprehensively segmented based on product type, application, end-user, and communication technology, reflecting the diverse requirements across the built environment. Product segmentation distinguishes between switches (classified further by mechanism: toggle, rocker, smart), dimmers (classified by technology: analog/phase-cut, digital/smart), and receptacles (classified by function: standard, GFCI, AFCI, USB integrated). This granular categorization allows manufacturers to tailor features specifically for safety compliance, aesthetic preference, or digital connectivity needs. The analysis of these segments is crucial for understanding demand elasticity and mapping competitive intensity across specialized niches, particularly where regulatory requirements or technological maturity vary significantly, such as between the highly regulated North American market and the rapidly evolving infrastructure of Southeast Asia.

Application segmentation focuses on distinguishing between residential, commercial (offices, retail, hospitality), and industrial environments, each presenting unique demands. Residential demand is highly sensitive to aesthetic appeal and smart home integration complexity, prioritizing wireless solutions. Commercial applications emphasize durability, centralized control, energy management capabilities, and integration with Building Management Systems (BMS), driving demand for networked switches and dimmers. Industrial settings prioritize robust, high-durability components that can withstand harsh operational conditions, focusing on safety and regulatory compliance above aesthetic factors. Analyzing the varying needs across these applications highlights the necessity for diversified product portfolios capable of meeting rigorous performance specifications across vastly different operating environments and user expectations.

Segmentation by communication technology—including Wi-Fi, Bluetooth, Zigbee, Z-Wave, and proprietary protocols—is increasingly vital as the market shifts toward connectivity. Wireless standards like Zigbee and Z-Wave are preferred for large-scale, mesh networking in commercial settings due to their low power consumption and stability, while Wi-Fi dominates consumer preference for simplicity and direct integration with home networks. Understanding the adoption rate of these protocols provides critical insights into the future landscape of interoperability and connectivity standards, revealing which ecosystems are gaining traction among both device manufacturers and platform providers. The rise of standards like Matter promises to simplify this fragmented communication landscape, potentially reshaping segment demand in the coming years by unifying the control architecture across various product types.

- By Product Type:

- Switches (Rocker, Toggle, Push Button, Smart Switches)

- Dimmers (Rotary, Slide, Digital/Touch, Smart Dimmers)

- Receptacles (Standard Duplex, GFCI, AFCI, USB Receptacles, Tamper-Resistant)

- By Application:

- Residential

- Commercial (Office Buildings, Retail, Hospitality)

- Industrial

- By Communication Technology:

- Wired (Traditional Electrical Systems)

- Wireless (Wi-Fi, Bluetooth, Zigbee, Z-Wave, Others)

- By End-User:

- Original Equipment Manufacturers (OEMs)

- Aftermarket (Installation and Replacement)

Value Chain Analysis For Switches and Dimmers and Receptacles Market

The value chain for the Switches and Dimmers and Receptacles Market begins with the upstream procurement of essential raw materials, including high-grade plastics (polycarbonate, ABS), conductive metals (copper, brass), and electronic components (semiconductors, microprocessors for smart devices). Upstream analysis reveals significant dependence on efficient global supply chains for specialized electronics, particularly for smart products, where volatility in semiconductor pricing and availability directly impacts manufacturing costs and lead times. Key activities at this stage involve meticulous material quality control to ensure compliance with electrical safety standards, demanding strong relationships with material suppliers who can guarantee both consistency and sustainable sourcing practices, increasingly important due to environmental regulations and corporate responsibility initiatives.

The midstream stage involves manufacturing and assembly, where operational efficiency and automation are critical competitive factors. Traditional manufacturers focus on large-scale production volumes and cost optimization for standard devices, while smart device manufacturers concentrate on integrating complex electronic subassemblies, firmware development, and rigorous quality assurance testing for connectivity and safety features. The distribution channel is robust and multi-layered, relying significantly on large electrical distributors, wholesalers, and retail chains (such as home improvement stores) for indirect sales to contractors and end-users. Direct sales primarily occur through specialized channels serving large institutional projects, such as agreements with major commercial builders or smart building system integrators, requiring tailored product solutions and technical support.

Downstream analysis focuses on installation, maintenance, and end-user adoption. The professional electrician and contractor segment acts as a crucial gatekeeper, heavily influencing product selection based on ease of installation, perceived reliability, and adherence to local electrical codes. The rapid pace of technology means continuous training is necessary for installers to handle complex smart wiring devices, which often require specific configuration protocols. The shift towards connected devices also necessitates post-sale software support and firmware updates, transforming the long-term relationship between the manufacturer and the end-user/installer. This increasing complexity requires manufacturers to invest heavily in robust technical documentation, digital tools for configuration, and accessible customer support platforms to ensure smooth adoption and sustained functionality in the field.

Switches and Dimmers and Receptacles Market Potential Customers

The potential customer base for the Switches and Dimmers and Receptacles Market is inherently broad, segmented primarily by end-use application intensity and technological requirements. Residential end-users represent a substantial volume segment, driven by new home construction and remodeling projects. These buyers, whether homeowners or residential developers, prioritize aesthetic design, value for money, and user-friendly smart integration capabilities, focusing heavily on products that enhance lifestyle and curb appeal. The adoption rate in this segment is highly influenced by marketing efforts, accessibility through major retail channels, and the ease with which products can be installed or retrofitted into existing electrical systems without major structural modifications.

Commercial customers constitute a high-value segment, encompassing sectors such as corporate offices, educational institutions, healthcare facilities, and the expansive hospitality industry. These institutional buyers are primarily motivated by energy efficiency mandates, operational cost savings, building safety compliance, and robust integration with centralized Building Management Systems (BMS). For commercial environments, the durability, reliability, and network management capabilities of smart switches and dimmers are paramount. They often require bulk purchases of standardized, enterprise-grade components that support sophisticated scheduling, daylight harvesting, and seamless network provisioning across large, distributed physical footprints, emphasizing performance over individual aesthetic features.

A third critical segment includes industrial facilities, utility companies, and specialized infrastructure projects. Industrial buyers require highly specialized, ruggedized receptacles and switches designed for extreme environmental conditions, high voltage, and stringent safety standards, often involving specialized components like industrial grade safety disconnects or heavy-duty outlets. Furthermore, electrical contractors, independent system integrators, and electrical wholesalers function as vital intermediary customers, purchasing products in bulk for installation projects and serving as key influencers in the procurement process. These intermediaries seek products offering competitive pricing, consistent supply availability, code compliance, and technical support that minimizes installation time and potential callbacks, making them crucial leverage points in the market's commercial strategy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 29.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Legrand S.A., Schneider Electric SE, Eaton Corporation plc, Hubbell Incorporated, Leviton Manufacturing Co., Inc., Lutron Electronics Co., Inc., Siemens AG, Honeywell International Inc., ABB Ltd., Acuity Brands, Inc., Wenzhou G-TEK Electronics Co., Ltd., Panasonic Corporation, Koninklijke Philips N.V., GE Lighting (Savant), Cooper Lighting Solutions (Eaton), Jasco Products Company, TP-Link Corporation Limited, Wemo (Belkin International), Xiaomi Corporation, and Crestron Electronics, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Switches and Dimmers and Receptacles Market Key Technology Landscape

The technological landscape of the Switches and Dimmers and Receptacles Market is rapidly evolving from basic mechanical components to sophisticated electronic and connected devices, fundamentally transforming how electricity is controlled and utilized within buildings. Core technologies center around microcontroller units (MCUs) and System-on-Chips (SoCs) that enable smart functionality, including wireless communication, energy monitoring, and localized processing. Specific technological advancements include the move from traditional phase-cut dimming to digital dimming protocols like DALI (Digital Addressable Lighting Interface) and 0-10V, which offer superior granular control and color temperature adjustment capabilities, essential for high-end commercial and residential LED lighting systems. Furthermore, the integration of advanced safety technologies, such as improved fault detection algorithms in GFCI and AFCI receptacles, ensures faster and more reliable circuit protection, addressing increasing regulatory demands for enhanced fire and shock hazard prevention in modern electrical installations.

Wireless communication technology is arguably the most disruptive element in the current landscape. Key protocols battling for market dominance include Wi-Fi for its ubiquity and direct internet connectivity, Zigbee and Z-Wave for their robust, low-power mesh networking capabilities suitable for whole-house or whole-building deployments, and the emerging Thread protocol, which offers IPv6-based networking specifically designed for IoT devices. The industry is witnessing a strong movement toward protocol unification, largely driven by the adoption of the Matter standard, which aims to ensure seamless interoperability across devices from different manufacturers and ecosystems (e.g., Apple HomeKit, Google Home, Amazon Alexa). This unified approach simplifies product development and enhances the end-user experience, thereby accelerating consumer acceptance of smart controls.

Beyond connectivity and control, significant technological focus is placed on enhancing user interaction and power delivery capabilities. Modern receptacles increasingly incorporate high-power USB Type-C Power Delivery (PD) technology, capable of charging laptops and high-demand devices directly from the wall outlet, reducing the need for cumbersome external adapters. Furthermore, advancements in sensor integration, such including passive infrared (PIR) occupancy sensors and ambient light sensors embedded directly within the switch or dimmer plate, enable truly automated, context-aware control. These integrated sensing capabilities, often paired with edge AI processing, allow devices to intelligently manage energy consumption based on real-time environmental data, solidifying their role as essential smart building infrastructure nodes rather than merely passive electrical interfaces, thereby pushing the boundaries of energy efficiency and operational intelligence.

Regional Highlights

The global Switches and Dimmers and Receptacles Market exhibits highly diversified growth patterns and technological adoption rates across different major regions, dictated primarily by varying construction activity levels, regulatory environments, and prevailing consumer income levels.

- North America (United States, Canada, Mexico): North America holds a significant revenue share, characterized by high adoption rates of premium, smart, and interconnected devices. The market is heavily influenced by stringent safety standards, particularly the widespread mandate for GFCI and AFCI receptacles in residential and commercial settings, driving steady replacement cycles. Furthermore, the robust penetration of smart home hubs and ecosystems (like Amazon and Google) fuels demand for compatible smart switches and dimmers, making this region a leader in technological sophistication and early adopter of new connectivity standards such as Matter.

- Europe (Germany, UK, France, Italy, Spain): The European market is defined by a strong emphasis on energy efficiency, driven by EU directives and national building codes aimed at achieving net-zero energy goals. This accelerates the adoption of advanced digital dimmers (DALI systems) and occupancy-based controls in commercial structures. While smart home penetration is high, standardization is critical; European manufacturers often focus on aesthetically minimal designs and modular systems compatible with continental wiring standards, maintaining strong growth through mandatory renovation and green building initiatives.

- Asia Pacific (APAC) (China, Japan, India, South Korea, Southeast Asia): APAC is the fastest-growing region, propelled by massive urbanization, rapidly expanding middle-class populations, and large-scale infrastructural development across China and India. The market here is dual-natured: high-volume, cost-effective conventional products dominate in general construction, while key metropolitan areas (like Shenzhen and Tokyo) lead in smart home penetration and advanced industrial applications. Government smart city projects and local manufacturing capabilities are powerful market accelerators, particularly favoring regional brands focused on scalable wireless technologies.

- Latin America (Brazil, Argentina, rest of LATAM): Latin America represents an emerging market with moderate growth potential. Demand is closely tied to economic stability and construction cycles. While conventional switches and receptacles form the core market, there is increasing interest in basic smart controls and energy management solutions, particularly in commercial and luxury residential segments in major economies. Market penetration is often hampered by fluctuating regulatory standards and economic volatility, requiring manufacturers to maintain competitive pricing strategies and focus on essential safety features.

- Middle East and Africa (MEA) (Saudi Arabia, UAE, South Africa): The MEA market is heavily influenced by large-scale, state-funded mega-projects, especially in the Gulf Cooperation Council (GCC) countries, focusing on high-end commercial and residential developments. These projects demand premium, often imported, products with advanced specifications, including integrated automation and sophisticated lighting control systems that meet international safety and sustainability standards. Growth is concentrated geographically and driven by luxury construction and hospitality sector expansions, whereas Africa primarily focuses on foundational electrification projects driving demand for standard, reliable components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Switches and Dimmers and Receptacles Market.- Legrand S.A.

- Schneider Electric SE

- Eaton Corporation plc

- Hubbell Incorporated

- Leviton Manufacturing Co., Inc.

- Lutron Electronics Co., Inc.

- Siemens AG

- Honeywell International Inc.

- ABB Ltd.

- Acuity Brands, Inc.

- Wenzhou G-TEK Electronics Co., Ltd.

- Panasonic Corporation

- Koninklijke Philips N.V.

- GE Lighting (Savant)

- Cooper Lighting Solutions (Eaton)

- Jasco Products Company

- TP-Link Corporation Limited

- Wemo (Belkin International)

- Xiaomi Corporation

- Crestron Electronics, Inc.

Frequently Asked Questions

Analyze common user questions about the Switches and Dimmers and Receptacles market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the growth of the Switches and Dimmers and Receptacles market?

The primary driver is the global proliferation of smart home and smart building technology, coupled with increasingly strict governmental regulations mandating enhanced energy efficiency and electrical safety standards (e.g., compulsory use of GFCI and AFCI receptacles in modern construction).

How are smart switches and dimmers different from traditional mechanical products?

Smart switches and dimmers incorporate integrated electronic components, microprocessors, and wireless communication capabilities (Wi-Fi, Zigbee, etc.) that enable remote control, scheduling, voice activation, and seamless integration with broader smart building management systems, moving beyond simple on/off mechanical functionality.

Which geographical region exhibits the highest growth potential in this market?

The Asia Pacific (APAC) region, particularly driven by large-scale infrastructure development, rapid urbanization in China and India, and rising disposable incomes leading to increased adoption of advanced residential technologies, is projected to show the highest Compound Annual Growth Rate (CAGR) through 2033.

What technological standards are critical for future market development?

Interoperability standards, specifically the adoption of unified protocols like Matter and Thread, are critical for future growth, as they resolve fragmentation issues across diverse smart home ecosystems, simplify device connectivity, and accelerate consumer confidence in connected electrical infrastructure.

What are the main safety innovations driving the receptacle segment?

The main safety innovations include mandatory use of Ground Fault Circuit Interrupters (GFCI) and Arc Fault Circuit Interrupters (AFCI) to prevent electrical shock and fire hazards, alongside the widespread adoption of Tamper-Resistant Receptacles (TRR) to protect children from accidental electrical contact, making compliance a key purchasing factor.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager