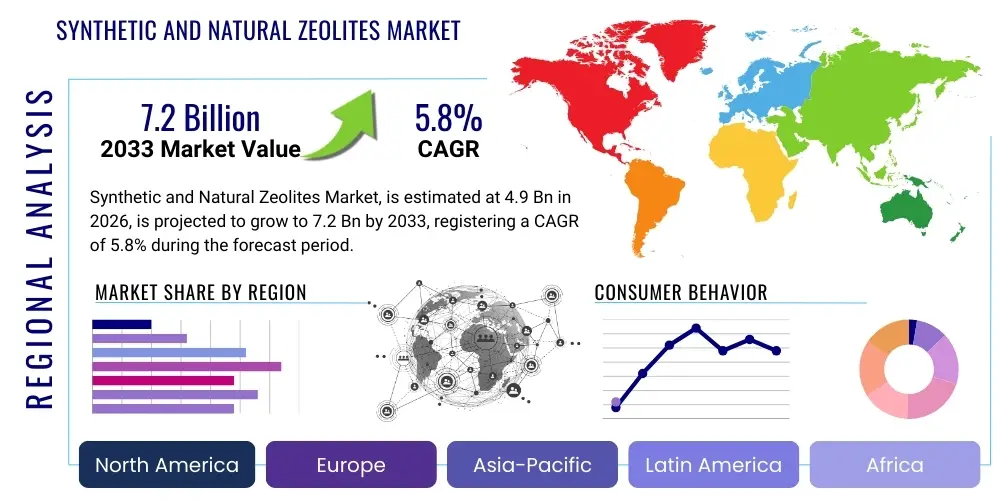

Synthetic and Natural Zeolites Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442235 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Synthetic and Natural Zeolites Market Size

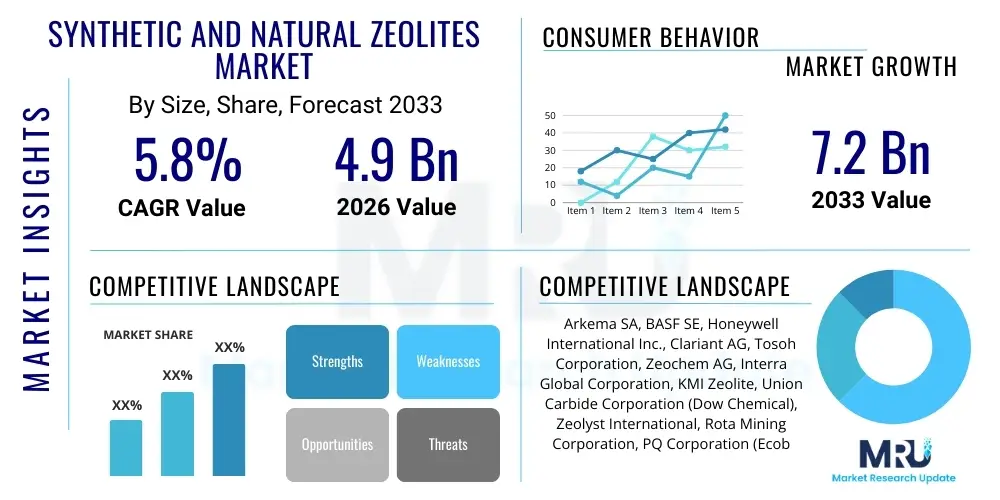

The Synthetic and Natural Zeolites Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.9 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Synthetic and Natural Zeolites Market introduction

The Synthetic and Natural Zeolites Market encompasses a diverse range of crystalline aluminosilicates characterized by porous structures, high surface area, and exceptional ion-exchange and molecular sieving capabilities. Zeolites, both naturally occurring minerals and commercially synthesized compounds, are foundational materials in industrial chemistry due to their highly uniform pore size and selectivity. These unique properties make them indispensable across numerous high-value sectors, driving consistent demand growth globally. Key synthetic zeolites include types such as Zeolite A, Zeolite X, and Zeolite Y, while natural zeolites often include Clinoptilolite and Mordenite, each tailored for specific industrial functions.

Major applications of zeolites center around catalysis in petrochemical refining, environmental remediation, and detergent formulation. In the refining industry, zeolite catalysts are critical components in Fluid Catalytic Cracking (FCC) units, significantly improving the yield and quality of gasoline and diesel fuels. Furthermore, the robust ion-exchange capacity of zeolites is heavily utilized in water treatment for removing heavy metals and ammonium ions, and in laundry detergents where they serve as effective builders replacing environmentally harmful phosphates. Their role in pollution control, especially in automotive exhaust systems as adsorbents for NOx reduction, underscores their environmental significance and contributes substantially to market expansion.

The primary driving factors for the market include stringent global environmental regulations mandating better water and air purification standards, increasing demand for high-performance catalysts in the burgeoning energy sector, and robust expansion in industrial and agricultural applications. The inherent benefits of zeolites, such as non-toxicity, thermal stability, and low cost of natural variants, further cement their position as preferred materials over alternatives like activated carbon or polymeric resins. Continuous innovation in synthetic zeolite synthesis, particularly the development of hierarchical zeolites and metal-organic frameworks (MOFs) incorporating zeolitic structures, promises enhanced performance characteristics and broader utility, propelling the market forward.

Synthetic and Natural Zeolites Market Executive Summary

The global Synthetic and Natural Zeolites Market is characterized by accelerating demand driven primarily by environmental applications and the growth of the petrochemical sector, particularly in Asia Pacific. Business trends indicate a shift toward specialized, high-purity synthetic zeolites optimized for niche catalytic reactions and gas separation processes, commanding premium pricing. Key industry players are focusing on expanding production capacity, especially for molecular sieve manufacturing, and are investing heavily in research to develop novel synthesis routes that reduce energy consumption and waste. Strategic collaborations between zeolite manufacturers and end-user industries (like automotive and refining) are becoming crucial to ensure materials meet increasingly strict performance specifications, thereby solidifying long-term supply agreements and stabilizing revenue streams.

Regionally, Asia Pacific maintains dominance due to rapid industrialization, high levels of infrastructural spending, and growing regulatory pressure to address industrial effluent and air pollution, especially in China and India. This region exhibits robust demand for both natural zeolites used in agriculture and water purification, and synthetic zeolites essential for chemical processing. Conversely, North America and Europe demonstrate mature markets, primarily driven by replacement demand in catalytic applications and the development of advanced synthetic zeolites for specialized functions like carbon capture and storage (CCS) and specialized healthcare uses. These developed markets prioritize sustainability and high-efficiency zeolites, often utilizing advanced materials technology.

Segment trends reveal that the synthetic zeolites segment, specifically the specialty grades, is expected to register the highest CAGR, largely fueled by sophisticated catalytic converters and the expansion of the adsorption segment for industrial gas separation (oxygen, nitrogen). While natural zeolites remain cost-effective solutions for large-scale applications like wastewater treatment and soil amendment, the synthetic market dictates technological advancements and profitability. Within applications, the Catalyst segment continues to hold the largest market share owing to the high volume requirement in the oil and gas sector, while the Adsorbents segment is projected to experience rapid growth due to increasing industrial focus on air quality control and moisture removal in natural gas processing.

AI Impact Analysis on Synthetic and Natural Zeolites Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Synthetic and Natural Zeolites Market frequently revolve around optimizing synthesis processes, predicting material performance, and accelerating discovery of novel zeolitic structures. Users are keenly interested in how machine learning can shorten the notoriously lengthy R&D cycles required to synthesize new zeolites with specific pore sizes and thermal stabilities. Common themes include the application of AI in high-throughput screening of potential zeolitic frameworks, managing complex production parameters in real-time to ensure quality consistency, and using predictive models to forecast demand fluctuations across different end-use sectors, thereby improving supply chain efficiency and reducing inventory costs. There is a general expectation that AI will be transformative, moving the industry from empirical, trial-and-error synthesis toward precise, data-driven material engineering, ultimately lowering manufacturing costs and accelerating commercialization.

AI is already showing significant promise in refining the production of synthetic zeolites, where parameters such as temperature, pH, mixing speed, and aging time must be tightly controlled to achieve desired crystallinity and particle size. Machine learning algorithms can analyze vast datasets generated during synthesis runs to identify non-linear relationships between input variables and final product quality, allowing manufacturers to optimize reaction conditions proactively. Furthermore, in the realm of adsorption and catalysis, AI-driven simulations are being used to model molecular interactions within zeolite pores, enabling researchers to predict catalytic activity and selectivity for complex reactions with far greater accuracy than traditional computational methods. This predictive capability significantly reduces the need for expensive and time-consuming laboratory experiments, accelerating the deployment of highly efficient catalytic materials in critical industries like petrochemical refining and environmental scrubbing.

The integration of AI also addresses major supply chain challenges inherent in a material market dependent on global commodities. Predictive maintenance models, powered by machine learning, minimize unexpected downtime in large-scale zeolite production facilities, ensuring continuous output. On the natural zeolite front, AI is being used in geological surveying and mineral processing to optimize extraction techniques, improving purity and yield from natural deposits while minimizing environmental disruption. The synergistic application of AI in both synthesis and application modeling is poised to revolutionize the design and manufacturing of zeolites, enhancing material properties for applications like carbon capture (CO2 adsorption capacity) and industrial gas separation, thereby maximizing their commercial and environmental utility.

- AI-driven optimization of synthetic zeolite crystal growth parameters for enhanced purity and yield.

- Machine learning algorithms applied to high-throughput screening for discovering novel zeolite frameworks and structures.

- Predictive modeling of catalytic activity and molecular sieving performance, reducing experimental cycles.

- AI integration in smart manufacturing and process control systems for real-time quality assurance in production.

- Optimization of supply chain logistics and inventory management based on forecasted end-user demand across industries.

DRO & Impact Forces Of Synthetic and Natural Zeolites Market

The market dynamics of synthetic and natural zeolites are shaped by a powerful confluence of driving forces, inherent constraints, and emerging technological opportunities. The primary driver is the global emphasis on environmental sustainability, specifically the tightening of air and water quality regulations, which mandates the use of highly efficient filtration and catalytic materials. Zeolites, with their unparalleled efficiency in removing pollutants, heavy metals, and utilizing them in catalytic converters for emissions reduction, are intrinsically positioned to benefit from this regulatory push. Furthermore, the persistent growth in the petrochemical industry, particularly in developing economies, continues to fuel high demand for FCC catalysts, which are zeolite-based. Conversely, market growth is restrained by the high capital investment required for synthetic zeolite manufacturing plants and the intense competition from alternative materials like activated alumina and specific grades of porous carbon, particularly in low-value water treatment applications. The variability in quality and supply consistency of natural zeolites also poses a practical restraint for high-specification industrial uses.

Opportunities for significant market expansion are abundant, particularly in niche high-value sectors. The development of next-generation applications such as carbon capture and storage (CCS) presents a massive potential market, leveraging zeolites' superior CO2 adsorption properties. Additionally, the shift toward sustainable agriculture and aquaculture provides an avenue for increased natural zeolite use as soil conditioners, feed additives, and water purifiers. Technological advancements in nano-zeolites and hierarchical zeolites offer opportunities to create materials with superior performance characteristics, overcoming the diffusion limitations sometimes found in traditional microporous structures, thus broadening their applicability in complex catalytic processes and drug delivery systems. Investing in decentralized, modular zeolite synthesis technologies could also lower the entry barriers for smaller manufacturers and specialized material producers.

The impact forces within this market are substantial, creating a dynamic competitive landscape. Environmental mandates act as a crucial external force, dictating demand spikes in specific application areas like automotive catalysts (e.g., SCR systems). Technological innovation serves as a continuous internal force, where the ability to synthesize tailored zeolites rapidly translates directly into competitive advantage and market share gain, especially in the specialty chemical sector. Economic volatility, particularly the price of feedstocks like alumina and silica, exerts influence on manufacturing costs, particularly for synthetic variants. Furthermore, geopolitical shifts affecting the global oil and gas industry have a direct, high-impact effect on the demand for large-volume FCC catalysts. Successful players must navigate this complex interplay, capitalizing on environmental necessity and technological progression while mitigating risks associated with input costs and regulatory changes.

Segmentation Analysis

The Synthetic and Natural Zeolites Market is segmented primarily based on product type (natural vs. synthetic), application, and end-use industry. This segmentation provides a granular view of market dynamics, revealing that while natural zeolites maintain relevance due to cost-effectiveness in bulk applications like agriculture and construction, synthetic zeolites dominate high-value, performance-critical sectors such as refining and advanced catalysis. The synthetic segment is further diversified into categories like Zeolite A, Zeolite X, Zeolite Y, and ZSM-5, each tailored for specific molecular sieving or catalytic functions. Understanding these distinct segments is critical for manufacturers to align their R&D and production capabilities with targeted market needs, focusing either on high-volume, low-margin natural zeolite production or specialized, high-margin synthetic products.

- By Product Type:

- Natural Zeolites (e.g., Clinoptilolite, Mordenite)

- Synthetic Zeolites (e.g., Zeolite A, Zeolite X, Zeolite Y, ZSM-5, Chabazite)

- By Application:

- Catalysts (e.g., FCC, Hydrocracking)

- Adsorbents (e.g., Gas Separation, Drying, Purification)

- Detergent Builders

- Ion Exchange (e.g., Water and Wastewater Treatment)

- Others (e.g., Medical, Agriculture, Construction)

- By End-Use Industry:

- Petroleum Refining & Petrochemicals

- Chemicals

- Water & Wastewater Treatment

- Automotive (Emissions Control)

- Agriculture & Aquaculture

- Detergent & Household Care

Value Chain Analysis For Synthetic and Natural Zeolites Market

The value chain for the Synthetic and Natural Zeolites Market begins with the upstream sourcing of raw materials. For natural zeolites, this involves mining and initial beneficiation processes to enhance purity and particle size distribution. For synthetic zeolites, the key feedstocks are high-purity silica and alumina sources (e.g., sodium silicate, aluminum hydroxide), which are typically sourced from the base chemical industry. The quality and consistent supply of these upstream components are paramount, as slight impurities can significantly compromise the final performance of the synthesized zeolite, especially for demanding catalytic applications. Managing feedstock price volatility and ensuring long-term supply agreements are crucial tasks in this stage of the value chain, directly impacting the manufacturing cost base.

The core of the value chain is the manufacturing process, where natural zeolites undergo sophisticated processing (milling, activation, thermal treatment) and synthetic zeolites are created via hydrothermal synthesis, crystallization, and calcination. This step involves significant R&D effort and capital expenditure, especially in optimizing synthesis routes to achieve specific framework types and morphological features (e.g., pore size, surface area). Post-manufacturing, the products enter the distribution channel, which is highly specialized. Direct sales are common for high-volume, strategic buyers (e.g., major refineries purchasing FCC catalysts), allowing for tailored product specifications and technical support. Indirect distribution, involving specialized chemical distributors, handles lower volume orders and reaches diverse smaller end-users across various geographical regions, particularly for detergent grades and agricultural applications.

The downstream analysis focuses on the integration of zeolites into end-user processes. For catalysts, this involves collaboration with specialized catalyst preparers who combine the zeolite powder with binders and matrix materials to form shaped products (pellets, spheres). In the environmental and water treatment sectors, zeolites are often sold as functional materials integrated into filtration beds or municipal water treatment systems. The final stage involves providing technical service and support to ensure optimal performance of the zeolite material in the specific industrial environment. The value addition is highest in the synthesis of high-performance, specialized synthetic zeolites (like ZSM-5 or metal-loaded chabazite for SCR), whereas natural zeolites compete primarily on bulk pricing and availability for commodity uses.

Synthetic and Natural Zeolites Market Potential Customers

The primary customers for synthetic and natural zeolites are diverse industrial entities requiring highly selective catalysts, efficient adsorbents, or superior ion-exchange media. The single largest consumer segment is the petroleum refining and petrochemical industry, which relies heavily on synthetic zeolites (especially Zeolite Y and ZSM-5) for Fluid Catalytic Cracking (FCC), hydrocracking, and various reforming processes essential for producing transportation fuels and basic chemical building blocks. These customers demand extremely high purity, consistent thermal stability, and specific acidity profiles, often leading to long-term procurement contracts directly with specialized zeolite manufacturers.

Another major segment comprises the manufacturers of detergent and household care products, which utilize synthetic zeolites (primarily Zeolite A) as phosphate replacements or builders to sequester hard water ions, enhancing cleaning efficiency. This customer base is highly price-sensitive and requires large, consistent volumes of standard-grade material. Furthermore, the environmental and water treatment sectors represent a rapidly expanding customer base, including municipal water facilities, industrial effluent treatment plants, and air purification system manufacturers. These buyers leverage both natural (for bulk filtration and heavy metal removal) and synthetic (for specialized gas separation and air purification) zeolites, driven by regulatory compliance and operational efficiency goals.

Emerging and high-growth potential customers include manufacturers in the agricultural and aquaculture sectors, where natural zeolites are used extensively as soil conditioners, nutrient delivery enhancers, and feed additives for livestock and fish to improve nutrient absorption and manage waste. Automotive manufacturers, particularly those focusing on emissions control technologies like Selective Catalytic Reduction (SCR) systems, are vital customers for specialized synthetic zeolites (such as copper-exchanged chabazite) that selectively reduce harmful NOx emissions. Finally, specialized chemical companies and pharmaceutical manufacturers occasionally require highly tailored zeolites for molecular separation, purification, and controlled drug delivery systems, representing the premium end of the customer spectrum demanding unique, customized solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.9 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Arkema SA, BASF SE, Honeywell International Inc., Clariant AG, Tosoh Corporation, Zeochem AG, Interra Global Corporation, KMI Zeolite, Union Carbide Corporation (Dow Chemical), Zeolyst International, Rota Mining Corporation, PQ Corporation (Ecobat), Shijiazhuang Jianda High-Tech Chemical Co., Ltd., W.R. Grace & Co., Zeolite Products, Blue Pacific Minerals, Zeo Inc., G&T Zeolite, C.C.IC. Zeolite, NanoScape AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Synthetic and Natural Zeolites Market Key Technology Landscape

The technological landscape of the Synthetic and Natural Zeolites Market is rapidly evolving, driven by the need for enhanced performance, lower production costs, and greater sustainability. A core technological focus is the development of novel synthesis methods for high-silica zeolites (HSZs), which exhibit superior hydrothermal stability and acidity, making them ideal for challenging catalytic environments, such as those found in high-temperature petrochemical processes. Traditional hydrothermal synthesis methods are being refined using structure-directing agents (SDAs) to precisely control the crystallographic framework and morphology, leading to tailored zeolites with specific catalytic or adsorption selectivity. Furthermore, researchers are increasingly utilizing green chemistry principles, exploring solvent-free or mechanochemical synthesis routes to reduce the environmental footprint and energy consumption associated with large-scale production, appealing to sustainability-conscious end-users.

A significant area of advancement lies in the creation of hierarchical zeolites, which address the diffusion limitations of conventional microporous materials. Hierarchical structures incorporate both micropores (for selective separation and catalysis) and larger mesopores or macropores (for rapid mass transport), significantly enhancing reaction rates and efficiency, especially for large organic molecules. Technologies such as dealumination, desilication, and the use of carbon templates are instrumental in creating these multi-scale pore structures, which are vital for next-generation applications like biomass conversion and heavy oil upgrading. The ability to control both the microscopic structure and the macroscopic form (e.g., beads, monoliths) through advanced shaping techniques is critical for their practical deployment in industrial reactors and filtration systems.

Beyond material structure, advanced characterization and application technologies are transforming the market. High-resolution electron microscopy, X-ray diffraction, and advanced spectroscopic techniques are being used to rigorously analyze and validate the structural integrity and surface chemistry of commercial zeolites. Furthermore, technology integration focuses on embedding zeolites into complex systems, such as incorporating metal nanoparticles into zeolite matrices (metal-organic frameworks or supported catalysts) to enhance specific catalytic functions like Fischer-Tropsch synthesis or selective oxidation. The convergence of material science, nanotechnology, and advanced manufacturing ensures that zeolites continue to be at the forefront of adsorption, separation, and catalytic technology, pushing performance boundaries in environmental remediation and energy production.

Regional Highlights

- Asia Pacific (APAC): Dominance Driven by Industrialization and Environmental Compliance

Asia Pacific is the largest and fastest-growing market for synthetic and natural zeolites, primarily fueled by rapid industrialization, massive infrastructure development, and increasing energy consumption, particularly in China, India, and Southeast Asian nations. The region’s strong focus on developing its domestic petrochemical and refining capacity drives high demand for synthetic zeolite catalysts. Simultaneously, growing population density and escalating levels of industrial pollution necessitate stringent wastewater and air quality controls, boosting the application of zeolites in environmental cleanup. The availability of significant natural zeolite reserves in countries like China and South Korea also supports the widespread use of natural zeolites in low-cost, high-volume applications such as agriculture and construction materials. Investment in new manufacturing facilities for both standard and specialty zeolites is concentrated here, aiming to cater to the immense domestic and export market requirements.

The regulatory landscape in APAC, while historically lagging, is quickly catching up to Western standards, especially concerning automotive emissions (e.g., adoption of Bharat Stage VI norms in India) and industrial discharge limits. This regulatory evolution ensures sustained high demand for advanced synthetic zeolites required in Selective Catalytic Reduction (SCR) systems and specialized adsorption processes. The competitive pricing of raw materials and lower labor costs contribute to the region’s strength as a global manufacturing hub for zeolites, making it a critical strategic area for global market players seeking expansion.

- North America: Maturity and Focus on Specialty Catalysts and Gas Separation

North America holds a substantial share of the global zeolite market, characterized by mature industrial sectors and a strong emphasis on high-performance materials. The demand here is primarily driven by replacement cycles for catalysts in the established U.S. petrochemical and refining industry, which requires high-quality, thermally stable synthetic zeolites to maintain operational efficiency and meet stringent product specifications. Furthermore, the region is a global leader in industrial gas processing, including natural gas dehydration and oxygen/nitrogen separation, creating robust demand for molecular sieve adsorbents. Environmental regulations, particularly concerning vehicle emissions (EPA standards) and industrial air quality, mandate continuous upgrades to catalytic systems, favoring advanced, customized synthetic zeolite formulations.

Innovation is key in the North American market, with significant investment directed toward applications related to energy transition, such as specialized zeolites for biofuel production and emerging carbon capture technologies. Manufacturers in this region focus on R&D to develop proprietary zeolitic materials with superior mechanical and chemical resilience. While natural zeolite usage is present, especially in niche agricultural and absorbent applications, the synthetic segment dominates the overall market value due to the high technological requirements of the energy and chemical sectors.

- Europe: Stringent Environmental Standards and Circular Economy Initiatives

The European market is defined by some of the world's most rigorous environmental and climate change policies, significantly influencing zeolite demand. The push towards achieving net-zero emissions drives high consumption of specialty zeolites used in advanced catalytic converters (Euro 6/7 standards) and industrial pollution control systems. Europe is also a major adopter of zeolites in detergent formulations, largely due to early governmental restrictions on phosphate use, establishing a stable, albeit mature, market segment for Zeolite A. The strong regulatory environment necessitates continuous innovation, particularly in sustainable zeolite synthesis methods and their integration into circular economy models.

Furthermore, European research institutions and companies are pioneers in developing zeolites for novel applications, including targeted drug delivery systems, heat storage, and hydrogen purification. The region's focus on material circularity encourages research into regenerating spent zeolites and utilizing waste materials (like fly ash) as precursors for synthetic zeolite production. Despite slower overall industrial growth compared to APAC, the high value placed on specialized, sustainable, and performance-driven materials ensures the region remains a vital segment for high-margin synthetic products.

- Latin America (LATAM) and Middle East & Africa (MEA): Growth Driven by Resource Processing

The Middle East and Africa region is witnessing considerable growth driven almost entirely by the massive expansion of its oil and gas processing capacities. New refinery construction and upgrading projects in the Gulf Cooperation Council (GCC) countries create substantial demand for high volumes of synthetic zeolite FCC and hydrocracking catalysts. The focus is primarily on large-scale industrial applications related to resource monetization. Latin America, particularly Brazil and Mexico, demonstrates steady demand, supported by refining activity and extensive use of natural zeolites in agricultural soil improvement and water purification, benefiting from large domestic reserves and the vast agricultural footprint of the region. Both regions represent promising growth corridors as local governments increasingly enforce environmental protocols.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Synthetic and Natural Zeolites Market.- Arkema SA

- BASF SE

- Honeywell International Inc.

- Clariant AG

- Tosoh Corporation

- Zeochem AG

- Interra Global Corporation

- KMI Zeolite

- Union Carbide Corporation (Dow Chemical)

- Zeolyst International

- Rota Mining Corporation

- PQ Corporation (Ecobat)

- Shijiazhuang Jianda High-Tech Chemical Co., Ltd.

- W.R. Grace & Co.

- Zeolite Products

- Blue Pacific Minerals

- Zeo Inc.

- G&T Zeolite

- C.C.IC. Zeolite

- NanoScape AG

Frequently Asked Questions

Analyze common user questions about the Synthetic and Natural Zeolites market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference in application between synthetic and natural zeolites?

Synthetic zeolites are engineered for high purity, uniform pore size, and tailored performance, making them essential for high-value applications like complex petroleum catalysis, specialized gas separation (molecular sieves), and advanced emissions control. Natural zeolites are typically used in large-volume, cost-sensitive applications such as soil conditioning, animal feed additives, and bulk municipal water treatment due to their lower cost and inherent ion-exchange capabilities.

Which key industry drives the highest demand for synthetic zeolites globally?

The Petroleum Refining and Petrochemical industry is the major consumer, specifically utilizing synthetic zeolites as catalysts in Fluid Catalytic Cracking (FCC) units, hydrocracking, and isomerization processes. These zeolites are fundamental to optimizing the yield and quality of gasoline, diesel, and basic petrochemical intermediates, representing the single largest market segment by value.

How do environmental regulations specifically impact the growth of the zeolite market?

Strict environmental regulations, particularly those governing air quality (e.g., mandates for NOx reduction in vehicles and industrial stacks) and water purity (limits on heavy metals and ammonia), directly drive demand. Zeolites are critical components in Selective Catalytic Reduction (SCR) systems for NOx abatement and highly effective ion exchangers for removing contaminants from wastewater, positioning them as essential materials for compliance.

What emerging technologies are expected to broaden the future application scope of zeolites?

Emerging technologies focus heavily on Carbon Capture and Storage (CCS), where specialized zeolites offer highly efficient and regenerable adsorbents for CO2 capture from flue gas. Additionally, the development of hierarchical zeolites (combining micro and mesopores) and nano-zeolites is opening doors to advanced applications in sustained drug delivery, high-efficiency biomass conversion, and next-generation membrane separation technologies.

Which geographical region is forecasted to exhibit the highest market growth rate for zeolites?

Asia Pacific (APAC) is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is attributed to extensive infrastructure investments, rapid capacity expansion in the chemical and refining sectors in countries like China and India, and increasing governmental enforcement of environmental protection policies, which necessitate the use of efficient zeolite materials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager