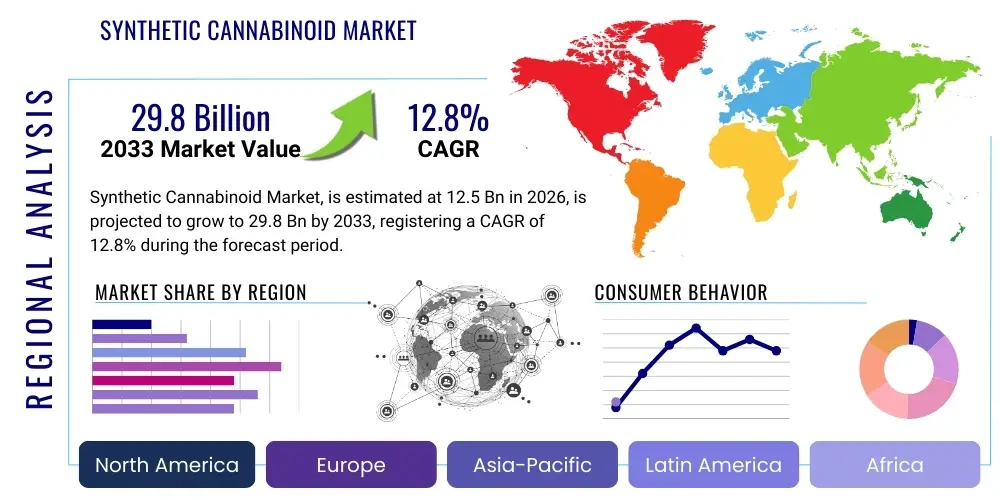

Synthetic Cannabinoid Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442535 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Synthetic Cannabinoid Market Size

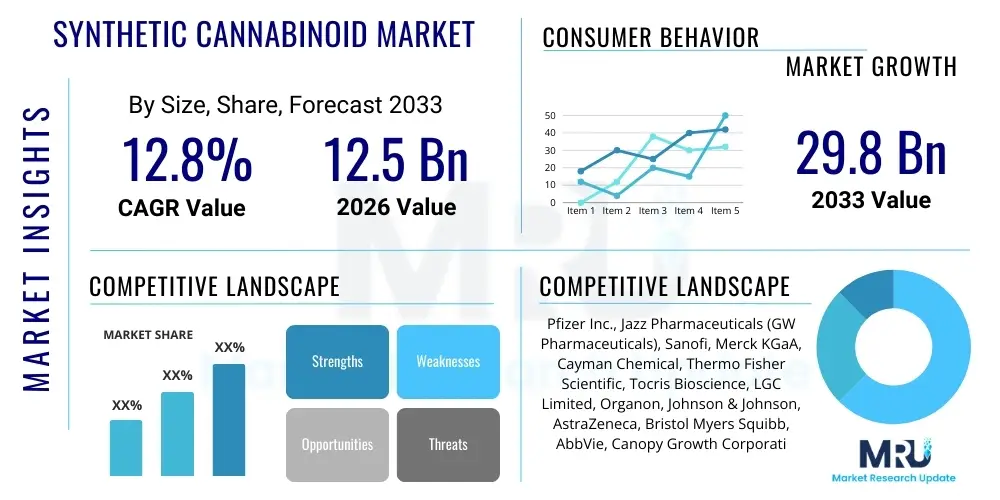

The Synthetic Cannabinoid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at $12.5 Billion in 2026 and is projected to reach $29.8 Billion by the end of the forecast period in 2033.

This projected expansion is fundamentally driven by accelerating pharmaceutical research efforts aimed at isolating and optimizing highly selective synthetic cannabinoid analogs for targeted therapeutic applications. Unlike plant-derived cannabinoids, synthetic variants offer precise control over chemical structure, enabling the development of compounds that selectively target specific cannabinoid receptors (CB1 or CB2) without the undesirable psychoactive side effects associated with non-selective activation. Furthermore, the scalability and consistency achievable through synthetic manufacturing processes provide a significant advantage over agricultural cultivation and extraction, satisfying the high-volume, high-purity demands of clinical development and commercialization.

However, the rapid growth trajectory is continuously modulated by the highly complex and often contradictory global regulatory landscape. While legitimate pharmaceutical development faces rigorous safety and efficacy hurdles, the market must also contend with the pervasive challenge posed by illicit synthetic cannabinoids (often termed 'Spice' or 'K2'), which necessitate constant monitoring and regulatory intervention (scheduling, banning) to protect public health. The market size estimation carefully factors in the increasing investment in legitimate research, particularly in pain management, multiple sclerosis, and epilepsy, while acknowledging the regulatory friction that exists due to the history of misuse of related compounds.

Synthetic Cannabinoid Market introduction

The Synthetic Cannabinoid Market encompasses the development, production, and distribution of chemically synthesized compounds designed to interact with the endogenous cannabinoid system (ECS) in the human body. These products range from highly purified, pharmaceutical-grade active pharmaceutical ingredients (APIs) intended for clinical use, to specialized research chemicals utilized in academic and corporate laboratories for studying receptor pharmacology and signaling pathways. Products are typically defined by their target specificity—either binding to the central nervous system receptor CB1 or the peripheral receptor CB2—allowing researchers to explore non-psychoactive therapeutic avenues, such as inflammation and localized pain relief, distinct from the historically known effects of Δ9-tetrahydrocannabinol (THC).

Major applications for synthetic cannabinoids are predominantly concentrated within the pharmaceutical sector, focusing on indications where current treatments are inadequate. This includes the management of chemotherapy-induced nausea and vomiting (CINV), severe forms of epilepsy (such as Lennox-Gastaut syndrome), chronic neuropathic pain, and symptomatic relief for multiple sclerosis. The key benefit driving adoption is the ability to create novel compounds with superior potency, predictability, and receptor selectivity compared to botanicals. This chemical precision minimizes off-target effects, enhances bioavailability, and provides intellectual property protection necessary for large-scale pharmaceutical investment. Driving factors include breakthroughs in ECS understanding, escalating global pain management crises, and technological advancements in drug screening and synthetic chemistry that allow for rapid analog generation and optimization.

The operational environment for this market is characterized by stringent quality control requirements and profound scientific complexity. Market participants are leveraging advanced organic synthesis techniques to create structurally unique molecules that offer therapeutic benefit while avoiding the regulatory pitfalls associated with psychoactivity. The ongoing validation of synthetic analogues in advanced clinical trials is crucial for market maturation. Furthermore, the capacity to produce these compounds economically and at high purity levels ensures consistent supply chains necessary for global clinical translation, fundamentally underpinning the long-term growth prospects across both established and emerging healthcare economies.

Synthetic Cannabinoid Market Executive Summary

The Synthetic Cannabinoid Market exhibits dynamic business trends characterized by aggressive mergers, acquisitions, and strategic partnerships primarily centered around securing pipeline assets in neurology and immunology. Major pharmaceutical entities are increasingly acquiring specialized biotech firms focused on ECS modulation to diversify their therapeutic portfolios and capitalize on the significant therapeutic promise of selective CB receptor ligands. Furthermore, there is a distinct trend towards vertical integration within the research chemical supply chain, where key chemical providers are enhancing their analytical capabilities to meet the extraordinarily high purity and documentation requirements demanded by preclinical and academic research institutions globally, ensuring compliance with evolving research standards.

Regional trends reveal a clear dichotomy in market development. North America, driven by the United States’ robust biotech funding and accelerated FDA approval pathways for certain orphan drugs derived from cannabinoid science, currently dominates revenue generation. This leadership is supported by a mature healthcare infrastructure and high patient willingness to participate in clinical trials for novel pain and neurological treatments. Conversely, the Asia Pacific (APAC) region is emerging as a critical hub for outsourced contract manufacturing and preclinical research due to competitive operating costs and increasing investment in domestic biotechnology sectors, although market penetration for final therapeutic products remains low due to highly conservative regulatory frameworks in several major economies.

Segmentation trends illustrate a significant shift toward selective modulators, particularly selective CB2 agonists, which are non-psychoactive and hold immense promise in treating peripheral inflammation and fibrotic diseases without impacting central nervous system function. While established segments, such as oral CBD analogs for epilepsy, continue to provide baseline revenue stability, the fastest growth is observed in early-stage research focused on novel receptor targets beyond the traditional CB1 and CB2, including GPR55 and related endocannabinoid metabolic enzymes. This strategic focus on novel targets signifies the market's evolution from simple mimicry of natural cannabinoids to sophisticated pharmacological engineering designed to precisely modulate specific aspects of the ECS.

AI Impact Analysis on Synthetic Cannabinoid Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Synthetic Cannabinoid Market primarily revolve around safety, the acceleration of illegal drug design, and the regulatory ability to keep pace with algorithmic innovation. Users are highly concerned about AI's potential to rapidly generate novel synthetic cannabinoid structures (novel psychoactive substances, or NPS) that evade current legal scheduling, thereby exacerbating the illicit market crisis. Simultaneously, there is strong optimism regarding AI’s application in legitimate drug discovery—specifically, the potential for machine learning to accurately predict the pharmacological activity and toxicity profiles of thousands of synthetic analogs, thereby drastically cutting down the time and cost associated with preclinical screening and ensuring safer, more effective pharmaceutical candidates reach clinical development faster.

The pharmaceutical segment is leveraging AI and machine learning platforms to address the fundamental challenges of combinatorial chemistry inherent in this market. AI algorithms are highly effective at analyzing massive datasets relating to receptor binding kinetics, structure-activity relationships (SAR), and metabolic pathways. This capability allows researchers to rapidly narrow down millions of potential synthetic structures to a few dozen highly promising, target-specific molecules. This precision engineering, guided by AI, significantly reduces the 'fail early' cost associated with traditional drug discovery, focusing investment only on candidates with optimal selectivity, potency, and bioavailability, thus fundamentally reshaping the market’s R&D expenditure allocation.

Furthermore, AI plays a crucial role in regulatory and anti-illicit efforts. Regulatory bodies and forensic science laboratories are deploying AI-driven predictive modeling tools to anticipate the next generation of illicit synthetic structures before they appear on the market. These models analyze chemical scaffold hopping patterns used by clandestine labs, allowing for proactive scheduling and rapid toxicological assessment. On the manufacturing side, AI optimizes complex synthetic routes, predicting ideal reaction conditions, maximizing yield, and minimizing the generation of impurities, which is essential for meeting the stringent quality standards required for pharmaceutical applications, thereby enhancing both efficiency and product safety across the legal supply chain.

- Accelerated discovery of selective cannabinoid receptor agonists/antagonists.

- Predictive toxicity and ADMET (Absorption, Distribution, Metabolism, Excretion, Toxicity) modeling reduces preclinical failure rates.

- Optimization of complex chemical synthesis pathways, lowering production costs and increasing purity.

- AI-driven analysis of structure-activity relationships (SAR) for superior pharmacological profiles.

- Development of proactive forensic tools to identify and schedule novel illicit synthetic cannabinoids (NPS).

- Enhanced personalization of cannabinoid-based therapies through patient data analysis.

DRO & Impact Forces Of Synthetic Cannabinoid Market

The Synthetic Cannabinoid Market is shaped by powerful and often conflicting forces, summarized by critical Drivers, Restraints, and Opportunities (DRO). Key drivers include the overwhelming need for novel, non-opioid pain management solutions, where synthetic cannabinoids offer targeted pain relief with potentially reduced addiction liability compared to conventional narcotics. The consistent, scalable manufacturing of high-purity APIs—impossible to achieve with natural cultivation—is a major logistical driver for pharmaceutical manufacturers. Opportunities are vast, particularly in developing non-psychoactive drugs targeting peripheral inflammation, fibrosis, and oncology support, exploiting the selective CB2 receptor pathway with minimal central nervous system involvement.

However, market expansion is heavily restrained by the severe regulatory complexity and negative public perception stemming from the historical misuse of illicit synthetic compounds. Regulatory bodies, globally, approach any cannabinoid analog with extreme caution, demanding extensive long-term safety data, which significantly prolongs the R&D timeline and increases clinical trial costs. Furthermore, the risk of therapeutic products being diverted or becoming associated with the highly dangerous illicit synthetic market creates profound reputational and operational risks for legitimate industry players, necessitating extraordinarily robust supply chain controls and regulatory compliance measures that act as a substantial barrier to entry.

The impact forces are fundamentally rooted in technological innovation and societal acceptance. Advancements in synthetic biology, enabling the microbial production of complex cannabinoid molecules (fermentation-based cannabinoids), threaten traditional chemical synthesis methods by offering potentially cleaner and more sustainable production routes. Moreover, evolving public and governmental attitudes towards cannabis, generally trending towards liberalization, are creating a more favorable environment for clinical research and investment, forcing regulators to differentiate clearly between legitimate pharmaceutical compounds and scheduled illicit substances. Strategic success hinges on the ability of manufacturers to deliver precise, clinically validated molecules that address unmet medical needs while successfully navigating the complex web of controlled substance regulations.

Segmentation Analysis

Segmentation is crucial for understanding the Synthetic Cannabinoid Market, primarily due to the diverse spectrum of molecular targets, application areas, and regulatory statuses surrounding these compounds. The market must be analyzed based on the chemical structure's intended interaction with the endocannabinoid system, differentiating products by their specificity for CB1 (central effects, typically high regulatory control) versus CB2 (peripheral effects, often lower regulatory hurdles for inflammation/pain). This structural segmentation directly impacts the regulatory pathway, the clinical application, and the ultimate commercial viability of the synthetic molecule.

The key market dimensions include segmentation by Product Type (focused on receptor affinity), Application (driven by clinical need), and End-User (distinguishing research/academic consumption from commercial pharmaceutical production). The 'Application' segment is rapidly diversifying beyond established neurological uses into dermatology, gastrointestinal health, and pain management, reflecting the growing understanding of the widespread role of the ECS throughout the body. End-user categorization helps distinguish between the high-volume demand of large pharmaceutical companies (focused on commercial scale-up) and the specialized, high-purity requirements of academic and contract research organizations (CROs) that drive basic pharmacological discoveries.

Geographic segmentation remains paramount, as regional market dynamics are almost entirely dictated by local legislation regarding controlled substances and pharmaceutical development timelines. Markets with established medical cannabis frameworks or streamlined drug approval processes (like North America) tend to lead in therapeutic adoption, while regions with strict controls (such as parts of Asia and the Middle East) primarily engage in basic research chemical supply or serve as potential manufacturing hubs. Understanding these segment-specific regulatory frameworks is essential for any player seeking to strategically penetrate or expand within this highly regulated global market.

- By Product Type:

- Selective CB1 Agonists

- Selective CB2 Agonists

- Dual CB1/CB2 Modulators

- Receptor Antagonists

- Metabolic Enzyme Inhibitors (e.g., FAAH inhibitors)

- By Application:

- Pain Management (Chronic, Neuropathic, Cancer-related)

- Neuropsychiatric Disorders (Epilepsy, Schizophrenia, Anxiety)

- Autoimmune and Inflammatory Diseases (Multiple Sclerosis, Arthritis)

- Oncology Support (CINV, Cachexia)

- Research & Development (Preclinical Testing, Receptor Studies)

- By End-User:

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Contract Research Organizations (CROs)

- Specialty Pain & Neurology Clinics

- By Synthesis Method:

- Chemical Synthesis

- Microbial Fermentation (Synthetic Biology)

- By Regulatory Status:

- FDA Approved/EMA Cleared

- Investigational New Drugs (INDs)

- Research Use Only (RUO) Chemicals

Value Chain Analysis For Synthetic Cannabinoid Market

The value chain for the Synthetic Cannabinoid Market begins upstream with the sourcing of specialized precursor chemicals and advanced chemical synthesis. This stage is highly IP-intensive, focusing on proprietary reaction methodologies that ensure chiral purity and yield highly specific molecular structures. Due to the controlled nature of many related substances, supplier qualification and secure warehousing of raw materials are critical, often involving highly specialized contract manufacturing organizations (CMOs) that can handle controlled substance regulations (e.g., DEA scheduling). The complexity of multi-step organic synthesis requires significant technical expertise and investment in specialized chemical reactors and isolation equipment, minimizing batch variation and ensuring compliance with stringent cGMP (Current Good Manufacturing Practice) standards.

The midstream involves purification, formulation, and quality control (QC). Given the sensitive nature of the compounds, achieving pharmaceutical-grade purity (often 99%+) is non-negotiable, relying heavily on advanced analytical techniques like chiral chromatography and mass spectrometry to detect trace impurities. Formulation involves transforming the API into a stable dosage form, such as capsules, oral solutions, or transdermal patches, requiring specialized pharmaceutical development expertise. Distribution channels are highly bifurcated: for pharmaceutical products, distribution is strictly controlled, direct to licensed pharmacies, hospitals, and specialized clinics, adhering to cold chain and controlled substance tracking protocols. Conversely, research-use-only chemicals follow a direct-to-laboratory model, often managed by specialized chemical distributors that require strict end-user certification.

Downstream analysis focuses on market access and intellectual property enforcement. Direct channels involve pharmaceutical companies marketing patented drugs directly to prescribing physicians and payers, necessitating extensive clinical evidence and pricing negotiations. Indirect channels involve partnerships with specialty distributors or market access consultancies to navigate complex reimbursement landscapes in different territories. A major challenge across the downstream segment is preventing product diversion into unregulated markets, requiring robust security measures throughout the supply chain and continuous monitoring of sales patterns. The effectiveness of the value chain is ultimately measured by its ability to deliver high-quality, fully compliant therapeutic products to patients while maintaining the strictest control over the synthesized chemical assets.

Synthetic Cannabinoid Market Potential Customers

The primary cohort of potential customers for pharmaceutical-grade synthetic cannabinoids consists of large pharmaceutical and biotechnology companies heavily invested in therapeutic areas such as pain, neurology, and immunology. These entities are buyers of APIs for late-stage clinical trials and eventual commercialization, seeking compounds with optimized pharmacological profiles (high selectivity, improved half-life, and reduced toxicity). They demand significant manufacturing scalability and impeccable regulatory documentation (e.g., Drug Master Files). Their purchasing decisions are guided by clinical trial success rates, patent life, and the potential market size of the targeted medical indication, such as severe refractory epilepsy or chronic neuropathic pain, where patient need is critical.

A second, crucial customer base comprises academic research institutions, government laboratories (e.g., NIH, CDC), and specialized Contract Research Organizations (CROs). These customers require smaller, highly diverse libraries of synthetic cannabinoid analogs for fundamental pharmacology studies, receptor binding assays, and early-stage preclinical screening. Their priority is chemical diversity, immediate availability, and ultra-high purity (>99.5%), often purchasing 'Research Use Only' (RUO) compounds. CROs, in particular, serve as intermediaries, offering specialized services related to drug metabolism and pharmacokinetic (DMPK) testing of novel synthetic structures on behalf of smaller biotech clients who lack in-house capabilities, thus driving demand for customized synthesis services.

Finally, specialized clinical settings, including pain management clinics and neurology centers, represent the ultimate end-users consuming the formulated prescription products. Their uptake is contingent upon favorable drug scheduling, robust payer reimbursement policies, and demonstrated clinical efficacy over existing treatment standards. Beyond human medicine, emerging potential customers include veterinary pharmaceutical companies exploring synthetic cannabinoids for pet pain and anxiety management, and specialized diagnostic firms utilizing cannabinoid receptor ligands as highly specific probes in medical imaging or laboratory diagnostics to study disease progression related to ECS dysfunction.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $12.5 Billion |

| Market Forecast in 2033 | $29.8 Billion |

| Growth Rate | CAGR 12.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pfizer Inc., Jazz Pharmaceuticals (GW Pharmaceuticals), Sanofi, Merck KGaA, Cayman Chemical, Thermo Fisher Scientific, Tocris Bioscience, LGC Limited, Organon, Johnson & Johnson, AstraZeneca, Bristol Myers Squibb, AbbVie, Canopy Growth Corporation, Norac Pharma, Mallinckrodt Pharmaceuticals, Takeda Pharmaceutical Company Limited, Indivior PLC, Curaleaf Holdings, Inc. (R&D Division), Sativex. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Synthetic Cannabinoid Market Key Technology Landscape

The core technology landscape for the Synthetic Cannabinoid Market is anchored in advanced organic chemistry methodologies, specifically the ability to execute highly controlled and reproducible multi-step synthesis reactions. Key technologies include stereoselective synthesis techniques, which are crucial for producing specific enantiomers required for targeted therapeutic action, as often only one chiral form provides the desired pharmacological effect. Furthermore, continuous flow chemistry is gaining prominence, allowing manufacturers to move from traditional batch processing to continuous, highly optimized production. This shift enhances safety, improves efficiency, reduces reaction time, and provides superior consistency, which is vital for meeting cGMP standards for pharmaceutical APIs and ensuring rapid scale-up once clinical validation is achieved.

Analytical and quality control technologies form the secondary technological pillar, necessitated by the imperative of high-purity and regulatory compliance. High-Performance Liquid Chromatography (HPLC) coupled with advanced mass spectrometry (LC-MS/MS) is the industry standard for identity confirmation, quantitative analysis, and comprehensive impurity profiling. These tools are essential for distinguishing the desired therapeutic molecule from trace amounts of reaction byproducts or potentially toxic impurities. Furthermore, Nuclear Magnetic Resonance (NMR) spectroscopy is widely used to definitively confirm the structure of novel synthetic analogues. The integration of laboratory information management systems (LIMS) is also critical for maintaining detailed, auditable documentation required by the FDA, EMA, and other global regulatory bodies due to the controlled nature of these substances.

An emerging disruptive technology is synthetic biology, particularly the use of engineered microbial hosts, such as yeast or algae, for the biosynthetic production of rare or complex cannabinoids and their synthetic analogs. While still maturing, this technology promises a cleaner, potentially more environmentally friendly, and highly scalable manufacturing route that bypasses traditional, complex, and sometimes hazardous chemical synthesis. By genetically programming microorganisms to express the necessary enzyme pathways, manufacturers can achieve consistent and high-yield production of specific molecules. This biosynthetic approach is attractive because it significantly reduces the reliance on volatile chemical supply chains and may simplify the regulatory pathway regarding precursor control, offering a significant long-term technological advantage in market competition.

Regional Highlights

Regional dynamics are critical in defining the growth trajectory and operational challenges within the Synthetic Cannabinoid Market, primarily dictated by prevailing healthcare infrastructure, R&D investment levels, and the local regulatory environment concerning controlled substances. North America, specifically the United States, commands the largest market share due to its established pharmaceutical industry, high concentration of biotechnology firms, and substantial venture capital funding directed toward cannabinoid research. The permissive regulatory stance, particularly within the research realm and the accelerated approval of certain cannabinoid-based drugs (like Epidiolex), has solidified its market leadership, driving both clinical trials and commercial adoption in pain and neurological disorders.

Europe represents the second-largest market, characterized by stringent yet harmonized regulatory oversight through the European Medicines Agency (EMA). European academic institutions, particularly in the UK, Germany, and Switzerland, are global leaders in fundamental cannabinoid receptor research and neuroscience, driving demand for research-grade synthetic analogs. However, market penetration for commercial products is often slower than in the US due to conservative national health system formulary inclusions and complex pricing and reimbursement negotiations, requiring companies to tailor their commercial strategies to individual member state requirements, despite centralized EMA approval.

The Asia Pacific (APAC) region is projected to experience the highest growth rate, though starting from a lower base. Growth is fueled by increasing healthcare expenditure in developed nations (Japan, South Korea, Australia) and the emergence of China and India as critical hubs for large-scale, cost-effective API manufacturing and Contract Research Organization (CRO) services. While therapeutic use is often restricted by conservative government policies concerning controlled substances, the region's increasing capability in synthetic chemistry and growing focus on pain management and chronic disease research make it strategically vital for upstream manufacturing and supply chain diversification for global market players.

- North America (U.S., Canada): Market dominance driven by strong R&D funding, high incidence of neuropathic pain, and established FDA regulatory pathways for novel drugs. Key focus on commercializing selective CB1 and CB2 agonists.

- Europe (Germany, UK, France, Italy): Robust academic research base; centralized regulatory environment (EMA) leading to high purity standards. Growth driven by governmental recognition of ECS therapeutic potential, especially in multiple sclerosis and palliative care.

- Asia Pacific (China, Japan, India, Australia): Fastest growing region; increasingly important for low-cost, high-volume API synthesis (China, India). Australia leads in clinical trials and medical acceptance, while other nations maintain restrictive access.

- Latin America (Brazil, Mexico): Emerging market characterized by increasing healthcare liberalization and growing patient advocacy for alternative pain treatments, though regulatory environments remain fragmented and unpredictable.

- Middle East and Africa (MEA): Smallest current market share; characterized by extreme regulatory conservatism, primarily limited to small-scale academic research or highly controlled, specialized import programs for established pharmaceuticals.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Synthetic Cannabinoid Market, encompassing pharmaceutical manufacturers, specialized chemical suppliers, and biotechnology innovators driving the next generation of targeted therapies.- Pfizer Inc.

- Jazz Pharmaceuticals (GW Pharmaceuticals)

- Sanofi

- Merck KGaA

- Cayman Chemical

- Thermo Fisher Scientific

- Tocris Bioscience

- LGC Limited

- Organon

- Johnson & Johnson

- AstraZeneca

- Bristol Myers Squibb

- AbbVie

- Canopy Growth Corporation (R&D Division)

- Norac Pharma

- Mallinckrodt Pharmaceuticals

- Takeda Pharmaceutical Company Limited

- Indivior PLC

- Curaleaf Holdings, Inc. (R&D Division)

- Sativex

Frequently Asked Questions

Analyze common user questions about the Synthetic Cannabinoid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes synthetic cannabinoids used in medicine from illicit synthetic cannabinoids?

Pharmaceutical synthetic cannabinoids are single, high-purity chemical entities with validated structures, designed to selectively target specific cannabinoid receptors (e.g., CB2) for therapeutic effects like pain relief, minimizing psychoactivity. Illicit synthetic cannabinoids are uncontrolled, structurally diverse, highly potent, non-selective chemical mixtures manufactured clandestinely, often leading to unpredictable and dangerous health outcomes due to contamination and unknown dosages.

Which specific medical applications are driving the growth of the legitimate market?

The primary growth drivers are severe neurological disorders, specifically refractory epilepsies (e.g., Dravet syndrome), chronic neuropathic and cancer pain management where conventional opioids are contraindicated or ineffective, and the treatment of spasticity associated with multiple sclerosis. Focused R&D on selective CB2 agonists for inflammation and fibrosis also contributes significantly to market expansion.

How does the regulatory environment impact market entry for new synthetic cannabinoid drugs?

The regulatory environment, governed by bodies like the FDA and EMA, requires extensive preclinical toxicology and costly, multi-phase clinical trials to prove both safety and efficacy, often requiring Schedule I/II classification handling. The requirement to distinguish the product from scheduled illicit substances necessitates meticulous documentation, stringent supply chain security, and heightened scrutiny of manufacturing processes, significantly elevating the barrier to market entry.

Is synthetic biology replacing traditional chemical synthesis in this market?

While traditional chemical synthesis remains the dominant and commercially proven method, synthetic biology (e.g., microbial fermentation) is rapidly emerging as a disruptive alternative. It offers advantages in environmental sustainability, precursor sourcing independence, and potentially higher consistency for complex, non-psychoactive molecules, especially as technology matures and production yields increase.

What role do selective CB2 agonists play in future market development?

Selective CB2 agonists are central to future growth as they primarily target the peripheral nervous and immune systems, offering therapeutic benefits for conditions like arthritis, chronic pain, and autoimmune disorders without activating the psychoactive CB1 receptor in the brain. This selectivity mitigates adverse side effects, making them highly desirable candidates for broad-market pharmaceutical development and commercial adoption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager