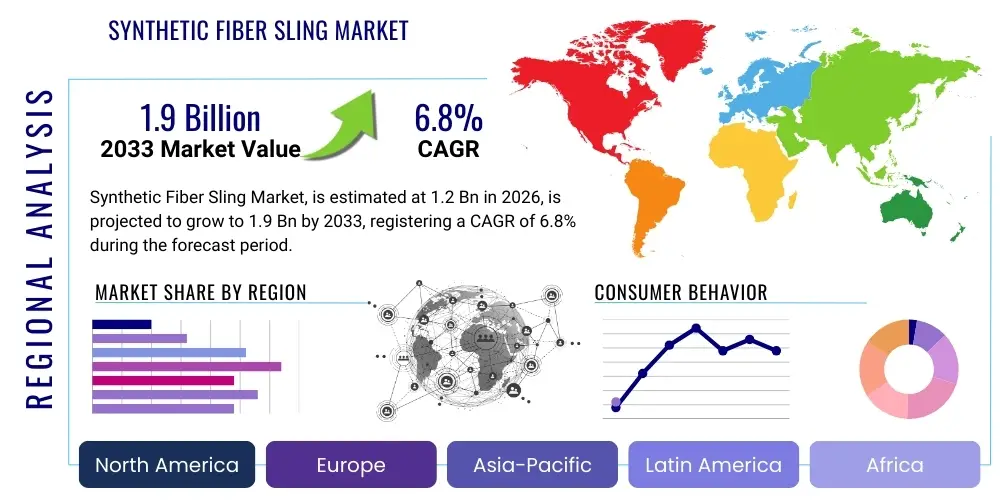

Synthetic Fiber Sling Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441536 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Synthetic Fiber Sling Market Size

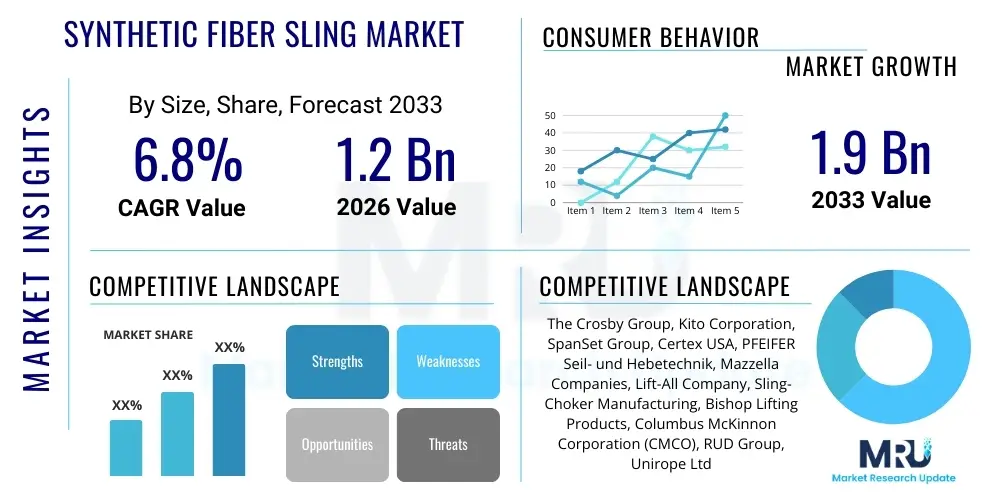

The Synthetic Fiber Sling Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.9 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating demand for safer and lighter material handling solutions across burgeoning industrial sectors, notably construction, maritime logistics, and large-scale manufacturing. The inherent advantages of synthetic slings, such as resistance to mildew, abrasion, and certain chemicals, compared to traditional chain or wire rope slings, solidify their expanding market penetration.

Synthetic Fiber Sling Market introduction

The Synthetic Fiber Sling Market encompasses the manufacturing, distribution, and utilization of lifting slings fabricated from high-strength synthetic materials, primarily polyester, nylon, and polypropylene. These essential rigging tools are engineered to facilitate the secure lifting and maneuvering of heavy loads in diverse operational environments. Key applications span high-rise construction, infrastructure development, offshore oil and gas operations, heavy machinery manufacturing, and complex logistical transportation. The principal benefits of synthetic slings include their lightweight nature, superior flexibility, reduced risk of damaging delicate loads due to their soft contact surface, and excellent resistance to corrosion and moisture. Market expansion is actively driven by rigorous global industrial safety regulations, mandating the use of certified lifting equipment, coupled with technological advancements leading to stronger, more durable synthetic fibers capable of handling increasingly heavy-duty applications while maintaining a crucial safety margin. Furthermore, the cyclical recovery in global infrastructure spending significantly contributes to sustained demand within this sector.

Synthetic Fiber Sling Market Executive Summary

The Synthetic Fiber Sling Market demonstrates robust business trends characterized by a significant shift toward specialized, high-performance materials and customized rigging solutions designed for critical lift scenarios. Key industry players are increasingly focusing on vertical integration and acquiring certifications (such as ASME B30.9 and EN 1492-1) to ensure compliance and gain competitive advantage, promoting a trend toward premium, high-safety-rated products. Regionally, the Asia Pacific market is poised for the fastest expansion, fueled by massive ongoing infrastructural projects in countries like China, India, and Southeast Asian nations, alongside the rapid expansion of the marine and shipping industries. North America and Europe maintain stable, mature markets where innovation focuses heavily on digital integration for load monitoring and traceability. Regarding segment trends, the polyester segment dominates due to its cost-effectiveness and excellent load-bearing properties, while the heavy-duty load capacity segment is experiencing accelerated demand, reflecting the increasing scale and weight of components handled in renewable energy installations (e.g., wind turbine components) and industrial fabrication.

AI Impact Analysis on Synthetic Fiber Sling Market

Common user questions regarding AI's impact on the Synthetic Fiber Sling Market often center on how automation and predictive maintenance can enhance operational safety, whether AI can optimize sling lifespan and replacement schedules, and how smart monitoring systems integrate with existing rigging infrastructure. Users are keen to understand if AI-driven analysis of stress and usage patterns can reduce catastrophic failures and improve compliance tracking. The key themes revolve around enhancing safety protocols through real-time data interpretation, optimizing inventory management of slings based on predictive wear, and improving traceability and certification verification processes. Concerns often relate to the cost of integrating such systems and the need for specialized training for existing rigging personnel.

The integration of Artificial Intelligence (AI) into the synthetic fiber sling value chain primarily impacts the design, manufacturing quality control, and end-user safety monitoring phases. In manufacturing, AI algorithms analyze material defects at microscopic levels, ensuring higher consistency and quality control than traditional inspection methods. This application minimizes material wastage and guarantees that slings meet stringent breaking strength requirements from the point of fabrication. Furthermore, AI-driven simulation tools are being utilized during the design phase to model complex stress distributions under dynamic load conditions, allowing engineers to develop next-generation synthetic compositions that offer superior resistance to cutting, abrasion, and cyclic loading fatigue. This predictive design capability shortens the time-to-market for high-specification slings required in extreme environments, such as deep-sea or aerospace component handling.

For end-users, the profound influence of AI is manifested through smart rigging systems. These systems incorporate embedded sensors (IoT devices) within the synthetic fibers or at connection points, which transmit real-time data on load weight, tension, temperature, and usage cycles. AI processes this massive data stream to provide predictive maintenance alerts, estimating the Remaining Useful Life (RUL) of the sling based on actual operational stress rather than time-based scheduled inspections. This shift from reactive or time-based maintenance to predictive, condition-based replacement significantly enhances operational safety by identifying compromised equipment before failure occurs, thereby maximizing uptime and reducing the risk of costly industrial accidents. The resulting improvement in safety compliance and asset utilization generates substantial long-term cost savings for heavy industry operators.

- AI-Enhanced Quality Control: Utilizing machine learning algorithms to detect micro-defects in fiber materials during production, ensuring consistent safety factors.

- Predictive Maintenance Systems: Implementation of AI to analyze real-time sensor data (tension, temperature, duration) from 'smart slings' to predict wear patterns and optimal retirement schedules.

- Optimized Inventory Management: AI-driven forecasting of sling replacement needs based on operational intensity across various industrial sites.

- Design Simulation and Material Optimization: Employing AI modeling to refine synthetic fiber compositions and weave structures for enhanced abrasion and chemical resistance.

- Automated Compliance Documentation: Using AI to automatically log and verify inspection records, usage history, and certification status, simplifying adherence to regulatory standards (e.g., OSHA, ASME).

DRO & Impact Forces Of Synthetic Fiber Sling Market

The Synthetic Fiber Sling Market is simultaneously shaped by powerful growth Drivers, significant Restraints, and compelling Opportunities, creating a dynamic set of Impact Forces that dictate market direction. Primary drivers include increasingly stringent global industrial safety standards and regulations, particularly in developed economies, which necessitate the routine replacement of outdated or non-compliant equipment, coupled with the inherent benefits of synthetic materials—namely, safety, reduced weight, and superior flexibility—making them preferential choices over traditional steel alternatives. However, the market faces restraints, chiefly the limited temperature tolerance and susceptibility to specific chemical attacks characteristic of some synthetic materials, alongside the prevalent issue of counterfeit or sub-standard products in developing regions that erode trust in quality manufacturers. Opportunities arise from the rapid expansion of capital-intensive sectors such as wind energy installation and specialized heavy logistics, demanding customized, ultra-high-capacity synthetic slings, as well as advancements in material science introducing hybrid fiber solutions with enhanced durability and cut resistance.

One of the most powerful impact forces is the cyclical nature of global construction and infrastructure spending. When major governmental and private infrastructure projects are launched—such as high-speed rail networks, specialized port facilities, or large-scale energy plants—the demand for heavy-duty lifting equipment, including synthetic slings, sees an immediate and substantial surge. Conversely, economic downturns leading to postponed capital expenditures act as a strong dampening force. Furthermore, the relentless pressure from safety regulatory bodies, like the Occupational Safety and Health Administration (OSHA) in the US and the European Agency for Safety and Health at Work (EU-OSHA), forces end-users to adopt best practices and invest in premium, verifiable lifting gear, thereby sustaining the market even during periods of moderate industrial activity. This regulatory environment ensures that safety and certification remain non-negotiable purchasing criteria, favoring established, high-quality manufacturers.

The ongoing material innovation within polymer and fiber engineering represents a critical opportunity that profoundly influences the market’s future. Manufacturers are leveraging nanotechnology and specialized coatings to address historical restraints, such as improving resistance to UV degradation, heat exposure, and sharp edges. The development of slings made from materials like high-performance polyethylene (HPPE) or specialized aramid fibers offers load-bearing capacities comparable to steel while retaining the lightness and flexibility of synthetics. This technological advancement allows synthetic slings to penetrate previously inaccessible heavy-lift segments dominated by chain or wire rope, thereby broadening the total addressable market. The competitive impact force centers on manufacturers differentiating their products through certified safety ratings, superior durability claims, and robust traceability features, essential for mitigating liability risks for end-users.

| Factor | Description |

|---|---|

| Drivers |

|

| Restraints |

|

| Opportunities |

|

| Impact Forces |

|

Segmentation Analysis

The Synthetic Fiber Sling Market is segmented based on Material Type, Load Capacity, End-Use Industry, and Configuration. Understanding these divisions is crucial for strategic market positioning and product development, as demands vary significantly across applications, from lightweight industrial tasks to heavy-duty infrastructural lifts. The Material Type segmentation is essential as it determines the specific characteristics such as chemical resistance, breaking strength, and overall durability. The End-Use Industry segmentation highlights where the core demand originates, with Construction and Manufacturing being major consumers due to continuous material handling requirements. Configuration segmentation reflects diverse rigging needs, requiring products such as flat web slings, round slings, or specialty basket configurations, each optimized for different lifting geometries and load distributions.

- By Material Type:

- Polyester Slings (Dominant due to cost and versatility)

- Nylon Slings (Preferred for shock absorption and resistance to alkalis)

- Polypropylene Slings (Used for buoyancy and resistance to acids)

- High-Performance Fibers (e.g., Dyneema, Aramid, UHMWPE)

- By Load Capacity:

- Light Duty (Up to 5,000 lbs)

- Medium Duty (5,001 lbs to 20,000 lbs)

- Heavy Duty (Above 20,000 lbs)

- By Configuration:

- Flat Web Slings (Standard and popular for general use)

- Round Slings (Endless loop for high-capacity choke hitches)

- Eye-and-Eye Slings

- Endless Slings

- By End-Use Industry:

- Construction and Infrastructure

- Manufacturing (Automotive, Heavy Machinery)

- Oil & Gas and Energy (Onshore and Offshore)

- Marine and Shipbuilding

- Logistics and Transportation

Value Chain Analysis For Synthetic Fiber Sling Market

The value chain for the Synthetic Fiber Sling Market begins with the upstream procurement of specialized polymer resins and high-tenacity yarns, which are the foundational raw materials. Key upstream activities involve the chemical processing of crude oil derivatives to create materials like PET (Polyester), Polyamide (Nylon), or Polypropylene, alongside the critical spinning process that transforms these resins into high-strength fibers. Innovation at this stage, particularly in fiber engineering and coating technologies, directly determines the tensile strength, abrasion resistance, and cost structure of the final product. Strong relationships with reliable and certified fiber suppliers are paramount, as the quality of the synthetic yarn dictates the ultimate safety rating and lifespan of the sling, which is regulated by international standards organizations.

The midstream stage encompasses the core manufacturing processes: weaving or knitting the yarn into webs (for flat slings) or winding into endless loops (for round slings), followed by rigorous cutting, stitching, and finishing processes. Precision industrial sewing using automated machinery is critical to achieving the required safety factor, typically 5:1 or 7:1. Quality assurance checks, including destructive testing and certification tagging, form a vital part of this stage. Companies often invest heavily in patented weaving patterns or specialized coatings to differentiate their products in terms of durability and weather resistance. Efficient management of this phase, including minimizing material waste and optimizing machinery throughput, is key to maintaining competitive pricing while adhering to the highest safety specifications mandated by regulatory bodies like ASME or OSHA.

The downstream segment involves distribution channels, sales, and aftermarket services. Distribution relies on both direct sales, especially for large, customized industrial contracts (e.g., selling directly to major offshore operators or wind farm developers), and indirect sales through specialized industrial distributors, hardware wholesalers, and certified rigging supply houses. These distributors often provide essential value-added services such as certified inspection, repair, and training for end-users, ensuring the proper and safe application of the slings. The final consumers range from small local construction firms to multinational corporations. The effectiveness of the indirect channel hinges on maintaining a trained network capable of adhering to safety standards and offering localized inventory and immediate technical support, which is critical given the frequent replacement cycle of synthetic slings due to required retirement protocols.

Synthetic Fiber Sling Market Potential Customers

The primary end-users and potential customers for synthetic fiber slings are concentrated within sectors requiring frequent and safe handling of heavy, often irregularly shaped, or sensitive loads. The Construction and Infrastructure sector represents a foundational customer base, utilizing slings extensively for lifting structural steel beams, concrete panels, pre-cast components, and heavy construction equipment. As infrastructure projects globally become larger and more complex, requiring tighter deadlines and higher safety scrutiny, the demand for certified, high-quality synthetic slings, preferred for their flexibility and reduced weight compared to wire rope, remains consistently strong. These customers prioritize slings with high capacity and robust protection against site abrasion.

The Manufacturing sector, particularly the heavy machinery, automotive assembly, and aerospace industries, forms another significant customer segment. In manufacturing environments, synthetic slings are indispensable for maneuvering expensive and highly finished components, such as machine tools, engine blocks, or fuselage sections, where preventing surface marring is critical. Customers in this segment often require custom-sized round slings or specialty web slings designed for cleanroom conditions or specific temperature tolerances. The oil and gas industry, encompassing both onshore exploration and volatile offshore platform maintenance, demands slings engineered for chemical resistance and extreme weather durability, often leading them to procure specialized, certified high-performance fiber options to meet stringent offshore safety protocols.

Furthermore, the rapidly expanding Renewable Energy sector, specifically wind and solar farm installation, is generating enormous demand for specialized heavy-duty slings. Erecting massive wind turbine components—nacelles, blades, and tower sections—requires rigging gear that combines extremely high lifting capacity with the delicate handling necessary to prevent damage to expensive composite materials. These customers frequently require customized, ultra-high-capacity round slings made from Dyneema or aramid fibers. Finally, the Marine, Shipbuilding, and Logistics industries utilize synthetic slings for cargo loading/unloading, ship repair, and port operations, where resistance to saltwater and UV degradation is a critical purchasing criterion. The recurring nature of sling replacement based on mandatory retirement protocols ensures continuous purchasing activity across all these diversified end-user segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Crosby Group, Kito Corporation, SpanSet Group, Certex USA, PFEIFER Seil- und Hebetechnik, Mazzella Companies, Lift-All Company, Sling-Choker Manufacturing, Bishop Lifting Products, Columbus McKinnon Corporation (CMCO), RUD Group, Unirope Ltd., Tandemloc, Inc., DSR Co., Ltd., WireCo WorldGroup, Suncor Stainless, Inc., Southeast Rigging, Inc., Peerless Industrial Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Synthetic Fiber Sling Market Key Technology Landscape

The technology landscape in the Synthetic Fiber Sling Market is centered on material science innovation, advanced manufacturing techniques, and the digitalization of rigging equipment. Advanced material technologies are continuously introducing synthetic fibers, such as Ultra-High-Molecular-Weight Polyethylene (UHMWPE, marketed as Dyneema or Spectra), which provide an exceptional strength-to-weight ratio, allowing for the creation of slings that are significantly lighter yet possess breaking strengths comparable to steel wire rope. This focus on specialized fibers aims to overcome the traditional limitations of standard polyester and nylon, specifically regarding improving resistance to cutting, abrasion, and cyclic fatigue. Furthermore, specialized coatings, often involving polyurethane or proprietary polymer blends, are applied post-production to enhance resistance against environmental degradation, including UV radiation, moisture absorption, and mild chemical exposure, thereby extending the operational lifespan and safety profile of the slings.

In manufacturing, the technology focus is on precision weaving and stitching machinery. Automated computer-controlled sewing systems are utilized to ensure uniform stitch density and pattern integrity, which is critical for maximizing the Working Load Limit (WLL) and safety factor. Manufacturers employ non-destructive testing (NDT) methods, such as visual inspection aided by high-resolution imaging and load testing in certified rigs, to validate the structural integrity of every batch. A major technological trend is the adoption of automated certification and marking technologies, including thermal transfer printing and laser etching, to ensure permanent traceability and legibility of critical safety information, which is a key requirement for AEO-optimized search results related to compliance verification.

Digital integration, or the concept of 'Smart Rigging,' represents the frontier of technological advancement. This involves embedding Radio Frequency Identification (RFID) tags, near-field communication (NFC) chips, or miniaturized IoT sensors directly into the sling’s webbing or identification tag. These technologies enable digital tracking of the sling's entire lifecycle, recording usage intensity, inspection dates, and mandated retirement schedules. This data is often linked to cloud-based asset management software, providing rigging managers with real-time insights into the condition and compliance status of their lifting inventory. This digital traceability vastly improves maintenance efficiency and regulatory adherence, mitigating the risk associated with human error during manual inspection and data logging, thereby offering a significant value proposition to large industrial clients focused on operational excellence.

- Advanced Fiber Composites: Utilization of UHMWPE and Aramid fibers for high-capacity, low-weight rigging solutions.

- Polymer Coating Technology: Application of specialized external coatings to enhance resistance to abrasion, chemicals, and ultraviolet radiation.

- Precision Automated Stitching: Employing computerized sewing machines to ensure optimal seam strength and consistency required for certification.

- Embedded RFID/IoT Technology: Integration of smart chips for automated asset tracking, inspection logging, and real-time usage monitoring (Smart Slings).

- Non-Destructive Testing (NDT): Advanced stress testing and high-resolution visual inspection methods to guarantee compliance with specified safety factors.

Regional Highlights

The global Synthetic Fiber Sling Market exhibits distinct regional dynamics driven by variances in industrial development, regulatory frameworks, and infrastructural investment levels. North America, particularly the United States, represents a mature market characterized by extremely high safety standards (enforced by OSHA and ASME B30.9) and a strong emphasis on certified, high-quality products. The market here is driven by replacement demand and the ongoing maintenance requirements of large energy, transportation, and aerospace manufacturing hubs. Innovation adoption, especially 'smart rigging' featuring RFID and advanced monitoring systems, is high due to the premium placed on liability mitigation and operational efficiency. The demand centers around specialized, heavy-duty applications catering to complex lifts in construction and renewable energy projects.

Europe mirrors North America in terms of regulatory strictness (governed by EN standards), focusing heavily on sustainable manufacturing practices and product durability. Western European nations, notably Germany and the UK, demonstrate strong demand for specialized polyester and high-performance slings utilized extensively in the automotive manufacturing sector and advanced shipbuilding. The European market is also at the forefront of adopting environmentally friendly materials and processes within the synthetic sling value chain. Eastern Europe, while growing, often focuses on cost-effectiveness, though increasing integration into the EU framework is gradually elevating safety and quality requirements, driving demand for mid-to-high-quality certified slings.

Asia Pacific (APAC) stands out as the highest growth region globally, propelled by unparalleled investment in infrastructure, urbanization, and industrial expansion, particularly in China, India, and Southeast Asia. The sheer scale of construction, port development, and power generation projects creates immense demand for lifting equipment. While price sensitivity remains a factor in certain segments, the rising focus on worker safety due to increasing regulatory pressure and international project standards is accelerating the transition from uncertified, low-cost alternatives to internationally certified synthetic slings. This region offers the most significant opportunities for global manufacturers seeking volume expansion, especially within the medium and heavy-duty polyester sling segments catering to marine logistics and high-rise construction.

- North America: High adoption of smart rigging technologies; demand driven by rigorous safety standards and specialized aerospace/energy lifting requirements.

- Europe: Focus on high-quality manufacturing standards (EN compliance); strong demand from advanced automotive and specialized offshore wind sectors.

- Asia Pacific (APAC): Fastest growing market fueled by monumental infrastructure development, urbanization, and rapid expansion of marine logistics and manufacturing bases.

- Middle East & Africa (MEA): Significant demand originating from the robust oil & gas sector and ongoing large-scale construction projects (e.g., Saudi Arabia’s Vision 2030), emphasizing chemical and heat-resistant slings.

- Latin America: Growth tied to commodity exports and mining infrastructure; gradual regulatory maturation leading to increased need for certified lifting solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Synthetic Fiber Sling Market.- The Crosby Group LLC

- Kito Corporation

- SpanSet Group

- Certex USA (A Lifting Solutions Group Company)

- PFEIFER Seil- und Hebetechnik GmbH

- Mazzella Companies

- Lift-All Company, Inc.

- Sling-Choker Manufacturing Ltd.

- Bishop Lifting Products, Inc.

- Columbus McKinnon Corporation (CMCO)

- RUD Group

- Unirope Ltd.

- Tandemloc, Inc.

- DSR Co., Ltd.

- WireCo WorldGroup

- Suncor Stainless, Inc.

- Southeast Rigging, Inc.

- Wabtec Corporation (through subsidiaries)

- Grip-Rite Slings

- Gunnebo Industries AB

Frequently Asked Questions

Analyze common user questions about the Synthetic Fiber Sling market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Synthetic Fiber Sling Market?

The most significant driver is the increasing enforcement of strict industrial safety regulations worldwide (e.g., ASME, OSHA), which mandates the use of certified, regularly inspected lifting gear. This regulatory pressure, combined with the material advantages of synthetic slings (lightweight, non-marring), pushes industrial users toward adoption and frequent replacement cycles.

Which material type dominates the Synthetic Fiber Sling Market, and why?

Polyester slings dominate the market primarily due to their superior cost-effectiveness, excellent general load-bearing capacity, good resistance to most common industrial acids, and high tensile strength. They offer the best balance of performance and price for general-purpose rigging in construction and manufacturing.

How is technology impacting the lifespan and safety of synthetic slings?

Technology is enhancing sling safety through the integration of embedded RFID/IoT chips, enabling real-time digital traceability and logging of inspection history and usage intensity. This "smart rigging" approach facilitates predictive maintenance, allowing users to retire compromised slings based on actual condition rather than scheduled guesses, drastically reducing failure risks.

What are the main drawbacks of synthetic slings compared to wire rope or chain?

The primary limitations of synthetic fiber slings are their susceptibility to damage from high heat (above 200°F or 93°C for polyester/nylon), vulnerability to sharp edges (requiring corner protection), and potential degradation upon exposure to specific concentrated chemicals, which necessitates careful material selection based on the operating environment.

Which end-use industry represents the fastest-growing demand segment for heavy-duty slings?

The Renewable Energy sector, particularly large-scale wind turbine installation and maintenance, represents the fastest-growing demand segment for heavy-duty synthetic slings. These projects require specialized, high-capacity, non-conductive slings made from high-performance fibers to safely handle extremely heavy and delicate composite components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager