Synthetic Quartz Glass UV-LED Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443287 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Synthetic Quartz Glass UV-LED Market Size

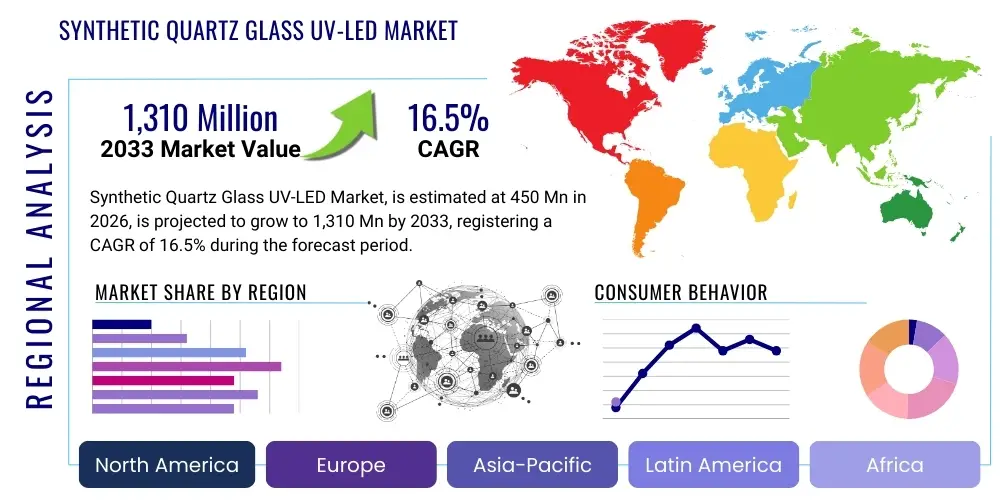

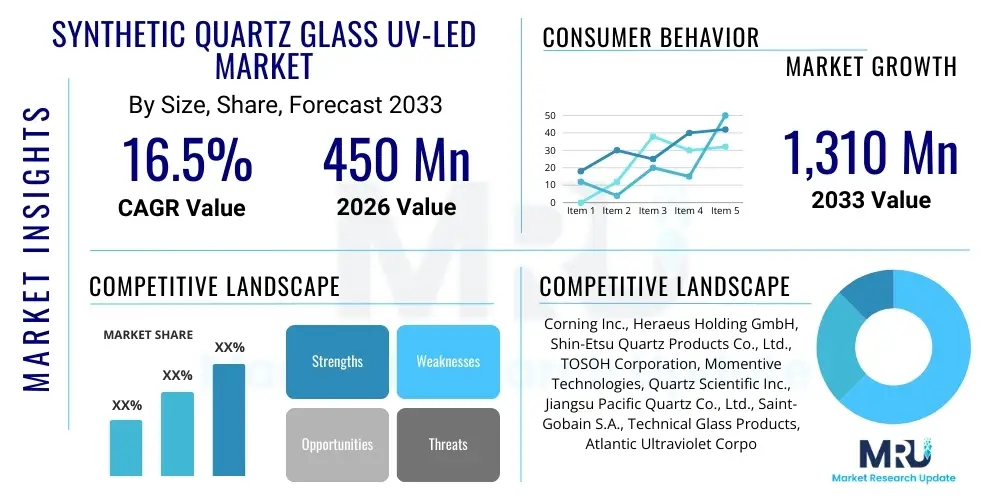

The Synthetic Quartz Glass UV-LED Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 1,310 Million by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by the accelerating global demand for effective, mercury-free sterilization and purification solutions, particularly within water treatment, air purification, and advanced medical device manufacturing sectors. Synthetic quartz glass is indispensable in high-performance UV-LED applications due to its exceptional transparency across the deep-UV spectrum (below 280 nm) and superior thermal stability, which is critical for the reliable operation and longevity of UV-C LEDs.

The market expansion is directly correlated with technological advancements in Deep Ultraviolet (DUV) LED fabrication, where efficiency and output power are continuously improving. Synthetic quartz glass acts as the primary optical window and encapsulant, ensuring maximum transmission efficiency for germicidal wavelengths without degradation. The stringent regulatory environment concerning water quality and pathogen control, coupled with the miniaturization trend in portable sterilization devices, further drives the necessity for high-purity synthetic quartz components optimized for UV-LED systems. Manufacturers are increasingly investing in advanced manufacturing processes, such as vapor phase axial deposition (VAD) and flame hydrolysis, to meet the stringent purity and dimensional requirements of these advanced optical interfaces.

Synthetic Quartz Glass UV-LED Market introduction

The Synthetic Quartz Glass UV-LED Market encompasses the production and supply of highly purified, artificially synthesized quartz glass components specifically designed for integration with Ultraviolet Light Emitting Diodes (UV-LEDs). Unlike natural quartz, synthetic quartz glass is characterized by extremely low impurity levels and minimal hydroxyl content, providing unparalleled transmission performance, especially in the crucial UV-C wavelength range (200 nm to 280 nm) utilized for sterilization and disinfection. This specialized material serves as optical windows, lenses, and protective shields, crucial for maintaining the operational efficiency and extending the lifespan of high-power UV-LED modules, which are rapidly replacing traditional mercury lamps across various industries due to their compact size, energy efficiency, and environmental safety.

Major applications driving this market include point-of-use and point-of-entry water purification systems, medical sterilization equipment, surface disinfection units in hospitals and public transport, and specialized industrial curing processes (e.g., inks and adhesives). The key benefits offered by synthetic quartz glass in this context are its exceptional resistance to solarization (darkening under UV exposure), high thermal shock resistance, and chemical inertness. The combination of these attributes ensures that the UV radiation output remains stable and powerful throughout the device's operational life, critical for germicidal effectiveness. The shift towards sustainable and instantaneous disinfection methods, accelerated by global health concerns, is a primary catalyst for the adoption of UV-LED solutions requiring high-grade synthetic quartz optics.

Driving factors include the rising adoption of UV-C technology in consumer appliances for sterilization, increasing governmental regulations mandating mercury reduction (such as the Minamata Convention), and rapid advancements in semiconductor technology enabling higher power density UV-LED chips. Furthermore, the integration of UV-LEDs into flowing water systems necessitates robust, highly transmissive materials like synthetic quartz to ensure adequate germicidal doses are delivered. The continuous innovation in material science focused on ultra-low-OH content synthetic quartz further strengthens its market position as the material of choice for next-generation UV-LED devices.

Synthetic Quartz Glass UV-LED Market Executive Summary

The Synthetic Quartz Glass UV-LED Market is witnessing robust expansion, driven by critical business trends centered around environmental safety and public health mandates. Key business trends include the rapid transition from conventional UV sources to mercury-free UV-LED technology, fostering high demand for high-purity optical materials. Manufacturers are focusing on vertical integration and strategic partnerships to secure raw material supply and optimize fabrication techniques, aiming for superior uniformity and low defect density essential for DUV applications. The market is also characterized by intense R&D investment focused on developing synthetic quartz with enhanced resistance to deep UV degradation, particularly for high-irradiance applications in industrial settings and advanced semiconductor fabrication tools. Efficiency improvements in synthesizing methods, such as continuous synthesis techniques, are lowering production costs, making high-performance UV-LED systems more accessible across diverse consumer and industrial segments.

Regionally, Asia Pacific (APAC) dominates the market, primarily fueled by the massive electronics manufacturing base and stringent environmental regulations in countries like China, Japan, and South Korea, which heavily invest in water and air purification infrastructure. North America and Europe follow, exhibiting strong demand from the healthcare sector for advanced, portable sterilization solutions and from the municipal water treatment sector seeking reliable disinfection methods. Regional trends emphasize localized production capabilities to mitigate supply chain vulnerabilities and cater to specific regional regulatory standards pertaining to water safety and chemical usage. The focus in developed regions is increasingly shifting towards integrating smart, IoT-enabled UV-LED sterilization systems, which further require precision-engineered synthetic quartz components for optimized sensor integration and optical performance verification. Emerging economies are accelerating adoption in response to improving sanitation standards and public health initiatives.

Segment-wise, the market is broadly segmented by application (Disinfection/Sterilization, Curing, Analytical Instruments) and by type (Low-OH Content, Standard-OH Content). The Disinfection/Sterilization segment, particularly water treatment and surface disinfection, holds the largest market share and is projected to register the highest growth rate due to global efforts to combat waterborne pathogens and airborne viral transmission. Trends within the materials segment indicate a strong preference for ultra-low-OH synthetic quartz glass, which maximizes transmission efficiency at the critical 265 nm germicidal wavelength, ensuring optimal performance in demanding applications like advanced photolithography and high-flow disinfection systems. Material purity remains the crucial competitive differentiator, driving specialization in manufacturing processes to eliminate metallic and hydroxyl impurities that absorb DUV light and compromise system efficacy. The industrial curing segment is also exhibiting substantial growth, utilizing specialized synthetic quartz for high-speed, temperature-resistant optical systems required for UV-LED curing of protective coatings.

AI Impact Analysis on Synthetic Quartz Glass UV-LED Market

User queries regarding AI's influence on the Synthetic Quartz Glass UV-LED market often center on three key themes: predictive manufacturing quality control, optimization of synthetic material synthesis processes, and the integration of AI in end-user UV disinfection systems. Users are keenly interested in how Artificial Intelligence can minimize defects in the highly sensitive quartz fabrication process, thereby improving yields and reducing the cost associated with producing ultra-high-purity glass crucial for DUV transmission. Common concerns also revolve around AI’s role in managing complex supply chain logistics for specialized raw materials (like silicon tetrachloride) and optimizing energy consumption during the high-temperature synthesis phase. Expectations highlight AI-driven design optimization for UV-LED optical modules, where algorithms simulate light paths through complex quartz geometries to maximize germicidal irradiance uniformity and efficiency, a critical performance metric for disinfection systems.

The integration of AI and Machine Learning (ML) fundamentally transforms the synthetic quartz manufacturing paradigm, moving from reactive quality assurance to proactive process control. In the manufacturing phase, AI algorithms analyze real-time data streaming from sensors monitoring temperature gradients, deposition rates, and gas flow dynamics during the VAD or plasma synthesis processes. This continuous analysis allows for the instant identification and correction of minor deviations that could lead to impurities or structural defects in the resultant quartz ingot, dramatically enhancing material consistency and DUV transparency. This level of precision is unattainable through traditional statistical process control (SPC) methods alone, addressing the critical industry need for flawless optical components in high-irradiance applications.

Furthermore, at the system integration level, AI is deployed to optimize the performance of the final UV-LED product, especially in dynamic environments such as flowing water systems or complex air ducts. ML models predict the optimal pulsing frequency, power output, and required exposure time based on real-time environmental factors (e.g., water turbidity, flow rate, or air volume) monitored by integrated sensors. This intelligence ensures that the required germicidal dose is consistently delivered while minimizing energy consumption and maximizing the operational life of both the LED chip and its protective synthetic quartz enclosure. This synergy between advanced material science and predictive intelligence is accelerating the adoption of high-performance, maintenance-friendly UV-LED disinfection solutions globally.

- AI-driven Predictive Maintenance: Optimizes operational lifespan of synthesis reactors and fabrication machinery, minimizing downtime and defect rates.

- Process Parameter Optimization: ML algorithms refine gas composition, temperature profiles, and cooling rates in flame hydrolysis/VAD, ensuring ultra-low OH content and high purity.

- Defect Detection and Classification: Real-time image processing and deep learning models accurately identify micro-bubbles, striae, and stress birefringence in quartz ingots.

- Supply Chain Forecasting: AI predicts demand fluctuations for specialized raw materials (e.g., high-purity SiCl4), ensuring material availability and cost efficiency.

- Optical Performance Simulation: ML tools simulate light propagation through complex quartz geometries, optimizing lens and window designs for maximum DUV transmission efficiency.

DRO & Impact Forces Of Synthetic Quartz Glass UV-LED Market

The Synthetic Quartz Glass UV-LED Market is primarily driven by the imperative need for environmentally friendly and highly effective sterilization technologies, countered by high manufacturing complexity and cost, while seizing opportunities presented by emerging miniaturized applications. The core driver is the global regulatory shift away from mercury-containing UV lamps (Restraint: Minamata Convention enforcement acts as a driver for adoption but can also be a challenge if infrastructure transition is slow). Opportunities arise particularly in the consumer electronics sector for portable sanitization devices and in advanced lithography tools requiring precise, consistent DUV illumination. The primary impact forces shaping the market include stringent regulatory requirements for material purity in contact with potable water, the accelerating pace of UV-LED chip power density improvements (requiring superior thermal management provided by quartz), and continuous cost reduction pressures necessitating efficiency gains in synthetic quartz production methods.

Drivers: A paramount driver is the exponential growth in demand for UV-C disinfection systems across municipal, industrial, and consumer sectors, spurred by heightened awareness of pathogen transmission and the reliability of germicidal irradiation. Synthetic quartz glass, with its superior deep-UV transparency (up to 90% transmission at 254-270 nm) and resistance to solarization, is the only commercially viable material capable of sustaining the performance of high-output UV-C LEDs over extended periods. Furthermore, the miniaturization trend in UV-LED modules, especially for integrated applications in household appliances, HVAC systems, and wearable devices, mandates the use of precision-fabricated, high-strength quartz components capable of maintaining optical integrity within compact and thermally challenging environments. This intrinsic material superiority drives mandatory inclusion in high-performance systems.

Restraints: The primary restraint is the inherently high production cost and complexity associated with synthesizing ultra-high-purity quartz glass. The process requires specialized, energy-intensive high-temperature reactors, pristine cleanroom environments, and highly specialized raw materials (such as high-purity silicon tetrachloride), leading to elevated capital expenditure and operational costs compared to standard glass or natural quartz. Additionally, technical challenges related to achieving perfect striae-free and bubble-free large-diameter quartz ingots, essential for uniformity in optical performance, limit yield rates and restrict supply capacity, thereby creating bottlenecks in meeting surging global demand. The intellectual property landscape surrounding advanced synthesis techniques further restricts market entry for new competitors.

Opportunities: Significant opportunities exist in the deep-UV lithography sector, particularly Extreme Ultraviolet (EUV) and Deep Ultraviolet (DUV) applications for semiconductor manufacturing, which require flawlessly pure synthetic quartz optics. The relentless scaling of chip technology mandates defect-free materials for high-numerical aperture lenses and masks. The emerging market for UV-LED curing systems in flexible electronics and 3D printing also presents a lucrative opportunity, demanding custom-designed synthetic quartz optical assemblies optimized for high thermal loads and specific curing wavelengths. Moreover, developing hybrid quartz materials or specialized surface treatments using nanotechnology to enhance scratch resistance and anti-fouling properties for water purification applications represents a key area for innovation and market penetration.

Segmentation Analysis

The Synthetic Quartz Glass UV-LED market is comprehensively segmented based on its material characteristics, intended application, and the specific manufacturing process utilized, reflecting the diverse technical requirements across end-user industries. This structured segmentation allows for granular analysis of market drivers and growth vectors, emphasizing the technical specifications necessary for high-performance UV-LED integration. The segmentation by type, specifically focusing on hydroxyl (OH) content, is critical, as ultra-low OH quartz is indispensable for high-intensity DUV transmission, while standard grades suffice for less demanding, longer-wavelength applications. Geographically, market performance is highly dependent on regional investment in water infrastructure and advanced manufacturing capabilities.

The most lucrative segment, defined by application, remains Disinfection and Sterilization, covering both static surface treatment and dynamic fluid flow systems. Within this segment, water disinfection accounts for the majority revenue due to the global emphasis on secure drinking water sources and the scalability of UV-LED technology in municipal and industrial settings. However, the fastest-growing segment is expected to be Industrial Curing, where the instant on/off capability and reduced heat footprint of UV-LEDs, protected by robust synthetic quartz optics, are revolutionizing processes in automotive coating, electronics assembly, and printing, rapidly displacing bulky traditional mercury-vapor systems.

Furthermore, segmentation by manufacturing process—including Flame Hydrolysis (FH), Plasma CVD, and the VAD method—is essential as each technique dictates the purity, structure, and maximum size of the quartz material, directly influencing its suitability for specific UV-LED integration levels. Continuous process improvements in these synthesis methods are vital for market penetration, ensuring competitive pricing and reliable supply of flawless optical components necessary for high-volume manufacturing of consumer and industrial UV-LED products. Understanding these diverse technical segments is paramount for strategic market positioning and resource allocation.

- By Type:

- Ultra-Low OH Content Synthetic Quartz Glass (Used for UV-C LEDs & DUV Lithography)

- Standard OH Content Synthetic Quartz Glass (Used for UV-A/UV-B LEDs & General Optics)

- By Application:

- Disinfection and Sterilization (Water Treatment, Air Purification, Surface Disinfection, Medical Devices)

- Industrial Curing (Coatings, Adhesives, Printing Inks)

- Analytical and Scientific Instruments (Spectrophotometers, Environmental Monitoring)

- Semiconductor and Photolithography Equipment

- By End-Use Industry:

- Water and Wastewater Treatment

- Healthcare and Life Sciences

- Electronics and Semiconductors

- Manufacturing and Industrial

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Synthetic Quartz Glass UV-LED Market

The Synthetic Quartz Glass UV-LED market value chain is intricate and highly specialized, beginning with the sourcing and purification of extremely high-grade raw materials, primarily silicon tetrachloride (SiCl4). Upstream analysis reveals that the initial purification of SiCl4 is a bottleneck, as trace metal impurities must be reduced to parts per billion (ppb) levels to ensure the resultant synthetic quartz exhibits the required deep-UV transmission characteristics. Key players in this phase focus on advanced distillation and chemical processing techniques. The manufacturing stage involves specialized synthesis methods like VAD or flame hydrolysis, demanding high capital investment and technical expertise to grow large, defect-free quartz ingots. Quality control, involving optical testing for homogeneity and birefringence, is critical before the ingot is processed into preforms, tubes, or slabs.

The midstream focuses on precise fabrication and machining, where quartz ingots are cut, ground, polished, and coated (e.g., with anti-reflective or hydrophobic layers) to create the final optical components—lenses, windows, and sleeves—tailored for specific UV-LED wavelengths and geometries. This phase is characterized by precision engineering and relies heavily on CNC machining and highly skilled labor. Integration occurs downstream, where these custom-designed synthetic quartz optics are mounted into UV-LED modules by device manufacturers, often involving hermetic sealing or specialized bonding techniques to prevent moisture ingress and enhance thermal dissipation, crucial factors for UV-LED reliability.

Distribution channels for the synthetic quartz components are typically direct, particularly for high-volume or highly customized orders serving large UV-LED system integrators and semiconductor equipment manufacturers. Indirect distribution, involving specialized technical distributors or agents, is more common for standard-sized components used in smaller-scale consumer UV products or regional aftermarket suppliers. The technical complexity and requirement for deep application knowledge necessitate strong direct communication between the synthetic quartz manufacturer and the UV-LED system designer. The ultimate end-users are municipal water facilities, hospitals, and industrial manufacturing plants, which purchase the integrated UV-LED systems.

Synthetic Quartz Glass UV-LED Market Potential Customers

Potential customers for synthetic quartz glass components used in UV-LED systems span a wide range of industries prioritizing sterilization, precision curing, and advanced instrumentation. The largest segment of end-users consists of Original Equipment Manufacturers (OEMs) specializing in water and wastewater disinfection systems, including producers of point-of-use water filters, in-line industrial water sterilization units, and municipal water treatment infrastructure builders. These customers require highly reliable, large-format synthetic quartz sleeves and windows capable of enduring continuous exposure to high-intensity UV-C radiation and harsh chemical environments, often procuring large, customized volumes directly from specialized quartz fabricators. The demand here is non-negotiable on purity, as failure affects public health compliance.

Another major customer segment includes manufacturers of healthcare and life science equipment, such as producers of medical sterilization carts, diagnostic instruments, and DNA analysis systems. In this context, synthetic quartz is utilized for its chemical inertness and precise optical properties, ensuring accurate measurement and effective sterilization of sensitive tools and surfaces. Furthermore, the burgeoning demand for portable and household sterilization devices (e.g., bottle sterilizers, toothbrush sanitizers, and air purifiers) represents a rapidly growing customer base, characterized by high volume, standardized component requirements, and sensitivity to component cost, driving the need for scalable and efficient quartz manufacturing processes.

Finally, the electronics and semiconductor industry forms a technically sophisticated, albeit smaller volume, customer group. Manufacturers of DUV and EUV lithography equipment are premier buyers, requiring the highest grade, most expensive synthetic quartz with zero defects for critical components like lens elements, prism substrates, and reticle handling parts. Their procurement is driven solely by performance and consistency, making them key customers for ultra-high-purity, low-OH synthetic quartz. Additionally, industrial manufacturers utilizing UV-LED curing for bonding complex materials, such as in aerospace and high-end automotive assembly, are increasingly important buyers seeking robust quartz optics for high-power, focused illumination systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 1,310 Million |

| Growth Rate | 16.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Corning Inc., Heraeus Holding GmbH, Shin-Etsu Quartz Products Co., Ltd., TOSOH Corporation, Momentive Technologies, Quartz Scientific Inc., Jiangsu Pacific Quartz Co., Ltd., Saint-Gobain S.A., Technical Glass Products, Atlantic Ultraviolet Corporation, Fusion UV Systems Inc. (Heraeus), GLO-Quartz Electric Heater Company Inc., Raesch Quarz (Germany) GmbH, Precision Engineered Products LLC, QSIL, Rusquartz, Beijing Sanhe Quartz Industry Co., Ltd., Guangde Yuzhong Quartz Co., Ltd., Jelight Company Inc., OptiSource LLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Synthetic Quartz Glass UV-LED Market Key Technology Landscape

The technology landscape for the Synthetic Quartz Glass UV-LED market is dominated by advanced material synthesis and precision fabrication techniques aimed at minimizing impurities and maximizing deep-UV transmission. The primary synthesis methods include Flame Hydrolysis (FH), where highly purified silicon tetrachloride (SiCl4) is reacted with oxygen and hydrogen in a high-temperature flame, resulting in synthesized silica soot that is then consolidated into glass ingots. An alternative, the Vapor Phase Axial Deposition (VAD) method, is highly favored for producing large, high-purity quartz boules, essential for high-end optical applications, offering superior control over the OH content, which is crucial for UV-C performance. Recent technological innovations focus on plasma-based synthesis methods, offering even greater purity and control over the resulting material structure, targeting the zero-defect requirement of DUV lithography optics.

In addition to bulk synthesis, post-processing technologies are vital for market competitiveness. This includes advanced annealing techniques used to relieve internal stress and eliminate micro-structural defects (like striae and bubbles) that negatively affect optical homogeneity, especially under high thermal loads from powerful UV-LED arrays. Surface treatment technologies, such as plasma etching and specialized anti-reflective (AR) coatings, are essential for maximizing the transmission efficiency of the quartz component, particularly important in multi-wavelength UV-LED systems. For water treatment applications, R&D is focused on developing durable anti-fouling coatings applied to the exterior of synthetic quartz sleeves, preventing biofilm buildup and maintaining disinfection efficacy without frequent manual cleaning, thereby reducing operational costs for end-users.

The convergence of synthetic quartz manufacturing with semiconductor fabrication techniques is also a key technological trend. This involves employing high-precision wafer-level processing and bonding techniques to integrate quartz windows directly onto UV-LED packages, ensuring hermetic sealing and optimal thermal dissipation. Furthermore, advancements in metrology are crucial; sophisticated instruments capable of measuring parts-per-billion levels of metallic contamination and quantifying minor differences in refractive index are necessary to qualify synthetic quartz for the most demanding applications, such as those requiring Vacuum Ultraviolet (VUV) transmission (below 200 nm), although UV-LEDs primarily focus on the UV-C band (250-280 nm) for germicidal action. This constant push for material perfection ensures the continued dominance of synthetic quartz in the high-performance UV optics domain.

Regional Highlights

- North America: North America is a significant market for Synthetic Quartz Glass UV-LED applications, primarily driven by stringent health regulations governing water quality and the rapid adoption of mercury-free technologies in industrial processes and healthcare facilities. The United States, in particular, demonstrates strong demand fueled by substantial investments in municipal water infrastructure upgrades utilizing UV-C LED disinfection, replacing aging chlorine-based systems in specific applications. The region is also a hub for medical device manufacturing and advanced semiconductor R&D, necessitating access to the highest-grade ultra-low-OH synthetic quartz for precision instrumentation and DUV lithography equipment. Technological innovation is concentrated here, with major quartz producers partnering directly with UV-LED chip manufacturers and system integrators to co-develop customized optical solutions. The market growth is also supported by the increasing consumer trend toward home and portable UV sterilization products.

- Europe: The European market exhibits strong growth, underpinned by environmental mandates and a leading position in advanced manufacturing and automotive sectors, driving the demand for UV-LED curing systems. The enforcement of EU directives promoting the reduction of hazardous substances (like mercury) strongly favors the transition to UV-LED technologies, thereby boosting the requirement for specialized synthetic quartz components. Germany and France are key consumers, driven by their robust industrial base demanding high-speed, precision UV curing of coatings and adhesives. Furthermore, Northern European countries show high penetration rates of decentralized water and air purification systems in commercial buildings, integrating high-efficiency UV-LED modules protected by synthetic quartz sleeves. Emphasis on energy efficiency and sustainable technology further accelerates the market here.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market globally, propelled by immense governmental investment in infrastructure, especially in China, India, and Southeast Asian nations focused on improving sanitation and water security for dense populations. China is both a major producer and consumer, driven by its expansive electronics and semiconductor manufacturing industries, which require vast quantities of high-purity synthetic quartz for lithography and component manufacturing. Japan and South Korea, established leaders in UV-LED chip technology, drive innovation in high-power UV-C devices, subsequently creating substantial domestic demand for corresponding high-transparency synthetic quartz optics. The region’s rapid industrialization and urbanization continue to necessitate scalable, reliable disinfection solutions, making it the epicenter of UV-LED adoption and synthetic quartz consumption.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions are emerging markets characterized by rapidly increasing deployment of UV-LED solutions in response to water scarcity and infectious disease control efforts. While smaller in scale compared to APAC or North America, LATAM and MEA show high potential, particularly in decentralized water treatment and small-scale medical sterilization applications. Investment is often focused on cost-effective, durable UV-LED systems, which still require high-quality synthetic quartz for operational reliability in challenging environmental conditions (e.g., high heat or humidity). Regulatory harmonization and infrastructure development are key factors influencing the pace of market penetration in these developing regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Synthetic Quartz Glass UV-LED Market.- Corning Inc.

- Heraeus Holding GmbH

- Shin-Etsu Quartz Products Co., Ltd.

- TOSOH Corporation

- Momentive Technologies

- Quartz Scientific Inc.

- Jiangsu Pacific Quartz Co., Ltd.

- Saint-Gobain S.A.

- Technical Glass Products

- Atlantic Ultraviolet Corporation (Quartz components division)

- Fusion UV Systems Inc. (A Heraeus subsidiary)

- GLO-Quartz Electric Heater Company Inc.

- Raesch Quarz (Germany) GmbH

- Precision Engineered Products LLC

- QSIL

- Rusquartz

- Beijing Sanhe Quartz Industry Co., Ltd.

- Guangde Yuzhong Quartz Co., Ltd.

- Jelight Company Inc.

- OptiSource LLC

Frequently Asked Questions

Analyze common user questions about the Synthetic Quartz Glass UV-LED market and generate a concise list of summarized FAQs reflecting key topics and concerns.Why is synthetic quartz glass preferred over natural quartz or standard glass for UV-LED applications?

Synthetic quartz glass is highly favored due to its extremely low hydroxyl (OH) content and minimal metallic impurities, which ensures maximum transparency and superior transmission efficiency in the crucial UV-C spectrum (200-280 nm) required for germicidal action. It also exhibits high thermal stability and robust solarization resistance, guaranteeing the long-term performance and reliability of high-power UV-LED systems, a critical factor where standard glass materials fail.

What is the primary factor driving the high cost of synthetic quartz glass manufacturing?

The high cost is primarily driven by the stringent purity requirements and the specialized, energy-intensive synthesis processes, such as Vapor Axial Deposition (VAD) or flame hydrolysis. These methods necessitate ultra-high-purity raw materials (SiCl4) and strictly controlled, high-temperature environments to eliminate trace impurities and structural defects, leading to high operational expenditures and lower production yields compared to conventional glass fabrication.

How do the manufacturing methods (VAD vs. Flame Hydrolysis) affect the final synthetic quartz product?

Flame Hydrolysis (FH) is known for high production rates but typically results in slightly higher OH content, limiting transmission efficiency in the deepest UV-C wavelengths. Vapor Axial Deposition (VAD) offers superior control over impurity levels, producing ultra-low OH quartz essential for the highest DUV performance (e.g., lithography and high-power sterilization), albeit often at a higher cost and slower production rate for large ingots.

Which end-use application dominates the consumption of synthetic quartz glass for UV-LEDs?

The Disinfection and Sterilization application segment currently dominates the consumption of synthetic quartz glass components. This dominance is driven by the massive global requirement for clean water and the widespread integration of UV-C LED technology into water treatment plants, air purification systems, and medical surface disinfection devices as a safe, chemical-free alternative to traditional methods.

What role does the hydroxyl (OH) content play in synthetic quartz for UV-LEDs?

Hydroxyl (OH) content is a critical parameter; even trace amounts absorb strongly in the UV-C and VUV regions, significantly reducing the efficiency of the UV-LED system. Therefore, manufacturers aim for ultra-low OH content synthetic quartz glass, typically below 1 ppm, especially for high-power UV-C applications where maximizing germicidal light output through the optical window is paramount for compliance and effectiveness.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager